The Irs Classifies Virtual Currencies As Property What Does That Mean

Under U.S. tax law, bitcoin and other cryptocurrencies are classified as property and subject to capital gains taxes. But you only owe taxes when those gains are realized.

Just because your Coinbase portfolio drastically grew in value last year doesn’t mean that you’ll be writing out a check to Uncle Sam come April. Similar to trading stocks, you only need to list gains you earn from bitcoin as income when you decide to sell.

“If you never sell your bitcoin, you never owe cash,” Ben Weiss, COO of CoinFlip, the largest Bitcoin ATM provider in the country, tells CNBC Make It. “Bitcoin is treated like if you bought and sold a stock.”

Records You Must Keep

You must keep separate records for each transaction, including:

- type of tokens

- date you disposed of them

- number of tokens youve disposed of

- number of tokens you have left

- value of the tokens in pound sterling

- bank statements and wallet addresses

- a record of the pooled costs before and after you disposed of them

You may also want to keep other records such as wallet addresses.

HMRC might ask to see your records if they carry out a compliance check.

When Youll Owe Taxes On Cryptocurrency

Because the IRS considers virtual currencies property, their taxable value is based on capital gains or losses basically, how much value your holdings gained or lost in a given period.

When you trade cryptocurrencies or when you spend cryptocurrency to buy something, those transactions are subject to capital gains taxes, because youre spending a capital asset to get something or get another asset, says Shehan Chandrasekera, CPA, head of tax strategy at CoinTracker.io, a crypto tax software company.

The difference between the amount you spent when you bought or received the crypto and the amount you earn for its sale is the capital gain or capital loss what youll report on your tax return. Broadly speaking, if you bought $100 worth of Bitcoin and sold it for $500, youd see a capital gain of $400. If your Bitcoin lost value in that time, youd instead face a capital loss. If your losses exceed your gains, you can deduct up to $3,000 from your taxable income .

The amount of time you owned the crypto plays a part, too. If you held onto a unit of Bitcoin for more than a year, it would generally qualify as a long-term capital gain. But if you bought and sold it within a year, its a short-term gain. These differences can affect which tax rate is applied. The tax rate also varies based on your overall taxable income, and there are limits to how much you may deduct in capital losses if your crypto asset loses value.

Also Check: Www.1040paytax

Exchanging Cryptocurrency For Another

If you use one type of cryptocurrency to purchase another one there is no reporting requirement. It is only until you either gift them, convert them to fiat currency, or buy something else, then you need to report it.

Reporting cryptocurrencies can seem complicated, which is why our intuitive software will assist you in doing it correctly. Plus, you can always seek advice from one of our tax professionals who is available on live chat within the app.

How Are Crypto Donations Taxed

Donating your crypto is tax free and deductible as long as you are donating to a registered charity.

Donations greater than $500 have to be reported on Form 8283.

The amount of your donation that is tax deductible depends on how long you have held the assets:

- For crypto held for more than 1 year, you can deduct up to 30% of your Annual Gross Income

- For crypto held for less than a year, you can deduct up to 50% of your Annual Gross Income and the lesser of cost-basis or the fair market value of the donated cryptoâ

You May Like: Where’s My Refund Ga State Taxes

Do You Pay Taxes On Crypto

You’re required to pay taxes on crypto. The IRS classifies cryptocurrency as property, and cryptocurrency transactions are taxable by law just like transactions related to any other property.

Taxes are due when you sell, trade, or dispose of cryptocurrency in any way and recognize a gain. For example, if you buy $1,000 of crypto and sell it later for $1,500, you would need to report and pay taxes on the profit of $500. If you dispose of cryptocurrency and recognize a loss, you can deduct that on your taxes.

Buying crypto on its own isn’t a taxable event. You can buy and hold cryptocurrency without any taxes, even if the value increases. There needs to be a taxable event first, such as selling the cryptocurrency.

The IRS has been taking steps to ensure that crypto investors pay their taxes. Tax filers must answer a question on Form 1040 asking if they had any type of transaction related to a virtual currency during the year.

Crypto exchanges are required to file a 1099-K for clients who have more than 200 transactions and more than $20,000 in trading during the year. The IRS has also issued summonses to crypto exchanges to find investors who had at least $20,000 in cryptocurrency transactions from 2016 to 2020.

