Use A Secure Method To Mail Your Return

Always use a secure method, such as certified mail return receipt requested, when you’re sending returns and other documents to the IRS. This will provide confirmation that the IRS has actually received your documents or payment.

In addition to addressing it correctly and using sufficient postage, be sure the envelope is postmarked no later than the date your return is due. The date of the registration is the postmark date if you use registered mail. The date stamped on the receipt is the postmark date if you use certified mail.

Can I Apply For A Payment Extension Via Post

So, you have filled out your tax return and you have an unexpectedly large tax bill to pay. But, you dont have the money to pay it right now, what do you do?

Well, you should always try to file your tax return on time to avoid paying any extra fines.

Then you should apply for a short-term payment extension or a long-term extension if you need more time.

You can apply for a short-term extension if you owe up to $100,000, but long-term extensions are restricted to people who owe up to $50,000.

If you are on low income, there will be smaller fees for applying for these payment extensions.

You can also set up direct debit payments through the post.

You can make both of these applications through the post, however, it is quicker and cheaper to do it online.

Mailing Address For Estimated Tax Payment

For people who are required to make an estimated tax payment, Form 1040-ES, which is the estimated tax voucher can be used to submit your payment to the IRS using the following addresses.

Tip: The mailing address of Form 1040-ES can be slightly different every year. Normally, you can find the latest mailing address in Page 5 of 2022 Form 1040-ES.

Visit IRS about Form 1040-ES to learn more.

| The State You Live in | Where to Mail |

|---|---|

| P.O. Box 802502Cincinnati, OH 45280-2502 |

The following group of people should mail their Form 1040- E.S. to the Internal Revenue Service, P.O. Box 1300, Charlotte, NC 28201- 1300 USA.

- People who live in a foreign country

- People who live in American Samoa

- People who are excluding income under internal revenue code 933

- People who live in Puerto Rico

- People who use an FPO or APO address

- People who file form 2555, 2555 EZ, 4563

- People who are dual-status aliens, or non-permanent residents of Guam, or the U.S. Virgin Islands.

However, it is important to note that if you are a bona fide resident of Guam, you are expected to mail your Form 1040-ES to the Department of Revenue and Taxation, Government of Guam, P.O. Box 2307, GMF, GU 93921.

For a bona fide resident on U.S. Virgin Islands, the mailing address is: Virgin Islands Bureau of Internal Revenue, 6115 Estate Smith Bay, Suite 225, St. Thomas, VI 00802.

Read Also: How Do You Pay Owed Taxes

When To File Your Return

If you file your return on a calendar year basis, the 2020 return is due on or before . A fiscal year return is due on the 15th day of the 4th month following the end of the taxable year. When the due date falls on a Saturday, Sunday, or holiday, the return is due on or before the next business day. A fiscal year return should be filed on a tax form for the year in which the fiscal year begins. For example, a 2020 tax form should be used for a fiscal year beginning in 2020. See Directive TA-16-1, When a North Carolina Tax Return or Other Document is Considered Timely Filed or a Tax is Considered Timely Paid if the Due Date Falls on a Saturday, Sunday, or Legal Holiday.

Out of the Country: If you are out of the country on the original due date of the return, you are granted an automatic four month extension to file your North Carolina individual income tax return if you fill in the Out of Country circle on Page 1 of Form D-400. Out of the Country means you live outside the United States and Puerto Rico and your main place of work is outside the United States and Puerto Rico, or you are in military service outside the United States and Puerto Rico. The time for payment of the tax is also extended however, interest is due on any unpaid tax from the original due date of the return until the tax is paid.

Nonresident Aliens: Nonresident aliens are required to file returns at the same time they are required to file their federal returns.

Where To Mail Paper Tax Returns

Depending on where you live, which form you are filing and whether you are including a payment or not the IRS has different addresses where you will need to send your papers, and payment if necessary. The IRS provides a handy link to where you can check where your documents need to go broken down by category. You can check by state or outside the 50 states and the District of Columbia for Forms 1040, 1040-SR, 1040ES, 1040V, amended returns 1040-X, and extensions 4868. Or you can check where to send your documents by specificreturn type.

Looking for the status of your tax refund? Use Wheres My Refund? to start checking the status of your refund 24 hours after #IRS acknowledges receipt of your e-filed tax return:

You May Like: How Are Property Taxes Calculated In Texas

When Do I Need To Post My Tax Return By

You must submit your federal tax returns once a year. The deadline for this submission is known as tax day and it marks the end of the financial year.

