Always Exempt Purchases Exemption Certificate Not Required

The following items are always exempt, so you do not have to give retailers an exemption certificate or any other type of documentation:

- seeds and annual plants, the products of which are commonly recognized as food for humans or animals

- seeds and annual plants usually only raised to be sold in the regular course of business

- cattle, sheep, swine, goats

- chickens, turkeys, ducks, geese, guineas, squabs ostriches, rheas or emus

- horses, ponies, mules and donkeys

- medications, tonics, restoratives or other therapeutic preparations purchased with a prescription from a veterinarian

- water and

- feed for farm animals, ranch animals and wild game, including oats, hay, chicken scratch, wild bird seed and deer corn.

You Must Apply To Receive An Agricultural Assessment

Landowners must file Form RP-305, Agricultural Assessment Application or Form RP-305-r, Agricultural Assessment Application Renewal with the assessor to receive an agricultural assessment for their parcels. Landowners must apply for an agricultural assessment, and the farmland must satisfy certain gross sales and acreage eligibility requirements.

Land Outside An Agricultural District

Land outside an agricultural district may qualify for an agricultural assessment. The requirements and application procedure are the same. However, land located outside of an established agricultural district that receives and agricultural assessment is required to remain in agricultural use for eight years or be subject to a payment for conversion to non-agricultural use.

Read Also: When Is The Deadline To File Your Income Tax

Machinery And Equipment Purchase Or Rental

Exempt when used directly and primarily in agricultural or livestock production:

- Self-propelled implements

- Implements customarily drawn or attached to a self-propelled implement

- Auxiliary attachments which improve the performance, safety, operation, or efficiency of the farm machinery or equipment

Exempt when used in agricultural production and attached to or towed by a self-propelled implement of husbandry:

- Snow blower

- Blade

- Rotary cutter

Certain farm machinery and equipment which is not self-propelled or attached to self-propelled equipment are also exempt from tax.

Exempt when used primarily in agricultural production and attached to or towed by a self-propelled implement of husbandry or any vehicle:

- Diesel fuel trailer

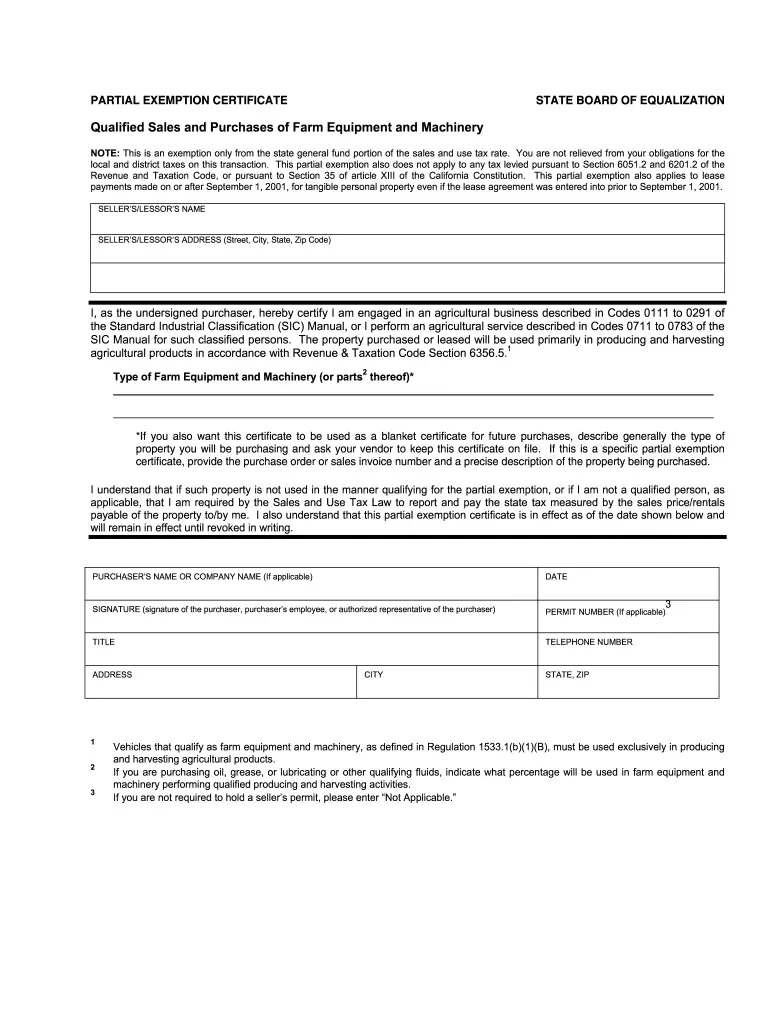

Farm Equipment And Machinery

A partial exemption from the sales and use tax became available under section 6356.5 for the sale, storage, use, or other consumption of farm equipment, machinery and their parts to qualified persons for use in qualifying activities. The partial exemption also applies to leases of certain farm equipment and machinery.

The partial exemption applies only to the state sales and use tax rate portion. The exemption does not apply to any local, city, county, or district taxes. Sales and purchases of farm equipment, machinery and parts will continue to be subject to the remaining portion of the sales and use tax rate consisting of the local, city, county and any applicable district taxes.

Qualified person means:

- Someone engaged in a line of business described in Codes 0111 to 0291 of the Standard Industrial Classification Manual , or

- A person or employee who assists a person engaged in those codes by performing the activities in SIC Codes 0711 to 0783.

The farm equipment, machinery and parts must be used primarily in producing and harvesting agricultural products. “Primarily” means 50% or more of the time.

Farm equipment and machinery means “implements of husbandry” as defined in Revenue and Taxation Code section 411. Qualifying property includes, but is not limited to:

- Agricultural heating and cooling equipment

- Dairy production equipment

- Wind machines

The following criteria will qualify a lease for the partial exemption:

Partial Exemption Certificates

See also:

Also Check: Where Can I Get Taxes Done For Free

Land Included In Agricultural Assessments

Agricultural assessments is limited to land used in agricultural production, defined to include cropland, pasture, orchards, vineyards, sugarbush, support land, and crop acreage either set aside or retired under Federal supply management or soil conservation programs. Up to 50 acres of farm woodland is eligible for an agricultural assessment per eligible tax parcel. Land and water used for aquacultural production are eligible, as is land under a structure within which crops, livestock or livestock products are produced. Land visibly associated with the owner’s residence is ineligible.

Farmland That Is Taken Out Of Agricultural Production

If farmland that has received an agricultural assessment is converted to a nonagricultural use , a payment to recapture the taxes forgone for converting such land will be imposed.

The assessors determines whether a conversion has occurred on the basis of the facts of each case. Conversion is defined as “an outward or affirmative act changing the use of agricultural land.” Non use of the property disqualifies such land from receiving an agricultural assessment, but is not considered a conversion. Similarly, land converted to a nonagricultural use through oil and gas exploration, or extraction activity, or through eminent domain or through the purchase of land or the conveyance of a conservation easement to protect the New York City Watershed, or through other involuntary proceedings would be ineligible for an agricultural assessment but would not be subject to a payment for conversion.

Payments for the conversion of agricultural land to a nonagricultural use are added to the taxes levied upon the land so converted. The property may be subject to a tax sale should such payment remain unpaid. Therefore, these payments generally become the responsibility of the owner of the land at the time of conversion.

90 Day Notice: Whenever a conversion occurs, the landowner shall notify the assessor within 90 days. Failure to notify may result in a penalty of two times the payments owed to a maximum of $1,000.

Also Check: How Much Do I Owe In Property Taxes

Livestock And Domesticated Fowl

Exempt – Livestock

Livestock is domesticated animals to be raised on a farm for food or clothing. The following are examples of livestock that are exempt from tax:

- Sheep

- Bison

- Fish and other animals which are products of aquaculture

* Farm deer includes fallow deer, red deer, elk, sika, whitetail, and mule deer but not free-ranging whitetail or mule deer. Farm deer does not include unmarked free-ranging elk.

