Can You File Taxes On Your Own If Married

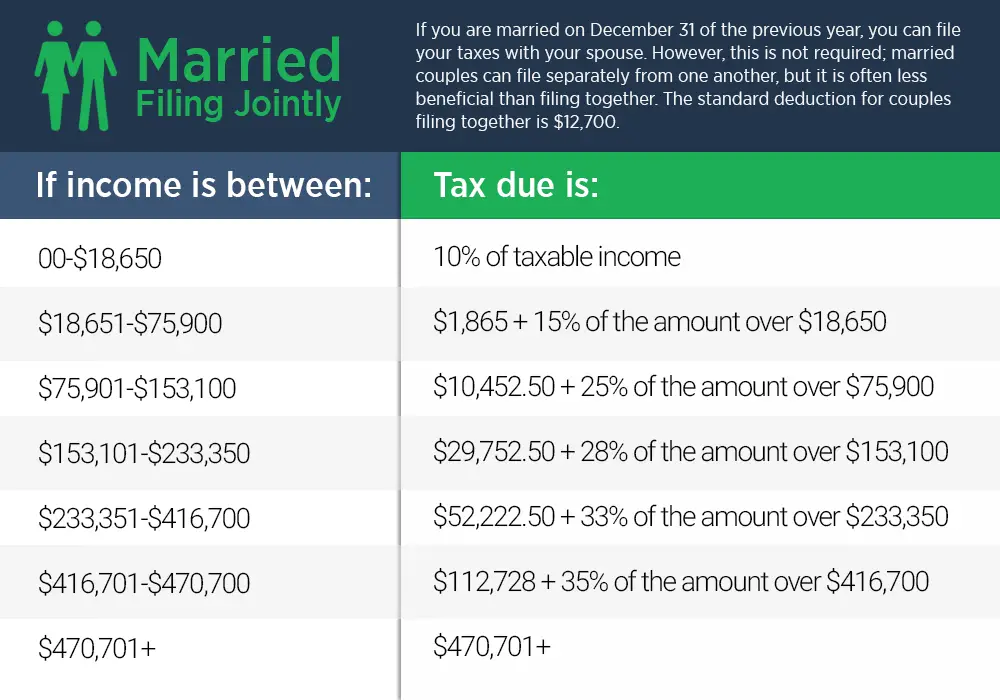

If you’re legally married as of December 31 of the tax year, the IRS considers you to be married for the full year. Usually, your only options are to file as either married filing jointly or married filing separately. Using the married filing separately status rarely works to lower a couple’s tax bill.

When You Should File Separately

As mentioned previously, there is one instance in which it can make sense for even a happily married couple to file separately. This occurs when a couple has no children and one spouse earns a great deal more than the other, and the lower-earning spouse has sizable itemized deductions.

For example, a couple with a wife who works as a corporate executive making $200,000 a year and a husband who makes $40,000 a year as a teacher would normally file jointly. But this year, the husband incurs $15,000 in medical expenses for cancer treatments. The IRS only allows taxpayers to deduct unreimbursed medical expenses in excess of 10% of adjusted gross income. If the couple were to file jointly, then this threshold would be $24,000 , thus making the entire expense nondeductible. But if the husband were to file separately, then the threshold would only be $4,000, allowing him to deduct $11,000 of expenses on his return.

The wife would have to itemize as well, but if the couple normally itemizes anyway, then there is no real disadvantage to doing this. Of course, the couple will probably still be better off filing jointly if they have to forfeit other credits such as one of the educational credits. In cases like that, it may be best to prepare three separate tax returns and compare the net results of a joint return versus separate returns.

Filing Separately Vs Filing Jointly

While filing separately may have a few advantages for certain couples, there are certain tax matters to consider before deciding to file separately. It is possible for some separate tax returns to get higher taxes, as well as a higher tax rate. Compared to joint filers, separate filers have a much lower standard deduction.

