Which Payment Method Is Best For Me

My payment is due today:

Online, telephone or in-person payments made via your financial institution that are completed before your banks cut-off time if it is before your due date will be reflected as payments made on time. Check with your financial institution to find out the cut-off time applicable to you.

Online payments by card through Paymentus made on weekdays do not have a cut-off time until 10PM. This means payments made on a due date before 10PM via Paymentus should be reflected as payments made on time.

I want a payment receipt:

You will receive a physical receipt when paying in-person at one of our Client Service Centres and an electronic confirmation when paying online by card.

I want to pay online:

You can pay your property tax bills online by payment card.

I am house-bound:

You can pay via your financial institution online or by telebanking, online by payment card, through our PAD plan or by mail.

I have no computer:

You can pay via your financial institution in-person or by telebanking, through our PAD plan, by mail or by dropping off a chequeat one of the secure payment drop-boxes located outside the main entrance of the Kanata Client Service Centre at 580 Terry Fox Drive or the Orleans Client Service Centre at 255 Centrum Boulevard.

Paypal And Paypal Credit

- Convenience fee of $3 or 3% PayPal payments

- PayPal credit offers financing options for qualified property owners

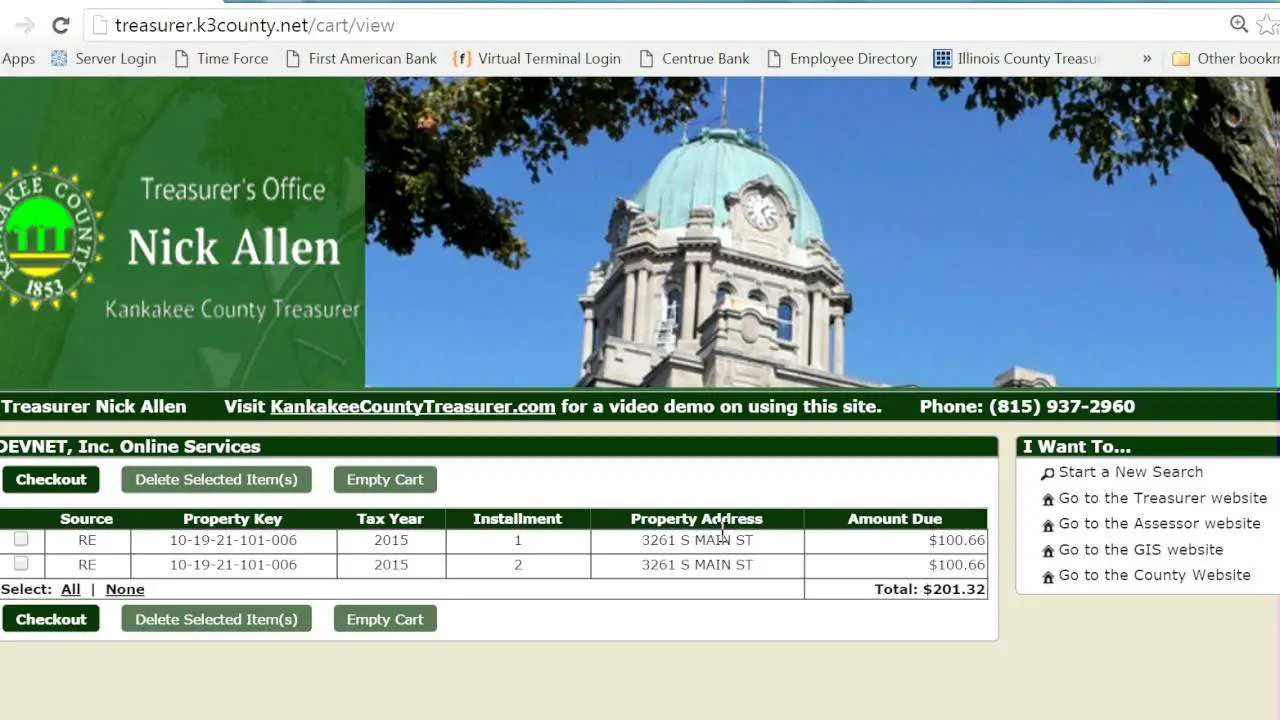

Installment Payment Plan Dates

The first and second installments are based on ¼ of the previous years taxes. The third and four installments are ½ of the remaining actual tax liability for the current year.

