How Capital Gains Tax Works In Ontario

In todays financial environment, many individuals make the choice to invest, whether it is an investment in stocks, shares in a mutual fund, real estate holding investment or an investment in exchange-traded funds.

Essentially, the term capital gains is if the value of the asset increases, the amount of capital that you have invested increased. In other words, you have gained capital. Since this is a form of income, you are required to pay capital gains tax in Ontario when the capital gain is realized. Realized capital gain means that you have sold or traded the investment, solidifying the increase in your gained capital and putting the capital in your pocket. Its at this point that you are required to pay capital gains tax in Ontario.

Conversely, you are not required to pay capital gains tax in Ontario if the gains are not realized, meaning you have not sold off the investment and gained that capital from sale as a result of the increase in value.

Did you sell your property in the last year and make a profit? Did you see an increase in your stocks and trade it off in your favour? Then its more than likely that capital gains tax is going to be an influential element of your personal tax return. If you do sell the property and make a profit an increase in capital you have to pay tax on it at that point unless the property you are selling is your primary residence and qualifies for the primary residence exemption.

Selling Property When You Are Older Than 65 Years

Do seniors have to pay capital gains? This exemption works best for those who want to save on taxes. If you are above 65 years old, you will not be liable to pay the capital gains tax once you sell your property. Even if you do not intent to use the proceeds from the auction of the property to purchase your new home, you are completely exempt from the capital gains tax.

We recommend that if you are planning to sell your property in your early 60s, consider waiting until you are above 65 to sell your property so that you can avoid paying the capital gains tax.

However, there is a specific condition that you must meet in order to be exempt from capital gains tax at old age. The stipulated condition is that the property you are selling needs to be your habitual residence. In simpler terms, you need to provide proof that you have lived for a minimum of the past 3 years on the property, before you sell it, in order to be completely exempt from the capital gains tax.

How To Get Into A Lower Tax Bracket And Pay A Lower Federal Income Tax Rate

Two common ways of reducing your tax bill are credits and deductions.

-

Tax credits directly reduce the amount of tax you owe they don’t affect what bracket you’re in.

-

Tax deductions, on the other hand, reduce how much of your income is subject to taxes. Generally, deductions lower your taxable income by the percentage of your highest federal income tax bracket. So if you fall into the 22% tax bracket, a $1,000 deduction could save you $220.

In other words: Take all the tax deductions you can claim they can reduce your taxable income and could kick you to a lower bracket, which means you pay a lower tax rate.

Also Check: How Does H& r Block Charge

Disposing Of Your Shares Of Or Interest In A Flow

When you dispose of your shares of, or interest in, a flow-through entity, calculate the capital gain or loss in the same way as with any other disposition of capital property .

Report these dispositions on Schedule 3 as follows:

For more information, see Property for which you filed Form T664or T664.

Certain circumstances may create a special situation for a flow-through entity described in items 1 to 6 of What is a flow-through entity?. This happens if you dispose of your remaining shares of, or interest in, such an entity in the 1994 to 2020 tax years and have filed Form T664. If this is the case, in the year you dispose of the shares, use the ECGB available for the entity immediately before the disposition to increase the ACB of the shares or interests.

The ACB adjustment will either reduce your capital gain or will create or increase your capital loss from disposing of the shares or interest in the flow-through entity.

