How To Calculate Your Tax Bracket In Retirement

The easiest way to calculate your tax bracket in retirement is to look at last years tax return.;

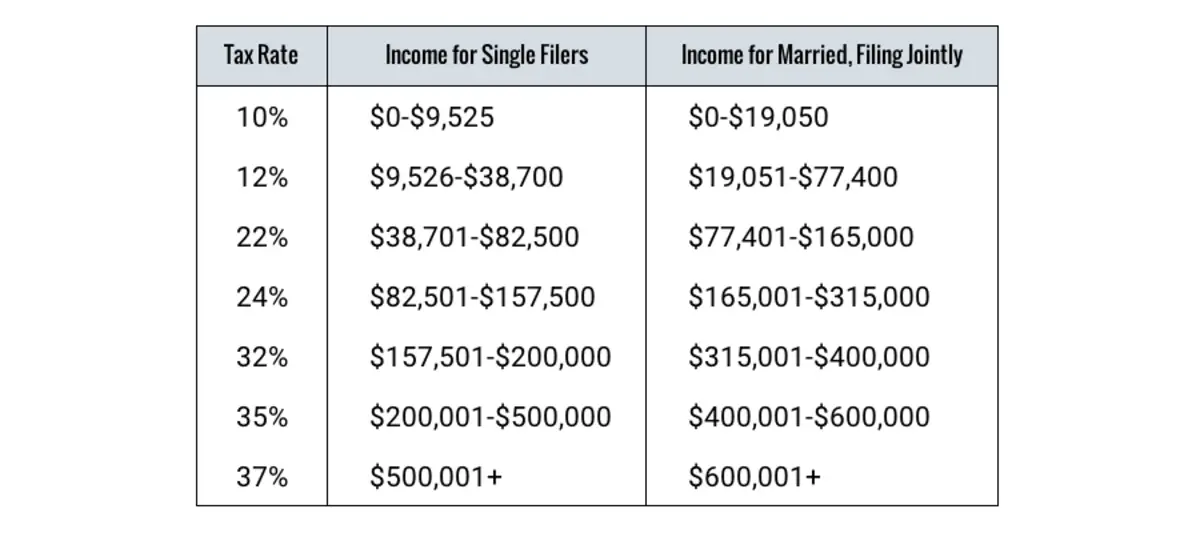

For 2020, look at line 10 of your Form 1040 to find your taxable income. Next, compare your taxable income to the tax brackets and rates for the year which can be found in Table 1 on this page of the Tax Foundations website.

Based on your taxable income and filing status, such as single filer or married filing jointly, youll find out if your marginal tax bracket was 10%, 12%, 22%, 24%, 32%, 35% or 37% for the year 2018.

Its important to note:

this wont tell you your current years tax bracket. It will only tell you the top tax bracket you fell in last year.

Each year, the amount of taxable income subject to each tax bracket changes due to inflation and potential tax law changes. You can find the 2020 tax brackets here in Table 1, as well.

That said:

You can use last years tax return to figure out how you ended up in the tax bracket you fell in. Then, you can use that information to plan how to you might be able to change that for this year or next year.

Pros And Cons Of Tax Brackets

Tax bracketsand the progressive tax system that they createcontrast with a flat tax structure, in which all individuals are taxed at the same rate, regardless of their income levels.

-

Higher-income individuals are more able to pay income taxes and keep a good living standard.

-

Low-income individuals pay less, leaving them more to support themselves.

-

Tax deductions and credits give high-income individuals tax relief, while rewarding useful behavior, such as donating to charity.

-

Wealthy people end up paying a disproportionate amount of taxes.

-

Brackets make the wealthy focus on finding tax loopholes that result in many underpaying their taxes, depriving the government of revenue.

-

Progressive taxation leads to reduced personal savings.

What Is A Federal Allowance

A federal withholding allowance refers to information that is on the W-4 form for tax years before 2020. You generally fill out a W-4 when you start a new job or experience a life change, like having a child. Your W-4 helps your employer understand how much tax to withhold from your paycheck. Before 2020, the number of personal allowances you took helped determine the amount your employer withheld the more allowances you claimed, the less tax your employer would withhold. But the IRS changed the W-4 starting with the 2020 tax year. The new form eliminates personal allowances.Learn more about the new W-4.

Also Check: Can I Use Bank Statements As Receipts For Taxes

Did Tax Tables Change For 2021

Yes. Each year, the IRS adjusts the tax brackets to account for inflation. Below are the income thresholds for tax year 2021.

