Do I Have To Pay Taxes On Inheritance

The Franchise Tax Board, which functions similarly to the Internal Revenue Service for the state of California, will not impose any estate taxes on the inheritance that is received, regardless of the amount of the decedents estate. This only applies at the level of the state the federal government has its own set of regulations regarding the estate tax.

Sell Inherited Property Fast With A Cash Sale

Another option for selling an inherited house is to look for home buying companies. This option is one of the quickest ways to sell a house and eliminates much of the typical time-consuming and expensive processes you normally have to go through when selling real estate.

Most cash buyers are going to be businesses, like SoCal Home Buyers. Companies like ours specialize in buying homes with as little stress as possible. While the final sale price may not be as much as you would get through a standard sale with an agent, you can usually sell the house as is and the sale can be finalized in a matter of days instead of months.

A cash home sale can be the ideal option if your parents home has fallen into disrepair or if you live out-of-state and do not want to worry about the property for months on end.

Federal State And Inheritance Tax On House Rules Explained

First things first, lets go over all the federal estate taxes, inheritance taxes, and state tax youll be expected to pay when inheriting an asset in the state of California, so you can get familiar with whats expected of you as the recipient.

When a person dies and leaves an asset behind for their family, the recipient automatically becomes responsible for paying a number of different taxes the asset is liable for, including federal estate tax, state inheritance tax, and capital gains taxes.

Luckily, that doesnt necessarily mean youll have to add all these taxes onto your tax bill as soon as you become a beneficiary of an inherited home.

In fact, you might end up paying the minimum taxable amount or almost nothing at all as long as you fit certain thresholds!

Generally speaking, most people wont have to pay any federal estate tax, as according to the latest IRS regulations, youll only have to pay federal estate tax if the assets in question are worth $11.70 million or more, which likely wont be the case in the majority of inheritance cases.

If you inherit a property in California, you also wont have to pay state estate taxes, making the process a lot simpler and affordable, but that doesnt mean you wont have to prepare for other tax considerations.

So, lets go over all the different tax rules you could be subjected to and see what, exactly, you could be responsible for paying:

Read Also: Can I Still Do My Taxes

What Is The 7 Year Rule In Inheritance Tax

If you survive for seven years after donating a gift, there is no need to pay tax on that donation, unless the gift was made as part of a trust arrangement. The term for this principle is the 7-year rule. If you pass away within seven years after donating a gift and there is inheritance tax to pay, the total amount of tax that must be paid is determined by when you donated the gift.

