S You Can Take Now To Make Tax Filing Easier In 2022

Use online account to securely access the latest information available about your federal tax account and see information from your most recently filed tax return on IRS.gov.

You can:

- View the amounts of the Economic Impact Payments you received

- Access Child Tax Credit Update portal for information about advance Child Tax Credit payments

- View key data from your most recent tax return and access additional records and transcripts

- View details of your payment plan if you have one

- View 5 years of payment history and any pending or scheduled payments

Act now if you need to create an account.

Organized tax records make preparing a complete and accurate tax return easier. It helps you avoid errors that lead to processing delays that slow your refund and may also help you find overlooked deductions or credits.

Wait to file until you have your tax records including:

- Form 1099-INT if you were paid interest

- Other income documents and records of virtual currency transactions

- Form 1095-A, Health Insurance Marketplace Statement, to reconcile advance Premium Tax Credits for Marketplace coverage

- Letter 6419, 2021 Total Advance Child Tax Credit Payments to reconcile your advance Child Tax Credit payments

- Letter 6475, Your 2021 Economic Impact Payment, to determine whether you’re eligible to claim the Recovery Rebate Credit

Notify the IRS if your address changes and notify the Social Security Administration of a legal name change.

Remember, most income is taxable. This includes:

When Social Security Benefits May Be Taxable

When determining whether you need to file a return and you receive Social Security benefits, you need to consider tax-exempt income because it can cause your benefits to be taxable even if you don’t have any other taxable income.

Here’s an example of where you may need to file, even with tax-exempt income:

- You are under age 65 and receive $30,000 in Social Security benefits, but also receive another $31,000 in tax-exempt interest. $14,700 of your Social Security benefits will be considered taxable income.

- This is greater than your standard deduction and you would need to file a tax return.

To figure out if your Social Security benefits are taxable:

- Add one-half of the Social Security income to all other income, including tax-exempt interest.

- Then compare that amount to the base amount for your filing status.

- If the total is more than the base amount, some of your benefits may be taxable.

TurboTax can help you estimate if you’ll need to file a tax return and what income will be taxable.

TurboTax Tip: If you have had federal taxes withheld from your paycheck, you might want to file a return even when you are not required to, so you can receive your tax refund.

Nonprofit Organizations May Get Special Treatment From The Irs But Many Still Need To File Taxes Every Year Learn More About Nonprofit Tax Obligations Here

What you’ll learn:

Understanding tax filing obligations and deadlines is an important part of operating a successful nonprofit organization. It usually includes determining which tax forms your nonprofit needs to file. Failing to file your nonprofit tax return on time can lead to late fees and even the loss of tax-exempt status for your nonprofit. Most nonprofit organizations do not pay income taxes, but it is important to understand when your nonprofit may be required to pay.

Also Check: What Is The Tax Bracket For 2021

How Do Social Security Benefits Impact Filing Requirements

Now that you know your gross income is a primary factor in whether you have to file taxes, you may be wondering how Social Security benefits factor in.

In some cases, you wont need to pay taxes on your Social Security, but it all comes down to your combined income.

Combined income includes:

-

Half of your Social Security income

-

Your tax-exempt interest

Youll need to pay taxes if your combined income is greater than $25,000 as an individual or greater than $32,000 if married filing jointly. However, you wont pay taxes on more than 85% of your Social Security benefits. How much of your Social Security income is subject to tax will depend on your combined income.

If youre filing as an individual and your income is between $25,000 and $34,000, 50% of your benefits are taxed0. If your income exceeds $34,000, 85% of your benefits are taxed.

If youre filing a joint return, 50% of your benefits are taxed if your income is between $32,000 and $44,000. If your income exceeds $44,000, 85% of your benefits are taxed.

For each year you receive Social Security, you should receive a Form SSA-1099 from the Social Security Administration. This form is for tax-filing purposes and outlines how much you received in Social Security benefits for the year.

Knowing Your Tax Obligations

Understanding the IRSs annual threshold limits is a primary factor in determining whether or not you must file a tax return each year. Most individuals will have similar tax scenarios from year to year, which can be helpful in knowing and understanding your tax obligations.

However, some people may experience drastic changes from year to year as a result of a drop in income from a lost job, a marriage, new children, or even a jump in income when moving beyond dependency or higher education. The IRS provides detailed information each year for every scenario, so the key is staying up to date on the requirements relative to your personal situation. You should also maintain a record of your returns for up to six years.

You May Like: How Does Payroll Tax Work

Do I Need To File Even If Im Not Required To By Filing Status Age And Income Level

In some cases, yesyou will still need to le a tax return if any of the following apply:

- You owe any taxes, such as alternative minimum tax, taxes on a retirement plan distribution, household employment taxes, and Social Security and Medicare taxes that were not withheld from income.

- Repayment of the First-Time Homebuyer Credit.

- You received a distribution from a health savings account, Archer MSA, or Medicare Advantage MSA.

- You had at least $400 in self-employment income.

- You earned $108.28 or more from a church or qualified church-controlled organization that is exempt from employer Social Security and Medicare taxes.

