Submit Copy B To The Independent Contractor

Once your Form 1099-NEC is complete, send Copy B to all of your independent contractors no later than January 31, 2021.

You can download and print a version of Copy B from the IRS website and send it to your independent contractor. This process is explained in further detail on the first page of Form 1099-NEC.

Keep An Eye On Your Business Income

W-2 employees have it easy when it comes to tracking their yearly income. Their employer does that on their behalf. On the other hand, independent contractors need to record your business income or earnings in as much detail as possible so you can easily calculate your net income and determine your taxes.

What Is A 1099 Form And How Does It Work

9 Minute Read | September 27, 2021

Are you one of the 56.7 million freelance workers in the U.S.?1 Congratulations! Technically that means you are self-employed. Whether youre designing websites or selling cupcakes, you are your own businessthe CEO of You, Inc. At least thats how Uncle Sam sees you.

Working for yourself definitely has its perks, but it also comes with its own challengesespecially when tax season comes around. One of those challenges is figuring out what to do with those 1099 tax forms that start coming in from all those clients who paid you for a job well done.

Dont worry, well walk you through what a 1099 tax form is, why you got one , and what youre supposed to do with them.

Recommended Reading: Can You File Missouri State Taxes Online

Deductions For Independent Contractors

To help offset some of the additional tax costs that independent contractors have, the government allows them to take quite a few deductions. If you are looking to pay less, it is in your best interest to account for every single dollar that your business spent. Moreover, because the deductions are defined very loosely, you can pretty much claim anything that you had to pay for in the regular course of business. For instance, if your business is in the fitness industry, claiming the vitamins that you consume as a business expense is not far-fetched at all. This is where using Taxhub could come in extremely handy as you will receive an in-depth review of all possible deductions that are common in your sector.

What Is The Self

Self-employment tax consists of Social Security and Medicaretaxes for individuals who work for themselves. Employees whoreceive a W-2 only pay half of the total Social Security and Medicare taxes, while their employer isresponsible for paying the other half. Self-employedindividuals are responsible for paying both portions of theSocial Security and Medicare taxes.

Read Also: How Much Does H& r Block Charge To Do Taxes

What Should I Do If I Received Interest On A Refund From The Department But Did Not Receive Form 1099

Interest received on your refund is taxable and must be included in federal adjusted gross income regardless of the amount. The amount of interest paid on your refund is reported on the refund check. If you did not keep a record of the amount of refund interest received, you should contact the Department, at 1-877-252-3052 to determine the amount of refund interest received during the tax year. Include the amount of refund interest received in the calculation of your federal adjusted gross income.

Paying Taxes As An Independent Contractor

For tax purposes, the IRS treats independent contractors as self-employed individuals. That means youre subject to a different set of tax payment and filing rules than employees.

Youll need to file a tax return with the IRS if your net earnings from self-employment are $400 or more. Along with your Form 1040, youll file a Schedule C to calculate your net income or loss for your business. You can file a Schedule C-EZ form if you have less than $5,000 in business expenses.

Youll also have to pay self-employment tax, which covers the amounts you owe for Social Security and Medicare taxes for the year. As of 2019, the self-employment tax rate is 15.3%. You can calculate your self-employment tax using Schedule SE on Form 1040.

An additional 0.9% Medicare surtax applies to high-income earners. For tax year 2020, the Medicare surtax applies to single filers and heads of household whose income exceeds $200,000, married couples filing jointly whose income exceeds $250,000 and married couples filing separately with income of $125,000 or more.

If as an independent contractor, you expect to owe $1,000 or more in taxes when you file your annual return, youll have to make estimated quarterly tax payments. These regular payments cover your self-employment tax and your income tax liability for the year. The first quarterly tax payment for each tax year is due in April. Subsequent payments are due in June and September, and then January of the following year.

Recommended Reading: Do I Need W2 To File Taxes

What If You Don’t Get All Your 1099s

Taxpayers should record all of their tax documents to ensure that they have received them in time for filing their taxes. If you haven’t received a 1099, contact the employer or payer to request the missing documents. If the 1099 does not arrive in time, taxpayers are required to file their tax return by the tax filing today for that year.

It’s important to remember that you are responsible for paying the taxes you owe even if you dont get the form. If the company submits a 1099 form to the IRS, but you don’t receive it for some reason, the IRS will send you a letter saying you owe taxes on the income. Please note that the letter may not arrive in a timely manner.

If a taxpayer hasn’t received the expected 1099 for income earnedeven if the business didn’t file the 1099 formthe taxpayer might be able to report it under miscellaneous income. However, it’s best to contact a tax professional to determine the correct way to file for your particular tax situation.

