Do I Need To File Even If Im Not Required To By Filing Status Age And Income Level

In some cases, yesyou will still need to le a tax return if any of the following apply:

- You owe any taxes, such as alternative minimum tax, taxes on a retirement plan distribution, household employment taxes, and Social Security and Medicare taxes that were not withheld from income.

- You received a distribution from a health savings account, Archer MSA, or Medicare Advantage MSA.

- You had at least $400 in self-employment income.

- You earned $108.28 or more from a church or qualified church-controlled organization that is exempt from employer Social Security and Medicare taxes.

- You received an advance payment of the Premium Tax Credit for health insurance bought from a health insurance marketplace. You should receive Form 1095-A with the amount of the advance payments.

- Advance payments of the health coverage tax credit were made for you, your spouse or a dependent. You should receive Form 1099-H with the amount of the advance payments. Note: For tax year 2020, any excess amount of advance premium tax credit payments received doesnt have to be repaid, according to the American Rescue Plan .

- You were required to file Form 965 for a triggering event or Form 965-A for an elected installment payment.

Is Social Security Taxed After Age 70

After age 70, there is no longer any increase, so you should claim your benefits then even if they will be partly subject to income tax. Your earnings are not subject to any tax if you hold the account at least five years and are over 59.5 years old. If you have a traditional IRA, you can convert it into a Roth IRA.

