What Is An Agricultural Organization

For the purpose of paragraph 149, an agricultural organization is an entity organized and operated for one or more of the following purposes:

- the advancement or furtherance of agriculture

- the betterment of the conditions of those engaged in agricultural pursuits

- the improvement of the grade or quality of their pursuits

- the development of a higher degree of efficiency in their respective occupations

Are You A Non

If you are a non-registrant, you cannot claim ITCs to recover any of the GST/HST paid or payable on your costs to build or substantially renovate the subsidized housing . If you are a qualifying non-profit organization, although you may have been entitled to claim a PSB rebate of that tax, you are not able to recover all of the tax payable on your construction or renovation costs.

In this case, you are generally entitled to claim a rebate to recover the tax you paid on the costs to build the housing that you could not previously recover since you are considered to have made a self-supply of the subsidized housing and have to account for the tax on that self-supply. For more information on the rebate for a taxable sale of real property by a non-registrant, see Guide RC4033, General Application for GST/HST Rebates, and Form GST189, General Application for Rebate of GST/HST.

Example

You are a non-profit organization in Alberta and you are not a GST/HST registrant. You construct multiple-unit housing to make long-term residential rentals to seniors and for which you receive government funding. You paid $8,000 GST on the purchase of the land and $15,000 GST on the construction of the building. You claimed a PSB rebate for that tax.

You report this amount of tax on line 103 of Form GST62. You file that form and remit the tax by July 31, 2015.

Chapter 2 How To Complete The Npo Information Return

The information in this section follows the order of the lines on the return, which is divided into the following seven parts:

Part 1 Identification Part 2 Amounts received during the fiscal period Part 3 Statement of assets and liabilities at the end of the fiscal period Part 4 Remuneration Part 5 The organization’s activities Part 6 Location of books and records Part 7 Certification

You have to complete all parts of the return that apply to the organization.

Read Also: How To Appeal Property Taxes Cook County

Can I File Early

No. The information on the annual return must reflect the corporation’s situation on its anniversary date of each year of filing. For example, if your corporation was incorporated under the NFP Act on July 12, the annual return is due within 60 days of July 12 the next year and every year after that. The information appearing on the return should reflect the corporation’s situation on July 12 of each year of filing.

If you file the annual return before the anniversary date, it will not be accepted.

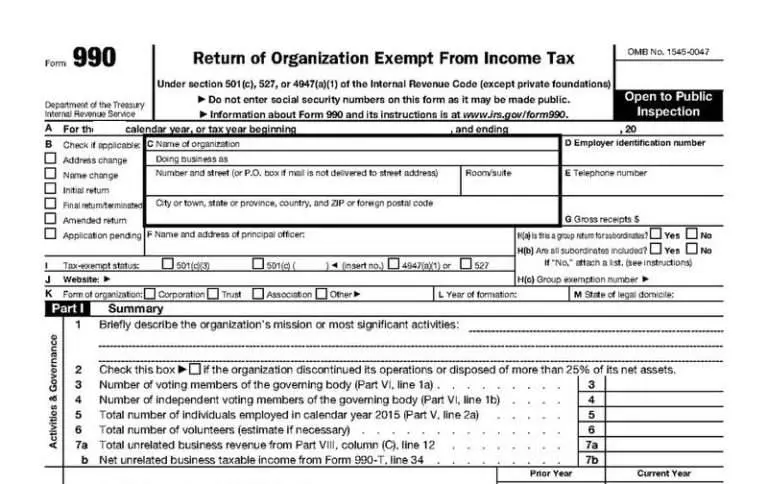

How Your Organization Can Use Its Form 990 To Attract Donors

Your Form 990 is a public document. Once filed, the IRS makes this available to the public.Many organizations also publish theirs on their website as a public relations tool. In fact, yourForm 990 can serve as the face of your organization, and be used to attract more donors.

- Your organization can use its Form 990 to demonstrate fiduciary responsibility. Prospectivedonors want to know that a healthy percentage of their donations are spent on directly on furthering the organizations mission.

