What If You Need Your Actual Tax Return

If your tax transcript won’t meet your needs, you can still access your tax return in other ways. If you used TurboTax Online to prepare your taxes, you can access your tax return by signing in to your TurboTax account and navigating to the “Your tax returns & documents” section.

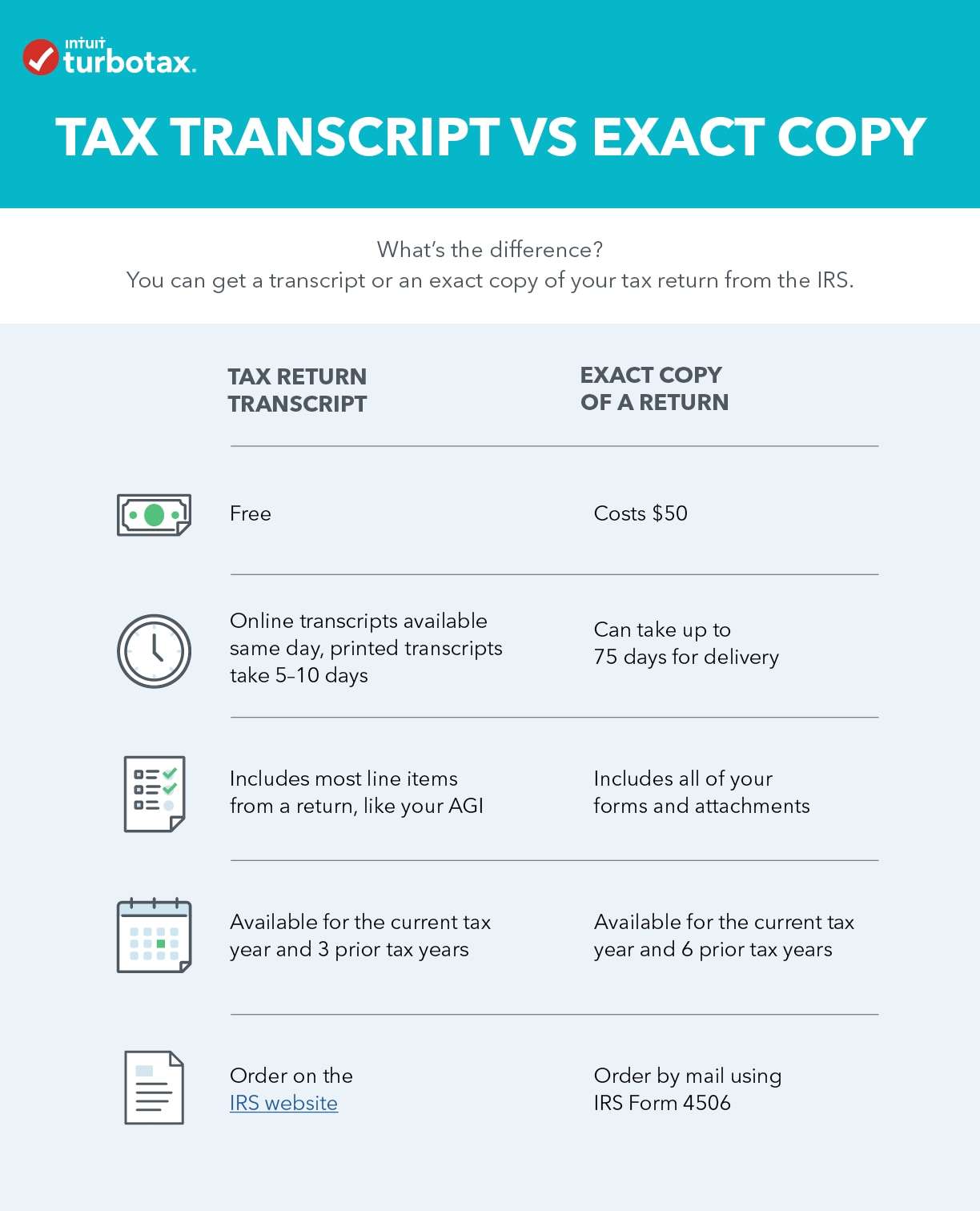

If you prepared your taxes in another way, you need to complete IRS Form 4506 and mail it to the IRS along with a $43 fee for sending you a copy of your tax return . These requests can take up to 75 days to process. So, you’ll want to make sure a tax transcript won’t cut it before starting this process.

