What Is Happening When Wheres My Refund Shows My Refunds Status As Approved

Weve approved your refund. We are preparing to send your refund to your bank or directly to you in the mail. This status will tell you when we will send the refund to your bank . Please wait 5 days after weve sent the refund to check with your bank about your refund, since banks vary in how and when they credit funds.

How To Track The Progress Of Your Refund

The IRS has eliminated the guesswork of waiting for your tax refund by creating IRS2Go, an app that allows you to track the status of your return. You can also check the status of your refund with the Wheres My Refund? online portal.

Both tools provide personalized daily updates for taxpayers 24 hours after a return is e-filed or four weeks after the IRS has received a paper return. After inputting some basic information , you can track your refunds progress through three stages:

Once your refund reaches the third stage, you will need to wait for your financial institution to process a direct deposit or for a paper check to reach you through the mail.

Financial Help During Covid

Your refund will be automatic if your income is from:

- employment

- investments

- an employee share-scheme benefit where tax is already deducted

- schedular payments

- New Zealand superannuation .

If youre self-employed or get income from somewhere not listed above, you need to:

Log in to Inland Revenue to see if you have a refund.

While youre there:

- check your contact information is correct

- nominate a bank account where IR can deposit your refund.

You May Like: Can I Endorse My Tax Refund Check To Someone Else

What Do These Irs Tax Refund Statuses Mean

Both IRS tools will show you one of three messages to explain your tax return status.

- Received: The IRS now has your tax return and is working to process it.

- Approved: The IRS has processed your return and confirmed the amount of your refund, if you’re owed one.

- Sent: Your refund is now on its way to your bank via direct deposit or as a paper check sent to your mailbox.

Can Any Other Person Get My Refund

As per the law, only the person whose excessive tax is deducted is eligible to get a refund. However, there are a couple of exceptions to this: When your income is included in any other persons income , then the latter alone can get your refund.In case of death, incapacity, insolvency, liquidation or any other reason when you are unable to claim/receive a refund, then your legal representative or trustee or guardian or receiver shall be entitled to your refund.

You May Like: How To Find Out Your Tax Rate

What Are The Common Filing Mistakes To Avoid

Common filing mistakes include not filing an Income Tax Return when you have received a notification from IRAS to file, and using previous years’ relief claims for the current Year of Assessment even though your circumstances had changed. Find out moreon the common filing mistakes to avoid.

For self-employed persons, sole-proprietors and partners, you may find out more about common filing mistakes specific to your trade, business, vocation or profession.

If you have successfully filed, you will see an acknowledgement page on the screen after you click ‘Submit’. If you do not see an acknowledgement page, please check your filing status at myTax Portal .

Irs Takes On More Duties

This tax season is unlike any other.

The IRS has been handling rollouts for three stimulus programs since April 2020.

Now, the IRS is preparing to launch a way to send money each month to families who qualify for an expanded child tax credit. That effort is to begin in July.

In addition, the IRS is taking steps to automatically refund some tax money relating to jobless benefits money this spring and summer.

The follow-up refunds would apply to people who filed their tax return reporting unemployment compensation before the recent tax break for unemployment benefits was put into place as part of the American Rescue Plan.

The first special refund payouts will likely be made in May, and they will continue into the summer.

A tax rule change that excludes a portion of unemployment benefits from being included as income was signed into law March 11, roughly a month after the 2021 tax season began. Tax forms and tax software had to be updated after the season started to reflect the change.

Right now, the IRS said tax returns are opened in the order received.

“As the return is processed, it may be delayed because it has a mistake including errors concerning the Recovery Rebate Credit, is missing information, or there is suspected identity theft or fraud,” the IRS said.

“If we can fix it without contacting you, we will.

“If we need more information or need you to verify that it was you who sent the tax return, we will write you a letter.”

You May Like: How To Cash Out Bitcoins Without Paying Taxes

How Do I Claim Missing Stimulus Money On My Taxes

If you were eligible for all or some of the first stimulus check of up to $1,200 per person or the second stimulus check of up to $600 per person, but that money never arrived , you can claim your missing money on your 2020 tax return as a Recovery Rebate Credit. This credit would either increase the size of your total tax refund or lower the amount of taxes you owe.

You’ll file for the Recovery Rebate Credit on the 2020 Form 1040 or Form 1040-SR to claim a catch-up stimulus payment. The IRS will provide a Recovery Rebate Credit Worksheet to help you work out if you’re missing a payment and for how much. We’ve got full instructions on how to file for a Recovery Rebate Credit on your taxes here.

How To Calculate Your Tax Refund

Every year when you file your income taxes, three things can happen. You can learn that you owe the IRS money that the IRS owes you money or that youre about even, having paid the right amount in taxes throughout the year. If the IRS owes you money it will come in the form of a tax refund, while if you owe the IRS money, youll have a bill to pay. Our tax return estimator can help you figure out how much money could be coming your way, or how much youre likely to owe.

