Do You Even Have To File Taxes

Whether you have to file a tax return this year depends on your income, tax filing status, age and other factors. It also depends on whether someone else can claim you as a tax dependent.

Even if you dont have to file taxes, you might want to do it anyway: You might qualify for a tax break that could generate a refund. So give tax filing some serious consideration if:

-

You qualify for certain tax credits.

Do You Have To File A Tax Return In Canada If You Have No Income

Even if a person does not earn a living, they will have to file a tax return. If you wish to know when it is needed to file your taxes, here is a list from the government to please specify how it will need to be done. Tax is due in 2017. Your tax return has been requested by a representative of your company.

If You Need To Change Your Return

You can make a change to your tax return after youve filed it, for example because you made a mistake. Youll need to make your changes by:

- 31 January 2022 for the 2019 to 2020 tax year

- 31 January 2023 for the 2020 to 2021 tax year

If you miss the deadline or if you need to make a change to your return for any other tax year youll need to write to HMRC.

Your bill will be updated based on what you report. You may have to pay more tax or be able to claim a refund.

Theres a different process if you need to report foreign income.

Read Also: How To Get A Pin To File Taxes

How Do I File Returns For Back Taxes

OVERVIEW

When would someone file back taxes, and what does this process typically look like?

Should you file back taxes? It may not be too late to file a previous year’s tax return to pay what you owe or claim your refund. Learn more about why one may choose to file back taxes and how to start this process.

Why Do I Need To File Taxes From Previous Years

For most people, filing back taxes isnât optionalâitâs required by law. While some people donât have to file tax returns because they didnât make enough money, most do. In fact, the threshold for filing for self-employed workers is lower than most since you have to file a return if you have self-employment income of $400 or more.

If youâre not sure whether you need to file, check out the IRSâs Do I Need to File a Tax Return? interactive tool.

Other reasons you may need to get caught up on your tax filing obligations include:

