All You Need To Know Is Yourself

Answer simple questions about your life and TurboTax Free Edition will take care of the rest.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Know which dependents credits and deductions

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

-

See which education credits and deductions you qualify for

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Paycheck Calculators To Estimate Your Pay

Here are some calculators that will help you analyze your paycheck and determine your take-home salary.

ADP Salary Payroll Calculator

Free salary reports covering virtually every occupation, as well as information on salary, benefits, negotiation, and human resources issues for U.S. and Canadian markets. Salary negotiation tips, small business solutions, and cost of living comparisons are also available.

You Can Claim A Withholding Exemption

You can claim an exemption from withholding on a W-4 form. There isn’t a special line for this on the form, but you can claim it by writing “Exempt” in the space below Line 4 if you qualify. You also have to provide your name, address, Social Security number and signature. You qualify for an exemption in 2021 if you had no federal income tax liability in 2020, and you expect to have no federal income tax liability in 2021.

Be warned, though, that if you claim an exemption, you’ll have no income tax withheld from your paycheck and you may owe taxes when you file your return. You might be hit with an underpayment penalty, too.

An exemption is also good for only one year so you have to reclaim it each year. If you were exempt in 2020 and wanted to reclaim your exemption for 2021, you had to submit a new Form W-4 by February 16, 2021. Likewise, if you claim an exemption for 2021, you’ll need to submit another W-4 form by February 15, 2022, to keep it next year.

You May Like: How Can I Make Payments For My Taxes

When Should I File A Payment Trace For My Missing Money

The IRS also offers a payment trace as a way to find your funds, including from missing stimulus checks. You can request a trace — which means filing an inquiry into the location of your IRS money — by mailing or faxing Form 3911 to the tax agency. Even if the IRS says you’re ineligible for advance payments, it’s best to submit a payment trace in case there’s a portal error.

Your payment will be traceable if it has been at least five days since the deposit date and the bank hasn’t received the money, four weeks since the check was mailed or six weeks if it was mailed to a forwarded address listed by USPS. If the check was mailed to a foreign address, you can ask for a payment trace after nine weeks.

How Should I Tax My Employee’s Bonus Check

All bonuses for W-2 type employees are taxable for FICA, Medicare, and withholding. FICA is 6.2% , Medicare is 1.45% , and withholding.

The IRS includes bonus wages in its definition of “supplemental wages” in the Pub 15 . Their guidelines stipulate that the Federal Withholding rate on supplemental wages amounting to less than $1,000,000 in a calendar year is 25%. Go over $1,000,000 in supplemental wages, and the rate should be equal to the highest rate of income taxation for that year .

The Pub 15 also describes an alternate method which basically amounts to “put the supplemental wages in on the check with the regular wages and let the system calculate at whatever rate it will”. Essentially, if you combine the bonus with the employee’s regular salary , the system will take the taxable wages for that check, annualize them , and determine the employee’s tax bracket accordingly. This will likely result in a higher withholding tax rate than the employee normally pays, but possibly still less than 25%.

If you decide to disregard the IRS guidelines on the topic* and would prefer to withhold less money from the bonus through payroll so that the employee gets more money in their net check, there are several ways you can go about it:

1. No withholding taxes. Simply block them in Payroll Processing > Payroll Entry > Individual Time Entry.

3. Withholding taxes left alone. Put the bonus in and let the system calculate based on normal pay frequency and exemption status.

