Form For Estimated Tax Payments

Taxpayers who are required to make estimated quarterly payments must use Form IL-1040ES and mail it to the Illinois Department of Revenue. Failure to make timely tax payments can results in two different tiers of penalties. The first applies to people who file late or file without paying the tax they owe. The initial penalty amount is the lesser of 2% of the amount owed or $250. The Department of Revenue then sends a notice of nonpayment. If IL taxes are not paid or the return is not filed within 30 days of receiving a notice, an additional fee of the lesser of 2% of the amount due or $250 is added to the initial penalty.

Note: States & U.S. territories may make changes to their tax laws with little notice. We do our best to keep this information up-to-date, but it is provided on an “AS IS” basis. For more see our terms.

Register For A New Unemployment Insurance Account Number

Newly-created businesses must register with IDES within 30 days of start-up. .

a. Report to Determine Liability Under the Illinois Unemployment Insurance Act using the UI-1 form

b. Report to Determine Liability for Domestic Employment – If you or your organization paid a domestic worker or combination of domestic workers cash wages totaling at least $1,000 in a calendar quarter during the current or preceding four years, you or your organization is an employer liable under the Illinois Unemployment Insurance Act. Common types of domestic employees are: live-in companions, housekeepers, butlers, maids, chauffeurs and baby sitters. Babysitting, laundry or other services performed outside the home of the person or organization for which the services are provided do not constitute domestic service. Use the UI-1 DOM form.

How To Collect Sales Tax In Illinois

It is quite simple to collect taxes in Illinois if you have a physical location within state lines. The state follows a simple origin-based sales tax system this means tax rates are established by geographical location, and the set rate is collected at the time of sale.If you are an online retailer with tax nexus obligations in Illinois, you have a few more details to sort through. Illinois charges you with the responsibility of charging the origin-based tax rate of your customers geographic locations. So, you must know the specific rate for the zip code to which you are shipping, and you are required to charge that particular tax rate.

Recommended Reading: Do You Pay Taxes On Unemployment

Illinois State Tax Credits

Some credits for individual taxpayers include the following:

- Property tax credit: If you own a home in Illinois, you may be able to take the Illinois Property Tax Credit for up to 5% of the Illinois real estate tax you paid on your principal residence. You must meet income limitations to claim this credit.

- Earned income tax credit: For 2019, this credit is worth 18% of your federal earned income credit, if you qualified for it.

- K-12 education expense credit: If you had qualifying education expenses, you may be eligible for a credit of up to $750 per family.

Illinois Income Tax Filing Deadline Delayed

Gov. Pritzker announced that his administration is extending the individual income tax filing and payment deadline from April 15 to May 17.

The Illinois Department of Revenue will continue to process tax refunds for those filing ahead of the deadline.

The filing extension does not apply to estimated tax payments that are due on April 15, 2021. These payments are still due on April 15 and can be based on either 100% of estimated or 90% of actual liability for 2021, or 100% of actual liabilities for 2019 or 2020.

According to IDOR, 2.4 million taxpayers have already filed their individual income tax returns to date. Over 79% of the taxpayers that have already filed are expecting a refund this year. Last year, over 6.4 million income tax returns were filed, and 87% of people filed electronically.

Also Check: How Much Tax Should I Be Paying Per Paycheck

You May Like: How Much Does H& r Block Charge To Do Taxes

The Property Tax Credit

The property tax credit is equal to 5% of Illinois property tax paid on your primary residence. You must own the residence, and you cant claim this credit if your federal AGI exceeds $250,000, or $500,000 if youre married and file a joint return. Complete Schedule ICR with your Illinois tax return to claim it.

What Is Lake County Doing To Lower My Bill

Lake County has more than 200 individual entities that levy property taxes, which is why the Lake County Board is pursuing partnerships and looking for consolidation opportunities to reduce this number. Consolidation efforts are centered around partnerships that will enhance efficiency, accountability, and cost savings.