- You received an advance payment of the Premium Tax Credit for health insurance bought from a health insurance marketplace. You should receive Form 1095-A with the amount of the advance payments.

- Advance payments of the Health Coverage Tax Credit were made for you, your spouse or a dependent. You should receive Form 1099-H with the amount of the advance payments.

- You are required to file Form 965-A for an elected installment payment.

- You are claimed as a dependent, but your income exceeded the filing requirement threshold.

Do I Need To File A Us Tax Return As A Non

Most often, non-U.S. citizens residing in the United States who earn other income in the U.S. are required to file a tax refund. If a non-U.S. citizen is involved in a U.S. business or trade, receives U.S. income, or is responsible for filing taxes for an individual who adheres to the previous points, they will need to file a tax return.

Don’t Miss: How To Report 1099 K Income On Tax Return

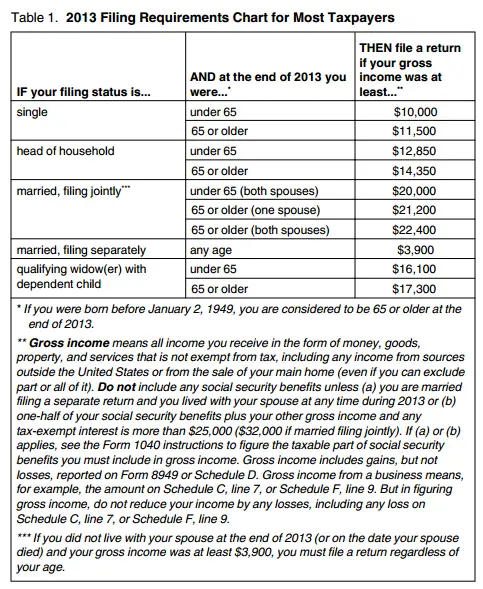

Individuals Required To File A North Carolina Individual Income Tax Return

The following individuals are required to file a 2021 North Carolina individual income tax return:

- Every resident of North Carolina whose gross income for the taxable year exceeds the amount shown in the Filing Requirements Chart for Tax Year 2021 for the individual’s filing status.

- Every part-year resident who received income while a resident of North Carolina or who received income while a nonresident that was attributable to the ownership of any interest in real or tangible personal property in North Carolina, or derived from a business, trade, profession, or occupation carried on in North Carolina, or derived from gambling activities in North Carolina and whose total gross income for the taxable year exceeds the amount shown in the Filing Requirements Chart for Tax Year 2021.

- Every nonresident who received income for the taxable year from North Carolina sources that was attributable to the ownership of any interest in real or tangible personal property in North Carolina, or derived from a business, trade, profession, or occupation carried on in North Carolina, or derived from gambling activities in North Carolina and whose total gross income from all sources both inside and outside of North Carolina for the taxble year exceeds the amount shown in the Filing Requirements Chart for Tax Year 2021. For nonresident business and employees engaged in disaster relief work at the request of a critical infrastructure company, refer to the Personal Tax Division Bulletins.

If Your Child Has Unearned Income Only

A child who has only unearned income must file a return if the total is more than $1,150 for 2022.

Example: Sadie, an 18-year-old dependent child, received $1,900 of taxable interest and dividend income during 2022. She didn’t work during the year. She must file a tax return because she has unearned income only, and her total income is more than the unearned income threshold for 2022.

However, if your child’s interest and dividend income total less than $11,500, you can elect to include that income on your return rather than file a return for the child. In this event, all income over $2,300 is taxed at your tax ratesyou could end up paying more with this method.

You May Like: How Much Can Teachers Claim On Taxes

What Is Inheritance Tax

We touched on inheritance tax briefly above, but at the state level, inheritance tax may affect you. Like estate taxes, it depends on where you live. Only a handful of states charge inheritance tax including Iowa, Kentucky, Maryland, Nebraska, New Jersey, and Pennsylvania.

Typically, spouse and children do not pay inheritance tax and in some states other blood relatives are exempt, but it varies by location. Some states, though, like Maryland, have both an estate and inheritance tax which means some beneficiaries could get hit twice with state taxes even if the estate is exempt from federal taxes.

Everyone, beneficiaries or executors, though, should watch out for capital gains. Thats what triggers a tax liability when the estate earns money after the death. Its best to work with a licensed tax professional to ensure you handle the estate appropriately to avoid excessive tax, while paying what you legally owe.

Penalties For Not Paying Your Taxes

Even if you file an extension to submit your tax return, you must pay any estimated tax you owe by April 15, 2022. If you do not pay your taxes, you will be charged a penalty and owe interest on any unpaid balance.

The penalty for failing to pay your taxes by the due date is 0.5 percent of your unpaid tax for each month or part of a month that your return is late. This penalty is capped at 25 percent of late unpaid taxes. If you file your return on time and request to pay by an installment agreement, the penalty drops to 0.25 percent for each month or part of a month of the installment agreement.

Youre also charged interest on the unpaid balance, which compounds daily. The rate is set each quarter and is based on the federal short-term rate, plus an additional 3 percent.

