Tax Return Taking So Long It May Be Because Of Incorrect Information

In most cases, you will find the IRS is reviewing your tax return and therefore there is a delay due to errors or incomplete information. Knowing some of the common mistakes can help you avoid them in the future:

Avoid Mistakes With E-Filing and Professional Help

Get A Copy Of A Tax Return

Mail the following items to get an exact copy of a prior year tax return and attachments:

- A completed Form 4506.

- $43 fee for each tax return requested. Make the check or money order payable to the United States Treasury.

Send them to the address listed in the form’s instructions. The IRS will process your request within 75 calendar days

Find Out If Your Tax Return Was Submitted

You can file your tax return by mail, through an e-filing website or software, or by using the services of a tax preparer. Whether you owe taxes or youre expecting a refund, you can find out your tax returns status by:

-

Looking for emails or status updates from your e-filing website or software

If you file your taxes by mail, you can track your tax return and get a confirmation when the IRS has received it. To do so, use USPS Certified Mail or another mail service that has tracking or delivery confirmation services.

Don’t Miss: What Does It Mean To Grieve Taxes

Can I Call The Irs If My Tax Refund Is Delayed

When your tax return is taking a long time, your first instinct may be contact the IRS. However, calling the IRS because your refund is delayed will likely result in little to no helpunlessthe Wheres my Refund tool tells you to do so. Otherwise, the IRS will contact you by mail if they need more information to process your tax return.

Ways To Make The Tax Refund Process Easier

Find your tax refund fast by proactively checking your IRS federal tax return status. Before filing and using the IRS Wheres My Refund portal to track your 2020 government return, consider:

- Reviewing your return carefully. Mistakes can delay your returns progress on the tax refund tracker. Be sure to review your information carefully before filing with the IRS.

- Filing early. The earlier you file, the sooner you can check the status of your IRS federal tax return. Early filing also provides more time to deal with issues should something go wrong.

- E-Filing your return. Instead of spending 6-8 weeks wondering wheres my tax refund from the IRS?, do yourself a favor and file electronically. E-Filed government returns are typically processed in under half the time as paper returns.

- Opting for direct deposit. Avoid waiting for your check by having your IRS refund deposited into your account. Once the WMR reads Refund Approved, your money will be ready to spend.

- Tracking your 2020 refund right away. Staying up-to-date on your return ensures youre in the loop every step of the way.

Recommended Reading: Payable Account Doordash

Tax Refund Status Faqs

The IRS usually sends out refunds within three weeks, but sometimes it can take a bit longer. For example, the IRS may have a question about your return. Here are other common reasons for a delayed tax refund and what you can do.

At H& R Block, you can always count on us to help you get your max refund year after year. You can increase your paycheck withholdings to get a bigger refund at tax time. Our W-4 calculator can help.

The IRS usually sends out most refunds within three weeks, but sometimes it can take a bit longer if the return needs additional review.

The IRS’ refund tracker updates once every 24 hours, typically overnight. That means you don’t need to check your status more than once a day.

Your status messages might include refund received, refund approved, and refund sent. Find out what these e-file status messages mean and what to expect next.

Having your refund direct deposited on your H& R Block Emerald Prepaid Mastercard® Go to disclaimer for more details110 allows you to access the money quicker than by mail. H& R Block’s bank will add your money to your card as soon as the IRS approves your refund.

Amended returns can take longer to process as they go through the mail vs. e-filing. Check out your options for tracking your amended return and how we can help.

Check The Status Of Your Income Tax Refund

ONLINE:

- Click on TSC-IND to reach the Welcome Page

- Select Check the Status of Your Refund found on the left side of the Welcome Page.

-

You must have your social security number and the exact amount of the refund request as reported on your Connecticut income tax return. Enter the whole dollar amount of the refund you requested. For example, if you requested a refund of $375, enter 375.

NOTE: Please be aware that for all direct deposit refunds you must allow at least two business days after the date the refund is processed for the credit to be in the account.

TELEPHONE:

- Call our automated refund system 24 hours a day and check the status of your refund by calling 800-382-9463 or 860-297-5962 . You will need your social security number and the exact amount of the refund request as reported on your income tax return. Enter the whole dollar amount of the refund you requested followed by the # sign. For example, if you requested a refund of $375, enter 375#. You can only check the status of the refund for the current filing season by telephone.

Paper Returns: Due to the volume during the filing season, it takes 10 – 12 weeks to process paper returns. Until the return is processed, your return will not appear on our computer system and we will not be able to check its status or to give you information about your refund. NOTE: Please consider using one of the electronic filing options. Visit our Online Filing Page for more information.

Don’t Miss: Are Plasma Donations Taxable

Q2 Can I Request A Transcript If I Filed Jointly With My Spouse And My Name And Ssn Was Listed Second On Our Tax Return

Yes, a secondary taxpayer may request any transcript type that is available.

