Financial Facts About Canada

The average monthly net salary in Canada is around 2 997 CAD, with a minimum income of 1 012 CAD per month. This places Canada on the 12th place in the International Labour Organisation statistics for 2012, after France, but before Germany.

In Canada income tax is usually deducted from the gross monthly salary at source, through a pay-as-you-earn system. Self-employed individuals are required to file an income tax return every year. The deduction includes the Federal and Provincial income taxes.

Canada has one of the most stable business climates in the world and is regarded as an attractive investment destination, according to Forbes and Bloomberg. The World Economic Forum declared the country’s banking system to be the most prosperous in the world, for seven years consecutively.

According to the Organisation for Economic Co-operation and Development , Canada is the third best country to live in the world, with the best quality of life, after Australia and Sweden. Canada is often praised for its universal health care system, its clean and friendly cities, its world-class universities, and its multicultural population.

Canada is an immigrant-friendly country with a immigration system that recognizes the importance of immigrants and their potential contribution to the Canadian society. According to official statistics, over 28% of the population was born outside the country, with most immigrants coming from China, India, and the Philippines.

Where Is My Unemployment Tax Break Refund

- Visit and login to your account. If you don’t have an Internal Revenue Service account, it will take some time as you have to go through several steps to get one.

- After logging into your account, you will see the account homepage. Click View tax documents.

- On the next page, click the Get Transcript button.

When To File An Amended Tax Return For Unemployment Benefits

In that case, they must submit an amended return if they are eligible for additional benefits due to the change in the gross income level. The more complex solutions start at the end of the first phase and involve couples being registered as married together. An unemployment benefit is a taxable income.

