Taxpayers Are Asking Irs: Where Is My Refund And Where Is My Stimulus Payment

Many taxpayers are still waiting for their tax refunds or stimulus checks, while the IRS works … through a backlog of tax returns.

getty

Ive received a number of letters from readers of this forbes.com column asking for help with both tax refunds and stimulus payments. They want to know, whats going on? I have some answers, but, unfortunately, no advice to each reader, as each delay could be situational, that is, unique to the person experiencing the delay.

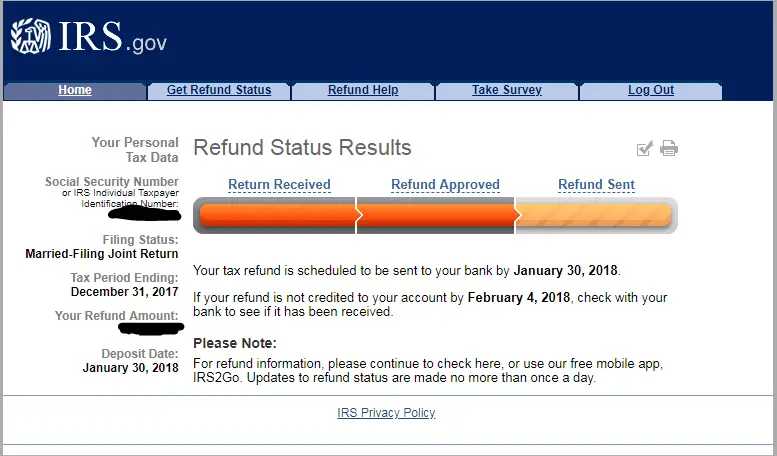

What Is Happening When Wheres My Refund Shows My Refunds Status As Approved

Weve approved your refund. We are preparing to send your refund to your bank or directly to you in the mail. This status will tell you when we will send the refund to your bank . Please wait 5 days after weve sent the refund to check with your bank about your refund, since banks vary in how and when they credit funds.

How Quickly Will I Get My Refund

We issue most refunds in less than 21 calendar days.

It is taking the IRS more than 21 days to issue refunds for some 2020 tax returns that require review including incorrect Recovery Rebate Credit amounts, or that used 2019 income to figure the Earned Income Tax Credit and Additional Child Tax Credit .

Also Check: When Do We Start Filing Taxes 2021

One More Thing To Know About Your Tax Refund

It’s actually something you kind of want to avoid. It may seem great to get a big check from the government, but all a tax refund tells you is that you’ve been overpaying your taxes all year and needlessly living on less of your paycheck the whole time.

For example, if you got a $3,000 tax refund, you’ve been giving up $250 a month all year. Could having an extra $250 every month have helped with the bills? If you want to get that money now rather than later, you can adjust your withholdings by giving your employer a new IRS Form W-4 .

How To Track Your Federal Tax Refund If It Hasn’t Arrived Yet

If you just filed recently, you should know your federal tax refund check could take up to 120 days to arrive. Here’s what else we found.

If you see “IRS TREAS 310” on your bank statement, it could be your income tax refund.

Whether you’ve already filed your taxes or you’re planning to do so by the final due date — that’s Oct. 15 if you file a tax extension — you’ll need to know how to track your refund. Be aware that the IRS is still facing a backlog of unprocessed individual returns, 2020 returns with errors and amended returns that require corrections or special handling. And while refunds typically take around 21 days to process, the IRS says delays could be up to 120 days.

The tax agency is also juggling stimulus checks, child tax credit payment problems and refunds for tax overpayment on unemployment benefits. The money could give families some financial relief but an overdue tax refund could also be a big help. If you don’t file your 2020 tax return soon, you’ll likely owe late fees or more interest — and you could be missing out on your tax refund, stimulus checks or child tax credit payments, which you may only be eligible for with your 2020 tax return.

You May Like: Do You Have To Pay Taxes On Plasma Donations

What Should You Do

While you can always call the IRS for help , try this first.