Please note, only the account and the tax return transcript types are available using Get Transcript by Mail. Use Form 4506-T, Request for Transcript of Tax Return, if you need a different transcript type and can’t use Get Transcript Online.

Q4 I Got A Message That Says The Information I Provided Does Not Match What’s In The Irs Systems What Should I Do Now

Verify all the information you entered is correct. It must match what’s in our systems. Be sure to use the exact address and filing status from your latest tax return. If youre still receiving the message, you’ll need to use the Get Transcript by Mail option or submit a Form 4506-T, Request for Transcript of Tax Return.

Don’t Miss: How To Look Up Employer Tax Id Number

Can You View Old Tax Returns Online

After the IRS has processed your return, you can access them for free. Since the past three years, people are able to take advantage of the program as well. In the IRSs Get Transcript Online section, they are able to have their transcripts processed. All transcript types can be viewed and printed from this web site, including digital ones.

Use A Tax Return To Validate Identity

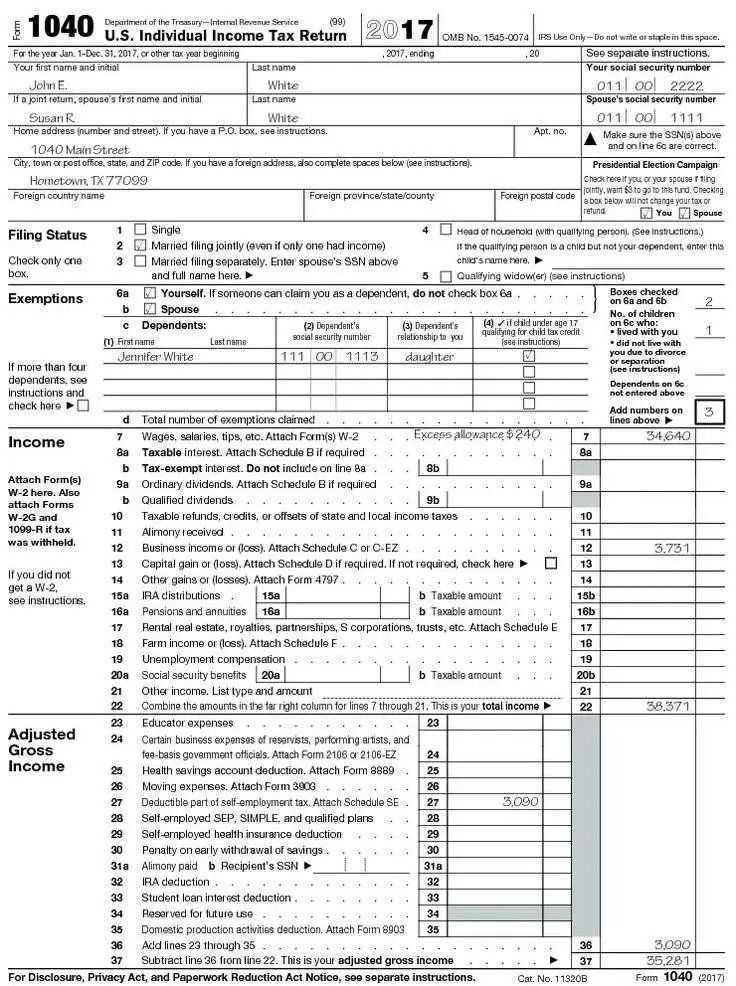

Taxpayers using a tax filing software product for the first time may need their adjusted gross income amount from their prior years tax return to verify their identity. Taxpayers can learn more about how to verify their identity and electronically sign tax returns at Validating Your Electronically Filed Tax Return.

Those who need a copy of their tax return should check with their software provider or tax preparer first, as prior-year tax returns are available from the IRS for a fee.

Also Check: Irs Employee Lookup

Why Is My Tax Refund Coming In The Mail Instead Of Deposited Into My Bank Account

There are a couple of reasons that your refund would be mailed to you. Your money can only be electronically deposited into a bank account with your name, your spouse’s name or a joint account. If that’s not the reason, you may be getting multiple refund checks, and the IRS can only direct deposit up to three refunds to one account. Additional refunds must be mailed. Also, your bank may reject the deposit and this would be the IRS’ next best way to refund your money quickly.

It’s also important to note that for refunds, direct deposit isn’t always automatic. Just in case, sign in to your IRS account to check that the agency has your correct banking information. If you are receiving a refund check in the mail, learn how to track it from the IRS to your mailbox.

One More Thing To Know About Your Tax Refund

It’s actually something you kind of want to avoid. It may seem great to get a big check from the government, but all a tax refund tells you is that you’ve been overpaying your taxes all year and needlessly living on less of your paycheck the whole time.