Recommended Reading: Efstatus/taxact

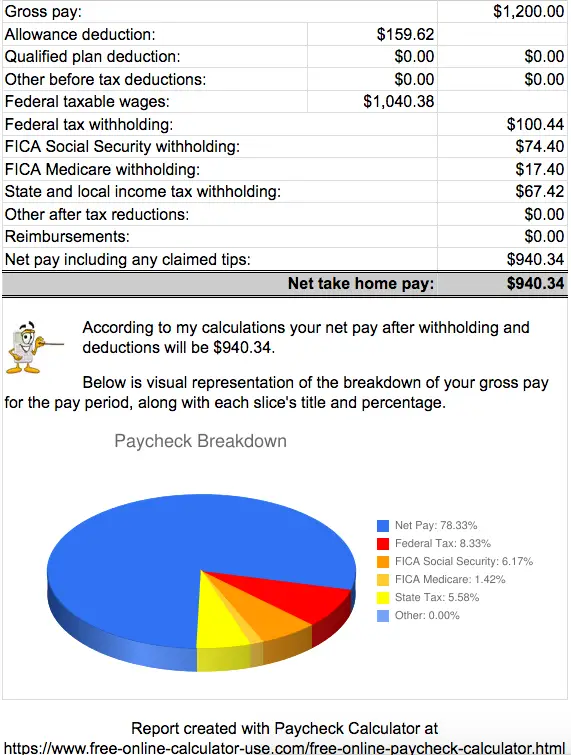

Calculating Your Net Paycheck

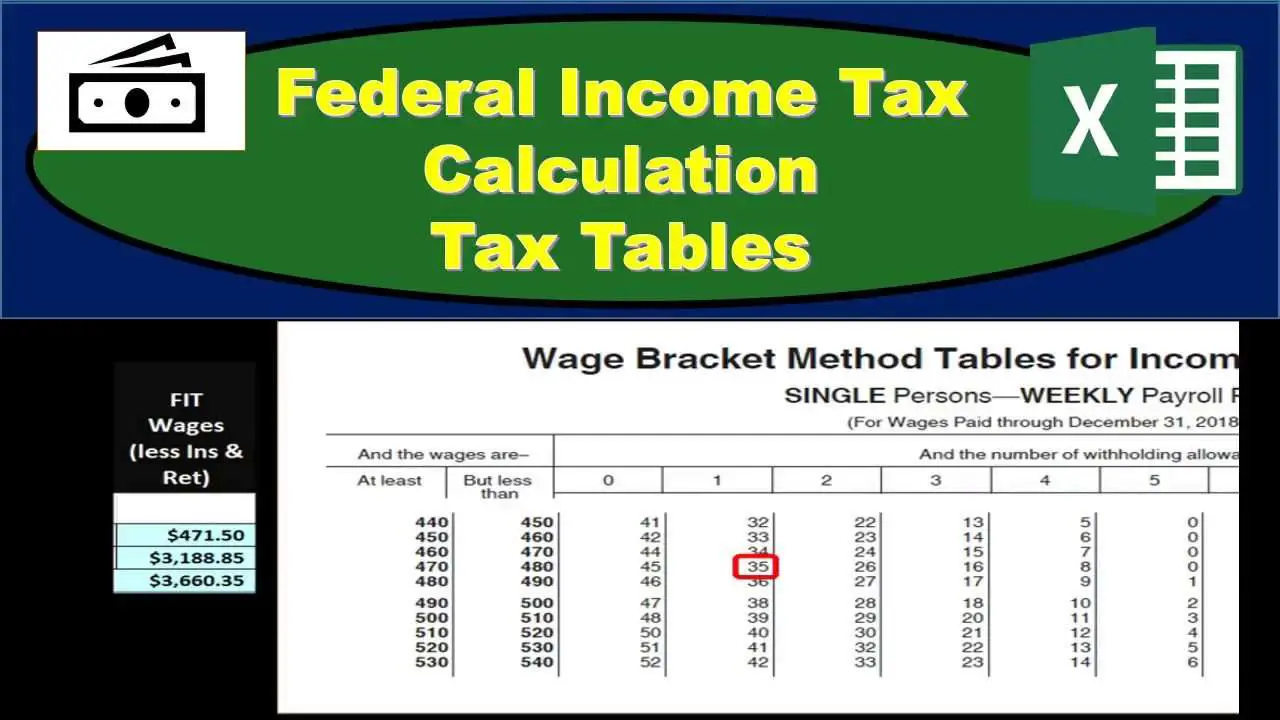

Want to know what your paycheck will look like before you take a job? There is a way to figure out exactly how much youll have left after FICA, federal taxes, state taxes, and any other applicable deductions are removed. You need a few pieces of information in order to calculate your take-home pay:

- The amount of your gross pay. If you earn a fixed salary, this is easy to figure out. Just divide the annual amount by the number of periods each year. If you are paid hourly, multiply that rate by 40 hours to determine your weekly pay.

- Your number of personal exemptions. When you start a new job, you fill out a W-4 form to tell your employer how much to withhold from your check.

- Your tax filing status. There are standard federal and state tax deductions that vary depending on whether you are single, married filing jointly, married filing separately, head of household, or a surviving spouse.

- Other payroll deductions. This category could include contributions to a 401 retirement plan, health insurance, life insurance, or a flexible spending account for medical expenses. It also may include union dues or any other garnishments that are taken from your wages. It helps to categorize these according to pre-tax and after-tax contributions, to deduct them from either your gross salary or after-tax calculation.

What Is The Average Income In Australia

The median monthly household income in Australia is $7,391.25 before tax and other deductions. This works out to a salary of $88,695 per year although it’s important to remember that this counts for households, not individuals. 50% of people also earn less than this figure, and the statistics only include those people who earn enough to pay income tax.

Most taxpayers tend to be paid an annual salary, and all employees should earn a minimum wage that’s set based on their industry or occupation. The currentAustralian National Minimum Wage is $19.84 per hour. Full-time workers usually work 38 hours or more per week. This means that a full-time worker on minimum wage could expect their pre-tax earnings to total $753.80 per week, $3,266.46 per month, or $39,197.60 per year.

These figures put Australia 3rd in theInternational Labour Organisation’s 2018 ranking of the highest minimum wage by country.

Australia is a large country with six states and a diverse workforce. While its immigration system can be hard to navigate, the country attracts many so-called working holiday makers. Australia’s capital city of Canberra has a thriving construction sector with many jobs also available in the Australian Defence Force. The famous city of Sydney is also a popular destination for workers, and it only ranks as the 66th most expensive global city to live in according to the Mercer 2020 Cost of Living Survey.

Don’t Miss: Do You Have To Pay Taxes On Plasma Donations

Is Irs Still Sending Out Unemployment Refunds California

Not only are unemployment benefits refunded. The IRS will continue to send regular tax returns for 2020, incentivizing round three payments, additional incentive payments for those affected by evasion, and monthly advances for the 2021 child tax credit. Can I track my tax refund directly via deposit?