Capital Gains Taxes On Property

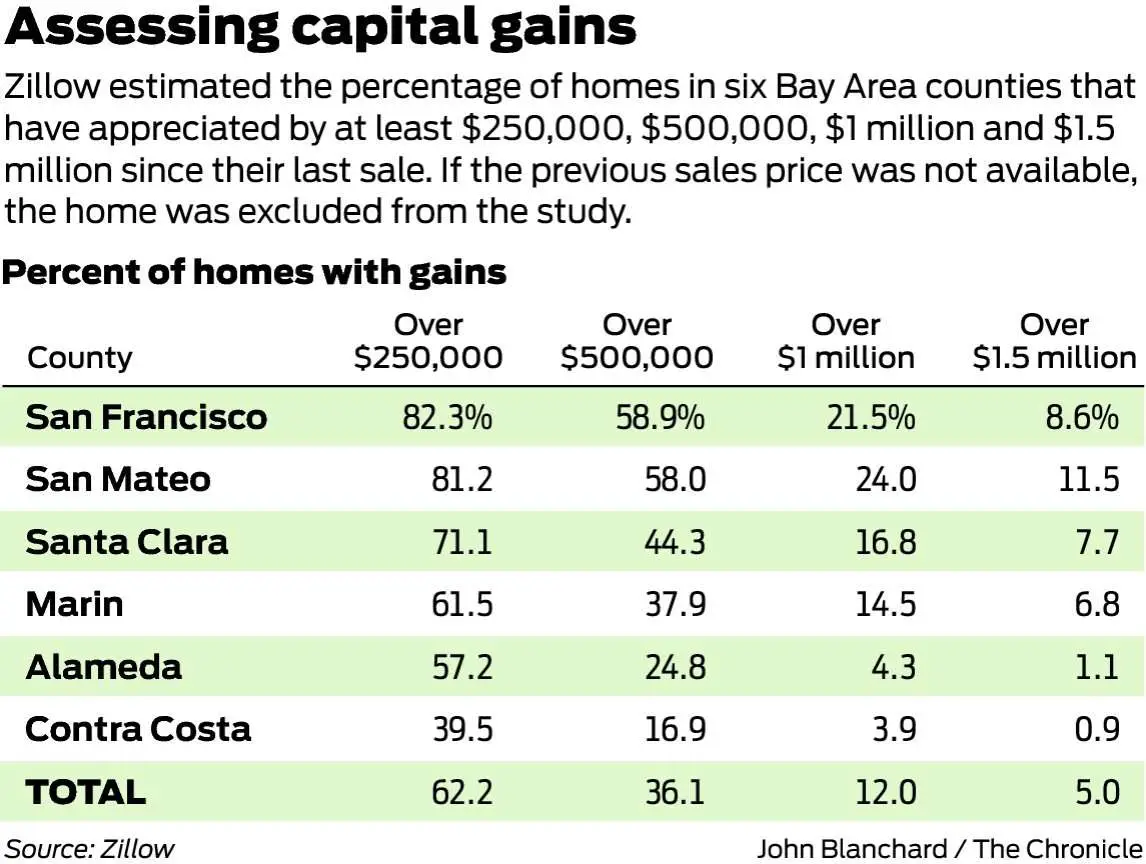

If you own a home, you may be wondering how the government taxes profits from home sales. As with other assets such as stocks, capital gains on a home are equal to the difference between the sale price and the seller’s basis.

Your basis in your home is what you paid for it, plus closing costs and non-decorative investments you made in the property, like a new roof. You can also add sales expenses like real estate agent fees to your basis. Subtract that from the sale price and you get the capital gains. When you sell your primary residence, $250,000 of capital gains are exempted from capital gains taxation. This is generally true only if you have owned and used your home as your main residence for at least two out of the five years prior to the sale.

If you inherit a home, you don’t get the $250,000 exemption unless you’ve owned the house for at least two years as your primary residence. But you can still get a break if you don’t meet that criteria. When you inherit a home you get a “step up in basis.”

Nice, right? Stepped-up basis is somewhat controversial and might not be around forever. As always, the more valuable your family’s estate, the more it pays to consult a professional tax adviser who can work with you on minimizing taxes if that’s your goal.

Recommended Reading: How Much Does H& r Block Charge To Do Taxes

Example Of Taxation On Long

- Using Indexation:

- Tax on capital gains without Indexation :

Mr. Mishra bought a plot of land for Rs.10,00,000 in the year 2005. After 10 years had elapsed, in January 2015, he sold off his land for Rs.30,00,000.

