Want To Save This Guide For Later

No problem! Just enter your email address and we’ll send you the PDF of this guide for free.

A taxpayer whose installment agreement is monitored by the IDRS will receive Notice CP 523, Defaulted Installment Agreement Notice of Intent to Levy. A defaulted installment agreement may be reinstated without manager approval if it is determined that the agreement was terminated because of an additional liability and if addition of that new liability will result in no more than two additional monthly payments and the agreement will not extend beyond the Collection Statute Expiration Date , and Terminated Installment Agreements).

The IRS will first make a lien determination before considering the request for reinstatement. Default and reinstatement terminations due to the taxpayer missing and/or skipping payments will require manager approval.

The taxpayer may request a Collection Appeals Program hearing to discuss the proposed terminations and actual terminations of installment agreements. The law provides for the taxpayer to appeal a termination of an installment agreement.

See the Regular Installment Agreement section. The IDRS stands for Integrated Data Retrieval System, a mission critical system consisting of databases and operating programs that support IRS employees working active tax cases within each business function across the entire IRS Privacy Impact Assessment, 8/21/2013).

How Do I Revise My Payment Plan Online

You can make any desired changes by first logging into the . On the first page, you can revise your current plan type, payment date, and amount. Then submit your changes.

If your new monthly payment amount does not meet the requirements, you will be prompted to revise the payment amount. If you are unable to make the minimum required payment amount, you will receive directions for completing a Form 433-F, Collection Information Statement PDF or Form 433-B, Collection Information Statement for Businesses PDF and how to submit it.

To convert your current agreement to a Direct Debit agreement, or to make changes to the account associated with your existing Direct Debit agreement, enter your bank routing and account number.

If your plan has lapsed through default and is being reinstated, you may incur a reinstatement fee.

Choose A Payment Method

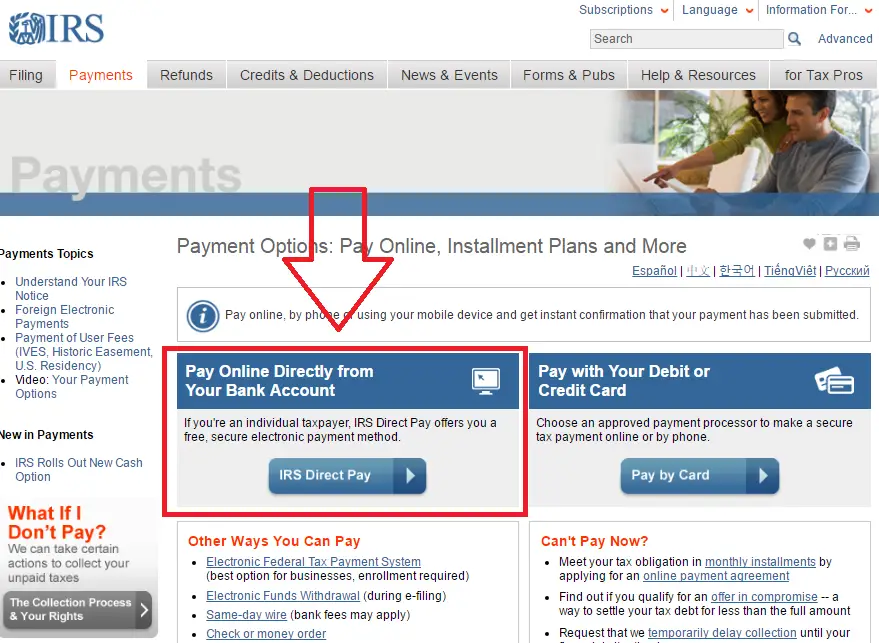

You can pay your tax instalments online, in person, or by mail. There are several payment options with different processing times for each.

- Online:

- In person or by mail:

- Use your instalment remittance voucher to pay in person or by mail

You will need your instalment remittance voucher to ensure your payment is applied to the correct account.

Your remittance voucher is included in your instalment reminder package the CRA mails to you, unless you pay instalments by pre-authorized debit.

Choose your payment method:

- call our automated TIPS line at 1-800-267-6999

If your payment is not honoured, the CRA will charge a fee.

Also Check: Efstatus.taxactcom

Covid Related Repayments Information Below:

You may use three different methods to calculate your instalment tax payments.

- You can pay the amount indicated on your instalment reminder form this is called the no-calculation option. The CRA calculates your net tax owed on the reminder form by using past years information. In 2019, for instance, March and June payments would be based on 2017 net tax owed. For September and December, your payments would be the difference between your net tax owed in 2018 minus what you paid in March and June. This option is best for those whose financial and employment situations are relatively static over long periods of time.