- Learn how the County Board has kept the tax levy flat for Fiscal Years 2020 and 2021.

- Learn more about consolidation efforts and how your property tax dollars are used to help make Lake County a great place to live, work and visit.

Also Check: Can You Change Your Taxes After Filing

How To File Your Illinois State Tax Return

There are four options to file.

- File with tax-preparation software.

- E-file through the states free online service, MyTax Illinois.

- File with the assistance of a tax professional.

- Send a paper return by U.S. mail.

If your paper return includes a payment, send it to

Illinois Department of Revenue

If your paper return does not include a payment, send it to

Illinois Department of Revenue

Springfield, IL, 62794-9041

If You Owe And Cant Pay

If you dont pay the tax that you owe by the due date, the state can assess penalties and add interest charges. Publication 103 Penalties and Interest for Illinois Taxes has the details.

You can request an installment plan by completing Form CPP-1, Payment Installment Plan Request. If the amount you need to pay off exceeds $5,000 , youll also need to file an additional form. And you can only get a payment plan if youre current on your filing obligations.

Don’t Miss: How To Stop Property Tax Auction

A Right To Know How Your Property Tax Dollars Are Being Spent

The Treasurer sends out tax bills and collects and distributes funds for all Lake County taxing districts. While taxpayers pay their property taxes to the Lake County Treasurer, Lake County government only receives about seven percent of the average tax bill payment. School districts get the biggest portion .

Do I Need To File Using The Same Filing Status As My Federal Return

Generally, you should use the same filing status as what is listed on your federal return. However, there are a few exceptions:

- If you file a joint federal return and you are an injured spouse , you should file separate Illinois returns using the married filing separately filing status.

- If you file a joint federal return and one spouse is a full-year Illinois resident while the other is a part-year resident or a nonresident , you may choose to file married filing separately.

If you are in a civil union, you must file your Illinois return using the same filing status as on your federal return.

For more information, see:

Also Check: How To Reduce Income Tax

You May Like: When Do I Pay Taxes On Stocks

Welcome To Chicago Business Direct

Chicago Business Direct is the Citys new and improved platform that combines all of your city tax and license needs in one place. Business owners, and/or their legal representatives, may apply for City of Chicago business licenses, renew business licenses, file tax returns, and make tax payments online. To pay and file your taxes using Chicago Business Direct, you will need a user profile. If you are an owner or officer of a business account and have an active user profile under the Chicago Business License Application System , you will not have to create a new profile. As a business owner or officer, your profile will automatically be linked to your business account and you will have access to all tax and license services.

If your business is not required to be licensed and/or you are a new user, you must create a new user profile to log in to Chicago Business Direct. Account numbers and PINs will no longer be used to file tax returns and make tax payments online. As a business owner you may also grant another person the ability to pay and file taxes on your behalf, provided they have an approved user profile . Creating a user profile is fast, easy, and secure.

If you would like to search Chicago business tax ordinances, please click on the following link:

Business Return Electronic Filing Information

Business Electronic Filing Mandate – If an income tax return preparer prepares 25 or more acceptable, original corporate/partnership income tax returns using tax preparation software in a calendar year, then for that calendar year and for each subsequent calendar year thereafter, all acceptable corporate/partnership income tax returns prepared by that income tax preparer must be filed using electronic technology.