What Is The Inheritance Tax

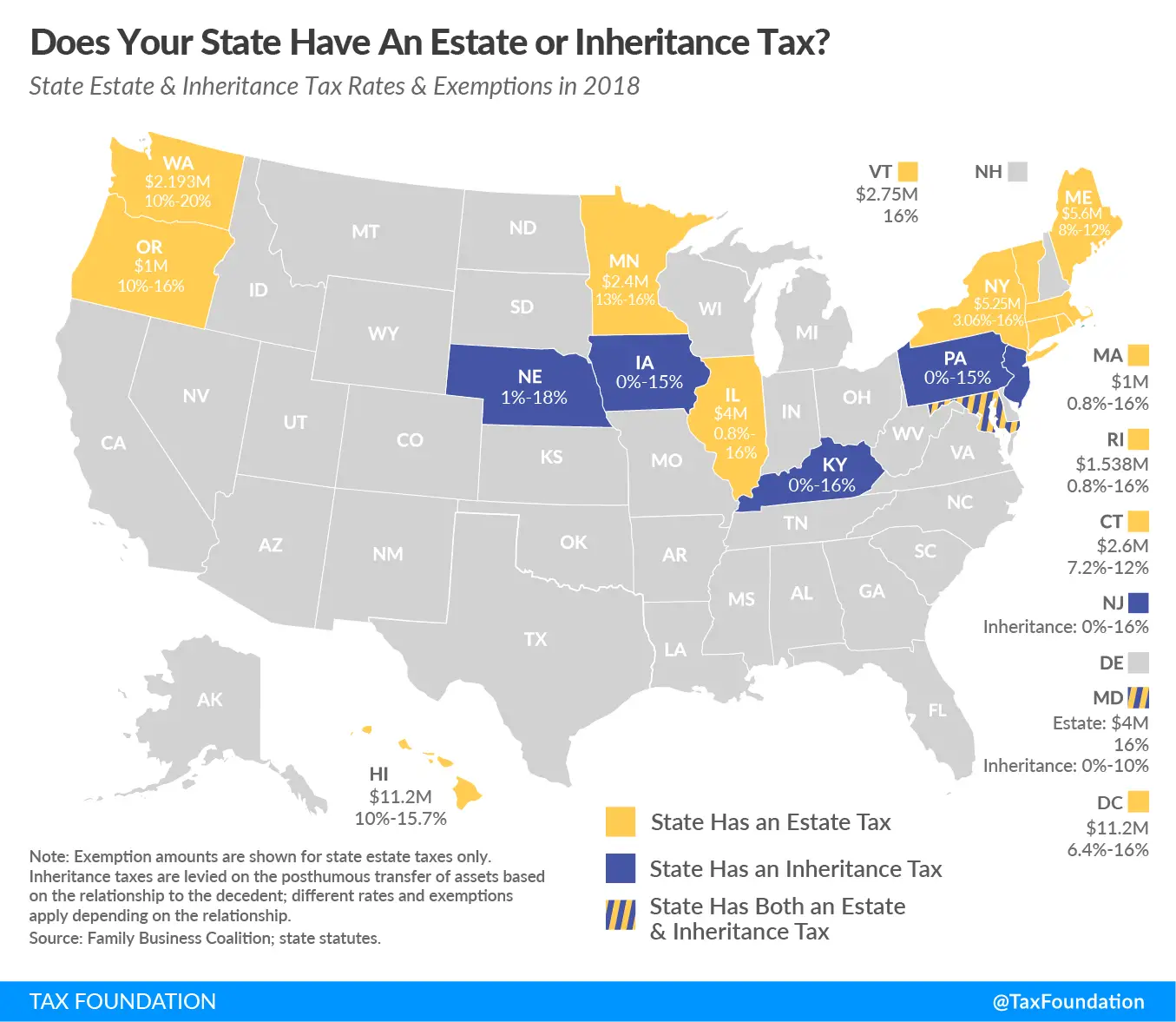

Inheritance tax is a state tax on money or property left to others after someone dies. Inheritance taxes are relatively rare. In 2022, only six states have an inheritance tax.

Estate tax works differently and is more common. An estate taxes the value of the property at the time someone dies, leading some people to call it a death tax. Twelve states, Washington, DC, and the federal government have an estate tax. Maryland is the only state that has both an inheritance and an estate tax.

Also Check: How To Get Comps For Property Tax Appeal

What Is Your Estate Worth

For instance, if you have 1 million going through probate, 1 million passing by non-probate transfers, and 4 million in an irrevocable living trust. Then your estate is valued at 6 million dollars.

Death taxes are imposed on everything in the 6 million dollar estate, not just the one million dollars passing through probate.

