What You Get From Turbotax’s Free Version

TurboTax offers a free version for simple tax returns only it lets you file a Form 1040 and this year can handle unemployment income reported on a 1099-G.

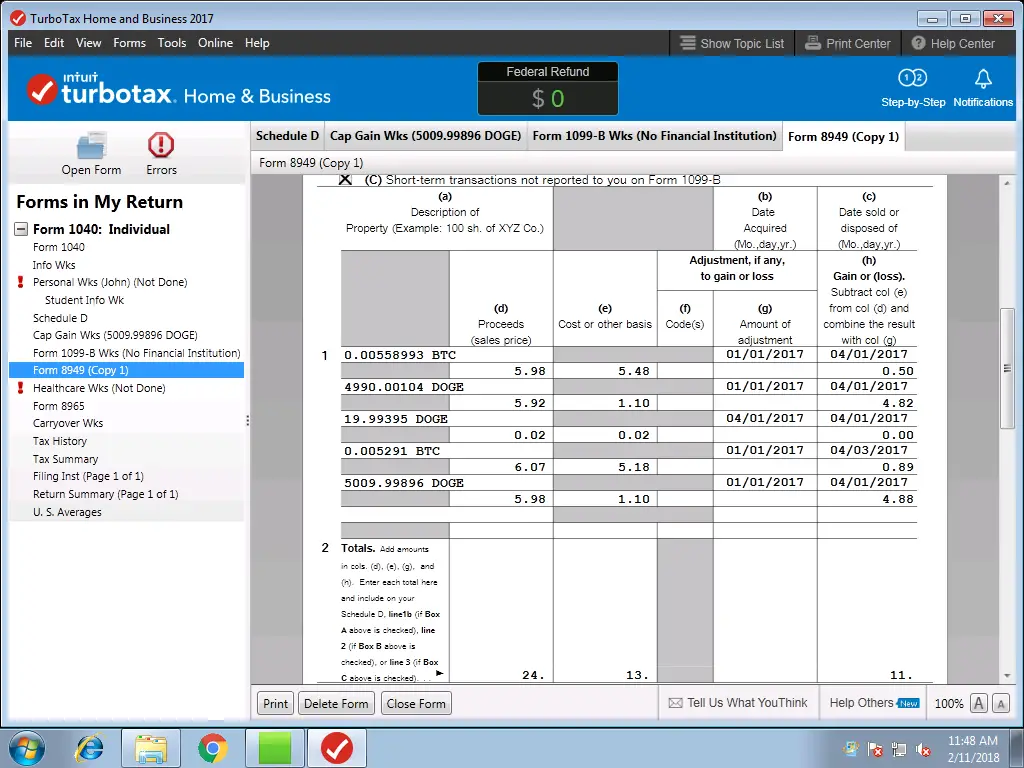

But it cant itemize deductions or handle schedules 1, 2 or 3 of Form 1040, which means it probably wont work for you if you plan to deduct mortgage interest, report business or freelance income, report stock sales or income from a rental property, or deduct student loan interest.

No More Expensive Middleman

Gone are the days where you need to use an expensive tax accountant or lawyer to file your US expat taxes! Thanks to our certified built-in connection with the IRSs e-file system, our do-it-yourself expat tax software allows you to be in control of your own expat tax return.

No more waiting on an expensive middleman to review your return! Save money and time and do-it-yourself!

How Long Is My Extension Good For

If you filed an extension by May 17, 2021 , it extends your filing deadline to .

- An extension of time to file your return does not mean an extension of time to pay your taxes.

- If you expect to owe money, you’re required to estimate the amount due and pay it with your Form 4868. As long as you do that, the extension will be granted automatically.

Recommended Reading: What Is Deduction In Income Tax

Find All The Tax Credits And Deductions You Can Claim

Based on experience, its nearly impossible to remember which tax credits and tax deductions apply to you personally, or which apply to your business venture. Understanding that if youre running a business, or have self-employed income, you likely have more on your mind like earning income and are not fixated on tax news to see whats new, whats changed and what no longer counts. Whether you have 70-years of tax experience or 70-hours of tax experience, everyone has come to rely on the expertise that is put into TurboTax. TurboTax searches over 400 credits and deductions automatically for you, so you can be ensured that you are seeing every possible deduction or tax credit that might apply to you. By doing that, you not only maximize your deductions but you also maximize your refund and keep more of that hard-earned money in your pocket.

