Creation Of Economic Nexus

This came about in June 2018, when the United States Supreme Court ruled in South Dakota v Wayfair that states can also require online sellers to collect sales tax based on the volume or value of transactions into a state, which create economic nexus.

One of the reasons behind the move to tax economic nexus is important in this case South Dakota does not impose income tax on its residents, which means it relies heavily on sales tax. As physical businesses lose more business to remote sellers, failure to tax these retailers results in a loss of tax revenue to the state.

In Wayfair vs.South Dakota, the state estimated that $50 million had been lost in sales tax revenue.

Personal Liability For Paying Taxes

If a corporation, association, or partnership fails to pay sales and use taxes, the officers or partners are personally liable for the tax, interest, and penalty due.

A person selling a business must file final tax returns and pay all taxes due. However, the new owner should withhold a sufficient amount of the purchase price to pay any unpaid tax, interest, and penalty in case the seller fails to pay the final tax due. If the new owner intentionally fails to do this, the new owner is personally liable for the tax.

Online Sales And Sales Tax

Online sales have changed the sales tax landscape, and the situation continues to evolve as taxing agencies figure it out. More and more businesses, even small home-based ones are now remote sellers meaning they sell their goods in other states where they dont have a nexus. The U.S. Census Bureau has tracked online sales from 2010, and theyve risen steadily, with 14% of all sales in the first quarter of 2020 taking place online. The upsurge in marketplace sellers, like Shopify, Etsy, Bookshop.com and other places where entrepreneurs can sell goods without having to manage their own selling website, has boosted online sales for small businesses and the shutdowns from the coronavirus pandemic have spurred many small businesses that were focusing on bricks-and-mortar sales to sell online.

After several years of confusion, the 2018 Supreme Court South Dakota vs. Wayfair decision determined that online sales are subject to sales tax. The court left it to the states to determine how to tax online sales, since the states are already setting their own tax rates and rules.

In most states, online taxes dont apply to smaller businesses, with size determined by sales, number of transactions, or in some cases, both.

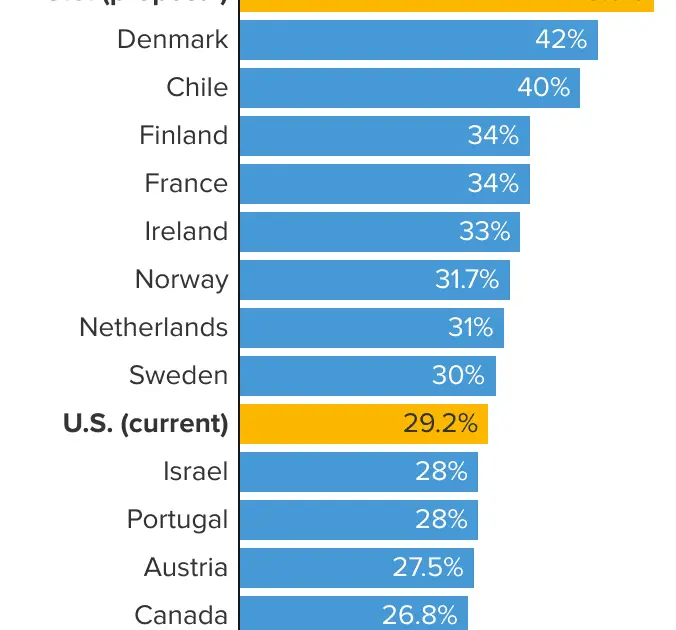

The general maximum is $100,000 in sales, or 200 transactions, but that differs widely depending on the state.

The sales dollar amount is $500,000 in California and New York. Other states, like Tennessee and Arizona, are reducing it by year until it reaches $100,000.

Read Also: What Is The Last Date You Can File Your Taxes

Sales Tax Vs Use Tax: Whats The Difference

Tax collected by the retailer here in California is called sales tax, and the retailer is responsible for reporting and paying the tax to the state. When an out-of-state or online retailer doesn’t collect the tax for an item delivered to California, the purchaser may owe “use tax,” which is simply a tax on the use, storage, or consumption of personal property in California.

Why Is There A Use Tax

The use tax, which was created in July 1935, is a companion to California’s sales tax that is designed to level the playing field between in-state retailers who are required to collect tax, and some out-of-state retailers who are not. Use tax, just like sales tax, goes to fund state and local services throughout California.