You May Like: How Much Are Taxes For Doordash

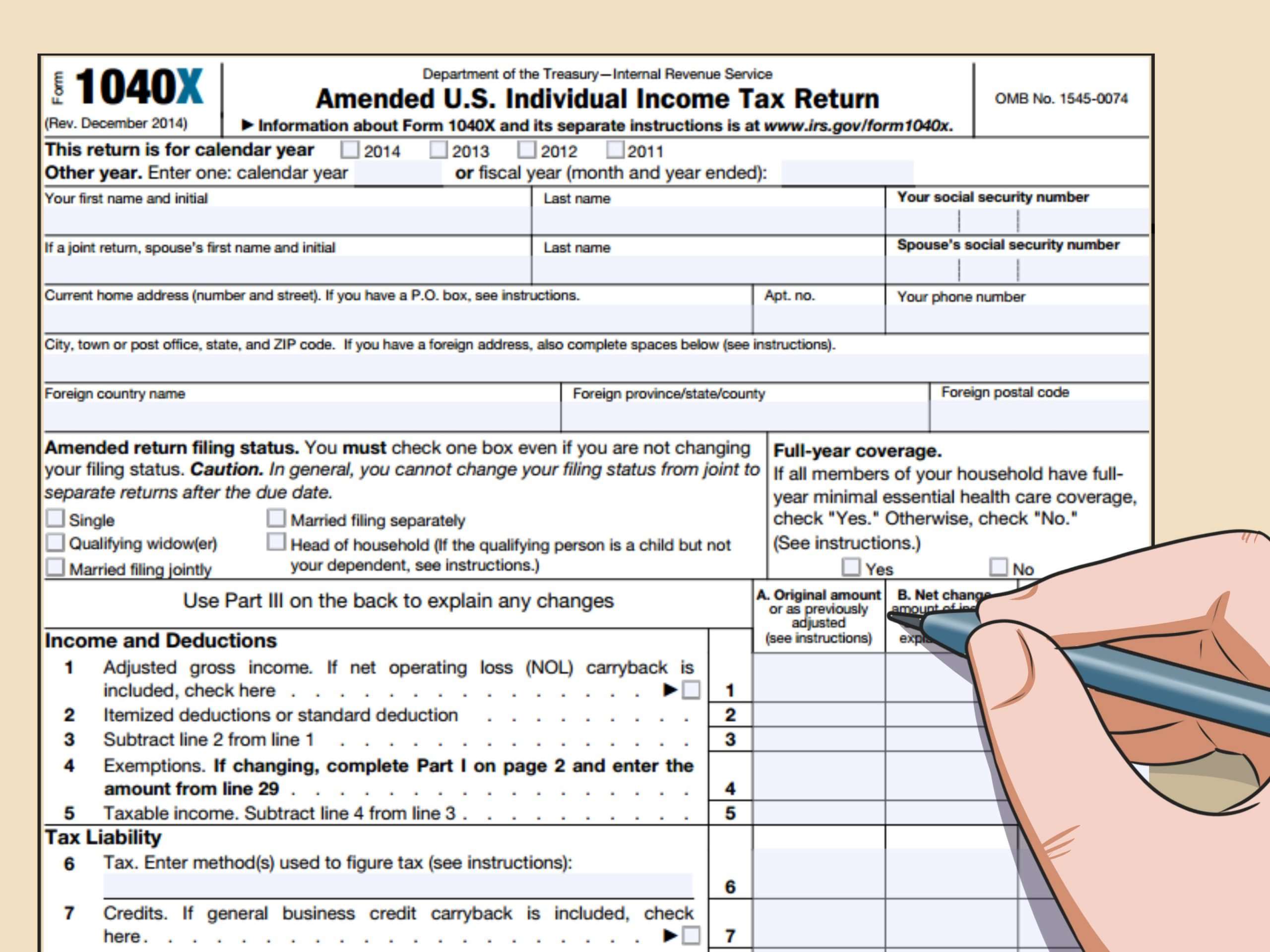

How To Amend Your Prior

If it turns out that you made an error on your nonresident alien tax return, you can easily fix it! Simply, follow the steps in the article above.

A tax return can be considered incorrect for many reasons. And while making a mistake is not such a big deal, its crucial to file an amended tax return, where appropriate.

Can You Refile Taxes If You Forgot Something Canada

Using My Account: For those that have registered for CRAs My Account service, adjustments will be carried out online every calendar year. You can now select Change my return from the drop-down list. If you need to correct or add information, select the tax year you would like to adjust and enter line numbers and figures.

Also Check: Do You Claim Plasma Donation On Taxes

When Your Child Must File

For income above a certain level, the tax rate of the parents will be used. Four tests determine whether a dependent child must file a federal income tax return. A child who meets any one of these tests in 2021 must file:

- If the child only has unearned income above $1,100

- If the child only has earned income above $12,550

- If the child has both earned and unearned income, and the child’s gross income is greater than either $12,550 or their earned income plus $350, whichever is less.

- The child’s net earnings from self-employment are $400 or more

Additional rules apply for children who are blind, who owe Social Security and Medicare taxes on tips or wages not reported to or withheld by the employer, or who receive wages from churches exempt from employer Social Security and Medicare taxes.

Can I Claim Tax Back If I Leave Uk

You may have a chance to claim back some income taxes paid when you are working or living abroad. To claim back some income taxes that you have paid, please fill out the form P85 Leaving the UK getting your tax right for HMRC to receive. If you owe income tax, the form allows you to claim a refund.

Read Also: How Does Doordash Do Taxes

An Offer In Compromise

An offer in compromise is a bit more complex. It involves reaching an agreement with the IRS to pay less than your full balance due. An offer in compromise is typically only approved if youre unable to pay through an installment plan and comes with an application fee. Youll probably need the help of a professional for this option.

You must establish that you cannot pay your balance through an installment agreement or by any other means. All your past due tax returns must be filed before the IRS can grant you this relief, and you must have made some payment toward taxes in the current year, either through withholding from your paychecks or by sending in quarterly estimated payments, even though you havent filed a tax return for the year yet.

Always File And Pay The Tax On Time

If you fail to file and pay tax on time, the government associated with the financial institution can take various measures. Therefore, it is necessary to understand the seriousness of taxes and follow the rules to avoid any risk.

Do not ignore any emails or letters you get about taxes and if you find yourself in a situation that cannot be solved, then get some advice or help from your financial institution.

