Get Your Federal Tax Refund Fast

Not only have we tried to make it as painless as possible to prepare and file your return, filing electronically will also get your tax refund much faster. After all, it’s your money. Why wait any longer than necessary to get it back.

At E-file.com, we work to get your federal tax refund as fast as possible thanks to the electronic filing program with the IRS. Filing electronically with the IRS and selecting to have your refund direct deposited to your bank allows you to get your refund as fast as possible.

Sharing Or Gig Economy

If you earn incomeas a rideshare driver,rental host,or online seller,your business is part of the gig economy.

The gig economy, also called sharing economy,or access economy,is any activity where people earn incomeproviding on-demand work,services, or goods.

Often, it’s through a digital platformlike an app or website.

Visit the irs.govGig Economy Tax Center,where you will find general information abouttax issues that arise in the gig economyand how to file your taxes.

American Opportunity Tax Credit

The American Opportunity Tax Credit helps offset costs for post-secondary education. It was introduced in 2009 and requires that couples filing jointly have a modified adjusted gross income of no more than $160,000 to be eligible for full credit. Couples who make $160,000 to $180,000, meanwhile, can apply for a partial AOTC.

The maximum reward is an annual credit of $2,500 on qualified educational expenses for the first four years that a student attends an approved postsecondary institution.

Also Check: How Do Taxes Work With Doordash

What Is Married Filing Separately

Married filing separately is a tax status for married couples who choose to record their respective incomes, exemptions, and deductions on separate tax returns.

The alternative to married filing separately is . Usually, it makes sense financially for married couples to file jointly. However, when one spouse has significant medical expenses or miscellaneous itemized deductions, or when both spouses have about the same amount of income, it might be wiser to file separately.

How Bench Can Help

Filing taxes may be the finish line, but bookkeeping is the marathon that gets you there. With Bench, you have a team of experts running that distance for you.

Your Bench bookkeeping team automates your financial admin by connecting bank accounts, credit cards, and payment processors to import information into our platform. Your team also answers questions and completes your tax prep ahead of filing.

With a premium Bench subscription, we handle your bookkeeping and provide year-round tax services, including tax filing. We file your federal and state taxes and give you access to unlimited, on-demand consultations with a tax professional. Weâre here to ensure youâre up-to-date on the latest tax information, maximizing every deduction and seizing available tax credits to minimize your tax bill. Learn more.

Recommended Reading: Doordash Tax Tips

How To File Taxes For An Llc With No Income:

Filing taxes for an LLC with no income depends on the business structure. An LLC that is treated as a partnership by the IRS must file an information return usingForm 1065 even if it has not earned any income.

An LLc that is treated as a corporation by the IRS, must file an income tax return using Form 1120, unless they are exempt under section 501. According to the IRS, Exempt organizations include charities and religious organizations.

If an LLC is treated as a disregarded entity by the IRS, they must still report their lack of income via Schedule C .

File Your Taxes Online

In 2019, 92% of Americans chose online electronic filing. Thatâs because filing online:

