State And Local Personal Property Taxes

Deductible personal property taxes are those based only on the value of personal property such as a boat or car. The tax must be charged to you on a yearly basis, even if it’s collected more than once a year or less than once a year.

Some taxes and fees you can’t deduct on Schedule A include federal income taxes, social security taxes, transfer taxes on the sale of property, homeowner’s association fees, estate and inheritance taxes, and service charges for water, sewer, or trash collection. Refer to the Instructions for Form 1040 and Form 1040-SR and Publication 17 for more taxes you can’t deduct.

Deducting Your Homes Depreciation

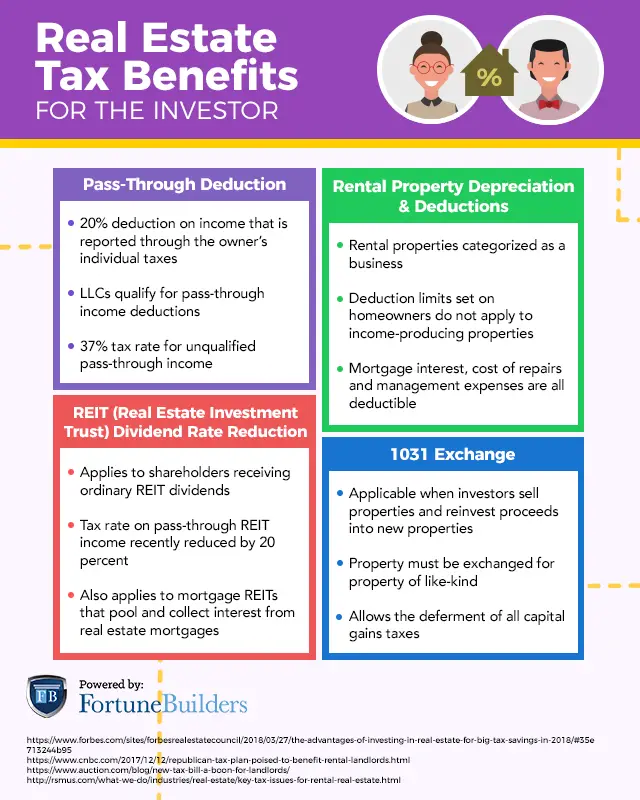

Over time, wear, tear and obsolescence lowers the value of your rental property and its contents. This process, known as depreciation, is tax deductible. You can claim depreciation as soon as your home or apartment is available for rent, even if you dont have any tenants yet. The deduction can be taken for the expected life of the property, but it must be spread out over multiple years Keep in mind, though, that the value of the structure can depreciate, but not the value of the land.

You can also claim the value of equipment that helps you run your rental business, like your computer or automobile, as well as improvements you make to the property that add value, adapt its use or extend its life. This could include installing a new roof, adding furniture or updating the household appliances. To qualify as a deductible expense, it must be expected to last for more than a year, be valuable to your rental business and lose value over time. IRS Publication 946, How to Depreciate Property, can help you navigate this sometimes convoluted process.

Rules For The Property Tax Deduction

You can claim a deduction for real property taxes if the tax is uniformthe same rate is applied to all real property in the tax jurisdiction. The revenues raised must benefit the community as a whole or the government. The tax can’t be paid in exchanged for any special service or privilege that only you would enjoy.

You must own the property to be able to claim the deduction. The tax isn’t deductible if you pay your mother’s property taxes for her because she’s getting up in years and is having a hard time making ends meet, because that tax isn’t levied on you personally.

Recommended Reading: Do I Have To Pay Taxes On Social Security Income

How Do I Claim The Property Tax Deduction

Because the standard deduction is so high, you’ll probably need other deductions beyond real estate taxes to make itemizing worthwhile.

If you decide to take the property tax deduction, here’s how you do it:

You claim the property tax deduction when you file your federal income tax return. You’ll use Schedule A to figure the deduction.

