New York Sales Tax Nexus

Businesses that have a physical location in the state of New York are required to collect sales tax. This is known as “nexus”. Most other businesses will not have New York sales tax nexus, except for the following:

- Businesses that sell tangible personal property and make 12 or more deliveries of these products using their own vehicles. In other words, delivery by common carrier or LTL providers do not count toward these deliveries.

- You have employees or other representatives in state who solicit sales or products or services.

- You solicit the sale of tangible personal property or services via catalog or other advertising materials, and have some additional connection with the state.

- If you are associated with a vendor in-state, via an ownership test. (See this PDF for complete details.

- If you have New York affiliates, and your sales to New York buyers exceeds $10,000 in a calendar year, you will incur click-through nexus, and be required to collect and remit sales tax, the same as an in-state retailer.

Are Shipping & Handling Subject To Sales Tax In New York

In the state of New York, the laws regarding tax on shipping and handling costs are relatively simple. Essentially, if the item being shipped is taxable, and if you charge for the shipping as part of the order, then the shipping charge is considered to be taxable. If the item is not taxable, then the shipping is not seen as being taxable either. If the items being shipped are promotional materials, and the shipping charge is separately stated on the invoice, then no tax is applied to the shipping costs.

Corporation Tax Changes In 2019 Budget

This summary highlights the corporation tax changes that were part of the 2019- 2020 New York State budget. Most notably, several tax law provisions were amended, including the contributions to the capital of a corporation, entire net income for stock life insurance companies, and unrelated business taxable income. Additionally, electronic filing and payment mandates have been extended through December 31, 2024, and the tax shelter penalty and reporting requirements have been extended through July 1, 2024.

Recommended Reading: Does Doordash Take Taxes

How To Identify The Rate And Compute Sales Tax

Example: Taxpayer A lives in Saratoga County and travels to a mall located in Albany County to purchase a new television. The sales tax due is based on the combined state and local rate in effect in Albany County because that is where Taxpayer A took ownership and possession of the television, even though the television will be used in Taxpayer A’s home in Saratoga County.Example: Taxpayer B lives in Dutchess County but works in White Plains in Westchester County. At lunchtime, they bring their car to a shop near work to have the oil changed. Sales tax will be collected at the combined state, Westchester County, City of White Plains, and MCTD rates because those are the combined rates in effect where they took possession of the car on which the maintenance service was performed. If the repair shop delivered the car to them in Dutchess County, then the Dutchess County rate would have applied instead of the Westchester County and White Plains rates. The MCTD rate would still apply since Dutchess County is in the MCTD. Example: Taxpayer C shops online and orders a new tea pot from an Internet retailer. The tea pot will be delivered to their home in Erie County. Taxpayer Cs purchase will be subject to sales tax at the combined state and Erie County rate since the tea pot is being delivered to them there.

You can use two resources to find the correct combined state and local sales tax rates:

Other Sales Taxes And Fees

Certain businesses may be required to collect one or more of the additional sales and use taxes and fees described below. These taxes and fees must be collected and remitted in the same manner as the state and local sales taxes. The sales tax returns and schedules have designated lines and reporting codes for you to report the additional sales taxes and fees separately.