Withdrawals From A Retirement Account

When you withdraw money from your traditional IRA, in most cases it is taxable. You will receive a Form 1099-R that reports your total withdrawals for the year. The form also covers other types of distributions you receive from pension plans, annuities and profit-sharing plans. Usually the 1099-R will show the taxable amount of the distribution on the form itself and will report the amount of federal tax that was withheld.

Also Check: Www.1040paytax.com

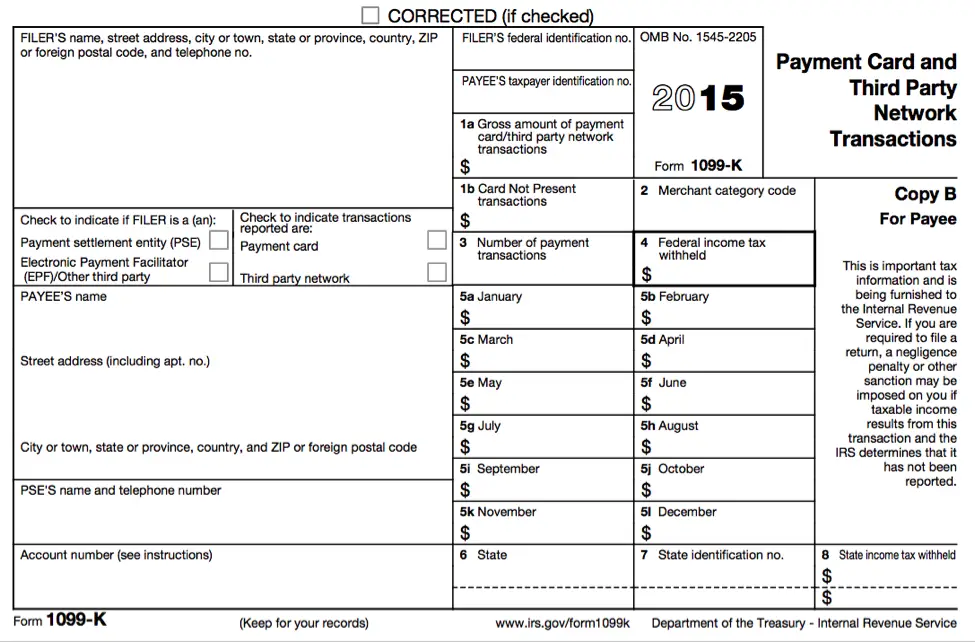

Do I Qualify For A 1099

In the US, the state your taxpayer information is associated with will determine your qualification for a Form 1099-K. In most states, accounts meeting both of the following criteria qualify for a Form 1099-K and must be reported to the IRS by Square:

More than $20,000 in gross sales from goods or services in the calendar year

AND more than 200 transactions in the calendar year

Square may report, solely within its discretion, on amounts below these thresholds to meet state and other reporting requirements:

How Strong Is A Verbal Agreement In Court

Most business professionals are wary of entering into contracts orally because they can difficult to enforce in the face of the law.

If an oral contract is brought in front of a court of law, there is increased risk of one party lying about the initial terms of the agreement. This is problematic for the court, as there’s no unbiased way to conclude the case often, this will result in the case being disregarded. Moreover, it can be difficult to outline contract defects if it’s not in writing.

That being said, there are plenty of situations where enforceable contracts do not need to be written or spoken, they’re simply implied. For instance, when you buy milk from a store, you give something in exchange for something else and enter into an implied contract, in this case – money is exchanged for goods.

Recommended Reading: How Much Taxes Do You Pay On Slot Machine Winnings

Projecting An Income Estimate For The Tax Year

Independent contractors with steady incomes can estimate their current year’s projected income on the basis of last year’s earnings.

Those freelancers whose incomes fluctuate significantly from one quarter to the next may be better off calculating each quarter’s individual tax payment on the basis of that quarter’s income and expense deductions.

When To Ask For Help

Although taxpayers are responsible for recording their income and filing their taxes, there are times when you don’t know what to do about a situation. In these situations, ask for help from the IRS or a tax advisor.

For example, if a taxpayer does not receive a 1099-R , and contacting the payer has not resolved the issue, the IRS suggests that you contact them. The IRS will, in turn, contact the payer or employer on your behalf.

Don’t Miss: How Much Does H& r Block Charge To Do Taxes

Who Needs To Get A 1099 Form

Usually, anyone who was paid $600 or more in non-employment income should receive a 1099. However, there are many types of 1099s for different situations. Also, there are many exceptions to the $600 rule, meaning you may receive a 1099 even if you were paid less than $600 in non-employment income during the tax year.

