More Resources For Finding Tax Professionals

Many tax professionals are members of organizations that will assist you in finding a professional nearby.

Massachusetts Society of Enrolled Agents

An enrolled agent is a tax practitioner licensed by the U.S. Department of the Treasury to represent any taxpayer before the Internal Revenue Service and state taxing authorities. Find an enrolled agent in Westwood, MA.

Massachusetts Society of Certified Public Accountants

A CPA is an accountant who has satisfied education and experience requirements and successfully completed an exam testing business, auditing and general accounting skills. CPAs are required to continue their professional education to keep up with new rules and regulations. Look for a CPA who specializes in taxes. Find a CPA in the Metro West Region.

National Association of Tax Professionals

A paid tax professional will have an IRS Preparer Tax Identification Number and must include it on the tax returns they prepare. Tax professionals have different levels of representation rights. Some will have unlimited representation rights before the IRS and others will have limited representation rights or may be authorized only to prepare returns. Find a tax professional in Westwood, MA and surrounding towns.

Library Newsletter

Find out about upcoming events, new titles, and all things Westwood Library. New in 2022: Don’t miss our *new* Youth Services Newsletter and quarterly Book Buzz updates!

Answered By: Jed Cridland

Yes, all branches should have the 1040 and 1040EZ forms and the instructions for each of those forms. We do NOT receive any other forms from the IRS and we do NOT receive ANY South Carolina state tax forms. We usually receive the forms in mid-January and will continue to distribute them until we run out. If you need a form other than the 1040 and 1040EZ, a library employee can help you print a form from the IRS or South Carolina state tax website for 10 cents per page. We cannot give you tax advice, nor can we tell you which forms you will need, so if you do need forms printed, please have the form number ready before making your request.

Tax Forms Instructions And Information

The tax season official start date is January 24.

The filing deadline to submit 2021 tax returns is April 18th.

- Many software companies and tax professionals will be accepting tax returns before the start of tax season and will then submit the returns when IRS systems open. Taxpayers can visit IRS.Gov/GetReady for more tips on preparing to file their 2021 tax return.

- The IRS strongly encourages people to file their tax returns electronically for faster refunds. As in past years, the IRS will begin accepting and processing individual tax returns once the filing season begins. For taxpayers who usually file early in the year and have all of the needed documentation, there is no need to wait to file. They should file when they are ready to submit a complete and accurate tax return.

Important note from the IRS: The IRS reminds taxpayers that, by law, the IRS cannot issue refunds claiming the Earned Income Tax Credit before mid-February. While the IRS will process those returns when received, it cannot issue related refunds before mid-February.

You May Like: Is Freetaxusa A Legitimate Company

Earned Income Tax Credit

The Earned Income Tax Credit, EITC or EIC, is a benefit for working people with low to moderate income. To qualify, you must meet certain requirements and file a tax return, even if you do not owe any tax or are not required to file. EITC reduces the amount of tax you owe and may give you a refund. More Info.

Need Wifi On The Go Check Out A Mobile Hotspotat The Westwood Public Library

The Library now offers Mobile Beacon 4G mobile hotspots. Internet service is provided on Sprints 4G LTE network allowing library patrons access to high-speed internet service anywhere a cell phone signal can be received. Up to 10 devices can be connected, with unlimited data. Must be at least 18 years of age to check out a hotspot.

Don’t Miss: Doordash 1099

Resources Available At Harford County Public Library

HCPL staff welcome the opportunity to assist customers in finding tax forms and instructions on the federal and Maryland state tax websites and other state tax websites.

Maryland and federal income tax forms may be downloaded and printed using library computers. Reproducible Federal income tax forms for the current tax year may be available later in the tax season and may be photocopied at the library. The print and photocopy charge at the library is $0.25 per page. Please note that paper copies of State of Maryland tax forms, instructions and multiple copies of paper copies of Federal IRS forms are not available at the Library. Find Library locations and hours.

If a particular form cannot be located, please ask for help at the Information Desk.

Our libraries have reference and circulating books to help with preparing either personal or business income tax forms. For a list of tax related materials owned by the library search the Harford County Public Library catalog, type “tax”, “income tax” or “small business taxation” or similar keyword into the search box. Harford County Public Library staff cannot provide tax advice. Information and links are offered only as a convenience and Harford County Public Library is not responsible for content.

