The Gdvs Makes No Guarantees Regarding The Awarding Of Tax Exemptions

The administration of tax exemptions is as interpreted by the tax commissioners of Georgias 159 counties.

GDVS personnel will assist veterans in obtaining the necessary documentation for filing. The actual filing of documents is the veterans responsibility.

To obtain verification letters of disability compensation from the Department of Veterans Affairs, please call 1-800-827-1000 and request a Summary of Benefits letter.

Any questions pertaining to tax exemptions at the local level should be asked to and answered by your County Tax Commissioners office. The GDVS can only verify the status of a veterans or surviving spouses eligibility.

Abatement of Income Taxes for Combat Deaths

Georgia law provides that service personnel who die as a result of wounds, disease, or injury incurred while serving in a combat zone as a member of the U.S. armed forces are exempt from all Georgia income taxes for the taxable year of death. Additionally, such taxes shall not apply for any prior taxable year ending on or after the first day served in the combat zone.

Ad Valorem Tax on Vehicles

This exemption applies to either the annual property tax or the title tax, whichever is applicable.

The exemption is granted on ONLY one vehicle the veteran owns and upon which the free Disabled Veteran license plate is attached. Veterans who qualify for the Purple Heart or Medal of Honor specialty license plates are also exempt.

Business Certificate of Exemption

Is The Georgia Sales Tax Destination

Georgia is a destination-based sales tax state, which meansthat sales tax rates are determined by the location of the buyer when the transaction is completed. This means that, for orders placed via the internet/mail by a customer within Georgia from a Georgia vendor, the vendor must collect a sales tax rate applicable at the buyer’s address . This can significantly increase the complication of filing your sales tax return, because different sales tax rates must be charged to different buyers based on their location.

Using A Third Party To File Returns

To save time and avoid costly errors, many businesses outsource their sales and use tax filing to an accountant, bookkeeper, or sales tax automation company like Avalara. This is a normal business practice that can save business owners time and help them steer clear of costly mistakes due to inexperience and a lack of deep knowledge about Georgia sales tax code.

Avalara Returns for Small Business is an affordable third-party solution that helps business owners simplify the sales tax returns process and stay focused on growing their business. Learn how automating the sales tax returns process could help your business. See our offer to try Returns for Small Business free for up to 60 days. Terms and conditions apply.

Recommended Reading: How Much Does H And R Block Charge

How To Use A Georgia Resale Certificate

If you buy products at retail in order to resell them, you can often avoid paying sales tax when purchasing those products.

In Georgia, this process involves presenting a Georgia Sales Tax Certificate of Exemption to the merchant from whom youre buying the merchandise to be resold.

Heres a quick guide on what you need to know to buy products for resale and to sell products for resale in Georgia.

Failure To Collect Georgia Sales Tax

If you meet the criteria for collecting sales tax and choose not to, youll be held responsible for the tax due, plus applicable penalties and interest.

Its extremely important to set up tax collection at the point of sale its near impossible to collect sales tax from customers after a transaction is complete.

You May Like: How Much Does H& r Block Charge To Do Taxes

What Items Are Subject To Sales Tax

Products, services, and transactions subject to sales tax

- tangible personal property

- gas, electricity, refrigeration and steam, and telephone service

- selected services

- food and beverages sold by restaurants, taverns, and caterers

- hotel occupancy and.

What All Does Tax Free Weekend Include

During a sales tax holiday, a state encourages consumer spending by allowing tax-free purchases of certain items such as school supplies, computer equipment, clothing and footwear, and sometimes energy-efficient home appliances and severe-weather preparedness items, according to the Sales Tax Institute.

Read Also: Mcl 206.707

Stay Informed On Sales And Use Tax

Join the Sales Tax Institute mailing list and get updates on the latest news, tips, and trainings for sales and use tax.

By submitting this form you are agreeing to join the Sales Tax Institutes mailing list so the Sales Tax Institute can send you email notifications including our monthly newsletter, monthly sales tax tips digest, information about upcoming courses and sales tax resources. Submitting this form will add your email to our mailing list. We will never share or sell your info. to view our privacy policy.

Contact

910 W. Van Buren Street, Suite 100-321Chicago, IL 60607

When To Charge Another State’s Tax

You would typically collect sales tax for another state only if you have a physical presence in that state. In legal terms, this is known as having sales tax nexus there.