How Do Death Taxes And Estate Taxes Work

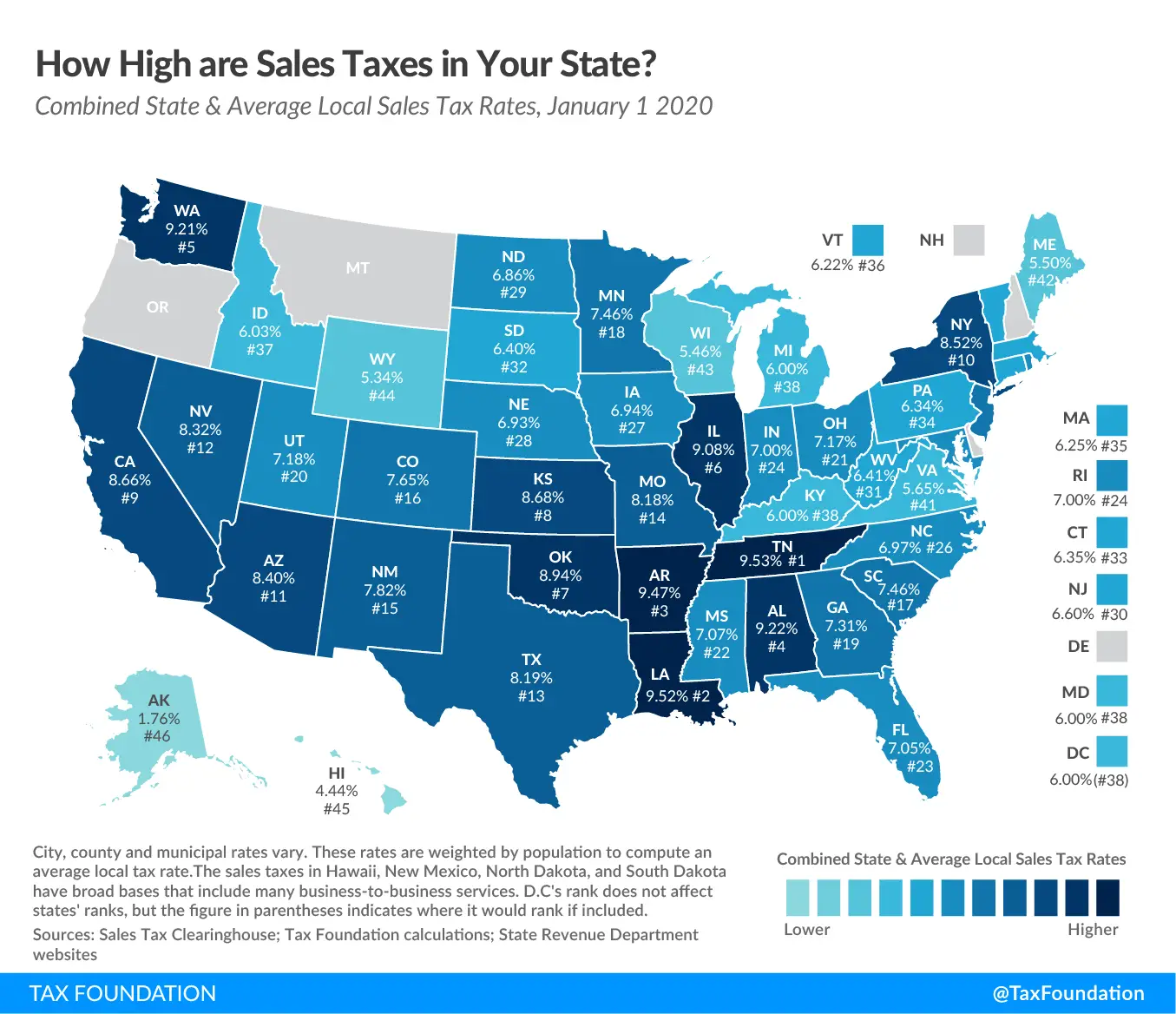

State and federal laws vary, but the general idea is that only estates valued at or above certain amounts are subject to estate taxes. This is true on both the state and federal level.

The amount an estate must be worth to incur estate taxes is called the threshold. This amount is also referred to as an exemption.

For example, if you live in a state where the threshold for estate taxes is $5 million and your estate is worth $4 million, your estate is not subject to any estate taxes on the state level.

If in that example your estate is worth $6 million, your estate is subject to estate taxes on the state level.