Exempt – Domesticated Fowl

Domesticated fowl is fowl raised as a source of food, either meat or eggs. Examples of domesticated fowl are:

- Chickens

- Pigeons

Taxable animals

The following are examples of animals that, even if raised on a farm as a source of food or clothing, are taxable:

- Mink

How Many Acres Is Classified As A Farm

A farm is a tract of land cultivated for the purpose of agricultural production. A farm is classified of having $1,000 or more of agricultural products being produced or sold. A Small Farm, according to USDA census is a farm that is 179 acres or less in size, or earns $50,000 or less in gross income per year.

You May Like: How Much Is Tax In Alabama

Exemption Certificates And Refunds

To make qualifying purchases, other than motor fuel and diesel motor fuel, without paying sales tax, a farmer or commercial horse boarding operator must fill out Form ST-125, Farmers and Commercial Horse Boarding Operators Exemption Certificate, and give it to the seller. See below for special rules for purchases of motor fuel and diesel motor fuel.Any sales tax paid on a purchase that otherwise qualifies for the exemption can be refunded. See Tax Bulletins How to Apply for a Refund of Sales and Use Tax , and Sales Tax Credits .

Ohio Agricultural Sales Tax Exemption Rules

Farmers have been exempt from Ohio sales tax on purchases used for agricultural production for several decades. However, this does not make all purchases by farmers exempt. Currently, Ohio sales tax is charged on all sales of tangible personal property and services unless there is an exception to this tax. Farming is one of the exceptions. Since the majority of exceptions or exemptions from the Ohio sales or use taxes are based on the use of the items or services purchased, it would be difficult for the Department of Taxation to provide a list of taxable and exempt items or services. For a farmer to claim exception or exemption, the farmer must be using the items or services in a manner eligible for the tax exemption.

Also Check: Where Do I Report 1099 Q On My Tax Return

Ways To Get A Small Farm Tax Break

Many successful business people own homes in the country, with significant acreage around them. If youre one of these people, and youre tired of paying big taxes on that extra land, you may want to consider using it for a small farm. On a small farm, you can raise crops or livestock. Here are a few tips to making the most of a small farm on your land.

Before you do anything, make sure your local zoning department allows farming. If youre growing food for you and your family only, you dont have to worry. But once you start selling the food you grow, or livestock you raise, youll need a special business permit and potentially the okay from the health department.

While all 50 states provide tax breaks for agricultural land, their rules are different, depending on where you live and what youre farming. Most states require you put a certain amount of land in use, and some require a certain amount in profits, to show that youre actually in the small farm business.

In order to get the tax breaks, you need to prove to the IRS that your farm is an actual business not a hobby farm. A hobby farm is a farm typically a few horses, other livestock or crops used for leisure and enjoyment.

-

An extensive line of coverage for today’s farm & ranch operations.

Agricultural Buildings Tax Credit

For newly constructed or reconstructed agricultural structures, New York’s Real Property Tax Law allows a ten-year property tax exemption. Application for the exemption must be made within one year after the completion of such construction. The agricultural structures and buildings will be exempt from any increase in the property’s assessed value resulting from the improvement.

Once granted, the exemption continues automatically for ten years. The exemption will terminate before the ten-year period if the building or structure ceases to be used for farming operations, or the building or structure or land is converted to a non-agricultural or non-horticultural use.

Learn more about this opportunity.

Continue

Read Also: When Do We Start Filing Taxes 2021

Finding Out About The Status Of An Application

If a landowner includes a self-addressed, stamped envelope with the application, the assessor must notify the landowner of the approval, modification, or denial of the application. The assessor will inform the applicant at least ten days before the date for hearing assessment complaints which in most towns is the fourth Tuesday in May. If an application is denied, the assessor must also state the reason on the form. For applications approved, the assessor must show how the total assessed value is apportioned between the eligible and ineligible parts of the property for the current year and prior year. A landowner may request the municipal or school tax collector to disclose the dollar value of reduction in tax liability attributable to lands receiving an agricultural assessment.