- The second option is the prior-year option, which uses your net tax owed from the last tax year to determine what you owe this year. The prior-year option may apply to you if you have maintained a similar financial situation for the past year, but two years ago, you had a different financial or employment situation.

- The last option is the current-year option, which is solely based on this years tax information. This option may apply to you if your employment or financial situation has recently changed.

Should I Use A Tax Settlement Firm

Your best option is typically to work directly with the IRS rather than hiring a tax settlement company if you owe taxes. Plenty of firms claim that they can reduce your tax debt or stop wage garnishment, but the Federal Trade Commission warns that most taxpayers wont qualify for the programs they advertise.

The FTC has received numerous complaints from taxpayers who say that certain tax settlement firms not only failed to negotiate a settlement for them, but they also didnt submit the necessary paperwork to the IRS. They charged unauthorized fees.

The FTC recommends carefully reviewing a tax relief companys fee structure and cancellation policies before hiring one to represent you. A better solution is often to contact the Taxpayer Advocate Service, an independent division of the IRS, for unresolved issues with the IRS. Only a certified public accountant , an enrolled agent, or an attorney can represent you before the IRS if you want the assistance of a third party.

Recommended Reading: Efstatus.taxact.com Login

You Can Pay Taxes With Your Credit Card But Should You

Weve gone through the how but before paying taxes on a credit card, its important to focus on the why. Here are some prompts to think about whether paying taxes on a credit card makes sense:

- Do you need more time to pay your taxes? If you do, the answer may be yes no matter what other considerations come into play. This is especially true if you have a 0% APR offer that you can utilize to buy you some time. The fee you pay for using plastic payment may seem tiny compared to a tax penalty or a high interest rate.

- What rewards will you receive? If you have a card that pays a 2% or higher rate of return, you will at least break even with most of the services that handle credit card payments.

- Do you have a large minimum spend requirement to meet to earn a welcome bonus? If you have a card that has a large spending requirement, it might be worth knocking out a large amount of that spending in one go, even if there are fees involved. Missing out on the welcome bonus will cost you much more than the fees charged.

Comparing Federal Tax Payment Options

The first thing to understand about paying taxes with a credit card is that this transaction will not be free. Third party payment processors charge fees to process transactions and submit payments to the Internal Revenue Service and they charge additional fees for the convenience.

When it comes to federal taxes, the IRS makes things easy by providing information about paying a tax bill on its own website. The IRS also authorizes three companies to process credit card payments for federal taxes.

The graphic below shows the three companies authorized to accept payment for a federal tax bill along with the respective fees they charge.

There are a few additional details to note about paying your federal taxes with a credit card, per the IRS:

- Tax payments over $100,000 may come with special requirements and these payments must be processed over the phone instead of online.

- Different types of tax payments come with a maximum number of times you can pay with a credit card each year.

- Employers federal tax deposits cannot be paid with a credit card.

Read Also: Wheres My Refund Ga State

If You Can Pay Your Debt Over Time An Installment Plan May Be The Right Solution

The most widely used method for paying an old IRS debt is the monthly installment agreement, or IA. If you owe $50,000 or less, you should be able to get an installment payment plan for 72 months just by asking for it. If you owe more than $50,000, you will have to negotiate with the IRS to get one and provide financial information. As part of its Fresh Start program, the IRS recently adopted new rules making it easier to obtain an installment agreement. The threshold for qualifying for an installment agreement without having to provide financial information was increased from $25,000 to the current $50,000 amount and the timeline for paying was increased to 72 months from 60 months.

You must be current on this year’s tax returns. If IRS computers show that you haven’t filed all past due tax returns, you will not be eligible for an IA. Likewise, if you are self-employed, you must be current on your quarterly estimated tax payments for the current year. Finally, if you have employees, you must be current on payroll tax deposits and Form 941 filings to get an IA.

But don’t assume that a payment plan is your best option — there are definite drawbacks. The biggest is that interest and penalties continue to accrue while you still owe. Combined with penalties, the interest rate is often 8% to 10% per year. It’s possible to pay for years and owe more than when you started.