Do You Have To Report Cryptocurrencies On Fbars

An FBAR is the Foreign Bank Account Report a filing requirement for Americans who have a total of over $10,000 in foreign bank and investment accounts at any time during a year.

An article by The National Law Review states there are talks that FinCEN is seeking to establish an FBAR requirement for cryptocurrency accounts in 2021. Furthermore, if such a law is established, crypto accounts will need to be reported under the FATCA law.

Also Check: Have My Taxes Been Accepted

What Is Cost Basis

Cost Basis represents how much money you put into purchasing your property . Cost basis includes purchase price plus all other costs associated with purchasing your cryptocurrency .

From our examples above, itâs easy to see this formula in action. If you buy 1 Litecoin for $250, your cost basis is $250 per Litecoin. If you sell or trade it when itâs worth $400, that $400 is the fair market value. Applying the formula:

$400 – $250 = $150 Gain

Fairly straightforward.

Now, letâs dive into a more complex example to see how you would calculate your gains and losses using this same formula when you have a number of transactions instead of just one or two.

What Are The Cryptocurrency Tax Rates For 2021

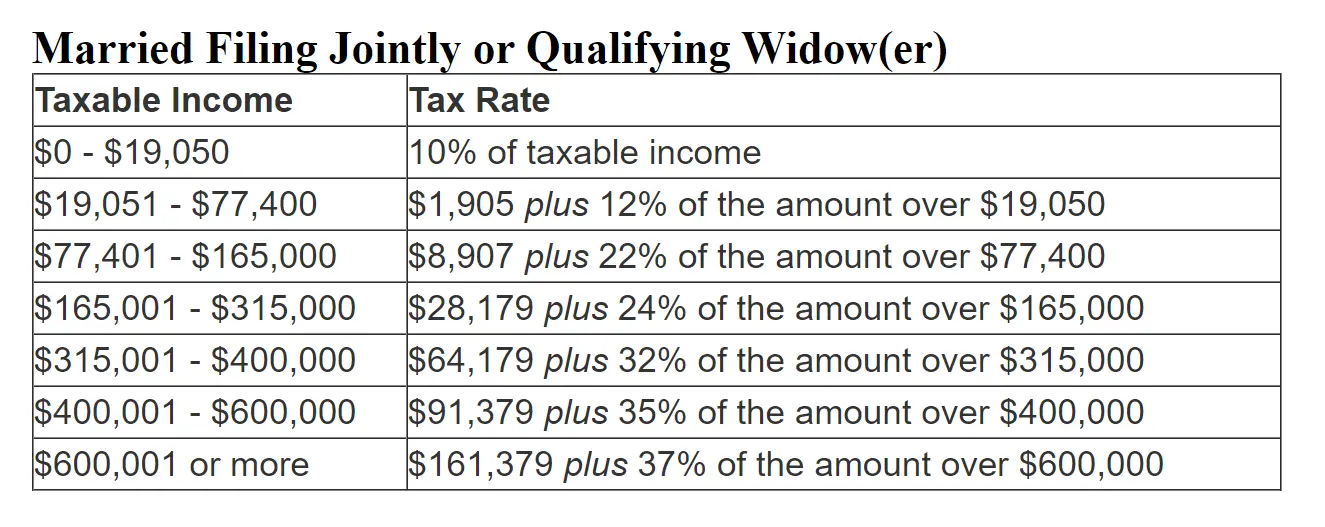

Cryptocurrency tax rates depend on your income, tax filing status, and the length of time you owned your crypto before selling it. If you owned it for 365 days or less, then you pay short-term gains taxes, which are equal to income taxes. If you owned it for longer, then you pay long-term gains taxes.

Here are cryptocurrency tax rates for 2021 on long-term gains:

|

Tax Rate |

|---|

|

> $523,600 |

Data source: IRS.

You can choose to sell older coins first to pay the lower long-term gains tax rates. Imagine you’ve been buying Bitcoin regularly for the past two years and now you’ve decided to sell some. By selling Bitcoin you’ve had for more than a year, it will be considered a long-term gain and you’ll pay a lower crypto tax rate on it.

