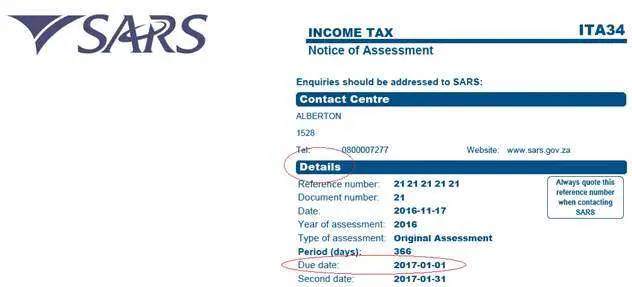

How To Check Income Tax Refund Status Through E

- Step 1: Visit

- Step 2: Enter the PAN, acknowledgement number, and captcha code.

- Step 3: Click on Submit to check the status of your refund.

You can also login to your account on the official website of the Income Tax Department to check the status of your refund.

Income Tax Refund Status

| The income tax department requires a few clarifications on your income tax return details. | You will have to contact your jurisdictional Assessing Officer | |

| Rectification Proceeds, refund determined, sent out to refund banker | The rectified income tax refund request has been accepted by the income tax department. | You will have to wait for a few days and then check your refund status. |

| Rectification Proceeded on, No Demand No refund | Your request for rectification has been accepted but there is no demand or refund. | You do not have to pay the income tax department any money. The income tax department also does not have to pay you any amount. |

| Rectification proceeded, demand determined | The rectified income tax refund request has been accepted. You still have to pay more tax. This will have to be paid within 30 days of this notice. | You will have to crosscheck your efiling. |

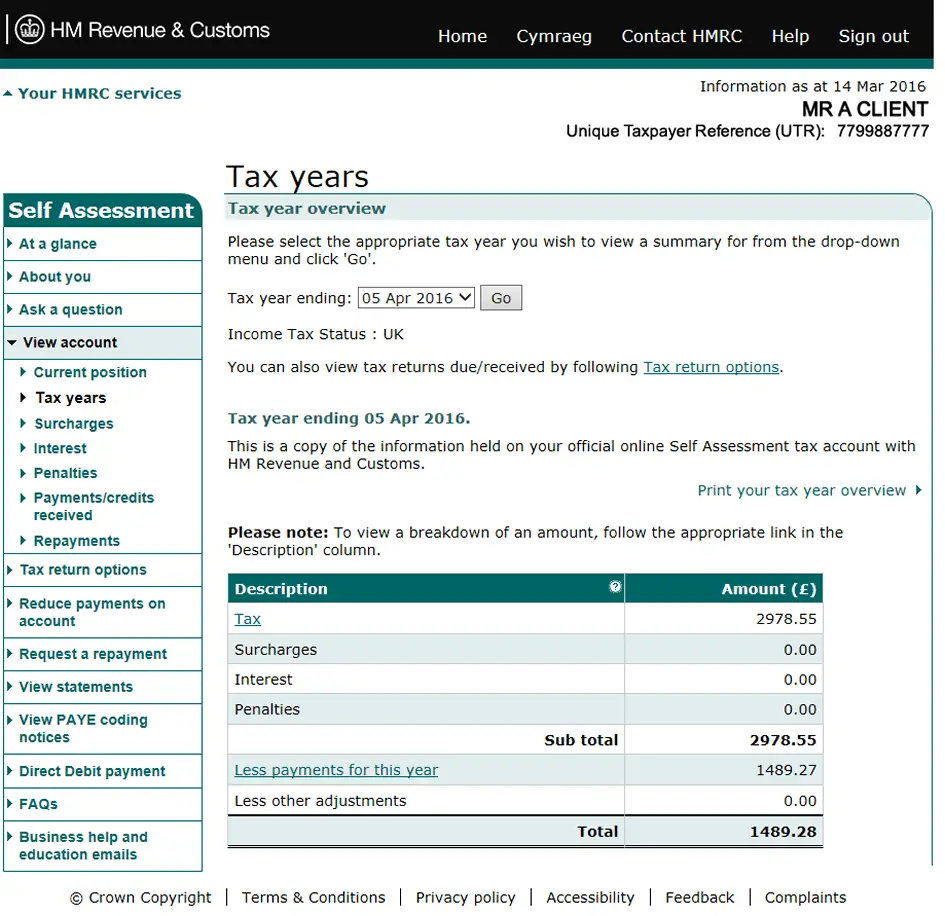

View Your Annual Tax Summary

- English

View your Annual Tax Summary and find out how the government calculates and spends your Income Tax and National Insurance contributions.