Turbotax Live Assist & Review

Have a specific question about your taxes? TurboTax Live Assist & Review is just what you need. Youll get access to your very own TurboTax Expert who will assist you while you prepare your taxes, and also provide a full professional review before you file.

Our team of TurboTax Experts have an average of 17 years of experience, and have helped to prepare hundreds of tax returns for customers just like you.

If youre self-employed, TurboTax Live Assist & Review Self-Employed is designed for anyone filing as a freelancer, contractor, or small businesses, or even for side income whatever your situation, our TurboTax Experts will help find and claim every credit and deduction that applies to you, so you get your maximum refund.

Don’t Miss: How To Apply For Irs Tax Forgiveness

Common Forms To Gather

One of the first things to do is gather all of the forms you’ll need to file your tax return. Consider starting a folder for your tax return at the beginning of a tax year. Then, put any important tax information you receive in that folder until you’re ready to file your tax returns.

Most of these forms will show up after the end of a tax year in January or early February. However, some forms may show up even later. It’s important to wait until you receive all of the forms you’re expecting before you file your tax return or you may leave out an important item.

Common forms to look out for include:

Forms may be mailed to you or you may be able to access them online. If you haven’t received your W-2, check with your employer, online, or even with the IRS. TurboTax tax software can import your W-2 electronically and even notify you when your W-2 is available to begin your tax return.

Check your tax information from last year to see if you received the same forms this year. If you’re missing something, check to see if you no longer need that information. For instance, you may no longer receive a Form 1099-INT if you closed your bank account that issued it last year.

Additionally, you may experience new situations in a tax year that you haven’t experienced before. You’ll have to make sure you think through the year to determine if there are any new forms you may receive so you can keep an eye out for them.

Not Free No Help When The Irs Sends A Letter And Still Waiting For Refund Four Months Later

I used the TurboTax app to file my refund in early February. The app was relatively easy to use, but it did get old going in circles sometimes. Unfortunately, the free option really is not usable. If you have to file state taxes like just about everyone, then you will have to pay $40 per state. If youre a college student in another state like me, that means two states so $80. Of course, no student discount. Honestly, that was not too bad since I was supposed to get a lot back.Unfortunately, that was not what happened. I did get some from one the state returns, but that was it. The IRS sent a letter for a health insurance form that didnt even apply to me. If you want help with that, guess what? It will cost you even more money! At that point, I wasnt paying TurboTax any more so I went off on my own. Eventually I got it figured out, but not without massive disruption to my school work. None of that help was thanks to TurboTax which sends you to FAQs that dont really apply.They have online discussions which appear to have many people with the same problem. This program is made to look easy- and it is at first- but the headache it causes later is not worth it. Never had trouble like this with H& R Block so I think Ill go back to them next year. Whatever you do, dont use TurboTax. It is seriously not worth it. Still waiting for that federal tax refund BTW.

Read Also: When Will My Tax Return Come

If You Are Getting A Refund:

This is one of the great little secrets about the federal tax law. If you have a refund coming from the IRSas about three out of four taxpayers do every yearthen there is no penalty for failing to file your tax return by the deadline, even if you don’t ask for an extension. However, this might not be the case for state taxes.

That’s not to say there aren’t very good reasons for filing on time. Even if you have a refund coming, consider the following:

- You can’t get your money back until you file, so you should file as soon as you can to get your money as soon as possible.

- The statute of limitations for the IRS to audit your return won’t start until you actually file your return. So, the sooner you file, the sooner the clock starts ticking.

- Some tax elections must be made by the due date, even if you have a refund coming. This applies to a very tiny percentage of taxpayers.