Recommended Reading: How Much To Do Taxes At H& r Block

Make Changes To Your Ui Account

Complete the changes online at the MyTax Illinois website or the Notice of Change form UI-50 for:

- Phone Number Change/Name Change/Address Change/Miscellaneous Changes

- Business Name change without change in legal entity

- Reorganization, Sale or Other Organizational Change

- Request to Close UI Account

Complete the forms below for Wage/Name/Social Security Corrections

Report Entity Changes

Did you acquire your Illinois business or any portion of it by purchase, reorganization or a change in entity, for example, a change from sole proprietor to corporation? If yes, report the changes online at the MyTax Illinois website or complete the forms below:

Power of Attorney, Third Party Agent Grant Power of Attorney to a Third Party Agent and Register as a Third Party Agent for Multi-account Filers

Combined Power of Attorney LE-10 and Special Mailing UI-1M These forms are used to represent an employer before the director in any and all matters, to act in the Employers stead with the same consequences as the Employer. The special mailing form is to notify the Department of a request to have correspondence sent to an address other than your business address or to terminate a preexisting address.

Need More Time About Tax Filing Extensions

You may find that you need additional time to file your taxes. This might be because you are waiting for an ITIN approval or missing some of your necessary documents. If you need additional time to file your federal return, you can file for an Automatic Extension of Time to File Your U.S. Tax Return. You should submit the extension form before the deadline listed above. More information can be found on the IRS link above.

Recommended Reading: Can You Refile Your Taxes From Previous Years

When Must I File A Nonresident Tax Return

You have to file a nonresident return in the state in which you work if theres no reciprocity, but you wont have to pay any taxes. Your home state will provide you a tax credit or some means of adjustment for the taxes youd pay to other states.

The reciprocal agreement doesnt automatically get applied. You have to fill out a form thats specific to your work state with your employer to make sure the taxes owed to your work state arent withheld from the pay you earn. If you dont fill out one of these state-specific forms then youll have to file a non-resident tax return.

You also have to file a nonresident return if you had state taxes withheld by your employer for the wrong state and need a refund from that state, or if you generated some non-employment revenue in a state other than your own.

SPRINGFIELD, Ill. The Illinois Department of Revenue will begin accepting 2020 state individual income tax returns on Friday, February 12, the same date that the Internal Revenue Service begins accepting federal individual income tax returns.

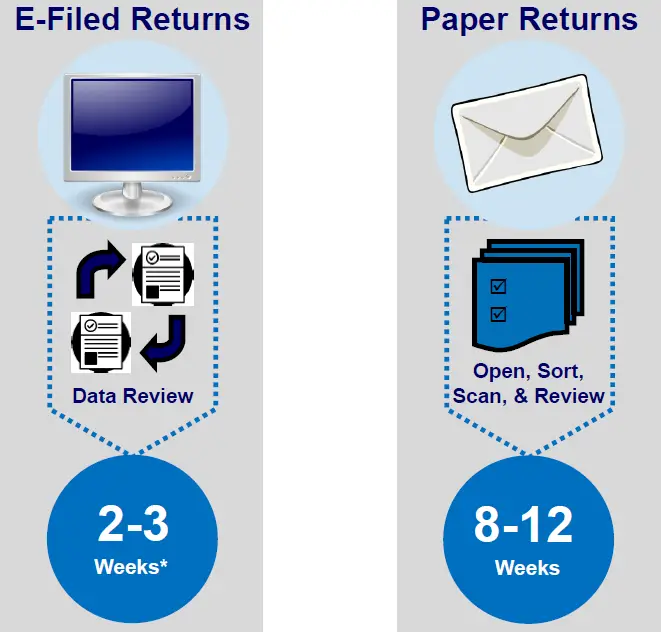

If a taxpayer electronically files an error-free return, they should receive a direct deposit refund in four to six weeks, if applicable.

Last year, IDOR saw a 2.7% increase in the number of electronic filers of the 6,443,623 individual income tax returns, 87% were filed electronically and 63% received refunds.

Filing And Payment Deadline

For 2019 state taxes, the state has extended the filing and payment deadline. Illinois residents now have until July 15, 2020 to file their state returns and pay any state tax they owe for the year. As with the federal deadline extension, Illinois wont charge interest on unpaid balances between April 15 and July 15, 2020.