- Doesnât require you to fill out paper forms

- Gets your return to the IRS faster

- Lets you receive your refund electronically via direct deposit

- Is as secure or safer than sending your forms in the mail

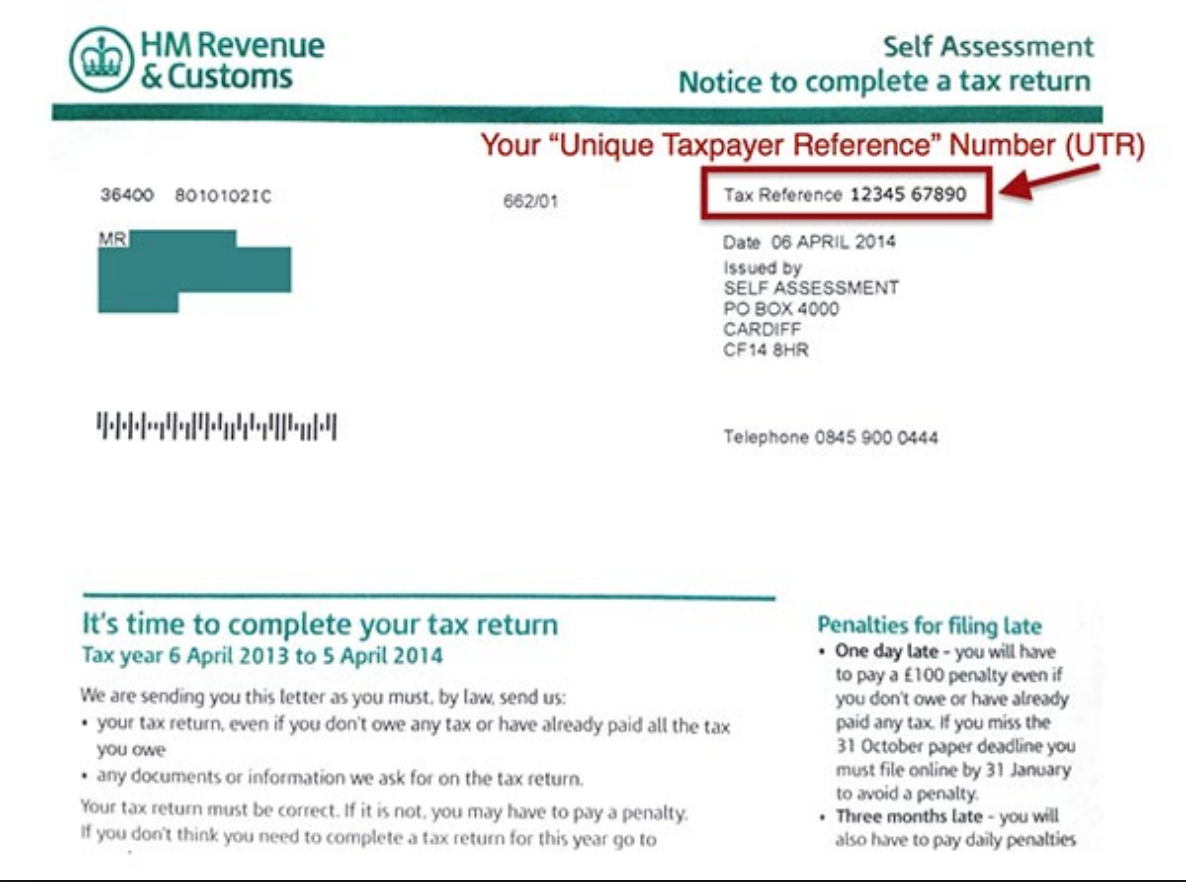

When you file your own taxes online with the IRS , you have two options: Free File and Free File Fillable Forms. If your adjusted gross income for the year is less than $72,000, you can use Free File. If itâs over that, youâll have to use Free File Fillable Forms. If your tax situation is complex, you may need to hire a professional to help with tax filing. The cost of tax filing varies, but having that peace of mind can make it worthwhile for small business owners.

Recommended Reading: Doordash 1099 Example

Set Up A Sole Proprietorship

If youâre a sole proprietor, you run your own business as an individual and are self-employed.

To establish a sole proprietorship, you must:

- Choose a business name, for tax purposes, even if itâs your name

- Obtain licenses, permits, and zoning clearance

- Visit CalGold for more information

You may:

- File a fictitious business name statement with the county recorder

- Obtain an Employer Identification Number

- Visit the Employment Development Department for more information

Nerships: A Tax Overview

In its simplest form, a partnership will be treated from a tax standpoint as if it is a sole proprietorship for more than one person. That is, the businesss income and expenses will be included on each partners individual tax return. Each partners proportionate amount of losses and revenues, as laid out in the general partnership agreement, should be reflected on their own personal tax return. However, the process for doing this is slightly different than a sole proprietorship.

The partnership will file annual information regarding its income, deductions, losses, gains, etc., but this information does not relate to a separate tax rate. Instead, this information is transferred to a Schedule K-1 that each partner will use on their personal income tax return. Schedule K-1 is essentially used in place of a Schedule C for a sole proprietorship. It is not as detailed a Schedule C because it does not include an itemization of expenses. Cost information is included in the partnership annual reporting, Form 1065.

LLP

General partnerships do not have the added protection of limited liability like an LLC or corporation. However, Limited Liability Partnership structures are available. LLPs are also pass-through entities like a general partnership, but they are appealing because of the extra layer of asset protection.

You May Like: How To Pay Taxes As A Doordash Driver

How Are Business And Personal Taxes Filed

As a sole proprietor, you will have to file the income you acquire from your business on a Schedule C form. This form is filed along with your personal income taxes. If you file this way, you cannot file a tax return for your business separately. The same applies if you’re a single member of a limited liability company, also commonly referred to as an LLC. The only way you would not file your income and expenses from your business on the Schedule C form is if you choose to file as a corporation.

