How To Claim The Salt Deduction On Your 2021 Taxes

You can only claim the state and local tax deduction if you itemize deductions on your tax return. That means you do not take the standard deduction. Most tax filers do not qualify to itemize because the standard deduction is worth more than itemizing for them.

When you itemize, you can claim the SALT deduction on Line 5 of Schedule A. This line is called âState and local taxes.â For older tax returns, the line numbers on Schedule A are different, but very similar.

Learn more in our guide to filing your taxes

Texas Sales Tax Nexus

A sales tax nexus is a term that means that a retailer as a significant presence within a state. If you have nexus in Texas, you are required to collect and remit sales tax on your businesss orders.

A business with a physical presence within the state of Texas will have nexus. That means if you have an office within the state, you must collect sales tax on retail sales.

Other activities that create Texas sales tax nexus are:

- Having an employee, or other agent who operates under the authority of the seller, within the state

- Having an independent salesperson within the state

- Having a distribution center in Texas

- Storing products within a Texas-based warehouse, including Fulfillment by Amazon warehouses

For a complete list of activities that may cause your business to have nexus in Texas, please refer to this web page maintained by the state of Texas.

If you are unsure whether your business is required to collect sales tax, consult with a tax attorney or other licensed professional.

Sales Tax By State 2021

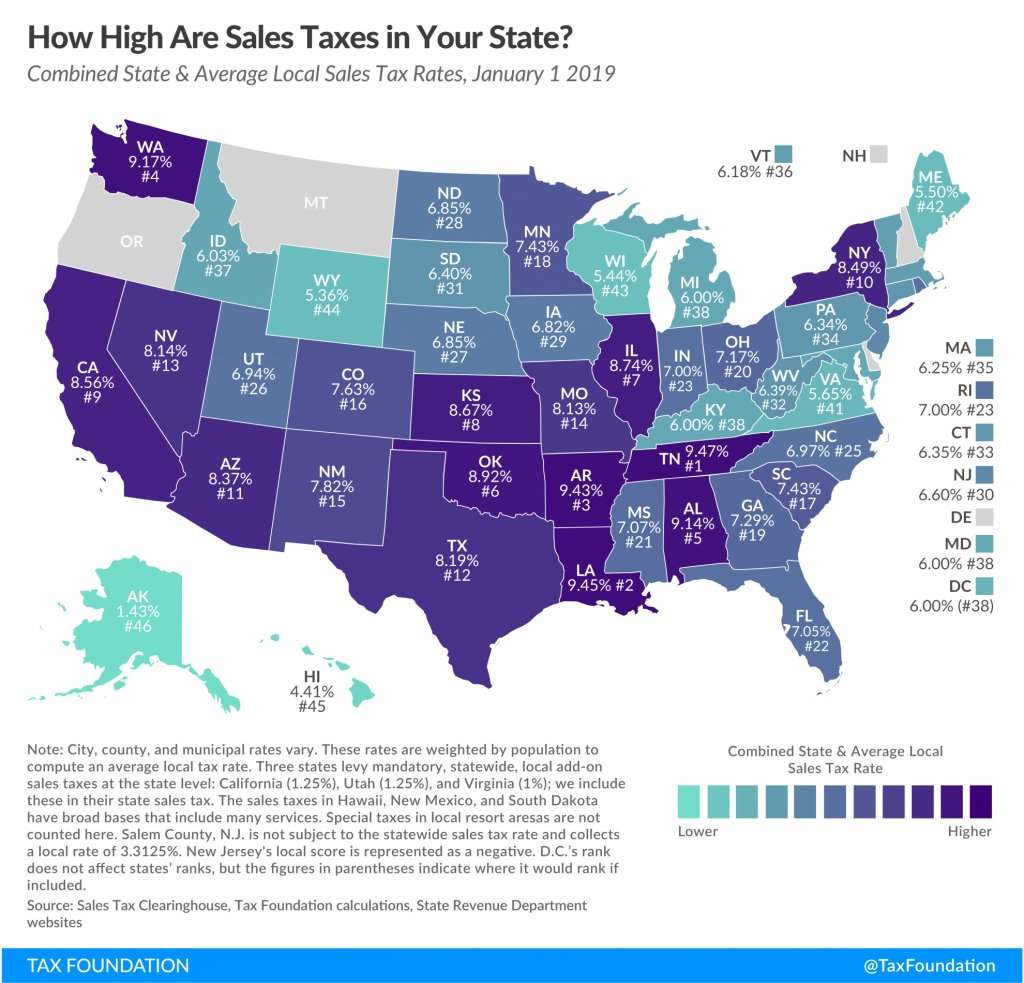

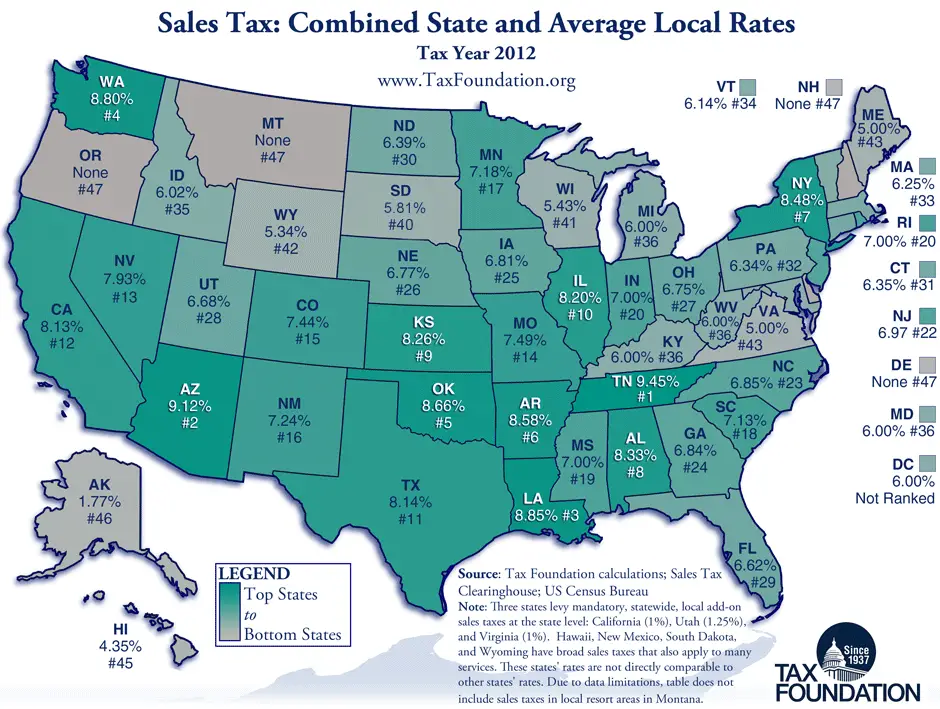

Most states have a sales tax ranging between 4% and 7%. The average sales tax for a state is 5.09%. 32 states fall above this average, and 18 states fall below this average, suggesting that the few states with a sales tax of 0% bring down the average.

There is only one state with a sales tax over 7%, which is California, and is also the state with the largest population. There are six states with sales tax under 4%. Colorado has a sales tax of 2.9%. The other five, Oregon, New Hampshire, Montana, Delaware, Alaska, have state sales taxes of 0%.

The average local sales taxes range from -.03% to 5.14%. The average average local sales tax is 1.45%. There are 18 states whose average local tax is above this average and 32 states that are below it. This is the inverse of how the state sales tax is distributed.

There is only one state with an average local sales tax above 5%–Alabamawhich also has a state sales tax of 4%. New Jersey is the only state with a negative average local sales tax . 12 other states have an average local sales tax of 0%. These states are Delaware, Montana, New Hampshire, Oregon, Maine, Kentucky, Maryland, Michigan, Massachusetts, Connecticut, Rhode Island, Indiana. There seems to be no correlation between state tax and average local tax.

There are five states that have an average local tax higher than their state tax– Alaska, New York, Colorado, Louisiana, Alabama.