Can I File My Taxes Online For Free If Im A Non

Yes. TurboTax makes it easy to file your Candian tax return as a non-resident. In fact, if youre a non-resident you can use any of the TurboTax Online products, including TurboTax Free. For more info, read about How Residency Status Impacts Your Tax Return

With more than 20 years experience helping Canadians file their taxes confidently and get all the money they deserve, TurboTax products, including TurboTax Free, are available at www.turbotax.ca.

Also Check: What Does Agi Mean For Taxes

H& r Block Vs Turbotax

The start of a new year means its time to file your federal tax return. Many people stress about filing taxes but there are a number of tax filing services to make the process easier. Two of the most well-known services are H& R Block and TurboTax. They both offer a friendly user experience. They provide information along the way so you understand what youre doing. And they both offer affordable filing options. Which of these services should you use when you file your 2020 taxes?

Go beyond taxes to build a comprehensive financial plan. Find a local financial advisor today.

Get Our Top Investigations

Heres what happened when we went looking.

Our first stop was Google. We searched for irs free file taxes.

And we thought we found what we were looking for: Ads from TurboTax and others directing us to free products.

The first link looked promising. It contained the word free five times! We clicked and were relieved to see that filing for free was guaranteed.

We started the process by creating the profile of a TaskRabbit house cleaner who took in $29,000. We entered extensive personal information. TurboTax asked us to click through more than a dozen questions and prompts about our finances.

After all of that, only then did we get the bad news: TurboTax revealed this wasnt going to be free at all. Turns out the house cleaner didnt qualify because he is a independent contractor. The charge? $119.99.

Then we tried with a second scenario. We went back to TurboTax.com and clicked on FREE Guaranteed. This time, we went through the process as a Walgreens cashier without health insurance, entering personal information and giving the company lots of sensitive data.

Again, TurboTax told us we had to pay this time because theres an extra form if you dont have insurance. The charge? $59.99.

But wait. Are the house cleaner and the cashier not allowed to prepare and file their taxes for free because of their particular tax situations? No! According to the agreement between the IRS and the companies, anyone who makes less than $66,000 can prepare and file their taxes for free.

Don’t Miss: Where Can I Get Taxes Done For Free

Can I File My Taxes Online For Free

In Canada, TurboTax makes it simple for anyone with any tax situation to file their taxes for free. These are just a few of the tax situations you could have and use TurboTax Free to file your taxes with the CRA:

- Youre working for an employer and/or are self employed

- Youre a student looking to claim tuition, education, and textbook amounts

- You were unemployed for part or all of 2020, including if you claimed CERB

- Your tax situation was impacted by COVID-19, including if you had to work from home and want to claim related expenses

- You have dependants and want to ensure you claim all related credits and deductions

- Youre retired and receive a pension

- You have medical expenses to claim, including amounts related to COVID-19

- Its your first time filing your taxes in Canada

There are a few situations where youll need to print and mail your return instead of filing online using NETFILE. Dont worry though, you can still enter all your tax info online and well guide you through the process of mailing your return to the CRA.

A Quick Look At Turbotax

TurboTax has been around since the mid-1980s. Part of its popularity is due to the fact that its owned by Intuit. Intuit also makes a software called Quickbooks, which millions of companies use to manage their accounting. But TurboTax is also popular because it offers a user-friendly design and straightforward step-by-step guidance.

Like H& R Block, TurboTax has a free filing option that allows you to file your federal return and one state return at no cost. However, the free option only supports simple returns with form 1040. If you want to itemize your deductions with schedule A , you will need to upgrade to a paid plan. There are three paid plans that run from $60 to $120 for federal filing. State filing is always $45 per state, with paid plans. The free option includes one free state return.

| TurboTax Filing Options | |

| Federal: $170.00 State: $50.00 | Best for self-employed, independent contractors, freelancers, consultants and small business owners Comes with all previous features, plus access to self-employment tax experts, maximizing business deductions |

TurboTax doesnt have any physical locations like H& R Block, but it does provide access to tax experts . It will cost extra for you to get access to an expert, but there are four plans available, corresponding to the four plans listed in the table above.

