Who Should File A 1040 Tax Form

If you receive these types of income or losses, you may need to file a 1040 tax form:

- Self-employment income of $400 or more

- Income you receive as one of these:

- Partner in a partnership

- Beneficiary of an estate or trust

You must file a Form 1040 if you have any of these:

- Tips you didnt report to your employer.

- Youre eligible for the premium tax credit.

- Your employer didnt withhold Social Security and Medicare taxes from your pay.

- Youre repaying the first-time homebuyer credit.

- You have a foreign account.

- You received distributions from a foreign trust.

- You qualify for the foreign earned income exclusion.

- You qualify to exclude income from sources in Puerto Rico or American Samoa since you were a bona fide resident of either.

Closing Of Individual Po Box Addresses Could Affect Your Clients

Effective January 1, 2022, certain Post Office Boxes will be closed in Hartford, CT and San Francisco, CA. If you have pre-printed mailing labels for one of these payment addresses, destroy them now. To avoid delays, use the current address shown below. IRS encourages the use of electronic payment options available on IRS.gov.

Is Form 1040 The Correct Tax Return Form For Me

For most taxpayers, 1040 is the appropriate tax filing form to use. However, if any of the following situations apply to you, the 1040 tax form may be the wrong form or require additional forms:

About the Author

Jo Willetts, Director of Tax Resources at Jackson Hewitt, has more than 25 years of experience in the tax industry. As an Enrolled Agent, Jo has attained the highest level of certification for a tax professional. She began her career at Jackson Hewitt as a Tax Pro, working her way up to General Manager of a franchise store. In her current role, Jo provides expert knowledge company-wide to ensure that tax information distributed through all Jackson Hewitt channels is current and accurate.

Read Also: Form 1040 State Tax Refund

What Are The Most Recent Changes To Form 1040

The biggest change to Federal Form 1040 is that a new Line 30 has been added for the Recovery Rebate Credit. This is for taxpayers who didn’t receive payments or could have received a larger payment from the government when economic impact payments went out in 2020. These taxpayers can claim that amount as a refundable credit here.

Additionally, the “Amount You Owe” section of Form 1040, will now state: “Schedule H and Schedule SE filers, line 37 may not represent all of the taxes you owe for 2020.” This means that since employers were allowed to defer payments of the employer’s share of social security tax due to the CARES Act, this deferred amount will be reported in the payments section of Form 1040, Schedule 3, Line 12e. It will be entered as a “Deferral for certain Schedule H or SE filers.”

Another change to Form 1040 is that there are now three lines to report withholdings. On Form 1040, Line 25a will be for W-2 withholdings, Line 25b will be for 1099 withholdings, and Line 25c will be for other withholdings.

There is also a new deduction for charitable cash contributions of up to $300. These will be reported on Schedule A, Line 10b for taxpayers taking the standard deduction.

Finally, there is a new credit for sick and family leave for certain self-employed individuals. This credit will be entered on Schedule 3, Line 12b and will be calculated on Form 7202.