Minimize Your Property Taxes

As a farmland owner in Ontario, you may be eligible to apply for a property tax reduction through the Farm Property Class Tax Rate Program.

As an eligible applicant under the program:

- Your farm residence and one acre of surrounding land will be taxed at your municipality’s residential tax rate

- The remainder of the farm assessment on the property will be taxed at 25% of the residential tax rate

Farm properties that do not qualify under the program will be taxed at the residential rate.

Farm Property Class Tax Rate Programc/o Agricorp 1 Stone Road West, PO Box 3660, Stn Central Guelph ON N1H 8M4

Don’t Miss: How Do You File An Amendment To Your Tax Return

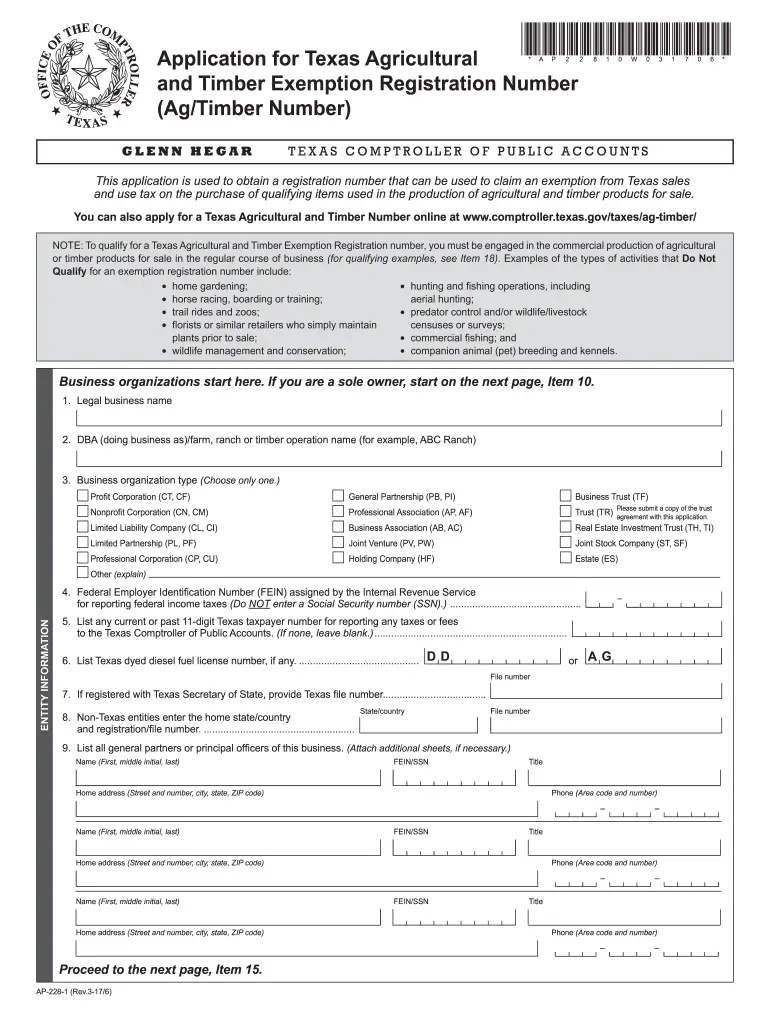

How To Apply For A Texas Agricultural And Timber Registration Number

To claim a tax exemption on qualifying items, you must apply for an agricultural and timber registration number from the Comptroller. You must include the Ag/Timber Number on the agricultural exemption certificate or the timber exemption certificate when buying qualifying items.

Ag/Timber Numbers must be renewed every four years, regardless of when the number was first issued. Renewed and new Ag/Timber Numbers expire Dec. 31, 2023.

You must enter the expiration date on the exemption certificate you give to retailers on your qualifying purchases. If you already have an exemption certificate on file that includes your Ag/Timber Number, you can add the expiration date to the exemption certificate and initial it for the retailers records.

