Which Miles Can Be Deducted

Not every mile counts as a tax deduction. The following are eligible for tax deductions:

- Miles driven to pick up passengers

- Miles driven with a passenger in the car

- Miles driven returning from drop-off points to a place to wait for another ride request

- Any other mileage related to the business

The first drive of the day, from your home to the location where you wait for passengers, cannot be deducted for business mileage. Likewise, your last ride commuting home cannot be deducted. These miles are considered commuting miles, which are not deductible. In addition, any driving done for personal reasons during the day , cannot be deducted. Even if they are done between rides.

Perfect For Independent Contractors And Small Businesses

TurboTax Self-Employed searches over 500 tax deductions to get you every dollar you deserve.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Know which dependents credits and deductions

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

-

See which education credits and deductions you qualify for

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Calculate Mileage Covered For Medical Purposes

The allowed medical mileage for tax deduction purposes is the one taken when travelling to and from a hospital or medical care centre.

Tolls, parking fees and all the other associated travel fees should be listed separately.

The medical mileage in 2018 can be deducted at the rate of 18 cents per mile driven.

Don’t Miss: Is Freetaxusa A Legitimate Site

Calculating Itemized Expenses With The Actual Vehicle Expenses Deduction

When it comes to the “actual expenses” method, it is very important to hold on to all receipts for taxes or qualifyingà business travel expenses

The actual expenses approach allows for several car expenses to be deducted, such as:

- gasoline

- car title / licensing / registration fees

- depreciation

Make sure to keep track of the personal miles vs. business miles you put on your car every month: you will need an estimation of the percentage of your car’s business use. For example, you use your personal vehicle for personal errands 60 percent of the time and 40 percent of the time exclusively for business use: this means that, when you are calculating actual expenses for the tax year, Ã your car’s “business use” is at 40 percent.

Use the following formula to calculate the actual vehicle expenses deduction: take the sum total of your car expenses for the tax year and multiply it by the percentage of the miles you spent on a business-related driving activity. For example: if your total vehicle expenses for the tax year were $4,000 and you know that your business miles comprise 40 percent of car-related expenditures, you have: 4000 x 0.4 = 1600. That’s $1,600 you can deduct for travel expenses that tax year.

Taking advantage of these deductions is a great way for independent contractors to avoid paying taxes.

Find Your Total Mileage

When you claim your mileage deduction on a Schedule C , youll likely need to input how many miles you drove in total during the year, including personal and commuting miles. You need to make sure your total mileage deduction makes sense when compared to your total miles driven. Ideally youd note your odometer readings at the beginning and end of the year, but you could also use old maintenance receipts to figure your total mileage . Once you find this number, youve got a range for what your actual deductible mileage is. Youll know that your actual deductible mileage is somewhere between your total miles, and your rideshare miles.

You May Like: Do You Have To Pay Taxes On Plasma Donation Money

Which Mileage Rate Do You Use To Calculate Deductions

Great question! Not everyone qualifies for the standard IRS mileage rate. To qualify:

- You cant claim depreciation deductions on the car except on a straight-line basis

- You have to use the standard rate for the first year of your business activities. In later years, you can mix it up a little and swap between the two methods. If you are leasing your car, you have to use the standard mileage rate for the entire length of your lease.

- You cant claim special depreciation allowance

- You cant have five cars or more in operation for your business at the same time.

Calculating Your Business Mileage For Taxes

The simple calculation is to divide your total number of miles by your business miles to get your business usage.

Lets do an example:

Say you drove 500 miles in total in 2020. That is for personal and professional purposes.

In those 500 miles, you did 5 business trips that totaled 100 miles.

To calculate your business share, you would divide 100 by 500.

100/500 = 0.20

Your business mileage use was 20%.

Now to calculate the mileage deduction. Simply multiply the business miles by the mileage rate. 100 * 0.56 = $56 tax deduction in 2021

Recommended Reading: Irs Company Lookup

Which Method To Choose

In general, self-employed people who drive a moderate amount tend to save more with actual expenses. But those who use their cars a lot for work â including rideshare and delivery drivers â tend to do better with the standard mileage method.