- From:

- 5 February 2021 See all updates

Use this service to view your Annual Tax Summary. The summary shows:

- your taxable income from all sources that HMRC knew about at the time that it was prepared

- the rates used to calculate your Income Tax and National Insurance contributions

- a breakdown of how the UK government spends your taxes – this makes government spending more transparent

The summary might be different from other HMRC tax calculations. This could be because:

- your circumstances have changed

- some sources of income are not included

The summary is for information only. You do not need to contact HMRC or your employer.

Sign in using your Government Gateway user ID and password, if you do not have one, you can create one when you view your summary.

Understanding Your Refund Status

As you track the status of your return, you’ll see some or all of the steps highlighted below. For more information about your status and for troubleshooting tips, see Understanding your refund status.

Want more information about refunds? See these resources:

Respond to a letter Your refund was adjusted

Don’t Miss: How To Buy Tax Lien Properties In California

How To View Last Years Tax Return

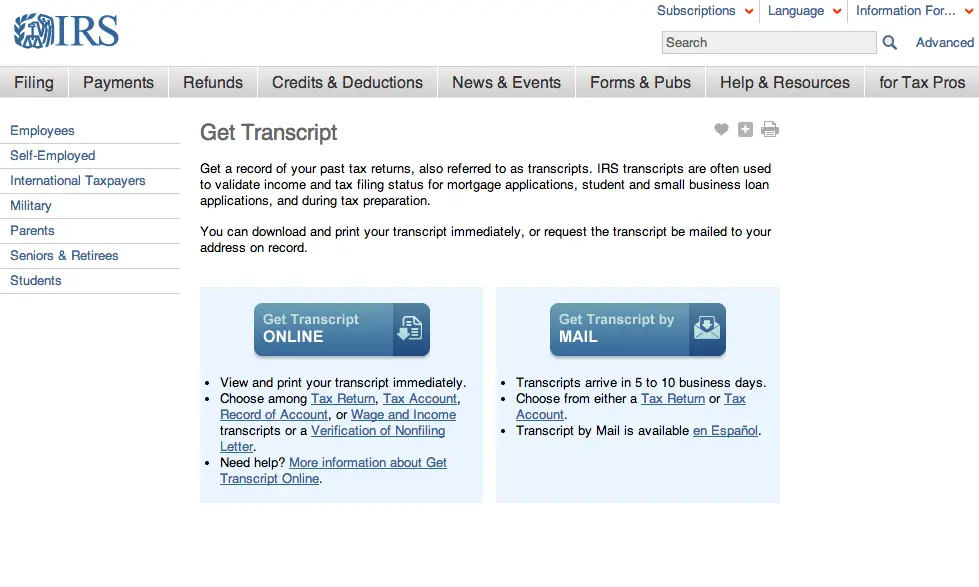

Order a Transcript

How can I get tax information from last year?

- To get your prior year return: Sign in to your TurboTax account here if youre havent already. Select Documents from the left menu. Use the drop-down menu to choose the tax year you want and then select Download tax PDF.

Unclaimed Federal Tax Refunds

If you are eligible for a federal tax refund and dont file a return, then your refund will go unclaimed. Even if you aren’t required to file a return, it might benefit you to file if:

-

Federal taxes were withheld from your pay

and/or

-

You qualify for the Earned Income Tax Credit

You may not have filed a tax return because your wages were below the filing requirement. But you can still file a return within three years of the filing deadline to get your refund.

Recommended Reading: Is Plasma Donation Money Taxable

How To Check Your Refund Status

Use the Where’s My Refund tool or the IRS2Go mobile app to check your refund online. This is the fastest and easiest way to track your refund. The systems are updated once every 24 hours.

You can to check on the status of your refund. However, IRS live phone assistance is extremely limited at this time. Wait times to speak with a representative can be long. But you can avoid the wait by using the automated phone system. Follow the message prompts when you call.

Q12 How Do I Request A Transcript For An Older Tax Year When Its Not Available Online

Tax return and record of account transcripts are only available for the current tax year and three prior tax years when using Get Transcript Online. Note: There is a show all + expand button below the online tax account transcript type that may provide additional tax years you need. Otherwise, you must submit Form 4506-T to request a transcript for a tax year not available.

Tax return and tax account transcripts are also limited to the current and prior three tax years when using Get Transcript by Mail. However, you may be able to get older tax account transcripts by calling our automated phone transcript service at 800-908-9946. Otherwise, you must submit Form 4506-T.

Also Check: Amended Tax Return Online Free

Undelivered Federal Tax Refund Checks

Refund checks are mailed to your last known address. If you move without notifying the IRS or the U.S. Postal Service , your refund check may be returned to the IRS.