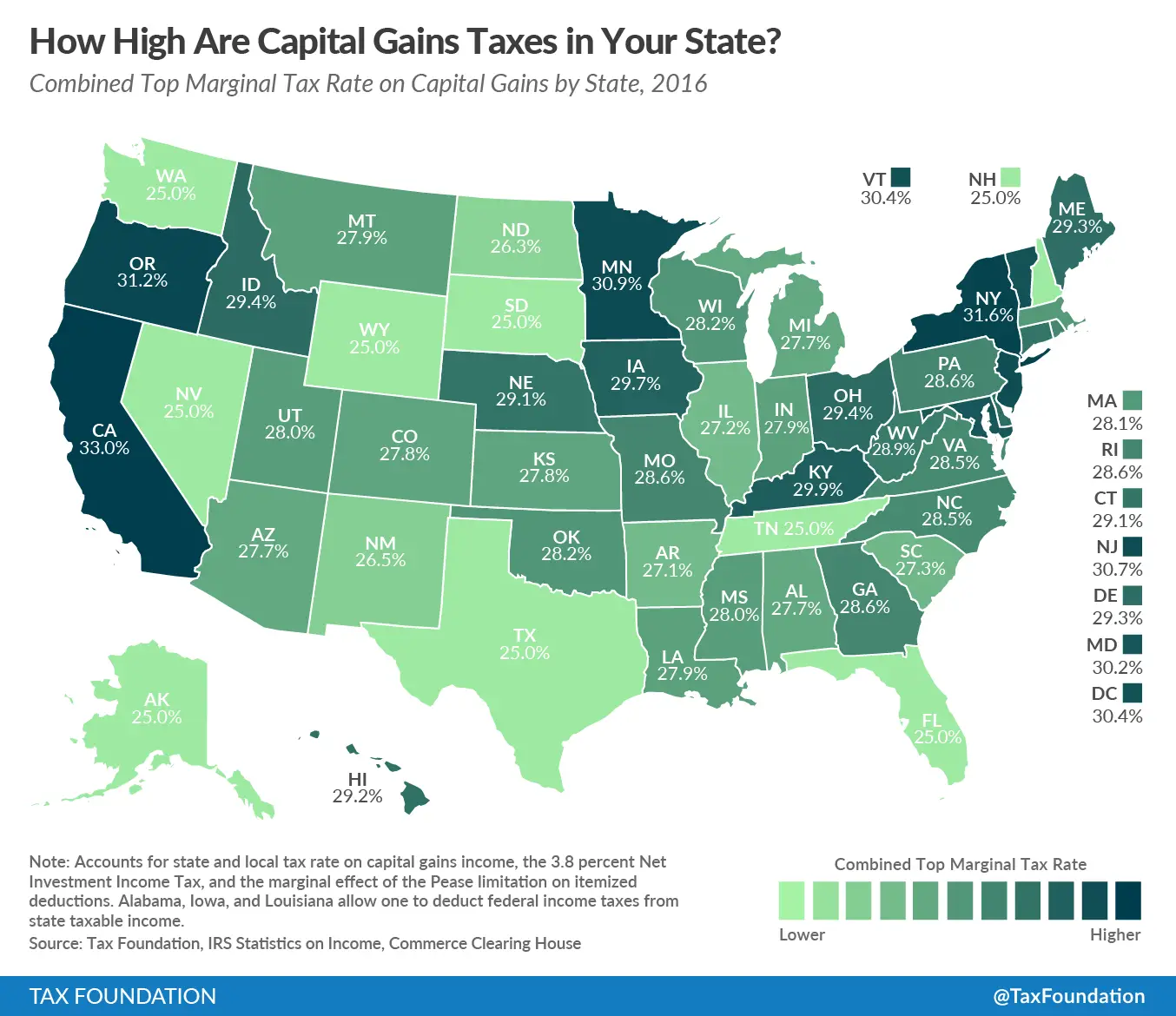

Recommended Reading: How To Get Out Of Capital Gains Tax

How Much Will I Have To Pay

For how much you might have to pay, every issue is different. And the answer will vary depending on the case. And how much the estate is worth.

Also, remember that in 2022 an individual subjected to death taxes would have to have an estate valued at 12.06 million. For couples, it is over 24.12 million.

Further, neither of the case examples above would be subjected to death taxes. That is a result of the estates being valued at under 12.06 million.

Deal With Possessions First

Before you decide how to handle the property, youll need to clear it out. Take advantage of this opportunity to set the right tone and establish a pecking order. If the instructions left behind werent explicitly clear, set some ground rules.

For example, take inventory of all the valued possessions, and let the adult children start picking first. Work down the list until everyone is mostly satisfied with what they have. This is the best time to get everyone in a rational mindset, while working together to sort out their feelings during the process.

How you handle the possessions will set the tone for the rest of the process. If you let things get chaotic now, theyre only going to stay chaotic when you approach the issue of selling the property.

Recommended Reading: How Do You Find Out If Your Taxes Were Filed

What If I Cant Pay The Taxes When I Inherit Property

If you cant pay the big tax bill right away, the costs of keeping the inherited house will just continue to mount. Unless you sell itquick. The house and yard have to be maintained, utilities have to be paid. And there is always a security to think of, especially if the house is vacant. Of course, youll also need to keep it insured so you dont lose everything in the event of a disaster, manmade or not. These ongoing expenses will add to your financial burden and credit worries. Selling your inherited house before your credit is ruined is the obvious, and permanent, solution. By selling, you can settle the tax debt with the proceeds and potentially walk away with some cash as well as peace of mind.