Input Any Additional Pay The Employee Receives

If the employee is salaried, you will only see two fields: bonus and commission. Fill in those amounts, if applicable.

If the employee is hourly, you should see four fields: overtime worked, bonus, commission, and salary. This is your opportunity to add in any additional pay they should receive this pay period. If the employee earned overtime, input in the number of overtime hours they worked. One thing to keep in mind for California employees is that this calculator does not account for double-time pay. The tool calculates overtime pay using time and a half.

You May Like: Mcl 206.707

Get Tax Help However You Need It

Know the price of tax prep before you begin as part of our No Surprise Guarantee. Go to disclaimer for more details15

Social Security Tax Rates

The Social Security program provides benefits to retirees and those who are otherwise unable to work due to disease or disability. Social Security often provides the only source of consistent income for people who can no longer workespecially for those with modest earnings histories.

Because Social Security is a government program aimed at providing a safety net for working citizens, it is funded through a simple withholding tax that deducts a set percentage of pretax income from each paycheck. Workers who contribute for a minimum of 10 years are eligible to collect benefits based on their earnings history once they retire or suffer a disability.

Social Security benefits are capped at a maximum monthly benefit amount based on earnings history. To prevent workers from paying more in taxes than they can later receive in benefits, there is a limit on the amount of annual wages or earned income subject to taxation, called a tax cap.

For 2021, the maximum amount of income subject to the OASDI tax is $142,800, capping the maximum annual employee contribution at $8,853.60. For 2022, the maximum amount of income subject is $147,000, capping the maximum annual employee contribution at $9,114.00. The amount is set by Congress and can change from year to year.

Also Check: Ein Reverse Lookup Free

How Your Texas Paycheck Works

Your hourly wage or annual salary can’t give a perfect indication of how much you’ll see in your paychecks each year because your employer also withholds taxes from your pay. You and your employer will each contribute 6.2% of your earnings for Social Security taxes and 1.45% of your earnings for Medicare taxes. These taxes together are called FICA taxes.

No matter which state you call home, you have to pay FICA taxes. Income you earn that’s in excess of $200,000 , $250,000 or $125,000 is also subject to a 0.9% Medicare surtax. Your employer will not match this surtax, though.

Any premiums that you pay for employer-sponsored health insurance or other benefits will also come out of your paycheck. The same is true if you contribute to retirement accounts, like a 401, or a medical expense account, such as a health savings account . These accounts take pre-tax money so they also reduce your taxable income.

Your marital status, pay frequency, wages and more all contribute to the size of your paycheck. If you think too much or too little money is being withheld from your paycheck, you can file a fresh W-4 with your employer at any time during the year. When you do this, be sure to indicate how much extra income you want withheld so as to avoid a tax bill come April each year.

Will I Get My Unemployment Compensation Tax Refund This Summer

Since May, the IRS has awarded more than a million unemployment benefits totaling more than $10 billion. The IRS will continue to review and adjust tax returns for this category this summer. The IRS’s efforts have focused on easing the burden on taxpayers so that most people don’t have to take extra steps to obtain refunds.

Also Check: Efstatus.taxact 2013

Current Fica Tax Rates

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total.

Combined, the FICA tax rate is 15.3% of the employees wages.

Do any of your employees make over $137,700? If so, the rules are a little different. Read more at the IRS website.

How Much Will I Be Taxed If I Earn 24000 A Year

If you make £24,000 a year living in United Kingdom, you will be taxed £4,016. That means that your net pay will be £19,984 per year, or £1,665 per month. Your average tax rate is 16.7% and your marginal tax rate is 32.0%. This marginal tax rate means that your immediate additional income will be taxed at this rate.

Also Check: Tax Deductions Doordash

How To Calculate Your Net Pay

How do I calculate my net pay after taxes?

Figure out the take-home pay by subtracting all the calculated deductions from the gross pay, or using this formula: Net pay = Gross pay – Deductions .

How do I calculate my take home pay from my gross salary?

How do I calculate my net pay after taxes? Figure out the take-home pay by subtracting all the calculated deductions from the gross pay, or using this formula: Net pay = Gross pay Deductions . How do I calculate my take home pay from

How Do I Determine Which Percentage To Elect

Every employee must consider the facts of their own situation and adjust their election accordingly.