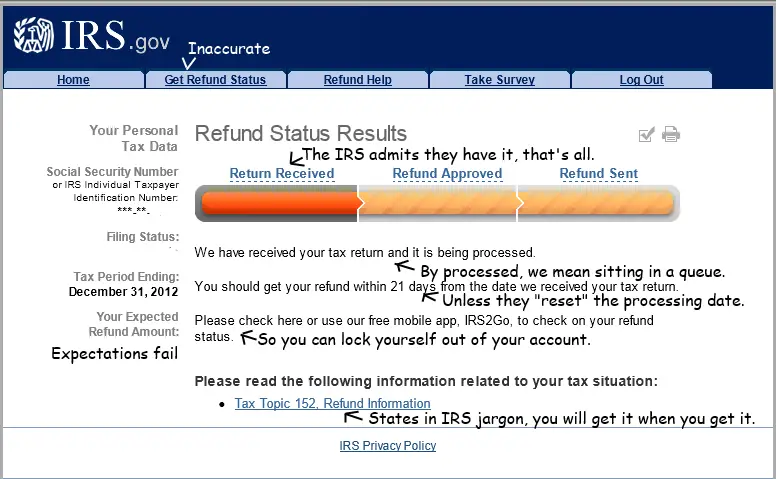

Go to Wheres My Refund? on IRS.gov. Click on the Check My Refund Status blue box, then enter your Social Security number or ITIN , your filing status and the exact refund amount that was on your tax return. The tool has a tracker that shows three stages: Return Received Refund Approved and Refund Sent.

That site is updated once a day, typically overnight, according to the IRS spokesperson.

When Should I File A Payment Trace For My Missing Money

The IRS also offers a payment trace as a way to find your funds, including from missing stimulus checks. You can request a trace — which means filing an inquiry into the location of your IRS money — by mailing or faxing Form 3911 to the tax agency. Even if the IRS says you’re ineligible for advance payments, it’s best to submit a payment trace in case there’s a portal error.

Your payment will be traceable if it has been at least five days since the deposit date and the bank hasn’t received the money, four weeks since the check was mailed or six weeks if it was mailed to a forwarded address listed by USPS. If the check was mailed to a foreign address, you can ask for a payment trace after nine weeks.

Read Also: Harris County Property Tax Protest Services

How Do I Use The Where’s My Refund Tool To Check The Status Of My Tax Refund

To check the status of your 2020 income tax refund using the IRS tracker tools, you’ll need to give some information: your Social Security number or Individual Taxpayer Identification Number, filing status — single, married or head of household — and your refund amount in whole dollars . Also, make sure it’s been at least 24 hours before you start tracking your refund.

Using the IRS tool Where’s My Refund, go to the Get Refund Status page, enter your SSN or ITIN, filing status and exact refund amount, then press Submit. If you entered your information correctly, you’ll be taken to a page that shows your refund status. If not, you may be asked to verify your personal tax data and try again. If all the information looks correct, you’ll need to enter the date you filed your taxes, along with whether you filed electronically or on paper.

The IRS also has a mobile app called IRS2Go that checks your tax refund status — it’s available in English and Spanish. You’ll be able to see if your return has been received, approved and sent. In order to log in, you’ll need some information — your Social Security number, filing status and expected refund amount. The IRS updates the data in this tool overnight, so if you don’t see a status change after 24 hours or more, check back the following day. Once your return and refund are approved, you’ll receive a personalized date by which to expect your money.

You can check on your refund through the IRS2Go mobile app.

Why Is There Still An Irs Backlog

Because of the pandemic, the IRS ran at restricted capacity in 2020, which put a strain on its ability to process tax returns and created a backlog. The combination of the shutdown, three rounds of stimulus payments, challenges with paper-filed returns and the tasks related to implementing new tax laws and credits created a “perfect storm,” according to a National Taxpayer Advocate review of the 2021 filing season to Congress.

The IRS is open again and currently processing mail, tax returns, payments, refunds and correspondence, but limited resources continue to cause delays. The IRS said it’s also taking more time for 2020 tax returns that need review, such as determining recovery rebate credit amounts for the first and second stimulus checks — or figuring out earned income tax credit and additional child tax credit amounts.

Here’s a list of reasons your income tax refund might be delayed:

- Your tax return has errors.

- It’s incomplete.

- Your refund is suspected of identity theft or fraud.

- You filed for the earned income tax credit or additional child tax credit.

- Your return needs further review.

- Your return includes Form 8379 , injured spouse allocation — this could take up to 14 weeks to process.