Read Also: Is Doordash Taxable Income

Check On Sales Tax Exemptions

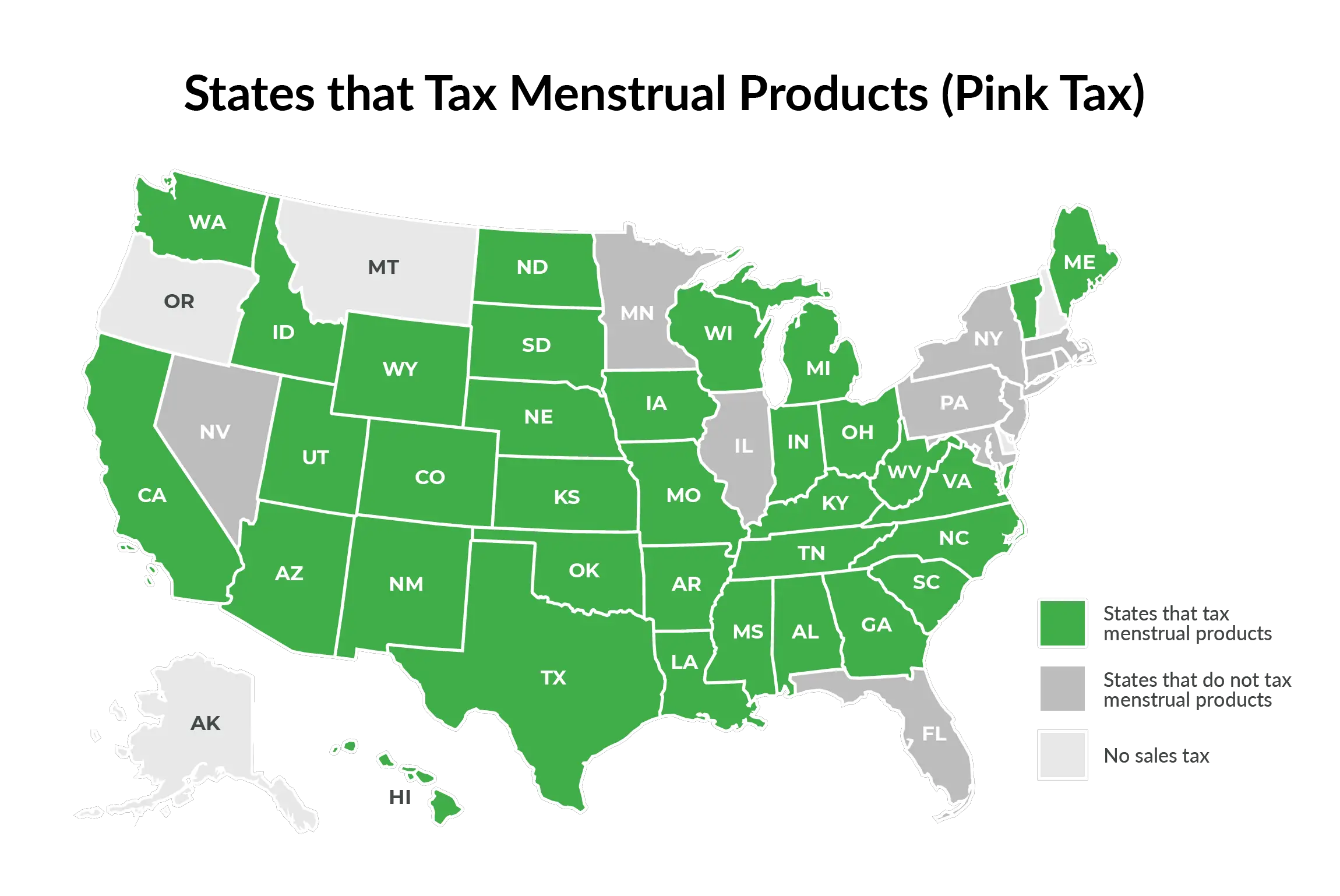

In some instances, the products you are selling may be exempt from sales taxes. Some products, like food and prescription medications, may be exempt from sales tax check with your state if you think your products might be exempt.

You may also want to look into getting a sales tax certificate if you buy products for resale. The process of getting this exemption certificate and the requirements are different for each state, and it applies to

- Products purchased for resale and raw materials

- Some non-profits in some states

If someone wants to buy from you and says they are a reseller or that they are buying for resale, they need to show you a valid resellers permit. Make sure to keep a copy of this permit in case you are questioned by state sales tax agents.

New Jersey And New York Propose Taxes On Financial Transactions

New York has proposed Assembly Bill 5215 and Senate Bill 3980, which would impose a new tax on the purchase of securities having a New York connection. Security would be broadly defined to include shares of stock, partnership interests, bonds, notes and derivative financial instruments, such as options, futures contracts, etc. Varying tax rates would apply to covered transactions, and a hierarchy would apply to determine who pays the tax . Similarly, New Jersey Assembly Bill 4402 and Senate Bill 2902 would impose a tax on persons or entities that process 10,000 or more financial transactions through electronic infrastructure located in New Jersey during the year. The tax rate would be $0.0025 per financial transaction processed through electronic infrastructure in New Jersey. For specific details, each states respective proposals should be reviewed.

You May Like: Efstatus Taxact Com 2016

New York State Sales Tax

In the state of New York, the sales tax that you pay can range from 7% to 8.875% with most counties and cities charging a sales tax of 8%.

The sales tax rate in New York actually includes two separate taxes: sales tax and use tax. The state groups these together when talking about sales tax and both taxes are the same rate so it doesnt matter where you purchase things. New York sales tax is currently 4%. Each county then charges an additional sales tax between 3% and 4.5%.

Counties in the metropolitan commuter transportation district also collect a sales tax of 0.375%. This applies to all taxable sales within the counties of Bronx, Kings , New York , Queens, Richmond , Dutchess, Nassau, Orange, Putnam, Rockland, Suffolk, Westchester.

| Sales Tax in New York Counties |

| County |

| 8% |

Services Subject To Tax In New York City

New York City collects sales tax on certain services that the state doesnt tax. Examples include beautician services, barbering, tanning and massage services. The city also charges sales tax at health and fitness clubs, gymnasiums, saunas and similar facilities. If youre trying to improve your credit, keep in mind that New York City charges sales tax on most credit reporting services.

