What Happens If You Dont Make The Payments

If you owe more than $1,000, the IRS wants you to make payments throughout the year as you go. If you fail to pay enough income taxes through withholding or quarterly estimated taxes, you may encounter a penalty for underpayment.

Further, you may be charged a penalty if your estimated tax payments are late, even if you should receive a refund when you file your tax return.

Its best to pay your taxes on time throughout the year according to the estimated tax payment schedule.

If you work as a farmer or fisherman or qualify as a certain higher income taxpayer, there are special rules for estimated tax payments. If at least two-thirds of your gross income for 2020 or 2021 is from farming or fishing, you only need to pay 66.6 percent of the tax to be shown on your 2021 return instead of 90 percent.

Calculate Your Quarterly Estimated Taxes

Once you have determined that it is likely or even possible you will have to pay quarterly estimated tax, you will need to calculate them. Here it is in a nutshell:

- Project your yearly income.

- Subtract expected deductions.

- Determine your income tax and self-employment tax. Self-employment tax is 15.3% and you can determine your tax bracket by consulting the IRS tax table.

- Divide by four to determine your quarterly federal estimated tax liability.

There is more than one way to calculate your quarterly estimated taxes, so you know how much to put aside. However, you estimate, be aware of new legislation that changes the landscape a bit in 2020. Recent legislation extended certain tax benefits that had expired at the end of 2017 through 2020 including the tuition and fees deduction and the deduction for mortgage insurance premiums.

Calculating your quarterly estimated taxes sounds harder than it is, because there are tools and methods to help you. Following are the main ones.

What Is The Self

Self-Employment Tax Rates For 2019-2020 For the 2020 tax year, the self-employment tax rate is 15.3%. Social Security represents 12.4% of this tax and Medicare represents 2.9% of it. After reaching a certain income threshold, $137,700 for 2020, you wont have to pay Social Security taxes above that amount.

You May Like: How Do Investments Affect Taxes

Calculating And Paying Your Taxes

Youâll pay all these federal taxes together, four times a year when you pay estimated quarterly taxes.

To calculate how much tax you need to pay, use the Estimated Tax Worksheet, which is part of Form 1040-ES.

Youâll also use Form 1040-ES to file your quarterly estimated taxes.

For a more detailed walk-through of estimated taxes, check out our article How to Calculate and Pay Estimated Quarterly Taxes.

Or if you want to get straight to calculating, use our Self-Employed Tax Calculator below.

You May Like: Do You Have To Pay Taxes On Plasma Donations

How Is The Self

Wondering how much you’ll pay in self-employment taxes for the current tax year? Here are the steps to calculate this figure:

- Determine your net earnings. Subtract your business expenses and deductions from your gross income.

- If that number is higher than 0, multiply it by 92.35%, the amount of your self-employment income that is subject to the self-employment tax.

- Multiply that number by the current self-employment tax rate. For the 2021 tax year payable on April 18 of 2022 the rate stood at 15.3%.

- This final number is the self-employment tax you owe.

For assistance in determining your self-employment tax, you can use the Schedule SE tax form from the IRS.

Don’t Miss: Who Can I Call For Free Tax Questions

How Do You File Taxes For Freelance Work

You must file a tax return if your earnings were $400 or more if you do freelance work. You’ll file Schedule C as a sole proprietor, along with your personal tax return. You can file your taxes yourself or work with a tax professional. A tax professional can be well worth the expense if you have income from multiple sources, have worked in multiple states, or want additional assistance.

Bonsai Tax Calculates Your Quarterly Income Tax And Self

The Bonsai Tax app is the happy medium between going it alone and hiring an accountant. The former is time- and effort-consuming, the latter is expensive. Adapting a digital, cloud-based tax tool, designed specifically for the 1099 contractors’ needs, into your business-operating toolkit will do away with most of the labor, while not costing an arm and a leg.

The Bonsai Tax system records your income, scans and imports expense receipts, sorting them into deduction categories to write off at the end of the tax year, generates expense reports to keep you aware of your spending, provides quarterly estimates of how much money you owe in taxes, and fills out the majority of your tax return, come April tax time — all the while safely storing your data in a cloud-based online account. Ã

The Bonsai Tax software not only helps with tasks, it guides you through the tax record-keeping and filing chores, making you more mindful of doing taxes, while getting à more comfortable with the process. Try it for free and experience the Bonsai peace of mind for yourself!