Forms And Backup Withholding

In certain circumstances, income reported on a Form 1099 may be subject to backup withholding. The payers of the income will do the following if backup withholding applies:

- Show the tax withheld on Form 1099, and

- Withhold tax at a rate of 24%, if any of these apply:

- You dont provide the payer with your tax identification number, like your Social Security number .

- The taxpayer identification number you provide is incorrect.

- The IRS notifies the payer that youve been underreporting interest or dividends.

- You havent certified that youre exempt from backup withholding.

Don’t Miss: Where’s My Tax Refund Ga

Tax Information Reporting For Online Sellers

Everything you need to know about IRC Section 6050W

Internal Revenue Code Section 6050W states that all US payment processors, including PayPal, are required by the Internal Revenue Service to provide information to the IRS about certain customers who receive payments for the sale of goods or services through PayPal.PayPal is required to report gross payments received for sellers who receive over $20,000 in gross payment volume AND over 200 separate payments in a calendar year. In order to help you understand these information reporting obligations, we have prepared the following FAQs. After reviewing the following FAQs, we recommend you consult your tax advisor to assess tax implications of Form 1099-K reporting.

If youve recently received a notice to update your PayPal account information, please download the following PDF guide and refer to the FAQs.

Tax Deductions For Independent Contractors

Deductions lower your taxable income for the year. Independent contractors claim them as business expenses on their taxes. Depending on the kind of business you own, your deductible expenses might include:

- Advertising costs

- Rent or lease payments

- Equipment purchases

Independent contractors can also claim a deduction for health insurance premiums they pay out of pocket. That includes premiums paid for medical, dental and long-term care insurance. If you pay for your spouses and childrens insurance, you may be able to deduct those costs, as well. The exception to the rule is that you cant deduct premiums for health insurance if you have access to a spouses insurance plan.

As an independent contractor, you can also deduct personal expenses, such as mortgage interest paid, interest paid to student loans and real estate taxes. You can also get a tax break for contributing to a self-employed retirement plan or a traditional IRA. If youre looking for a retirement plan option, consider a SIMPLE IRA, . These plans allow for deductible contributions, with qualified withdrawals taxed at your ordinary income tax rate in retirement.

Read Also: How Much Does H& r Block Charge To Do Taxes

Tax Tips For 1099 Workers

From how and when to pay taxes to types of deductions you can take, its important to understand whats different when youre an independent worker.

1. Self-employment taxes. In general, most workers must pay Social Security and Medicare taxes. If you work as a company employee, your employer typically withholds this from your paycheck as part of payroll taxes. By contrast, 1099 workers need to account for these taxes on their own.

The self-employment tax rate for 2021 is 15.3% of your net earnings . While the Medicare portion of the tax applies no matter how much you earn, the Social Security portion applies to earnings up to $137,700 for 2020. You should also know that you can deduct half of this tax as a deductible expense.

2. Quarterly estimated tax payments. The US is a pay-as-you-go tax system, which means you’re required to pay taxes on your income periodically throughout the year. When youre a company employee, employers withhold income tax from your paycheck automatically. On the other hand, 1099 workers need to make estimated tax payments to the IRS and applicable state revenue departments on their own on a quarterly basis. How much will you need to pay? If you use H& R Blocks Self-Employed Online filing product, it will help you estimate your payments based on your previous years income.

Take note: You wont receive the forms if certain criteria are not met, but you still must report the income. Here are the details.

When To Use Form 1099

Unless you received $10 or more in dividends from some type of financial institution, you will not receive a Form 1099-DIV. Companies do not have to report dividends received to you on a Form 1099-DIV unless they have paid you $600 or more. Even if you dont receive this form from one of the entities that paid you dividends, you must report all dividend income you have received on your tax return. Sometimes your Form 1099-DIV is included in your year-end statement if you have a brokerage account.

In this case, you may not receive a Form 1099-DIV separate from your brokerage statement. You are still responsible for reporting the income on your taxes.

You use Schedule B to list the dividends you have received during the tax year if they are ordinary dividends and more than $1,500. Ordinary dividends include those paid on stock, employee stock options and real estate investment trusts.