Don’t Miss: How Do I Protest My Property Taxes In Harris County

What If I’m Still Waiting For A Payment To Arrive

If you’re missing money from one of the previous checks due to an IRS error or outdated information, it may arrive with your December payment. But if it doesn’t, you can either wait for the issue to be resolved when you file your taxes or you can file a payment trace with the IRS. Before you do that, track your check to make sure it’s not already on the way.

Note that if you gained a dependent since you last filed taxes, the IRS wouldn’t have that information on file. If that’s your case, you won’t get any money until you file your taxes next year.

How The Treasury Offset Program Works

Here’s how the Treasury Offset Program works:

If you owe more money than the payment you were going to receive, then BFS will send the entire amount to the other government agency. If you owe less, BFS will send the agency the amount you owed, and then send you the remaining balance.

Here’s an example: you were going to receive a $1,500 federal tax refund. But you are delinquent on a student loan and have $1,000 outstanding. BFS will deduct $1,000 from your tax refund and send it to the correct government agency. It will also send you a notice of its action, along with the remaining $500 that was due to you as a tax refund.

The Internal Revenue Service can help you understand more about tax refund offsets.

Don’t Miss: Buying Tax Liens California

Will The Payments I Received This Year Affect My Taxes Next Year

The child tax credit payments you got this year could potentially affect your taxes . Here’s how:

- You received an overpayment and the IRS didn’t adjust the amount on later payments. You’ll have to pay this back.

- You received payments you didn’t qualify for. You’ll have to pay the IRS back.

- Your income changed, and you didn’t report it to the IRS. This could result in a larger or smaller tax refund or you owing the IRS, depending on if your income was higher or lower than what the IRS used to calculate your payment.

- You opted out of the payments this year, so your payout will be larger next year.

- You received money for a child that’ll turn 18 by the end of 2021. You may have to pay that money back.

Your taxes could be affected by the child tax credit payments.

Who Qualifies For Advance Payments

To qualify for advance payments of the Child Tax Credit, you must have:

- Filed a 2019 or 2020 tax return and claimed the Child Tax Credit on the return or

- Given us your information in 2020 to receive the Economic Impact Payment with the Non-Filers: Enter Payment Info Here tool or

- Given us your information in 2021 with the Non-Filer: Submit Your Information tool and

- Lived in a main home in the United States for more than half the year or filed a joint return with a spouse who has a main home in the United States for more than half the year and

- A qualifying child who is under age 18 at the end of 2021 and who has a valid Social Security number and

- Made less than certain income limits.

Also Check: Where Is My State Refund Ga

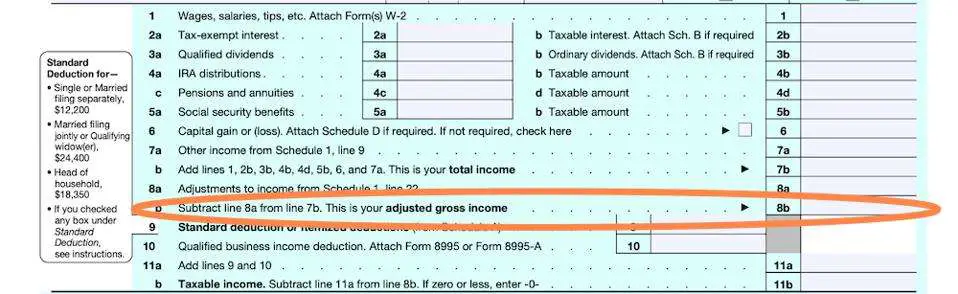

Why Is My Refund Different Than The Amount On The Tax Return I Filed

All or part of your refund may have been used to pay off past-due federal tax, state income tax, state unemployment compensation debts, child support, spousal support, or other federal nontax debts, such as student loans. To find out if you may have an offset or if you have questions about an offset, contact the agency to which you owe the debt.

We also may have changed your refund amount because we made changes to your tax return. This may include corrections to any incorrect Recovery Rebate Credit amount. Youll get a notice explaining the changes. Wheres My Refund? will reflect the reasons for the refund offset when it relates to a change in your tax return.

Tax Topic 203, Refund Offsets for Unpaid Child Support, Certain Federal and State Debts, and Unemployment Compensation Debts has more information about refund offsets.

How To Get The Refund

If you are owed money and you’ve filed a tax return, the IRS will send you the money or use it to pay off other owed taxes automatically.

You typically don’t need to file an amended return in order to get this potential refund.

Instead, the IRS will adjust the tax return you’ve already submitted.