The top tax rate remains 37% for individual single taxpayers with incomes greater than $523,600 . Below are the other rates:

- 35%, for incomes over $209,425

- 32%, for incomes over $164,925

- 24%, for incomes over $86,375

- 22%, for incomes over $40,525

- 12%, for incomes over $9,950

The lowest rate is 10% for incomes of single individuals with incomes of $9,950 or less .

What Is Federal Income Tax

Federal income tax is taxes on income, both earned and unearned , according to the IRS. In the U.S., both individuals and businesses must pay federal income tax.

Federal taxes are the U.S. governments main source of funding. In 2019, individual income taxes accounted for approximately 50% of the federal governments nearly $3.5 trillion in total revenue, according to the Congressional Budget Office.

Taxes help keep the federal government running and providing essential services, such as benefits for senior citizens, veterans, the disabled and low-income families. Tax revenue also supports other important government operations and departments, like defense, transportation, health, justice and international affairs.

You May Like: How To Get My Income Tax Return Copy Online

Ways To Get Into A Lower Tax Bracket

You can lower your income into another tax bracket by using tax deductions such as charitable donations or; deducting property taxes and the mortgage interest paid on a home loan and property taxes. Deductions can lower how much of your income is ultimately taxed.

Tax credits, such as the earned income tax credit, or child tax credit, can also put you into a lower tax bracket. They allow for a dollar-for-dollar reduction on the amount of taxes you owe.

How To Calculate Tax Bracket

Tax Bracket Rates 2021 If you are currently working in Canada or elsewhere, you might be considering tax rates that are significantly lower than those for Americans. The past ten years have seen a sharp decline for Canadian tax rates and this could be due to the current economic conditions in Canada after the collapse from the collapse of the housing market in Canada. In these times of economic turmoil there are more people employed and therefore there are also more tax deductions on earnings for Canadian citizens. Although this might appear like an excellent deal to those who are eligible, the vast majority of people will not get to take advantage of this and must accept higher tax rates.

There are several different types of tax bracket 2021 available in Canada and one of which is one called the Federal income tax. It is the smallest tax bracket in Canada that is applicable to the taxable earnings of the individual or the company. For corporate income taxation, the tax bracket that is applicable is the 15 percent tax bracket. The amount that the taxpayer pays to the government every year is then sent to their local Social Development Canada office for processing. After processing the tax and deducting the tax, the money deducted is sent directly to the person.

Read Also: Who Can I Call About My Tax Refund

How To Use A Tax Table

Using the IRS’s tax tables is straightforward once you know your taxable income and filing status.

The tax tables display the single, married filing jointly, married filing separately, and head of household filing status options. If you’re a qualifying widow or widower, you should use the married filing jointly column on the table.

First, find the line that corresponds to your taxable income for the year. Once you find that, look to the right and use the number in the column associated with your filing status to input the tax amount on line 16 of Form 1040 or Form 1040-SR.

Tax tables can be found in several official IRS documents. Each set of document may have the tax tables on different pages. The below example uses the tax tables found in the 2020 1040 and 1040-SR Tax and Earned Income Credit Tables publication. Based on these tables, a single person with a taxable income of $35,027 would turn to page 7 of this document. They would then find the line corresponding to their taxable income, which is a taxable income of at least $35,000 but not greater than $35,050. Next, they’d look to the right on this line to the number in the single-filing status column. This number, 4,006, would then be input on line 16 of Form 1040 or Form 1040-SR as the tax amount.

Keep in mind that this is not your final tax owed. Further down on the tax return form you will continue making other adjustments for tax credits, federal income tax withheld, and more.

Do I Have To File Taxes If I Made Less Than $10000

If your gross income was less than $10,000, you may not have to file a federal income tax return. But you may still want to file if you worked during 2020 and your employer withheld tax from your paycheck. Filing a tax return even if youre not required to do so is the only way to get any tax youre owed refunded to you.

You May Like: How To Figure Out Tax Percentage

How Do You Know Your Tax Bracket And Tax Rate

Tax Bracket Rates 2021 If youre currently employed in Canada, you may be paying taxes less than those of Americans. The last ten years has seen a significant decrease on Canadian tax rates and this could be due to the current economic conditions in Canada following the downturn of the collapse of the real estate market for homes in Canada. In the current economic climate, there are a lot more workers and, consequently, there are greater deductions for income of Canadian citizens. Although this might seem like something that is worth it for those who are eligible, the vast majority of people will not be able to take the benefit and have to accept higher tax rates.

