Effect Of Deductions And Exclusions

The deductions and exclusions available to homeowners are worth more to taxpayers in higher tax brackets than to those in lower brackets. For example, deducting $2,000 for property taxes paid saves a taxpayer in the 37 percent top tax bracket $740, but saves a taxpayer in the 22 percent bracket only $440. Additionally, even though they only represent about 26 percent of all tax units, those with income of $100,000 or more received over 90 percent of the tax benefits from the mortgage interest deduction in 2018. That difference results largely from three factors: compared with lower-income homeowners, those with higher incomes face higher marginal tax rates, typically pay more mortgage interest and property tax, and are more likely to itemize deductions on their tax returns.

What Are Tax Deductions

Tax deductions are expenses you can legally deduct from your taxable income, thereby lowering your taxable income and, consequently, your tax liability. These deductions are designed to encourage certain activities, including investing in a trade or contributing towards a retirement account.

The expenses usually occur within the tax year, and to write them off, you subtract them from your gross income. Doing so also allows you to figure out the exact amount of tax you owe.

For instance, if you operate a small business, the law allows you to deduct the costs you incur to operate your business profitably. The Internal Revenue Service doesn’t exactly provide a list of tax deductions you can write off.

However, the tax principle in Code Section 62 indicates that any expense you incur while producing an income constitutes a valid write-off.

This essentially means that with the proper business purpose, you could convert even personal expenses to business expenses.

For experienced small business owners, it’s relatively easy to identify expenses with a legitimate business purpose. Indeed, most of them almost always consider an item’s tax purpose before purchasing it.

What Tax Breaks Will You Be Eligible For

Clearly, there are plenty of tax breaks you may be eligible to enjoy as a homeowner. But to capitalize on these, you’ll need to itemize your deductions on your tax return rather than claim the standard deduction. You’ll need to run the numbers to see if itemizing makes sense, but if it does, you may save yourself a lot of money by virtue of owning a home.

Recommended Reading: How To Get Tax Info From Unemployment

Fees Penalties Or Bonuses Paid For A Loan

You can deduct the fee you pay to reduce the interest rate on your loan. You can also deduct any penalty or bonus a financial institution charges you to pay off your loan before it is due. Treat the fee, penalty or bonus as prepaid interest and deduct it over the remaining original term of your loan.

For example, if the term of your loan is five years and in the third year you pay a fee to reduce your interest rate, treat this fee as a prepaid expense and deduct it over the remaining term of the loan. For more information, see Prepaid expenses.

Claiming Property Taxes On Your Tax Return

OVERVIEW

If you pay taxes on your personal property and real estate that you own, you payments may be deductible from your federal income tax bill. Most state and local tax authorities calculate property taxes based on the value of the homes located within their areas, and some agencies also tax personal property. If you pay either type of property tax, claiming the tax deduction is a simple matter of itemizing your deductions on Schedule A of Form 1040.

Apple Podcasts | Spotify | iHeartRadio

Recommended Reading: When Is Tax Due 2021

Does My Home Qualify For The Mortgage Interest Deduction

You can only claim the mortgage interest tax deduction if your mortgage is for a qualified home, as defined by the IRS. As long as they qualify, you can write off mortgage interest on both your main home and a second home, as long as each home secures the mortgage debt.

The IRS considers a home to be any residential living space including houses, apartments, condos, mobile homes, and houseboats that has sleeping, cooking, and toilet facilities.

Extra Food And Beverages Consumed By Self

This information is for self-employed:

- on foot

- bicycle couriers

- rickshaw drivers

They can deduct the cost of the extra food and beverages they must consume in a normal working day because of the nature of their work.

The daily flat rate that can be claimed is $23.

If you are claiming this deduction you should be prepared to provide logbooks showing the days worked and the hours worked on each of these days during the tax year. The CRA may also ask for dispatch slips or other documents to support the days worked during the tax year.

If you want to claim more than the flat-rate amount, the CRA will also need:

- supporting receipts for all food and beverages claimed

- something that clearly shows the extra amount of food and beverages required because of the nature of your work, and how this amount exceeds what the average person would consume in terms of both cost and quantity

Also Check: How Do I Defer My Taxes

How Is Rental Income Taxed In Canada

The tax rate for your rental income is going to depend on whether you are filing as an individual, in a partnership, or in a corporation.