If you were expecting a federal tax refund and did not receive it, check the IRS’Wheres My Refund page. You’ll need to enter your Social Security number, filing status, and the exact whole dollar amount of your refund. You may be prompted to change your address online.

You can also to check on the status of your refund. Wait times to speak with a representative can be long. But, you can avoid waiting by using the automated phone system. Follow the message prompts when you call.

If you move, submit a Change of Address – Form 8822 to the IRS you should also submit a Change of Address to the USPS.

What Is An Irs Tax Transcript

An IRS tax transcript contains a summary of your tax return items but only partially displays your personal information to protect your privacy. Depending on the type of transcript you request, it can present your full financial and tax-related information. Items such as your taxable income will be broken down by items as reflected on Form W-2.

If you need a tax transcript, you can request one any time for free through the IRS Get Transcript website.

Don’t Miss: Buying Tax Liens California

Change Your Tax Return

If any information is incorrect or missing from the tax return you have received, you must make the necessary changes. For example, you may have bought a house or a car, sold shares or got married.

You can make changes in the tax return after you have submitted. Remember to re-submit the tax return after you making the changes.

For help on what to change and why, visit our overview of topics and deductions in the tax return.

Q11 Can I Use Get Transcript If Im A Victim Of Identity Theft

Yes, you can still access Get Transcript online or by mail. If were unable to process your request due to identity theft, youll receive an online message or a letter if using the mail option that provides specific instructions to request a transcript. You may also want to visit our Identity Protection page for more information.

Also Check: Www.1040paytax.com Official Site

Employer Information For Individual Tax Return Preparation And Electronic Filing

If you are an individual taxpayer seeking to file a current or prior year tax return or a tax professional preparing a current or prior year return for a client, please remember that all financial entries on all transcript types are fully visible. If you are seeking a missing Form W-2 or Form 1099 information, there is a process for obtaining those current-year documents.

If an unmasked Wage & Income transcript is necessary for tax return preparation and electronic filing, a tax professional may contact the Practitioner Priority Service line. An unmasked Wage and Income Transcript will fully display employers names, addresses and Employer Identification Numbers needed for tax software preparation and for electronic filing. If the tax professional has proper taxpayer authorization, but it’s not on file, they can fax the authorization to the IRS assistor and an unmasked Wage and Income transcript will be sent to the practitioners Secure Object Repository , available through e-Services. Tax professionals must have an e-Services account and pass Secure Access authentication to use the SOR option.

PLEASE NOTE: The requested transcript will remain in the SOR for a limited time. The transcript automatically will be removed from the SOR after three days once you view it or after 30 days if it is not viewed. Print or save the transcript if you want to keep a copy.

Documents Required To Fill Itr

It is important to have all the relevant documents handy before you start your e-filing process.

- Bank and post office savings account passbook, PPF account passbook

- Salary slips

- Aadhar Card, PAN card

- Form-16– TDS certificate issued to you by your employer to provide details of the salary paid to you and TDS deducted on it, if any

Interest certificates from banks and post office

- Form-16A, if TDS is deducted on payments other than salaries such as interest received from fixed deposits, recurring deposits etc. over the specified limits as per the current tax laws

- Form-16B from the buyer if you have sold a property, showing the TDS deducted on the amount paid to you

- Form-16C from your tenant, for providing the details of TDS deducted on the rent received by you, if any

- Form 26AS – your consolidated annual tax statement. It has all the information about the taxes deposited against your PAN

- a) TDS deducted by your employer

- b) TDS deducted by banks

- c) TDS deducted by any other organisations from payments made to you

- d) Advance taxes deposited by you

- e) Self-assessment taxes paid by you

- Tax saving investment proofs

- Proofs to claim deductions under section 80D to 80U

- Home loan statement from bank

Don’t Miss: Have My Taxes Been Accepted

How The Treasury Offset Program Works

Here’s how the Treasury Offset Program works:

If you owe more money than the payment you were going to receive, then BFS will send the entire amount to the other government agency. If you owe less, BFS will send the agency the amount you owed, and then send you the remaining balance.

Here’s an example: you were going to receive a $1,500 federal tax refund. But you are delinquent on a student loan and have $1,000 outstanding. BFS will deduct $1,000 from your tax refund and send it to the correct government agency. It will also send you a notice of its action, along with the remaining $500 that was due to you as a tax refund.

The Internal Revenue Service can help you understand more about tax refund offsets.

File With Approved Tax Preparation Software

If you don’t qualify for free online filing options, you can still file your return electronically with the help of commercial tax preparation software. View approved software options.