Don’t Miss: How Much Is Sales Tax In Illinois

Does The Irs Ever Negotiate The Amount Owed

Under certain circumstances, the IRS is authorized to resolve a tax liability by accepting less than full payment. An “offer in compromise” is an agreement between a taxpayer and the IRS that settles the taxpayer’s tax debt. There are three circumstances under which the IRS is authorized to compromise:

Form 656: Offer in Compromise Package should be completed to file an Offer in Compromise with the IRS. Included with the Form 656 package are Form 433-A, Collection Information Statement for Wage Earners & Self-Employed Individuals and Form 433-B, Collection Information Statement for Businesses.

- You may need to complete the appropriate Form 433 and should be prepared to provide other documentation and explanations as they are requested.

- Various options are available for accepted Offers in Compromise requests, such as a reduced total payment and scheduled monthly payments.

- Defaulting on an accepted offer in compromise can result in the IRS filing suit against you and reinstatement of the original tax debt, plus interest and penalties.

How Do I Get Help Filing My Taxes Online

If at any point you have a question about your taxes or the software, you can browse answers on our online help forum 24/7, or post a question for our online community of users and experts. While youre filing you may realize that youre looking for more guidance or help with your taxes. In that case you can upgrade to a different TurboTax Online product at any time without losing any of the data youre already entered.

Need more help? TurboTax Live Assist & Review gives you unlimited tax advice from one of our tax experts as you do your taxes, plus a final review before you file to make sure you didnt miss anything. Or if you want to hand off your taxes to one of our experts, TurboTax Live Full Service allows you to simply upload your documents and our experts will complete and file your return for you.

Don’t Miss: When Are Alabama State Taxes Due

If You’re Getting A Refund

No matter how you file, you can choose to receive your refund several ways.

A direct deposit to a bank account is the fastest option. You can also have it loaded onto a Turbo Visa Debit Card or sent as a paper check.

Other options include applying the refund to next years taxes and directing the IRS to buy U.S. Savings Bonds with your refund.

You have the option of paying for the software out of your refund. But theres a $40 charge to do that.

A Quick Look At H& r Block

H& R Block has provided consumer tax filing service since 1955. Its become one of the most popular filing services since then, because it combines simple tools and helpful guidance. Thats useful whether youve never filed taxes or whether youve been filing for decades. Of course, tools and guidance come at a price. H& R Block currently offers four digital filing options. You can see the options and pricing in the table below.

| H& R Block Filing Options | ||

| Filing Option | ||

| Federal: Free State: Free | Best for new filers or simple tax returns supported forms include 1040 with some child tax credits | |

| H& R Block Deluxe | Federal: $29.99 State: $36.99 | Best for maximizing your deductions includes all free features plus forms for homeowners allows you to itemize |

| H& R Block Premium | Federal: $49.99 State: $36.99 | Best for investors and rental property owners all More Zero and Deluxe features, plus accurate cost basis Schedule C-EZ, Schedule D, Schedule E, Schedule K-1 |

| H& R Block Self-Employed | State: $36.99 | Best for small business owners all Free, Deluxe and Premium features, plus Schedule C |