Why would the IRS owe you a tax refund? There are several possible scenarios. You might have overpaid your estimated taxes or had too much withheld from your paycheck at work. You might also qualify for so many tax deductions and tax credits that you eliminate your tax liability and are eligible for a refund. A tax return calculator takes all this into account to show you whether you can expect a refund or not, and give you an estimate of how much to expect.

You May Like: Can I Check My Property Taxes Online

When Are Taxes Due

For most years, the deadline to submit your tax return and pay your tax bill is April 15. But for your 2020 taxes, it was pushed back about a month to May 17, 2021 due to the Coronavirus pandemic. Theres currently no such plan in place for the 2021 tax year, for which youll file in early 2022.

If you still cant meet the tax filing deadline for the upcoming year, you can file for an extension. But the sooner you file, the sooner you can receive your tax refund.

About Where’s My Refund

Use Where’s My Refund to check the status of individual income tax returns and amended individual income tax returns you’ve filed within the last year.

Be sure to use the same information used on your return: Social Security Number, Tax Year, and Refund Amount.

If you submitted your return electronically, please allow up to a week for your information to be entered into our system.

Read Also: Where Do I Report 1099 Q On My Tax Return

Get Your Refund Faster: Tell Irs To Direct Deposit Your Refund To One Two Or Three Accounts

Eight out of 10 taxpayers get their refunds by using Direct Deposit. It is simple, safe and secure. This is the same electronic transfer system used to deposit nearly 98 percent of all Social Security and Veterans Affairs benefits into millions of accounts.

Combining direct deposit with electronic filing is the fastest way to receive your refund. IRS issues more than 9 out of 10 refunds in less than 21 days. Taxpayers who used direct deposit for their tax returns also received their economic impact payments quicker. You can track your refund using our Wheres My Refund? tool.

Direct deposit is easy to use. Just select it as your refund method through your tax software and type in the account number and routing number. Or, tell your tax preparer you want direct deposit. You can even use direct deposit if you are one of the few people still filing by paper. Be sure to double check your entry to avoid errors.

Dont have a check available to locate your routing and account number? A routing number identifies the location of the banks branch where you opened your account and most banks list their routing numbers on their websites. Your account number can usually be located by signing into your online banking account or by calling your bank branch.

Direct deposit also saves you money. It costs the nations taxpayers more than $1 for every paper refund check issued, but only a dime for each direct deposit made.

If Youre Worried About Your Tax Bill

If you are worried about how to pay your bill or whether you can afford to pay it, we can help.

We want to work with you to find an affordable way for you to pay the tax you owe, for example paying what you owe in instalments.

Contact us about Self Assessment

- phone: 0300 200 3310

- alternative ways to contact us

You May Like: Do Seniors On Social Security Have To File Taxes

Deduct Child Care Expenses

Childcare has quickly become one of the largest household expenses for young families. Thankfully, the CRA allows you to claim these expenses as a tax deduction on your tax return.

In most cases, childcare expenses must be claimed by the parent with the lower net income.

Basic limit for childcare expenses

- Eligible children born in 2012 or later = $8,000

- Number of eligible children born in 2002 to 2011 = $5,000

Pro tip: In addition to the usual fees from daycares or in-home providers, most overnight camps and summer day camps are also eligible for the childcare deduction.

Are There Any Important Tax Dates To Know

Yes, the following dates are important to keep in mind for tax season.

- Deadline to file and pay your tax bill if you have one is April 18, 2022

- Deadline to file an extended return is October 17, 2022

Click here for a more complete list of important tax dates.

The information in this article is current through tax year 2021.

Recommended Reading: What Does Agi Mean For Taxes

How To Check Income Tax Refund Status

You can check income tax refund status in the following manner:

With Income Tax login

- Visit the income tax official website

- Enter your PAN, password and captcha code to login.

- On the dashboard click on View returns/forms.

- Choose income tax return in the drop-down.

Without Income Tax Login

- Select the assessment year for which you want to check the refund status

- Enter Captcha Code and proceed

Through Tax2win

- Enter your PAN, email address, and select the relevant assessment year

- Enter acknowledgement number if you also want to know the receipt / e -verification status of your ITR

Why Would My Tax Refund Come In The Mail

There are a couple of reasons that your refund would be mailed to you. Your money can only be electronically deposited into a bank account with your name, your spouse’s name or a joint account. If that’s not the reason, you may be getting multiple refund checks, and the IRS can only direct deposit up to three refunds to one account. Additional refunds must be mailed. Also, your bank may reject the deposit and this would be the IRS’ next best way to refund your money quickly.

It’s also important to note that for refunds, direct deposit isn’t always automatic. Some are noticing that like the stimulus checks, the first few payments for the child tax credit were mailed. Just in case, parents should sign in to the IRS portal to check that the agency has their correct banking information. If not, parents can add it for the next payment.

For more information about your money, here’s the latest on federal unemployment benefits and how the child tax credit could affect your taxes in 2022.