It helps to get organized before you start to work on your taxes — whether you do them yourself or you get help. Begin by finding your tax records for the real estate taxes you paid as well as the receipts for any cars, RVs, or boats you bought during the year. Next, gather your W-2s and 1099s to determine how much you paid in state and local income taxes.

If you plan to claim a deduction for sales taxes instead of income taxes, gather your receipts to calculate actual expenses. Otherwise, use the optional sales tax tables found at the end of Schedule A or the IRS’s sales tax deduction calculator to estimate what you paid.

Take a close look at your records to make sure you’re not trying to deduct something the IRS doesn’t allow .

Once you’ve organized your tax records and receipts, think about any other deductions you may be able to take, including the ones for mortgage interest, medical and dental expenses, charitable contributions, and casualty and theft losses.

If you work with a tax accountant, they should run both scenarios to make sure you get the best tax treatment possible. This can be well worth the money you pay.

Solar Energy Systems Equipment Credit

If you purchased solar energy system equipment, entered into a lease of solar energy system equipment, or purchase power generated by solar energy system equipment not owned by you for at least 10 years, you may be eligible to claim the solar energy system equipment credit. The system must be installed at your principle residence and be used to produce energy for heating, cooling, hot water, or electricity for residential use.

Recommended Reading: How To File State Taxes By Mail

Gst/hst New Residential Rental Property Rebate

You may be eligible for the GST/HST New Residential Rental Property Rebate if you are a:

- landlord who purchased a newly constructed or substantially renovated residential rental property

- landlord who built your own residential rental property

- landlord who made an addition to a multiple-unit residential rental complex

- builder who had to account for the GST/HST under the self-supply rules because you sold a residential unit to an individual and leased the related land to that individual under a single written agreement

- person who had to account for the GST/HST under the self-supply or change-in-use rules because you made an exempt lease of land used for residential purposes

To be eligible for the new residential rental property rebate, the fair market value on the qualifying residential unit at the time tax was payable on the purchase or self-supply of the property must be less than $450,000 and for land or a site in a trailer park the fair market value must be less than $112,500.

The rental accommodation or land must be intended for long-term use as a residence.

The rebate will go to the person who paid the GST/HST Landlord for rental accommodations or Lessor of the land for leased land.

For more information, visit the CRAs Guide RC4231, GST/HST New Residential Rental Property Rebate.

Distribution Across Income Levels

As with other tax deductions, SALT deduction benefits accrue more for higher-income taxpayers than lower-income taxpayers. Two factors explain this pattern: higher incomes directly lead to more state and local income taxes and are correlated with higher sales and property tax payments stemming from greater consumption and taxpayers with higher incomes are subject to higher marginal tax rates, so each dollar deducted from tax liability results in greater tax savings.

Table 2 shows the JCT projections of SALT benefits by income class in tax years 2017 and 2019. Taxpayers with more than $100,000 of AGI received the vast majority of SALT benefits in both 2017 and 2019 . Taxpayers with income between $50,000 and $200,000 received a larger share of total benefits in 2019 than 2017 , whereas the opposite trend occurs for taxpayers with more than $200,000 . Taxpayers with less than $50,000 received relatively little benefit from the SALT deduction in both years.

Table 2. Income Distribution of SALT Deduction Benefit, 2017 and 2019

|

11.7 |

Joint Committee on Taxation, Estimates of Federal Tax Expenditures For Fiscal Years 2016-2020, December 2019, JCX-3-17 and Joint Committee on Taxation, Estimates of Federal Tax Expenditures For Fiscal Years 2019-2023, December 2019, JCX-55-19.

Table 3. Illustrative Example: State and Local Tax Rates and SALT Cap Effects

|

$44K |

$16K |

You May Like: Which Tax Return Did You Have From Last Year

What Is The Property Tax Deduction

State and local property taxes are generally eligible to be deducted from the property owner’s federal income taxes. Deductible real estate taxes include any state, local, or foreign taxes that are levied for the general public welfare. They do not include taxes charged for home renovations or for services like trash collection.