Your physical presence might be a retail store, a warehouse, or a corporate office, even if the facility is not open to the public. Entering into an affiliate agreement with a resident of the state may also establish a physical presence or nexus there in some states.

Check with your tax advisor as to whether traveling to a state and conducting business there would create nexus if you do business at your customer’s locations. This might cause that state’s sales tax rules to trigger.

Read Also: Have My Taxes Been Accepted

How To Get A Georgia Sales Tax Certificate Of Exemption

A business can purchase items to resell without paying state sales tax. The tax liability is passed from the distributor to the retailer, who will then charge sales tax to the end-user of the item.

Wholesalers and distributors will require a sales tax number and a Georgia Sales Tax Certificate of Exemption to document the items being purchased are for resale.

The Utility Refund & Savings

Lets Grow Together

In Georgia, after the exemption is approved, the business may receive a refund on the portion of overpaid tax theyve paid for the past 36 months and also receive an exemption on future utility usage, based off the exemption percentage identified.

Business in Georgia? Reach out to SmartSave and start saving today.

Don’t Miss: How Much Does H& r Block Charge To Do Taxes

Georgia Sales Tax Compliance

If youre planning on filing a sales and use tax return in Georgia, youll need to know the followinginformation:

– Total sales in Georgia

– Amount of sales exempt from tax

– Amount of sales tax collected

– Amount of taxable sales

Georgia sales tax compliance has a state-level sales tax rate of 4%. However, in Atlanta and Clayton County, the Motor Vehicle taxes 1% less than the normal rate. The sale of food is tax exempt at the state level. Although you dont have to pay taxes on food at the state level, there are still taxes applied to the sale of food at Georgias local level.

Purchases Made In Other States

Emory has been approved for exemption from sales tax in a number of other states. These exemption certificates are available at Emory Finance Web.

Each state has varying laws regarding what items they exempt from the imposition of state taxes. Where a state tax exemption exists, it generally covers the purchase of tangible personal property used for University business.

If you will be traveling and intend to make purchases in a state that is not included in the list at the web site, contact the Office of the Controller to determine if an exemption may be obtained. Note that some states do not exempt non-profit organizations from any of the state taxes imposed.

You May Like: What Does Agi Mean In Taxes

Georgia’s Sales Tax By The Numbers:

Georgia has alower-than-average state sales tax rate of 4%, but the actual combined sales tax rates are higher than averagewhen local sales taxes from Georgia’s 315 local tax jurisdictions are taken into account.

Rankings by Average State + Local Sales Tax:

Ranked 16th highest by combined state + local sales tax

Ranked 25th highest by per capita revenue from state + local sales taxes

Rankings by State Sales Tax Only:

Ranked 21st highest by state sales tax rate

Ranked 41st highest by per capita revenue from the statewide sales tax

Georgia has a statewide sales tax rate of 4%, which has been in place since 1951.

Municipal governments in Georgia are also allowed to collect a local-option sales tax that ranges from 2% to 4.9% across the state, with an average local tax of 3.527% .The maximum local tax rate allowed by Georgia law is 4%.You can lookup Georgia city and county sales tax rates here.

This page provides an overview of the sales tax rates and laws in Georgia. If you are a business owner and need to learn more about things like getting a sales tax permit, filing a sales tax return, or making tax-exempt purchases for resale see the Georgia Sales Tax Handbook’s Table of Contents above.

What Steps Should A Business Take To Accept A Resale Certificate

When a business is presented with a resale certificate, it is the sellers responsibility to verify the buyers information is correct and maintain records to demonstrate the sellers due diligence. Failing to verify this information may put the liability of paying Georgia sales taxes on the seller.

Before accepting a resale certificate, a seller should:

- Review the resale certificate to make sure it is completely filled out.

- Verify the purchasers Georgia Sales Tax ID with the Department of Revenues Verification Tool.

- Sellers are also responsible for considering whether the goods and services sold are consistent with their type of business. For example, if the buyers business is a car dealership, but they want to purchase office supplies tax-free, the seller should investigate further.

- Keep a file of resale certificates.

Don’t Miss: How Much Does H& r Block Charge To Do Taxes

Information Needed To Register For A Sales Tax Permit In Georgia

Before you begin the process of registering with the state, make sure you have access to the following information:

- Federal tax ID, typically called the EIN, issued by the IRS

- Knowledge of your business entity structure

- Business owner information

- North American Industry Classification System number

- Start date with the state of Georgia

To get started, choose the link titled Register a New Georgia Business on the website. Click Next and follow the prompts that walk you through the process of registering with the state of Georgia.