Read Also: Filing Taxes With Doordash

What Is Exempt From Sales Tax In New York

The Tax Law exempts purchases for resale most sales to or by the federal and New York State governments, charitable organizations, and certain other exempt organizations sales of most food for home consumption and sales of prescription and nonprescription medicines. Sales tax also does not apply to most services.

New York Releases Advisory Opinion On Sales For Solar Energy Systems

The New York Department of Taxation and Finance issued an Advisory Opinion on the application of sales and use tax on the sale and installation of residential and commercial solar energy systems. Petitionerstwo partnerssold commercial and residential solar energy systems to customers primarily located in upstate New York. One partner procured and provided components required for the installation of the solar energy systems, and the other partner was responsible for the transportation and installation at customers sites. The Department concluded that retail sales and installations of both residential and commercial solar energy systems were exempt from sales tax but are exempt from local tax only if the locality has enacted the exemption. Please see New York Advisory Opinion No. TSB-A-20S for further discussion.

Don’t Miss: Appeal Cook County Taxes

How To Claim The Salt Deduction On Your 2020 Taxes

You can only claim the state and local tax deduction if you itemize deductions on your tax return. That means you do not take the standard deduction. Most tax filers do not qualify to itemize because the standard deduction is worth more than itemizing for them.

When you itemize, you can claim the SALT deduction on Line 5 of Schedule A. This line is called âState and local taxes.â For older tax returns, the line numbers on Schedule A are different, but very similar.

Learn more in our guide to filing your taxes

New York State Extends Income Tax Filing Deadline

New York states income tax filing deadline is being moved to July 15 to comply with the federal governments decision to push back the traditional filing date due to the coronavirus outbreak.

Disclaimer: Please note this is the information that is readily available at this time, it is subject to change so please consult your Withum tax advisor.

You May Like: How To Pay Taxes For Doordash

New York Holds Purchase And Lease Of Picasso Painting Was Not A Sale For Resale

An LLC taxpayerowned by two family trustspurchased a one-half interest in a Picasso painting. The other 50-percent purchaser was the father of the two sons in whose name the trusts were established. Sales tax was paid on the transaction by both purchasers. A few years latersubsequent to a lease of the painting structured between the LLC and the fatherthe LLC sought a refund for the sales tax it paid on its original purchase of the painting on the grounds the purchase was a sale for resale. Retroactively going back and using the lease as a basis for sale for resale argument was not successful. New York reasoned that in order to be a sale for resale, the taxpayer would have needed to show its sole purpose for purchasing the painting was to lease it. Here, however, the additional purpose for purchasing the painting was because it was an investment and added to the taxpayers art collection.

May 2, 2020

When To File Taxes In New York

When you register for sales tax, New York will assign you a certain filing frequency. Youâll be asked to file and pay sales tax either monthly, quarterly, or annually.

Usually the frequency they choose is based on the amount of sales tax you collect from buyers in New York. High-revenue businesses file more frequently than lower volume businesses, for example.

New York sales tax returns are due on the 20th day of the month following the reporting period. If the due date falls on a weekend or holiday, then your sales tax filing is generally due the next business day.

Don’t Miss: Do Doordash Drivers Get Taxed

New York City Taxes On Certain Services

New York City imposes local sales tax on certain services performed or delivered in New York City, including:

- beautician, barbering, and hair restoring

- tanning

You must file Schedule N with your sales tax return to report sales and remit the sales tax due on the above services that fall within the special rules for New York City sales. Note: Interior decorating and design services performed within New York City are subject to the state portion of the sales tax only and are not subject to the New York City local sales tax. For more information see Tax Bulletin Interior Decorating and Design Services .

Nyc Releases Changes For Business Tax Filers

The New York City Department of Finance has released a new issue of its Business Tax Practitioner Newsletter, which discusses the Tax Cuts and Jobs Act as it relates to changes for business tax filers including reporting IRC § 965 income, foreign-derived intangible income , and global intangible low-taxed income . In addition, the newly amended Real Property Income and Expense rules were discussed with respect to the increased penalties for owners of income-producing property who fail to file RPIE statements for three consecutive years. The penalty is increased to 5% of the final actual assessed value for the calendar year in which such statement was to be filed.

Read Also: Plasma Donation Taxable Income

Who You Bought The Used Car From

If you buy a used car from a relative, such as a parent or step-parent, child or step-child, sibling or spouse, you will enjoy a sales tax exemption. However, the seller must also not be a registered auto dealer. And dont forget to file a DTF-802 Form when you purchase your vehicle from a relative or any other individual.