Of course, how much money you’ll save with each method depends on how fuel-efficient your vehicle is, as well as what kind of work you do.

To see an in-depth comparison of the two methods, check out our detailed breakdown of actual expenses vs. the standard mileage deduction!

Use A More Fuel Efficient Vehicle

Driving a smaller car makes a great difference the fuel cost is about half for a small sedan than for a very large SUV. Similarly, drive with a less powerful engine than you need. Don’t pay for an eight-cylinder engine when four cylinders work just fine. Unless you’re hauling heavy loads on a routine basis, the extra cost of a bigger engine results in more money spent on gasoline.

Recommended Reading: Pastyeartax Com Review

How To Calculate Your Mileage Reimbursement

Before we show you the fairly straight forward calculation that will help you find your mileage reimbursement, be aware that you need to qualify to use the IRS’s standard mileage rate. Check our guides on the side menu for more details about the current mileage rate.

Also, be aware that if you’re an employee, your employer might use a different rate than the one we use here. They may also have different rules for mileage reimbursement. If you’re self-employed, you should check the current mileage rates to make sure you use the correct ones. In this post you can find out how to calculate your mileage for taxes.

How Can You Prove An Oral Contract

Unfortunately, without solid proof, it may be difficult to convince a court of the legality of an oral contract. Without witnesses to testify to the oral agreement taking place or other forms of evidence, oral contracts won’t stand up in court. Instead, it becomes a matter of “he-said-she-said” – which legal professionals definitely don’t have time for!

If you were to enter into a verbal contract, it’s recommended to follow up with an email or a letter confirming the offer, the terms of the agreement , and payment conditions. The more you can document the elements of a contract, the better your chances of legally enforcing a oral contract.

Another option is to make a recording of the conversation where the agreement is verbalized. This can be used to support your claims in the absence of a written agreement. However, it’s always best to gain the permission of the other involved parties before hitting record.

Don’t Miss: Doordash Tax Deduction

Determine Your Method Of Calculation

A taxpayer can choose between two methods of accounting for the mileage deduction amount:

- The standard mileage deduction requires only that you maintain a log of qualifying mileage driven. For the 2022 tax year, the rate is 58.5 cents per mile for business use, up 2.5 cents from 2021.

- The deduction for actual vehicle expenses requires that you retain all receipts and other relevant documentation relating to the costs of driving.

Topic No 510 Business Use Of Car

If you use your car only for business purposes, you may deduct its entire cost of ownership and operation . However, if you use the car for both business and personal purposes, you may deduct only the cost of its business use.

You can generally figure the amount of your deductible car expense by using one of two methods: the standard mileage rate method or the actual expense method. If you qualify to use both methods, you may want to figure your deduction both ways before choosing a method to see which one gives you a larger deduction.

Standard Mileage Rate – For the current standard mileage rate, refer to Publication 463, Travel, Entertainment, Gift, and Car Expenses or search standard mileage rates on IRS.gov. To use the standard mileage rate, you must own or lease the car and:

- You must not operate five or more cars at the same time, as in a fleet operation,

- You must not have claimed a depreciation deduction for the car using any method other than straight-line,

- You must not have claimed a Section 179 deduction on the car,

- You must not have claimed the special depreciation allowance on the car, and

- You must not have claimed actual expenses after 1997 for a car you lease.

To use the standard mileage rate for a car you own, you must choose to use it in the first year the car is available for use in your business. Then, in later years, you can choose to use the standard mileage rate or actual expenses.