Here are the 10 states with the highest sales tax rates:

Also Check: Car Sales Tax In North Carolina

Combined State And Local Sales Tax Rates

Five states do not have statewide sales taxes: Alaska, Delaware, Montana, New Hampshire, and Oregon. Of these, Alaska allows localities to charge local sales taxes.

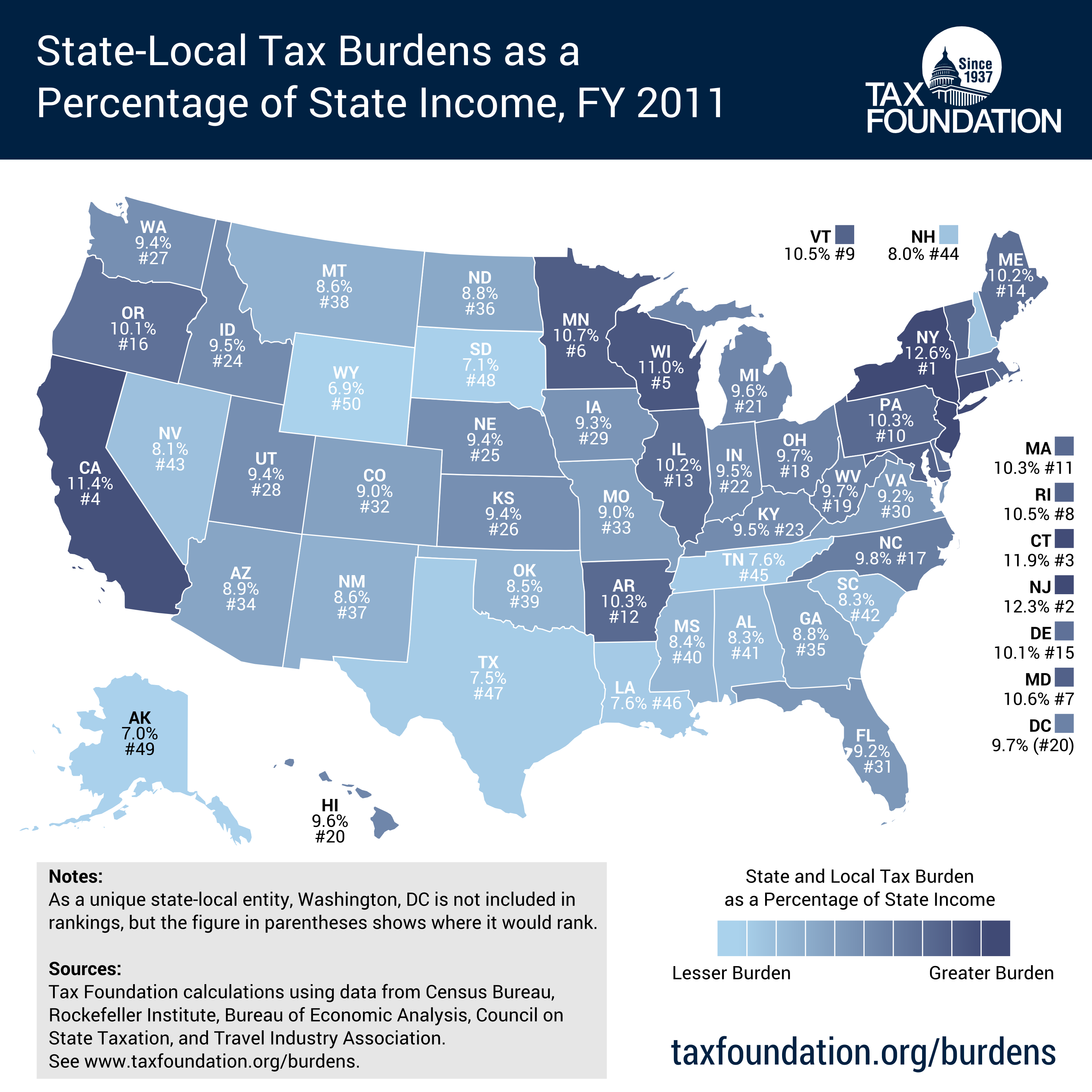

The five states with the highest average combined state and local sales tax rates are Louisiana , Tennessee , Arkansas , Washington , and Alabama . The five states with the lowest average combined rates are Alaska , Hawaii , Wyoming , Wisconsin , and Maine .