Read Also: How To Report Ppp Loan Forgiveness On Tax Return

How To Avoid Irs Penalties

When it comes to cryptocurrency taxes, keep things as honest and transparent as possible. The IRS views cryptocurrency as property, and so any capital gains acquired from the sale or transfer of said property must be reported as income, the same as the sale or transfer of any other asset. You are also allowed to report losses if sales or transfers resulted in a capital loss. Then, you can write off up to $3,000.

To avoid IRS penalties, always report your earnings accurately. You should accurately calculate losses or gains to ensure your figures are correct. To determine your capital loss/gain, take the purchase price of your position, including fees, and subtract it from the selling price. If the number is negative, you took a loss. If its positive, you profited. Accurate recordkeeping is absolutely essential, even for crypto traders.

Cryptocurrency Taxes In Germany

Cryptocurrencies are viewed as private money and a financial instrument, meaning any monetary value in digital form. Purchases made with cryptocurrency are tax-free. By and large, only commercial activities are taxed, that is a purchase/sale of coins in a short period of time . Income tax is 14%-45%.

Don’t Miss: How To File Taxes Without Income To Get Stimulus Check

The Importance Of Working With A Boston Tax Lawyer Who Can Provide Cryptocurrency Tax Assistance

With these types of issues in mind and understanding the potentially-substantial tax, interest and penalty obligations that come with failing to timely report cryptocurrency transactions most cryptocurrency investors will benefit greatly from the assistance of an experienced tax lawyer. This is true with regard to prospectively addressing tax reporting issues, retrospectively amending incomplete tax returns, responding to IRS warning letters, and defending against audits and investigations.

An experienced tax lawyer will be able to help you with cryptocurrency-related tax compliance in numerous respects, including:

- Determining which of your cryptocurrency transactions qualify as taxable events that need to be reported to the IRS

- Determining whether you have any local, state or international tax obligations related to your cryptocurrency investments

- Assessing your potential exposure and executing an effective strategy with regard to disclosing previously-unreported cryptocurrency transactions

- Filing all necessary new and amended tax returns

- Representing you in direct communications with the IRS and other tax authorities, including during tax audits and criminal tax investigations

- Negotiating offers in compromise and deferred prosecution agreements

- Developing tax strategies for avoiding future issues at the state, federal and international levels

How To Calculate Gains And Losses

Say you have the following transaction history on Coinbase:

- 1/1/20 – Buy 1 BTC for $12,000

- 2/2/20 – Buy 1 BTC for $10,000

- 3/3/20 – Buy 1 BTC for $8,000

- 4/4/20 – Trade 0.5 BTC for 8 ETH â

With this transaction history, you first trigger a taxable event when you trade 0.5 BTC for 8 ETH. To calculate the gain/loss, you need to subtract your cost basis of 0.5 BTC from the fair market value at the time of the trade.

The question here is, what is your cost basis in the 0.5 BTC that you traded for 8 ETH? After all, you have purchased 3 different bitcoins all at different prices prior to this trade.

To answer this, you have to determine which bitcoin you are disposing of in this scenario.

To determine the order in which you sell various cryptocurrencies, accountants use specific costing methods like First-In First-Out or Last-In First-Out . The standard method is First-in First-out.

These costing methods work exactly how they sound. For First-In First-Out, the asset that you purchased first is the one that gets sold off first. So you are essentially disposing of your crypto in the same order that you first acquired them.

If we use First-In First Out for our example above, we âsell offâ that first bitcoin which was acquired at $12,000 on 1/1/20. The cost basis in this first bitcoin is $12,000, making the cost basis for 0.5 of this BTC $6,000 .

As denoted in the example, the fair market value at the time of 0.5 BTC at the time of trading was $4,000.

Recommended Reading: Do You Have To Pay Taxes On Plasma Donations

Crypto Taxes In The United States Of America

If you live in the USA and have bought, sold or exchanged cryptocurrencies over the last year, you may owe short-term capital gains tax at the same rate as your usual income tax bracket. This applies to any losses or gains on crypto assets that you have held less than one year. Up to $3,000 of losses can also be deducted to lessen your tax bill, with any excess carrying over to later years.