Also Check: How Does Doordash Do Taxes

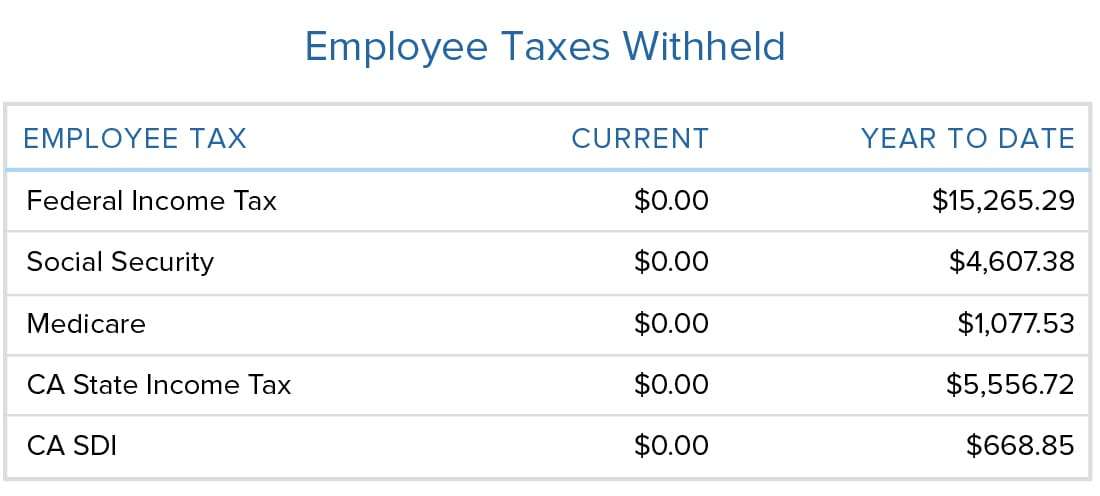

How Your Paycheck Works: Fica Withholding

In addition to income tax withholding, the other main federal component of your paycheck withholding is for FICA taxes. FICA stands for the Federal Insurance Contributions Act. Your FICA taxes are your contribution to the Social Security and Medicare programs that youll have access to when youre a senior. Its your way of paying into the system.

FICA contributions are shared between the employee and the employer. 6.2% of each of your paychecks is withheld for Social Security taxes and your employer contributes a further 6.2%. However, the 6.2% that you pay only applies to income up to the Social Security tax cap, which for 2021 is $142,800 . Any income you earn above $142,800 doesnt have Social Security taxes withheld from it. It will still have Medicare taxes withheld, though.

There is no income limit on Medicare taxes. 1.45% of each of your paychecks is withheld for Medicare taxes and your employer contributes another 1.45%. If you make more than a certain amount, you’ll be on the hook for an extra 0.9% in Medicare taxes. Here’s a breakdown of these amounts:

- $200,000 for single filers

- $250,000 for married taxpayers filing jointly

- $125,000 for married taxpayers filing separately

Take Advantage Of Benefits

If you sign up for the benefits, be sure to take advantage of them. The eye insurance may be great, but if you never use it, you are just throwing money away.

Similarly, you need to make sure that you use all of the money in your flexible spending account . This can be tricky because you have to estimate the amount of money that you’ll need each year to cover healthcare costs since the money does not roll over year-to-year. However, if you utilize your FSA correctly, it can save you big on health insurance costs.

Recommended Reading: Can Home Improvement Be Tax Deductible

What Should I Put On My W

If you got a huge tax bill when you filed your tax return last year and dont want another, you can use Form W-4 to increase your withholding. Thatll help you owe less next time you file. If you got a huge refund last year, youre giving the government a free loan and could be needlessly living on less of your paycheck all year. Consider using Form W-4 to reduce your withholding.

Here are some steps you might take toward a specific outcome:

Under What Conditions Is The Income Received For Services Performed In North Carolina By The Spouse Of A Servicemember Exempt From North Carolina Income Tax And Withholding Tax

The income earned for services performed in North Carolina by the spouse of a servicemember who is legally domiciled in a state other than North Carolina is exempt from North Carolina income tax if the servicemember is present in North Carolina solely in compliance with military orders the spouse is in North Carolina solely to be with the servicemember and the spouse is domiciled in the same state as the servicemember. All three conditions must be met to qualify for exemption.

For tax years beginning January 1, 2018, the Veterans Benefits and Transitions Act of 2018 amended the Servicemembers Civil Relief Act to allow the spouse of a servicemember to elect to use the same residence as the servicemember for state tax purposes. A spouse making this election will be considered to be domiciled in the same state as the servicemember.

Also Check: How Do I Protest My Property Taxes In Harris County

Dave Ramsey On Adjusting Your Withholding

Heres a discussion that Dave Ramsey had with a caller on his show recently about adjusting tax withholdings by updating your W-4.

Are you withholding too much onyour paycheck? Are you considering filling out a new W-4 to give yourself a pay raise? Do you prefer getting a large refund at the end of the year?

How We Use Your Personal Data

How we use your information depends on the product and service that you use and your relationship with us. We may use it to:

- Verify your identity, personalize the content you receive, or create and administer your account.