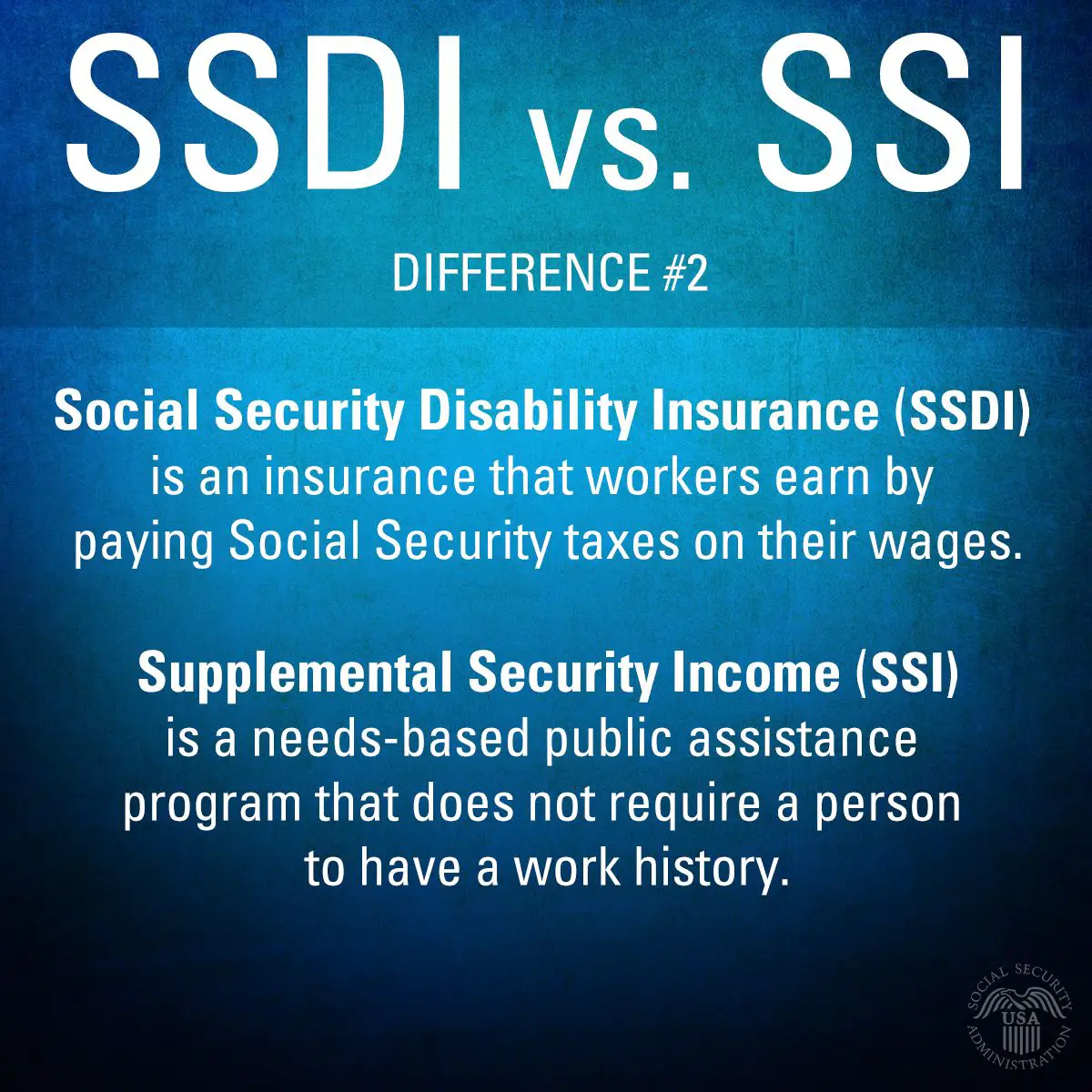

What Is A Supplemental Security Income

Put simply, its a program that provides monthly payments to adults and children with a disability or blindness who have an income and resources below a specific financial limit, which is roughly around having less than $2,000 if youre single.

This rises to $3,000 in available assets for a couple and excludes disability saving accounts, so theres some workaround with those thresholds.

The supplemental security payments can also be made to people age 65 and older without disabilities who meet the financial qualifications, but its worth noting here that not all states will provide the same amount of this supplementary income because its not funded by social security taxes and is supported by local funds.

The payments, however, can be reduced when you have countable income, which includes payments from unemployment, social security retirement, and even free food or shelter.

Read Also: How To Challenge Property Tax Assessment

When Do People On Disability Have To File Taxes

Sometimes you have to file taxes even if you dont have much income other than disability benefits. Filing is usually mandatory when you owe the IRS money, or if you are self-employed and make more than $400.

There are times when youll want to file a return even though you dont have to. For example, if you expect a refund of payroll taxes withheld by an employer or if you qualify for a tax credit, you need to file taxes to get the money. However, remember that SSDI payments aren’t generally taxed, so you cannot get a disability tax refund. If you earn only SSDI, consider whether you need to file.

Additionally, a portion of Social Security disability benefits may be taxable if you have too much other income. The rules the IRS uses to determine if benefits are taxable are the same that apply to Social Security retirement benefits.

To find out if some of your benefits may be taxable, add 50 percent of your annual disability payments to your other income. If the total is over $25,000 and you file as a single person, at least 50 percent of your Social Security disability benefits may be taxable, and you have to report the taxable amount on your tax return. If you file a joint return with your spouse, the limit is $32,000.

Read More:Do You Pay Taxes on Disability Payments?

Short Term Disability Income Is Usually Taxed By The Irs

When your employer pays for the policy , the IRS considers those premium payments to be untaxed income so they take taxes on the back-end when you make a claim and get benefits. However, if you paid for some or all of the premiums with your own after-tax dollars, then that portion of the income is not subject to federal tax.

Don’t Miss: How Much Property Tax Is Deductible

Why Did I Receive A Form 1099g

Form 1099G reports the total taxable income we issue you in a calendar year. This income is reported to the IRS. As taxable income, these payments must be reported on your federal tax return, but they are exempt from California state income tax.

Total taxable benefits include:

Note: Benefits are taxed based on the date the payment was issued.

Do You File Taxes When Receiving Disability Payments

When you work as an individual for a company, your employer deducts taxes from your paycheck. Every year you receive a W-2 form telling you how much your income is taxable and the taxes you have paid for the year. Once you file your taxes, you can see how much you owe or how much the government owes you. In fact, those taxes are what make disability benefits possible.

This process fairly straightforward. However, for Social Security Disability recipients, it isnt that simple. Disability payments arent always taxable. So, when do you file taxes when receiving disability payments? The easy answer is always. You file taxes when you have income. Here are ways to see if your benefits are taxable.

Recommended Reading: Is Past Year Tax Legit

Remember To Check Your Earnings History

If you dont receive Social Security benefits, this is a great time to review your earnings history by looking at your Social Security Statement . Its important because your future Social Security benefits will be based on your earnings history we received from the IRS. Underreported earnings will mean lower monthly benefit payments when you are ready to start receiving them.

Use your Statement to review your earnings history and to see personalized benefit estimates so you can plan for your future.

Tax season doesnt have to be a stressful time of year. And for many people, its an opportunity to claim additional money. Thanks to the American Rescue Plan, more Americans can claim larger Child Tax Credits and Earned Income Tax Credits for 2021.