For instance, in 2021, married couples that filed separately only got a $12,550 standard deduction, whereas joint filers had a $25,100 one. Failing separately will also automatically disqualify you from some of the credits and tax deductions that joint filers have access to.

Whats more, separate filers are unable to take a deduction for student loan interest, and they are also stuck with a smaller IRA contribution deduction. When filing separately, the capital loss deduction limit is $1,500. Concurrently, on a joint return, the capital loss deduction limit is $3,000.

Also Check: Tax Write Offs Doordash

Tax Rules For Married Couples Who Live Separately

Generally, taxpayers who file using the head of household filing status receive greater tax benefits than single taxpayers or married taxpayers who file separately. As long as both spouses agree to file their taxes jointly, and they are still legally married on Dec. 31, the IRS allows them to file their taxes as married taxpayers filing jointly. The IRS considers the spouses as legally married if they have not received a final decree of divorce. The IRS defers to a state’s definition of “legally married,” and spouses who were married at common law pursuant to their state’s marriage laws can file their taxes as married taxpayers. However, only opposite-gender spouses can file their taxes as married taxpayers, even when their states recognize civil unions and same-sex domestic partnerships.

Video of the Day

Need A Loan Get One In 3 Simple Steps

If you are considering applying for a personal loan, just follow these 3 simple steps.

Apply

Apply online for the loan amount you need. Submit the required documentation and provide your best possible application. Stronger applications get better loan offers.

Accept

If your application meets the eligibility criteria, the lender will contact you with regard to your application. Provide any additional information if required. Soon youll have your loan offer. Some lenders send a promissory note with your loan offer. Sign and return that note if you wish to accept the loan offer.

Repay

The loan then gets disbursed into your U.S. bank account within a reasonable number of days . Now you need to set up your repayment method. You can choose an autopay method online to help you pay on time every month.

About Stilt

Stilt provides loans to international students and working professionals in the U.S. at rates lower than any other lender. Stilt is committed to helping immigrants build a better financial future.

We take a holistic underwriting approach to determine your interest rates and make sure you get the lowest rate possible.

Learn what others are saying about us on , Yelp, and or visit us at . If you have any questions, send us an email at

You May Like: Doordash Taxes How Much

Eligibility Requirements For Married Filing Separately

If youre considered married on Dec. 31 of the tax year, then you may choose the married filing separately status for that entire tax year. If two spouses cant agree to file a joint return, then theyll generally have to use the married filing separately status.

If you have a dependent living at home and youre considered unmarried by the IRS, you may qualify for the head-of-household filing status, which is typically more beneficial than married filing separately.

To be considered unmarried for tax purposes you must meet all the following criteria:

- You lived separately from your spouse from July to December of the tax year .

- You file separate tax returns.

- You paid more than half the cost of maintaining your home for the tax year.

If you meet the criteria to be considered unmarried and want to file as head of household you must also have had a child, stepchild or foster child residing with you for more than half the tax year that you can claim as your dependent.

A few life events may cause you to change your status to or from married filing separately, including the following:

You Want To Protect Your Own Finances Or Need To Follow State Law

Lastly, not to plant the seeds of doubt, but filing separately might be smart if you suspect your spouse may be committing tax fraud, is behind on tax payments, or owes child support, because you’ll be protected from shady behavior and your refund won’t be held up by the IRS.

Also keep in mind that if you and your spouse work or live in different states, your state may require you to file separately in your state and jointly for your federal returns to ensure you won’t be taxed twice on the same income. The exception to this rule is if you live in a community property state where all marital assets are considered joint property.

Also Check: Irs Forgot Ein

Consequences Of Filing Your Tax Returns Separately

On the other hand, couples who file separately receive few tax considerations. Separate tax returns may give you a higher tax with a higher tax rate. The standard deduction for separate filers is far lower than that offered to joint filers.

- In 2021, married filing separately taxpayers only receive a standard deduction of $12,500 compared to the $25,100 offered to those who filed jointly.

- If you file a separate return from your spouse, you are automatically disqualified from several of the tax deductions and credits mentioned earlier.

