Factors That Go Into Shopper Earnings

While Instacart is one of the least transparent companies in the gig economy, here are some factors that go into how much you earn with their algorithm:

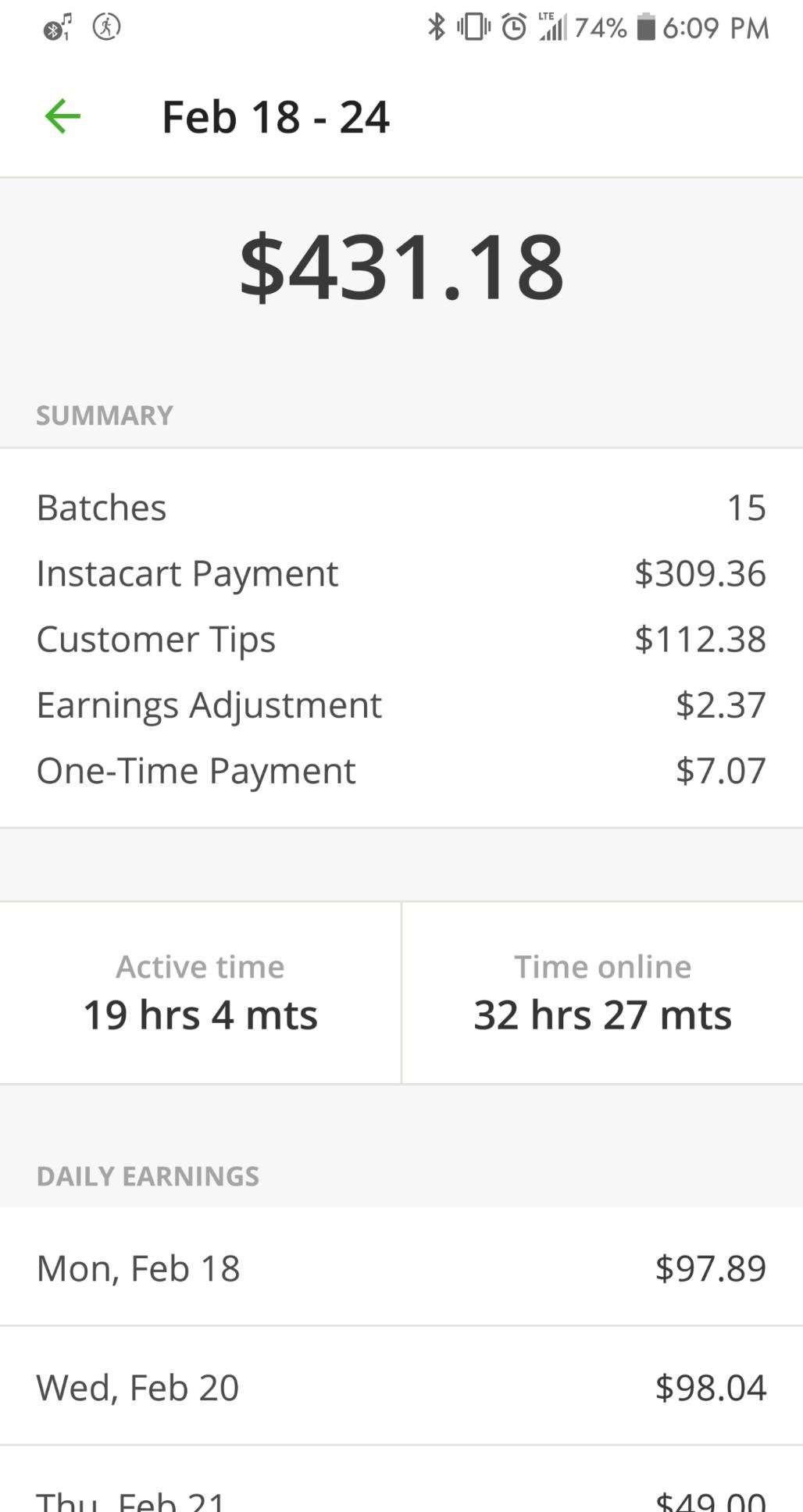

- Batch Incentive: This is the base pay youll receive for your order based on the items your customer has requested. This payment typically increases if there are particularly heavy or bulky items on their shopping list.

- Distance: A small mileage reimbursement is calculated into your pay, though the exact value varies by city.

- Current demand: Much like Uber and Lyft, Instacart offers peak hour pricing incentives when demand is high, so you can earn extra money on top of your standard fares.

- Tips: When people tip Instacart, the Shoppers keep 100% of the tips they earn.

You may get bonus offers directly from Instacart once in a while, but for the most part, the factors above will affect your overall income the most.

Minimum Batch Payment

Instacart shoppers are paid a minimum amount for every batch, or order, they complete.