Read Also: How To Report Nonemployee Compensation On Tax Return

Do You Want A 1099 Or A W

Asked another way, independent contractor or employee? It seems like such a simple question. As we approach year-end, companies and workers everywhere may not think about it but they should.

If youre an employee, taxes have to be taken out. That means youll receive an IRS Form W-2 in January. In contrast, if youre an independent contractor, youll get full pay with no deductions. Of course, you are liable for your own taxes. Come January, assuming your total pay was $600 or more, youll receive an IRS Form 1099.

But is it that simple? What if youre the employer not the recipient? This is one of the more momentous decisions in the tax world. In fact, it goes well beyond taxes and covers workers compensation, unemployment insurance, state and federal wage and hour laws, pension laws, nondiscrimination laws and more.

Its hard to think of a more pivotal issue. Yet this decision is made thousands of times a day all over America. Sometimes it is done without much thought. Some employers ask 1099 or W-2? as if they were asking how you take your coffee.

If youre the worker, you may be tempted to say 1099, figuring youll get a bigger check that way. You will in the short run, but youll actually owe higher taxes. As an independent contractor, you not only owe income tax, but self-employment tax too. On the first $113,700 of income, thats a whopping 15.3% rate. Beyond $113,700, the rate drops to 2.9%.

Paying Taxes As A 1099 Worker

As a 1099 earner, youâll have to deal with self-employment tax, which is basically just how you pay FICA taxes. The combined tax rate is 15.3%. Normally, the 15.3% rate is split half-and-half between employers and employees. But since independent contractors donât have separate employers, theyâre on the hook for the full amount. If youâd like more details on why things work this way, check out our beginnerâs guide to self-employment tax.

But for now, think of self-employment tax as those double-pop popsicles. It can be split between two people, but it comes in a single package. Thereâs no way to avoid paying for both sticks even if itâs just you.

Luckily, only your net earnings are subject to self employment taxes. Thatâs your gross income minus your business write-offs.

Don’t Miss: Are You Taxed On Cryptocurrency Gains

State And Local Taxes

When applicable, you may also need to pay state income taxes. Currently, there are only nine states where you will not have to worry about this, and they include the following:

- Texas

- Tennessee

- New Hampshire

If you reside anywhere else, you will pay 7% or less of your net earnings to your state. Keep in mind that, even though they technically have a state-level tax, neither Tennessee nor New Hamshire impose taxes on actively earned income, just dividends and interest.

Develop A Bulletproof Savings Plan

Tax experts across the board emphasized the importance of responsible saving so that youve got enough cash stored up to meet your tax obligations each quarter and at the end of the year.

Krause says many freelancers and private contractors entrap themselves in a pay with the next check type of mentality.

As a 1099 contractor, it can be easy to see your whole check as usable money and to convince yourself youll put more into your tax savings next check, Krause said. Doing this is incredibly difficult to recover from and is a very slippery slope.

She and Mastio suggest opening a separate savings account into which you can deposit money youll use for your tax payments.

Make it a priority and build it into your monthly budgeting. If it has been a problem in the past, simply open up a separate bank account and transfer 25-30 percent of each months earnings to this account and use that account to make your quarterly tax payments, Mastio said. You may end up over-estimating your payments, but at least you avoid the headache and panic of setting aside too little.

Also Check: When Do I Have To Pay My Taxes By

Dont Activate The Debit Card

The goal with all of these strategies is to limit your access to your tax money. To that end, itâs best to not even activate the new debit card or store it in your wallet.

Think of it this way: The second the money gets transferred into your tax account, it no longer belongs to you, it belongs to Uncle Sam. Cutting off access points will remove the temptation to spend whatâs not yours.

How Are Taxes Calculated For Independent Contractors

To calculate their quarterly taxes, independent contractors must estimate their adjusted gross income, taxable income, taxes, deductions and credits. Its often helpful to use the previous years federal tax return as a guide.

This article is intended to be used as a starting point in analyzing independent contractor taxes and is not a comprehensive resource of requirements. It offers practical information concerning the subject matter and is provided with the understanding that ADP is not rendering legal or tax advice or other professional services.

