Its Tax Time Youve Got Questions Weve Got Answers

Ottawa, Ontario

Canada Revenue Agency

The Canada Revenue Agency understands that the COVID-19 pandemic has affected the usual ways Canadians manage their taxes. The CRA is here to answer questions you may have regarding your tax affairs, and to help you successfully file your income tax and benefit return.

Here are the answers to the top questions were asked at tax time, as well as some answers about COVID-19 benefits. You can also check out our questions and answers about filing your taxes for help on COVID-19 benefits, and the tax filing process.

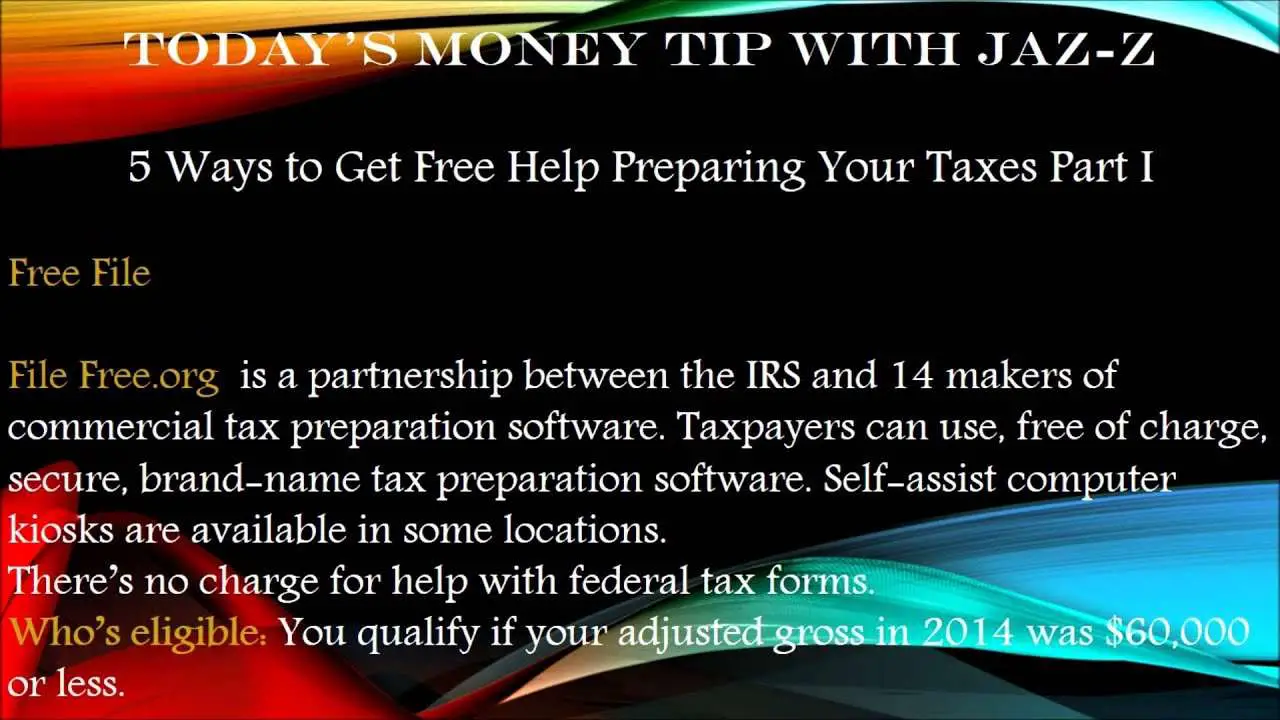

Volunteer Income Tax Assistance Program

This program offers free help to people who make $56,000 or less, the disabled and those who speak limited English. IRS-certified volunteers help prepare basic tax returns and electronic filing for those who qualify.

VITA sites during tax season are in places such as community centers, libraries, schools, and malls. To find one call 800-906-9887 or use the VITA Locator Tool.