Recommended Reading: Efstatus.taxact.com

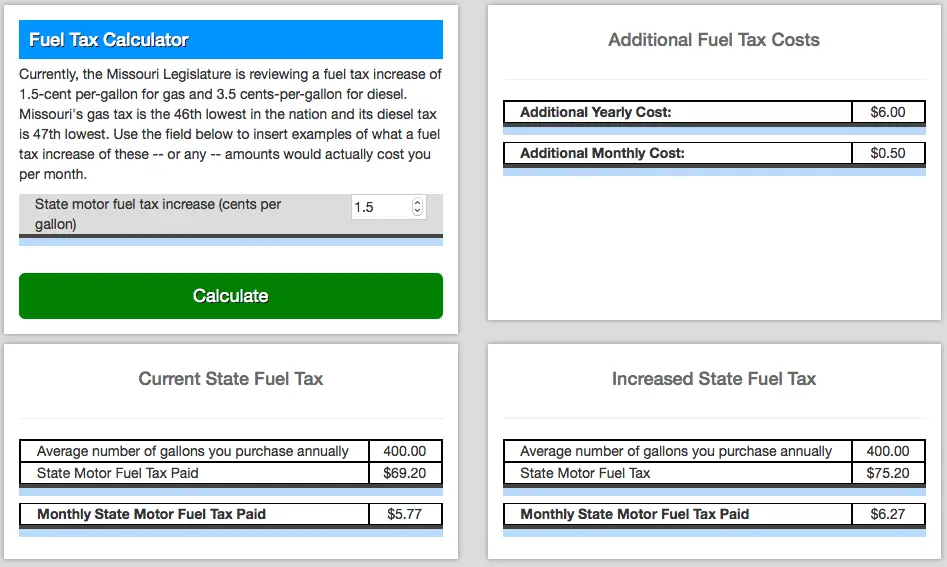

Calculating The Gas Tax

So we gathered together some of these weird people and decided: hey, let’s tax ourselves for every gallon . How much? Well, Europeans pay about $4.50 per gallon. But even we weren’t ready for anything that steep. So we settled on $.50 a gallon

Most of us just keep the receipt slips when we fill up or keep a little ledger in the car and add up the gallons every quarter and multiply by $.50. Then we get together for quarterly or bi-annual gatherings with tea and cookies and pool or revenues. Can you imagine the kind of people who you’re drinking tea with? Selfish, miserly, stingy folks are welcome but so far haven’t shown up!

What Is An Excise Tax

There are two types of taxes when it comes to excise tax .

An ad valorem excise tax are fixed percentage rates attached to certain goods or services . For example, Washington D.C. has a whopping 14.5 percent ad valorem tax attached to hotel bookings, whereas nearby Virginia has none.

Specific excise taxes are set on a per-unit basis. Some of the more common federal excise taxes are cigarettes , beer , and cruise ship fare . As you can see, some specific excise taxes are low in comparison to the price of goods or services , while others are more expensive .

Since excise taxes can be levied by the feds, the state, and the city, they can add up certain items. Returning to the District of Columbia, local cigarette-specific excise taxes are $4.98 per pack of 20. Add that to the $1.01 federal excise tax, and DC cigarette smokers are looking at an extra $6 for every pack they purchase.

Don’t Miss: Do I Have To File Taxes For Doordash

How To Calculate Excise Tax

As mentioned, excise taxes are often levied on a business. That means you wont necessarily see the tax on your receipt, though there are obviously a few exceptions. For example, hotels will typically list the state lodging tax on an invoice, but your favorite local brewery will probably not specify excise taxes on the menu or bar tabtheyll just include it in the final price of the drink.

You can look up most excise taxes online with a simple search. These taxes are public information because they are voted into law by elected constituents.

Will I Have To Post Security

Before the minister issues you a permit, registration certificate or a designation, you may need to provide security through a surety bond or letter of credit.

In most cases, the amount of security required is an amount equal to three months’ average tax collectable and payable or $1 million, whichever is greater.

Acceptable forms of security include:

- Irrevocable Letters of Credit issued by and redeemable at an Ontario branch of a Canadian Chartered Bank in the standard form approved by the ministry.

- Surety Bonds issued by financial institutions registered with the Financial Services Commission of Ontario to deal in surety. See list of registered financial institutions.