If you are the sole proprietor of your rental units, the tax rate is going to be the same as your personal tax rate. You will use this form to file. Partnerships will split the income between the partners, and then each partner will pay on that income at their personal tax rate. Finally, businesses will pay the appropriate tax rate for their business and location the national tax rate for rental income is 38%.

For a complete guide to how your personalized tax situation might look like, check out this article all about rental income taxation in Canada.

Significant Budget Amendment In 2017 Impact Explained With An Example

Till FY 2016-17, loss under the head house property could be set off against other heads of income without any limit. However, form FY 2017-18, such set off of losses has been restricted to Rs 2 lakhs. This amendment would not really affect taxpayers having a self-occupied house property. This move will have an impact on taxpayers who have let-out/ rented their properties. Though there is no bar on the amount of home loan interest that can be claimed as a deduction under Section 24 for a rented house property, the losses which could arise on account of such interest payment can be set off only to the extent of Rs 2 lakhs.

Here is an example to help you comprehend the impact of the amendment:

| Particulars |

| Total income from house property | Restricted to . Balance loss of Rs 2.4 lakhs can be carried forward for the next 8 AYs |

Recommended Reading: Can You File Missouri State Taxes Online

You May Like: When Are Kansas State Taxes Due

How Much Property Tax Can You Deduct

You may deduct up to $10,000 for a combination of property taxes and either state and local income taxes or sales taxes. You might be able to deduct property and real estate taxes you pay on your: Primary home. Co-op apartment

- The tax is imposed on an annual basis, even if collected more or less than once per year. You can deduct up to $10,000 of state and local taxes, including personal property taxes. Claim the itemized deduction on Schedule A State and local personal property taxes .

Lower Your Taxable Income

The way to lower your tax bill using mortgage interest deductions is to fill out IRS Form 1098.

Your lender will send you statements that break out how much you pay each month in mortgage interest.

Sum those interest payments and compare the benefits of itemizing versus taking a standard deduction.

You are eligible to take interest payment deductions of up to $1,000,000. The limit is $500,000 for married couples filing separately.

Recommended Reading: Do Businesses Pay Income Tax

What Is Property Tax

Property tax is real estate tax paid by the owner of a property. It is based on the value of the property. Your property is assessed by local government to determine how much your property is worth and how it should be taxed.

Property taxes are a major source of income for city, county, and state governments.

Deducting Your Insurance Premiums

Lenders can stipulate that homeowners get an insurance policy before securing their mortgage. Luckily, any form of insurance is considered an ordinary and necessary rental property expense and is thus deductible. The deduction applies to basic homeowners insurance as well as special peril and liability insurance.

If you have employees, you can deduct the cost of their health and workers compensation insurance too. Although insurance premiums tend to be a bit higher for rentals, this boost can help offset that. Landlords can also deduct losses, including those caused by hurricanes, earthquakes, flood and theft.

You May Like: How To Pay Federal And State Taxes Quarterly

Who Qualifies For A Homestead Property Tax Credit

You may qualify for a property tax credit if all of the following apply:

- You own or were contracted to pay rent and occupied a Michigan homestead for at least 6 months during the year on which property taxes and/or service fees were levied. If you own your home, your taxable value was $135,000 or less

- Your total household resources were $60,000 or less

- If 100% of your total household resources were received from the Michigan Department of Health and Human Services, you do not qualify

Note: You may be required to submit documentation to support your claim. See Homeowners or Renters Checklist for details.