Mobile App: IRS2GO Now Available

The Library Does Not Offer Tax Prep Assistance

Library staff are unable to recommend forms, assist with any part of the filling process, or provide ANY advice regarding income tax preparation. Staff may assist with printing from our computers , or with pointing patrons in the direction of the print copies detailed above.

To search for free tax prep assistance near Bluffton, Ohio, visit:

Read Also: H& r Block Early Access W2

Local Tax Help At Library Locations

UB School of Management – Free Tax Preparation IRS-certified students from the UB School of Management will again provide free tax preparation services to individuals and families with annual incomes below $54,000. The service is provided by the IRS-sponsored Volunteer Income Tax Assistance program with volunteers from the UB chapter of Beta Alpha Psi, an international honors organization for accounting and finance students, with help from the UB Accounting Association.

Volunteer Income Tax Assistance The Volunteer Income Tax Assistance program offers free tax help to people who generally make $55,000 or less, persons with disabilities and limited English speaking taxpayers who need assistance in preparing their own tax returns. IRS-certified volunteers provide free basic income tax return preparation with electronic filing to qualified individuals. Please double check what to bring before attending a session.

Aarp Tax Assistance At The Library

OCLS will once again be partnering with AARP to provide tax assistance. This year, AARP volunteers will be available, at select locations, to provide free income tax help.

Customers will need to make an online appointment through the AARP website: . The appointment scheduling site should be live by mid to late January and walk-ins will not be accommodated. The Library is not involved in scheduling appointments.

AARP Volunteers will be at the following locations: South East Branch- Mondays and Thursdays, February 3 – April 14, 10 AM – 2 PM South Creek Branch- Wednesdays and Thursdays, February 2 – April 14, 10 AM – 2 PM West Oaks Branch- Tuesdays and Fridays, February 1 – April 15, 10 AM – 2 PM

For information customers may visit: www.aarp.org/taxaide

Don’t Miss: Pin Number To File Taxes

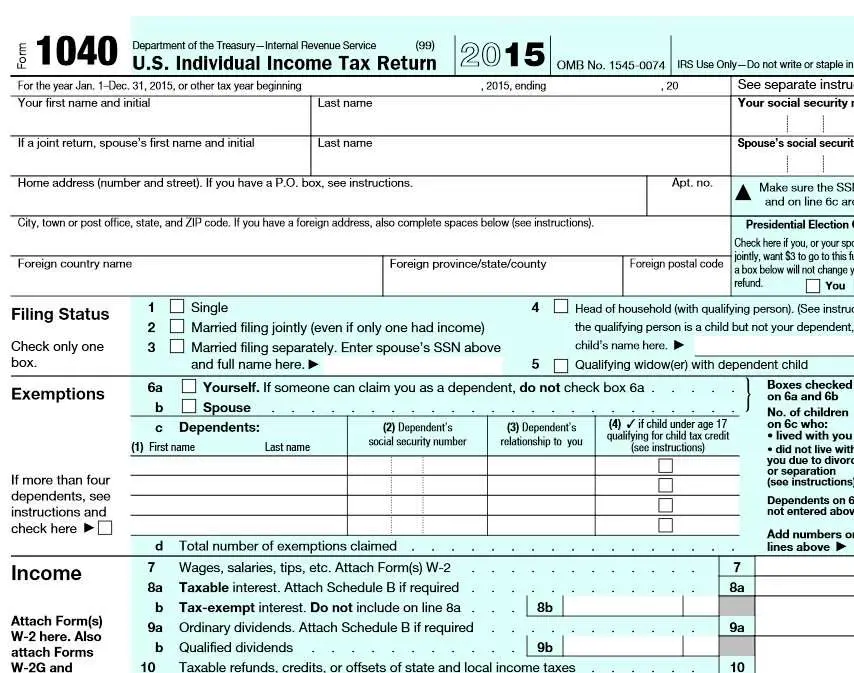

Federal Tax Forms And Resources

New Filing Deadline: May 17, 2021

The Form 1040 and 1040-SR as well as other forms and publications can be downloaded from the IRS website or ordered by calling 1-800-TAX-FORM .

For income below $72,000, a free File Software Lookup Tool on the IRS website is a great resource to find free e-filing software products that match your situation. For those with income above $72,000, free fillable forms are available from February 12, 2021.

Public libraries currently have a limited number of tax forms available.

| Island |

|---|

Where Can I Pick Up Tax Forms Near Me

Whether youre running out of time or simply running out of printer ink, there are plenty of places to snag income tax forms in your town.