Irs Introduces New Form 1040

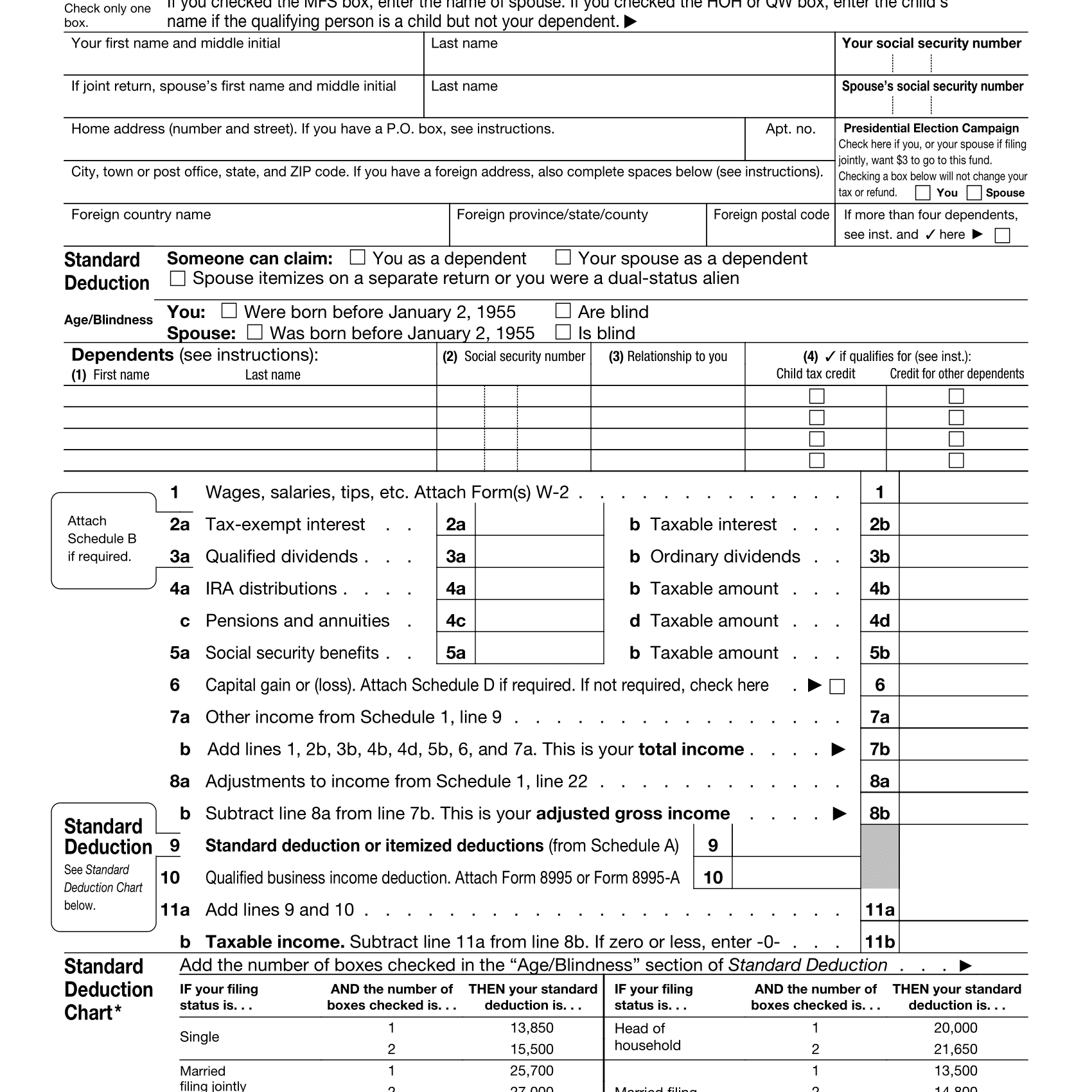

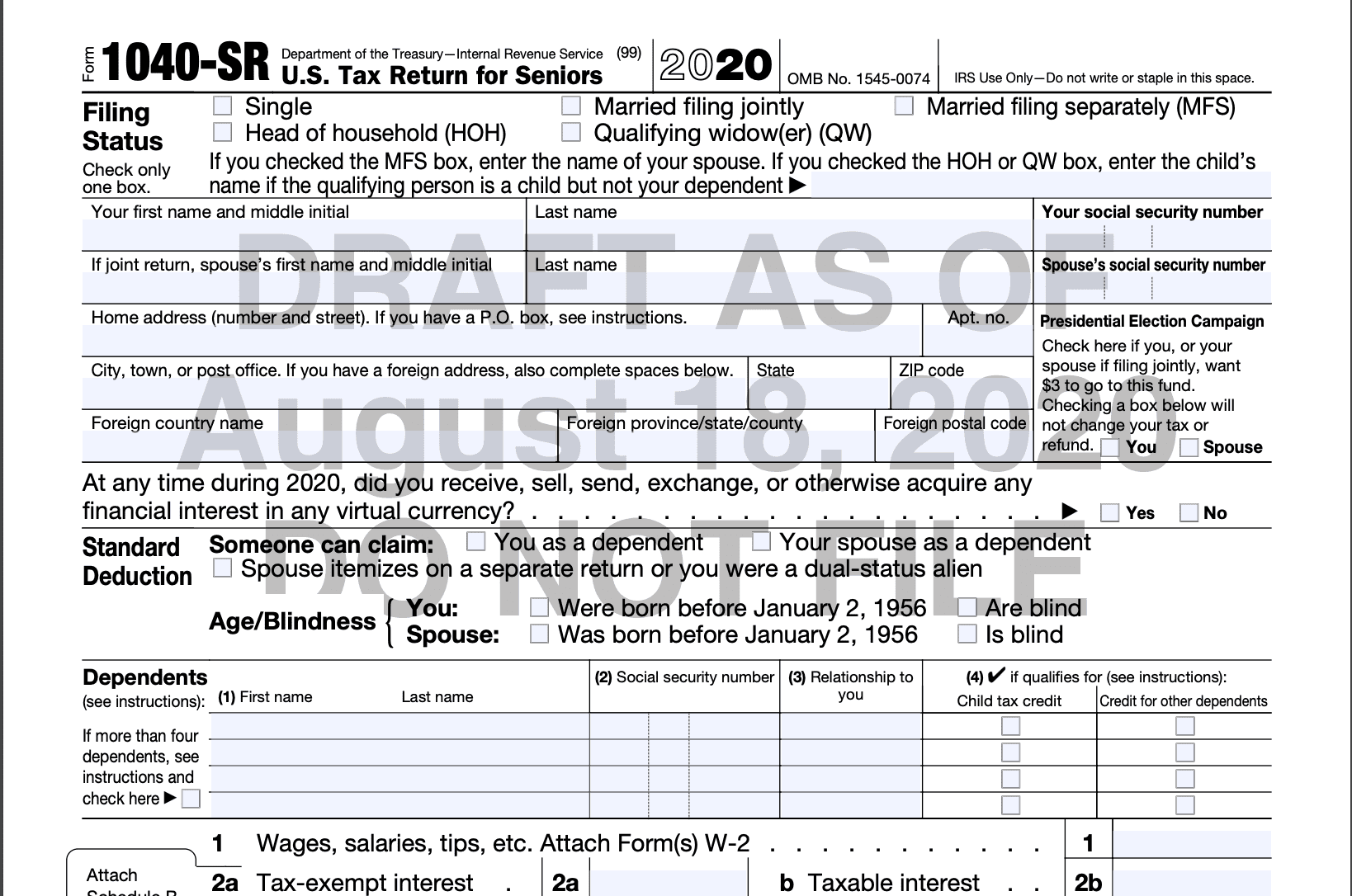

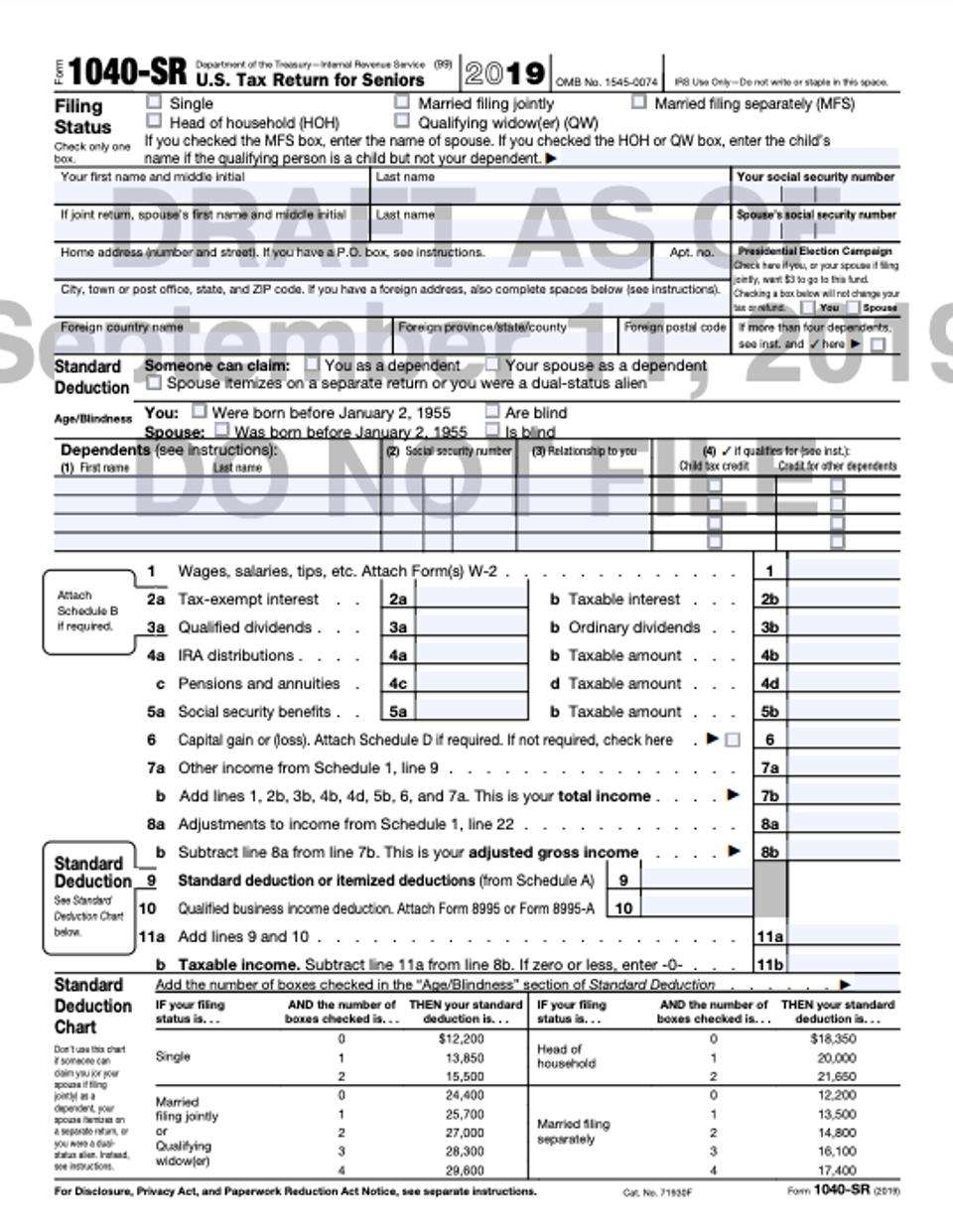

The new form features larger text and a standard deduction chart, with the goal of making it easier for over 65s to read and understand

The IRS has introduced a re-designed version of Form 1040 which has been altered to make it easier to read and use for those aged 65 or over.

The new form, named 1040-SR, has been introduced as a requirement of the Bipartisan Budget Act of 2018, which demanded that the IRS offer a form which is designed specifically for seniors. US Taxpayers who are 65 or over are eligible to use the new form to file their 2019 Tax Returns, which are due on April 15 . The new form features a larger font and a standard deduction chart, but according to the Tax Advocacy Panel , both the new 1040-SR and the existing 1040 forms “use the same “building block” approach introduced last year that can be supplemented with additional Schedules 1, 2 and 3 as needed”.

TAP also explain that:

– “Taxpayers born before January 2, 1955, have the option to file Form 1040-SR whether they are working, not working or retired. The form allows income reporting from other sources common to seniors such as investment income, Social Security and distributions from qualified retirement plans, annuities or similar deferred-payment arrangements.

– “Seniors can use Form 1040-SR to file their 2019 federal income tax return, which is due April 15, 2020. All lines and checkboxes on Form 1040-SR mirror the Form 1040, and both forms use all the same attached schedules and forms.”

Don’t Miss: How To Correct State Tax Return

What Is Form 1040

If you are 65 or older you have the option of using Form 1040-SR: U.S. Tax Return for Seniors rather than the standard Form 1040 when you file your taxes in April. It is virtually identical to Form 1040 except that it has larger type and gives greater prominence to the senior-specific tax benefits.

Form 1040 and Form 1040-SR are now the standard forms used by taxpayers, whether or not they itemize deductions. Form 1040 was revised and simplified and Form 1040-SR was introduced with the Bipartisan Budget Act of 2018.

That act also abolished Form 1040-EZ, which was designed for taxpayers with uncomplicated tax situations, and Form 1040A, which was confusingly similar to the old Form 1040.

Which 1040 Form To Use For Your Taxes

Thankfully, now that the IRS has consolidated the 1040 form, you need only one to use for your taxes. However, depending on your filing status, you might be required to fill out additional schedules if you meet certain criteria.

Many people will only need to file Form 1040 and no schedules, according to the IRS. Consult the following table to see if youll need additional forms:

|

Tax Schedules to Use in Addition to Form 1040 |

|

Schedule |

Check Out:Every Document You Need to Defend Yourself During an Audit

Recommended Reading: Do You Have To Pay Taxes On Plasma Donations

What Is The Purpose Of A 1040 Form

Taxpayers use the federal 1040 form to calculate their taxable income and tax on that income. One of the first steps is to calculate Adjusted Gross Income by first reporting your total income and then claiming any allowable adjustments, also known as above-the-line deductions. Your AGI is an important number since many deduction limitations are affected by it.

