What Is An Irs Tax Transcript

An IRS tax transcript contains a summary of your tax return items but only partially displays your personal information to protect your privacy. Depending on the type of transcript you request, it can present your full financial and tax-related information. Items such as your taxable income will be broken down by items as reflected on Form W-2.

If you need a tax transcript, you can request one any time for free through the IRS Get Transcript website.

Q12 How Do I Request A Transcript For An Older Tax Year When Its Not Available Online

Tax return and record of account transcripts are only available for the current tax year and three prior tax years when using Get Transcript Online. Note: There is a show all + expand button below the online tax account transcript type that may provide additional tax years you need. Otherwise, you must submit Form 4506-T to request a transcript for a tax year not available.

Tax return and tax account transcripts are also limited to the current and prior three tax years when using Get Transcript by Mail. However, you may be able to get older tax account transcripts by calling our automated phone transcript service at 800-908-9946. Otherwise, you must submit Form 4506-T.

Get A Transcript Of A Tax Return

A transcript is a computer printout of your return information. Sometimes a transcript is an acceptable substitute for an exact copy of your tax return. You may need a transcript when preparing your taxes. They are often used to verify income and tax filing status when applying for loans and government benefits.

Contact the IRS to get a free transcript . There are two ways you can get your transcript:

-

Online – To read, print, or download your transcript online, you’ll need to register at IRS.gov. To sign-up, create an account with a username and a password.

Don’t Miss: How To Get Stimulus Check 2021 Without Filing Taxes

Ways To Get Transcripts

You may register to use Get Transcript Onlineto view, print, or download all transcript types listed below.

If you’re unable to register or you prefer not to use Get Transcript Online, you may order a tax return transcriptand/or a tax account transcript using Get Transcript by Mailor call 800-908-9946. Please allow 5 to 10 calendar days for delivery.

You may also request any transcript type listed below by faxing/mailing Form 4506-T, Request for Transcript of Tax Returnas instructed on the form.