What Happens After You Apply for a Sales Tax Permit in Georgia?

Keep in mind, once you have an active sales tax permit in Georgia, you will need to begin filing sales tax returns. Our team can handle your sales tax returns for you with our Done-for-You Sales Tax Service. You can also learn more about how to file and pay a sales tax return in Georgia by .

During the permit registration process, you chose a username and password. This is what you will use to continue to access your online account. Please make sure you keep that information somewhere safe and accessible.

After your online permit registration submission, you should receive your tax account number within 15-30 minutes via the email address you provided when registering. Once logged into your account, you may then print a copy of your Sales and Use permit there. Also, a paper copy of your Sales and Use permit should arrive at your mailing address within 7-10 business days.

Michigan Sales Tax Compliance

Michigan sales tax compliance is fairly easy to follow and understand. Michigan has a state-level sales tax rate of 6%. The state does not offer reduced rates, but there are exemptions available for businesses with the correct certificate of exemption. Some of these exempt businesses include churches, schools, wholesalers, resale retailers, government 5013 and 5014 organizations, and more. Outside of these types of companies, most businesses will collect and remit a 6% sales tax rate on sales.

You May Like: How Much H And R Block Charge For Taxes

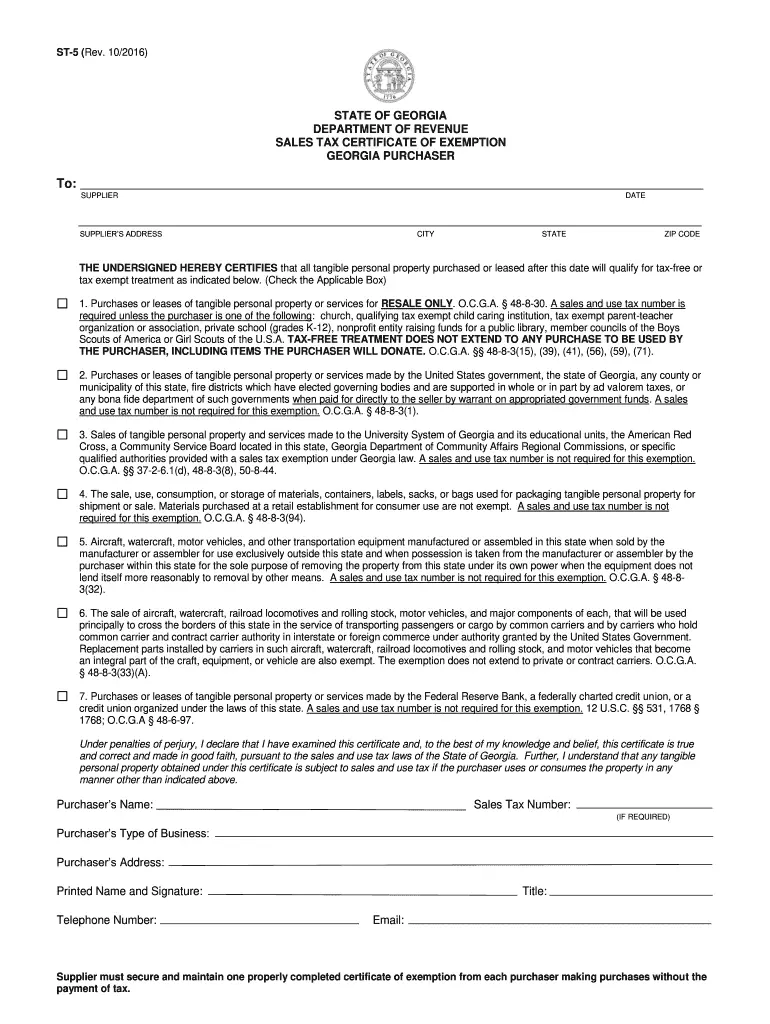

How To Use Sales Tax Exemption Certificates In Georgia

A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases. You will need to present this certificate to the vendor from whom you are making the exempt purchase – it is up to the vendor to verify that you are indeed qualified to make a tax-exempt purchase.

How To Get A Georgia Sales And Use Tax Certificate Of Registration:

Georgia is in the process of switching over to a fully-online sales tax permitting process, so Form CRF-002 is no longer used. Instead, you can register for an account with the Georgia Tax Center. You will also use this web portal to file tyour sales tax returns and pay your tax liabilities. If you have any issues throughout the process, you can reach out to the Georgia Taxpayer Services Division at877-423-6711.