- Publicly accessible 990s also demonstrates that you are complying with all applicable laws.

- Your Form 990 can also showcase good governance and ethics by providing information on how executive compensation is determined and explaining conflict of interest policies you have in place.

Most importantly, you can use your Form 990 to showcase your organizations accomplishments and plans for the forthcoming year.

You May Like: Www.1040paytax.com

Annual Exempt Organization Return: Who Must File

Generally, tax-exempt organizations must file an annual information return. Tax-exempt organizations that have annual gross receipts not normally in excess of $25,000 are not required to file the annual information return, but may be required to file an annual electronic notice Form 990-N. In addition, churches and certain religious organizations, certain state and local instrumentalities, and other organizations are excepted from the annual return filing requirement. For more information, download Publication 557, Tax-Exempt Status for Your Organization. In addition, Publications 4221-PC and 4221-PF explain the filing and recordkeeping rules that apply to section 501 tax-exempt public charities and private foundations respectively.

Tax-exempt organizations, other than private foundations, must file Form 990, Return of Organization Exempt From Income Tax, or Form 990-EZ, Short Form Return of Organization Exempt From Income Tax. The Form 990-EZ is designed for use by small tax-exempt organizations and nonexempt charitable trusts. An organization may file Form 990-EZ, instead of Form 990, only if it satisfies thresholds relating to its gross receipts during the year and its total assets at the end of the year. If your organization fails to meet either of these conditions, you cannot file Form 990-EZ. Instead you must file Form 990. All private foundations exempt under 501 must file Form 990-PF, Return of Private Foundation.

An integrated auxiliary of a church,

Form 990 Deadline Extensions

If for some reason, your nonprofit cannot make the deadline of May 15th to file your nonprofit taxes, you have the option to extend your time by six months.

You can apply for this 990 deadline extension by filing a Form 8868. If approved, this moves the deadline for filing to November 15th for the majority of nonprofit organizations.

You May Like: Do You Have To Pay Taxes On Plasma Donations

Form 102: The Federal Tax Exemption Application

501 tax-exempt status gives benefits like income and property tax exemptions, tax-deductibility of donations, access to grant money, and more. The smallest non-profits can use the Streamlined Application for Recognition of Exemption Under Section 501 of the Internal Revenue Code is downloadable Form 1023-EZ, which is available online,

There is an Eligibility Worksheet to determine if your non-profit is eligible to use the streamlined form. Company’s need an EIN to apply for 501 tax exemption. If you will hire people, check the IRS withholding tables and estimate the amount of payroll taxes because you may not be exempt from these.

Applying Online

Apply at www.irs.gov. Click “Apply for an EIN Online” under “Tools” section on the home page. Using the online assistant is the easiest way to apply.

On the application, it is imperative to select “nonprofit” as the entity type, and be sure to download the proof of EIN as a PDF. Print several copies.

Applying by Fax/Mail

From the IRS site, download Form SS-4. Choose “nonprofit organization” for business entity type. Answer the required questions about your organization’s business activity.

Mail your Form SS-4 to the IRS per the form’s instructions or fax your SS-4 for a faster reply. Each state has a different fax number. You can find the appropriate number on the instructions.

Applying by Phone

Applying by phone is easy. Call the IRS at 829-493 between 7:00 a.m. and 10:00 p.m. EST.

Who Files The Irs Form 990 Which Form 990 Do We File

Most federally tax-exempt organizations file a 990. All 501 private foundations file a 990.

The IRS provides information to help you determine which form to file.

- Larger nonprofits with gross receipts of more than $50,000 file Form 990 or 990-EZ

- Smaller nonprofits with gross receipts of less than $50,000 file Form 990-N

- Private foundations file Form 990-PF

- Find more information on which forms to file.

Also Check: Prontotaxclass

Apply For A Retail Sales And Use Tax Exemption

Nonprofit Online is a quick, efficient, and secure way for you to apply for and print your sales and use tax certificate. You can access Nonprofit Online to edit certain registration information and renew your expired or expiring exemption, as well as reprint lost certificates without having to contact us. You may also send secure email to us through a protected environment.