You May Like: How To Get Social Security Tax Statement

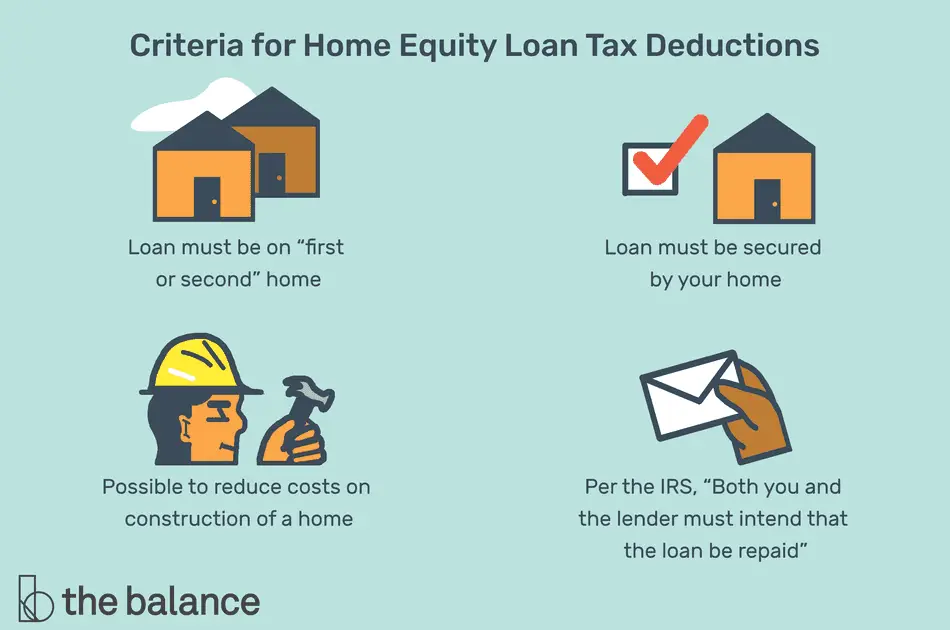

Deducting Interest From A Heloc Or Home Equity Loan

Equity is the current value of your home minus how much you have left on your mortgage. If your home is worth $300,000 and youve made $50,000 in payments against the mortgage principal, you have $50,000 in equity.

You can receive part of the equity as cash without selling your home, by using it as collateral for a home equity line of credit or a home equity loan.

Whether you take out a HELOC or a home equity loan, the interest may be deductible just like ordinary mortgage interest. As with mortgage interest, the HELOC or home equity loan debt must be secured by a qualified home if you default on the HELOC or home equity loan, your home could go into foreclosure, meaning you could lose the home.

Don’t Miss: When Do You File Taxes 2021

What Is Escrow And How Does It Pay For My Property Taxes

Escrow is an account set up by your lender through which you can pay your property taxes and insurance premiums. Under these escrow arrangements, you pay extra with each mortgage payment, and your lender deposits these extra dollars in an escrow account. When your property taxes and homeowners insurance bills are due, your lender uses the funds in this account to pay them on your behalf.

In this way, property taxes affect your mortgage payments, making them higher than they would be if you didn’t escrow your taxes and insurance. Escrow arrangements, though, can reduce the risk of you missing your property tax payments, and even if you pay your property taxes through an escrow account, you can still deduct them on your income taxes.

Employees And Independent Contractors

Whenever you hire anyone to perform services for your rental activity, you can deduct their wages as a rental business expense. This is so whether the worker is an employee or an independent contractor .

Find out tax rules that apply to landlords who hire independent contractors to help them with their rental business, see Hiring Independent Contractors for Your Rental Activity.

Every Landlord’s Tax Deduction Guide

Read Also: How Much Tax Do You Pay On An Ira Withdrawal

Solar Energy Systems Equipment Credit

If you purchased solar energy system equipment, entered into a lease of solar energy system equipment, or purchase power generated by solar energy system equipment not owned by you for at least 10 years, you may be eligible to claim the solar energy system equipment credit. The system must be installed at your principle residence and be used to produce energy for heating, cooling, hot water, or electricity for residential use.

Deducting Your Maintenance And Repairs

While home improvements are deductible through depreciation, the tax code does allow you to deduct certain repair and maintenance costs separately. The big difference is that these efforts keep your property in rentable condition, but do not add significant value. According to the IRS, examples of improvements include additions , landscaping, heating and air conditioning, plumbing, insulation, interior upgrades .

If you hire someone else to do the work, you can deduct the labor costs. The same goes for property or on-site managers, should you choose to hire one. If you take the do-it-yourself approach, you can deduct any rental fees for tools and equipment. Homeowner association and condo fees would are also deductible following the same principle.

You May Like: When Is The Due Date For Taxes

The Tax Cuts And Jobs Act Limit

The TCJA limits the amount of property taxes you can claim. It placed a $10,000 cap on deductions for state, local, and property taxes collectively beginning in 2018. This ceiling applies to any income taxes you pay at the state or local level, as well as property taxes. All these taxes fall under the same umbrella.