Recommended Reading: How To Calculate Quarterly Taxes

We Are Going To Show You How To File Taxes Online With Turbotax

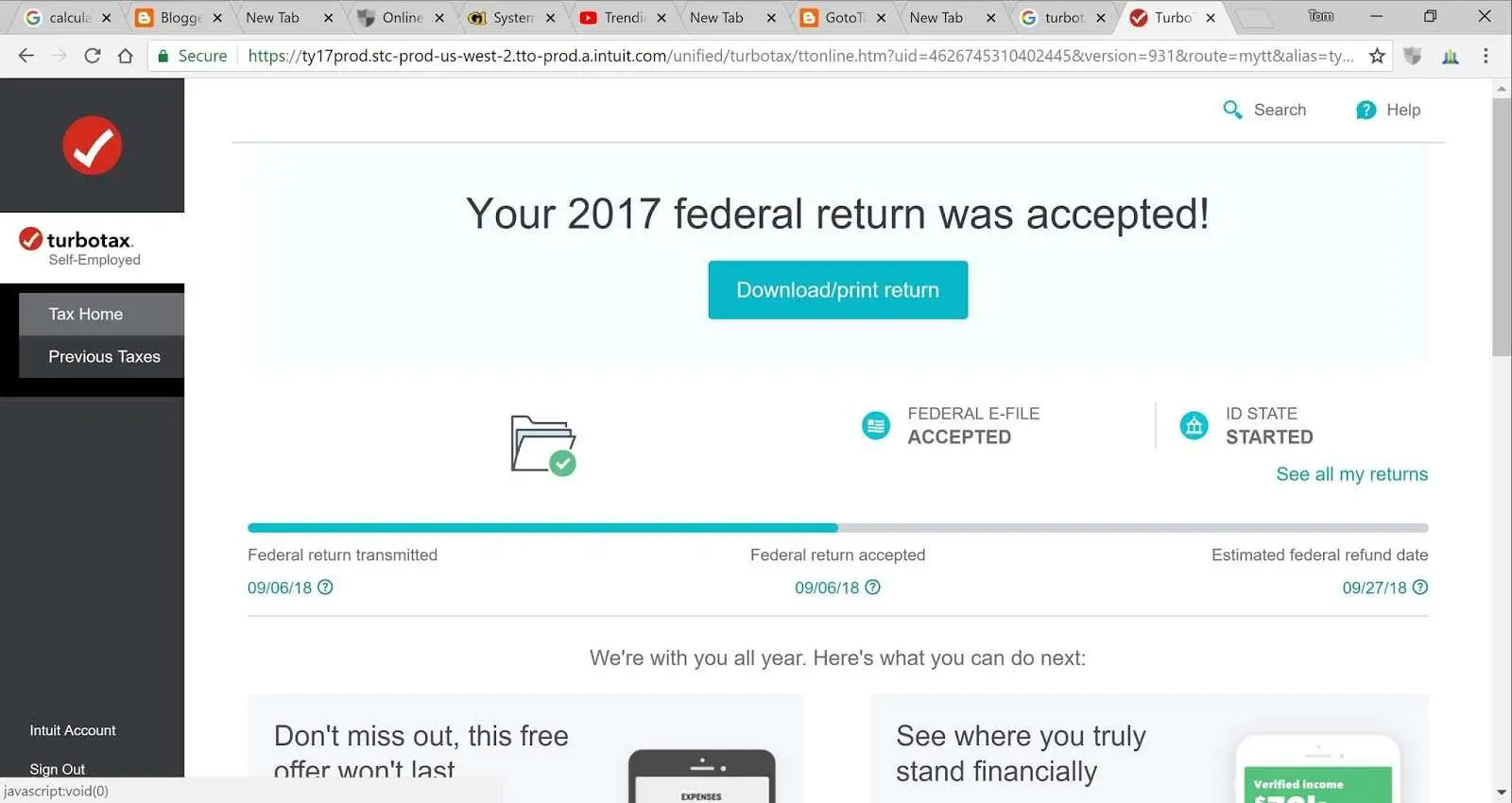

The step-by-step process offered by TurboTax makes filing your taxes easier than ever before. We highly recommend using it because its the fastest way to get your refund and filing with paper forms will result in a delay in processing.

Filing your taxes online couldnt be easier. You can create an account with TurboTax and begin filing your tax return.

First, TurboTax will ask you some basic questions. The first few questions involve where you live and whether youre married. After that, youll be asked to give a basic financial picture.

Youll be asked to give pieces of information like:

- Do you have an employer-sponsored retirement plan?

- Have you made any charitable donations this year?

- Are you working for yourself?

These questions are vital for TurboTax to understand which tax forms youre going to need to provide to submit your tax return successfully.

The next stage of the process now that you have received a filing status is to provide your 1099, W-2, and any additional forms relevant to your situation. If your employer has a partnership with TurboTax, you only need to provide your employer identification number, and your form will automatically be imported.

If not, you can scan in this form by yourself, but it may take longer because your employer will have to provide it to you first.