- 1st Installment ¼ of the total estimated taxes discounted at 6%. Payment is due June 30

- 2nd Installment ¼ of the total estimated taxes discounted at 4.5%. Payment is due September 30.

- 3rd Installment ¼ of the total estimated taxes plus ½ of the adjustment for actual tax liability discounted at 3%. Payment is due December 31st.

- 4th Installment ¼ of the total estimated taxes plus ½ of the adjustment for actual tax liability. Payment is due March 31st.

Delinquent installment payments must be paid in full with the next installment payment. Unpaid installments are delinquent on April 1 and are subject to the same rules that apply to delinquent taxes.

If a taxpayer chooses to discontinue participation, they will not be entitled to receive the discounts provided by law. For more information, contact the Property Tax Department by phone at .

Recommended Reading: Pin Number To File Taxes

What Is A Homes Assessed Value

One factor that affects your property taxes is how much your property is worth. You probably have a good understanding of your homes market valuethe amount of money a buyer would pay for your place.

Still, tax municipalities use a slightly different number its called your homes assessed value.

Tax assessors can calculate a homes current assessed value as often as once per year. They also may adjust information when a property is sold, bought, built, or renovated, by examining the permits and paperwork filed with the local municipality.

Theyll look at basic features of your home , the purchase price when it changes hands, and comparisons with similar properties nearby.

Sometimes a homes assessed value will be strikingly similar to its fair market valuebut thats not always the case, particularly in heated markets. In general, you can expect your homes assessed value to amount to about 80% to 90% of its market value. You can check your local assessor or municipalitys website, or call the tax office for a more exact figure for your home. You can also search by state, county, and ZIP code on publicrecords.netronline.com.

If you believe the assessor has placed too high a value on your home, you can challenge the calculation of your homes value for tax purposes. You dont need to hire someone to help you reduce your property tax bill. As a homeowner, you may be able to show how you determined that your assessed value is out of line.

Pay Directly To The City

to pay property tax directly to The City of Calgary. See for more information.

The Tax Instalment Payment Plan is a monthly instalment plan that allows you to pay your property taxes by monthly pre-authorized debit, rather than in a single annual payment. Find out more about the Tax Instalment Payment Plan .

Reduce the risk of late payment penalties by requesting and returning your TIPP agreement early.

TIPP payment not honoured by your bank – making a replacement instalment

Making a replacement instalment, like all other tax payments, can be made through one of the other property tax payment options listed on this page. Replacing a payment before it becomes dishonoured will not stop the next monthly TIPP instalment from being withdrawn or prevent service fees. For more information on replacement instalments, see non-payment and service charges.

Making a lump sum payment to lower your monthly payment amount

Your monthly TIPP payments can be lowered by making a lump sum payment and requesting a recalculation. If you decide to make a lump sum payment, it cannot be automatically withdrawn. A lump sum payment, like all other tax payments, can be made through one of the other property tax payment options listed on this page.

Third floor, Calgary Municipal Building800 Macleod Trail S.E.

Cheque or money order

Avoid last minute lineups and late payment penalties by bringing your cheque to Corporate Cashiers today, post-dated on or before the due date.

You May Like: How To Pay Taxes With Doordash

Important Electronic Payment Information

All credit card and eCheck payments will take 3 to 5 business days to process and post to your account. However, your payment will be posted as of the date of the online transaction. Before you begin the credit card or eCheck payment process, it is important to make the necessary modifications to your spam blocker to allow the confirmation e-mail to be sent to you. Once you receive the e-mail confirmation, you can go back and enable your spam blocker. You may also include the to your authorized list of senders.

If you should have any questions or concerns, please feel free to contact the Office of the Tax Assessor-Collector during our regular business hours at 210-335-2251.

How Is Property Tax Calculated

To determine your tax bill, the tax office multiples your propertys assessed value . For example, if your home is assessed at $200,000, and the local tax rate is 1%, your tax bill would be $2,000. Of course, the higher the assessed value, the higher the tax bill.

Some local governments apply the tax rate to just a portion of the assessed value. This is known as the assessment ratio. If your home is assessed at $200,000, and your county has an assessment ratio of 80% and a tax rate of 1%, your tax bill would be $1,600 .

Read Also: How Do I Do My Taxes For Doordash

Property Tax Overpayments At Year

If an overpayment has created a credit less than $3,000 on your tax account at the end of the year, the credit will be transferred and applied to the next upcoming tax billing. This only occurs if there has not been an ownership change within the year of the credit and that the account is in good standing. If there are arrears on the account, such as other charges the credit will not be automatically transferred.