As noted below, the Tax Cuts and Jobs Act capped the property tax deduction, along with other state and local taxes, starting with 2018 taxes. The law capped the deduction for state and local taxes, including property taxes, at $10,000 . Previously, there was no limit on the deduction.

Do I Have To Calculate The Oeptc

No, you do not have to calculate your entitlement. After you apply, the 2021 OEPTC will be calculated for you and, if you are entitled, your payments will be issued as explained in question 6. If you are not entitled, in most cases, you will receive a notice explaining why.

For the prior-year calculation sheets, go to Ontario energy and property tax credit calculation sheets.

Don’t Miss: How To Get Tax Preparer License

Record Keeping Tips From The Irs

In order to profit from the tax benefits of owning a rental property, the IRS requires investors to keep good records. Good records help investors to:

- Identify the source of income and expenses

- Track deductible expenses

- Prepare tax returns

If a tax return is selected for an audit, investors must be able to provide documentary evidence such as receipts, canceled bills or proof of payment, and support for travel expenses. Investors who are unable to provide evidence to support tax deductions may be subject to additional taxes, penalties, and interest.

How To Claim A Property Tax Deduction

To claim a property tax deduction, the tax must apply only to the value of the personal property owned and be charged on an annual basis, irrespective of when the government collects it from you. Therefore, if the state tax was only charged at the time the property was purchased then it does not meet the IRS definition of a deductible personal property tax.

As stated earlier, property tax can only be deducted if the owner chooses to itemize deductions. It makes sense for a taxpayer to itemize deductions if the sum of all their eligible itemized expenses is greater than the standard deduction allowed in a given tax year.

Recommended Reading: How To File Taxes Doordash

Distribution Across States And Congressional Districts

The SALT cap’s effect is in part a function of state and local tax policies. For example, greater effective rates levied on taxes that qualify for the deduction would increase the amount of SALT-eligible tax payments and therefore increase the probability that a taxpayer will have SALT deductions that exceed the cap. State and local tax rates could thus affect both the number of taxpayers with higher tax liability from the SALT cap and the amount of those increases .

Differences in local incomes and price levels are another determinant of the SALT cap’s effect. Wages and prices are the bases against which state and local governments levy SALT-eligible income, sales, and property taxes. Consider two households that are in separate localities and have different incomes but the same tax rates and the same purchasing power. In other words, adjusting for their local price levels, each household is able to purchase the same sets of goods and services. Although each household faces the same set of purchasing options on the public and private markets, the household facing higher price levels is more likely to have SALT payments in excess of the SALT cap.

|

Figure 2. Average SALT Deduction Amount by Congressional District, 2017 |

|

Internal Revenue Service, SOI Income Tax Stats. Calculations performed by CRS. Notes: Income categories reflect an adjusted gross income concept. Calculations exclude taxpayers with negative income. |

Note For Business And Professional

If you cannot apply the rebate, grant, or assistance you received to reduce a particular expense, or to reduce an asset’s capital cost, include the total in Part 3C at line 8230, “Other income,” on Form T2125. For more information, go to Grants, subsidies, and rebates.

The following may be considered when determining operating expenses:

You May Like: How To Calculate Payroll Tax Expense

Business Tax Fees Licences And Dues

You can deduct any annual licence fees and some business taxes you incur to run your business.

You can also deduct annual dues or fees to keep your membership in a trade or commercial association, as well as subscriptions to publications.

You cannot deduct club membership dues if the main purpose of the club is dining, recreation, or sporting activities.

Deducting Your Legal And Professional Fees

Landlords can deduct certain professional fees in relation to the rental property. If you use a CPA or computer software to prepare your tax return, be sure to deduct the cost.

Hire a lawyer to oversee rental paperwork at any point in the year? Deduct those exorbitant hourly fees. Use a real estate agent to find your tenants? Deduct the commission. Advertise the property in the newspaper, over the radio, or online? Deduct those ad dollars.