Use The Wheres My Refund Toolbut Understand Its Limitations

The IRS encourages taxpayers to use the Wheres My Refund tool to check the status of their tax return instead of calling the agency. The tool displays your refund status for the most recent tax year the IRS has on file with one of three status notes: refund received, refund approved, or refund sent. Youll need to enter your Social Security number, filing status and the expected refund amount to access this information.

But the Taxpayer Advocate Service notes limitations to the tool: It doesnt explain why your refund is delayed, where the return is in the filing process, or steps you need to take to address the delay.

It just reflects that the return has been received, that the refund was approved, or that the refund was sent, the offices 2021 report to Congress, written by Collins, explained. For millions of taxpayers, that meant many months without any status updates, and some are still waiting for their refunds.

Customer service representatives often lack additional information that can put a taxpayer at ease, the report said. Particularly for taxpayers who need their refunds to pay for current living expenses, the absence of information can cause deep concern and sometimes panic, leading to more telephone calls that are just as unproductive.

Read Also: How To Do Taxes On Doordash

Proof Of Your Identity And Tax Status

If someone else is doing your taxes, you will need to show them your drivers license or state ID. If you are married and filing a joint return, both you and your spouse need to be there while the person is doing your taxes. You and your spouse need to sign the return before it’s filed.

If you are doing your taxes yourself, you need Social Security numbers or Individual Taxpayer Identification Numbers for yourself, your spouse, and your dependents.

Options For Tax Preparation

United Way of Central Alabama is providing tax services again this year. In response to the COVID-19 pandemic, however, we have established new processes to assist you with your taxes in a safe and secure manner.

Preparing Your Own Return

If you are interested in preparing your own return, MyFreeTaxes.com now offers FREE online software for your state and federal returns. There are no income limits for this service. Telephone support is available for prompt answers to any questions you may have.

If there are additional questions about getting taxes prepared for free, please call 2-1-1 or 1-888-421-1266.

Tax Preparation by United Way Volunteers

United Way of Central Alabama offers free volunteer tax preparation for households with annual income of $54,000 or less.

In order to safely serve you, United Way is offering a contact-free, online intake for volunteer tax preparation this year. For an appointment, or to request accommodations, please call 2-1-1 or 1-888-421-1266.

Who Qualifies for Free Tax Preparation?

- If you earn $54,000 or less per year, you qualify for free tax assistance provided by United Way. Call 2-1-1 or 1-888-421-1266 for appointment information.

- If you are interested in preparing your own returns, you can file online for free. There is NO income limit to file state and federal taxes at MyFreeTaxes.com.

What Information Do Tax Filers Need to Gather to be Ready for Tax Preparation?

How Do I Contact United Way for Free Tax Assistance?

You May Like: Do You Have To File Taxes For Doordash

Identity Theft And Unemployment Claims

If you collected unemployment benefits during the year, you will get a tax form from the Michigan Unemployment Insurance Agency called a 1099-G form. During the pandemic, some people have used stolen identities to collect money from unemployment benefits. If someone used your name to collect unemployment benefits, you will get a 1099-G form in the mail even though you did not get unemployment benefits.

The envelope with the 1099-G form will have instructions about what you should do if you were a victim of identity theft. After the UIA investigates the fraud claim, it will send a new 1099 form showing that you did not actually receive benefits. To learn more about this issue, visit the UIAs page about tax forms and identity theft.

How Do You Register For My Account

To register for My Account, go to canada.ca/my-cra-account and select CRA register.

You will need to provide:

- your social insurance number

- your current postal or zip code

- an amount you entered on your income tax and benefit return

If you previously registered for My Account to apply for COVID-19 benefits, you are encouraged to enter the security code you received in the mail to access all of My Accounts features.

You May Like: Do I Have To Pay Taxes On Plasma Donation

Submit Irs Forms By Fax

The IRS put an end to faxing and mailing tax transcripts in June 2019. Receiving forms and instructions by fax isn’t the best way to transmit sensitive information, but you can still fax some documentation.

Fax to the number listed on your CP06 audit notice if you have to transmit required supporting documentation during an audit of your tax return.