Please share this blog with family and friends and remember that Social Security is here to help secure your today and tomorrow.

Reporting Income To The Ssa

Although SSI benefits arent taxable, you must nonetheless report all sources of your income to the Social Security Administration if youre collecting SSI. But you do not have to report SSI income to the IRS. The distinction isnt so much whether benefits are reportable, but to whom theyre reportable and why.

You must report all sources of income to the SSA because your need for financial support might be partiallyif not entirelyerased if you come upon another source of income. This extra income could mean that you would no longer be eligible for SSI.

State and federal laws change frequently, and the information in this article may not reflect your own states laws or the most recent changes to the law. For current tax or legal advice, please consult with an accountant or an attorney.

Understandably, the SSA wants to know about this turn of events. Likewise, if you should become employed so youre earning , this would most likely reduce your benefits. However, it may not completely eliminate your benefits.

According to the SSA, reportable income includes all money that comes into your household, including money that you or your spouse receives. The money doesnt have to be earned from a job. If you win a little money from a scratch-off ticket or receive a cash gift from a family member, you must report these things to the SSA.

There are a few sources of income that the SSA does exclude from counting against you for qualifying purposes, such as rent subsidies.

You May Like: Does South Carolina Tax Retirement Income

A Helping Hand From An Indianapolis Social Disability Lawyer

When you have complications with your Social Security disability benefits claim, the help of an Indianapolis social disability lawyer is crucial to getting the assistance you need. In order to get back on track with your Social Security benefits claim, download a copy of our complimentary book, 8 Mistakes to Avoid When Filing for Social Security Disability Benefits, then contact a Social Security lawyer at Hensley Legal Group for a no-cost consultation at 472-3333.

Can I Claim My Parent As A Dependent If

they receive Social Security Retirement Benefits?

Yes. Your parent is receiving benefits for the time and effort they put in while on the workforce. This amount is not included in their gross income amount for the year. That means that Rule #4 above is still met even if their benefits come to more than $4,000 annually.

EXCEPTION: If your parent decides to go back to work after retiring, then that income could affect Rule #4 and Rule #5 above. Heres how. If their income amount from the new job comes out to be more than $4,000 for the year, then you can not claim them as a dependent on your taxes. In turn, if they are providing more than 50% of their own support with the new job, then you cannot claim them as a dependent either.

they receive Social Security Disability?

Yes. Millions of Americans each year enter into the Social Security Disability program because they are no longer able to work due to a medical condition. Disability is available to those whose condition is expected to last longer than 12 consecutive months . One can receive this benefit until they are either no longer disabled or have reached full retirement age.

EXCEPTION: You can claim your parent as a dependent on your tax return without their benefit being affected. However, Social Security benefits can limit any wage income they receive while on disability .

they receive Supplemental Security Income ?

they have a job?

Recommended Reading: How Much Does H& r Block Charge To Do Taxes

Recommended Reading: How Do I Look Up My Car Taxes

You Don’t Have To Report Ssi Income To The Irs

kali9 / Getty Images

Supplemental Security Income benefits are considered to be government assistance, which means they aren’t taxable. Like welfare benefits, they don’t have to be reported on a tax return.

Some confusion arises, however, because the Social Security Administrationnot the IRSdoes require you to report income information in order to qualify for SSI. Here’s how income affects SSI.

Disability Insurance: Taxes And Deductibility

Your ability to work and earn an income is likely the most important asset you have. Disability insurance also known as disability income insurance can give you income to live on if you become temporarily or permanently disabled. Its not just for accidental injuries most disability is caused by illness and medical issues. And it can happen to anyone: The Social Security Administration estimates one in four 20-year-olds will experience a disability during their working years.1

Thats why many professionals say disability insurance is as important a source of financial protection as life insurance. But while life insurance proceeds are generally not taxable, thats not necessarily the case with disability insurance: depending on the type of coverage and how it was paid for, the benefit could be taxed like ordinary income, at a different rate, or not at all. This article will help you understand what is taxable and what is not by explaining:

Recommended Reading: What Do You Do If Your Taxes Are Late

Permanent And Total Disability

A person has a permanent and total disability if both of the following apply:

- They cant engage in any substantial gainful activity because of a physical or mental condition and

- A doctor determines their condition:

- Has lasted continuously for at least a year or

- Will last continuously for at least a year or

- Can lead to death

How To File Taxes When Receiving Social Security Disability Payments

Each and every year U.S. citizens have to file taxes with the Internal Revenue Service . When you work for an employer, tax season is rather simple and straightforward. Your employer deducts taxes from your weekly paychecks and, at the end of the year, provides you with a W-2 telling you how much money you made and how much of that money went to the government. That information is then used to file your taxes with the IRS. Tax season isn’t so simple and straightforward for Social Security Disability beneficiaries, but it doesn’t have to be a financial nightmare. If you have begun receiving payments from the Social Security Administration , the following information will help you get through the upcoming tax season and will help you understand how to file your IRS tax return.