Post OfficeEven if you have a tax office nearby theres really no reason to go stand in line there just to get the income tax forms you need. Head to your local post office and locate your necessary income tax forms there. Usually, they have a standee available for walk-ins to grab whatever they need, and better yet, its generally located in the lobby so you can run in and out. Just dont go during lunchtime, as the post office is somewhat crowded with people rushing there to do their normal post office business during their lunch hour.

LibraryIf the post office is a no go or theyve simply run out of income tax forms, head to your local library. Not just public libraries, either university and sometimes even high school libraries will often carry income tax forms.

Ive often found the library has the most complete set of income tax forms. The librarians will have more time to help you locate the correct income tax forms you need, too. But watch out, sometimes, they split up incomes tax forms and their instructions. Make sure to grab both!

Read Also: How Do I Get My Pin For My Taxes

Online Forms Instructions And Services

Online Forms, Instructions and Services

State of New Mexico Tax FormsFill out and print PIT forms, instructions and publications.File your State tax return electronically.

IRS Forms Federal forms, instructions and publications – plus tips on filing your materials, and details on returns.

File Federal returns electronically through an IRS eFile Service.

The MyFreeTaxes Partnership provides free state and federal tax preparation and filing assistance for qualified individuals. Its easy, safe, secure and 100 percent free.

Affordable Care Act Tax ProvisionsThe Affordable Care Act was enacted on March 23, 2010 — containing some tax provisions that took effect this year, as well as more that will be implemented during the next several years. Learn more about the general provisions now in effect, plus specifics for individuals and families.

Tips on Preparing for Tax Season

- The IRS periodically issues and updates tax tips for individuals and businesses that can be useful in preparing tax filings.

Volunteer Income Tax Assistance Program

If you live in Calvert, Charles, Prince Georges or St. Marys counties and your household income is less than $57,000 a year, the Lifestyles of SOMD Volunteer Income Tax Assistance program is available at Lexington Park Library, Wednesdays, February 2 April 13 to help you prepare your income taxes.Register for your tax assistance appointment today

You May Like: Protesting Property Taxes In Harris County

Tax Resources And Information

There are numerous free options available for taxpayers to obtain tax products, tax preparation and assistance in filing their tax returns:

- Forms and instructions are available online.

- All KDL branches will have paper copies of a limited number of popular forms available for free.

- Please contact us for an up-to-date inventory.

- Many libraries also have a master book of current federal forms available for reproduction. Library staff can assist you in finding and printing tax forms, although legal and ethical codes prohibit staff from giving income tax advice or opinions.

The IRS will begin accepting tax returns in January. The deadline to file this year is Monday, April 18 2022. Individual and business taxpayers no longer receive paper income tax packages in the mail from the IRS. The IRS has taken this step because of the continued growth in electronic filing and the availability of free options to taxpayers, as well as to help reduce costs.

Volunteer Income Tax Assistance

The Volunteer Income Tax Assistance program offers free tax help to people who make $57,000 or less, persons with disabilities, people who are age 60 or older and limited English-speaking taxpayers who need assistance in preparing their own tax returns. IRS-certified volunteers provide free basic income tax return preparation with electronic filing to qualified individuals. Schedule your free tax prep appointment by calling 211.

You May Like: How To Do Taxes Doordash

Tax Forms And Filing Your 2021 Income Taxes

01/05/2022

“The hardest thing in the world to understand is the income tax.” ~Albert Einstein

Tax time is here! Many Library patrons rely on IndyPL for tax forms and filing instruction booklets.

In order to encourage more tax payers to file electronically, both the Internal Revenue Service and the Indiana State Department of Revenue are limiting distribution of paper forms and instructions. Here is what to expect if you come into a Library for tax documents.

- This year, some Library locations will receive a limited number of Federal and State tax forms and instructions.

- After the limited supplies are depleted, we will print tax forms for free, but not multi page booklets and instructions. You may use a Library computer to view tax instructions and booklets online, or you can print them on our printers at $0.15 per black-and-white page.

- Library staff cannot help you select or fill out your tax forms.

- See our Frequently Asked Questions below for more information.

Links to printable tax forms online or by phone:

- Find printable IRS Federal Tax Forms& instructions here or call 1-800-829-3676.