Tax Counseling For The Elderly

As the name implies, this federally funded program is for older taxpayers. Although it was set up to help people ages 60 and older and makes the elderly a priority, theres no enforced age limit to this free service. The tailored advice answers questions about pensions and retirement-related issues unique to seniors.

The AARP Foundation Tax-Aide program runs most TCE sites. To find one near you, use the AARP Site Locator Tool or call 888-227-7669.

You May Like: Dasher Tax Form

How Do I Connect With A Tax Expert In Turbotax Live

It’s easy to get help with TurboTax Live. As you prepare your taxes, you can quickly connect with one of our credentialed tax experts by selecting the Live Help icon.

The process is a little different if you’re using the TurboTax mobile app. We’ve got instructions for how to connect with a tax expert on the app.

Military Onesource Tax Resource Center

The Military OneSource tax resource center operated by the U.S. Defense Department provides free tax preparation software, live chat help, and referrals to military tax consultants for service members and some veterans. It also has a locator tool for VITA counselors with expertise in military tax issues coordinated through the U.S. military.

Recommended Reading: What Is The Sales Tax In Philadelphia

Connect With The Irs Online

One of the best ways to get the information you need is directly from the IRS website at IRS.gov. You can download almost any form or publication here. You’ll find a lot of information right at your fingertips, including answers to frequently asked questions, tax law changes, and even planning calculators. It’s not a substitute for talking directly with a tax expert, but the site can point you in the right direction when you need answers to basic tax questions.

As for that tax refund you’re expecting, there’s a special tool available to track its status, too. Just go to “Where’s My Refund?” and click on “Check My Refund Status.”

Need Tax Help Got Tax Questions

Weve been helping people with taxes for over 60 years. So we know a few things. Actually, we know everything about taxes. You can too. Here youll find tax tips, helpful tax information and incredibly useful tools.

Recommended Reading: Cook County Board Of Review Deadlines

What Is Your Balance Owing Or Where Is Your Refund

You can easily find your balance owing or refund amount by logging into My Account or the MyCRA mobile web app.

If you have a refund, you will also find the refund method, the date it was sent, and the amount refunded.

If you have questions about your refund, you can call the Tax Information Phone Service at 1800-267-6999.

What Is The Irs Fresh Start Program

The IRS Fresh Start is not really a single program, but rather a series of changes the IRS has made to the tax code. The IRS has implemented several programs around Fresh Start since 2011. The idea is to make it easier for individuals who owe back taxes to pay the IRS while avoiding a lien on their vehicle or home.

Today, the Fresh Start Program is no longer available, but many of the negotiating structures that were created for the program exist for taxpayers.

The program increased the threshold for a lien from $5,000 to $10,000. Taxpayers can also apply to have a lien withdrawn when their taxes owed are less than $25,000, and they agree to automatic installment payments. There are different tools available to help struggling individuals and small businesses pay off and/or eliminate some of their debt. The goal is to allow citizens to pay taxes without liens and excess fees. The current program is now called the Fresh Start Initiative, formerly named the Fresh Start Program.

Who Can Qualify for the Fresh Start Initiative?

Don’t Miss: Efstatus Taxact 2016

Does The Irs Forgive Tax Debt After 10 Years

This one is complicated, but yes, there technically is a statute of limitations on IRS tax collection. But it only goes into effect if specific criteria are met. Your tax debt can be canceled after 10 years if the IRS makes no effort to collect on your account and if you dont contact the IRS. However, this is not as simple as just waiting a decade without ever paying what you owe.

The date begins once you receive written notice from the IRS concerning what you owe. For example, if you filed your tax return on April 15th, 2019, and got a notice in the mail dated June 1, your statutory period would have begun on June 1st. The date is called the CSED . Some situations can also delay the CSED by halting the clock on the 10-year time frame. These include:

Filing for bankruptcySubmitting an offer in compromise to settle back taxesFiling a lawsuit against the IRSHaving your assets held in court custody due to divorce, judgments against you, etc.