Copies Of Tax Returns

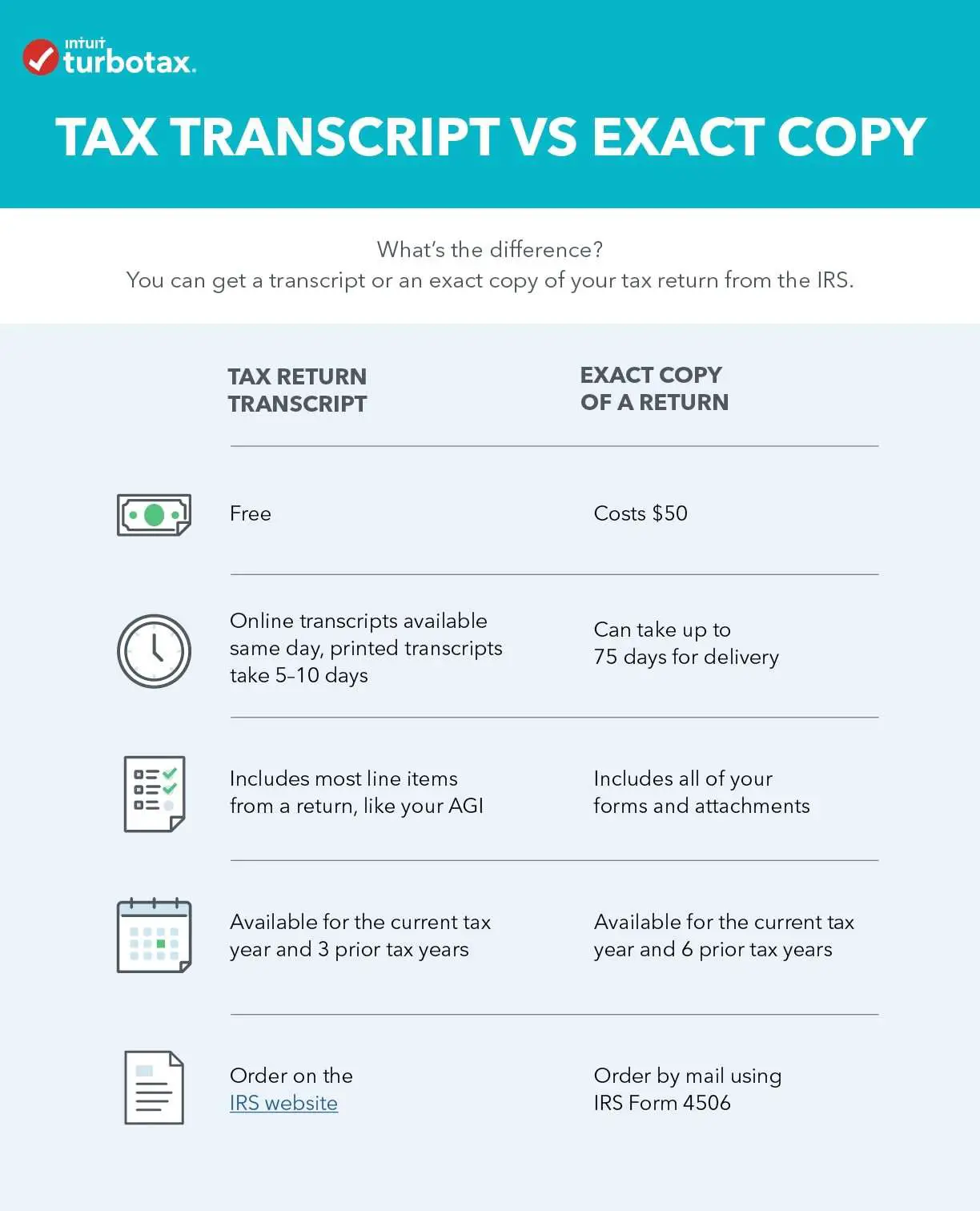

Taxpayers who need an actual copy of a tax return can get one for the current tax year and as far back as six years. The fee per copy is $50. A taxpayer will complete and mail Form 4506 to request a copy of a tax return. They should mail the request to the appropriate IRS office listed on the form.

Taxpayers who live in a federally declared disaster area can get a free copy of their tax return. More disaster relief information is available on IRS.gov.

Also Check: 1040paytax.com Official Site

What If You Need Your Actual Tax Return

If your tax transcript won’t meet your needs, you can still access your tax return in other ways. If you used TurboTax Online to prepare your taxes, you can access your tax return by signing in to your TurboTax account and navigating to the “Your tax returns & documents” section.

If you prepared your taxes in another way, you need to complete IRS Form 4506 and mail it to the IRS along with a $43 fee for sending you a copy of your tax return . These requests can take up to 75 days to process. So, you’ll want to make sure a tax transcript won’t cut it before starting this process.

Remember, with TurboTax, we’ll ask you simple questions about your life and help you fill out all the right tax forms. Whether you have a simple or complex tax situation, we’ve got you covered. Feel confident doing your own taxes.

How Do I Get A Copy Of My State Tax Return

You may be able to obtain a free copy of your California tax return. Go to MyFTB for information on how to register for your account.

You may also request a copy of your tax return by submitting a Request for Copy of Tax Return or written request.

There is a $20.00 fee for each tax return year you request. There is no charge for a copy of your return if you’re requesting a return for a tax year in which you were the victim of a designated California state disaster or federal disaster.

Include a check or money order for the total amount due, made out to the Franchise Tax Board.

It may take up to four weeks from the date of your request to receive a copy of your return.

Also Check: Michigan Gov Collectionseservice

Avoid The Rush: Get A Tax Transcript Online

IR-2019-17, February 15, 2019

WASHINGTON The Internal Revenue Service today reminded taxpayers who need their prior-year tax records to either complete their 2018 tax return or to validate their income can use Get Transcript Online or Get Transcript by Mail.