On line 11 of the tax year 2020 Form 1040, you will report your AGI. You can reduce it further with either the standard deduction or the total of your itemized deductions reported on Schedule A. Itemized deductions include expenses such as:

- mortgage interest,

- state and local income taxes or sales taxes,

- charitable contributions, and

- excess medical expenses.

If the total of your itemized deductions does not exceed the standard deduction for your filing status, then your taxable income will usually be lower if you claim the standard deduction. Beginning in 2018, exemption deductions are replaced with higher child tax credits and a new other-dependent tax credit.

TurboTax will do this calculation for you and recommend whether choosing the standard deduction or itemizing will give you the best results.

More 1040 Tax Form Help

Want more 1040 tax form guidance? View H& R Blocks tax filing options to fit with your unique tax situation.

Whether you make an appointment with one of our knowledgeable tax pros or choose one of our online tax filing products, you can count on H& R Block to help you complete your Form 1040.

Related Topics

Learn more about letter 852C, why you received it, and how to handle an IRS bill for unpaid tax with help from the tax experts at H& R Block.

Don’t Miss: How To Buy Tax Lien Properties In California

Question About Virtual Currency Transactions

Form 1040-SR asks the cryptocurrency question: “At any time during 2021, did you receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency?” The IRS is trying to make sure virtual currency transactions, such as Bitcoin purchases, are being reported. Their goal is to collect the taxes due on these transactions by requiring you to disclose if you made any transactions.

Altered Wording For The Tax You Owe With Your Return

Line 37 usually details the amount of tax you owe for the year. This year’s Form 1040-SR states this is the amount you owe now. Certain taxes may be deferred under coronavirus relief, so the line item was updated to explain this is the amount you must pay with your return and that you may still owe additional tax from your 2020 return in future years due to tax deferrals.

Remember, with TurboTax, we’ll ask you simple questions about your life and help you fill out all the right tax forms. With TurboTax you can be confident your taxes are done right, from simple to complex tax returns, no matter what your situation.

You May Like: Have My Taxes Been Accepted

Get More With These Free Tax Calculators And Money

-

See if you qualify for a third stimulus check and how much you can expect

-

Know what dependents credits and deductions

-

Know what tax documents you’ll need upfront

-

Learn what education credits and deductions you qualify for and claim them on your tax returnGet started

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Who Can File Using Form 1040

Anyone age 65 or older can opt to use Form 1040-SR instead of Form 1040. There aren’t any other caveats that come with using this form. For example, you are not forced to take the standard deduction if you choose to file with Form 1040-SR.

Since these forms are virtually identical in function, the main reason to use Form 1040-SR is if you’re filling out your tax return by hand rather than online. Form 1040-SR has larger type and larger boxes to write numbers in, making it slightly easier for seniors to read and fill out.

Recommended Reading: How Do I Protest My Property Taxes In Harris County

A New Tax Form Targets A Specific Audience

One of the biggest changes that taxpayers faced last year as a result of tax reform was a new 1040 tax form. The IRS eliminated the popular 1040-EZ and 1040A short forms, requiring everyone to use the full revised Form 1040. Last year’s 1040s offered a primary return page that was short and chock-full of information, but many found the numerous schedules and attachments difficult to follow.

Now, the IRS is bringing a new option to a key group of taxpayers. Seniors 65 or older will have the opportunity to file on a brand new tax form, Form 1040-SR, which more closely resembles the old short-form returns from before new tax laws took effect. Below, we’ll look at the form and the requirements for using it.

How To Fill Out 1040

If you have any business you need to provide the IRS with your additional income information. To do that, you need to input your personal data first. The form comprises four pages including a standard deduction chart, which is a kind of a reminder to facilitate calculations.

The 1040-SR form is a very simple one to fill out as there are many tips there on how to make exact calculations and what to input in a particular line. The characters and lines are bigger in 1040-SR to allow seniors to deal with it.

Also Check: Www.1040paytax.com Official Site

New Form 1040 Instructions

Here are the new 1040 form instructions as of 2019 from the IRS:

You will use the redesigned Form 1040, which now has three new numbered schedules in addition to the existing schedules such as Schedule A. Many people will only need to use Form 1040 and none of the new numbered schedules. However, if your return is more complicated , you will need to complete one or more of the new numbered schedules. Below is a general guide to which schedule you will need to use based on your circumstances. See the 1040 instructions for the schedules for more information. If you e-file your return, you generally wont notice much of a change and the software will generally determine which schedules you need.