There are several different types of tax bracket 2021 in Canada One of them are the Federal Income Tax. This is the lowest tax bracket in Canada and it is applied to the taxable earnings of an individual or business. Taxation on corporate income is a tax that corporations pay. the tax bracket applicable to corporations is the 15 percent tax bracket. The amount individuals pay in tax each year to the federal government is then transferred to their neighborhood Social Development Canada office for processing. After the tax is processed, the money that was deducted is sent directly to the person.

Tax Rates Vs Tax Brackets

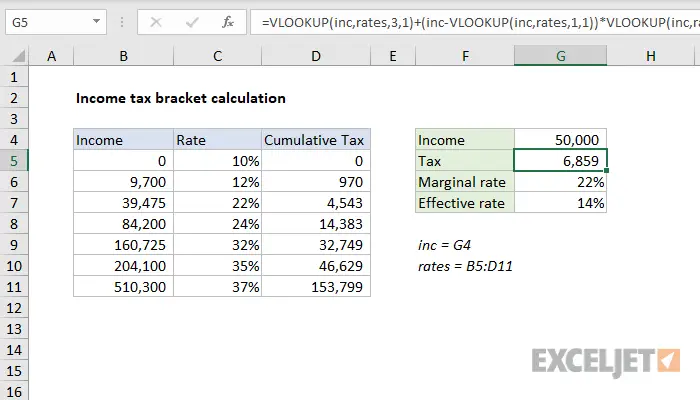

People often refer to their tax brackets and their tax rates as the same thing, but theyre not. A tax rate is a percentage at which income is taxed; each tax bracket has a different tax rate ,;referred to as the . However, most taxpayersall except those who fall squarely into the minimum brackethave income that is taxed progressively, so theyre actually subject to several different rates, beyond the nominal one of their tax bracket. Your tax bracket does not necessarily reflect how much you will pay in total taxes. The term for this is the effective tax rate. Heres how it works.

Consider the following tax responsibility for a single filer with a taxable income of $50,000 in 2020:

- The first $9,875 is taxed at 10%: $9,875 × 0.10 = $987.50

- Then $9,876 to $40,125, or $30,250, is taxed at 12%: $30,250 × 0.12 = $3,630

- Finally, the top $9,875 is taxed at 22%: $10,524 × 0.22 = $2,172.50

Add the taxes owed in each of the brackets, and you get $987.50 + $3,630 + $2,172.50 = $6,790.

Result: This individuals effective tax rate is approximately 13.5% of income.

You May Like: What Is The Sales Tax In Arkansas

How Much Do You Get Back In Taxes For A Child In 2020

There are multipletax breaks for parents, including the child tax credit. For 2020, the child tax credit is worth a maximum of $2,000 per qualifying child. Up to $1,400 of that amount is refundable meaning if the credit reduces your tax bill to zero, you could receive the difference back as a refund. Tax reform expanded the credit to also include a $500 nonrefundable credit for qualifying dependents who arent children, and boosted the phase-out limits to an AGI of more than $400,000 for taxpayers who are married filing jointly and $200,000 for everyone else. The higher limits mean that more people could qualify for the credit.

Understanding How Federal Income Tax Brackets Work

Once you know your filing status and amount of taxable income, you can find your tax bracket. However, you should know that not all of your income is taxed at that rate. For example, if you fall in the 22% tax bracket, not all of your income is taxed at 22%. Why is that?

The reason is that the U.S. income tax system uses a graduated tax system, designed so that individual taxpayers pay an increasing rate as their income rises as outlined in the 2020 tax table above.

Lets look at Sarah, whose filing status is Single and who has a taxable income of $50,000. Using the 2020 information above, we can determine Sarahs total tax.

For 2020, Sarah will pay $6,790 in tax.

Read Also: How Much Do I Need To Make To File Taxes

How Do Tax Brackets Work In Ontario

In Ontario, tax brackets are based on net income for income tax purposes. There are 5 tax brackets:

First:;$45,142;or lessSecond:;$45,142 up to $90,287Third: $90,287 up to $150,000Fourth; $150,000 up to $220,000Fifth:;$220,000;and over

Each tax bracket has a different rate of tax associated with it. If your net income falls in the second bracket, you will be taxed on the rate for the first bracket for the first $44,740, and the second bracket for the balance.