Don’t Miss: Can You Submit Taxes Late

What Is 1099 Income

Freelancer. Independent contractor. Self-employed. 1099 worker. Side hustler. There are many terms used to define workers who are not traditional employees. Regardless of the label, they are treated the same when it comes to taxes.

First things first: When you work for yourself, your employer does not withhold taxes from your paycheck and send them to the IRS. Instead, youâre expected to pay income taxes directly to the government.

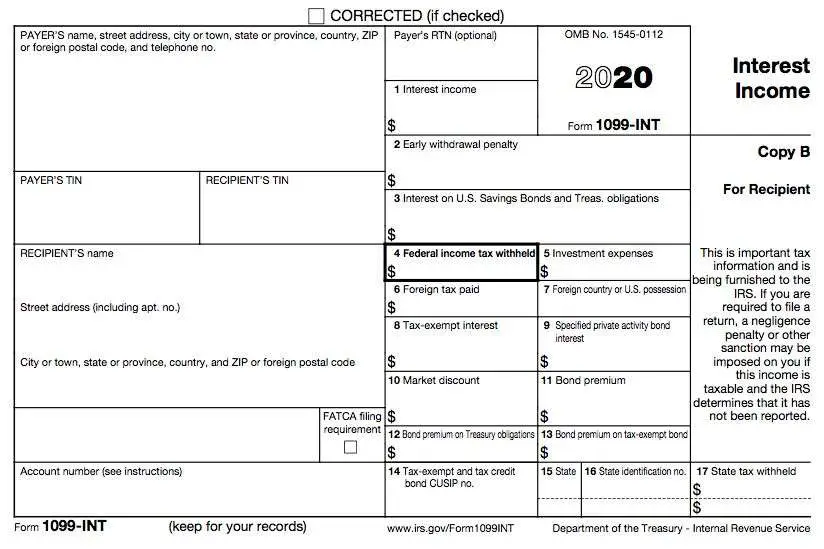

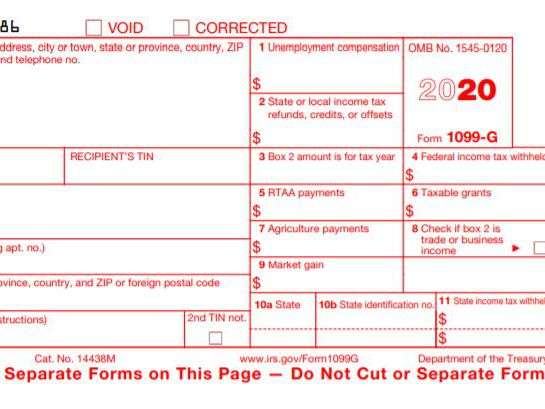

Like most things related to taxes, it all starts with paperwork. Instead of a traditional W-2, as a contractor you fill out a W-9. That allows the company that hired you to prove to the IRS that it doesnât owe payroll tax for your employment. Then, come tax season, you will receive an IRS form 1099 from each client, outlining exactly how much 1099 income you earned from that company over the course of the year.1

Myth : Your Taxes Are The Same Whether Youre Employed By Someone Else Or Self

As an employee, your employer typically pays half of the employment taxes on income you earn during the year. This means they pay half of your Social Security and Medicare taxes while you pay the other through tax withholding from each paycheck.

If you are self-employed, you must account for both halves of the self-employment tax because you are both the employee and employer. The good news is that you can deduct half of the amount you pay in self-employment tax from your income on your Form 1040. For example, $3,000 in self-employment tax reduces your taxable income by $1,500. In the 22% tax bracket, that would mean an income tax savings of $330.

Recommended Reading: How To File Federal Taxes For Free

Why Did I Receive A 1099

You probably received a 1099-NEC form because you worked for someone during the past year but not as an employee. For example, if you got paid as a freelancer or contractor, the person you worked for is required to keep track of these payments and give you a 1099-NEC form showing the total you received during the year.

Myths About Quarterly Taxes For The 1099 Tax Form

OVERVIEW

For those who pay quarterly taxesor those who don’t, but think they shouldknowing who pays and when estimated taxes are due may help you throughout the year.