Having your assets held in court custody due to divorce, judgments against you, etc.It takes six months after bankruptcy cases settle to get the clock restarted on the CSED. This means the IRS has more time to take collection actions against you, and the IRS will tend to ramp up these efforts before the statute of limitations expires.

Does State Tax Debt Ever Go Away?

Should You Try Riding out The Statute of Limitations?

Who Can I Call With A Tax Question

Did you know the IRS reports that it gets more telephone calls the day after Presidents Day than any other day of the year?

If youre one of the hopefuls directly calling the IRS, dont hold your breath. The agencys funding issues and shift in resources to handle new tax law and backlogs means its likely your call will go unanswered.

For perspective, a 2019 IRS watchdog report noted that in the first week of the 2019 tax season, callers routed to an IRS reached a person 38 percent of the time. This was after an average wait of 48 minutes. The wait times are increasing, and the odds of reaching an actual person are decreasing. Youre probably ready to hear an alternative solution. Dont worry, you have a lot of much less painful options.

Find Online Help

Check the IRS website. A major reason taxpayers call the agency is to ask about the status of their refund. For that, you can go to Wheres My Refund? on the IRS website . The page is updated once every 24 hours. Backlog from the shutdown notwithstanding, the agency is still saying it will process most returns within 21 days, so wait about three weeks before you start checking. Always check the IRS FAQ page before picking up the phone.

Try a free DIY Tax Forum

Get In-Person Assistance

If youd rather not jump through all of the IRS hoops to get in-person help, youll likely find dozens of professional service options in your area that provide in-person help.

Free Community-Based Help Centers

Read Also: Is Doordash A 1099

Free Tools To Help With Taxes

The IRS provides free publications, forms, and tools to help taxpayers:

-

Help and Resource Center – Learn about the many free services and resources that the IRS offers to taxpayers.

-

Interactive Tax Assistant – Use this tool to find answers to your general tax questions.

-

Tax Tools – Find interactive forms, calculators, and other helpful tools.

-

Choose a Tax Preparer – Get tips for finding a tax preparer with the credentials and experience to handle your tax needs. Learn how to file a complaint if your preparer has acted improperly.

-

Forms and Publications – Get tax forms and instructions. You can also search for specific titles or product numbers. The IRS also offers forms and publications for taxpayers with visual impairments.

Resources From The Irs

- Following major tax law changes, the IRS is urging taxpayers to use the IRS Withholding Calculator to check their tax withholding and make sure they have the right amount of tax taken out of their pay for their personal situation. Having too little tax withheld could mean a tax bill or a penalty. And with the average refund topping $2,800, some may prefer to get more money in their pay now. The earlier people check, the more time there is for withholding to take place evenly during the rest of the year. Additional information available in and .

Recommended Reading: Doordash Payable Account

Where Do You Get Your Tax Slips

Tax slips for the filing year are prepared by your employer or from other payers, such as your pension providers or financial institutions. If youve lost a slip or havent received one, ask your employer/payer for it.

For COVID-19 benefits recipients, you will receive a T4A and/or a T4E tax slip in the mail with the information to enter on your return. Residents of Quebec will receive both a T4A and RL-1 slip.

Registering for My Account may give you access to copies of your tax slips online. My Account will also give you access to use Auto-fill my Return, which quickly fills in parts of your return with the information the CRA has on file, including the tax slips for your COVID-19 emergency benefits.

If youre still missing information, you can use pay stubs and statements to estimate the amount of income to use when completing your income tax and benefit return. To avoid penalties and interest, file your return by the due date.

If youre looking for slips from previous years, you can get them through My Account.

Free Online Tax Preparation Programs

The IRS also has free online tools to prepare and file your federal tax return. If your income is $73,000 or less, you may be able to use one of the free online tools on the IRS Free File site to prepare your federal and possibly your state tax returns. These tools will guide you through filling out your tax return. If your income is more than $73,000, you can prepare and file your taxes for free using IRS Free Fillable Forms. This site will allow you to prepare and file your taxes online, but you will need to follow IRS instructions and fill out the forms on your own.

Read Also: Doordash Tax Withholding