Will I Pay The Amt In 2021

To determine whether you pay the AMT, the IRS first calculates your tentative minimum tax, which is based on your income minus the AMT exemption, before any deductions are applied.

In 2021, the AMT exemption for individuals is:

-

$57,300 for people with filing status

-

$73,600 for people with filing status single or head of household

-

$114,600 for people with filing status or qualifying widower

For 2020, the AMT exemption for individuals was:

-

$56,700 for people with filing status

-

$72,900 for people with filing status single or head of household

-

$113,400 for people with filing status or qualifying widower

If you owe more using the tentative minimum tax calculation than the regular tax calculation , then you have to pay AMT on the excess.

Use the following table to determine your tax rate according to the AMT. The income ranges represent your income minus the AMT exemption plus a handful of AMT-specific tax deductions.

You May Like: How To Avoid Federal Taxes

Tax Brackets Vs Tax Rates

As with most things involving the federal government, the terminology around taxes tends to be more confusing than it needs to be. When you boil it all down, here are the definitions of tax bracket and tax rate:

- A tax bracket is a range of income taxed at a specific rate.

- A tax rate is the actual percentage youre taxed at based on your income.

Its actually simpler than it sounds.

Choosing Standard Or Itemized Deductions

Once you know your AGI, you have the opportunity to lower your taxable income even more by subtracting either the standard deduction or your itemized deductionswhichever is greater.

When to consider the standard deduction

If your financial situation is straightforward, the standard deduction might be the best and simplest choice. The standard deduction for 2014 is $6,200 for single filers, $12,400 for married filing jointly and $9,100 for head of household.

When to consider itemizing deductions

If you pay a lot in state income taxes, have a mortgage on your home, give a lot to charity, have paid extensive medical bills or manage a lot of investments, you might be better off taking the extra time to itemize your deductions.

Examples of legitimate itemized deductions:

- Property taxes;

- State and local income taxes ;

- Specified medical and dental expenses that exceed 10 percent of your AGI , including limited amount of premiums paid for long-term care policies;

- Mortgage interest on first and secondary residences , plus interest on home equity loans ;

- Charitable contributions to tax-exempt organizations;

- Casualty and theft losses ;

- Investment interest expense ;

- Miscellaneous expenses, including impairment-related expenses for persons with disabilities and gambling losses to the extent of gambling winnings;

- In addition, the following can be itemized if the cumulative total is more than 2 percent of your AGI:

- Business expenses not paid by your employer ;

Don’t Miss: Are Property Taxes Paid In Advance

How Much Youre Taxed

Your total federal income tax owed is based on your adjusted gross income . When you complete your Form 1040;and its attached schedules, you enter all of your income from various categories, such as wages, interest and dividends, and business income. Then, you take various above-the-line deductions, such as contributing to an IRA or paying student loan interest. These deductions reduce your;gross income to arrive at your AGI.

Your AGI is used to determine your eligibility for certain tax breaks, but its not your taxable income. From AGI, you deduct either the standard deduction or itemized deductions to arrive at your taxable income.

Tax Brackets Filing Jointly Vs Single

The biggest difference in how you’re placed in a tax bracket is whether you are single or have other people to consider.

If you are an individual with no dependents or spouse, the lowest of the seven tax brackets goes from a yearly income range of $0 to $9700. That bracket pays a tax rate of 10%. The highest of the tax brackets is for anyone making more than $510,300 a year in taxable income; anything above that is taxed at a rate of 37%.

For married people jointly filing their taxes, the income range is usually doubled. For example, whereas the lowest tax bracket for single people is $0-$9,700, for joint married couples it’s $0-$19,400. At the highest end of it, though, that tapers off; income over $612,350 gets taxed at 37%.

Recommended Reading: How To Look Up Employer Tax Id Number

Upcoming Tax Brackets & Tax Rates For 2020

Note: This can get a bit confusing. The filing deadline for the 2020 tax year is April 15, 2021. Which means you account for your 2020 tax bill in 2021. Add the fact that the IRS released the ground rules for 2021 taxes in October 2020, and your head is swimming in a pool so perplexing that a state of confusion can be excused.

But wait. Come springtime, will Washington ponder another filing delay in response to a new or ongoing national emergency? You never know.

What we do know is the rates and brackets for the 2020 tax year are set.

Here is a look at what the brackets and tax rates are for 2020 :

2020 Tax Brackets| Tax rate |

|---|