Online By Payment Card

You can now pay property taxes online with MasterCard, VISA, American Express , Interac Online, MasterCard Debit or Visa Debit.

- You will require the 19 digit property tax roll number. View sample tax bill

- Interac Online, MasterCard Debit and Visa Debit allow you to pay online using money from your bank account. If your bank doesnt offer Interac Online it likely offers either Mastercard or Visa Debit. Interac Online Frequently Asked Questions.

- A service fee is applied by the service provider, Paymentus Corporation.

Go to the Paymentus website to make a property tax payment by payment card. Please verify that you are in the secure site by ensuring that the web address starts with https and is

If you choose to make an online property tax payment with a credit card, Interac Online or Debit you may do so at any personal or public internet access point.

Read Also: Efstatus Taxact Com Login

Refund Or Credit Transfer

Requests for refund or transfer of a credit balance due to an overpayment will require proof of payment. Fees may apply.

Copies of the following are acceptable proof of payment:

- cancelled cheque

- bank statement

- cashiers paid stamp on a bill/statement paid at one of the Citys Inquiry and Payment counters

- receipt of debit payment made at one of the Citys Inquiry and Payment counters

Note: A printout of the payment history from the Property Tax Lookup and Utility Bill Lookup is not acceptable proof of payment.

Additional documents are required, if:

Your property has undergone a change in ownership:

- Provide a Statement of Adjustments

- If a vendor is requesting a refund and a sale has transpired, both the vendor and purchaser Statement of Adjustments along with the vendors forwarding address is required.

You are the Power of Attorney or the Executor of the Estate:

- Provide documents assigning Power of Attorney or Executor of Estate

- Provide a Statement of Adjustments

You are the tenant paying the utility bill and are not listed on the account:

- Provide a letter of direction from the property owner

You are the property owner and your tenant pays the utility bill:

- Provide a letter of direction from the tenant

Every Homeowner Pays Property Taxes Heres How

Lea Uradu, J.D. is graduate of the University of Maryland School of Law, a Maryland State Registered Tax Preparer, State Certified Notary Public, Certified VITA Tax Preparer, IRS Annual Filing Season Program Participant, Tax Writer, and Founder of L.A.W. Tax Resolution Services. Lea has worked with hundreds of federal individual and expat tax clients.

A property tax bill is part of the homeownership experience. Local governments collect these taxes to help fund projects and services that benefit the entire communitythings such as roads, schools, police, and other emergency services. There are two primary ways to pay your property tax bill: as part of your monthly mortgage payment or directly to your local tax office.

Read Also: Pastyeartax Com Reviews

Forms: Property Account Assessment And Taxes

School Support Declaration – for corporations

Mailing Address and Ownership Changes

Corrections or changes to mailing addresses, owner names and changes of ownership are administered by Alberta Land Titles. The City of Edmonton receives these updates electronically once they have been processed by Alberta Land Titles.

You can request a change of mailing address by submitting a Change of Address form. Changes or corrections to owners name and changes of ownership can be made by submitting the appropriate forms to Alberta Land Titles.

If you receive a “Please wait….” message opening PDF forms1. Right click on the link2. Choose the option to Save or Download the form to a known location on your computer, such as your desktop3. Locate the file on your local computer4. Open the file using Adobe Reader

Tax Receipts And Statements

The City will issue residents a receipt for property tax payment, record of payment or duplicate tax statement upon request.

- Refunds are processed on a first in, first out basis

- Please allow four to six weeks to process

- Should your refund be as a result of an Assessment reduction an application will be sent to you automatically upon processing your reduction. Please do not complete or submit a separate refund form.

Also Check: Efstatus.taxactcom

Pay Your Property Taxes

Property taxes are paid yearly for each property or manufactured home you own or lease. You pay your property taxes to the office that sent your tax notice.

All owners are responsible for any unpaid property taxes. If your property has multiple owners, each owner will be sent a copy of the property tax notice. To make sure the taxes are paid in full by the due date we recommend:

- all of the owners communicate and agree on how to share the taxes, and

- you have one owner make the payment.

You must pay or defer your property taxes in full by the due date indicated on your tax notice to avoid late payment penalties. If you are unable to pay your taxes in full before the due date, still claim the home owner grant to reduce the amount of tax you owe.