This service is available to anyone requesting a sales and use tax exemption for a nonprofit organization or a nonprofit church. You will be required to create a user ID and password in order to register your organization.

To apply or to search for a nonprofit organization, go to Nonprofit Online.

Unable to Apply Online?

Organizations that are unable to apply online can download Form NP-1 Application and Instructions or contact the Nonprofit Exemption Team at to request an application. Completed applications should be sent to Virginia Tax, Nonprofit Exemption Unit, P. O. Box 27125, Richmond, Virginia 23261-7125, or faxed to 804.786.2645.

What Is A Non

An NPO, as described in paragraph 149, is a club, society, or association that is not a charity and that is organized and operated solely for:

- social welfare

- pleasure or recreation

- any other purpose except profit

To be considered an NPO, no part of the income of such an organization can be payable to or available for the personal benefit of any proprietor, member, or shareholder, unless the proprietor, member, or shareholder is a club, society, or association whose primary purpose and function is to promote amateur athletics in Canada.

An NPO is exempt from tax under Part I of the Act on all or part of its taxable income for a fiscal period if it meets all of the above requirements for that period.

Note

Although a factual determination must be made in each case, most residential condominium corporations qualify as non-profit organizations under paragraph 149 because they are usually operated for a purpose other than profit.

For more information on whether the organization qualifies as an NPO described in paragraph 149, see Interpretation Bulletin IT-496R, Non-Profit Organizations.

Recommended Reading: How Much Is Payroll Tax In Louisiana

What Is A Nonprofit

A nonprofit organization is exactly what it sounds like an organization whose goal isnt to turn a profit. Instead, nonprofits offer some sort of service like charity, education, or religion. Some common nonprofits that might come to mind are the American Red Cross, Make-A-Wish Foundation, and St. Jude Childrens Research Hospital.

Some nonprofits are charities like the ones listed above. A charitable organization, according to the IRS, works to help the poor, defend human rights, advance education or science, and maintain monuments, among others. Other nonprofits are not charities, like museums and libraries.

Some nonprofits are tax exempt, meaning they do not have to pay federal corporate income tax. To be tax exempt, you must qualify in the eyes of the IRS.

Businesses Versus Nonprofit Organizations

When a business generates revenue, it may choose how it wants to use that money. The leaders of the business, whether it is a sole proprietorship, a partnership or a corporation, may reinvest the money in the business, pay it to stockholders, give themselves bonuses or almost anything else.

In contrast, NPOs must put any revenues they have back into the organization. NPOs can pay salaries to their employees and directors, and they may be allowed to hold some assets or cash from year to year.

Recommended Reading: How To Appeal Cook County Property Taxes

State Filing Requirements For Nonprofits

If a charitable nonprofit is an incorporated entity, it must follow state law requirements for annual or periodic registrations.

Each states law is slightly different, but most require nonprofit corporations to periodically confirm or update their basic contact information, such as mailing address, names of responsible parties, and registered agent. If a charitable nonprofit has employees, there are initial and periodic employment forms to file with the state Department of Labor. In some states charitable nonprofits need to apply for sales/use or property tax exemptions, separately from other corporate registrations. In addition, the majority of states require charitable nonprofits that are engaged in soliciting donations to register with the state to report on the nonprofits fundraising activities.

Consequences Of Unpaid Nonprofit Payroll Taxes

Consequences of unpaid payroll taxes for nonprofits fall mainly on the board members of the nonprofit organization who have not paid their payroll taxes. Many voluntary board members are not aware that they can be held personally liable for unpaid payroll taxes and may be required to pay the taxes and penalties on behalf of the nonprofit.

IRS Manual Part 5, Chapter 17, Section 7

Board members, particularly the board directors, must have oversight on making sure taxes are paid on time. The best way to stay on top of this is to have a tax deadline and information filing calendar for federal and state tax requirements.