For information on the third coronavirus relief package, please visit our American Rescue Plan: What Does it Mean for You and a Third Stimulus Check blog post.

You May Like: How Much Is Capital Gains Tax On Real Estate

What Expenses Can I Deduct

Yes, working for yourself might mean flexibility and freedom. But that freedom comes with a price tag. As a contractor, youâre responsible for most of the expenses that might be paid for in a traditional workplace, including office supplies, printing, mileage expenses and meals with clients.

So before you start putting away money for the IRS, it could be a good idea to take stock of all the money you spend to keep your business running smoothly. Then check the IRSâs guide to deducting business expenses.4 Every dollar you spend on your business is a dollar you can subtract from your income, reducing what you owe to the IRS.

What Happens If You Underestimate Your Taxes Owed

According to rules set out by the IRS, so long as you pay 100% in the present year of what you paid the previous year in quarterly estimated taxes, you canât be penalized for underpayingâeven if that amount turns out to be too low. This is sometimes called the safe harbor rule. If your income is over $150,000, however, you must pay 110% of last yearâs incomeâor 90% of the current yearâs incomeâin order to qualify for safe harbor.

If you underpay your quarterly estimated taxes, youâll know at tax time. In order to file your tax return, youâll be adding up your income for the yearâtaking into account deductible business expenses and other factorsâand determining your tax liability.

You can also determine whether youâve underpaid, and how much you will be penalized, by filling out Form 2210

Also Check: How Do I File My Taxes With Turbotax

Other Considerations In Estimating Taxes

If your earnings or deductions will be drastically different from the previous year, or if your earnings fluctuate throughout the year, estimate your profit separately each quarter. Add up your income and subtract your deductible expenses for the quarter. Calculate that quarter’s estimated tax payment based on your expected tax bracket, included in worksheets with Form 1040-ES. You’ll calculate the tax liability for the year-to-date and can adjust the amount paid if you find you are ahead or behind the amount owed.

Include other sources of income such as interest, dividends or capital gains, and deductions for exemptions, standard deductions or any tax credits for which you may qualify. Some special independent contractor deductions include a home office you may maintain, use of your vehicle for tax purposes and the cost of health insurance, if you can’t get it through your employer or your spouse’s employer.

Using the detailed estimated worksheets provided by the IRS will allow you a relatively accurate method for both estimating and paying your quarterly payments. Married taxpayers will need to incorporate a spouse’s income and withholding when calculating estimated taxes.

How Much Will Self

Self-employment tax goes to two separate government programs: Social Security and Medicare. All working people pay into these funds. For W-2 individuals, these taxes are known as âFICA taxes.â For everyone else, these taxes are collectively called âself-employment taxes,â and they have a combined rate of 15.3%. Unlike income tax, self-employment taxes only get applied to your business income. Meaning, income thatâs reported on a form 1099. You can read more about how this tax works in our beginnerâs guide to self-employment tax.Why not all business income is subject to self-employment tax

Only your net business income is actually subject to self-employment tax. âNet business incomeâ means your earnings minus any business write-offs you might have. This could be anything from inventory you buy for your business to your cell phone bill. The IRS lets you subtract all of those costs from your self-employment income and will only tax you on the remainder. This is why business write-offs are so important! Itâs the most effective way to lower your tax bill.

To get the most accurate tax projection, use your net monthly self employment income in the calculator above. If you use your gross income, you risk overpaying in taxes. How to find write-offs with Keeper Tax

Not sure what write-offs you can count? Give Keeper Tax a try. Our mission is to help self-employed workers find and claim all of their business write-offs.

You May Like: How To Calculate Gas For Taxes

How To Budget For Self

The United States operates on a âpay-as-you-goâ tax system. Meaning, taxes are due when the money is earned, not when your tax return is filed. If you expect to owe more than $1,000 in taxes, you should probably be making estimated tax payments. Not making payments throughout the year could result in penalties and interest when you finally file your tax return.

But making periodic tax payments is easier said than done. Between rent, groceries, and the occasional Starbucks latte, there never seems to be money leftover. If you relate to that, youâve come to the right place. Weâve compiled some tried and true methods to effectively manage yourself â and some common financial pitfalls to avoid.