Remember, with TurboTax, we’ll ask you simple questions about your life and help you fill out all the right tax forms. With TurboTax you can be confident your taxes are done right, from simple to complex tax returns, no matter what your situation.

Receiving The Transcript By Mail

Will Adoptions Take Off Following The End Of Roe V Wade

The US Supreme Courts widely anticipated decision Friday to uphold the Mississippi abortion law challenging Roe v. Wade marked the first time the high court addressed the constitutionality of first-trimester abortions since the landmark case made the procedure legal nationwide.

In the nearly five decades since the 1973 ruling, its basic principle was repeatedly affirmed and reaffirmed, even as the high court approved restrictions that include the 1976 Hyde Amendment against federal funding for most abortions and a 2003 ban on controversial partial-birth abortions.

Here is what you need to know about the landmark case:

Also Check: How Do You Do Taxes For Doordash

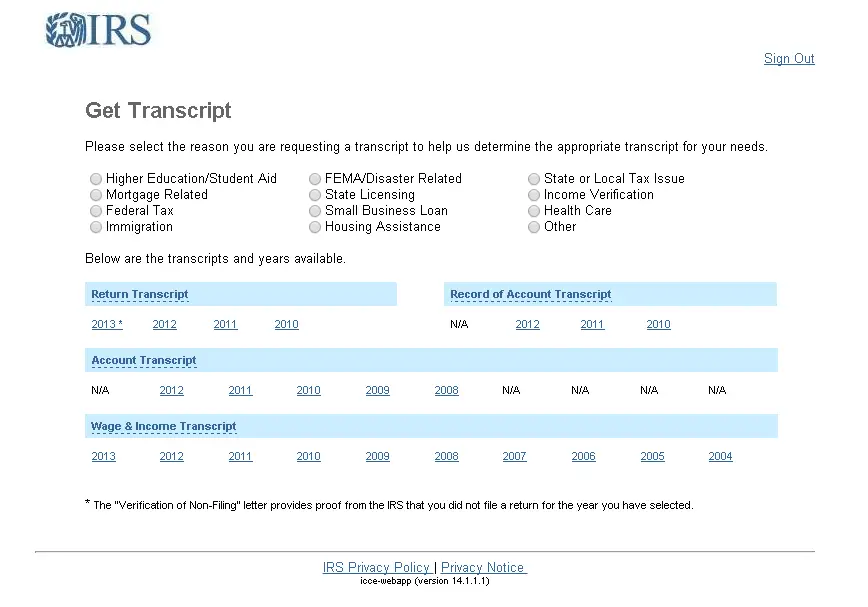

How Do I Get A Tax Transcript

A tax filer may also obtain a tax return transcript by electronically submitting a transcript request by going to the IRS website www.irs.gov, select Get Your Tax Record, then select the Get Transcript by Mail option. You can also submit a paper Form, 4506T-EZ or 4506-T, or by calling 1-800-908-9946.

Have There Been Subsequent Decisions Around Abortion In The Us

Since Roe v. Wade, the Supreme Court has handed down more than 20 decisions involving abortion, all of which upheld a womans constitutional right to an abortion during the first trimester.

They include the 1992 ruling in Planned Parenthood of Southeastern Pennsylvania v. Casey, which involved amendments to the Keystone States abortion law requiring women to provide informed consent and wait 24 hours before undergoing procedures, as well as notify their husbands, if married, or obtain parental consent if theyre minors.

In a bitter, 5-4 decision, the court reaffirmed Roe v. Wade but imposed a new standard for abortion restrictions that bans the imposition of an undue burden, defined as putting a substantial obstacle in the path of a woman seeking an abortion before the fetus attains viability.

Using that guideline, the majority opinion upheld three of the Pennsylvania amendments but tossed the one that required women to notify their husbands before getting abortions.

In an unusual move, the decision was written by three justices: Sandra Day OConnor, Anthony Kennedy and David Souter, all of whom have since retired.

Recommended Reading: How Do I File Taxes With Doordash

Who Needs A Tn Business License

If you own a business in Tennessee, you will need a TN business license. The license must be renewed every year, and it costs $50. These licenses are given out to companies that have US company number or operate within the state of Tennessee. Your business does not need to have a TN business license in order to operate.