If you are a partner in a business, you will need to file Form 1065, which is known as the Return of Partnership Income document. You will receive a K-1 from the partnership, and this will be reported on your personal income taxes.

Pass-through entities, also known as S corporations, file their taxes differently. All profits and losses from the business are passed down through the shareholders these profits and losses are reported on a personal income tax return but not using a Schedule C. Instead, a Schedule E is used. This allows for any taxes owed to be paid according to your individual tax rate.

If an S Corporation has a sub-chapter and you are a shareholder of it, you will need to complete Form 1120-S, which serves as an income tax return for S Corporations. After you file this form, you will then receive a K-1 from the S Corporation, and this K-1 is reported on your personal tax return.

So Can I Separate My Personal And Business Taxes

While this answer really does vary on a case-by-case basis, generally you can file separately if you are considered the employee of a business and paid a wage. Corporations are the one type of business structure where we are almost always filing business and personal taxes separate. LLCs, S-Corps, and Partnerships will all be able to file either separately or together depending on the specific structure of the business and the state in which you operate.

For more information on the different types of business entities, and what tax forms you are required to file for each, check out the IRSs information on business structures.

Read Also: Doordash Tax Calculator

Hire A Certified Business Accountant And Tax Professional

The simple truth is, taxes are confusing to begin with and trying to keep on top of them while also running your business is nearly impossible. This is why, if you are planning on starting your own business, you need to partner with a Mt. Dora, FL business accounting service and a business tax professional to help you correctly file your taxes.

Looking for a Florida public accountant to help you with your Florida business taxes? Relate CPA it a certified Mt. Dora, FL accounting firm who will work with you year-round to ensure your taxes are done correctly and on-time. For a free consultation with Relate CPA, give us a call at 410-753-4899 or fill out the contact us form on our website today.

John has prepared our taxes the last 2 years, and we have been very happy and satisfied with his work. His depth of knowledge about current laws, has been wonderful. He is very personable, and has been happy to answer tax questions in a prompt manner. I highly recommend him.

– Joshua F.

We Provide Qualified Tax Support

E-file’s online tax preparation tools are designed to take the guesswork out of e-filing your taxes. Our program works to guide you through the complicated filing process with ease, helping to prepare your return correctly and if a refund is due, put you on your way to receiving it. Should a tax question arise, we are always here help and are proud to offer qualified online tax support to all users.

If you’ve ever tried calling the IRS during the tax season, you probably know that telephone hold times at peak periods can be hours long. Our dedicated support team enables customers to get their questions answered just minutes after a question is sent, even during peak times. Simply send us a “help” request from within your account and our experts will begin working on your problem and get you an answer as quickly as possible. Prefer to call us? We also provide full telephone support to all taxpayers filing with our Deluxe or Premium software.

You May Like: How Do I Do Taxes For Doordash

Sole Proprietorship Or Llcs With One Member

Filing Deadline: April 15, 2022

If you own an unincorporated company by yourself, or youâre an independent contractor, or a Limited Liability Company with one member, file as a sole proprietor.

Filing as a sole proprietor means you report your business earnings and expenses through an extra form attached to your personal income tax returnâcalled a Schedule Câand pay taxes based on individual income tax rates.

Schedule C is only two pages, and the IRS has fairly detailed line-by-line instructions to help you get it right. When youâve finished, just subtract your total expenses from your earnings to get your net profit or loss. Include this number in your personal tax return.

If youâre planning on claiming itemized tax deductions, youâll need to tally those on Schedule A.

If your total income is below $72,000, you can use the IRS Free File software to file your taxes. If your income is higher than $72,000, you can still take advantage of the IRS free fillable forms.

If youâre going analog and filing a hard copy of your tax return with the IRS, find the address for your state here. Make sure itâs postmarked on or before the deadline.

Heads up: sole props and LLC members are considered self-employed, meaning theyâre subject to self-employment tax .

Top Credit Card Wipes Out Interest Into 2023

If you have credit card debt, transferring it to this top balance transfer card secures you a 0% intro APR into 2023! Plus, youll pay no annual fee. Those are just a few reasons why our experts rate this card as a top pick to help get control of your debt. Read The Ascent’s full review for free and apply in just 2 minutes.