If you owe taxes and dont file your return on time, youll be charged a penalty for failing to file. This is usually 5 percent of the tax owed for each month or part of a month your return is late. This penalty is also capped at 25 percent.

Also Check: How To Protest Property Taxes In Dallas County

Pros Of Filing An Income Tax Extension

- Avoid late-filing penalties: Filing an extension before the tax deadline could help you avoid a late-filing penalty equal to 5% per month on your tax due.

- More time to prepare a more accurate return: If your taxes are complicated or you’re still waiting to receive necessary documents, adding six months to your timetable will give you the extra time you need to file accurate taxes and take advantage of legal deductions.

- More time to fund a retirement account: If you’re self-employed, filing for a tax extension gives you an extra six months to fund a retirement savings account, including an Individual 401 plan or a Simplified Employee Pension IRA.

Welcome To Maine Fastfile

Maine Revenue Services solution to fast and secure tax filing. The Maine Fastfile service provides three options:

Modernized e-File e-File using tax preparation softwareThis service is offered through the IRS and provides one stop processing of federal and state returns. This is the do it yourself option through the purchase of tax preparation software either over-the-counter or online, prepare your own return and press send to e-file. Your return is sent through safe and secure channels, not via e-mail. Prices do vary so shop around .

OR e-File through a paid tax professional

Find a tax professional you trust to prepare and e-file your return. Nearly all tax preparers use e-file now and many are now required by law to e-file. But its still a good idea to tell your tax preparer you want the advantages of e-file your refund in half the time, or if you owe, more payment options.

Maine i-File i-File free for Maine taxpayersThis service is available for filing your individual income tax return including the Maine property tax fairness credit. The advantages of Maine i-File are:

Certain restrictions apply. See the directions page of the i-File application for more information.

Read Also: When Will I Get My Federal Tax Refund

Don’t Miss: Do You Have To File Taxes With Uber

Irs Electronic Free File For Federal Returns

You may qualify to electronically file your federal return for free by using IRS Free File Some of the companies participating in the IRS Free File service will file your Maryland return electronically for free as well. No matter what company you select, you can always return to file your Maryland tax return for free online, using our iFile or bFile services. Keep in mind that your Maryland return begins with your federal adjusted gross income, so you must prepare your federal return first before you can prepare your Maryland return.

Generally, you are required to file a Maryland income tax return if:

- You are or were a Maryland resident

- You are required to file a federal income tax return and

- Your Maryland gross income equals or exceeds the level listed below for your filing status. The filing levels also apply to nonresident taxpayers who are required to file a Maryland return.

Even if you are not required to file a federal return, you may be required to file a Maryland return if your Maryland addition modifications added to your gross income exceed the filing requirement for your filing status. Dependent taxpayers must take into account both their additions to and subtractions from income to determine their gross income.

For more information, see the instructions in the and nonresident tax booklet.

Filing Requirements for 2021 Tax Year

|

Filing Status |

|

| One spouse 65 or older | $ 26,450 |

| $ 26,450 |

Your income tax return is due July 15, 2022.

Irs Free File Available Until October 17 Midnight Eastern Time

Welcome to IRS Free File, where you can electronically prepare and file your federal individual income tax return for free using tax preparation and filing software. Let IRS Free File do the hard work for you.

IRS Free File lets you prepare and file your federal income tax online using guided tax preparation, at an IRS partner site or Free File Fillable Forms. Its safe, easy and no cost to you for a federal return.

To receive a free federal tax return, you must select an IRS Free File provider from the Browse All Offers page or from your Online Lookup Tool results. Once you click your desired IRS Free File provider, you will leave the IRS.gov website and land on the IRS Free File providers website. Then, you must create an account at the IRS Free File providers website accessed via IRS.gov to prepare and file your return. Please note that an account created at the same providers commercial tax preparation website does NOT work with IRS Free File: you MUST access the providers Free File site as instructed above.

Read Also: How Long Do I Have To File Tax Extension

You May Like: When Is Sales Tax Due In Ny

Why Is Turbotax Charging Me

If you make less than $36,000 a year and TurboTax is telling you it costs money to file, you are probably using the wrong version of TurboTax. Dont worry, there is a way to access the truly free version.

As ProPublica reported last year, TurboTax purposefully hid its Free File product and directed taxpayers to a version where many had to pay, which is called the TurboTax Free Edition. If you clicked on this FREE Guaranteed option, you could input a lot of your information, only to be told toward the end of the process that you need to pay.

You can access TurboTaxs Free File version here. This version is offered through the Free File agreement.

TurboTaxs misleading advertising and website design directed users to more expensive versions of the software, even if they qualified to file for free. After our stories published, some people demanded and got refunds. Intuit, the maker of TurboTax, faces several investigations and lawsuits because of this. The company has denied wrongdoing.

Following ProPublicas reporting, the IRS announced an update to its agreement with the tax-preparation companies. Among other things, the update bars the companies from hiding their Free File offerings from Google search results. It also makes it so each company has to name their Free File service the same way using the format: IRS Free File Program delivered by .

Read Also: How Long Should We Keep Tax Records