You can choose to file your state taxes with the Tennessee Department of Revenue Community Services and Technical Assistance Division. Tennessee requires everyone who operates an in-state business to have a Tennessee Business License.

This includes individuals involved in the day-to-day running of the business, such as owners, managers, and executives. A TN business license is required for any business that operates in Tennessee. This includes businesses, service providers, franchisees, and any other person who manages a TN company. This license is not licensed to individuals.

One must have a separate TN personal tax ID number to file taxes on their own behalf. A Tennessee business license is called a tourism business license and can be obtained online by any business that:Business tax in the United States is a complex topic, with many common misconceptions.

Why You Might Need An Irs Transcript

You might need your transcripts for any number of reasons. Maybe you just need your AGI, or you want to track and confirm payments youve made to the IRS. Most taxpayers access their transcripts because they must verify their income information for some reasonsuch as loan and student aid applications. You might also need transcripts to apply for housing assistance or federal health care programs.

Maybe youve just realized that your record-keeping habits arent all that they should be, and you have no record of your relationship with the IRS. In any case, getting transcripts isnt usually a prohibitive process for most taxpayers.

Recommended Reading: Ein Number Lookup Irs

Why Might You Need A Transcript

If you keep meticulous records and have all of your tax information neatly organized, you might not ever need a tax transcript. You’ll have your full 1040 to pull exactly what you need.

In the event you may have misplaced your documentation or it isn’t complete, you may need to pull your transcript to provide an official record of your tax information.

One common instance where you might need a tax transcript is when you apply for a mortgage and the lender wants to see a record of your tax history. Mortgage lenders commonly require at least two years of tax information to substantiate your income and typically want to receive it directly from the IRS rather than from the borrower.

You may also need a tax transcript when you apply for financial aid from a college or university through FAFSA. As another common example, you might need to have your tax transcript when you apply for federal health care programs like Medicaid.

Request A Business Tax Transcript

As mentioned earlier, the most common use for tax transcripts is to provide income verification to a lending institution thats considering you for a loan. In 2019, the IRS ceased mailing tax transcripts to third parties, except participants of the Income Verification Express Service program. Therefore, the easiest means for an individual to acquire a tax transcript is simply to request it directly from the IRS.

To get a business tax transcript, go to the IRS website, where you can request a transcript by mail or online. Whereas in previous years, individuals couldnt get an electronic copy of a tax transcript from the IRS without using a third-party service, the online request form now allows taxpayers to access their transcripts quickly and easily.

Read Also: Michigan Gov Collectionseservice

How Long Does It Take For My Verification To Be Reviewed

Once we get all your documents, we will ensure your file is complete. Then it will be processed by a counselor. This usually takes 2-4 WEEKS, but longer during May-September because we are busier. **PLEASE DONT MISS THE DEADLINE. This is the best way to ensure you get your aid in time. Find information about the priority deadline at: Contact Us Webpage.

How To Complete Any Form Tax Return Transcript Online:

PDF editor permits you to help make changes to your Form Tax Return Transcript from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

IR-2021-226, November 16, 2021

WASHINGTON The Internal Revenue Service today announced that, effective Nov. 15, 2021, tax professionals are able to order up to 30 Transcript Delivery System transcripts per client through the Practitioner Priority Service® line. This is an increase from the previous 10 transcripts per client limit.

Through PPS, tax professionals can order a variety of transcripts. Practitioners can receive transcripts for up to five clients per call. Theres no change to the number of clients.

Also Check: Doordash Mileage Taxes

How Do You Know When Your Tax Liability Was 0

There are two ways for your tax liability to be 0. The first is when the companys net worth is zero or when the company has paid all of its taxes. When your tax liability was 0, you should have received a Form 1099-MISC from the vendor with an amount less than $600.

This form is a report that provides the payer with assistance in identifying the amount of gross payments made to non-employees. The first tax that is due is the federal income tax or IRS in the United States. You can deduct from your income any state and local taxes that may be due.

When you know your total taxable income, subtract any qualified retirement expenses to determine your adjusted gross income. Your AGI is then used to calculate how much you will owe in taxes. The Tax Cuts and Jobs Act of 2017 eliminated the requirement for taxpayers to itemize deductions.