- In addition, separate filers are usually limited to a smaller IRA contribution deduction.

- They also cannot take the deduction for student loan interest.

- The capital loss deduction limit is $1,500 each when filing separately, instead of $3,000 on a joint return.

Delay In Filing A Return

When a joint income tax return fails to include both signatures, IRC section 6651 may impose an addition to the tax for a failure to timely file a return when due unless it is shown that such failure is due to reasonable cause and not due to willful neglect. This is equal to 5% for each month that the tax return is late, not to exceed 25% in total.

Reasonable cause requires the taxpayer to demonstrate that, even though she exercised ordinary business care and prudence, she nevertheless was unable to file her federal income tax return by the due date . Willful neglect is defined as conscious, intentional failure or reckless indifference . The major issue is whether the taxpayers exercised ordinary business care and prudence in handling their original jointly filed income tax return. A secondary issue is whether the taxpayers exercised ordinary business care and prudence in handling the original return when the IRS sent it back for the lack of one of the signatures to stop the running of the section 6651 tax penalty. If alterations to the original filed return show that the taxpayers knew that a signature was missing and that the missing signature would make the return insufficient for some business purposes, and nothing was done, then such conduct does not meet the standard of ordinary business care and prudence .

The majority rule in the federal court system is that an unsigned return does not start the running of the statute of limitations.

Also Check: Can You File Taxes With Doordash

When Should Married Couples File Taxes Separately

Filing separately also may be appropriate if one spouse suspects the other of tax evasion. In that case, the innocent spouse should file separately to avoid potential tax liability due to the behavior of the other spouse. This status can also be elected by one spouse if the other refuses to file a tax return at all.

How To Choose The Proper Filing Status For Your Tax Return

Obviously, choosing a filing status is an easy decision in some cases. If you are unmarried and do not provide care or living expenses for anyone else, then you will use the single filing status. You will want to use the head of household status if you are unmarried and provide care or living expenses for a legal dependent or parent. Similarly, if you are a qualifying widow or widower, then that is the status you should select. However, if you are married, then choosing between married filing separately vs jointly can sometimes be a difficult decision.

In most tax situations, you will be better off selecting the married filing jointly status. One of the situations in which you might need to file separately is if you have no children, one spouse has substantially higher taxable income, and the spouse with the lower income has large itemized deductions like medical expenses for the year. In that case, it might make sense for you to file separately, even if you file jointly every other year. As mentioned before, you can choose a different status in different years, so you should consult your tax professional to determine if filing separately makes sense in your situation.

Don’t Miss: Donating Plasma Taxes

What Are The Benefits Of Filing Jointly

There are many benefits to filing jointly. In general, you are eligible for a higher standard deduction and you can take advantage of multiple tax credits. Couples with children often receive even more deductions and tax advantages by filing a joint return. Regardless of your filing status, the due date for your return will remain the same. Even if you have a deferred tax liability, your taxes will be due on the same date whether you file jointly or separately.

Does Different Earning Methods Matter While Filing For Taxes

Whether your income comes from W-2 wages, business, or self-employment, it does not make any difference. The income tax team is only concerned with the overall wages that will be reported on a tax return. But, of course, there are always exceptions.

For example, one spouse might be a high earning W-2 employee, and the other might be a business owner. So, if the high and low salary spouse files together, this might phase the spouse doing business out of taking advantage of some of the incomes profits.

Nowadays, most tax software companies at a time calculate two returns. So, if spouses are still in doubt about the amount of tax, they can use the software to know the ultimate answer. Generally, with a click of a button, the tax specialist can inform you what your tax charge would look like in the case of separate returns.

However, I hope you now understand the benefits of filing taxes together in Canada. If not, continues the reading, the end of the article will understand everything about this.

Also Check: Do Tax Preparers Have To Be Licensed

When Married Filing Separately Will Save You Taxes

OVERVIEW

If youre married, there are circumstances where filing separately can save you money on your income taxes.