If you want to keep your withholding approximately the same as last year, use last years federal Form W-2, or your last pay stub, to calculate which withholding percentage to elect. For example, if box 1 of federal Form W-2 shows $40,000 in wages and box 17 shows $1,000 in state income tax withheld, divide box 17 by box 1 to determine your percentage . To keep your withholding the same as last year, choose a withholding percentage of 1.8% and withhold an additional $10.77 per biweekly pay period . Be sure to take into account any amount already withheld for this year.

If you want to withhold more, choose one of the higher percentages or choose to have an additional amount withheld.

Note: Underwithholding can result you owing tax and/or underpayment penalties when you le your Arizona return at the end of the year.

Also Check: Louisiana Payroll Calculator

Will I Get An Extra Tax Refund If I Receive Unemployment Benefits

Individuals who have received unemployment benefits and have already filed their 2020 tax returns may need to file an amended return to take advantage of the exemption and receive an additional refund. However, it is best to wait for more information from the IRS. In fact, the IRS is urging taxpayers to wait for more guidance.

How Do I Calculate My Net Pay After Taxes

How do I calculate my net pay after taxes?

How do I work out my net pay? net pay = gross pay deductions

Monthly, you make a gross pay of about $2,083. You determine that your monthly deductions amount to $700. To calculate your net pay, subtract $700 from your gross pay of $2,083. This would give you a monthly net pay of $1,383.

How much will I earn after taxes? Find out how much your salary is after tax

If you make $52,000 a year living in the region of Alberta, Canada, you will be taxed $11,566. That means that your net pay will be $40,434 per year, or $3,370 per month. Your average tax rate is 22.2% and your marginal tax rate is 35.8%.

How much do you take home on 30000? If your salary is £30,000, then after tax and national insurance you will be left with £24,040. This means that after tax you will take home £2,003 every month, or £462 per week, £92.40 per day, and your hourly rate will be £14.43 if youre working 40 hours/week.

Don’t Miss: Efstatus.taxactcom

Turn Talent Into Money

Pastimes serve vital roles for hobbyists seeking distractions from everyday life, but personal interests can also be tapped for income, under the right circumstances. For some, turning hobbies into money-makers gets in the way of leisure enjoyment, so benefits should be closely considered before taking a commercial turn.

How Much Tax Credits Should You Claim On Your Paycheck

In 2021, eligible salaries and expenses will be capped at $10,000 per quarter, and the loan amount can be 70% of these salaries/expenses. This means you can claim up to $28,000 in credit per employee per year. Come back with a trusted ERC calculator to find out how much you should be claiming in loans.

Also Check: Amend Tax Return Online For Free

Where Do I Claim The Employee Retention Credit On My Taxes

The non-refundable portion of the employee loyalty credit is always requested on line 11c, and the refundable portion of the credit is always requested on line 13d. Remark. Since IRS Form 941 Q1 must be filed by March 31, you must complete IRS 941X to properly claim the credit.

What Is FutaWhat is FUTA based on?Employers pay state unemployment tax based on workersâ wages. The FUTA tax is 6% on the first $ 7,000 of income for each employee. Most employers enjoy a maximum reduction of 5.4% from this FUTA tax to the federally approved unemployment tax.Quite simply, what does FUTA mean?The Federal Unemployment Tax Act is a payroll tax paid by employers on employee wages. The tax is 6.0% on the first 7,000 made by an employee with income abovâ¦

Are Taxes Taken Out Of Unemployment Benefits

You choose to withhold federal income taxes on your unemployment checks, just as your former employer withdrew the taxes from your paycheck by filing a voluntary withholding statement. However, this reduces the number of benefits they take home with you at a time when you may need all the money you can get.

Golden stimulusWhen can I expect the Golden State stimulus II payments? When can I expect to get paid for Golden State Stimulus II? The passed law does not specify how soon Californians will be able to receive this money, until July 15, 2022. However, the Franchise Tax Department’s website indicates that payments must begin in September 2021. The state recommended checking for updates here.Where is my â¦

Don’t Miss: 1040paytax Customer Service

Is A Pay Stub The Same As A Paycheck

Although paychecks and pay stubs are generally provided together, they are not one in the same. A paycheck is a directive to a financial institution that approves the transfer of funds from the employer to the employee. A pay stub, on the other hand, has no monetary value and is simply an explanatory document.