Example:

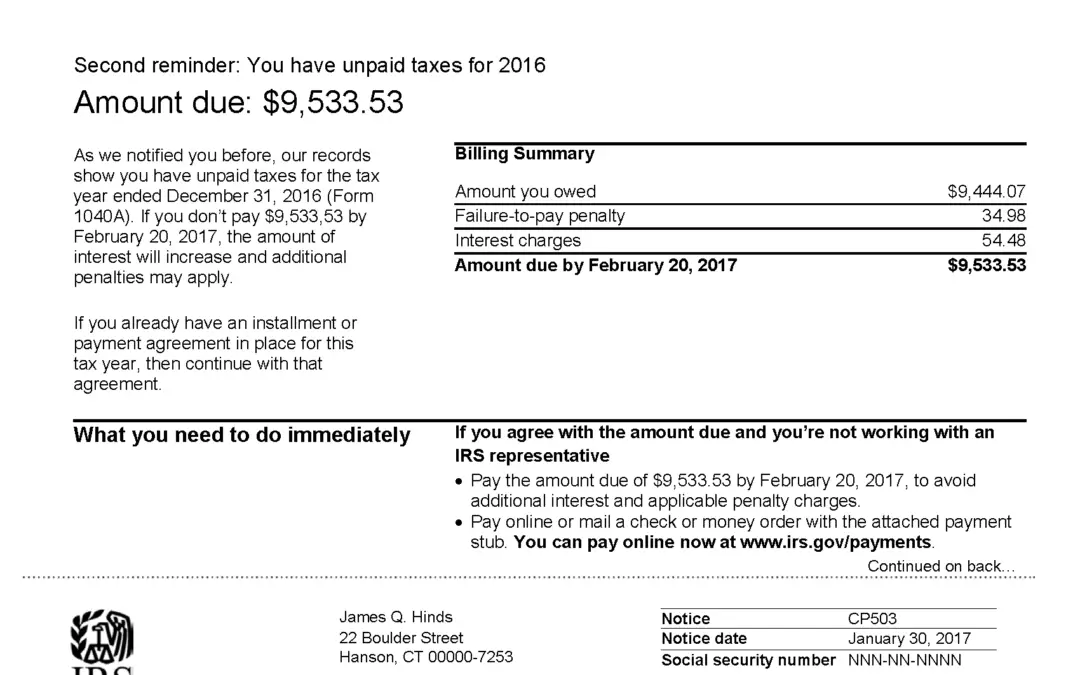

If you owe $50,000 or less, you can apply for your installment agreement online at the IRS website.

What Happens If You Can’t Pay Your Taxes

InvestopediaForbes AdvisorThe Motley Fool, CredibleInsider

What happens if you complete your tax return and find that you can’t pay the amount you owe?

This isn’t supposed to happen. You’re supposed to pay income taxes gradually throughout the year so that in April you won’t owe much or will even be entitled to a refund of overpaid taxes. Employees have income tax withheld from their paychecks. Self-employed taxpayers pay quarterly estimated taxes directly to the Internal Revenue Service .

But sometimes your life situation changes or an unusual one-time event occurs during the year. When you prepare your annual return, you may get an ugly surpriseyou owe hundreds or thousands of dollars that you didn’t expect and simply don’t have.

While this isn’t a good situation to be in, it’s not the end of the world. There are a number of ways to resolve it.

You May Like: Home Improvement Cost Basis

Working With A Tax Debt Relief Company

- Our team quickly identifies the best tax relief option for you, eliminating the need for hours of self-directed research and considering the pros and cons.

- We resolve your tax issues in a timely manner without making you stay on hold with federal and state tax bureaus.

- Together, we can expedite the process by helping you gather the documents you need to apply for the appropriate tax relief solution for your needs.

- Thanks to our experience negotiating with the IRS, were confident in our ability to secure the best possible outcome for your situation.

What Is A Violated Installment Agreement

The Department can cancel a payment plan after it begins, if it has been violated. A payment plan is considered violated if you do not:

- Sign and return the waiver that was included with your paperwork

- Make the full monthly payment on time

- File and pay any tax return due

- Provide a completed Statement of Income and Expenses when requested

If your payment plan is in violation and is subject to being canceled, the Department will notify you in writing.

Recommended Reading: Mcl 206.707

How Can I Pay My Federal Taxes With Installments Or Monthly Payments

How Can I Pay My Federal Taxes With Installments or Monthly Payments?

Every year, there are millions of taxpayers who find themselves unable to pay their taxes in full to the IRS. The IRS knows there will be some taxpayers coming up short. The good news is the federal government is happy to work with you. The bad news is, theyre relentless in their collection of back taxes and if left unattended, they can levy your bank account, garnish your paycheck, or put a lien on your property to settle your tax bill.

However, their cooperation comes at a price, called penalties and interest. Here are the steps you need to take if you wish to pay your federal income tax with installment payments.

Before you proceed to navigating the complicated maze that is the IRS on your own, we highly encourage all our readers to speak to a qualified Tax Relief Expert at our office. You can schedule a confidential, no obligation consultation to explore your options for tax relief www.SmithsTaxSolutions.com/Contact

Here are some steps you can take to get on an IRS payment plan if you cant pay your taxes in full.