Cost Inflation Index, CII= Index for financial year 2014-15/Index for financial year 2005-2006 = 1024/480 = 2.13

Indexed cost of purchase = CII x Purchase Price = 2.13 x 10,00,000 = 21,30,000

Long-term capital gain = Selling Price Indexed cost = 30,00,000 21,30,000 = Rs.8,70,000

Tax on capital gain = 20% of 8,70,000 = 1,74,000

There is an option of not going the complicated route of indexation and directly computing capital gain tax. In this case, only 10% of the non-indexed capital gain is charged as tax. Individuals are free to choose to use indexation and pay 20% tax or ignore indexation and pay 10% on their capital gains.

Quick Tip:In case the asset is held for a very long time and its value has multiplied manifold, chances are inflation wouldnt affect profits drastically and as such it would be beneficial to pay 10% tax on the non-indexed gain instead of using indexation and paying 20%.

What Is The 2020 Short

You typically do not benefit from any special tax rate on short-term capital gains. Instead, these profits are usually taxed at the same rate as your ordinary income. This tax rate is based on your income and filing status. Other items to note about short-term capital gains:

- The holding period begins ticking from the day after you acquire the asset, up to and including the day you sell it.

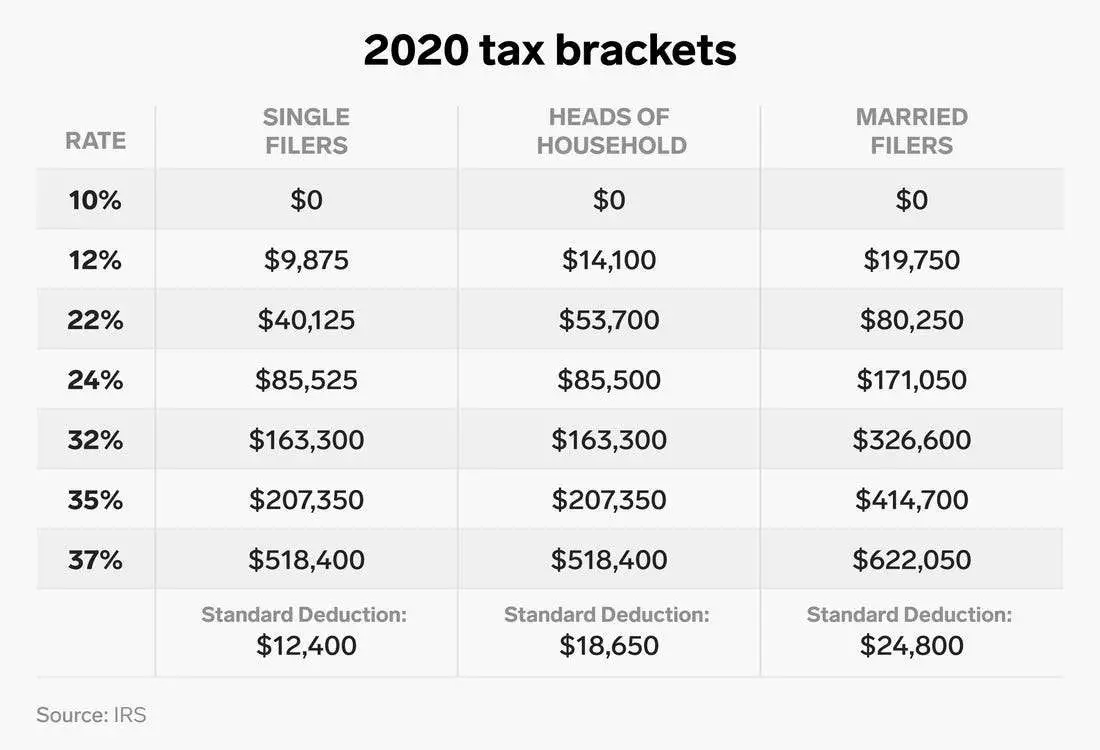

- For 2020, ordinary tax rates range from 10% to 37%, depending on your income and filing status.