Recommended Reading: What Are The Income Tax Brackets

How Does Social Security Disability Insurance Work

The amount you receive on a monthly basis is determined by your lifetime average earnings covered by Social Security. It will depend on your work and earnings history that was reported to Social Security, and the age at which you become disabled. The Social Security Administration provides a Disability Planner to help you determine how much you will receive.

The ways these benefits are calculated are actually revised annually by the SSA. You can learn more about this on the SSA website. In addition to the disability planner, SSA also has a disability starter kit that prepares you for your disability interview or online application. The SSA has a Disability Starter Kit to help you get ready for your disability interview or online application. The kit includes information about what SSA will need from you, what they intend to ask you, and general information about disability programs and the decision-making process.

How A Disability Lawyer Could Help

For many people, disability benefits can make all the difference in the world. But these benefits can come with complex rules around taxes that could cause problems down the line. If you need to seek disability benefits, a lawyer could help by:

- Explaining the tax implications of your benefits

- Showing how lump sum benefits could be applied to prior tax years

- Advising you about your options and helping you decide the best path forward

- Managing the stress and paperwork involved in a disability claim

- Advocating for you and your benefits throughout the disability claim process

You May Like: Will I Get Any Money Back From My Taxes

You May Like: Where To File My Taxes

What Happens If You Fail To Report Income To Ssi

If you fail to report changes in a timely way, or if you intentionally make a false statement, we may stop your SSI, disability, and retirement benefits. We may also impose a sanction against your payments. The first sanction is a loss of payments for six months. Subsequent sanctions are for 12 and 24 months.

Why Did I Get An Extra Payment From Social Security This Month

The extra payment compensates those Social Security beneficiaries who were affected by the error for any shortfall they experienced between January 2000 and July 2001, when the payments will be made. Who was affected by the mistake? The mistake affected people who were eligible for Social Security before January 2000.

Recommended Reading: Is Real Estate Tax The Same As Property Tax

What Should I Do If I Used All Or Part Of A Social Security Back Payment To Reimburse A Long

Special tax relief is available under §1341 of the Internal Revenue Code, again avoiding the need to amend a prior tax return. See IRS Publication 525. If the repayment to the LTD carrier is under $3,000, the taxpayer gets a deduction on the current years tax return. For repayments over $3,000, the taxpayer chooses either the deduction or a tax credit for the excess tax paid in the prior year. A subtle tax issue to watch: LTD reimbursements to the carrier also cause phantom taxable income in some cases, due to the separate 1099 forms issued for the year by SSA and by the carrier.

Read Also: When Do Social Security Benefits Become Taxable

Is Ssdi Back Pay Taxable

Back pay refers to SSDI benefits for the months when the individual was disabled while waiting for approval. SSDI back pay, including lump-sum payments, could increase SSDI recipients income for the year in which the individual receives them. This could lead to increased tax liability for individuals.

If SSDI recipients dont want to lose a portion of their back pay through taxation, they can apply their benefits owed from the year before to previous tax returns. Doing so would reduce their taxable income for the year when they receive their back pay.

Also Check: How To Pay Social Security Tax

How Social Security Disability Benefits Affect Your Tax Liability

Oftentimes, SSDI benefits recipients dont need to pay taxes because they tend to have minimal income from other sources. However, individuals may need to pay taxes on these benefits under certain circumstances. If a recipient has other sources of income,reporting SSDI income on tax returns may be necessary.

Generally, if you are a single filer, and your income falls between $25,000 and $34,000, you will need to report up to 50% of your SSDI benefits when you report your taxable income. If your annual income exceeds $34.000, up to 85% of your SSDI benefits may be taxable.

If you are married and file jointly with your spouse, up to 50% of your SSDI may be taxable if your combined income is between $32,000 and $44,000. If your combined income is over $44,000, you may need to pay federal income taxes on up to 85% of your SSDI benefits.