When A Dependent May Need To File A Tax Return

Taxpayers who are claimed as a dependent on someone’s tax return are subject to different IRS filing requirements, regardless of whether they are children or adults. A tax return is necessary when their earned income is more than their standard deduction.

The standard deduction for single dependents who are under age 65 and not blind is the greater of:

- $1,100 in 2020

- Or the sum of $350 + the person’s earned income, up to the standard deduction for an unclaimed single taxpayer which is $12,400 in 2020.

A dependent’s income can be “unearned” when it comes from sources such as dividends and interest. When a dependent’s unearned income is greater than $1,100 in 2020, the dependent must file a tax return.

Filing As A Dependent

If you are being claimed as a dependent on another tax return, the requirements for filing your own return will change. As a dependent, you cant claim your own standard deduction because that is used by the individual claiming you as a dependent.

Instead, your standard deduction as a dependent in 2020 is either $1,100, or your earned income plus $350 whichever is more. In the latter case, your deduction cannot be greater than the standard deduction for your status.

Consider Your Gross Income Thresholds

Most taxpayers are eligible to take the standard deduction. The standard tax deduction amounts that you’re eligible for are primarily determined by your age and filing status. These amounts are set by the government before the tax filing season and generally increase for inflation each year.

The standard deduction, along with other available deductions, reduces your income to determine how much of your income is taxable. As long as you don’t have a type of income that requires you to file a return for other reasons, like self-employment income, generally you don’t need to file a return as long as your income is less than your standard deduction.

For example, in 2020, you don’t need to file a tax return if all of the following are true for you:

- Under age 65

- Don’t have any special circumstances that require you to file

- Earn less than $12,400

Also Check: Is Plasma Money Taxable

How To Increase A Take Home Paycheck

Salary Increase

The easiest way to achieve a salary increase may be to simply ask for a raise, promotion, or bonus. However, this is assuming that a salary increase is deserved. For instance, an employee is in a legitimate position to ask for a raise or bonus if their performance exceeded original expectations, or if the company’s performance has noticeably improved, due in part to the employee’s input. If internal salary increases are not possible, which is common, try searching for another job. In the current job climate, the highest pay increases during a career generally happen while transitioning from one company to another. For more information about or to do calculations involving salary, please visit the Salary Calculator.

Reevaluate Payroll Deductions

Sometimes, it is possible to find avenues to lower the costs of certain expenses such as life, medical, dental, or long-term disability insurance. For instance, someone who is healthy with no major diseases or injuries can reconsider whether the most expensive top-of-the-line health insurance is necessary. In addition, each spouse’s company may have health insurance coverage for the entire family it would be wise to compare the offerings of each health insurance plan and choose the preferred plan.

Open a Flexible Spending Account

Work Overtime

Cash Out PTO

Temporarily Pause 401 Contributions

What Percentage Of Social Security Is Taxable

If you file as an individual, your Social Security is not taxable only if your total income for the year is below $25,000. Half of it is taxable if your income is between $25,000 and $34,000. If your income is higher than that, up to 85% of your benefits may be taxable.

If you and your spouse file jointly, you’ll owe taxes on half of your benefits if your joint income is between $32,000 and $44,000. If your income is above that, up to 85% is taxable income.

Read Also: Amended Tax Return Online Free

Penalty For Underpayment Of Estimated Tax

If you didnt pay enough tax throughout the year, either through withholding or by making estimated tax payments, you may have to pay a penalty for underpayment of estimated tax. Generally, most taxpayers will avoid this penalty if they owe less than $1,000 in tax after subtracting their withholdings and credits, or if they paid at least 90% of the tax for the current year, or 100% of the tax shown on the return for the prior year, whichever is smaller. There are special rules for farmers, fishermen, and certain higher income taxpayers. Please refer to Publication 505, Tax Withholding and Estimated Tax, for additional information.

However, if your income is received unevenly during the year, you may be able to avoid or lower the penalty by annualizing your income and making unequal payments. Use Form 2210, Underpayment of Estimated Tax by Individuals, Estates, and Trusts , to see if you owe a penalty for underpaying your estimated tax. Please refer to the Form 1040 and 1040-SR Instructions or Form 1120 Instructions , for where to report the estimated tax penalty on your return.

The penalty may also be waived if:

- The failure to make estimated payments was caused by a casualty, disaster, or other unusual circumstance and it would be inequitable to impose the penalty, or

- You retired or became disabled during the tax year for which estimated payments were required to be made or in the preceding tax year, and the underpayment was due to reasonable cause and not willful neglect.

How Do I Get My Tax Refund

Luckily for you, the IRS is very good about getting your tax refund to you.

In fact, you can check out the IRSs Wheres my refund? tool to find the status of your tax refund right now. And according to the IRS, they issue nine out of ten refunds back to the taxpayer within 21 days after they file their taxes.