This law has a significant impact on businesses in its effect on the tax liability as well as President Trumps recent tax reform effort. Of your tax liability is less than 0, then your business has not been profitable during the year. A business tax is the percentage of income that a company or corporation pays to the government.

A business tax may be imposed on the company or corporation, on its owners, or both. Business taxes vary by country and by state and local jurisdictions in which a company operates.

How To Get A Tax Transcript Online

You are able to immediately access your free transcript online, as you can do this by going to IRS.gov and using the Get Transcript tool.

Alternatively, if you would rather get your tax transcript using another method, you are able to get it by phone, by mail or by fax within five to 10 days from the point at which the IRS receives your request.

Should you need a copy of your filed and processed tax return, there is a $50 fee for each tax year. In order to receive this, you will need to fill in the Form 4506, Request for Copy of Tax Return.

Don’t Miss: Florida Transfer Tax Refinance

How Do I Get My Business Tax Return Transcript Online

If you are filing your business tax return online, a tax transcript is sent to the IRS and then they tax returns. The transcript will be sent automatically if you do not have an exemption. To obtain a transcript, you need to complete Form 4506-T.

In order to get the best deal on your business tax return, it is important to know how to lower your tax liability as much as possible. To do this, you should ask for your business tax transcript online and ask the accountant at a nearby firm.

Taxing professionals will make sure that youre giving yourself the biggest refund while also ensuring that youre only paying what is necessary in taxes. Business tax returns are filed and processed by the IRS in the order they were received. That means it can take a long time for the IRS to process your return.

It is possible to get your return processed faster by obtaining an e-file transcript rather than waiting on a paper return. When you start a new business, its important to make sure your taxes are in order. To access your return online and pay them, you need to file your taxes online.

The IRS also requires that you file your records electronically for preparation methods that are easier for the IRS to use. This can take anywhere from three months to a year to process depending on how long it takes for the IRS to receive your paper returns. If your business receives a tax return, you can find it on the IRS website.

What Does An Irs Transcript Show

There are five types of tax transcripts you can request from the IRS:

Don’t Miss: How To Find Employers Ein

Other Irs Transcript Access Options

Youre not out of luck if you dont have a cellphone or a loan in your name, or if you lack any of the other information required for online access. Youll just have to take the snail-mail approach. This requires only your Social Security number, the mailing address on your most recent return, and your date of birth. Unfortunately, you can only get tax return and tax account transcripts this way, and only for the current tax year and the three years before that.

The IRS indicates that it will probably take five to ten calendar days for the transcripts to arrive in your mailbox. You can still make the request online, but you wont have access to your information until the paper copy is delivered to you. You can also submit the request by calling 800-908-9946.

Youll have to take an additional step if you no longer live at the address cited on your last tax return, even if youve arranged for USPS to forward your mail. The post office cant do that with correspondence from the IRS, so youll have to complete and submit Form 8822 with your change of address before you submit Form 4506-T. The bad news is that it takes the IRS up to six weeks to process a taxpayers change of address.

Where Do I Find My Agi From Last Year

To retrieve your original AGI from your previous year’s tax return you may do one of the following:

Also, how do you get your AGI from last year?

To retrieve your original AGI from your previous year’s tax return you may do one of the following: Contact the IRS toll free at 1-800-829-1040. Complete Form 4506-T Transcript of Electronic Filing at no cost. Complete Form 4506 Copy of Income tax Return.

Secondly, where can I find my AGI for 2017? The AGI you should use to sign your 2017 return can be found on the following lines of your 2016 return : Form 1040, Line 38. Form 1040A, Line 21. Form 1040EZ, Line 4.

Correspondingly, how do I find my AGI for 2018?

Here are three ways to locate your 2018 AGI: 1) If you e-filed your 2018 Tax Return on eFile.com, sign into your eFile.com account and download/view your PDF tax return file from the My Account page. Find your prior-year AGI on line 7 of your Form 1040.

Can you get your AGI over the phone?

If you can‘t find a copy of last year’s return, you can call 800-829-1040. If you can provide certain information to the IRS, , and current address), you can receive the original AGI amount over the phone.

your W-2your AGIW-2your AGIyour AGIPINIRSIRSThe fivedigit PINfive digitsThe amount can be located on:

incomeincome

You May Like: How Do Taxes Work With Doordash