You May Like: Do You Have To Report Plasma Donations On Taxes

How To Calculate Short

Step 1: Start with the full value of consideration

Step 2: Deduct the following:

- Expenditure incurred wholly and exclusively in connection with such transfer

- Cost of acquisition

- Cost of improvement

Step 3: This amount is a short-term capital gain Short term capital gain = Full value consideration Less expenses incurred exclusively for such transfer Less cost of acquisition Less cost of improvement.

What Is The Capital Gains Rate For Retirement Accounts

One of the many benefits of IRAs and other retirement accounts is that you can defer paying taxes on capital gains. Whether you generate a short-term or long-term gain in your IRA, you dont have to pay any tax until you take money out of the account.

The negative side is that all contributions and earnings you withdraw from a taxable IRA or other taxable retirement accounts, even profits from long-term capital gains, are typically taxed as ordinary income. So, while retirement accounts offer tax deferral, they do not benefit from lower long-term capital gains rates.

Recommended Reading: How To Buy Tax Forfeited Land

Capital Gains Taxes On Owner

If you sell your home for a profit, thats considered a capital gain. But you may be able to exclude up to $250,000 of that gain from your income, or up to $500,000 if you and your spouse file a joint tax return.

To qualify, you must pass both the ownership test and the use test. This means you must have owned and used the real estate as your main home for a total period of at least two years out of the five years before the sale date. The two-year periods for owning the home and using the home dont have to be the same two-year periods. Typically, you cant take this exclusion if youve taken it for another home sale in the two years before the sale of this home.

Which Tax Rate Applies To Your 2022 Long

If you sell stocks, mutual funds or other capital assets that you held for at least one year, any gain from the sale is taxed at either a 0%, 15% or 20% rate. Those tax rates for long-term capital gains are typically much lower than the ordinary tax rates you’d otherwise pay, which currently can be as high as 37%.

However, which one of those capital gains rates 0%, 15% or 20% applies to you depends on your taxable income. The higher your income, the higher the rate.

The taxable income thresholds for the capital gains tax rates are adjusted each year for inflation. The IRS has already released the 2022 thresholds , so you can start planning for 2022 capital asset sales now.

Also Check: How Much Does H& r Block Charge To Do Taxes

Is It Possible To Live In Spain And Pay Taxes In The Uk

Spain has a double taxation treaty with United Kingdom that ensures that you do not pay tax on the same income in both Spain and the UK. In order to protect yourself from paying double taxes, you are supposed to declare your worldwide income to Spanish authorities as a resident.

Additionally, if you are not a resident, yet you earn global income from other countries, the tax authorities will only require you to pay tax on income that came from Spain.

Enjoy Your Capital Gains

There’s nothing better than a winning investment, and even though you’ll likely have to share some of your profits with the IRS, you shouldn’t let capital gains taxes get you down. By taking steps to minimize the impact of capital gains taxes, you’ll be able to put yourself in position to keep as much of your hard-won investment gains as you possibly can.

You May Like: How Can I Make Payments For My Taxes

Capital Gains And State Taxes

Whether you also have to pay capital gains to the state depends on where you live. Some states also tax capital gains, while others have no capital gains taxes or favorable treatment of them.

The following states have no income taxes, and therefore no capital gains taxes:

- Alaska

- Washington

- Wyoming

Colorado, Nevada, and New Mexico do not tax capital gains. Montana has a credit to offset part of any capital gains tax.

What Are The Problems With The Way We Tax Capital Gains Now

Although taxation on realization provides advantages with respect to liquidity and valuation, it also creates several problems. The underlying problem is that the current system does not tax a households economic income, which is the sum of the households consumption and the change in its wealth during the year. By this standard, all capital gains that occur in the year in question should be includedwhether realized or unrealized.