You May Like: How Much H And R Block Charge For Taxes

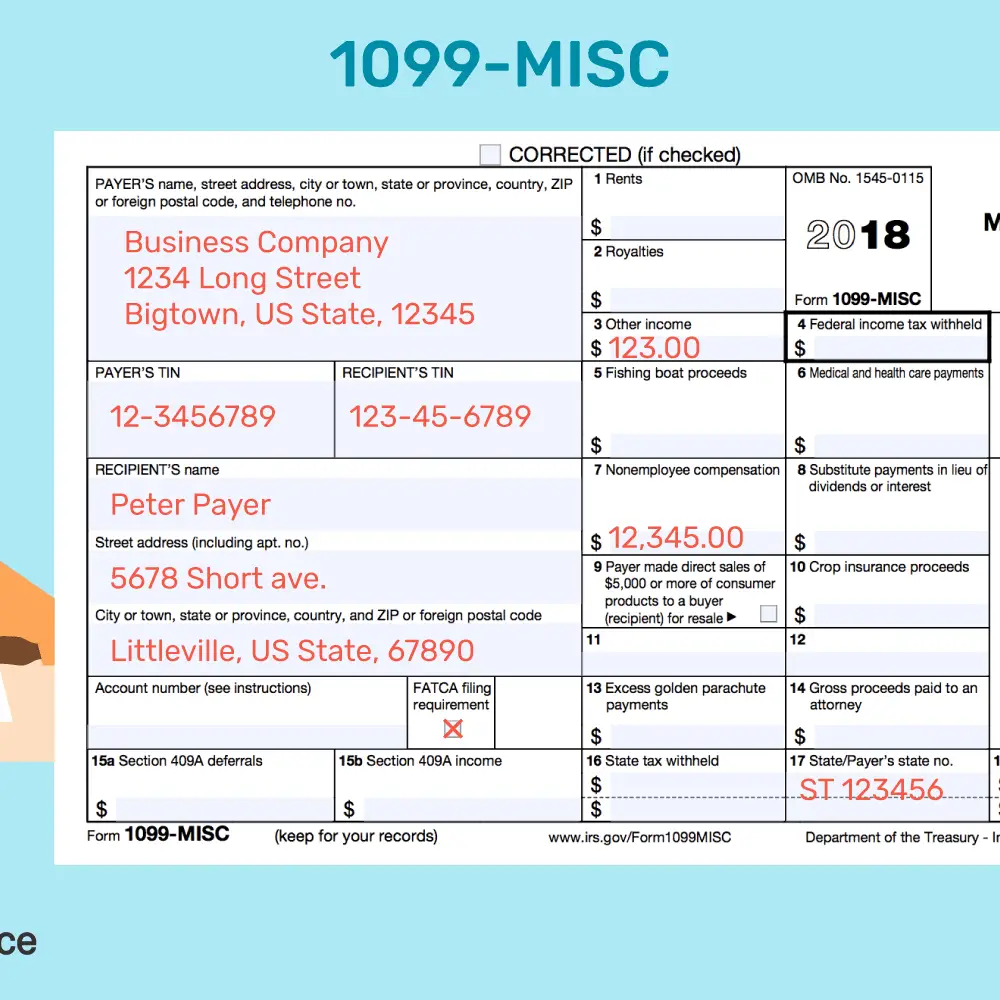

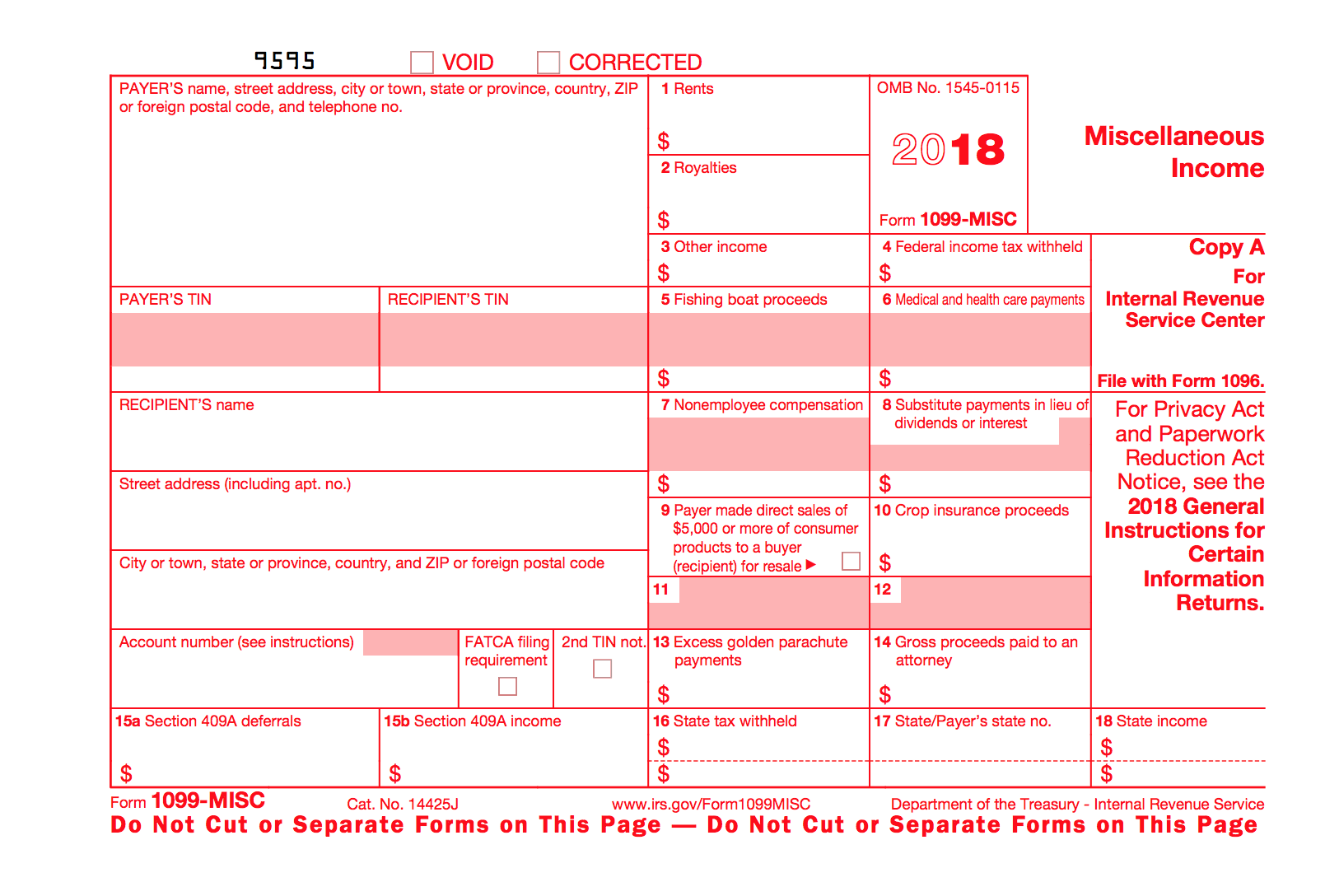

Who Gets A 1099

If you received $600 or more in payments from a particular business or client, they are required to send you a 1099-MISC form by January 31, as well as a copy to the IRS by the end of February. So, if five companies paid you more than $600 last year, you should be getting five 1099 formsone from each company.

If that January 31 deadline comes and goes and you still havent gotten your 1099 form, you should reach out to that company or client to get that straightened out.

But if you were paid through PayPal, a credit card or some other online payment system, you might get a 1099-K form from your clients instead. The 1099-K is a tax form that shows all the payments you received through a third-party transaction network. Businesses dont need to send you a 1099-K unless they paid you more than $20,000 or more than 200 times during the yearso you might not receive a tax form from them at all.

So, if you didnt get a 1099-MISC or 1099-K from a client you worked for, does that mean you dont have to report that income? Not so fast! Even if you earned, say, $400 for some freelance work and dont receive a 1099-MISC or 1099-K form from the company you freelanced for, youre still required to report that income and pay your taxes on it to the IRS.

How To Pay Estimated Taxes Online