However, if you haven’t yet filed your tax return, you should report this reduction in unemployment income on your Form 1040.

The deadline to file your federal tax return was on May 17.

Don’t Miss: How To Correct State Tax Return

Your Refund Was Sent To The Wrong Bank

Filing your return electronically is the fastest way to get your refund, especially if youre using direct deposit. That assumes, however, that you plugged in the right numbers for your bank account. If you transposed a digit in the routing or account number, your money could be sent to someone else’s account.

If your refund ends up in someone else’s bank account, you’ll have to work with the bank directly to get it back. The IRS says it can’tand won’tcompel the bank to return your money to you.

Kokua Line: How Can I Find Out If The Irs Received The Tax Return I Mailed Months Ago

Question: I mailed my federal income tax return on April 14 for the 2020 tax year and have checked the IRS website and cant find if the IRS received my tax return. I know if you mail it takes longer, but you would think at least they have a record even though not processed? It has been 11 weeks and I am wondering if there is a phone number to call to see if they have my tax return or do I have to file again?

Answer: There is a phone number, but you have a slim chance of getting through as the Internal Revenue Service struggles with an unprecedented backlog of 35 million individual and business income tax returns. The backlog includes about 16.8 million paper tax returns waiting to be processed about 15.8 million returns suspended during processing that require further review and about 2.7 million amended returns awaiting processing, according to a report Wednesday to Congress by the National Taxpayer Advocate .

IRS staff were overwhelmed by a huge number of phone calls 167 million during the 2021 filing season. Only 3 percent of callers reached live assistance on the 1040 line, the most frequently called IRS toll-free number, the report said.

The IRS says it is taking longer than usual to process mailed documents, including paper tax returns and all tax-return-related correspondence. We are processing all mail in the order we received it. Do not file a second return or call the IRS, the agency says on its website.

So what can you and others in the same boat do?

Don’t Miss: How To Buy Tax Lien Properties In California

Can I Look Up My Old Tax Returns Online

Online Using Get Transcript. They can use Get Transcript Online on IRS.gov to view, print or download a copy of all transcript types. Those who use it must authenticate their identity using the Secure Access process. Taxpayers can complete and send either Form 4506-T or Form 4506T-EZ to the IRS to get one by mail.

Will I Get Advance Child Tax Credit Payments Again Next Summer

There’s a debate ongoing in Congress to determine if the enhanced child tax credit payments should be extended past spring in 2022 — and if so, for how long? House Democrats on Nov. 19 passed the $1.75 trillion Build Back Better program that would extend the enhanced child tax credit for an additional year. However, at the moment it’s unclear what the outcome will be as the Senate now takes up the bill.

While Congress should come to an agreement on extending the payments this year, it’s possible the House and Senate won’t decide until 2022.

Also Check: Www.1040paytax.com Official Site

How You File Affects When You Get Your Refund

The Canada Revenue Agency’s goal is to send your refund within:

- 2 weeks, when you file online

- 8 weeks when you file a paper return

These timelines are only valid for returns we received on or before their due dates.

Returns may take up to 16 weeks if you live outside Canada and file a non-resident personal income tax return.

We may take longer to process your return if we select it for a more detailed review. See Review of your tax return by CRA for more information.

If you use direct deposit, you could get your refund faster.

Child Tax Credit: Missing A Payment Here’s How To Track It

If you’re looking for your November child tax credit check or one from the previous months, we’ll tell you how to trace it.

If you haven’t received your child tax credit check, it could be late.

Five child tax credit payments have been disbursed this year, with one left to go. However, if you haven’t received any checks yet or if you’re missing money from one of the other months, know that several glitches have caused child tax credit problems for parents each month. Don’t fret — we’ll help you figure out what’s going on.

We found that if only one parent in a married household made a correction to banking info or a mailing address, it could have reduced the amount of the payment. Also, parents might have received more money than they qualify for due to outdated tax information from old returns, and inaccurate payment amounts could affect their taxes in 2022.

We’re here to help you figure out how to review your payment history online using the IRS Update Portal and file a payment trace if a few weeks have passed and there’s no sign of your money. Here’s what you need to know if you plan to opt out of the final monthly check before the next deadline, Nov. 29 . Also, here’s the latest on the child tax credit extension. We’ve updated this story.

Recommended Reading: How To Buy Tax Lien Certificates In California