The next Tax Day is in April 2023. Currently, Tax Day 2023 is scheduled for April 15th.

Typically, Tax Day is on April 15th, but if it falls on a Sunday or a holiday, it can be pushed back to April 18th.

When you are posting your tax returns, it is recommended that you put them in the mail at least two weeks before the deadline.

Unclaimed Federal Tax Refunds

If you are eligible for a federal tax refund and dont file a return, then your refund will go unclaimed. Even if you aren’t required to file a return, it might benefit you to file if:

- Federal taxes were withheld from your pay

and/or

- You qualify for the Earned Income Tax Credit

You may not have filed a tax return because your wages were below the filing requirement. But you can still file a return within three years of the filing deadline to get your refund.

Don’t Miss: Can You File Taxes Now

Find Out If Your Tax Return Was Submitted

You can file your tax return by mail, through an e-filing website or software, or by using the services of a tax preparer. Whether you owe taxes or youre expecting a refund, you can find out your tax returns status by:

-

at 1-800-829-1040

-

Looking for emails or status updates from your e-filing website or software

If you file your taxes by mail, you can track your tax return and get a confirmation when the IRS has received it. To do so, use USPS Certified Mail or another mail service that has tracking or delivery confirmation services.

Mailing Addresses For Massachusetts Tax Forms

Use the following addresses for either an original or an amended return.

- Form 1 or a Form 1-NR/PY:

- Refund: Mass. DOR, PO Box 7000, Boston, MA 02204

- Payment: Mass. DOR, PO Box 7003, Boston, MA 02204

Also Check: Will I Be Taxed On My Stimulus Check

Where To File Your Return

Taxpayers using eFile will have their returns processed electronically once they are submitted.

For taxpayers filing using paper forms:

- If you expect a refund, be sure to mail your return to the North Carolina Department of Revenue, PO Box R, Raleigh, NC 27634-0001.

- If you owe taxes, mail your return and payment to the North Carolina Department of Revenue , PO Box 25000, Raleigh, NC 27640-0640. Make your check or money order payable to the NC Department of Revenue. Important: The Department will not accept a check, money order, or cashiers check unless it is drawn on a U.S. bank and the funds are payable in U.S. dollars.

How The Treasury Offset Program Works

Here’s how the Treasury Offset Program works:

If you owe more money than the payment you were going to receive, then TOP will send the entire amount to the other government agency. If you owe less, TOP will send the agency the amount you owed, and then send you the remaining balance.

Here’s an example: you were going to receive a $1,500 federal tax refund. But you are delinquent on a student loan and have $1,000 outstanding. TOP will deduct $1,000 from your tax refund and send it to the correct government agency. It will also send you a notice of its action, along with the remaining $500 that was due to you as a tax refund.

The Internal Revenue Service can help you understand more about tax refund offsets.