Where To Find Property Taxes Plus How To Estimate Property Taxes

Thankfully, in many cases, you may not have to calculate your own property taxes. You can often find the exact amount youll pay on listings at realtor.com®, or else you can enter a homes location and price into an online home affordability calculator, which will not only estimate your yearly taxes but also how much you can anticipate paying for your mortgage, home insurance, and other expenses.

Read Also: Do You Pay Taxes For Doordash

Roll Number Is The Account Number

Make sure the Calgary property tax account number registered in your banks bill payment profile matches the 9-digit property tax roll number shown on your tax bill or statement, entered without spaces or dashes. If an invalid 9-digit roll number is used it may result in a Payment Alignment fee of $25.

Roll number location on a property tax bill

Roll number location on a property tax statement of account

Apply payment to the correct property – check your roll number

The property tax roll number is linked to the property NOT the owner.

When you sell a property, that propertys tax roll number does not follow you to your next property.

Your new property will have its own roll number, which appears on your bill.

You must register your new propertys 9-digit roll number as the account number before making payment. Not changing the roll number registered with your bank will result in your payment being applied to your previous property, not your current bill. If your previous roll number is used to make the payment, it may result in a Payment Alignment fee of $25.

Need a copy of your tax bill? Visit Property Tax Document Request.

Keep your receipt as proof of the date and time of payment.

Add Calgary Property Tax As A Payee

Before making payment at an ATM add Calgary Property Tax as a payee and register your current roll number online, by phone or in person at a branch.

Add Calgary Property Tax payee to your bank accounts bill payment profile:Search keywords: Calgary property tax and select the payee name closest to Calgary Property Tax or Calgary Property Tax.

Cant find Calgary property tax as a payee or are unsure which payee to select?

Contact your bank for more information.

Recommended Reading: If I File Taxes Today Will I Get A Stimulus Check

Welcome To Tarrant County Property Tax Division

Tarrant County has the highest number of property tax accounts in the State of Texas. In keeping with our Mission Statement, we strive for excellence in all areas of property tax collections.

Our primary focus is on taking care of citizens. Please complete a blue comment card and drop in the designated location when you visit our offices, or use our electronic form to let us know how we are doing.

Please be aware that there is no fee to apply for exemptions through Tarrant Appraisal District or apply for refunds for overpayment or adjustments to your taxes. Please contact us if you have questions before paying a third party to assist you. Texas Attorney General Paxton has issued an alert on misleading tax exemption offers.

Save Time and Pay Online!

Create a profile and make a Half Payment, Quarter Payment, Partial Payment, or Full Payment using a Debit/Credit Card or e-Check.

Warning And Disclaimer By Dallas County Texas:

Your personal information is entered into the Chase’s on-line system. Chase is not an agent or a representative of Dallas County. Dallas County is not responsible for any errors, failures, virus or malfunctions, or other problems associated with the use of this computer or any online systems.

Dallas County is also not responsible for any unauthorized access to your personal information. User hereby shall forever waive, release, indemnify and hold harmless Dallas County, its Commissioners Court, County Judge, elected officials, assigns, officers, employees, agents and representatives from and against any and all losses, damages, injuries, causes of action, claims, demands, and liabilities related to this transaction. Please”log off” completely at the end of your transaction! Failure to do so will allow another user to access your personal information.

Don’t Miss: How Much Taxes Do You Pay For Doordash

Our Services Are Available Online By Phone Email Or Us Mail:

- Phone: Real Property Tax 206-263-2890

- Phone: Mobile Homes and Personal Property Commercial Property Tax 206-263-2844

- Email:

- Mail: King County Treasury Operations, 201 S. Jackson Street, Suite 710, Seattle, WA 98104 NOTE NEW MAILING ADDRESS

- Secure drop box: on side of 2nd Ave nearer to S Jackson ST

COVID-19 Update: The health and safety of our community and employees is our top priority. To help slow the spread of coronavirus , King County Treasury customer service operations are being provided remotely until further notice.

First-half property taxes are due May 2nd 2022

To review current amounts due please use the safe and secure online eCommerce System

What are Real Property and Personal Property Taxes?

- Real Property is residential or commercial land and structures

- Personal property is assets used in conducting a business

- Mobile homes and floating homes are taxed as personal property if not associated with a real property account

I know my parcel/account number

Need help? Check our Frequently Asked Questions , call 206-263-2890, or email .

Many changes have been made to the property tax exemption and deferral programs for seniors, people with disabilities, and military veterans with a service-connected disability.