How To Find If There Is A Lien On A House

1. Contact or visit the County Recorders Office2. Contact or Visit the County Assessors Office3. Contact of Visit the Property Title Company

Im looking to get approved for an FHA loan and I fear I may have an IRS lien against me is there any way to perform the search that the lender will perform to know if Im in the clear or not? Can I simply contact my local courthouse? Thanks in advance

squarryadministrator

If you are attempting to apply for a FHA loan then you will want to contact the relevant courthouse about this lien search as they can offer you official information that can be used for lending, hiring, academic applications, security clearances, etc..

A lien search can reveal all kinds of important information about debts that are unpaid or a loan that is still in effect. Its best practice to verify your lien information on regular basis for accuracy as sometimes there are errors, especially if youre trying to fix your background information for loans and such.

Understand What Your Business Income Is

The first step of being able to successfully verify your income from Doordash, Grubhub, Uber Eats, Lyft and other gig economy apps is to understand exactly what that income is.

Your income is NOT the money that comes from these gig companies. These lenders and creditors look at that money as your business revenue.

They also understand that a business has expenses. They want to know about those as well.

In other words, they want to know your profit. It’s important that they know both the income and the expenses, the profit and loss. They want to know how much is left over at the end of the day.

Your business could be bringing in a million dollars. However, if it’s paying out a million and a half dollars, lenders aren’t very confident that you’ll be able to keep up with your loan or rent payments.

You Should Be Tracking Your Actual Car Expenses As Well As Your Miles

I know that seems off topic.

This kind of balances some of what I said in that last section. The reality is, when we use our cars as much as most of us do, our real profits are often a fair bit higher than our taxable profits.

Look at the second P& L that I showed above .

Notice the detail on the car expenses? All of my fuel, registration, insurance and other costs are listed and broken down. I even have depreciation figured in.

The actual expense comes out to 33¢ per mile.

If I were to only list the 57.5 cents per mile that the IRS allows in 2020, my profits would be $2500 less. In other words, my actual income would look like it’s $2500 less than what it is.

You want to track both. You want to document both mileage amount AND actual costs.

I know I just said above that you want to line up with your taxable income. But if you have good records and good documentation of what your ACTUAL costs are you can demonstrate that you’re actually earning more.

Recommended Reading: Ccao Certified Final 2020 Assessed Value

Three Steps To Understanding How To Verify Your Income As A Gig Economy Contractor

There are no paystubs when you are a self employed contractor for Grubhub, Uber Eats, Postmates, Doordash, Lyft, Instacart or other gig economy apps, so how do I verify my income if I want to rent an apartment, get a car loan or take out a mortgage?

Here’s the important thing to remember. You are not an employee of any of these companies. You cannot and will not get a paystub or W2, or anything like that.

That means you may not be able to get any kind of proof from them verifying they paid you anything. . Does that mean you’re screwed when it comes to anything that requires income verification?

No. Not if you approach it right.

Read on for three steps you need to take to make sure you are properly presenting and verifying your income as a contractor for Doordash, Uber Eats, Grubhub, Lyft or any other gig economy apps.

But here’s what it boils down to:

You are presenting your information as a business owner. Not as an employee.

When you understand this one important fact, you’re in a better position to properly and successfully verify your income whether you’re applying for a loan, a mortgage, an apartment lease or anything similar.

How Do I Retitle My Vehicle If I Am A New Resident

New residents must retitle their vehicle in the State of Mississippi. If you own your vehicle outright with no lien holder, you will need your title from the other state, your registration from the other state, proof of residency in MadisonCounty, and your out of state license plate. Whoever is listed on the front of the out of state title as owner must appear the first time to apply for aMississippi title. If you have a lien holder, you will need your registration from the other state, the current full name and address of your lien holder, proof of residency in Madison County and your out of state license plate. If you have a lease vehicle, you will need POA from the Lease Company along with the license plate and registration from the other state.

You May Like: How To Protest Property Taxes In Harris County

Option : Check Your Ein Confirmation Letter

The easiest way to find your EIN is to dig up your EIN confirmation letter. This is the original document the IRS issued when you first applied for your EIN. The letter will show your business tax ID and other identifying information for your business.

-

If you applied online for your EIN, the IRS would have issued your confirmation letter right away, accessible online. You would have also had the opportunity to choose receipt by traditional mail.

-

If you applied by fax, you would have received your confirmation letter by return fax.

-

If you applied by mail, you would have received your confirmation letter by return mail.

Your EIN confirmation letter is an important tax and business document, so ideally you stored it away with other key paperwork, such as your business bank account information and incorporation documents.

In this sample EIN confirmation letter, you can find your EIN at the top of the page, as well as in the first paragraph.

