Putting It All Together: Calculating Your Tax Bill

To calculate how much you owe in taxes, start with the lowest bracket. Multiply the rate by the maximum amount of income for that bracket. Repeat that step for the next bracket, and continue until you reach your bracket. Add the taxes from each bracket together to get your total tax bill.

For example, the single filer with $80,000 in taxable income would pay the lowest rate on the first $9,950 he makes then 12% on anything earned from $9,951 to $40,525 then 22% on the rest, up to $80,000 for a total tax bill of $13,348.

Effectively, this filer is paying a tax rate of 16.69% , which is less that the 22% tax bracket our taxpayer actually is in.

But, wait. Effective tax rates dont factor in any deductions, so if you wanted get closer to what percentage of your salary goes to Uncle Sam, try using your adjusted gross income. Assuming the single filer with $80,000 in taxable income opted for the standard deduction , the amount of his AGI that went to the IRS was 13.28% a far cry from 22%.

For a final figure, take your gross income before adjustments. Add back in your allowable above the line deductions for example, retirement and health savings account contributions certain business-related expenses alimony paid and divide your tax bill by that number. The overall rate for our single filer with $80,000 in taxable income might be closer to 12% or even lower.

How To Reduce Taxable Income & Drop Into A Lower Tax Bracket

Two common ways to reduce your tax bill are by using . The first is a dollar-for-dollar reduction in the amount of tax you owe. The second trims your taxable income, possibly slipping you into a lower tax bracket.

Tax credits come in two types: nonrefundable and refundable.

Nonrefundable credits are deducted from your tax liability until your tax due equals $0. Examples include the child and dependent care credit, adoption credit, savers credit, mortgage interest tax credit, and alternative motor vehicle credit.

Refundable credits are paid out in full, no matter what your income or tax liability. Examples include the earned income tax credit , child tax credit, and the American Opportunity Tax Credit.

Which of these tax credits apply to your situation?

Deductions, on the other hand, reduce your taxable income. Accumulate enough of them in qualifying number or amount, and you can slide a tax bracket or two.

Popular deductions include:

What Are The Tax Brackets

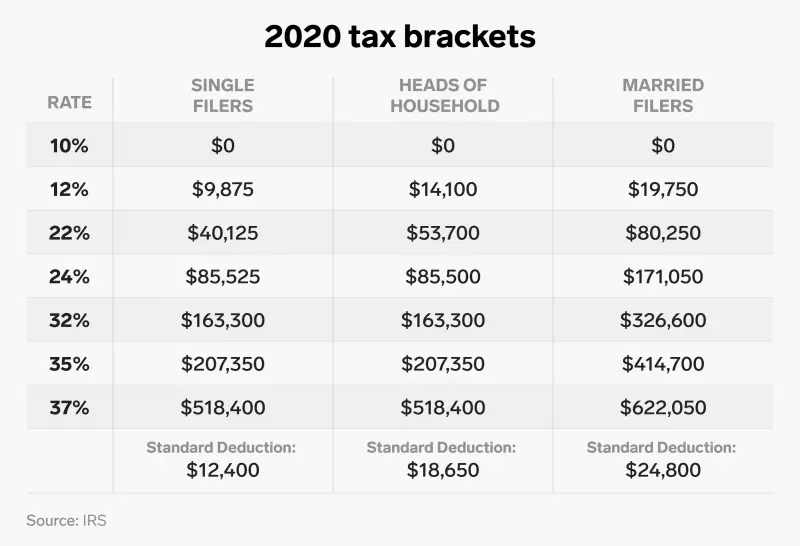

U.S. income tax rates are divided into seven segments commonly known as tax brackets. All taxpayers pay increasing rates as their income rises through these segments. If youre trying to determine your marginal tax rate or your highest federal tax bracket, youll need to know two things:

- your filing status. That means whether you file as single, married or as head of household.

- your taxable income. Your taxable income does not equal your wages rather its the total of your ordinary income sources minus any adjustments and deductions. Need help determining this number? Find out how to calculate your taxable income.