Don’t Miss: Form 5498 H& r Block

What Is A Sales Tax Certificate Of Exemption

When retailers purchase products to resell, they often dont pay sales tax to the supplier on the purchase. The sales tax will still be paid, but instead of the retailer paying sales tax, the retailer charges sales tax to their customer on the final value of the merchandise. The collected sales tax is then sent by the retailer to the Georgia Department of Revenue.

For example, when a pet store purchases dog toys from their supplier to sell in the store, the pet store owner wont typically have to pay sales tax to their supplier. When a customer purchases the dog toy, the retailer will charge sales tax to the customer based on the full price of the toy. The retailer will collect the sales tax from all their transactions and periodically send the sales tax to the state.

The purpose of the certificate is to provide evidence of why sales tax was not collected on a transaction. Similar names for a resale certificate include reseller number, sellers permit, exemption certificate, wholesale license, or resellers license. In order for the supplier to allow the tax-exempt purchase, the seller needs proof the buyer intends to resell the product by providing a valid resale certificate.

The sales tax exemption is only intended to be used for inventory that will be resold and not intended for the tax-free purchase of items used in normal business operations such as paper, pens, etc.

Where To Go If You Need Help Registering For A Sales Tax Permit In Georgia

If you are stuck or have questions, you can either contact the state of Georgia directly or reach out to us and we can register for a sales tax permit on your behalf.

How to contact the Georgia Tax Center if you have questions: You can contact the Georgia Tax Center by calling 423-6711 between 8:00 am 6:30 pm EST.

How to contact TaxValet if you want someone to handle your permit registration for you: You can learn more about our sales tax permit registration service by .

You May Like: Do You Have To Report Roth Ira On Taxes

How Do I Register To Collect State Sales Tax

You need to register your business with any state for which you’ll be collecting sales tax. To learn how to register, contact the state’s department of revenue or other tax authority. Be sure to have business information available, including your employer identification number, business address, and banking information if you plan to pay sales tax electronically.