Present Your Earnings By Way Of Profit And Loss

Do not tell a lender or apartment management company that you are an employee of Doordash, Uber Eats, Grubhub or any of the gig companies.

That’s going to get you off on the wrong foot. That’s because the bottom line is, you can’t back it up. You have no paystubs and you won’t be able to get any documentation or letter from these companies confirming you are an employee.

THAT is because you aren’t an employee.

You May Like: Harris County Property Tax Protest Services

How Can I Lookup If There Is A Lien On My Home

You can find out if there is a bank lien on a house by contacting County Recorders Office in the relevant county. You can typically find out if there is a bank lien on a house and who the home title holder is by searching by name or address.

Can a lien be placed due to student loan debt

Veness, according to the Department of Education, a lien can be placed on a student loan and there are not time constraints on this or statutes of limitations for them to collect this debt.

I am putting house up for sale and would love me to know if there are any liens on property located at 2306 Sheriff Drive in Grand Prairie, Tx 75051. I just wanted to know if anything would prevent me from selling my house

Terry, thank you for reaching out about our Free Lien Search Blog, we have researched your information for Grand Prarie, Texas and did not find any property liens in our public record resources. That being said, you can contact the Grand Prarie County Clerk and inquire about any outstanding liens against your property, sometimes property liens are delayed when being reported as public record. For your convenience,their phone number is 972-237-4465.

I am looking to see if there is a tax lien on this property .. 214314 County Rd. KK , Mosinee , Wisconsin

Need to know if i have a medical lien in millville Nj from medicad for a selttement

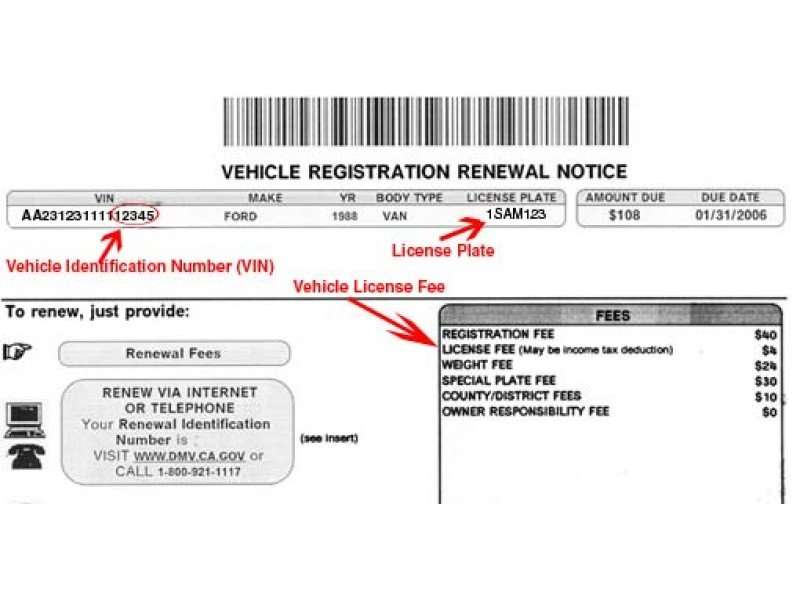

How Is The Cost Of A License Plate Computed

The VIN or Vehicle Identification Number from your vehicle is entered into the state/county computer, which pulls a value acquired by the State Tax Commission from R. L. Polk Black Book, a supplier of the Manufacturers Suggested Retail Price . This amount is multiplied times the millage rate for the area in which you reside, less the tag credit you receive in Mississippi when you purchase or renew your plate on time, plus any penalty if applicable.

Also Check: Efstatus.taxact.xom

Back It Up With Revenue Documentation

Anyone can put together a profit and loss statement and just make things up.

Banks and management companies want more than just that. This means you want to back it up.

After all, this is about VERIFYING your income as a contractor for Grubhub or Doordash or Uber Eats, Lyft, Instacart, or any other gig company.

How can you show mortgate or auto lenders, or apartment managers/owners that the income you are presenting is legitimate? What can you provide to give them confidence that you REALLY ARE making the money that you say you are?

Here’s an example of documentation requested by Churchill Mortgage when you are applying for a mortgage. Note that they ask for your personal tax filings AND your business tax filings . The main thing is, you want to back up anything you claim especially when it comes to revenue.

There are a couple of things in particular you can provide.

Ein Lookup: How To Find Your Business Tax Id Number

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

This article has been reviewed by tax expert Erica Gellerman, CPA.

A business tax ID number, also called an employer identification number or federal tax ID, is a unique nine-digit number that identifies your business with the IRS. Owners of most types of business entities need a business tax ID number to file taxes, open a business bank account, obtain a business license, or apply for a business loan.

How Much Do You Need?

Most people know their social security number by heart, but not all business owners know their business tax ID number. Your EIN isn’t something that you use on a day-to-day basis, so keeping this number top of mind isn’t as easy as remembering your company’s phone number or address.