You no longer get a $12,000 deduction if you spend $6,000 on state income taxes and $6,000 on property taxes, thanks to the TCJA. You can claim $10,000 of these expenses, but the law effectively forces you to leave $2,000 on the table, unclaimed.

The limit is only $5,000 if you’re married but file a separate return, and property taxes for personal foreign real property were eliminated entirely by TCJA.

What Is The Property Tax Deduction

The property tax deduction allows you as a homeowner to deduct the state and local taxes youve paid on your property from your federal income taxes. This includes your annual property taxes on the assessed value of your house as well as the taxes you may have paid at closing during the sale or purchase of the property.

Keep in mind, though, that taxes on things like home renovations or local services listed on your tax bill, like trash collection, are not deductible.

Recommended Reading: How To Deal With Taxes

Assessments For Local Benefits

You also cannot deduct amounts you pay for local benefits that tend to increase the value of your property. Local benefits include the construction of streets, sidewalks, or water and sewer systems. You must add these amounts to the basis of your property that is, the total value of the property for tax purposes. Increasing your basis this way will reduce any taxable profit when you sell the property.

However, there is an exception to this rule: Any part of a special assessment you pay that is for maintenance, repairs, or an interest charge for a local benefit for your property is deductible. You may claim this deduction only if the taxing authority sends you an itemized tax bill separately listing the amounts you must pay for construction, interest, and maintenance.

Example: A city assessed a front foot benefit charge against property that was benefited by construction of a water system. The city’s tax bill itemized the charge, showing how much was assessed for construction of the water system, interest, and maintenance costs. Taxpayers were allowed to deduct the amounts for interest and maintenance.

What’s The Difference Between A Tax Deduction And A Tax Exemption

Property tax exemptions are portions of a full tax amount that taxpayers dont have to pay. Some state and local governments offer exemptions to reduce or forgo the amount of taxes paid by some residents, usually on the basis of age, disability or military service. There is also a homestead exemption in many areas.

To see if your municipality offers an exemption and whether you qualify, check your local government’s website.

Read Also: How To Avoid Taxes On Rmd

Interest And Bank Charges

You can deduct interest incurred on money borrowed for business purposes or to acquire property for business purposes. However, there are limits on:

- the interest you can deduct on money you borrow to buy a passenger vehicle or a zero-emission passenger vehicle. For more information, go to Motor vehicle expenses.

- the amount of interest you can deduct for vacant land. Usually, you can only deduct interest up to the amount of income from the land that remains after you deduct all other expenses. You cannot use any remaining amounts of interest to create or increase a loss, and you cannot deduct them from other sources of income.

- the interest you paid on any real estate mortgage you had to earn fishing income. You can deduct the interest, but you cannot deduct the principal part of loan or mortgage payments. Do not deduct interest on money you borrowed for personal purposes or to pay overdue income taxes.

Taxes: What Parts Of My House Payment Are Tax Deductible

While there are plenty of expenses that come along with owning a house, there are some tax benefits too. If youre looking to get the most out of your home, here are four tax breaks for homeowners you want to stay on top and keep a record of.

Mortgage Interest Deduction

When you make your mortgage payments, you may have been surprised at how much of your money was going towards interest. The good news is that you may be able to deduct your home mortgage interest when you file your taxes. When you receive your Form 1098 at tax-time, youll find out how much mortgage interest you paid in box 1.

Property Taxes

Property taxes can be a big chunk of your housing expenses, but you may be able to deduct them on your taxes.

If you have an Impound/Escrow Account your property taxes are included with your mortgage payment so the amount paid annually will be reflected on your Form 1098 Mortgage Interest statement. If they are not impounded keep record of what you paid to your county assessor. You can also look at your property tax bill for the year, which you may also be able to look at what you paid online.

Keep in mind that the new tax law changed how much property taxes can be deducted. Under the new tax law, the maximum amount of state and local property, income, and sales taxes that can be deducted is $10,000. In the past, these taxes have generally been fully tax deductible.

Private Mortgage Insurance Premiums

Home Office Deduction

You May Like: How Much Is The First Time Home Buyers Tax Credit