You also pay your estimated taxes online through the IRS website. The IRS receives your payment almost immediately when you pay online. Plus, you dont have to worry about your payment getting lost in the mail. The system provides a confirmation number for all payments so you have proof if you run into any problems. Best of all, you can easily make payments from the comfort of your own home. No stamps required!

To learn more about paying estimated taxes online, check out our detailed blog post on the topic.

Also Check: What Does H& r Block Charge

What Is Irs Form 1099 And Form 1099

Form 1099 is an informational form that shows how much money you have received during a calendar year from a financial institution. It serves many purposes. It is not only used to report dividends but also retirement distributions, lottery winnings, interest payments, lawsuits, divorce settlements and real estate transactions, as well as dividend payments.

The official name for the Form 1099-DIV, on which dividends are reported to taxpayers each tax year, is Internal Revenue Service Form 1099-DIV: Dividends and Distributions. This form is used by banks, credit unions, mutual funds and other financial institutions to report the dividends paid to a taxpayer each calendar year. For 2021, if you received more than $10 in dividends from one of these institutions, you will receive a Form 1099-DIV. If you received dividends from more than one entity, you will receive a Form 1099-DIV from each of them. The businesses also submit a copy of each Form 1099-DIV you receive to the IRS.

You do not file this form with your taxes. Instead, you take the information from the form and use it in several locations on your tax return.