Why Would I File A Form 1040 Instead Of 1040a Or 1040ez

As of 2018, Forms 1040A and 1040EZ are no longer available although you can still use them to file tax returns for prior years. The shortening of the 1040 tax form through the 2017 tax reform caused these forms to become redundant.

The chief purpose of Form 1040-SR is to help seniors by providing a form with larger print. Form 1040-SR is the same as the Form 1040, only with larger print and the full standard deduction table, which includes additional amounts for taxpayers 65 or older or who are blind.

You May Like: How Much Does H& r Block Charge For Doing Taxes

Irs Form 1040 Instructions: How To Fill Out A 1040

The IRS own guidelines on filling out a 1040 form span more than 110 pages. Not every bit of information applies to every taxpayer, especially if youre a single, employed filer. Similarly, not all lines apply to all taxpayers: What figures you enter depends on what forms you receive, which depend on what sort of income you earn, investments you have, dependents you can claim, etc.

GOBankingRates line-by-line breakdown will help the process seem less daunting:

Heres When to Expect That Check:When Will You Get Your Tax Refund?

Items That Can Be Reported On A Form 1040

Since Form 1040-SR is functionally the same as Form 1040, you can report all the same types of income, deductions, credits, and other items that you can on Form 1040. This includes items such as:

- Wages, salaries, tips, taxable scholarships, and taxable fellowship grants

- Tax-exempt interest

- IRA distributions and their taxable amounts

- Pensions and annuities and their taxable amounts

- Social Security benefits and their taxable amounts

- Total capital gains or losses

- Other income from Schedule 1, including unemployment compensation

- Adjustments to income from Schedule 1

- Above-the-line charitable contributions deduction

- Total standard deduction or itemized deductions

- Qualified business income deduction

- Certain figures from Schedule 2 and Schedule 3

- Child tax credit or credit for other dependents

- Other taxes, including self-employment tax

- Federal income tax withheld from Form W-2, Form 1099, and other forms

- Estimated tax payments and amount applied from the previous year’s return

- Earned income credit

- Refund amount or amount owed now

- Estimated tax penalty

You can also use other IRS schedules with Form 1040-SR, such as Schedules 1, 2, and 3, to report information not directly reported on Form 1040-SR.

Don’t Miss: Taxes For Doordash

What Is The Purpose Of A 1040 Tax Form

Form 1040 is the standard federal income tax form people use to report income to the IRS, claim tax deductions and credits, and calculate their tax refund or tax bill for the year. The formal name of the form 1040 is “U.S. Individual Income Tax Return.”

There used to be three varieties that covered simple to complex tax situations. Now theres just form 1040 and 1040-SR.

Page 1 of form 1040

Here’s what the 1040 form does:

-

Asks who you are: The top of form 1040 gathers basic information about who you are, what tax filing status you’re going to use, and how many tax dependents you have.

-

Calculates taxable income: Next, form 1040 gets busy tallying all of your income for the year and all the deductions you’d like to claim. The objective is to calculate your taxable income, which is the amount of your income that’s subject to income tax. You consult the federal tax brackets to do that math.

-

Calculates your tax liability: Near the bottom of form 1040, you’ll write down how much income tax you’re responsible for. At that point, you get to subtract any tax credits that you might qualify for, as well as any taxes you’ve already paid via withholding taxes on your paychecks during the year.

-

Determines whether you’ve already paid some or all of your tax bill: Form 1040 also helps you calculate whether those tax credits and withholding taxes cover the bill. If they don’t, you may need to pay the rest when you file your form 1040. If you’ve paid too much, you’ll get a tax refund.

Who Can Use Form 1040

Seniors 65 and older dont have to be retired to use the new form, said Nicholas Yrizarry, CEO of Align Wealth Advisors in Laguna Hills, CA.

As long as you meet the age requirement, you can still earn money and use Form 1040-SR.

If youre below the age threshold, youll have to fill out the regular 1040, even if youve retired early, noted Elijah Kovar, partner and lead advisor with Minnesota-based retirement planning firm Great Waters Financial.

Read Also: How To Get Tax Preparer License