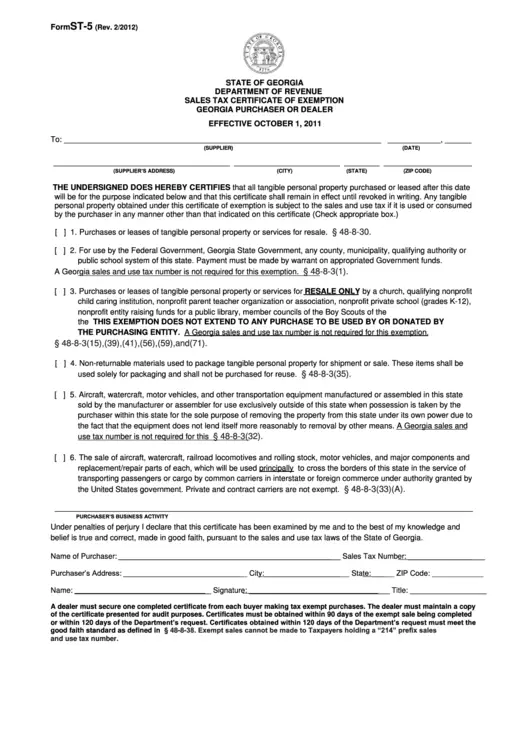

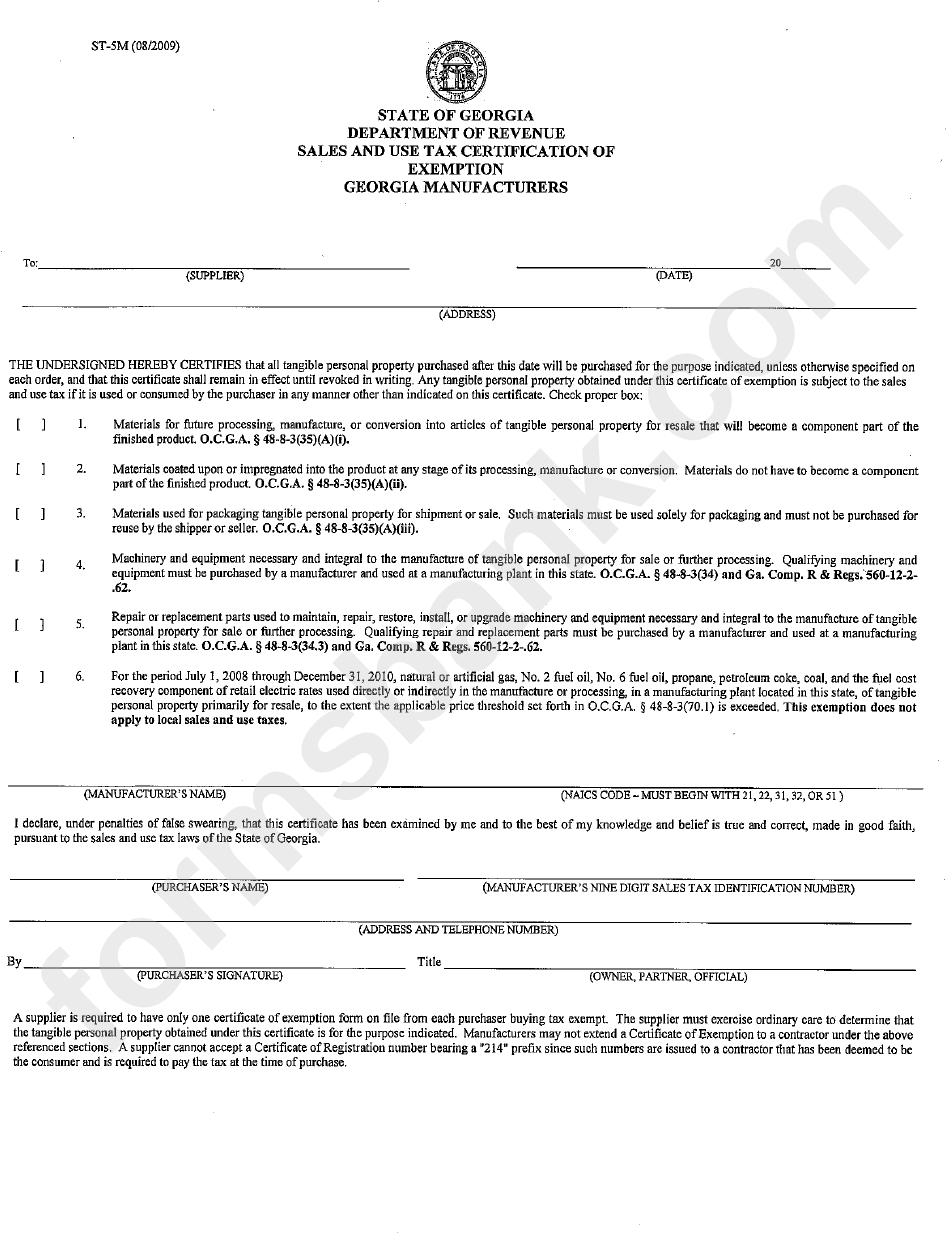

How To Fill Out The Georgia Sales Tax Certificate Of Exemption Form St

The Georgia Department of Revenue created a Sales Tax Certificate of Exemption to make things easier for documenting tax-free transactions.

Filling out the ST-5 is pretty straightforward but is critical for the seller to gather all the information.

If audited, the Georgia Department of Revenue requires the seller to have a correctly filled out ST-5 Sales Tax Certificate of Exemption. Without it correctly filled out, the seller could end up owing sales taxes that should have been collected from the buyer in addition to penalties and interest.

Also Check: Tax Lien Investing California

Types Of Sales Tax Permits Available

Georgia offers one type of permit, a Sales and Use Tax Permit. There is no fee to register for this permit with the state of Georgia.

If youre already feeling a little overwhelmed with this process, you should know that we can handle the entire permit registration process for you with our Sales Tax Permit Registration Service.

Georgia Sales And Use Tax

VI. APPLICATION OF SALES AND USE TAXES TO PARTICULAR BUSINESSES AND TAXPAYERS – SPECIAL ISSUES AND EXEMPTIONSA. Introduction.The determination of sales and use tax liability generally turns on whether the transaction in question is a sales transaction versus a service transaction or whether the property involved is tangible personal property versus intangible personal property. Even if the transaction in question involves the retail sale of tangible personal property, liability from sales and use tax may still be avoided if one of the seventy-two statutory exemptions contained in the Code applies.B. Airplanes/Airlines Charters.

Read Also: How Does H And R Block Charge