- Find printable State of Indiana and County Tax Formshere or order by phone at 317-615-2581 .

Tax preparation help:

Irs Free File Opens A New Window

IRS Free File provides options for free brand-name tax software or online fillable forms plus free electronic filing. Everyone can use Free File to prepare a federal tax return. Taxpayers who make $72,000 or less can choose from several commercial software providers. There’s no income limit for Free File Fillable Forms, the electronic version of IRS paper forms, which also has free e-filing.

The Kent County Tax Credit Coalition, opens a new window provides a directory of free tax preparation services and resources available to assist low- to moderate-income people and senior citizens.

Schedule your free tax prep appointment by calling 211.

You May Like: Doordash Payable Account

Tax Withholding Estimator For Next Year

The IRS encourages everyone to use the Tax Withholding Estimator to perform a quick paycheck checkup. The Estimator helps you identify your tax withholding to make sure you have the right amount of tax withheld from your paycheck at work.

If you are an employee, the Tax Withholding Estimator helps you determine whether you need to give your employer a new Form W-4, Employee’s Withholding Allowance Certificate . You can use your results from the Estimator to help fill out the form and adjust your income tax withholding. If you receive pension income, you can use the results from the estimator to complete a Form W-4P and give it to your payer.

Income Tax Form Preparation Assistance

Federal tax return preparation assistance is available if you qualify. Visit a Taxpayer Assistance Center for an appointment. If a same-day appointment is not available, a future appointment will be made within 5 business days. Other services provided

- Baltimore Office 31 Hopkins Plaza, Room G700 Baltimore, Maryland 21201 Monday – Friday – 8:30 a m – 4:30 p m

The IRS offerslive telephone assistance is available by calling 1-800-829-1040, or from Monday to Friday, from 7 a.m. to 7 p.m. local time. When calling, you may ask questions to help you prepare your tax return, or ask about a notice you have received. Live telephone assistance is also available for businesses. Call 410-547-6537, Monday-Thursday, 9 a.m.-1 p.m. Volunteers assist low-income individuals on matters involving tax disputes with the IRS, tax audits, or back taxes. Not a walk-in service.Tax-Aide Program by AARP Offers free volunteer-run federal tax assistance from February 1 through the middle of April for low- and middle-income taxpayers, with special attention to those 60 and over. Sites are operated on an appointment basis. Offers online federal tax assistance year-round. If you have a question, please use AARP’s Online Tax Assistance form to ask your Federal tax question through the AARP website. You can contact AARP Tax-Aide by phone at 888-OUR-AARP .

You May Like: Is A Raffle Ticket Tax Deductible

Other Tax Preparation Programs

- The Volunteer Income Tax Assistance and the Tax Counseling for the Elderly programs offer free help for taxpayers for those who qualify.

- Earn It Keep It Save It, is a coalition serving the Bay Area in partnership with United Way and will help with free tax prep.

- If you earned less than $54,000 in 2016, more free tax prep. The IRS Volunteer Income Tax Assistance and the Tax Counseling for the Elderly programs offer free tax help for taxpayers who qualify. In Spanish, Tagalog, and English.

Answered By: Sapl Faqslast Updated: Jul 20 2016 Views: 4005

The San Antonio Public Libraries will carry a selection of IRS forms between the months of January and April each year.

The San Antonio Public Library will no longer carry the full selection of IRS forms and publications that it has in previous years. Due to budgetary restraints imposed by Congress, the only forms being sent to libraries are the 1040, 1040A, and 1040EZ. No any other publications or schedules will be sent.

Please call ahead to check that the form you need is available at your library before you go to pick it up. The forms that are available are free. You can view the locations, hours and phone numbers at .

Ways to get the forms you need:

1. Have them mailed: If you prefer, you can call the IRS at 1-800-TAX-FORM to have the forms mailed to you, or you may place your order online .

2. Print them online: You may also print forms directly from the IRS website at www.irs.gov. Printing is also available for a fee at all libraries.

3. Pick up forms in person: Forms are available at the local IRS office at 8626 Tesoro Dr. San Antonio, TX 78217, 841-2090. Tax assistance is now by appointment only. Call in advance for hours and availability of specific forms.

4. Reproducible Notebooks: In addition, usually in late January or early February, most of our locations will also receive the notebook of all IRS forms. You can find a form in this notebook and copy it on a copy machine in the library. Library copier fees apply.

You May Like: Is 1040paytax Com Real