Of course, you might hit a few snags when trying to sell the house. First, the house has to be made marketable for most home buyers. If you are selling a home that needs major repairs, you may be looking at a variety of headaches, financial and logistical, that may last for months. Even if its not that extreme, any deferred maintenance should be taken care of and the house should be scrubbed clean then staged for showing.

Check Everyones Needs And Concerns

As with most estates, others involved may fear youre being motivated by greed. Talk to everyone else about their needs and concerns.

If you have a sibling thats in need of a new vehicle or is struggling with crippling debt, take their needs into account.

If everyone can see that theyll benefit from the sale of the home, theyre more likely to followthe plan that makes their and your lives easier.

Youll have much better luck getting things to move quickly if your family understands that you dont intend to make out like a bandit and leave them all in the dust. Incorporate them into the selling process as far as they wish to be incorporated.

Show everyone the value of the home on paper, and make sure they know the exact amount youve sold for. Youll need to make good on all of your promises, and everyone needs to walk away feeling like they got their fair share.

When meeting with your siblings youll also need to determine the following:

- Who will help prepare the home for sale?

- Is someone paying for the expenses of selling the house or is it coming from the estate?How will you split the proceeds?

- What sale price do you want to set?

- Who will accept the final offer?

List out each persons responsibilities for settling the estate and write down what portion of the proceeds each person will get, especially if it is not equal.

Also Check: How Does Ira Help With Taxes

How Is Inheritance Tax Calculated

Inheritance tax is calculated based on a tax rate applied to the amount that exceeds an exemption amount. The tax is usually assessed progressively. This means that the tax rate gets higher as the amount exceeds the threshold.

Tax rates usually start around 5% to 10% and generally rise to about 15% to 18%. The exemption amount and the rate assessed often depend on the relationship to the deceased.

As a general rule, the closer your relationship was to the decedent, the higher the exemption amount and the lower the tax rate. Surviving spouses are exempt from the tax in all states.

How Is Inherited Tax Calculated

Inheritance tax rules vary by state. Most states divide beneficiaries into different classes, depending on their family relationship to the deceased , and set exemptions and tax rates based on those categories.

Most states only apply tax to an inheritance above a certain amount. They then charge a percentage of this sum it may be flat or it may be graduated. Kentucky, for example, imposes a rate that ranges from 4% to 16%, rising as the inheritance amount does, from $1,000 to over $200,000. It also imposes a flat dollar figure, ranging from $30 to $28,670, based on the sum inherited.

Don’t Miss: How Many Undocumented Immigrants Pay Taxes

Does My Inheritance Get Taxed

Inheritances are not considered income for federal tax purposes, whether you inherit cash, investments or property. However, any subsequent earnings on the inherited assets are taxable, unless it comes from a tax-free source.

Determine A List Price

The last step in selling an inherited home is choosing a list price. Unfortunately, many children set unrealistically high expectations for the value of the home. This is especially true if it is a home they grew up in and view with strong sentimental feelings. With the high emotions that come with grief, your judgment can sometimes be impaired.

You will need to focus on fair market value to set a realistic list price for the house.

Don’t Miss: When Is Nys Accepting Tax Returns 2021

Federal Estate Tax In California

California residents may not be subject to state-level estate and inheritance taxes, but as the state with the largest population of billionaires, many wealthy California residents may face the federal estate tax.

But even the estates of billionaires dont have to pay the federal estate tax on 100% of the estates value.

To calculate the taxable amount of the estate:

Only then are the progressive federal estate tax rates applied to the taxable amount.

Does California Currently Have An Inheritance Tax

California does not have an inheritance tax. When the federal government enacted the Economic Growth and Tax Relief Reconciliation Act, a lot of states inheritance taxes were phased out and California was one of them. Furthermore, California requires a majority vote by its residents before enacting new legislation. Therefore, California has not had California inheritance tax laws since 2005.

However, federal income tax law still applies, although, as stated above California does not have a state income tax in 2019. More recently the California legislature attempted to pass a law that would have reinstated the California estate tax and imposed a new gift and generation-skipping tax on California residents beginning on January 1, 2021.