- Cash .

Following are links to approved forms:

A new legal entity, which results from the reorganization of an existing collector or registrant, or any entity that undergoes a substantial change in ownership or control, must apply to the ministry for a new designation or registration certificate and must provide new or revised security to reflect the new designation.

You May Like: Doordash Taxes Calculator

Irs Mileage Rate Deduction For Medical Situations

If you used your car for medical reasons, you may be able to deduct the mileage. “Medical reasons” include:

-

Driving to the doctor, hospital or other medical facility.

-

Driving a child or other person who needs medical care to receive medical care.

-

Driving to see a mentally ill dependent if the visits are recommended as part of treatment.

You can deduct parking fees and tolls as well.

If you dont want to deduct your mileage, you can deduct your unreimbursed out-of-pocket expenses, such as gas and oil. However, the expenses have to relate directly to the use of your car for medical purposes. Also, you can’t deduct repair and maintenance costs, depreciation or insurance.

Mileage isnt the only transportation cost you might be able to deduct as a medical expense. IRS Publication 502 has the details. Heres a big caveat: In general, you can deduct qualified, unreimbursed medical expenses that are more than 7.5% of your adjusted gross income.

» MORE:See what else you might be able to deduct as a medical expense

Actual Expense Method For Mileage Tax Deduction

If you use the actual expense method, keep track of what it costs to operate your car. From there, you can record what portion of the overall expenses applies to business use.

Again, you cannot use the actual expense method if you previously used the standard mileage rate on a leased vehicle.

For the actual expense method, include the following expenses:

- Gas

- Depreciation

- Lease payments

When you record what you spend on the above expenses, also include the date and a description of the costs.

How to calculate your actual expenses for business

To calculate actual expenses, figure out what percentage of your car you used for business purposes. You can do this by dividing your business miles driven by your total annual miles.

Next, multiply your business use percentage by your total car expenses.

Lets say your total car expenses for the year were $6,850:

- Lease Payments: $3,600

- Repairs: $1,000

- Tires: $250

You drove a total of 60,000 miles during the year. Of those 60,000 miles, 20,000 were for business purposes.

First, divide your business miles by your total miles:

20,000 business miles / 60,000 total miles = 33%

Now, multiply your business mileage percentage by your total car expenses:

33% X $6,850 = $2,260.50

You can claim approximately $2,260.50 for the business mileage deduction using the actual expense method.

Don’t Miss: Can Home Improvement Be Tax Deductible

Calculate The Mileage Between Trips

If you also have records on where one meeting ended and the next began, you can calculate the mileage that you drove between those two locations. Just be sure to include great notes on each drive that you add to your mileage log, and keep track of all of your supporting documents like Uber trip logs or appointment books.

Who Can Deduct Mileage For Charitable Reasons

If you travel to perform volunteer work, you can deduct the standard amount for the year. Alternatively, you can deduct your costs of oil and gas but not other vehicle expenses like depreciation, maintenance, insurance, and fees.

You can also deduct your costs for parking and tolls while volunteering no matter which deduction method you choose.

Don’t Miss: Ntla Tax Lien

Who Can Deduct Mileage For Medical Reasons

You can take a medical tax expense deduction only if your overall unreimbursed medical costs exceed 7.5% of your adjusted gross income . You can deduct your mileage at the standard rate of 18 cents per mile for 2022 and 16 cents per mile for 2021, or you can deduct your actual costs of gas and oil. Deducting parking costs and tolls is also allowed.

Youre allowed to deduct mileage for your own treatment. You can also claim this deduction if youre transporting a child to receive treatment or visiting a mentally ill dependent as part of a recommended treatment.

Record Odometer At End Of Tax Year

At the end of the tax year, the taxpayer should record the ending odometer reading. This figure is used in conjunction with the odometer reading at the beginning of the year to calculate the total miles driven in the car for the year. The information, including what percentage of miles driven were for business purposes, is required on Form 2106.

Don’t Miss: Doordash Taxes How Much