You May Like: What Do I Need To Complete My Taxes

Selling Across Many States

If you send products or inventory to a large, online company that distributes them to buyers for you, you may have created “connections” in many states in addition to your own.

For example, if you sell online from your own home in California and don’t have any business presence in other states, you typically have “nexus “or a physical presenceonly with California.

But if you sell your products through Amazons FBA program , you send inventory to Amazon first. That relationship would typically require you to collect sales tax from customers in other areas where Amazon does business.

With TurboTax Live Full Service Self-Employed, work with a tax expert who understands independent contractors and freelancers. Your tax expert will do your taxes for you and search 500 deductions and credits so you dont miss a thing. Backed by our Full Service Guarantee.You can also file your self-employed taxes on your own with TurboTax Self-Employed. Well find every industry-specific deduction you qualify for and get you every dollar you deserve.

Penalties Interest And Late Charges

A sales and use tax, withholding tax, admissions and amusement tax or tire recycling fee return that is filed late is subject to a 10 percent penalty and interest at a rate of not less than 1 percent per month. If you file a late sales and use tax or tire fee return, you may not claim the timely filing discount for vendors. If you do not file a missing return after receiving a notice, an estimated assessment may be levied and additional penalty applied. Additionally, a $30 service charge is applied for bad checks.

Don’t Miss: How To File Prior Year Taxes Online

Does Ebay Automatically Collect Sales Tax

Based on applicable tax laws, eBay will calculate, collect, and remit sales tax on behalf of sellers for items shipped to customers in certain states. Sellers offering delivery in the U.S are not able to opt out of selling items into the required states or to opt out of eBay automatically collecting sales tax.

Do You Have A Nexus In Another State

Here’s another wrinkle: Your business may have a “nexus” in another state, meaning that you have an affiliation or some other legal connection there that effectively subjects you to its tax laws. You might be obligated to collect that other state’s sales taxes and file a sales tax return there even if your primary location is in an origin-based state.

Most states with sales taxes define their nexus through a monetary threshold , a transaction threshold , or both.

Also Check: How Do I File My Illinois State Taxes Online

Should You Charge Sales Tax For Out

Whether you must charge your customers out-of-state sales taxes comes down to whether you’re operating in an origin-based sales tax state or a destination-based sales tax state. The process of determining which tax rates apply to individual purchases is referred to as “sales tax sourcing,” and it can be somewhat complicated to figure out.

Sourcing is mainly a concern for businesses that ship their products to other locations, such as internet-based operations, rather than retail businesses operating out of physical locations and selling to in-person consumers.

What States Require Ebay To Collect Sales Tax

From January 1, 2020, eBay will be collecting sales tax on eligible transactions for buyers in the following states Arizona, California, Colorado, Hawaii, Illinois, Maine, Maryland, Massachusetts, Michigan, Nevada, North Dakota, South Carolina, Texas and Utah.

Read Also: How Can I Get My Social Security Tax Statement

Import Fees Duty Foreign Taxes Value

In general, you may not take a credit for sales tax paid to a foreign country against the California use tax you owe.

Federal import duties or taxes are imposed under United States Code, Title 19, section 1505 and have no bearing on the application of California sales or use tax. The fact that a certain purchase is exempt from federal duty does not exempt that item from California use tax. For example, purchases of antiques more than 100 years old are subject to California use tax even if the purchase was exempt from the import duties.

If your purchase is subject to California use tax, any amounts you paid as import fees, duty, or other miscellaneous charges at the time of entry into California are generally not includable in the measure of tax.

Please note: the Federal import duties are imposed on the importer of record. If the importer of record is a consignee and the consignee is the seller, import duties included in the price of the property sold are subject to sales and use tax. See Regulation 1617, Federal Taxes.

If you paid any Value-Added Tax on your foreign purchase, those charges must be included as part of the purchase price subject to tax when you report and pay the use tax. You may not take a credit for VAT paid against the California use tax due.

Exemption Based On Use Of The Product

If the product is meant to be resold in the same form in which itâs purchased, it may qualify for a resale exemption. Dropshippers should definitely look into this! On the same note, if the item is used in the production of a final product, prior to resale, it too can be exempt. This exemption mostly applies to certain industries such as agriculture and manufacturing.