Also Check: Does Walmart Offer Tax Services

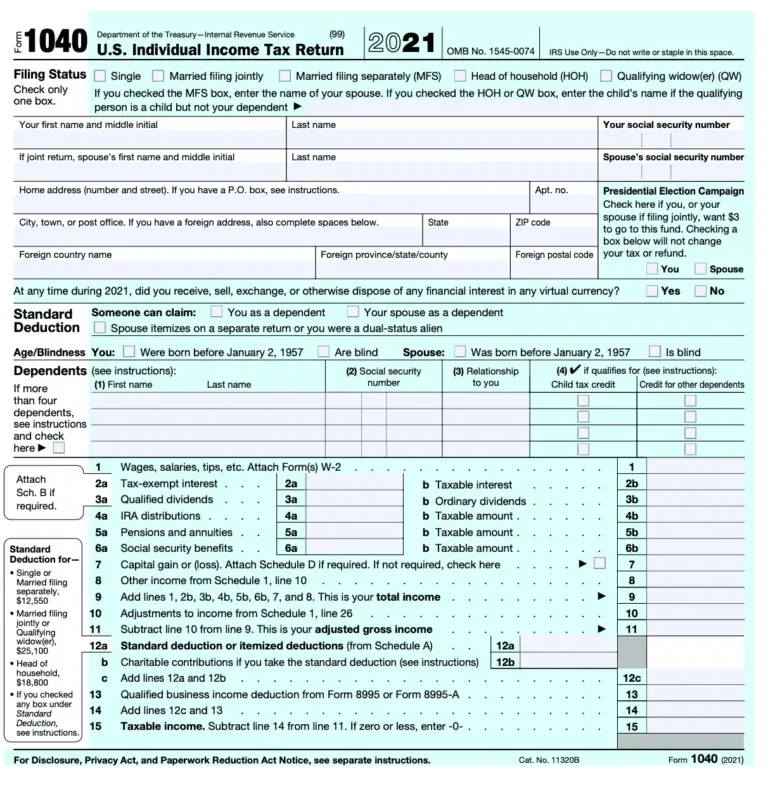

What Do I Need To File Taxes By Mail

Include all necessary tax forms for the IRS if you file by mail: your Form 1040 or 1040-SR, any schedules, and any other additional forms you have to fill out for your particular return. You should also include a check if you owe any taxes, or you can use IRS Direct Pay to make payment online from your checking or savings account.

Where Do I Send My 1040ez Form

Whichever version of the 1040 form you use , your 1040 form has to be mailed to the IRS upon completion. However, the answer to this question depends on where you are located. You can check our list below to determine your appropriate IRS mailing address.

Whats your biggest 2022 HR challenge that youd like to resolve

Answer to see the results

You May Like: When Will We Get Our Taxes 2021

Send A Paper Return By Mail

If you are mailing someone elses paper return

If you prepare other peoples returns, mail each persons return in a separate envelope. However, if you file returns for more than one year for the same person, put them all in one envelope.

Where Should I Mail My Tax Returns

There is no one address to mail your federal tax returns to.

Where the form needs to go will depend on exactly what return you are trying to file. Each type of form and tax return has its own mailing address and when you need to send it will depend on where in the country you live.

If you are filing but not making your tax payment then there will be a different address that you will need to use.

For example, if you are trying to file a Form 941 then you will need to use the following addresses:

| Connecticut, Delaware, District of Columbia, Georgia, Illinois, Indiana, Kentucky, Maine, Maryland, Massachusetts, Michigan, New Hampshire, New Jersey, New York, North Carolina, Ohio, Pennsylvania, Rhode Island, South Carolina, Tennessee, Vermont, Virginia, West Virginia, Wisconsin | Department of the Treasury |

|

P.O. Box 932100 Louisville, KY 40293-2100 |

You can find a full list of state by state addresses here on the IRSs website as well.

Also Check: What Happens If You Have Not Filed Tax Return

Bc Finance Minister Brings Rural Perspective To Provinces Bottom Line May Expand Speculation Tax

Katrine Conroy says she asked to keep her old job as British Columbias forests minister because there was unfinished business, but Premier David Eby had other plans and put her in charge of managing the provinces finances.

The veteran New Democrat, who was first elected in 2005, said she was surprised she was appointed finance minister in Ebys new cabinet.

Ms. Conroy inherits a budget with a projected surplus of $5.7 billion this year, but the good times are not expected to last, with private and government forecasters saying B.C.s economic growth will dip to less than 1 per cent next year.

Theres stuff to do, Ms. Conroy said Thursday in an interview. Theres big challenges. Actually, Im quite honoured he asked me to take on this portfolio.

Mr. Eby described his new cabinet as a blend of experienced politicians and energetic newcomers who will focus on big issues facing the province.

The new finance minister will bring a rural perspective to her portfolio, in contrast to the urban-centred views of Eby and other cabinet ministers from larger communities, the premier said on Wednesday.

He noted Ms. Conroy lives on a ranch and has been known to participate in family hunting trips.

Ms. Conroy said she and her cabinet colleagues will deliberate on how best to address the surplus and the challenges ahead.

The government promised a $400 renters rebate during the 2017 election campaign but has yet to implement the pledge.

Ping Your Pizza Is On Its Way Ping Please Rate The Driver Yes Constant Notifications Really Do Tax Your Brain

by Sharon Horwood, The Conversation

A ping from the pizza company. A couple of pings from your socials. Ping, ping, ping from your family WhatsApp group trying to organize a weekend barbecue.

With all those smartphone notifications, it’s no wonder you lose focus on what you’re trying to do do.

Your phone doesn’t even need to ping to distract you. There’s pretty goodevidence the mere presence of your phone, silent or not, is enough to divert your attention.

So what’s going on? More importantly, how can you reclaim your focus, without missing the important stuff?