Recommended Reading: Can I Pay My Taxes Online

Understanding Your Tax Refund Results

Our tax return calculator will estimate your refund and account for which credits are refundable and which are nonrefundable. Because tax rules change from year to year, your tax refund might change even if your salary and deductions dont change. In other words, you might get different results for the 2020 tax year than you did for 2019. If your income changes or you change something about the way you do your taxes , its a good idea to take another look at our tax return calculator. You can also use our free income tax calculator to figure out your total tax liability.

Using these calculators should provide a close estimate of your expected refund or liability, but it may vary a bit from what you ultimately pay or receive. Doing your taxes through a tax software or an accountant will ultimately be the only way to see your true tax refund and liability.

What To Do Once Your Refund Arrives

For many people, their IRS tax refund is the biggest check they receive all year, the IRS says. In anticipation of your windfall, its wise to have a plan for how youre going to use your windfall. Deciding how to spend, save or invest the money in advance can help stop the shopping impulse from getting the best of you.

Your refund is yours to use how you see fit and can be used to help pay for day-to-day expenses or invested for long-term financial stability.

If youre expecting a refund, put it to good use. Looking for inspiration? Bankrate offers five smart ways to invest your tax refund.

Recommended Reading: How To Get Stimulus Check 2021 Without Filing Taxes

Check Income Tax Refund Status Online Through Income Tax India E

Income Tax Department says : “Checking the online refund status is always good. It’s free and it tells you what’s going on?”

Please Note: Refund Status of income tax return that have been filed this year, must be updated in the Income Tax Department systems. You can check the latest status of tax refund by using this utility. Use the tool & check refund status now!

If you think your friends/network would find this useful, please share it with them We’d really appreciate it.

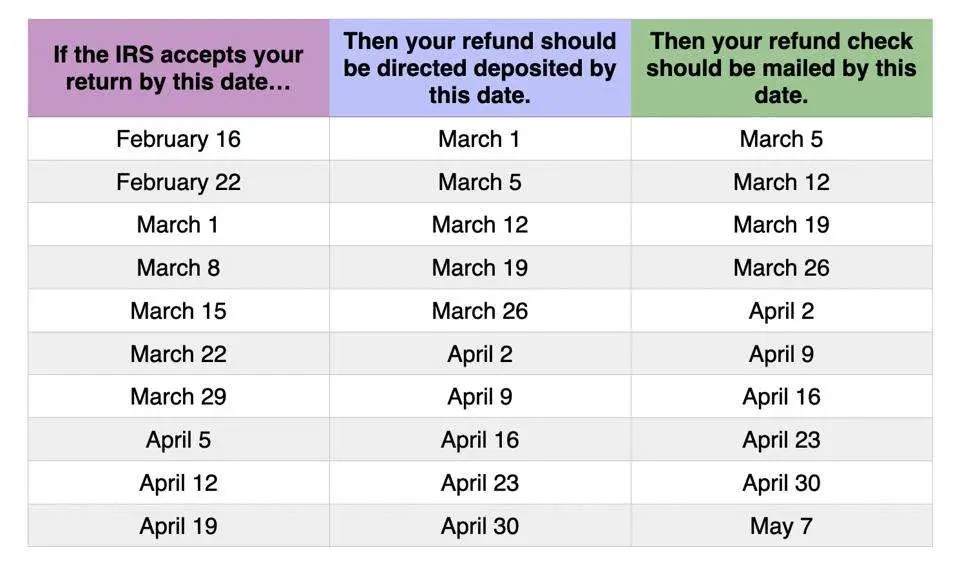

Irs Refund Schedule Chart

Here is a chart of when you can expect your tax refund for when the return was accepted . This is an estimate based on past years trends, but based on early information, does seem accurate for about 90% of taxpayers. Also, as always, you can use the link after the calendar to get your specific refund status.

Now, when to expect my tax refund!

|

2021 IRS Tax Refund Calendar |

||

|---|---|---|

|

Date Accepted |

||

If, for some reason, you didnt receive your return in the time specified above, give or take a few days, you can always use the IRSs tool called Get Refund Status. Since the link requires personal information, here is the non-html version: https://sa2.www4.irs.gov/irfof/lang/en/irfofgetstatus.jsp.

Once you enter all your information, it will tell you what is going on with your refund. Remember, if you input the wrong SSN, it could cause an IRS Error Code 9001, and might make your return be held for Identity Verification.

Also, many people are concerned because they received a Reference Code when checking WMR. Here is a complete list of IRS Reference Codes. Just match up the code with the one in the list, and see what the problem could be. As always, if you are concerned, you can .

Looking for an old IRS refund chart? We saved them for you below.

Prior Years’ Tax Refund Calendars

Recommended Reading: How To Know If My Taxes Were Filed

How Do I Check The Status Of My Refund

The IRS website features a handy web-based tool that lets you check the status of your refund, and there’s also a mobile app, IRS2Go. You can usually access your refund status about 24 hours after e-filing or four weeks after mailing in a return. To check your status, you’ll need to provide your Social Security number or ITIN, filing status and the exact amount of your refund. If your status is “received,” the IRS has your return and is processing it. “Approved” means your refund is on its way.

Read more: What’s your 2020 tax return status? How to track it and your refund money with the IRS