Also Check: Is 1040paytax Com Real

Correctly Classify Your Business

Failing to properly classify your business could result in overpaying taxes, Blake says. Deciding whether to classify your company as either a C Corporation, S Corporation, Limited Liability Partnership, Limited Liability Company, Single Member LLC or Sole Proprietor will have a different effect on your taxes. Its important that small businesses consult with an attorney and accountant to determine how their businesses should be classified.

Am I Really A Small Business Owner

When you think of the term small business what comes to mind?

- A small mom & pop store?

- Or, the little deli on the corner that sells those amazing wraps?

Being a small business owner does not require a store-front, nor does it require employees. You are a small business owner if you own a small business.

You are self-employed if you operate a business where you are the business, such as:

- Freelancers

- Ride-share drivers

- Contract writers

Whether you do dog walking as a side gig or sell your veggies at the local farmers market, congratulations, you are self-employed, and you likely have a small business.

Also Check: Restaurant Tax In Philadelphia

Types Of Business Structures

Now, let’s turn our attention tobusiness structures.

Early in the life of your small business, you’llneed to decide on the structure of ownership.

There are five common types ofbusiness organizations.

Sole Proprietorship,Partnership,Corporation,S Corporation,and Limited Liability Company.

Let’s look at the advantages and disadvantagesof each.

Seek Your Accountants Advice On Your Business Plan

A good accountant gives you advice on how to grow your business, Bhansali says. Seek their advice to determine how much to contribute to your retirement fund and whether you should take a bonus or delay it a year. Your accountant can tell you if buying a small space for your store or business – rather than renting – could save you money.

You May Like: Irs Forgot Ein

Standard Deduction For Married Filing Separately

As a result of the Tax Cuts and Jobs Act of 2017, the standard deduction rose substantially in the 2018 tax year.

A standard deduction is the portion of income thats not subject to tax, thereby reducing taxable income. The IRS allows tax filers to take a standard deduction. However, the deduction amount is dependent on your filing status, age, and whether you are disabled or claimed as a dependent on someone elses tax return.

For the 2021 tax year, the standard deduction for single taxpayers and married couples filing separately is $12,550. For heads of households, the deduction is $18,800, while for married couples filing jointly, it is $25,100.

For the 2022 tax year, the standard deduction for single taxpayers and married couples filing separately is $12,950. For heads of households, the deduction is $19,400, while for married couples filing jointly, it is $25,900.

As a result, one spouse must have significant miscellaneous deductions or medical expenses for the couple to gain any advantage from filing separately.

If you and your spouse both generated taxable income, calculate your tax bill as a joint and separate filer before filing, to determine which of the two will save you more money.

Is It Ok To File Separately When Married

In the case of commutation of marriage, December 31 is considered the due date. For the entire tax year of the married filing separately status if you wait until that last month of the year. Having to use married filing separately status is normally used by husbands and wives who cannot file a joint return because they couldnt agree to file the joint return with each other. The returns you file are separate from your personal tax returns.

Recommended Reading: How Do I File Taxes For Doordash

Small Business Tax Myths

My business didnt make any money so I dont have to report anything right? False.

Many businesses dont see a profit in the first year . You are still required to include details of your business on your tax return and if your business actually lost money, you can apply the loss to your other income.

I made less than $5000 so I dont have to file: False.

Although you may not owe any taxes on your business income, you may be responsible for Canada Pension Plan contributions. As a small business owner, you pay both your share of CPP and the employers share. The amount due is calculated by TurboTax Self-Employed on your tax return.

I am a student so the money I make is tax-free: False.

The CRA doesnt have special rules for small business owners who are still in school. The details of your self-employment must be included when you file your return.

If Youre Late Apply For An Extension

If you expect to miss your filing deadline, donât worry about the IRS throwing the book at you for not filing your taxes. You can always apply for an extension.

While this gives you some extra breathing room for getting your tax preparation complete, itâs important to note that you still have to pay your estimated taxes by the original deadline.

Recommended Reading: Protesting Harris County Property Tax

Legal And Professional Fees

Legal and professional fees, such as for accounting or legal services, which are directly related to operating a business can be deducted as business expenses. However, legal fees incurred in acquiring business assets usually are not deductible the fees paid for defending or perfecting title, acquiring or selling property, or developing and improving property must be capitalized and added to the property’s basis. The personal portion of legal fees for producing or collecting taxable income, for keeping your job, or for tax advice may be deductible on Schedule A if you itemize deductions. The cost of preparing the portion of your income tax return relating to your business as a sole proprietor or a partner can be deducted as a trade or business expense.