If you have traded coins bought over a year ago, you are liable for long-term capital gains. This depends on your household income and can be 0%, 15%, or 20% of any gains your investment made.

The IRS may require you to prove which coins were sold if you sold some which were held some for over a year but continued to buy more in the interim. If you can prove the coins you sold were older than a year, you are eligible for the lower long-term capital gains rate. The IRS gives limited options to evidence this, including using the specific units unique digital identifier such as a private key, public key, and address, or by records showing the transaction information for all units of a specific virtual currency, such as Bitcoin, held in a single account, wallet, or address.

Remember, its not just exchanging crypto for fiat that needs to be reported. In the US, you also need to declare if you:

How Will It Work

Following normal income tax rules, income received or accrued from crypto assets transactions can be taxed on revenue account under gross income.

Alternatively such gains may be regarded as capital in nature, as spelt out in the Eighth Schedule to the Act for taxation under the Capital Gains Tax paradigm. Determination of whether an accrual or receipt is revenue or capital in nature is tested under existing jurisprudence .

Taxpayers are also entitled to claim expenses associated with crypto assets accruals or receipts, provided such expenditure is incurred in the production of the taxpayers income and for purposes of trade.

Base cost adjustments can also be made if falling within the CGT paradigm. Gains or losses in relation to crypto assets can broadly be categorised with reference to three types of scenarios, each of which potentially gives rise to distinct tax consequences:

- Crypto assets can be acquired through so called mining. Mining is conducted by the verification of transactions in a computer-generated public ledger, achieved through the solving of complex computer algorithms.

- Investors can exchange local currency for a crypto asset by using crypto assets exchanges, which are essentially markets for crypto assets, or through private transactions.

- Goods or services can be exchanged for crypto assets. This transaction is regarded as a barter transaction. Therefore the normal barter transaction rules apply.

Also Check: Is Plasma Donation Taxable Income

Sending Crypto As A Gift

One of the first questions you can ask yourself is whether you sent crypto as a gift. If you have sent cryptocurrency as a gift, one time or spread throughout the year, totaling at least $15,000, youll need to report the transactions on Form 709. This is the gift tax return found in our software.

Plus, youll also need to inform the person you gave the gift to about the cost basis of your crypto. Meaning how much you paid in US dollars to purchase the quantity of crypto you sent as a gift.

Keep in mind, you only need to file Form 709 if you sent at least $15,000 worth of cryptocurrency to someone, either once or over multiple transactions throughout the year.

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our investing reporters and editors focus on the points consumers care about most how to get started, the best brokers, types of investment accounts, how to choose investments and more so you can feel confident when investing your money.

Don’t Miss: Notice Of Tax Return Change Revised Balance

How Are Swaps Taxed Decentralized Exchange Taxes

Token swaps on PancakeSwap, Uniswap, SushiSwap, or any other decentralized exchange are taxable events in the US. Even though trading on DEXs can be more anonymous than trading on centralized exchanges like Binance, the crypto tax reporting obligation remains.

Each token swap, essentially a crypto-to-crypto trade, must be reported to the IRS, and you have to determine the gain or loss for each trade.

How Does The Gst/hst Apply To Cryptocurrency

Where a taxable property or service is exchanged for cryptocurrency, the GST/HST that applies to the property or service is calculated based on the fair market value of the cryptocurrency at the time of the exchange.

If your business accepts cryptocurrency as payment for taxable property or services, the value of the cryptocurrency for GST/HST purposes is calculated based on its fair market value at the time of the transaction.

Keep all records that show how you calculated the fair market value.

Don’t Miss: How To Find Your Employer’s Ein

What Is Virtual Currency

Virtual currency is a digital representation of value that functions as a medium of exchange, a unit of account, and/or a store of value. In some environments, it operates like real currency , but it does not have legal tender status in the U.S. Cryptocurrency is a type of virtual currency that utilizes cryptography to validate and secure transactions that are digitally recorded on a distributed ledger, such as a blockchain.

Virtual currency that has an equivalent value in real currency, or that acts as a substitute for real currency, is referred to as convertible virtual currency. Bitcoin is one example of a convertible virtual currency. Bitcoin can be digitally traded between users and can be purchased for, or exchanged into, U.S. dollars, Euros, and other real or virtual currencies.