You May Like: Is Past Year Tax Legit

What States Are Sellers Required To Collect Sales Tax For

Sellers are generally required to collect sales tax in any state where they have a physical presence, which has been the case even before the recent Supreme Court decision. As of October 1, 2019, 34 states will require the collection of sales tax. In addition, if a seller meets any of the new economic nexus standards in other states, they would need to collect and remit sales tax in those states as well. Sellers should consult with their tax advisor about tax obligations for each state as the rules may vary on a state-by-state basis. If you use platforms other than eBay for selling, you may need to aggregate all of your sales into a state to determine if you have crossed that states threshold for economic nexus.

The Nexus Required Between Seller And State

The word “nexus” is used by the law to describe a connection. In this case its the connection sellers have with a particular area before they are required to charge and collect taxes for online sales there.

Different states and courts define this connection differently. However, most agree that if you have a store or an office in a state, this requires you to collect and submit sales taxes in that state.

Many states have laws that describe eligibility factors, so be sure to start there. If you aren’t certain whether you have a sufficient presence in a state for sales tax purposes, check with that state’s taxing agency.

Read Also: Do You Pay Taxes On Plasma Donations

Sales Tax Nexus Is Just A Fancy Legalese Way To Say Significant Connection To A State

If you, as an online retailer, have nexus in a state, then that state considers you on the hook for charging sales tax to buyers in the state.

Youll always have sales tax nexus in your home state. However, certain business activities create sales tax nexus in other states, too.

Ways to Have Sales Tax Nexus in Different States

- A location: an office, warehouse, store, or other physical presence of business.

- Personnel: an employee, contractor, salesperson, installer or other person doing work for your business.

- Inventory: Most states consider storing inventory in the state to cause nexus even if you have no other place of business or personnel.

- Affiliates: Someone who advertises your products in exchange for a cut of the profits creates nexus in many states.

- A drop shipping relationship: If you have a 3rd party ship to your buyers, this may create nexus.

- Selling products at a trade show or other event: Some states consider you to have nexus even if you only sell there temporarily.

- Economic nexus: You exceed a state-mandated dollar amount of sales in a state, or you make over a certain state-mandated number of transactions in a state.

Why Does Ebay Have A Tax Policy

There may be legal implications, fees and tax obligations associated with using eBay. Remember that its your responsibility to understand and comply with relevant laws and regulations, and that you have to pay relevant fees and taxes. Our full policy explains how and when eBay charges applicable taxes, and provides additional guidance on your tax obligations, but we recommend you talk with a tax professional if you have any questions.

Recommended Reading: How Do I Submit My Tax Return Online

Below Economic Nexus Thresholds

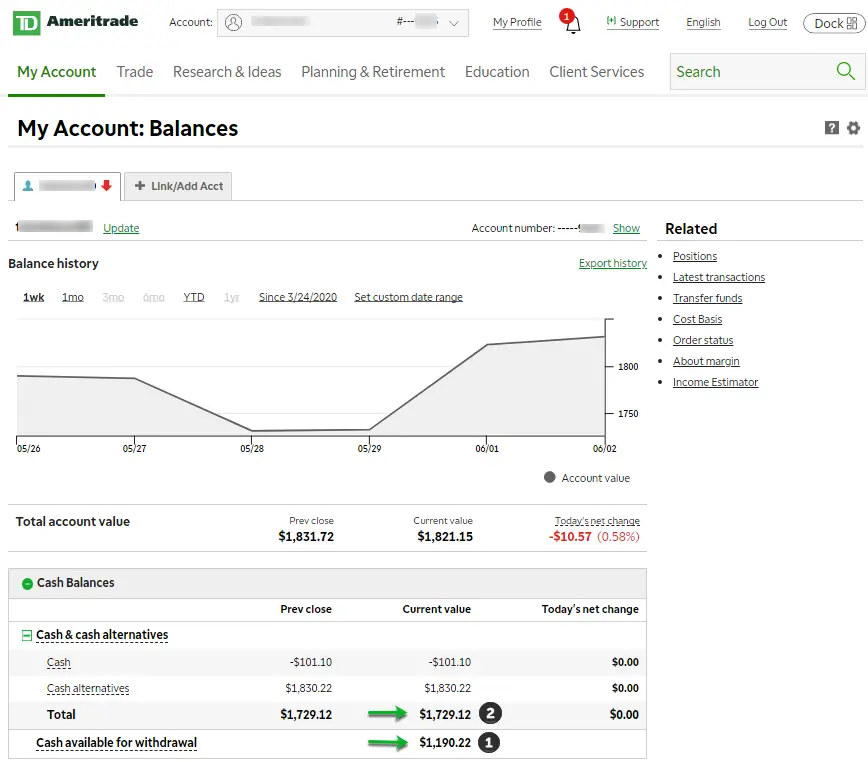

If youre collecting sales tax in your home state, but youre sure you havent hit economic nexus anywhere else, youre in a great position to set up systems before you need to start collecting.