You May Like: Doordash Driver 1099

A File Taxes Online With Tax Software

If youve used tax software in the past, you already know how to prepare and file taxes online. Many major tax software providers offer access to human preparers, too.

TurboTax, H& R Block, TaxAct and TaxSlayer, for example, all offer software packages or support options that come with on-demand, on-screen or online access to human tax pros who can answer questions, review your return and even file taxes online for you.

The IRS Free File program can get you free online tax preparation software from several tax-prep companies, including major brands. You must have less than $72,000 of adjusted gross income to qualify.

» MORE:See our picks for the year’s best tax filing software

If You Owe More Than You Can Pay

If you cannot pay what you owe, you can request an additional 60-120 days to pay your account in full through the Online Payment Agreement application or by calling 800-829-1040 no user fee will be charged. If you need more time to pay, you can request an installment agreement or you may qualify for an offer in compromise.

Read Also: How Does Doordash Do Taxes

Take Advantage Of Tax Credits And Breaks

A person can take advantage of tax breaks and credits even if they do not file a federal income tax return. Tax credits are the amount of money that is reduced in your tax due, and it is beneficial that tax deductions reduce your taxable income.

Several online tax companies help their customers to know about tax online. This also provides credit information even if you do not owe any tax. One such company is Taxopia, which helps its customers get to know about taxes online. You have to search Taxopia tax online to find everything about filing and paying tax.

Filing Back Taxes In Canada

You should file your taxes on time. This is the best way to avoid interest charges, penalties, and additional hassle from the Canada Revenue Agency . However, for many reasons, people sometimes do not file their taxes when they should. Maybe you forgot or maybe you didnt realize that you needed to file. Maybe you did not file on purpose. Sometimes, people believe that its in their best interest to not file their taxes if they dont have the money to pay their tax debt. This isnt true, but its a common belief and it happens.

For whatever reason, if you didnt file your taxes when you should have, and now youre wondering how far back you can file taxes in Canada, the good news is that it is possible to file prior year returns.

You May Like: How Much Tax Do You Pay For Doordash

Extension To File Your Tax Return

If you cant file your federal income tax return by the due date, you may be able to get a six-month extension from the Internal Revenue Service . This does not grant you more time to pay your taxes. To avoid possible penalties, estimate and pay the taxes you owe by the tax deadline of May 17, 2021.

Complete The Right Tax Forms

IRS forms change from year to year, so you need to make sure you use the forms for the tax year you need to file. If you use online tax software to file a return, make sure you select the correct year in the software.

If youâre filing without the help of software, you can and instructions for completing those forms at IRS.gov.

You can also work with a professional tax preparer if you donât feel comfortable filling out the forms on your own.

You May Like: How Does Doordash Do Taxes

I Have Questions About My Taxes Can I Call The Irs

While you can call the IRS, the agency recommends turning to online resources and its online form instead. Last year, the agency received 145 million calls between Jan. 1 and May 17 — more than four times the volume of an average year.

“Our phone volumes continue to remain at record-setting levels,” IRS Commissioner Chuck Rettig said in a . “We urge people to check IRS.gov and establish an online account to help them access information more quickly. We have invested in developing new online capacities to make this a quick and easy way for taxpayers to get the information they need.”

That said, if you do need to reach out to the IRS, you can call one of its dedicated regional phone lines, operating Monday through Friday, from 7 a.m. to 7 p.m. . Individuals can call 800-829-1040 and businesses can call 800-829-4933.

And there’s always the Interactive Tax Assistant, an automated online tool that provides answers to a number of tax law questions, including whether a type of income is taxable or if you qualify for certain credits and deductions.

If you have a question for the IRS specifically related to stimulus checks and your taxes, the IRS recommends that you check IRS.gov and the Get My Payment application.

Paying Debts And Collecting Tax Refunds

Paying any tax due on each completed return is relatively simple. The IRS wants your money, so it doesnt make the process challenging. You can go to its Direct Pay website to pay by electronic debit from your checking or savings account, and the IRS accepts credit card payments on its website, as well.