For example, if you got a $3,000 tax refund, you’ve been giving up $250 a month all year. Could having an extra $250 every month have helped with the bills? If you want to get that money now rather than later, you can adjust your withholdings by giving your employer a new IRS Form W-4 .

Recommended Reading: Cook County Board Of Review Deadlines

Q4 Can I Use Get Transcript If I’m A Victim Of Identity Theft

Yes, you can still access Get Transcript Online or by Mail. If we’re unable to process your request due to identity theft, you’ll receive an online message, or a letter if using the Mail option, that provides specific instructions to request a transcript. You may also want to visit our Identity Protection page for more information.

Get Transcript And The Customer File Number

Only individual taxpayers may use Get Transcript Online or Get Transcript by Mail. Many taxpayers use this service to satisfy requests for income verification. The Customer File Number is available for Get Transcript users. Taxpayers can manually enter a Customer File Number assigned to them, for example, by a lender or college financial office. That Customer File Number will display on the transcript either when it is downloaded or when it is mailed to the taxpayer.

Don’t Miss: How To Look Up Employer Tax Id Number

What Is Happening When Wheres My Refund Shows My Refunds Status As Approved

Weve approved your refund. We are preparing to send your refund to your bank or directly to you in the mail. This status will tell you when we will send the refund to your bank . Please wait 5 days after weve sent the refund to check with your bank about your refund, since banks vary in how and when they credit funds.

Can I Contact The Irs For Additional Help With My Taxes

While you could try calling the IRS to check your status, the agency’s live phone assistance is extremely limited. You shouldn’t file a second tax return or contact the IRS about the status of your return.

The IRS is directing people to the Let Us Help You page on its website for more information. It also advises taxpayers to get in-person help at Taxpayer Assistance Centers. You can contact your local IRS office or call to make an appointment: 844-545-5640. You can also contact the Taxpayer Advocate Service if you’re eligible for assistance by calling them: 877-777-4778.

Though the chances of getting live assistance are slim, the IRS says you should only call the agency directly if it’s been 21 days or more since you filed your taxes online, or if the Where’s My Refund tool tells you to contact the IRS. You can call 800-829-1040 or 800-829-8374 during regular business hours.