This amount was previously $3, but after a PR snafu when changing up their payment structure once again, the company increased the amount of the batch payments to between $7 and $10.

Full service batches are between $7 and $10, while delivery-only batches pay out $5.

Tips are also not included in the minimum batch payment, allowing shoppers and delivery drivers to earn even more each time they decide to work.

Instacart Bonuses

Aside from bonuses and incentives, tips make up the bulk of additional payments.

What Is Taxable Income

Income tax is applied to taxable income. So, what is your taxable income? The ATO defines taxable income as follows: Your taxable income is the income you have to pay tax on. It is the term used for the amount left after you have deducted all the expenses you are allowed to claim from your assessable income. Assessable income allowable deductions = taxable income.

Read Also: Donating Plasma Taxes

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Recommended Reading: Do I Have To File Taxes For Doordash

Change In Instacart Payment Structure

In the past, Instacart paid drivers and shoppers a flat delivery fee for their time.

However, when they decided to factor in large purchases and heavy items such as cases of water and soda, the company realized this would no longer work.

Hence the change that focuses more on the variables above to improve payments and make them more fair to Shoppers.

In fact, last year Instacart changed up how much it paid entirely.

The goal was to attract and retain shoppers and drivers by providing them with a payment structure that paid well, but that was also reasonable for the company.

After the changes, we feel that the changes are good for both sides of the table.

The main changes to the new payment structure include:

- Instacart now pays shoppers 100% of the tips they earn during deliveries. This is separate from a Shoppers base compensation.

- Instacart increased the minimum a shopper will earn from a batch payment.

Now lets take a look at a few factors that heavily impact how Instacart pays contractors.

How Does It Impact Earnings Figures

Delivery apps need a happy, motivated workforce so that customers remain on the platform.

To curb tip baiting, Instacart revised their tipping system.

The time window customers have to adjust tips went from three days to just 24 hours.

Customers who change the tip after their order has been delivered must now explain their reasoning in a feedback form.

Tip baiting too much will get users removed from the app.

The new tipping system discourages customers from tip baiting.

Prior to the new policy, drivers were at risk of losing a significant portion of their income.

Many relied on tips to double their pay.

The practice was especially bad for moderately successful shoppers because a tip can make the difference between making minimum wage or better.

Tip baiting makes shoppers feel used, and when their employee experience is bad, theyre not going to continue working.

You May Like: Efstatus Taxact 2015

What Is An Instacart Pay Bump

Occasionally, you will receive an Instacart pay bump if youve had a difficult or heavy order, but they are rare. In addition, if you choose to participate in an Instacart survey, video interview, study, or in-person shop along, Instacart will provide you a shopper bump deposited directly into your Instacart shopper app.

Average Payment Institution For Buyers

as accurate salary information and payment figures are hard to find, the average salary for merchants is quite difficult. Depending on the source you choose, the average salary ranges between $ 10 and $ 17 per hour. One of the largest websites and recruitment in the world: Instacart buyers earn an average of $ 10 per hour. This figure is at or around the minimum wage in many places.

Read Also: Doordash Payable Account

When Do Instacart Shoppers Get Paid Tips

Instacart Shoppers get paid weekly tips on Wednesdays alongside regular payment from batches they completed the previous week.

You keep 100% of all your tips, and you can see a breakdown of your delivery earnings and your total tips under your earnings tab within the Instacart Shopper app.

Note that customers have up to 24 hours to adjust tip amounts, so this can change how much you get paid if a customer changes their tip at the last moment.

Pay Instacart Quarterly Taxes

The first step of the Instacart shopper taxes is to calculate your estimated taxes and proactively pay estimatedincome taxes on a quarterly basis.

The IRS establishes the deadlines for the payment. We suggest you put a reminder on your phone. Missing quarterlydeadlines can mean accruing penalties and interest.

Find below the IRS quarterly estimated tax payment timeline:

- Q1 Deadline: April 15

- Q2 Deadline: June 15

- Q3 Deadline: September 15, 2022

- Q4 Deadline: January 15, 2022

Also Check: Ccao Certified Final 2020 Assessed Value

Are Instacart Prices Higher Than Other Providers

It depends on your zoning and whether youre an Instacart member. For the most part, the markup that you can expect from Instacart is marginally higher than most others, including from Shipt. Amazon doesnt have a markup, but may have higher delivery fees. While Insta is slightly higher, almost every single grocery delivery service will have a similar pricing model.

Wait I Cant Just Shop When I Feel Like It

In many locations, yes just like driving with Uber or Lyft, you can turn on the app and accept jobs as they come in.

But in other locations, Instacart requests you set your schedule and work the hours you choose. Drivers only receive potential orders through the app during your set hours.