For information on the third coronavirus relief package, please visit our American Rescue Plan: What Does it Mean for You and a Third Stimulus Check blog post.

The IRS considers taxpayers married if they are legally married under state law, live together in a state-recognized common-law marriage, or are separated but have no separation maintenance or final divorce decree as of the end of the tax year.

Of the 150.3 million tax returns filed in 2016, the latest year for which the IRS has published statistics , 3.07 million belonged to twosomes who filed separately.

- These partners reported individual income and expenses on individual tax returns.

- They had to agree on either itemizing expenses or using the standard deduction.

- By filing separately, their similar incomes, miscellaneous deductions or medical expenses likely helped them save taxes.

Is It Better To File Separately Or Jointly If Married

As a result, the tax rate may be lower. By joining together as husband and wife, married couples are more likely to gain financial advantage. TurboTax tax expert Lisa Greene-Lewis tells the story of one married couple who was filing their taxes jointly after their partners tax return went into effect, and getting some tax benefits when it did.

Don’t Miss: If I File Taxes Today Will I Get A Stimulus Check

Single Vs Married Tax Filing Options

People who need to file their taxes have five filing statuses available: single, head of household, married filing jointly, qualifying widow/er with a dependent child, or married filing separately. Anyone is eligible for one or two statuses only, but as your life goes on and circumstances change, so does your filing status.

When you get married, your filing status changes and your tax situation will follow it too. The IRS has special definitions when using the married and single filing statuses is possible.

To file your taxes as married, you will have to get married legally either on the last day of the tax year or before that. This will make you qualify as married for the IRS. Meanwhile, filing your taxes under the single status involves being either unmarried or legally separated or divorced on the tax years last day, which is December 31.

What is important to know is that you cannot file as single if you are married. If you got married legally to another person, then you must file as married. This applies to same-sex marriages as well.

Anyone who is married is unable to file as single or head of a household, and the IRS will simply expect you to file as married if you got married legally by a foreign or state government. Once you tie the knot, your only two choices when filing taxes will be married filing jointly and

How Can A Lawyer Help With Legal Advice

The tax company may calculate more amount to be given as a tax that you cannot understand. So, to know the correct amount based on your income and to prepare the complete file, it is better to contact an experienced lawyer. Moreover, a lawyer can give you all the legal advice related to taxes.

You can contact us as our lawyers have more than 15 to 20 years of experience in this matter. We do not want your and your partners earned money to go into the hand of others without any reason. Family Lawyer Of Edmonton is always ready to help their clients at any day at any hour.

I hope you have understood . So dont worry, take your time and make a wise decision.

Read Also: Efstatus Taxactcom

Many Factors Affect How Much Tax You Owe When You File Your Return

One way to fill out your Form W-4 is to estimate your tax liability as closely as possible for the current year, and then have an amount as close to your liability as possible withheld throughout the year. If something changes during the year for example, if you quit a job or buy a house, you can estimate your tax liability again and make any necessary adjustments.

Maximize A Disparity In Incomes

A spouse who earns much less than the other spouse may come out ahead by filing separately.

For example, if one spouse earns $1 million a year, and the other earns $80,000, that might be an instance where you would use married filing separately, says Ingram.

In this scenario, the low-income spouse would enjoy a lower tax bracket and may be able to claim some tax breaks.

You May Like: Ein Look Up Number

Status 4 Married Filing Separate Returns

Check filing status 4 if you and your spouse file separate tax returns. Write your spouse’s Social Security Number, name, and net income in the spaces provided at the top of the return in Step 2. The processing of refunds, alternate tax calculations, and/or low-income exemptions will be delayed without this information or supporting schedules.

Taxpayers using filing status 3 or 4 may have to prorate certain items between them on the return. These items include federal income tax refunds, additional federal income tax paid, etc. This information is included with instructions for each line of the return.

Nonresidents and Part-Year Residents of Iowa…

… who are married may file status 2, 3, or 4 for their Iowa return even if only one spouse had income from Iowa sources.