Other Notable Taxes In Texas

Texas has an oyster sales fee. Shellfish dealers in Texas are required to pay a tax of $1 per 300 pounds of oysters taken from Texas waters.

- Cameron County, Texas is located at 26.15° North, and contains the most southern point along the US-Mexico border.

- Three of the ten most populous cities in the country are in Texas.

- In 2014, Texas produced more oil than any country in the world except Saudi Arabia.

Don’t Miss: Do I Have To Pay Taxes On Plasma Donation

Texas Alcohol And Tobacco Taxes

Texas has a tax of 20 cents per gallon of wine and 19 cents per gallon of beer. Liquor, on the other hand, is taxed at $2.40 per gallon. All of these taxes are below average for the U.S.

Texas’ taxes on a pack of 20 cigarettes totals $1.41, which ranks in the middle of the pack on a nationwide basis.

Sales And Use Tax Rates

- The Texas state sales and use tax rate is 6.25 percent, but local taxing jurisdictions also may impose a sales and use tax up to 2 percent for a total maximum combined rate of 8.25 percent.

- Sales and use tax rates in the Houston region vary by city. The top 12 city sales and use tax rates range from 1 percent to 2 percent. All 12 cities have a total sales tax rate of 8.25 percent. Cities with less than a 2 percent rate have additional sales and use tax rates that may be related to transit, crime control, emergency services and more.

- Sales tax allocations from the City of Houston comprised the majority of total allocations in the region in 20, followed by Sugar Land, Conroe, Pasadena, Pearland, League City, Texas City, Baytown, Galveston, La Porte, Missouri City, and Friendswood.

Don’t Miss: Ein Reverse Lookup Free

Local Sales Tax Rates

The five states with the highest average local sales tax rates are Alabama , Louisiana , Colorado , New York , and Oklahoma .

No states saw ranking changes of more than one place since January. Most states which saw improved rankings did so only in comparison to those that enacted more substantial local rate increases.

Tampa and the rest of Hillsborough County, Florida, saw a non-legislative tax decrease in February, as the Florida Supreme Court ruled the countys 1 percent transportation surtax unconstitutional. The rate subsequently decreased from 8.5 percent to 7.5 percent, helping to drop the states standing from 22nd to 23rd highest.

California moved in the opposite direction, going from 9th to 8th highest. This shift is largely due to sales tax increases in the Bay Area. San Francisco and San Jose both increased their sales taxes by 0.125 percentage points as a result of voter-approved measures, while many other jurisdictions in the areaincluding the counties of Alameda, San Mateo, and Santa Claralikewise saw increases. Sales taxes rose elsewhere in the state, including in West Hollywood, where voters approved an increase from 9.5 to 10.25 percent, which went into effect in February.

Collection Payment And Tax Returns

Sales taxes are collected by vendors in most states. Use taxes are self assessed by purchasers. Many states require individuals and businesses who regularly make sales to register with the state. All states imposing sales tax require that taxes collected be paid to the state at least quarterly. Most states have thresholds at which more frequent payment is required. Some states provide a discount to vendors upon payment of collected tax.

Sales taxes collected in some states are considered to be money owned by the state, and consider a vendor failing to remit the tax as in breach of its fiduciary duties. Sellers of taxable property must file tax returns with each jurisdiction in which they are required to collect sales tax. Most jurisdictions require that returns be filed monthly, though sellers with small amounts of tax due may be allowed to file less frequently.

Sales tax returns typically report all sales, taxable sales, sales by category of exemption, and the amount of tax due. Where multiple tax rates are imposed , these amounts are typically reported for each rate. Some states combine returns for state and local sales taxes, but many local jurisdictions require separate reporting. Some jurisdictions permit or require electronic filing of returns.