The proposed tax would have given California residents that leave an estate worth $3.5 million or more would have been subject to the state estate tax at a rate of 40%, which is equal to the federal estate tax. The proposed tax would have been phased out at the current federal estate tax exemption of $11.4 million and avoiding double taxation. This law did not pass and therefore the state of California remains a state without an inheritance tax.

Read Also: Can I Still File My 2016 Taxes Electronically

How Much Can You Inherit Without Paying Taxes In 2021 In California

You will no longer be required to pay taxes on gifts of up to $15,000 to individuals beginning in 2021 .It is feasible to donate continually up to $11.7 million of your fortune without being liable to the gift tax if you have an estate that is worth $20 million over your lifetime.This limit is based on the size of your estate.

Sell The Property As Fast As You Can

The easiest way to avoid property headaches and capital gains tax is to sell the home as fast as possible, so the sale will be classed as a short-term capital gain and be taxed at a much lower rate.

This means that if you dont let the property appreciate over time and sell at the same price it was worth according to the step-up basis , youll be able to avoid paying capital gains altogether!

Of course, selling an inherited home that fast is no easy feat, and youll have to factor in the expenses of hiring a realtor to list it on top of appraisals, upgrades, and any other property expense youll need to shoulder in order to sell quickly.

The best course of action, in this case, will be to step away from the traditional selling path and get in touch with acash buyer instead!

Don’t Miss: How Much Tax Will I Pay On 15000 Self Employed

Welcome News For Wealthy California Residents

The California Legislature could not get a floor vote for Senate Bill SB 378, which would have reinstated the California estate tax and imposed a new gift and generation-skipping tax on California residents beginning on January 1, 2021. Even if this bill were passed and signed by Governor Newsom, it would need to be placed on the November 2020 ballot and approved by a majority of California voters before taking effect.

Proposed California Estate Tax

California residents leaving an estate worth $3.5 million or more would have been subject to the state estate tax at a rate of 40%, which is the same rate as the federal estate tax. The proposed tax would have been phased out at the current federal estate tax exemption of $11.4 million thus avoiding double taxation. This proposed bill would have essentially brought the estate tax exemption back down to what the federal amount was in 2009.

Example

To illustrate the impact of the California estate tax bill, an individual with an estate of $11.4 million would incur no federal estate tax but would have been subject to the California estate tax in the amount of $3,160,000 @40%. Simply stated, the excess of federal exemption over the California exemption would have been subject to tax.

TCJA and its impact on Estate and Gift Taxes

The annual gift tax exclusion is currently $15,000 per recipient. Spouses together can transfer a total of $30,000 per recipient.

Background of Californias Inheritance Tax

Martin Eisenberg | 805.413.7516 |

What If I Inherited Property From A Non

What happens if you are a California resident and you inherit property or assets from someone who lives in another state? Suppose you live in California and inherited money from a great-uncle who was a resident of Maryland. Maryland does impose an inheritance tax. Some states will exempt a small inheritance from their inheritance tax. For example, if you only inherited $10,000, you may be exempt and not have to pay a tax. Additionally, if you are married to the person who passed away, you will not have to pay an inheritance tax. However, if these exceptions do not apply, you will have to pay an inheritance tax.

Read Also: How Do I Get My Tax Transcript

The California Inheritance Tax And Gift Tax

As I previously mentioned, there is no inheritance tax in California, regardless of net worth. This is huge for my California financial-planning clients. If you are going to receive an inheritance from someone who lived in a state other than California, talk with your fiduciary financial planner to check their estate tax laws.

California does not levy a gift tax. However, the federal gift tax does still apply to residents of California. For 2021, the annual gift-tax exclusion is $15,000 per donor, per recipient. A giver can give anyone elsesuch as a relative, friend, or even a strangerup to $15,000 in assets a year, free of federal gift taxes.

Federal Estate Tax

You will often hear me talk about how California is a high-tax state I am a Los Angeles Financial Planner, after all. All the same, federal tax rates are typically higher than state taxes. California tops out at 13.3% per year, whereas the top federal tax rate is currently 37%.

For estates that exceed this amount, the estate tax starts at 18% and goes up to 40%.