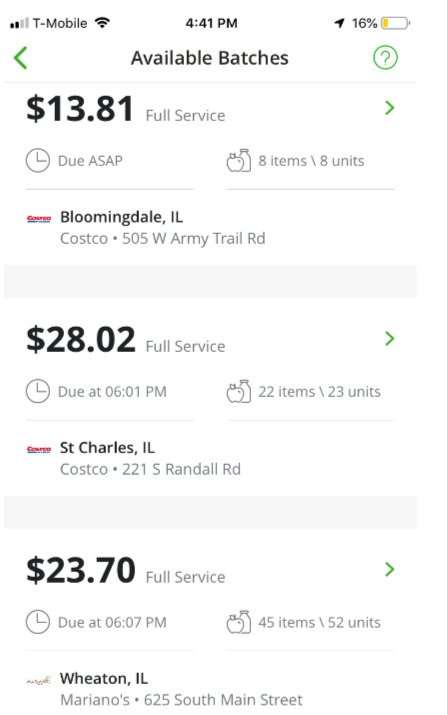

Normally orders will pop up at least 30 minutes before their scheduled start time. You can choose to accept them or pass on them. You might pass on an order because of the distance involved, the number of items, or pay earned.

In-Store Shoppers also set their own availability. They are then scheduled for shifts based on their availability, up to 29 hours a week.

Read Also: Www.1040paytax.com.

How Much Do Instacart In

Now that you know how much Instacart drivers make, you may be curious about how much youd make if you exclusively worked out of an Instacart partner store.

There are two key differences to be aware of regarding how In-Store and Full-Service Shoppers are paid.

First, In-Store Shoppers do not qualify for tips, which means the hourly wage youre offered is what youll end up earning.

You shouldnt expect bonuses or promotions on top of this pay.

Of course, the plus side of having a set wage is the fact that youll have an hourly guarantee every time you work.

Second, In-Store Shoppers are actually Instacart employees and not independent contractors.

In this role, youll have a traditional part-time job that allows you to make minimum wage and qualify for paid time off.

Though youll have to schedule your shifts in advance and will have lower pay than Full-Service Shoppers, you will have a more consistent schedule.

Instacart In-Store Shoppers make an average of $13 per hour, which is just a couple dollars lower than their full-service counterparts.

Indeed.com, another popular career and ratings site, reports that Instacart shoppers are paid around $17 per hour.

Of that number, 45% publicly reported that they are not happy with the amount that they are paid when working with Instacart.

Keep in mind that this figured is from only 46 ratings, so it is not really statistically accurate.

But.. it does give a good idea into compensation.

Does It Matter If Youre A Full

Some stores may use their own employees for certain tasks, while others will use independent contractors for the entire process. Whats important is which specific Instacart shopper position you accepted with the company that is paying you.

Different positions may have slightly different tax situations, though. For example, if you shop and deliver groceries, you could have mileage deductions for deliveries, but if you only shop, you likely wouldnt have a mileage deduction.

You May Like: Do You Have To Pay Back Taxes For Doordash

What Are Some Common Expenses For Full

Full-service shoppers are independent contractors, so shopping and driving for Instacart is a business, not just a job. Drivers need to track and account for different expenses, none of which are reimbursed by Instacart.

Lets take a look at a few common expenses Instacart full-service shoppers may face:

So I Got A Job At Instacart As A Contractor What Should I Be Doing To Be Prepared For Taxes

Ive been just finished this college semester and started looking for a summer job to keep me afloat as well as build a savings and I live with my

If you end up sending in too much via estimated taxes, when you do your real tax filing in April you would get a refund back, because the amount you sent in as estimated taxes is entered on a line on page 2 of Form 1040 and compared to the amount you really owe based on actual final income and expenses. So your estimated payment neednt be exact.

Figuring out how much tax to pay by the 4 deadlines could be a challenge if your income is variable. If you had no tax liability at all last year, you dont need to make estimated payments. Otherwise read Form 1040-ES for guidance about how to project your income, expenses, and essentially prepare a dummy Form 1040, Sched C, and Sched SE to determine how much the IRS expects .

Don’t Miss: How To Calculate Taxes For Doordash

How Is The Tax Calculated On Instacart Products

The taxes and/or fees you pay for products purchased through the Instacart platform are calculated in the same way as in a brick and mortar store. Depending on your location, the shipping or service charges you pay to Instacart in exchange for their services may also be taxable. Several taxes apply when placing an order:.

Personal Shopper Tax Guide

This post contains links to useful products and services. I may receive a referral fee if you make purchases using these links.

Do you need to know how to file your taxes or save money on your taxes if you worked as a personal shopper or delivery driver? This tax guide tells you what you need to know.

You May Like: How Much Should I Set Aside For Taxes Doordash

Do You Need Custom Tax Guide For Instacart

As an Instacart buyer, you’re an independent contractor, and while self-employment has its perks, it also means tax times are getting more challenging. That is why they have developed a personalized tax advisor for you, based on the advice of your tax specialists. Find out everything you need to know to optimize your tax season.