- Basic information about your business

- Social Security number

- If your business is registered with the Texas Secretary of State , your SOS file number

If you dont already have an eSystems/Webfile account with us, you will first register to create a secure online profile. Otherwise, log on as a returning user. The application takes about 10 minutes to complete. No signature is required, and we will issue your Ag/Timber Number at the end of the application process.

You can print the application and mail the paper version to us. Allow three to four weeks for processing time.

Rented Land And Agricultural Assessments

Land rented for agricultural purposes may receive an agricultural assessment. If the rented land satisfies the basic eligibility requirements described above, it is eligible for agricultural assessment. In addition, if the rented land does not satisfy the average gross sales value requirement, but does satisfy the other requirements, it may still be eligible if it is farmed, under a written rental agreement of at least five years, with the other farmland that satisfies all eligibility requirements. The applicant must substantiate the existence of the term of the rental agreement by providing the assessor with either a copy of the lease or Form RP-305-c, Agricultural Assessment Written Lease Affidavit for Rented Land. A start-up farm operation may include rented land.

Don’t Miss: How To Do My Own Taxes On Turbotax

Liquefied Petroleum Gas And Agriculture

Sales of LPG for agricultural use are not taxable when purchased by a qualified buyer and used in commercial crop or livestock production or harvesting.

You should obtain a timely LPG exemption certificate from the qualified buyer and maintain a copy in your records.

Nonagricultural use does not qualify for the exemption, even if used on a ranch or farm.

LPG is considered a use fuel you must have a Vendor Use Fuel Tax Permit to sell this fuel. You can register for this permit online.

How To Claim Exempt Status

Farmers need to obtain either form STEC U or STEC B at tax.ohio.gov/Forms.aspx. The blanket certificate is used when dealing with a vendor where multiple purchases will be made over time while the unit certificate is used for a one time purchase from a vendor. A completed form requires the vendor’s name, the reason claimed for the sales tax exemption, and the purchaser’s name, address, signature, date, and vendor’s number, if the purchaser has one. An example reason for the purposes of completing the form could read “purchases used for agriculture, horticulture, or floriculture production.” It is the buyer’s responsibility to provide the form to the vendor, although many vendors who frequently deal with farmers have blank forms available either in paper copy or electronically.

Don’t Miss: How To File 2016 Taxes

Can You Have An Agricultural Exemption On A Homestead Property In Florida

The answer is yes, you can. In such a case, the residential part of the property with its curtilage will be evaluated differently from the agricultural part of the property. This way the agricultural part of the property wont be covered by the homestead exemption.

However, in every case the benefit of classifying a part of the property as agricultural may not exceed the benefit of covering the entire property with a homestead tax exemption. It is, therefore, advisable to consult an attorney when deciding which exemption to claim.

EPGD Business Law is located in beautiful Coral Gables, West Palm Beach and historic Washington D.C. Call us at , or contact us through the website to schedule a consultation.

*Disclaimer: this blog post is not intended to be legal advice. We highly recommend speaking to an attorney if you have any legal concerns. Contacting us through our website does not establish an attorney-client relationship.*

Agricultural Exemption Farm Machines And Farm Trailers

A farm machine or trailer is exempt from motor vehicle sales and use tax if it is used at least 80 percent of the time in one of the following ways:

- to produce grass, food for people, feed for animals or agricultural products for sale or

Farm machine a self-propelled motor vehicle specifically adapted for, and primarily used to:

- apply plant food, fertilizer and agricultural chemicals in producing crops or

- to distribute livestock feed in raising livestock.

A self-propelled motor vehicle designed or adapted to primarily transport people or agricultural products is not a farm machine.

Farm trailer a trailer or semitrailer designed for and used primarily on a farm or ranch.

The term farm trailer does not include a motor vehicle designed for sleeping, dressing, lounging, restroom use or meal preparation, even if the vehicle is used to transport livestock or agricultural products.

A farm trailer used more than 20 percent of the time to transport livestock or property to and from competitions, shows, rodeos or other similar uses does not qualify for exemption.

Pick-up truck a pick-up truck is taxable, even if it is registered with farm plates.

Don’t Miss: How Do You Find Property Taxes By Address