Taxpayers often call or visit the IRS seeking their prior-year tax transcript, which is a record of their tax return. But the days around Presidents Day mark the busiest time of the year for the IRS. Taxpayers can avoid the rush by using online options that are faster and more convenient.

Its always a good idea to keep copies of previously-filed tax returns. That recommendation is more important this year because, for some taxpayers, certain data from the 2017 tax return the adjusted gross income — will be required to validate their electronic signature on their 2018 tax return due April 15 for most filers. This is especially true for taxpayers who have switched tax software products this year.

Generally, for returning users, the commercial tax software product will carry over the prior-year information and make for an easy, seamless validation process. However, taxpayers using a new tax software product for the first time may be required to enter the information manually.

Heres the way the electronic signature and signature validation work:

Q4 What If I Cant Verify My Identity And Use Get Transcript Online

Refer to Transcript Types and Ways to Order Them for alternatives to Get Transcript Online. You may use Get Transcript by Mail or you may call our automated phone transcript service at 800-908-9946 to order a tax return or tax account transcript be sent by mail. Please allow 5 to 10 calendar days from the time we receive your request for your transcript to arrive. The time frame for delivery is the same for all available tax years.

Read Also: Www.1040paytax.com

Q5 I Got A Message That Says The Information I Provided Does Not Match Whats In The Irs Systems What Should I Do Now

Verify all the information you entered is correct. It must match whats in our systems. Be sure to use the exact address and filing status from your latest tax return. If you are still receiving the message, you’ll need to use the Get Transcript by Mail option or submit a Form 4506-T to the IRS at the address or fax number provided in the instructions.

What Is A Tax Transcript And How Can You Get Yours

You may know that it is always helpful and important to keep copies of your old tax returns on file.

However, it can be all too easy for these copies to become misfiled or misplaced, especially if you move or face other challenges with your records.

If you need copies of your old tax returns and do not have them on hand, dont despair. You can get tax transcript, previous returns and other valuable information about your tax history, quickly and at no cost.

If youre getting ready to do your taxes in 2020 and you dont have helpful records, dont hesitate to request the documents that you need.

Recommended Reading: Mcl 206.707

How To Get Tax Transcript Online

There are a few different ways you can obtain your taxreturn transcript, but the easiest way is to use the IRSGet Transcriptwebsite. In order to access your information, the IRS will need enoughinformation to verify that it is you making the request, including thefollowing:

- Social Security number

- Your most recent tax filing status

- Your email address

- Your mailing address, as used on your most recent tax return

- At least one account number for a mortgage, loan, credit card or other credit item in your name

- A U.S.-registered mobile phone, with the account in your name.

The form will ask your reason for requesting the transcript. You are entitled to your records this is just to make sure that you are being provided with the correct document.

Before you can download and review the transcripts online, the IRS will verify your identity with an email message and a text code sent by SMS to your mobile phone.

If you have a credit freeze on your Experian credit report, you will need to lift the freeze before moving forward with online verification. You can call Experian back to place the freeze again after your verification is complete.

All five types of transcripts are available through the IRSonline service.

What Does An Irs Transcript Show

There are five types of tax transcripts you can request from the IRS:

Also Check: Michigan.gov/collectionseservice

How To Get Your Irs Tax Transcript Online

by Chris Dios | May 18, 2020 | Legal, Tax Tips

If youre an American taxpayer, the IRS has a file on you. The IRS tracks tax payments, income, deductions, and other important tax information. If you ever find yourself in need of this information, you can ask the IRS to send you a tax transcript that details all the information they have on file. If youre applying for a mortgage, student loan, or starting a new business venture, you will likely need to present a tax transcript at some point during the application process. However, its good to keep your tax transcripts on file even if you dont immediately need them. These reports can help you defend yourself if youre ever audited, and theyre a useful reference for tax planning.