Is it really such a big deal?

When you look at the big picture, those pings can really add up.

Although estimates vary, the average person checks their phone around 85 timesa day, roughly once every 15 minutes.

In other words, every 15 minutes or so, your attention is likely to wander from what you’re doing. The trouble is, it can take several minutes to regain your concentration fully after being interrupted by your phone.

If you’re just watching TV, distractions are no big deal. But if you’re driving a car, trying to study, at work, or spending time with your loved ones, it could lead to some fairly substantial problems.

Two types of interference

The pings from your phone are “exogenous interruptions”. In other words, something external, around you, has caused the interruption.

What if your phone is on silent? Doesn’t that solve the ping problem? Well, no.

Give your brain a break

How can I stop?

Read Also: How To Calculate Payroll Taxes In California

Make Sure You Mail On Time

The postmark on your envelope is what counts when mailing your tax return. Some post office locations offer extended hours and late postmarking before Tax Day.

You can purchase a certificate of mailingat the post office to prove that you mailed your return on a specific date. Keep the certificate the post office doesnt keep copies.

Before you mail that return, make sure you have the correct IRS, and include your return address on your mailing label and that you have enough postage.

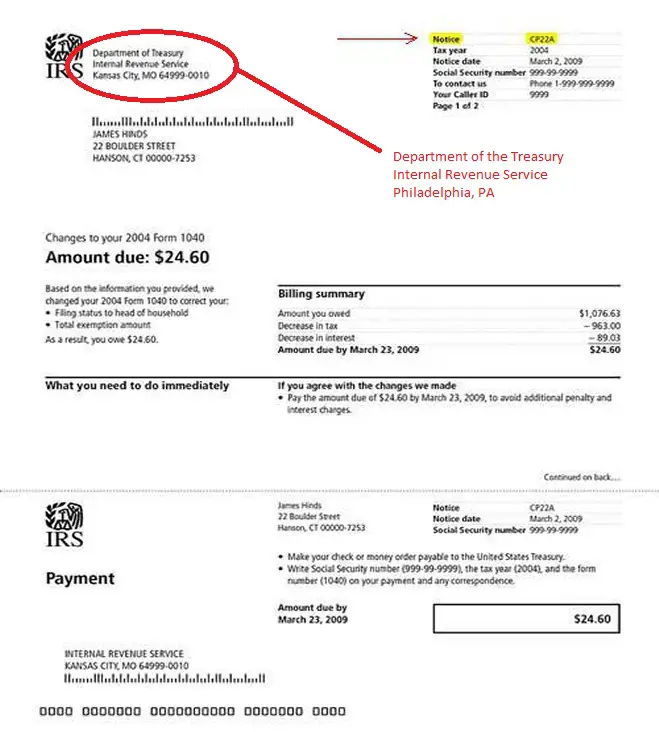

Mailing Address For Individual Tax Payment

For people who owe money on their tax balance, one way of making the payment is by mailing a money order or check to the IRS. The IRS may send you a notice stating your balance and where to send the payment, or you can use the payment voucher, which is Form 1040-V to pay the amount that is due on your Form 1040, 1040A, or 1040EZ. The following table summarizes the mailing addresses of any Form 1040-V payments according to people who live in the areas.

Tip You can find the mailing address on Page 2 of Form 1040-V. The mailing address of Form 1040-V can change every day.

Please visit IRS About 1040 Form to get the latest filling address.

| The State You Live in | Mailing Address |

|---|---|

| Arkansas, Connecticut, Delaware, District of Columbia, Illinois, Indiana, Iowa, Kentucky, Maine, Maryland, Massachusetts, Minnesota, Missouri, New Hampshire, New Jersey, New York, Oklahoma, Rhode Island, Vermont, Virginia, West Virginia, Wisconsin | Internal Revenue Service |

| P.O. Box 802501Cincinnati, OH 45280-2501 |

The following group of people should mail their forms to the Internal Revenue Service, P.O. Box 1303, Charlotte, NC 28201- 1303.

- People who live in a foreign country

- People who live in American Samoa

- People who live in Puerto Rico

- People who are excluding income under internal revenue code 933

- People who use an FPO or APO address

- People who file form 2555, 2555 EZ, 4563

- People who are dual-status aliens, or non-permanent residents of Guam, or the U.S. Virgin Islands.

Recommended Reading: How Far Can You Go Back To File Taxes