Don’t Miss: Efstatus Taxact Online

Personal Income Tax Rates

Resident individuals will be entitled to a personal allowance of GYD 780,000 or 1/3 of their income , whichever is greater.

Individuals with chargeable income of less than GYD 1,560,000 per annum pay tax at the rate of 28% where their chargeable income exceeds GYD 1,560,000 per annum, the incremental rate of tax applicable is 40%.

Income Tax In Central African Republic In 2022

Taxes, including personal income tax, expenses and limitations are reviewed by the Government in Central African Republic periodically and typically updated each year. Not that not all tax rates and thresholds in Central African Republic change annually, alterations to tax policy to support strategic economic growth in Central African Republic mean that the certain areas may be focused on to provide specific tax relief in Central African Republic or support growth in certain areas .

When tax policy in Central African Republic changes, the resultant tax tables also change. Tax tables in Central African Republic are simply a list of the relevent tax rates, fixed amounts and / or threholds used in the computation of tax in Central African Republic, the Central African Republic tax tables also include specific notes and guidance on the validity of scenarios and notes of the calculation of phaseout of specific tax elements within each taxation group .

Choose a specific income tax year to see the Central African Republic income tax rates and personal allowances used in the associated income tax calculator for the same tax year.

Recommended Reading: Is Donating Plasma Taxable Income

An Example Of How Canadas Federal Income Tax Brackets Work

If your taxable income is less than the $48,535 threshold you pay 15 percent federal tax on all of it. For example, if your taxable income is $30,000, the CRA requires you to pay $4,500 in federal income tax.

However, if your income is $200,000, you face several tax rates. This example shows how much federal tax you will pay on your 2020 taxable income. You need to make a separate calculation for your provincial tax due.

- The first tax bracket $0 to $48,535 is taxed at 15%, plus

- The next tax bracket over $48,535 to $97,069 is taxed at 20.5%, plus

- The following tax bracket over $97,069 to $150,473 is taxed at 26%, plus

- At this point, $150,473 of your income has been taxed. The final bracket on your remaining $49,527 is taxed at 29%.

- If you earn more than $214,368 in taxable income in 2020, the portion over $214,368 is taxed at the federal rate of 33%. This is called the top tax bracket and a common misconception is if your taxable income is in this top bracket, you will be taxed at 33% on your entire income.

Whats Going On With The Child Tax Credit Debate

A pass-through business is a sole proprietorship, partnership, or S corporation that is not subject to the corporate income tax instead, this business reports its income on the individual income tax returns of the owners and is taxed at individual income tax rates.

A tax bracket is the range of incomes taxed at given rates, which typically differ depending on filing status. In a progressive individual or corporate income tax system, rates rise as income increases. There are seven federal individual income tax brackets the federal corporate income tax system is flat.

A tax exemption excludes certain income, revenue, or even taxpayers from tax altogether. For example, nonprofits that fulfill certain requirements are granted tax-exempt status by the IRS, preventing them from having to pay income tax.

The standard deduction reduces a taxpayers taxable income by a set amount determined by the government. It was nearly doubled for all classes of filers by the 2017 Tax Cuts and Jobs Act as an incentive for taxpayers not to itemize deductions when filing their federal income taxes.

An individual income tax is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S.

Don’t Miss: How Do I File Taxes For Doordash

What Is A Tax Bracket

A tax bracket refers to a range of incomes subject to a certain income tax rate. Tax brackets result in a progressive tax system, in which taxation progressively increases as an individuals income grows. Low incomes fall into tax brackets with relatively low-income tax rates, while higher earnings fall into brackets with higher rates.

Empirical Evidence Related To Repatriation Of Profits Earned Abroad

As mentioned, a US parent firm that earns profits abroad will pay foreign income tax on those profits. If the foreign profits are returned to the home country, and the home corporate income tax rate is higher than foreign rate, the firm pays extra tax owed to home government. This gives companies an incentive to declare foreign profits permanently reinvested and leave them overseas. Next, I summarize findings from two types of studies that analyze repatriation issues.