- Provide specific products and services to you, such as portfolio management or data aggregation.

- Develop and improve features of our offerings.

To learn more about how we handle and protect your data, visit our privacy center.

Don’t Miss: Efstatus Taxact Online

Workers Don’t Need To Submit A W

Workers aren’t required to file a W-4 form with their employer every year but you might want to anyway. If you’re happy with your current tax withholding, then do nothing and leave your current Form W-4 in effect with your employer. You’re not required to periodically submit a new W-4 form.

However, if you start a new job, you’ll have to complete a W-4 form at that time. That’s the only way your new employer will know how much federal income tax to withhold from your wages. There’s no way around that requirement.

You’ll also have to file a new W-4 form if you want to adjust the amount of tax your current employer withholds from your paycheck. Ideally, you want your annual withholding and your tax liability for the year to be close, so that you don’t owe a lot or get back a lot when you file your return. We recommend an annual check using the IRS’s Tax Withholding Estimator to make sure you’re on track as far as your withholding goes . If your tax withholding is off kilter, go ahead and submit a new W-4 as soon as possible. This is especially important if you have a major change in your life, such as getting married, having a child, or buying a home.

Make A Retirement Contribution

One of the most effective ways to reduce taxes on a bonus is to reduce your gross income with a contribution to a tax-deferred retirement account. This could be either a 401 or an individual retirement account . The amount you donate to the retirement account, subject to limitations, reduces your taxable income so youll owe less.

The limitations are different for different types of retirement accounts. They also change from year to year. For 2021, the limits are

- IRA: $6,000, or $7,000 for taxpayers age 50 or older.

You cant get a deduction for a contribution to a Roth IRA.

Also Check: Where Can I Find My Tax Return From Last Year

Should I Use The Worksheet That Comes With Form W

You can use the worksheet on Form W-4. However, there are much easier and more accurate ways to fill out the form.

As mentioned previously, TaxAct can do the calculations for you. You simply answer a few questions, and the program automatically populates the form.

If you decide to use the worksheets, however, this is what you need to know:

- The Personal Allowances Worksheet: This worksheet is used for determining the number of deductions you can claim. The more allowances you claim, the less tax is withheld from your paycheck. For more information on the personal allowances worksheet, see our guide here.

- The Deductions and Adjustments Worksheet: If you plan to itemize deductions, the deductions and adjustments worksheet will help you determine what you can deduct. Income adjustments, like student loan interest or retirement contributions, can also be included. This step is meant to be an estimation of your tax liability and can be different than what you actually claim on your tax return.

- Two-Earners/Multiple Jobs Worksheet: This section is for people with multiple jobs or married people who both work. It calculates how much money you should withhold from your paycheck based on the additional income from having multiple jobs or earners.

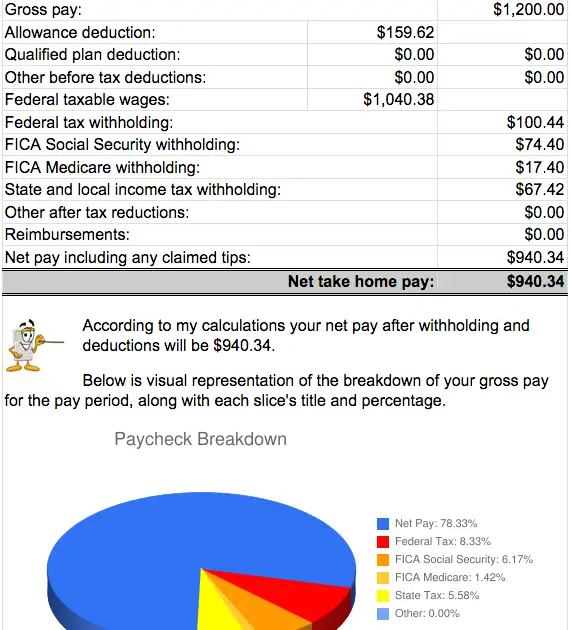

Summary Of Payroll Taxes

You should now have a better sense of what you’re getting for all those hours you put into your taxes. Like death, payroll taxes are a fact of life for employees and employers.