However, your EIN is essential for some very important business transactions, like filing business taxes and obtaining small business loans. Accuracy and speed matter in those situations. Not having your business tax ID can prevent you from getting crucial funding for your business or meeting a business tax deadline.

How to find your business tax ID number:

Check your EIN confirmation letter

Check other places your EIN could be recorded

Read Also: Do I Have To Pay Taxes On Plasma Donation

Why Do I Have A Medical Lien

A Medical Lien is a typically placed on a persons assets to recover medical expenses from a personal injury. Doctors, health care providers, hospitals and other care physicians have the right to file a medical lien to recover expenses owed for their services.

Can I find out if my house has a Lien with out using my name. I dont want to put that on internet and raise eye brows? Can you help if I just give address?

We can only perform a house lien by name with our database. You can check with the city recorder of your county if you want to see if there is a lien on your property.

Tag & Tax Together Program

In 2005, the North Carolina General Assembly passed a law to create a combined motor vehicle registration renewal and property tax collection system. The law transfers responsibility of motor vehicle tax collection to the N.C. Division of Motor Vehicles . This new Tag & Tax Together program was designed as a convenient way to pay annual vehicle tag renewals and property taxes in one transaction.

Beginning with renewal notices mailed in July 2013 and due in September 2013, your registration renewal and property tax will be due the same month each year. The NC DMV will send a new combined notice that includes both the vehicle registration fee and property taxes. You will not be permitted to renew your tag without paying all taxes owed on the vehicle.Please see the Tag & Tax Together Frequently Asked Questions section at the bottom of this page for additional information.

If you received a Combined Vehicle Registration Renewal and Property Tax Notice and have questions, please visit this page.

Recommended Reading: When Do You Do Tax Returns

Undelivered Federal Tax Refund Checks

Refund checks are mailed to your last known address. If you move without notifying the IRS or the U.S. Postal Service , your refund check may be returned to the IRS.

If you were expecting a federal tax refund and did not receive it, check the IRS’Wheres My Refund page. You’ll need to enter your Social Security number, filing status, and the exact whole dollar amount of your refund. You may be prompted to change your address online.

You can also to check on the status of your refund. Wait times to speak with a representative can be long. But, you can avoid waiting by using the automated phone system. Follow the message prompts when you call.

If you move, submit a Change of Address – Form 8822 to the IRS you should also submit a Change of Address to the USPS.

About Kelley Blue Book Values

For over 90 years, Kelley Blue Book has been The Trusted Resource for used car values, helping car owners understand what their used car is worth. Depending on the method of disposal, there actually may be more than one Blue Book Value for the consumer’s car, truck or SUV. The Kelley Blue Book Trade In Range shows what a consumer can expect to receive for their car this week when trading it in at a dealer. The Kelley Blue Book Private Party Value reports on a fair price when selling the car to an individual instead of doing a dealer trade in. Our Values are the results of massive amounts of data, including actual sales transactions and auction prices, which are then analyzed and adjusted to account for seasonality and market trends. Kelley Blue Book Values reflect local conditions in over 100 different geographic regions and are updated weekly to give consumers the most up-to-date used car pricing information.

Read Also: Efstatus.taxact.com.

How The Treasury Offset Program Works

Here’s how the Treasury Offset Program works:

If you owe more money than the payment you were going to receive, then TOP will send the entire amount to the other government agency. If you owe less, TOP will send the agency the amount you owed, and then send you the remaining balance.

Here’s an example: you were going to receive a $1,500 federal tax refund. But you are delinquent on a student loan and have $1,000 outstanding. TOP will deduct $1,000 from your tax refund and send it to the correct government agency. It will also send you a notice of its action, along with the remaining $500 that was due to you as a tax refund.

The Internal Revenue Service can help you understand more about tax refund offsets.

Why You Need To Know Your Business Tax Id Number

The IRS requires most types of businesses to apply for an EIN. The exceptions are some sole proprietors and owners of single-member LLCs, who can use their social security number instead of an EIN. But even small business owners who don’t have to get an EIN often opt to get one, so that they’re able to separate their business and personal finances.

If the IRS requires you to get an EIN or if you choose to get one, these are some of the situations where you’ll need to provide your business tax ID number:

-

When filing business tax returns or making business tax payments

-

When applying for a business loan

-

When opening a business bank account

-

When applying for a business credit card

-

When issuing Form 1099s to independent contractors

Although each of these transactions doesn’t happen regularly, when you consider all of them together, you’ll need to provide your EIN at least a few times per year. So, this is a number worth committing to memory and storing safely. Ideally, you should retrieve your business tax ID before you complete any of the transactions above.

Also Check: Is Plasma Donation Money Taxable