File Correctly and On Time

Waiting until after April 15 to file is also a poor plan, because you will only accrue more penalties. Also, filing an extension does not mean you have more time to pay. It simply means youll end up paying more with penalties and interest, sinking you deeper into a hole.

So make sure you file on time!

Ok, back to Form 9465

When The Irs Can Revoke An Installment Agreement

Once you receive approval of your IA, you and the IRS are bound by the terms of the agreement, unless any of the following are true:

- You fail to file your tax returns or pay taxes that arose after the IA was entered into. Although IRS computers do not continue to review your finances, they do monitor you for filing future returns and making promised payments.

- You miss a payment. Under the terms of all IAs, payments not made in full, and on time, can cause the IA to be revoked immediately. In practice, the IRS usually waits 30 to 60 days before revocation — at least on the first missed payment. You are entitled to a warning or a chance to reinstate the agreement.

- Your financial condition changes significantly — either for the better or worse. The IRS usually won’t find out about this unless you tell. The IRS may review your situation every year or two, however, and require you to submit a new Form 433-A in order to continue your IA.

- The IRS discovers that you provided inaccurate or incomplete information as part of the negotiation. For example, you may have omitted to mention certain valuable assets.

For more information on how to deal with the IRS to work out a payment plan, see Stand Up to the IRS, by Frederick W. Daily .

Read Also: Reverse Ein Search

The Tax Cuts And Jobs Act Changed The Way Tax Is Calculated

The IRS encourages everyone to perform a paycheck checkup to see if you have the right amount of tax withheld for your personal situation.

For employees, withholding is the amount of federal income tax withheld from your paycheck. The amount of income tax your employer withholds from your regular pay depends on two things:

- The amount you earn.

- The information you give your employer on Form W4.

For help with your withholding, you may use the Tax Withholding Estimator. You can use the Tax Withholding Estimator to estimate your 2020 income tax. The Tax Withholding Estimator compares that estimate to your current tax withholding and can help you decide if you need to change your withholding with your employer.

More details about the Tax Withholding Estimator and the new 2020 withholding tables can be found on the Frequently Asked Question pages:

Request A Penalty Abatement To Reduce Your Tax Bill

You may also want to contact the IRS to see if you can have any penalties waived through the first-time penalty abatement program, reasonable cause relief or statutory exception. You may qualify for the first-time penalty abatement program if you have not had penalties assessed to your account for the prior three years, you have filed all tax returns or filed an extension and you have paid or made arrangements for any taxes due.

If you do not qualify for the first-time penalty abatement, you may want to consider penalty relief through a reasonable cause. The IRS will consider your request if you can establish the following reasonable causes:

- You experienced a fire, casualty, natural disaster or other adverse weather conditions

- You are unable to obtain your financial or tax records

- You or an immediate member of the taxpayers family were impacted by a serious illness or death

Finally, you may also request penalty relief if you received incorrect written advice from the IRS, you may request relief through statutory relief. You will need to file a Form 843, Claim for Refund and Request for Abatement to request for penalty relief. Your form should include the written advice you relied on, the amount of taxes and penalties related to the advice.

Don’t Miss: 1040paytax Review

Fees For Irs Installment Plans

If you can pay off your balance within 120 days, it won’t cost you anything to set up an installment plan.

- If you cannot pay off your balance within 120 days, setting up a direct debit payment plan online will cost $31, or $107 if set up by phone, mail, or in-person.

- If not using direct debit, then setting up the plan online will cost $149.

- If not using direct debit, setting up the plan by phone, mail, or in-person will cost $225.

- If you’re a lower-income taxpayer, you may be able to reduce these fees.

What Happens If You Default On Your Irs Installment Agreement

If you have successfully negotiated an installment agreement with the IRS, congratulations! You no longer have to be constantly looking over your shoulder for threatening letters, property liens or visits from revenue officers.

Depending on your circumstances and the amount due, the hard part could be over or it could be just beginning as you start making payments. The important thing to remember is that the major condition of your installment agreement is that you make all of your payments in the agreed-upon amount on time.

Once you have made several payments, it is not the time to start slacking off on your responsibility. The IRS might excuse a late or missed payment or two if you have a really good excuse and it does not become a habit. After all life happens. An emergency or some other unforeseen issue may cause you either be late with your payment or unable to pay it at all.

If it appears to the IRS that you are not taking your installment seriously if they discover after the fact that you submitted erroneous information on your application or you just stop paying at all, you will be considered in default. And that is not a good position to be in. If you are in default on your installment agreement, the IRS has the option to terminate it and you will be back at square one with a big tax debt and no way to pay it.

Recommended Reading: Irs Federal Returns