Purchasers of goods who have not paid sales tax in their own jurisdiction must file use tax returns to report taxable purchases. Many states permit such filing for individuals as part of individual income tax returns.

Don’t Miss: Do I Have To File Taxes For Doordash

Exemptions For Seniors And The Disabled

Homeowners who are age 65 or older, or those who are disabled, can qualify for an additional $10,000 exemption for school district taxes and an exemption for other local property taxes that can’t be less than $3,000.

The school district can’t tax any more than what homeowners paid in the first year they qualified, so the tax is effectively frozen. Widows or widowers age 55 or older whose deceased spouse qualified for the 65-or-older exemption can continue to receive the exemption themselves if they apply.

The Texas Franchise Tax

Texas has no individual income tax as of 2021, but it does levy a franchise tax of 0.375% on some wholesalers and retail businesses. The rate increases to 0.75% for other non-exempt businesses. Also called a “privilege tax,” this type of income tax is based on total business revenues exceeding $1.18 million.

Sole proprietorships and some general partnerships are exempt from the franchise tax.

Franchise tax reports are due annually on May 15 or the next business day when this date falls on a weekend or a holiday. Interest on past-due franchise debts begins accruing 61 days after the due date, and penalties of up to 10% can apply after 30 days.

Also Check: Does Doordash Send You A 1099

Discounts Penalties Interest And Refunds

- Permitted sales taxpayers can claim a discount of 0.5 percent of the amount of tax timely reported and paid.

- Sales taxpayers who prepay can claim 0.5 percent for timely filing and paying, plus 1.25 percent for prepaying. See .

- A $50 penalty is assessed on each report filed after the due date.

- If tax is paid 1-30 days after the due date, a 5 percent penalty is assessed.

- If tax is paid over 30 days after the due date, a 10 percent penalty is assessed.

The Role Of Competition In Setting Sales Tax Rates

Avoidance of sales tax is most likely to occur in areas where there is a significant difference between jurisdictions rates. Research indicates that consumers can and do leave high-tax areas to make major purchases in low-tax areas, such as from cities to suburbs. For example, evidence suggests that Chicago-area consumers make major purchases in surrounding suburbs or online to avoid Chicagos 10.25 percent sales tax rate.

At the statewide level, businesses sometimes locate just outside the borders of high sales-tax areas to avoid being subjected to their rates. A stark example of this occurs in New England, where even though I-91 runs up the Vermont side of the Connecticut River, many more retail establishments choose to locate on the New Hampshire side to avoid sales taxes. One study shows that per capita sales in border counties in sales tax-free New Hampshire have tripled since the late 1950s, while per capita sales in border counties in Vermont have remained stagnant. Delaware actually uses its highway welcome sign to remind motorists that Delaware is the Home of Tax-Free Shopping.

State and local governments should be cautious about raising rates too high relative to their neighbors because doing so will yield less revenue than expected or, in extreme cases, revenue losses despite the higher tax rate.

You May Like: 1040paytaxcom

Stay Informed On Sales And Use Tax

Join the Sales Tax Institute mailing list and get updates on the latest news, tips, and trainings for sales and use tax.

By submitting this form you are agreeing to join the Sales Tax Institutes mailing list so the Sales Tax Institute can send you email notifications including our monthly newsletter, monthly sales tax tips digest, information about upcoming courses and sales tax resources. Submitting this form will add your email to our mailing list. We will never share or sell your info. to view our privacy policy.

Tips For Better Address Searches

- Check the spelling of the street name

- Use “Springwood St” instead of “Spring Wood St”,

- Use “Manor Rd” instead of “Maynor Rd”,

- Use “Belmont Dr” instead of “Bellmont Dr”,

- Use “Lemmon Ave” instead of “Lemon Ave”

Also Check: Power To Levy Taxes

Exemption For Disabled Veterans

Veterans of the U.S. Armed Forces who have been disabled as a result of their service might be eligible for a very generous disabled veteran’s exemption. This exemption is equal to 100% of the appraised value of their primary residence.