Taxation on realization creates what is called a lock-in effect. When the tax rate on capital gains is constant with respect to the holding period, investors are financially rewarded for deferring the sale of the asset for as long as possible. Under taxation upon realization, the effective after-tax return rises with the length of the holding period, even if the pre-tax return and tax rates are constant.

Taxation on realization creates what is called a lock-in effect encourages investors to retain their assets when the economy would benefit from a change in investment.

For example, compare a stock producing a 10 percent annual return and a bond that produces 10 percent interest each year. Assume that both the capital gains tax rate and the ordinary income tax rate are 30 percent. After one year, the bond would generate a 7 percent after-tax return. Similarly, if the stock were sold and the capital gains tax were paid, the stock would generate the same after-tax return of 7 percent.

Read Also: What Does Agi Mean In Taxes

Capital Gains Can Be Offset By Capital Losses

If you have been an investor in Spain for a while, you have probably realized that not all assets or properties appreciate in value over time. Sometimes the asset or property may lose its worth over time. If you sell the item for less than its original price, then you get a capital loss instead of a capital gain. The capital loss from an investment can offset capital gains.

For example, if you sell a stock and earn 50,000 in form of long term gains, but you end up selling another stock at only 20,000 in form of long-term losses, then the Spanish tax authorities will tax you on the 30,000 long term capital gains.

50,000 20,000= 30,000

In case the capital losses exceed the capital gains, you could use the loss to offset up to 3,000 of your other income. If the excess capital losses are more than 3,000, the amount that is above 3,000 can be carried forward to the future to offset any capital gains in the future.

Dividend Tax Rate 2021

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Dividends arent free money theyre usually taxable income. But how and when you own an investment that pays them can dramatically change the dividend tax rate you pay. There are many exceptions and unusual scenarios with special rules see IRS Publication 550 for the details but heres generally how dividend tax works.

You May Like: Michigan Gov Collectionseservice

What Do I Need To Do After I Form My C Corporation

A lot of states need c corps to file annual reports and pay franchise business tax obligations to keep their excellent standing. Failure to file annual reports and pay franchise taxes can lead to fines, notices, and also the failure to carry out business.

State regulations call for c corps to hold yearly conferences of shareholders and supervisors and also record conference mins. Owners and supervisors of a c corp usage business minutes to mirror modifications in management as well as essential corporate tasks.

incorporate.com can help you with every one of your internal paperwork demands. In addition, nearly all state, region, and local governments require c corps to finish service certificate, permit, as well as tax enrollment applications before beginning to operate.

How To File Taxes For Capital Gains

Keep in mind, if you file online with H& R Block, they will ask you the correct questions to let you know how to claim the capital gains deductions you qualify for and guarantee you will receive the largest refund ever.

There are numerous tax breaks available during tax season, such as mortgage interest and property tax deductions.

Recommended Reading: File Missouri State Taxes Free

Jeffrey H Kahn Harry M Walborsky Professor & Associate Dean For Business Law Programs Florida State University College Of Law

If Washington puts state capital gains taxes in place, might that pave the way for other states to do the same?

I do not think that the addition of a capital gains tax in the state of Washington would have much of a bearing on whether other states decide to impose one. The other considerations on whether to impose a state-level capital gains tax are likely more important.

For example, a capital gains tax on top of a higher federal tax might lead some to flee the state or at least make it less desirable to move there. We have seen a general trend of people moving from high tax states to low tax states and state governments are certainly aware of this.

I believe the pandemic has sped up the remote worker movement which allows people to be even more mobile and so tax rates may play an even larger role in residency decisions.

If the government expresses interest in raising capital gains taxes, could we see a stock sell-off in response? How might that affect the greater economy?

I believe a sell-off is certainty, especially if the increase is paired with the repeal of section 1014 which provides for a step-up basis at death.

The loss of value in the market will impact pension and retirement funds and make investments less attractive. It is unclear whether an increase will actually raise significantly more revenue so the trade-off does not appear to be worth it.