If your dealer factors in the sales tax at the time of purchase, you dont have to pay it again when registering your vehicle. However, if the auto dealer did not include it in the purchase price, you must pay what you owe during registration.

Recommended Reading: How To Appeal Property Taxes Cook County

Sales Tax Jurisdiction And Rate Lookup

With certain limitations, sales tax rates can be found on the Tax Department Web site, using the address and ZIP code of your customers, by visiting Find sales tax rates. Be sure to review Limitations on Use located within the lookup for an explanation of the limitations.

Publication 718, New York State Sales and Use Tax Rates by Jurisdiction

Publication 718 lists the combined general tax rates by jurisdiction, and the corresponding reporting codes.

Recommended Reading: Reverse Ein Lookup

New York Issues Guidance On The Application Of Tax Credits On Combined Returns

New Jersey has indicated that with respect to combined returns, tax credits belong to the taxable member that earned them, unless a specific statute authorizes the tax credit to be earned or awarded at the group level. Any credit carryover available for future use belongs to the taxable member that originally earned the credit. If a member leaves the group, that member takes with them any tax credit/carryforward they generated. Any carryforward must be reduced by the amount that is used by the group and/or member. For specific details, please consult New Jersey Division of Taxation Technical Bulletin TB-90 .

Jurisdiction Reporting Codes And Rate Changes

When you file your sales and use tax returns, you must report the sales tax collected for each jurisdiction separately. The Tax Department has assigned a specific reporting code for tax due for each local jurisdiction, which allows for proper accounting of the tax collected. As long as you use Sales Tax Web File or use the sales tax returns available from the Tax Department for the reporting period you are filing, the correct codes and rates will be provided to you.You can learn about rate changes in a few different ways:

Subscription service – We encourage you to register to receive e-mail notifications related to sales tax, including rate changes. These e-mail notifications include links to recently updated Web content and publications that list sales tax rates for localities.

Read Also: Do You Get Taxed For Doordash

Ny Provides Guidance To Tax Professionals Amidst Pandemic

A newsletter was recently issued by The New York Department of Taxation and Finance reminding tax professionals of the information on its website to provide relief during the COVID-19 pandemic. This information includes the extension of the income tax filing and payment due date to July 15, 2020, for individuals, fiduciaries, and corporations. Tax professionals should also have clients contact the Department if they cannot make their regularly scheduled tax payments due to COVID-19. The Department reminds tax professionals that the monthly sales tax return is due on May 20, 2020. For additional information, go to the Q& A section here.

Publication 873 Sales Tax Collection Charts For Qualified Motor Fuel Or Diesel Motor Fuel Sold At Retail

Publication 873 provides charts that show the amount of the local sales tax in the pump price of a gallon of automotive fuel. The charts in this publication apply only to jurisdictions that continue to impose sales tax on automotive fuels using a percentage sales tax rate. The charts in this publication are for use in verifying the sales tax due, not to establish pump prices.

Note: A Tax Bulletin is an informational document designed to provide general guidance in simplified language on a topic of interest to taxpayers. It is accurate as of the date issued. However, taxpayers should be aware that subsequent changes in the Tax Law or its interpretation may affect the accuracy of a Tax Bulletin. The information provided in this document does not cover every situation and is not intended to replace the law or change its meaning.

Recommended Reading: Do They Take Taxes Out Of Doordash

What Is Capital Gains Tax In New York State

In New York, capital gains are taxed at a rate of 8 percent, with the exception of in-state capital gains. As income, the state of Oregon imposes an excise tax of nine percent on capital gains. Long-term capital gains earned by an individual that are held up to three years must be reported on his or her income tax return.

File Sales Tax Returns

If youre registered for sales tax purposes in New York State, you must file sales and use tax returns quarterly, part-quarterly , or annually with the department. Even if your business did not make any taxable sales or purchases during the reporting period, you must file your sales and use tax return by the due date.

If you have taxable receipts of more than $500,000 or have an annual liability for prepaid sales tax on motor fuel and diesel motor fuel exceeding $5 million, you are required to participate in the departments PrompTax program. Other vendors may request to participate in the PrompTax program on a voluntary basis.

If you need to know how to file sales tax returns, Tax Bulletin Filing Requirements for Sales and Use Tax Returns explains the filing requirements. You can Web File all forms and schedules, including:

- monthly, quarterly, and annual sales tax returns

- PrompTax filers submitting Form ST-810

- no-tax-due returns and final returns

- the Sales Tax Record of Advance Payment

Recommended Reading: Protest Property Taxes In Harris County