Texas also offers a property tax exemption for solar- or wind-powered energy devices, as well as several exemptions for charitable organizations and businesses.

County Sales And Use Tax

In Texas, 124 counties impose a county sales and use tax for property tax relief. The county tax is collected in addition to state tax and any other local taxes as applicable.

The counties listed below have a 0.5 percent sales and use tax rate unless indicated with an asterisk .

| County Name |

|---|

- 1 County-wide special purpose district sales and use tax.

- 2 SPD sales and use tax in part of the county.

- 3 County has a county-wide SPD sales and use tax and an SPD sales and use tax in part of the county.

- 4 1% county tax rate, multiple county-wide SPDs.

If you have questions about local sales and use tax rate information, please contact us by email at .

Required Applications:

Don’t Miss: How To Appeal Property Taxes In Cook County

State Sales Tax Rates

The following chart lists the standard state level sales and use tax rates.

As of 12/1/2021

Many states allow non-standard rates on many items including meals, lodging, telecommunications and specific items and services. These rates are not represented in this chart. The range of local taxes is also included as a quick reference. This can be used to determine the combined state and local tax rate maximums and minimums. However, for accurate tax calculation, the specific jurisdiction tax rate should be used. The information concerning local use tax rates can be used to determine whether the use tax also applies to local taxes. If this column contains a YES, then local taxes apply to both intra-state and inter-state transactions. If this column contains a NO, then local taxes only apply to intra-state transactions.

Specific details can be seen by placing your mouse over this icon: More Information.

Sales and use tax rates change on a monthly basis. This chart is for informational purposes only. Specific questions should be addressed to your tax advisor. Rate information is gathered from various State Department of Revenue materials and various rate providers including Thomson Reuters, and Vertex, Inc.

| State |

|---|

See what previous Sales Tax Institute attendees have to say about their experiences.

Overview Of Texas Taxes

Texas is often considered tax-friendly because the state does not collect any income taxes. But there are other taxes that Texans have to pay, such as significant property and sales taxes.

| Household Income |

| Number of State Personal ExemptionsDismiss |

* These are the taxes owed for the 2021 – 2022 filing season.

Also Check: Plasma Donation Taxes

Texas Sales Tax Software

AccurateTaxs TaxTools products completely handle all aspects of Texass sales tax rate lookup and calculation for all destinations within the state of Texas, and all special tax classes such as prepared food. Configuring sales tax on your ecommerce store has never been easier. Contact us for more information or register for a free trial of the TaxTools software.

You can also use our free sales tax calculator to look up the rate for any address in the state of Texas.

AccurateTax believes that sales tax automation should be affordable for all businesses. The laws don’t make compliance easy, but our software helps. See how much time you can save by using AccurateTax.

Solutions

What Personal Property Is Taxed In Texas

In Texas, property tax applies to all personal property that is used to make an income. This can include automobiles, machinery, supplies, furniture, inventory, and more. If it is not directly responsible for earning income, it does not count, for example, when you drive your car to and from work, it doesn’t count as being used to make income, so it is exempt from personal property taxes.

You May Like: Tax Deductible Home Improvements

Sales Taxes In The United States

Sales taxes in the United States are taxes placed on the sale or lease of goods and services in the United States. Sales tax is governed at the state level and no national general sales tax exists. 45 states, the District of Columbia, the territories of Puerto Rico, and Guam impose general sales taxes that apply to the sale or lease of most goods and some services, and states also may levy selective sales taxes on the sale or lease of particular goods or services. States may grant local governments the authority to impose additional general or selective sales taxes.

As of 2017, 5 states do not levy a statewide sales tax.California has the highest base sales tax rate, 7.25%. Including county and city sales taxes, the highest total sales tax is in Arab, Alabama, 13.50%.

Sales tax is calculated by multiplying the purchase price by the applicable tax rate. The seller collects it at the time of the sale. Use tax is self-assessed by a buyer who has not paid sales tax on a taxable purchase. Unlike the value added tax, a sales tax is imposed only at the retail level. In cases where items are sold at retail more than once, such as used cars, the sales tax can be charged on the same item indefinitely.