Even advisor services can be written off so long as you meet to discuss the rental property. If you have to evict someone, this deduction would help cover the legal and court filing fees.

These are all considered operating expenses, and should be deducted as such. You cannot, however, deduct legal fees used to defend the title of your property or recover and improve property.

Also Check: When Do You Have To Pay Quarterly Taxes

How To Claim Rental Property Tax Deductions

In general, you should file rental property tax deductions the same year you pay the expenses using a Schedule E form. The process will be much more manageable if you keep detailed records of all income and costs related to the property as they occur. Plus, if youre ever audited, youll have to provide proof for every deduction you claim.

While weve reviewed several rental property tax deductions above, the filing process gets more complicated if you use the rental property as your primary residence at any point in a given tax year. Each years Schedule E form denotes the number of days that you can personally use your home and the percentage of days that the property can be rented out at fair market value before anything changes. In most cases, you wont be able to deduct expenses or losses for personal use on the Schedule E. You may be able to file them using a Schedule A form if you choose to itemize your deductions.

Can I Deduct Property Taxes

Generally, you can deduct real estate taxes paid on a property in the year you pay them.

Real estate taxes are deductible if:

- Based on the value of the property.

- Levied uniformly throughout your community.

- Used for a governmental or general community purpose.

- Assessed and paid before the end of the tax year.

You can deduct up to $10,000 of state and local taxes, including property taxes.

You May Like: Are Nonprofit Organizations Tax Exempt

How Much Is The 2021 Oeptc

The OEPTC you receive depends on a number of factors, including:

- your age

- your marital status

- the property tax paid by or for you

- the rent paid by or for you, if the rented accommodations were subject to municipal and education property tax

- the energy costs paid by or for you for living on a reserve

- the accommodation costs paid by or for you to live in a public or non-profit long-term care home, and your adjusted family net income

- whether you lived in a designated Ontario university, college, or private school residence

The maximum 2021 OEPTC is:

- $1,095 for non-seniors

- $1,247 for seniors

State And Local Real Estate Taxes

Deductible real estate taxes are generally any state or local taxes on real property levied for the general public welfare. The charge must be uniform against all real property in the jurisdiction at a like rate.

There are popular loan programs that finance energy saving improvements through government-approved programs. You sign up for a home energy system loan and use the proceeds to make energy improvements to your home. In some programs, the loan is secured by a lien on your home and appears as a special assessment or special tax on your real estate property tax bill over the period of the loan. The payments on these loans may appear to be deductible real estate taxes however, they’re not deductible real estate taxes. Assessments or taxes associated with a specific improvement benefitting one home aren’t deductible. However, the interest portion of your payment may be deductible as home mortgage interest. Refer to Publication 936, Home Mortgage Interest Deduction and Can I Deduct My Mortgage-Related Expenses? to see whether you might qualify for a home mortgage interest expense deduction.

If a portion of your monthly mortgage payment goes into an escrow account, and periodically the lender pays your real estate taxes out of the account to the local government, don’t deduct the amount paid into the escrow account. Only deduct the amount actually paid out of the escrow account during the year to the taxing authority.

Don’t Miss: How To Calculate Your Tax Bracket

Operating Expenses Are Deductible

Operating expenses for managing and maintaining a rental property are tax deductible. As the IRS explains, ordinary and necessary expenses may include:

- Advertising costs

- Homeowner and landlord liability insurance

- Utilities paid directly by the landlord

- Professional service fees, such as an accountant or real estate attorney

Home Accessibility Tax Credit

Renovations or expenses incurred which make homes safer or more accessible for Canadians 65-years of age or older, or for the disabled people of any age may qualify for the HATC provided they are being claimed by the eligible individual or by someone who looks after the individual and meets all of the CRAs requirements. Up to $10,000 in expenses can be claimed under the HATC. Since this is a non-refundable tax credit, you are eligible to receive 15% of the renovation costs as a reduction on your taxes.

Read Also: How To Calculate Tax In California