To file on paper, see Forms and Paper Filing below. If you do choose to file on paper, please note that, due to COVID-19 workplace protocols and mail delays, it will take longer for us to process your return.

Don’t Miss: How To Buy Tax Liens In California

How To Check The Status Of Your Coronavirus Stimulus Check

If you’re trying to find out the status of your coronavirus stimulus payment, go to the IRS’s Get My Payment page. You can learn whether your payment has been issued, and if it’s coming by direct deposit or mailed check.

Learn more about the stimulus payments, including whether you qualify for one and what, if anything, you may have to do to get yours.

Request Copies Of Previously Filed Tax Returns And Other Taxpayer

Keep in mind

- DOR does not keep records past a certain time, and may not necessarily still have what you are asking for.

- For printable forms which have never been filed visit, DOR tax forms and instructions.

- For guidance regarding how long you should keep Massachusetts tax records visit, 830 CMR 62C.25.1: Record Retention.

- For guidance regarding how long you should keep Federal tax records visit, How long should I keep records?

- For all other inquiries visit, DOR Contact Us.

Request online with MassTaxConnect

This request requires that you log into MassTaxConnect.Please note:

- If you are not already a registered MassTaxConnect user, you will need to create a MassTaxConnect username and password by visiting MassTaxConnect and selecting “Create My Username”.

- Your request for a copy of a previously filed personal income tax return may take several days to process.

Request by email

If you are the taxpayer or a person with a Power of Attorney for a taxpayer, then you may request taxpayer-specific records by emailing the request to the email address below.

If you are a U.S. government department or agency, then in some circumstances you may administratively subpoena quarterly wage records for a particular employer or employee.

Email your request together with your POA or email your federal agency administrative subpoena to

Don’t Miss: Property Tax Protest Harris County

Why Might You Need A Transcript

If you keep meticulous records and have all of your tax information neatly organized, you might not ever need a tax transcript. You’ll have your full 1040 to pull exactly what you need.

In the event you may have misplaced your documentation or it isn’t complete, you may need to pull your transcript to provide an official record of your tax information.

One common instance where you might need a tax transcript is when you apply for a mortgage and the lender wants to see a record of your tax history. Mortgage lenders commonly require at least two years of tax information to substantiate your income and typically want to receive it directly from the IRS rather than from the borrower.

You may also need a tax transcript when you apply for financial aid from a college or university through FAFSA. As another common example, you might need to have your tax transcript when you apply for federal health care programs like Medicaid.

New Mexico Imposes A Tax On The Net Income Of Every Resident And On The Net Income Of Every Nonresident Employed Or Engaged In Business In Into Or From This State Or Deriving Any Income From Any Property Or Employment Within This State

If you are a New Mexico resident, you must file if you meet any of the following conditions:

- You file a federal return

- You want to claim a refund of any New Mexico state income tax withheld from your pay, or

- You want to claim any New Mexico rebates or credits.

Nonresidents, including foreign nationals and persons who reside in states that do not have income taxes, must file here when they have a federal filing requirement and have income from any New Mexico source whatsoever. You must file Form PIT-1 to report and pay personal income tax.

The rates vary depending upon your filing status and income. The top tax bracket is 4.9%

The Department offers taxpayers the ability to file their tax return online. Online filing provides a faster turnaround time than filing a paper return. For example, if you are due a refund, it could reach you within two weeks.

The Department allows taxpayers to check the status of their refunds online through the Taxpayer Access Point . The taxpayer must establish an online account to check the refund status.

Read Also: How Can I Make Payments For My Taxes

Q4 What If I Cant Verify My Identity And Use Get Transcript Online

Refer to Transcript Types and Ways to Order Them for alternatives to Get Transcript Online. You may use Get Transcript by Mail or you may call our automated phone transcript service at 800-908-9946 to order a tax return or tax account transcript be sent by mail. Please allow 5 to 10 calendar days from the time we receive your request for your transcript to arrive. The time frame for delivery is the same for all available tax years.

What If You Need Your Actual Tax Return

If your tax transcript won’t meet your needs, you can still access your tax return in other ways. If you used TurboTax Online to prepare your taxes, you can access your tax return by signing in to your TurboTax account and navigating to the “Your tax returns & documents” section.

If you prepared your taxes in another way, you need to complete IRS Form 4506 and mail it to the IRS along with a $43 fee for sending you a copy of your tax return . These requests can take up to 75 days to process. So, you’ll want to make sure a tax transcript won’t cut it before starting this process.

Remember, with TurboTax, we’ll ask you simple questions about your life and help you fill out all the right tax forms. Whether you have a simple or complex tax situation, we’ve got you covered. Feel confident doing your own taxes.

Don’t Miss: Taxes For Doordash