Keep in mind that there are time limits for refunds, audits, and debt collection. In most cases, your refund “expires three years from the date your tax return was due. But if you owe other tax debtsbecause you have a balance due from another year, for exampleyour refund will typically be applied to offset that debt.

Create a plan for paying off your tax debts if it turns out that you owe the IRS money. You might also want to plan on how to protect yourself from an IRS investigation, assessment, federal tax lien, or possibly a levy. You may have a few options, such as setting up an installment agreement with the IRS for a monthly payment plan or asking for an offer in compromise.

The IRS can and will impose penalties and interest on tax liabilities that aren’t paid in full by the deadline for the tax return.

Don’t Miss: How To Find A Companys Ein

Where Do I Send Back Taxes

If the IRS mailed you a notice about your late taxes, you should mail your return to the address listed in that notice. Otherwise, where you mail your old tax returns depends on where you live and whether or not youâre including a payment with your return. The IRS instructions for Form 1040 of the year youâre filing for should also include the proper mailing addresses.

Questions And Answers About Filing Your Taxes

This web page will be updated periodically to incorporate changes that may affect you during tax-filing season.

The Canada Revenue Agency understands that COVID-19 has affected you, your family and your taxes. We remain committed to providing you with various measures of support and, as the crisis continues to evolve, we remain committed in helping you during these hard times.