Figure Out Your Profit Each Week

What did you earn for your business?

What did you spend?

What was left over? That’s your profit.

It’s a little more involved than that. Part of what you spent’ is the part that you can claim for your vehicle expenses. For the 2020 tax year, you can claim 57.5¢ of car expense for every mile you drive for business.

Here’s the thing: I don’t personally sit down and do book keeping every week. I just do a very basic calculation.

Earnings minus 57.5 cents per mile.

That’s the profit that I base my tax savings on. I don’t go to all the trouble to add up all the little things, because compared to my miles, they’re very little.

If I made $500 and drove 400 miles, I take $500 minus . In other words, I multiply my miles times the mile rate. 400 miles at 57.5¢ each is $230.

$500 minus $230.

I pay taxes on $270.

Keep it simple. Otherwise you’ll psych yourself out of doing anything at all.

Recommended Reading: License To Do Taxes

Can You Use Stride To Track Business Expenses

Stride is a free app that makes it easy to find and track deductible business expenses, take photos of receipts, and automatically log business miles. When you’re ready to file your tax return, you can use the app to download the IRSready report of all your deductions for the year. You can use it to supplement your schedule C.

Earn More On Your Terms

Instacart is a way to start earning a flexible income in as little as two weeks. The convenience of the Instacart app lets you choose your hours, your gigs, and your preferences. You get total flexibility and reliable work. With little setup, you can start earning when you need itas full-time work or as a side gig.

Also Check: How To File Taxes As A Doordash Driver

Cons Of Being An Instacart Shopper

On the downside, Instacart does not have a set minimum wage for its shoppers. This can be discouraging at times, especially when other shoppers receive higher earnings than others.

Another disadvantage of being an Instacart shopper is that it can be physically demanding at times. You may find that you have to deliver bulk orders, so it takes much of your energy to shop, load your truck, and then offload it once you reach the order destination.

Last, considering all the additional costs that you have to incur as an Instacart shopper, sometimes the wage you receive may not be sufficient to cover all the expenses.

Why Do You Need To Make Quarterly Payments

We know what you might be thinking. Why not just pay your taxes once a year, when you file your return? However, the IRS doesnt look too kindly on those who dont make enough tax payments throughout the year. It may be tempting to simply save all your tax payments for the year and throw them into a high-yield savings account. After all, Uncle Sam will still get paid in the end. In the meantime, maybe youll be able to make a few extra bucks in interest payments.

Unfortunately for you, the IRS frowns upon this practice. You can be charged interest and other penalties if you dont make at least quarterly payments. Do not wait until tax season to pay what you owe.

Read Also: How Much Are Taxes For Doordash

Also Check: Do I Have To Pay Taxes On Plasma Donation

Delivery Miles & Dispatch Miles

The app design makes it somewhat tedious, but a worker can calculate their total delivery miles for the week by pulling up each separate job and adding the individual figures for delivery miles listed at the job level. Dispatch miles are not similarly accessible while a worker must have GPS active to accept a job and so the app certainly could calculate dispatch miles, they do not currently do so. However, many workers do track these miles for their own personal accounting purposes, and there are in fact several helper apps which aid in this tracking.

56.5% of weekly pay reports included a total of delivery miles. We used that data to calculate that workers drove a median of 3.96 delivery miles per hour with an active job, then imputed that number of delivery miles per active hour to those weekly pay reports which lacked a figure for delivery miles. An alternative calculation based on mileage per order found a median 4.44 delivery miles per order the results of this calculation were similar, but because the time data was more robust we felt the first calculation was more reliable.

Do Grubhub Doordash Uber Eats Instacart Etc Report Our Earnings To The Irs

A lot of people get the idea that Doordash is under the table work, or that Grubhub income can go without being reported. Don’t make that mistake.

Before I go further: It’s YOUR job to track your earnings. It is not Grubhub’s job or Doordash’s or anyone else.

They will report our earnings. Don’t make the mistake of thinking that’s for our benefit. Most of these companies have made it clear that they don’t care about providing useful information to us .

They only report income for two reasons: One, they are required to, and two, it provides documentation to prove that the contractor expenses they report on their taxes are legitimate.

It’s easy for them to say okay, we spent $1 million on independent contractors and use that to keep their taxes down. The IRS then says okay, so who did you send it to?

This is where the reporting comes in. Door Dash says I paid Ron $12,500 and then Grubhub says I paid Ron $17,000. The IRS looks at that and then watches for my tax filings to see if I’ve reported at least $29,500. If I didn’t, either the gig companies are lying or I am.

When they report that they paid us money, that earnings report comes in the form of a 1099 form. For those of us in gig delivery, it’s usually one of two types. Some use the 1099-NEC and some use 1099-K. Sometimes one might use both.

Also Check: Does Doordash Issue 1099