To prevent costly nonprofit payroll filing errors, nonprofits may choose to either implement nonprofit payroll software designed specifically for state and federal compliance or outsource these services to a payroll service provider that specializes in nonprofit payroll requirements.

The following 7 tips provide guidelines in helping to keep your nonprofit compliant when handling nonprofit payroll responsibilities for compliance.

Read Also: How Much Does H& r Block Charge To Do Taxes

How To File Form 990

Filing Form 990-N is so simple that, technically speaking, the IRS doesn’t even consider it to be a tax return. It should take you no more than ten or 15 minutes to complete. You don’t even need to pay for a postage stamp to mail it to the IRS, because it must be sent electronically — paper copies of the form will not be accepted. This is why the IRS calls the form an “e-Postcard.” Form 990-N is filed online through the IRS Form 990-N Electronic Filing System web page. A one-time registration is required to access the IRS system.

You do not need any special software, just access to the Internet and an email address for your nonprofit. You then complete an online form that asks for your nonprofit’s legal name, address, website address , EIN, name and address of a principal officer , and tax year . You will also be asked whether your nonprofit has terminated or gone out of business.

If your Form 990-N was accepted, your nonprofit’s electronic filing will be listed on the IRS Tax Exempt Organization Search tool. Allow up to four weeks for the TEOS system to display your filing.

For more information on filing Form 990-N see the IRS website’s highly detailed Form 990-N information page.

How Will I Know When It Is Time To File

Corporations Canada will send a personalized reminder notice when your annual return is due to be filed. If you do not file on time, we will send a default notice approximately 90 days after your anniversary date.

The reminder notice and default notice will be sent by email if you have subscribed to our Annual Return Reminder Emails service. If you have not subscribed to this service, you will receive these notices by post at either the corporation’s registered office address or at any additional address you may have provided to Corporations Canada.

You May Like: Does Contributing To Roth Ira Reduce Taxes

Electronically File Your Form 990 On Time

The Taxpayer First Act, enacted on July 1, 2019, now mandates tax exempt organizations to electronically file their form 990s and other related forms. This cover,

- Forms 990, Return of Organization Exempt from income tax.

- Form 990-EZ, Short Form Return of Organization Exempt from income tax.

- Form 990-T, Exempt Organization Business Income Tax Return.

- Form 4720, Return of Certain Excise Taxes Under Chapters 41 and 42 of the Internal Revenue Code.

- 990-PF, Return of Private Foundation.

- Form 8872, Political Organization Report of Contributions and Expenditures.

- Form 1065 or U.S. Return of Partnership Income.

Transition Of Form 990

For small exempt organizations, the legislation specifically allowed a postponement . For tax years ending before July 31, 2021, the IRS will accept either paper or electronic filing of Form 990-EZ, Short Form Return of Organization Exempt from Income Tax. For tax years ending July 31, 2021, and later, Forms 990-EZ must be filed electronically.

Recommended Reading: Notice Of Tax Return Change Revised Balance

Does A Volunteer Organization Need To File Taxes

Volunteer organizations can run the gamut from business associations to recreational clubs to charitable organizations. All may rely solely or heavily upon community volunteers or members to run the organization and conduct their activities. If a volunteer organization files for tax-exempt status and receives approval, then that organization does not need to file taxes. Instead, it must file an information report. However, if the organization has no tax exempt status, it must file taxes.

Do I Also File Tax Forms With The State

Each state has slightly different tax requirements for nonprofits to complete and remain compliant. For example, in the state of New York, nonprofits are required to file a Form CHAR500. This page on the IRS website links out to the requirements necessary for each state so that your organization can research your specific tax form requirements.

Nonprofit taxes may seem confusing at first, but after youve learned about the rules, regulations, and best practices surrounding them, youll find them much more manageable.

In the rest of this article, well cover the in-depth information that organizations need to know about their tax seasons. You can read with us from the beginning or use the navigation below to jump to the section that most interests you:

Lets get started!

Recommended Reading: Buying Tax Liens California