Recommended Reading: Www.1040paytax.com Official Site

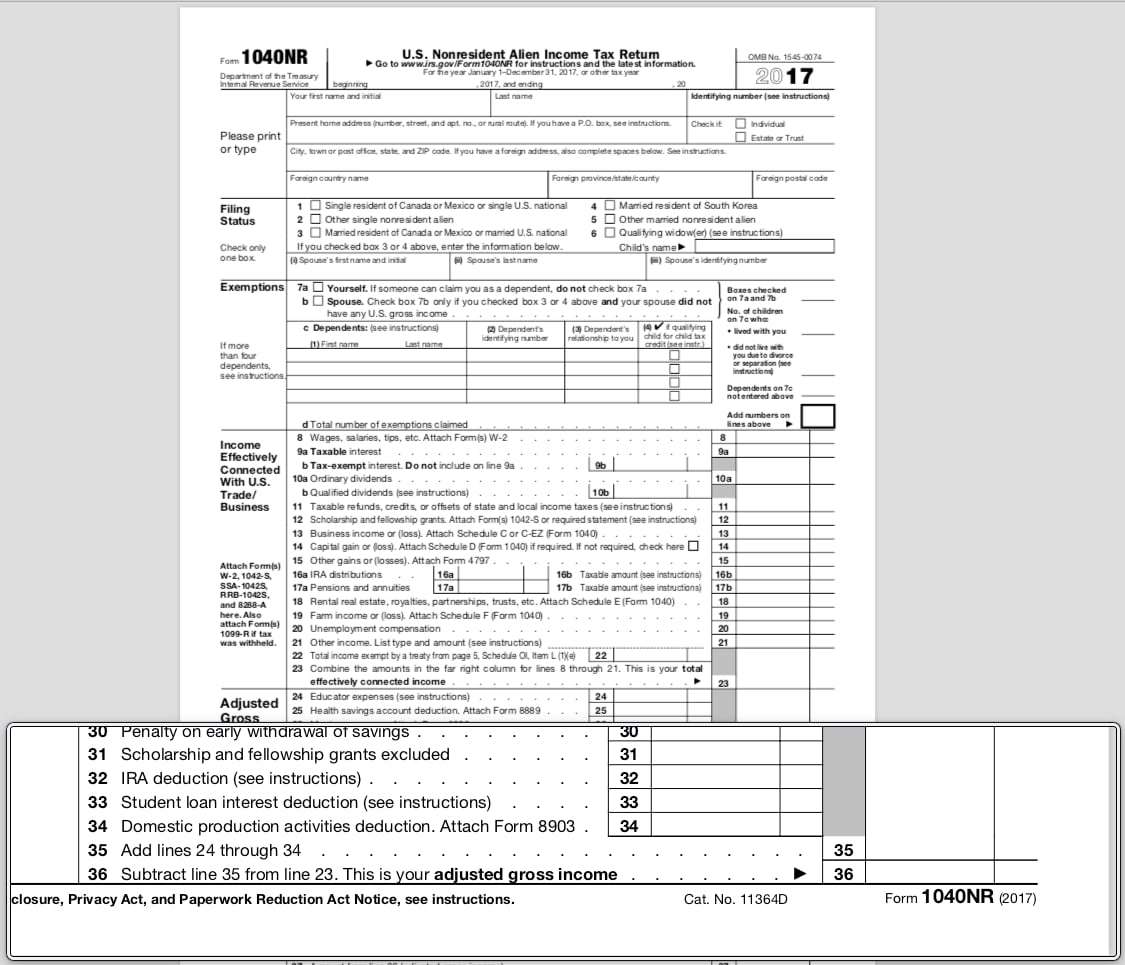

Im A Nonresident Alien I Dont Have To Pay Us Federal Income Tax How Do I Claim A Refund For Federal Taxes Withheld On Income From A Us Source When Can I Expect To Receive My Refund

To claim a refund of federal taxes withheld on income from a U.S. source, a nonresident alien must report the appropriate income and withholding amounts on Form 1040-NR, U.S. Nonresident Alien Income Tax Return PDF. You must include the documents substantiating any income and withholding amounts when you file your Form 1040NR. We need more than 21 days to process a 1040NR return. Please allow up to 6 months from the date you filed the 1040NR for your refund.

How To Check The Status Of Your Coronavirus Stimulus Check

If you’re trying to find out the status of your coronavirus stimulus payment, go to the IRS’s Get My Payment page. You can learn whether your payment has been issued, and if it’s coming by direct deposit or mailed check.

Learn more about the stimulus payments, including whether you qualify for one and what, if anything, you may have to do to get yours.

Read Also: Reverse Tax Id Lookup

How To Check The Status Of Your Income Tax Refund

Waiting for your tax refund from the Canada Revenue Agency can seem like an eternity. Instead of checking your mailbox daily, or looking at your bank account online every day, the CRA has other options you might want to consider. Before going through them, however, we must look at the NETFILE process to ensure you have successfully filed your tax return the first time around.

No filed return means no tax refund! You can usually expect your refund within two weeks after you successfully NETFILE, but may take longer if your return is selected for a review. For more information on your refund status, please see this CRA link: Tax Refunds: When to expect your refund.

Q7 Will Ordering A Transcript Help Me Determine When I’ll Get My Refund

MISHKANET.COM” alt=”Where do i find my agi on my taxes > MISHKANET.COM”>

MISHKANET.COM” alt=”Where do i find my agi on my taxes > MISHKANET.COM”> No, a tax transcript won’t help you determine when you’ll get your refund. IRS transcripts are best and most often used to validate past income and tax filing status for mortgage, student and small business loan applications, and to help with tax preparation.

The best way to check on your refund is by visiting Where’s My Refund? The codes listed on tax transcripts don’t provide any early insight regarding when we’ll issue your refund.

Don’t Miss: Do You Have To Claim Plasma Donation On Taxes

What Edition Of Turbotax Is Right For Me

Answer a few simple questions on our product recommender and we can help guide you to the right edition that will reflect your individual circumstances.

You can always start your return in TurboTax Free, and if you feel the need for additional assistance, you can upgrade to any of our paid editions or get live help from an expert with our Assist & Review or Full Service. But dont worry, while using the online version of the software when you choose to upgrade, your information is instantly carried over so you can pick up right where you left off.

With more than 20 years experience helping Canadians file their taxes confidently and get all the money they deserve, TurboTax products, including TurboTax Free, are available at www.turbotax.ca.

Why Is My Refund Different Than The Amount On The Tax Return I Filed

All or part of your refund may have been used to pay off past-due federal tax, state income tax, state unemployment compensation debts, child support, spousal support, or other federal nontax debts, such as student loans. To find out if you may have an offset or if you have questions about an offset, contact the agency to which you owe the debt.

We also may have changed your refund amount because we made changes to your tax return. This may include corrections to any incorrect Recovery Rebate Credit amount. Youll get a notice explaining the changes. Wheres My Refund? will reflect the reasons for the refund offset when it relates to a change in your tax return.

Tax Topic 203, Refund Offsets for Unpaid Child Support, Certain Federal and State Debts, and Unemployment Compensation Debts has more information about refund offsets.

Also Check: Is Door Dash Self Employed

All You Need To Know Is Yourself

Answer simple questions about your life and TurboTax Free Edition will take care of the rest.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Know which dependents credits and deductions

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

-

See which education credits and deductions you qualify for

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.