Don’t Miss: How Much To Save For Taxes Doordash

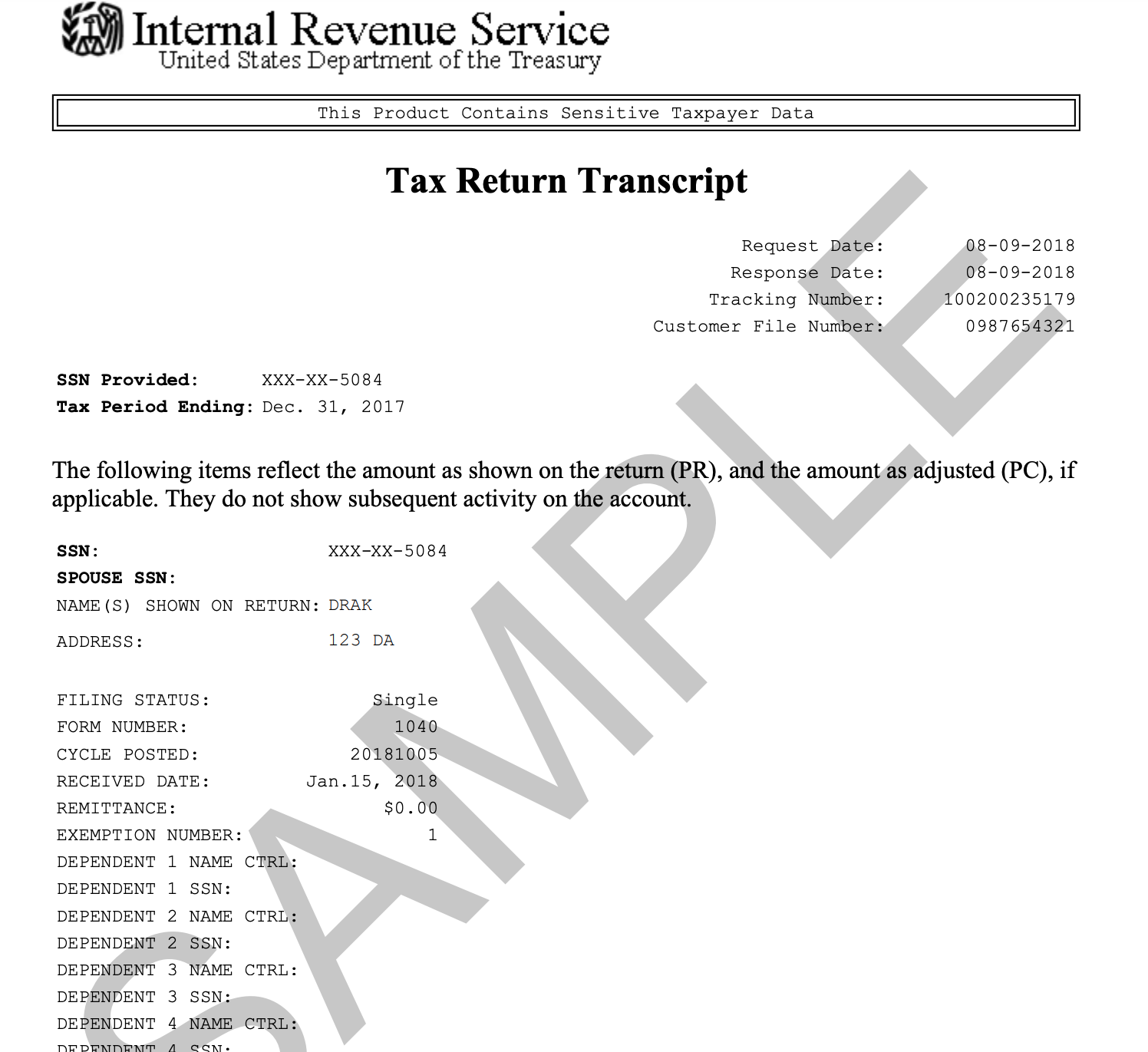

Why Do You Need Previous Year Agi When Filing Your Income Taxes The Truth Lies In Identity Verification

In todays blog post, we look at some more tax information, and will answer the question of why do you need previous year AGI in order to properly file your income taxes. For starters, there are some additional deductions that you may be able to get on your tax return if your Adjusted Gross income falls within certain limits, but mainly, it is used for verifying identity and to prevent against identity theft, in that if you can provide the Adjusted Gross Income from your prior years tax return, then there is a pretty good chance that it is actually you filing the return. Ill keep this post rather short, for no other reason than writing more than 600 words on Adjusted Gross Income would be painfully boring, and will explain other things you can do with your AGI, how you can reduce this to lower your taxable income, and also why this is important on your main tax return. In short, Ill ask why do you need previous year AGI when filing your income taxes, and will walk you through the gist of just about everything that youll likely need to know on the subject. For more information, read on or subscribe to our blog for additional details and information.

Other issues that Ill attempt to cover in this blog post include:

The most common tax forms filed in the United States

When to use Schedule C on your tax return

Why I like Taxslayer as a software better than Turbotax

Stocks

When To File Taxes: Everything To Know About 2022 Deadlines

Get all the details of this year’s tax season dates, including the deadline for extensions and when to expect your refund.

Dan Avery

Writer

Dan is a writer on CNET’s How-To team. His byline has appeared in Newsweek, NBC News, The New York Times, Architectural Digest, The Daily Mail and elsewhere. He is a crossword junkie and is interested in the intersection of tech and marginalized communities.

Tax deadlines are months away, but the IRS has already started issuing refunds.

The 2022 tax season introduces complicated tax changes — such as stimulus payments, child tax credits, unemployment insurance claims and other pandemic-related factors — and a warning from the IRS about expected delays in processing returns. The agency recommends filing your taxes electronically as early as possible and setting up direct deposit to get your refund faster.

“The pandemic continues to create challenges, but the IRS reminds people there are important steps they can take to help ensure their tax return and refund don’t face processing delays,” IRS Commissioner Chuck Rettig said in a statement announcing the start of the 2022 tax season.

For more, learn about tax deductions you don’t want to miss, the tax best software for 2022 and how to file your taxes for free.

Read Also: How Much Taxes Deducted From Paycheck Mn

Filing Your Own Return

You can use commercial software to complete your income tax return and file it online using the integrated NetFile Québec feature.

When you file your income tax return online, do not send us any paper copies of the return.

When can I file my income tax return using NetFile Québec?

2020 income tax return

- You can file your 2020 income tax return as of February 22, 2021.

Returns from previous years

- You can file your original 2017, 2018 and 2019 income tax returns in the four-year period following the taxation year covered by the return .

- If you did not file an income tax return for 2017, 2018 or 2019 taxation year, and we sent you a notice of assessment for the year covered by the return, you cannot file an original return using authorized software. You have to mail the return to us.

Amended income tax returns

- You can file an amended 2017, 2018 or 2019 income tax return as of February 22, 2021.

End of note