The IRS revamped its website a few years ago, and now its easier than ever to get your IRS transcript online. However, you need to know what you need to get started, so lets start with the basics. What exactly is an IRS tax transcript?

Get More With These Free Tax Calculators And Money

-

See if you qualify for a third stimulus check and how much you can expect

-

Know what dependents credits and deductions

-

Know what tax documents you’ll need upfront

-

Learn what education credits and deductions you qualify for and claim them on your tax returnGet started

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Recommended Reading: Oregon Tax Preparer License Renewal

Get A Copy Of A Tax Return

Mail the following items to get an exact copy of a prior year tax return and attachments:

- A completed Form 4506.

- $43 fee for each tax return requested. Make the check or money order payable to the United States Treasury.

Send them to the address listed in the form’s instructions. The IRS will process your request within 75 calendar days

What A Tax Transcript Includes

Your transcript will include all the same information that appears on your tax return, although its not laid out in the same format. Youll see your filing status, income, and any deductions and credits you claimed. However, your personal information wont appear on the transcriptat least not in its entirety.

The IRS has been actively taking steps to combat fraud and identity theft, and it now masks or blacks out portions of information on your transcript that thieves might like to know, such as the first five digits of your Social Security number and your complete telephone and account numbers. All of your tax financial information is displayed in full, however.

As of January 2019, your accountant or any other individual or entity who has a rightand your permissionto access your transcript must now enter a customer file number on line 5 of IRS Form 4506-T, the official Request for Transcript of Tax Return. Generally, the third party can assign the number. For example, a potential lender that wants a copy of your transcript might assign it with your loan number. What third parties cant use is your Social Security number. The IRS will enter the new number into its transcript database when it receives a Form 4506-T.

Recommended Reading: Do You Have To Report Plasma Donations On Taxes

Other Irs Transcript Access Options

Youre not out of luck if you dont have a cellphone or a loan in your name, or if you lack any of the other information required for online access. Youll just have to take the snail-mail approach. This requires only your Social Security number, the mailing address on your most recent return, and your date of birth. Unfortunately, you can only get tax return and tax account transcripts this way, and only for the current tax year and the three years before that.

The IRS indicates that it will probably take five to ten calendar days for the transcripts to arrive in your mailbox. You can still make the request online, but you wont have access to your information until the paper copy is delivered to you. You can also submit the request by calling 800-908-9946.

Youll have to take an additional step if you no longer live at the address cited on your last tax return, even if youve arranged for USPS to forward your mail. The post office cant do that with correspondence from the IRS, so youll have to complete and submit Form 8822 with your change of address before you submit Form 4506-T. The bad news is that it takes the IRS up to six weeks to process a taxpayers change of address.

How To Request Your Transcript By Mail

If you prefer to request your tax return transcript the old fashioned way, you can do so either by phone or mail, to order a copy of your transcripts by phone, call. To request your tax transcripts by mail, you will need to submit form 4506-T or 4506 T-EZ. You can find these forms on the IRS website under forms, instructions, and publications. You can also request a copy of your full tax return by submitting a 4506. Tax returns are available for the previous six years. A $50 fee per copy is assessed.

When ordering a copy of your transcripts or tax returns, having a plan is crucial. If you order your transcript online or via phone, it typically takes 5-10 about 15 days to arrive. It can take as long as 30 days to receive a transcript with a mailed request. Full tax returns take longer. If you order a copy of your full tax return, the turnaround time is 75 days.

Also Check: Notice Of Tax Return Change Revised Balance

Its A Simple Process And You Can Do It Online

You probably know youre supposed to keep copies of your filed tax returns for a period of years, but life happens. The Internal Revenue Service provides tax transcripts if you need to lay your hands on an old return that you lost or didnt save. The IRS is also glad to provide you with other forms and information about your tax history, free of charge.

Keep reading to learn more about the documents the IRS can provide you with, and how to get them.