Interestingly, accounting researchers have found that some firms do not repatriate earnings, even at low repatriation tax rates, because it can lead to a charge to earnings . That is, even at low tax rates repatriation is at times avoided by firms because it reduces earnings per share, which they believe that it hurts their stock price.

Second, research has been done that investigates what is done with the repatriated funds. Congress intended AJCA to create funds that could be used to hire US workers or capital spend to increase US production capacity. Tax executives state in surveys that they used the repatriated funds to increase investment but also say that they use other funds to repurchase shares and pay down debt. Faulkender and Petersen find little evidence that firms on net increased investment due to low repatriation tax rate. The latter authors argue that the bulk of the repatriated funds were on net used to repurchase shares.

Recommended Reading: Doordash Tax 1099

Personal Income Tax Brackets And Rates

| Taxable Income – 2021 Brackets | |

| Over $222,420 | 20.5% |

Tax rates are applied on a cumulative basis. For example, if your taxable income is more than $42,184, the first $42,184 of taxable income is taxed at 5.06%, the next $42,185 of taxable income is taxed at 7.70%, the next $12,497 of taxable income is taxed at 10.5%, the next $20,757 of taxable income is taxed at 12.29%, the next $41,860 of taxable income is taxed at 14.70%, the next $62,937 is taxed at 16.80%, and any income above $222,420 is taxed at 20.5%.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnât feature every company or financial product available on the market, weâre proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward â and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

You May Like: Do You Have To Pay Taxes On Plasma Donation Money

Adjusting Tax Bracket Parameters

Congress decides how many tax brackets there are and what the rates will be for each bracket. It’s the Internal Revenue Service’s job to adjust income thresholds to keep pace with inflation.

For example, in the 2021 tax year, for a married couple filing a joint return,

- The 10% bracket applied to the first $19,900 in taxable income.

- The 12% bracket went up to $8,050.

- The 22% bracket went up to $172,750, and so on.

- The top rate, 37%, applied when taxable income topped $628,300.

For single taxpayers, the thresholds were lower. The IRS announces the tax brackets for each year before that year begins.

Remember, with TurboTax, we’ll ask you simple questions about your life and help you fill out all the right tax forms. With TurboTax you can be confident your taxes are done right, from simple to complex tax returns, no matter what your situation.

We also offer a handy Tax Bracket Calculator to help you easily identify your tax bracket.

Income Tax Slab Rates Changes Expected In Budget 202: A Lot Of Relief On The Income Tax Front Is Expected By Taxpayers From The Union Budget 2022

Income Tax Slab, Rates Changes Expected in Budget 2022: A lot of relief on the income tax front is expected by taxpayers from the Union Budget 2022. In a pre-budget survey recently conducted by KPMG, most of the respondents said they expected an enhancement in the basic income tax exemption limit of Rs 2.5 lakh.

On the individual tax front, most respondents expect an enhancement in the basic income tax exemption limit of INR2.5 Lakh. Respondents also support an upward revision in the top income slab of INR 10 lakhs and above, and an increase in the existing section 80C deduction limit of INR 1.5 lakh, the survey report said.

According to Abhishek Soni, Co-founder and CEO, Tax2win, the basic exemption limits were last revised in 2017-18. So it is highly expected from this budget to increase the basic exemption limit so that it can help middle-class taxpayers to reduce their tax liability to some extent.

ALSO READ | PPF deposit limit raise to Rs 3 lakh/year suggested by ICAI Heres why

When asked about the most anticipated change for individual taxpayers during the survey, there were the following responses:

Read Also: Do I Have To Claim Plasma Donations On My Taxes

For Both Years You Can End Up In One Of Seven Different Federal Income Tax Brackets Each With Its Own Marginal Tax Rate Depending On Your Taxable Income

This is a unique time of the year for taxpayers. On the one hand, you’re getting ready to file your 2021 tax return . But, on the other hand, you’re also looking ahead and starting to think about how to handle your 2022 finances in a tax-efficient way. In either case, you need to be familiar with the federal income tax rates and tax brackets that apply to you.