Ultimately, though, how soon you get your refund back depends on two things:

- How you file your taxes

- How you elect to receive your refund

If you decide to file your taxes through good old fashioned pen and paper, its going to take considerably longer to get your refund back. In fact, youre going to have to wait four to six weeks before youre even able to check your status on their Wheres my refund? tool.

There is another route though: Electronic tax filings.

You receive your tax refund even faster when you file it electronically via platforms like TurboTax or IRS e-file. There you can elect to receive your refund through direct deposit . Its secure, fast, and the same way the government deposits millions of Social Security and Veteran Affairs benefits each year.

When you get your money back, be sure to put it to good use:

So you know how much youre getting back and how to get your money. Now lets get into what you might be getting WRONG about your tax refund.

Don’t Miss: Do You Have To Pay Taxes On Plasma Donations

Does Everyone Need To File An Income Tax Return

OVERVIEW

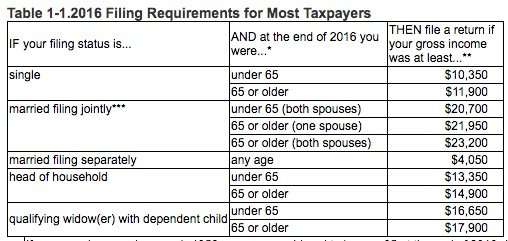

Not everyone is required to file an income tax return each year. Generally, if your total income for the year doesn’t exceed certain thresholds, then you don’t need to file a federal tax return. The amount of income that you can earn before you are required to file a tax return also depends on the type of income, your age and your filing status.

Apple Podcasts | Spotify | iHeartRadio

Is It Against The Law To Get Paid Under The Table

Weve all heard of someone getting paid under the table. Maybe youve known a friend whos received a payment like this, or you have yourself. Regardless, its something youre going to want to rethink immediately.

Getting paid under the table may be against the law. If youre working as a freelancer, its not generally as problematic because the employer isnt required to withhold taxes on your income anyway. But businesses that pay employees under the table can face criminal and civil penalties.

In addition to freelancers, common jobs that sometimes pay under the table are:

- Car sales

Read Also: Have My Taxes Been Accepted

Save The Right Paperwork All Year Long

Stay on top of tax-related paperwork throughout the year it will make your life easier during tax season. You might want to keep receipts for things like charitable donations, work-related expenses and medical bills, or other items from step 4. You may also want to keep statements from student loans or investments and any grants or fellowships. Having these handy and organized can help you determine whether to itemize and make the process easier. You should keep your paperwork after you file, too. The IRS recommends keeping records for at least three years.

Know The Standard Deduction

In general, you DONT need to file a tax return if your income was less than the standard deduction.For 2020, the standard deduction was $12,400 for those filing single. The standard deduction reduces taxable income. For someone making less than the standard deduction, their taxable income would be reduced to below $0.00. Obviously, that means there are no taxes due since there is no income to tax. The standard deduction does vary with filing status:

|

Standard Deduction 2020 Tax Year |

|

|---|---|

|

Single |

|

|

Qualifying Widow |

$24,800 |

For those over 65 years of age, the standard deduction increases depending on your filing status:

|

Over 65 Increase in Standard Deduction 2020 Tax Year |

|

|---|---|

|

Single or HoH |

|

|

$1,300 |

|

|

$2,600 |

Because of the higher standard deduction, someone over 65 can make more than someone less than 65 and still end up paying less in taxes or even no taxes.

For those who are legally blind, the standard deductions are:

|

Legally Blind Increase in Standard Deduction 2020 Tax Year |

|

|---|---|

|

Single or HoH |

|

|

$1,300 |

|

|

$2,600 |

With the standard deduction covered, lets look at filing income thresholds.

You May Like: Where’s My Tax Refund Ga

Keep An Eye On Your Income

You need to file a tax return if you meet or surpass certain levels of income during the year. If youre employed, look at your pay stub for the year to date incomeand if you have more than one job, be sure to add up your income from all your employers. Remember to include income from other sources, too, such as money you make on rental property, anything you sell, investments or interest.

How Much Income Can A Small Business Make Without Paying Taxes

Virtually all businesses have to file a tax return, but whether they actually owe taxes on that return and what kind of taxes depend on several factors.

Tax rates and at least one deduction depend on whether your business is a “pass-through” tax entity. Income and deductions trickle down from these small business structures to be reported by their owners or shareholders on their personal returns something you might want to consider if you’re starting a business for tax purposes. Technically, it’s not the business itself that pays taxes in this case, but taxes are paid all the same.

Pass-through businesses include sole proprietorships, partnerships, LLCs and S corporations. C corporations are separate tax entities subject to their own tax rates.