You dont need to do anything to get this extension. Its automatic for all Illinois taxpayers. But keep in mind that if youre expecting a refund, you might want to go ahead and file as soon as possible. During the coronavirus crisis, the state is continuing to process tax returns and issue refunds.

Illinois state tax returns and any tax you owe are due April 15, the same day that your federal return is due. But if that day falls on a weekend or holiday, the deadline will be the next business day.

State residents can get a six-month filing extension. If you get a longer extension to file your federal return though, the state will automatically match it.

But keep in mind: If you owe tax, you must file Form IL-505-I, Automatic Extension Payment for Individuals, and pay what you owe to avoid paying penalties and interest charges.

Read Also: Do You Have To File Taxes With Uber

Illinois Inheritance Laws: What You Should Know

Illinois levies no inheritance tax but has its own estate tax. In this article, we break down Illinois inheritance laws, including what happens if you die without a valid will and where you may stand if youre not part of the decedents immediate family. Estate planning is a complicated topic, though, and its a good idea to work with a financial professional to guide you through the process. If you dont already work with one, consider finding a financial advisor in your area.

Dont Miss: When Is Sales Tax Due

Illinois Income Tax Rebate

To qualify for the Illinois income tax rebate, you had to be an Illinois resident in 2021 and the adjusted gross income on your 2021 Illinois tax return must be under $200,000 . The size of your income tax rebate depends on your filing status and the number of dependents claimed on your 2021 Illinois tax return. Each qualifying person gets $50 , plus $100 per dependent for up to three dependents. So, for example, a qualified married couple with three children will get a $400 income tax rebate. If you add on a $300 property tax rebate, they could get as much as $700.

As with the property tax rebate, you had to file your 2021 Illinois income tax return with Schedule IL-E/EIC if you have dependents by October 17.

Recommended Reading: Do You Pay Taxes On Life Insurance Payout

Spouses In Illinois Inheritance Law

If you die intestate in Illinois, the amount your spouse inherits depends on whether or not you have living descendants, including children, grandchildren and great-grandchildren. If you have no living descendants, your spouse gets all of the intestate property.

If you have living descendants, your spouse will get half of the inheritance, and your descendants will get the other half of the inheritance. However, grandchildren will only receive a share if their parents are not alive to receive their share.

Also Check: How Do You Add Sales Tax

Your Illinois Sales Tax Filing Requirements

You have two choices for filing taxes in Illinois. You can file online at https://mytax.illinois.gov/_/, or by mail using form ST-1. Form ST-1 can downloaded and printed at http://www.revenue.state.il.us/TaxForms/Sales/ST-1.htm.If you have $0 in sales, but you maintain a business license, you are still required to file a zero sales tax return, despite the fact that you have no sales.In order to determine your tax obligation, total sales and total tax collected must first be determined. A series of calculations can then be applied to these numbers based on the type of tax obligation they require. Formulas and instructions are found on the Form ST-1 Instructions page located at http://tax.illinois.gov/TaxForms/Sales/ST-1-Instr.pdf .Taxes for prior months receipts are due on the 20th of each month, and late fees will accrue as follows:* 2% up to 30 days late * 10% after 30 daysA 1.75% discount is rewarded to those retailers who pay their sales tax on time.

Recommended Reading: Can I Do My Taxes Myself

What You Need To Fileand When

If you are a non-resident for tax purposes who received income in the U.S. during the last calendar year, you must file a tax return with the U.S. government. In addition to filing a federal tax return, you will likely need to file a return on the state level, as well.

Federal Tax Return

Federal taxes are those paid to the U.S. central government Internal Revenue Service . OIA pays for software licenses for our international population to use a special non-resident tax filing software.

State Tax Return

In addition to a federal tax return, many will also have to file a State of Illinois income tax return. If you resided and/or worked in more than one U.S. state during the past calendar year, you may have to file tax returns in all of the states in which you resided or worked. You should check the state revenue website of the other state where you lived and worked to figure out your tax filing obligations.