Track

To do this, make sure you have a system in place to track sales. During times of growth, periodically review your sales by state, as outlined above . Most platforms have some way of downloading sales data, and knowing a few basic spreadsheet formulas can save you tons of time adding them up.

Research

Starting to watch and listen for companies and software solutions will give you a head start when you do reach that point of needing them. If you know other ecommerce sellers, ask for reviews and recommendations on solutions to use.

Prepare for a Nexus Study

As your business grows, be prepared to commission a professional nexus study which will tell you where youve hit nexus and need to register.

How To Save On Sales Tax In All States

Costs add up this late in the holiday season, whether youre picking up last-last-last-minute Christmas gifts or shopping for Hanukkah. Not having to pay sales tax can help stretch dollars. Yet because most states tax most sales of goods and require consumers to remit use tax if sales tax isnt collected at checkout, the only way to avoid sales tax is to purchase items that are tax exempt.

Theres no statewide sales tax in Alaska, Delaware, Montana, New Hampshire, or Oregon, though more than 100 local governments levy local sales tax in The Last Frontier. Consumers living in those states expect to pay little or no taxes. Residents of other states can eliminate or reduce sales tax by keeping the following tax tips in mind.

Don’t Miss: What Is The Sales Tax In Philadelphia

Consumers May Be Required To Report And Pay Sales Or Use Taxes

For consumers that order tax-free items online, but live in states that charge a sales tax, they are technically required to report that purchase to their state tax agency and pay the sales tax directly to the agency. When consumers are required to do so, it is often called a “use” tax.

The sole difference between a sales tax and a use tax is the person that ends up giving the money to the state government. When it is a sales tax, the retailer is the one handing over the money, while a use tax is handed over directly by the consumer. However, collecting use taxes on small purchases often costs more than simply letting the consumer not pay the use tax. Instead, state tax agencies try to focus more on collecting use taxes for big ticket items that are purchased online with no sales tax, such as cars and boats.

Be aware, there are a number of states that have stepped up their enforcement of their use tax laws and are now trying to make their state residents pay the taxes that should be paid.

Exemptions Based On Use Of Property

Wholesale items that are being resold are generally not subject to sales tax. Raw materials that are intended to become an ingredient or component of property that is being manufactured, processed, assembled or refined for future sale are also typically exempt.

In addition, there are exemptions for products provided to support certain industries such as agriculture, manufacturing and industrial processing or to encourage certain activities for the public good, like pollution control.

Also Check: How To Reduce Taxes On Stock Gains

Outsourcing Your Sales Tax Returns

Of course, in this day and age, you can always pay someone else to do it. With sales tax, you have two basic options: an automated service, or a live person.

What can be automated, and what cant be.

Automated Platforms

When it comes to automated platforms, the two most reliable and well-known are TaxJar and Avalara.

Not Paying Sales Tax But Should Be

Start with a nexus study. If youve got more time than money, you could try to do it yourself, but if you have a large volume of sales, I dont recommend it.

A Sales Tax Nexus study will use all of your sales data to tell you where you have economic nexus, according to current regulations. It can also take into account exemptions for products like food and clothing . Generally a CPA or sales tax expert will conduct the study. At ECOM CPA, we have a dedicated sales tax specialist for this.

This study will allow you to find out if there are states where you may be delinquent and should file a past sales tax return. If so, your next steps will be to get the necessary permits in order, & start collecting sales tax.

Recommended Reading: How To Lower Property Taxes In Florida

Sales Tax Nexus Conditions For Each State

Most definitions of nexus include the terms doing business or engaged in business.

Nexus Requirements By State:

The below is the current list up to the point of this writing. Please consult the state websites to confirm.

- West Virginia See West Virginias business tax publication here.

- Wisconsin View activities which create Wisconsin nexus here .)

- Wyoming Wyoming considers vendors to have sales tax nexus. You can find Wyomings definition of vendor here under Article 1 State Use Tax.