The tax rates themselves didn’t change from 2021 to 2022. There are still seven tax rates in effect for the 2022 tax year: 10%, 12%, 22%, 24%, 32%, 35% and 37%. However, as they are every year, the 2022 tax brackets were adjusted to account for inflation. That means you could wind up in a different tax bracket when you file your 2022 return than the bracket you were in for 2021 which also means you could be subject to a different tax rate on some of your 2022 income, too.

Both the 2021 and 2022 tax bracket ranges also differ depending on your filing status. For example, the 22% tax bracket for the 2021 tax year goes from $40,526 to $86,375 for single taxpayers, but it starts at $54,201 and ends at $86,350 for head-of-household filers.

File Your Tax Return For Online

This article is provided for informational purposes only. It does not cover every aspect of the topic it addresses. The content is not intended to be investment advice, tax, legal or any other kind of professional advice. Before taking any action based on this information you should consult a professional. This will ensure that your individual circumstances have been considered properly and that action is taken on the latest available information. We do not endorse any third parties referenced within the article. When you invest, your money is at risk and it is possible that you may lose some or all of your investment. Past performance is not a guarantee of future results. Historical returns, hypothetical returns, expected returns and images included in this content are for illustrative purposes only.

We provide investment services and other financial products through several affiliates.

Wealthsimple Trade is offered by Canadian ShareOwner Investments Inc. , a registered investment dealer in each province and territory of Canada, a member of the Investment Industry Regulatory Organization of Canada and a member of the Canadian Investor Protection Fund , the benefits of which are limited to activities undertaken by ShareOwner.

Wealthsimple Invest and Work are offered by Wealthsimple Inc., a registered portfolio manager in each province and territory of Canada. Assets in your Invest and Work accounts are held with ShareOwner.

Also Check: Efstatus Taxact 2016

Understanding The Current Federal Income Tax Brackets

If someone asks you for your tax bracket, the person is almost certainly asking for your top marginal tax rate. Thats why, when youre reading the news, youll hear reference to filers in the top bracket or maybe taxpayers in the 37% bracket.

Americas top federal income tax bracket is varying over time quite a bit. Its hard to believe now, but top federal income tax rates were once as high as 92%.

You should keep in mind, as we noted earlier, that Biden has proposed raising the top bracket for wealthy tax payers up to 39.6%.

The tax reform passed by President Trump and Congressional Republicans lowered the top rate for five of the seven brackets. It also increased the standard deduction to nearly twice its 2017 amount.

The 2021 tax year standard deduction is $12,550 for single filers and married filers who file separately. Joint filers will have a $25,100 deduction and heads of household get $18,800.

History Of Federal Tax Brackets

Tax brackets have existed in the U.S. tax code since the inception of the very first income tax when the Union government passed the Revenue Act of 1861 to help fund its war against the Confederacy. A second revenue act in 1862 established the first two tax brackets: 3% for annual incomes from $600 to $10,000 and 5% on incomes above $10,000. The original four filing statuses were single, married filing jointly, married filing separately, and head of household, though rates were the same regardless of tax status.

In 1872, Congress rescinded the income tax. It didnt reappear until the 16th Amendment to the Constitutionwhich established Congress right to levy a federal income taxwas ratified in 1913. That same year, Congress enacted a 1% income tax for individuals earning more than $3,000 a year and couples earning more than $4,000, with a graduated surtax of 1% to 7% on incomes from $20,000 and up.

Over the years, the number of tax brackets has fluctuated. When the federal income tax began in 1913, there were seven tax brackets. In 1918, the number mushroomed to 78 brackets, ranging from 6% to 77%. In 1944, the top rate hit 91%. But it was brought back down to 70% in 1964 by then-President Lyndon B. Johnson. In 1981, then-President Ronald Reagan initially brought the top rate down to 50%.

Also Check: Does Doordash Take Taxes Out For You