Employees must pay a variety of taxes that are deducted from their paychecks, which include federal, state, and local income taxes and Medicare and Social Security taxes. Employers must match employee payments for Medicare and Social Security and also pay federal and state unemployment taxes.

Your federal, state, and local payroll tax liability depends on several factors, including your filing status and your tax rate.

Medicare and Social Security tax rates are fixed and help support these programs that provide income and health care coverage for retired people. Employers are responsible for deducting and depositing payroll taxes on a timely basis to the relevant taxing authority.

This content was created in partnership with the Financial Fitness Group, a leading e-learning provider of FINRA compliant financial wellness solutions that help improve financial literacy.

Read more information and tips in our Taxes section

You May Like: Is Plasma Donation Taxable Income

How Do I Sign Up For Direct Deposit

Many employers will put your paycheck into your bank or credit union account. This is called direct deposit. You do not have to pay fees to cash your check. You will get your money sooner.

Ask your employer if it has direct deposit. To sign up for direct deposit, give your employer information about your bank or credit union account.

Fatten Your Paycheck And Still Get A Tax Refund

OVERVIEW

If you usually get a tax refund, but would like to start putting more money in your pocket every month, we can help. Yes, you still have to fill out a W-4 form. But we’ve developed a quick and easy guide to assist you.

When you file your taxes and get a tax refund, most people celebrate. But have you ever taken a second to think about what a refund means? Over the course of the year, you paid more federal income tax than you owed. In other words, you gave Uncle Sam an interest-free loan.

If you’d rather have a fatter paycheck and a smaller refund, you can control this. All you have to do is submit a new Form W-4 to your employer to adjust your federal income tax withholding.

You May Like: Www.1040paytax.com Review

How Are These Taxes Being Calculated

If you are employed under a U.S.-registered business, the burden is off your shoulder as your employer will make the computation for you and automatically deducts it on your gross pay. However, if you are a self-employed or a freelancer, you need to make the calculations for yourself. You can use this app to compute your federal tax withholding. For state taxes, you may refer directly to your State Department of Revenue to know the imposed individual tax systems.

Adjusting Your Withholding Could Move Your Refund To Your Paychecks

If getting your refund throughout the year rather than at tax time sounds appealing, you can adjust your withholding today. To do so, you’ll need to fill out a new Form W-4 and submit it to your employer.

This form requires you to fill in a few sections depending on your situation. The more accurately you complete the form, the more precise your withholding should be.

- For those with multiple jobs or that have a spouse that works, you’ll need to complete Step 2.

- Otherwise, you can use Step 3, claiming dependents, and Step 4, other adjustments, to make changes to your withholding.

- These options allow you to reduce the tax withheld through claiming tax credits or deductions.

- They also let you add other sources of income or extra withholding if you find you want more money withheld from your paycheck.

Tools, such as withholding tax calculators, can help you figure out what to fill in on the various steps of Form W-4. You’ll have to answer questions about your tax situation before the calculator will tell you how to fill out your Form W-4.

Don’t Miss: Do You Have To Pay Taxes On Plasma Donations

How Do I Determine Which Percentage To Elect

Every employee must consider the facts of their own situation and adjust their election accordingly.

If you want to keep your withholding approximately the same as last year, use last year’s federal Form W-2, or your last pay stub, to calculate which withholding percentage to elect. For example, if box 1 of federal Form W-2 shows $40,000 in wages and box 17 shows $1,000 in state income tax withheld, divide box 17 by box 1 to determine your percentage . To keep your withholding the same as last year, choose a withholding percentage of 1.8% and withhold an additional $10.77 per biweekly pay period . Be sure to take into account any amount already withheld for this year.

If you want to withhold more, choose one of the higher percentages or choose to have an additional amount withheld.

Note: Underwithholding can result you owing tax and/or underpayment penalties when you le your Arizona return at the end of the year.

For How Long Is Form Nc

If claiming exemption from withholding, the certificate is effective for one calendar year and a new certificate must be completed and given to the employer by February 16 to maintain exempt status for the following tax year. If a new Form NC-4 EZ is not provided by February 16, the employer is required to withhold based on single status with zero allowances. If, during the year, the spouse no longer meets the requirements for exemption on line 4, the spouse must complete a new Form NC-4 EZ.

You May Like: Efstatus Taxact Com Login