Also Check: Csl Plasma Taxable

Exceptions To The Tax Slab

One must bear in mind that not all income can be taxed on slab basis. Capital gains income is an exception to this rule. Capital gains are taxed depending on the asset you own and how long youâve had it. The holding period would determine if an asset is long term or short term. The holding period to determine nature of asset also differs for different assets. A quick glance of holding periods, nature of asset and the rate of tax for each of them is given below.

| Type of capital asset | |

|---|---|

| Holding more than 36 months â Long Term Holding less than 36 months â Short Term | 20% Depends on slab rate |

Watch For Your Income Documents To Arrive

You should receive forms about how much income youve earned from your employers and other income sources in January or February. If you are a full-time employee, you will receive a Form W-2 detailing your earnings, as well as which taxes were withheld. If you work freelance or on a contract, you may receive a Form 1099-NEC detailing what you earned. You may also receive documents showing dividends or interest earned on investments , or student loan interest youve paid . If youre a college student , youll receive a Form 1098-T that shows how much you paid in tuition, as well as any amounts you received from grants or fellowships, to help you figure out deductions and credits related to education expenses.

You May Like: How To Correct State Tax Return

Expanded Penalty Waiver Available If 2018 Tax Withholding And Estimated Tax Payments Fell Short Refund Available For Those Who Already Paid 2018 Underpayment Penalty

The IRS lowered to 80 percent the threshold required for certain taxpayers to qualify for estimated tax penalty relief if their federal income tax withholding and estimated tax payments fell short of their total tax liability in 2018. In general, taxpayers must pay at least 90 percent of their tax bill during the year to avoid an underpayment penalty when they file. On January 16, 2019, the IRS lowered the underpayment threshold to 85 percent and on March 22, 2019, the IRS lowered it to 80 percent for tax year 2018.

This additional expanded penalty relief for tax year 2018 means that the IRS is waiving the estimated tax penalty for any taxpayer who paid at least 80 percent of their total tax liability during the year through federal income tax withholding, quarterly estimated tax payments or a combination of the two.

Taxpayers who have not filed yet should file electronically. The tax software was updated and uses the new underpayment threshold and will determine the amount of taxes owed and any penalties or waivers that apply. This penalty relief is also included in the revision of the instructions for Form 2210, Underpayment of Estimated Tax by Individuals, Estates, and Trusts.

How Much Of Your Social Security Income Is Taxable

Social Security payments have been subject to taxation above certain income limits since 1983. No inflation adjustments have been made to those limits since then, so most people who receive Social Security benefits and have other sources of income pay some taxes on the benefits.

No taxpayer, regardless of income, has all of their Social Security benefits taxed. The top-level is 85% of the total benefit. Here’s how the Internal Revenue Service calculates how much is taxable:

- The calculation begins with your adjusted gross income from Social Security and all other sources. That may include wages, self-employed earnings, interest, dividends, required minimum distributions from qualified retirement accounts, and any other taxable income.

- Then, any tax-exempt interest is added.

- If that total exceeds the minimum taxable levels, at least half of your Social Security benefits will be considered taxable income. You then have to take the standard deduction or itemize deductions in order to arrive at your net income.

The amount you owe depends on precisely where that number lands in the federal income tax tables.

Combined income = your adjusted gross income + nontaxable interest + half of your Social Security benefits

Also Check: Pastyeartax Reviews

Every Business Owner Dreads The Infamous Audit

The CRA somehow selects you from tens of thousands of tax returns and decides that itâs going to ask you to prove your income and expenses as declared on your tax return.

âWhile there are many types of audits ranging in severity and depth, the basic concept is the same. You need to show the CRA that what you reported reflects exactly what happened in your business.

âOn the income side, you may have to submit your invoices and bank statements â the CRA will see if your deposits match your invoices. On the expense side, you may have to submit receipts and bank statements â again the CRA will see if your expenses were actually incurred and evaluate if they relate to the business.

âStill, the concept of the audit may have you wondering: What if I have a cash business? If nothing moves through my bank account, how can they find out what I earned? Surely anybody can just make up an invoice or write up a receipt?

âThis is where the concept of reasonability comes in. The CRA has a number of controls in place to assess whether the amounts that you reported are reasonable relative to your business/industry.

âOf course there is no set criteria to determine if your income and expenses are completely reasonable from the CRAâs perspective. So will you be caught if you skim a little off the top? Will that $5,000 that you reduced from your earnings raise a red flag?

When Social Security Is Not Taxable

You won’t owe federal tax on your Social Security benefits if your total income falls below the taxable thresholds set by the IRS.

You won’t owe state taxes on your benefits if you live in any of the 37 states that don’t tax this income. You can minimize the tax burden by adopting one of the strategies below.

Also Check: How Much Does H& r Block Charge To Do Taxes