Almost Anyone: Credit Karma Tax

Every year, we also highlight Credit Karma Tax. This tax software is absolutely free. It wont upsell you on any featuresit doesnt even offer paid features.

Credit Karma offers a free credit report service that makes money by showing you personalized offers for financial products. Credit Karma Tax makes money in a similar way.

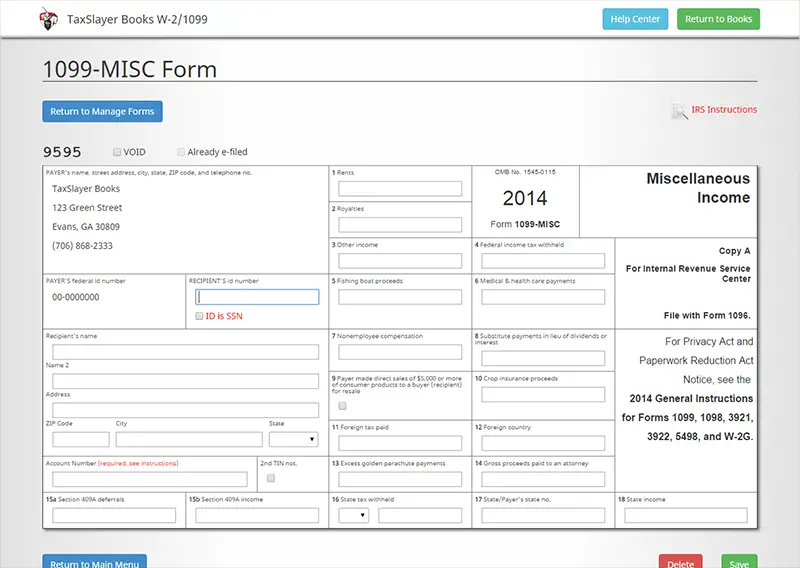

Not everyone can use this software, howeverCredit Karma Tax doesnt support a variety of more complicated situations and forms. For example, you cant file part-year state returns, multiple state returns, or nonresident state returns. You cant file forms like Form 1116 for the Foreign Tax Credit or Form 2555 for Foreign Earned Income. Here are the situations and forms that Credit Karma Tax doesnt support.

Note: Intuit, makers of TurboTax, now owns Credit Karma. Intuit completed its acquisition in December of 2020. However, the free Credit Karma Tax software is still available.

RELATED:How to View Your Credit Report For Free

Types Of Taxable Income

You have to report any taxable income you earn inside and outside Canada when you file your tax return. This includes:

- any full-time or part-time work

- self-generated income

- rental income, including renting out a portion of your home

- investments

- your pension

You do not have to report certain non-taxable amounts as income, including:

- allowances

- elementary, secondary and post-secondary school scholarships

File Your Tax Return For Online

This article is provided for informational purposes only. It does not cover every aspect of the topic it addresses. The content is not intended to be investment advice, tax, legal or any other kind of professional advice. Before taking any action based on this information you should consult a professional. This will ensure that your individual circumstances have been considered properly and that action is taken on the latest available information. We do not endorse any third parties referenced within the article. When you invest, your money is at risk and it is possible that you may lose some or all of your investment. Past performance is not a guarantee of future results. Historical returns, hypothetical returns, expected returns and images included in this content are for illustrative purposes only.

We provide investment services and other financial products through several affiliates.

Wealthsimple Trade is offered by Canadian ShareOwner Investments Inc. , a registered investment dealer in each province and territory of Canada, a member of the Investment Industry Regulatory Organization of Canada and a member of the Canadian Investor Protection Fund , the benefits of which are limited to activities undertaken by ShareOwner.

Wealthsimple Invest and Work are offered by Wealthsimple Inc., a registered portfolio manager in each province and territory of Canada. Assets in your Invest and Work accounts are held with ShareOwner.

You May Like: Http Efstatus.taxact.com

What Is Irs Free File

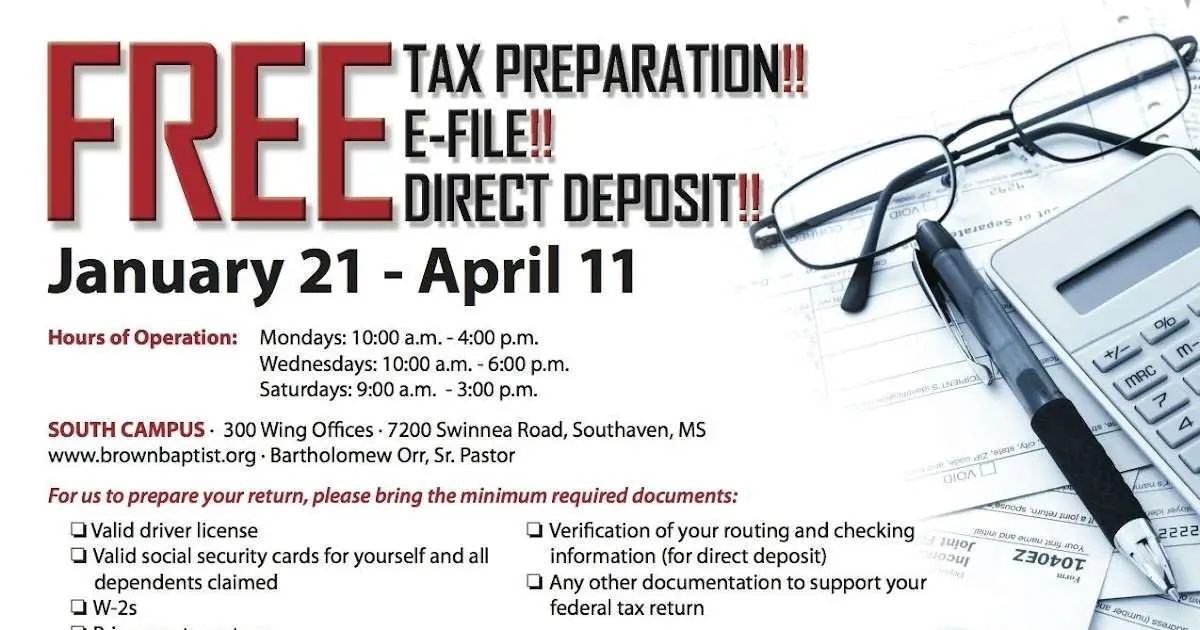

The IRS Free File Program is a public-private partnership between the IRS and many tax preparation and filing software industry leaders who provide their brand-name products for free. It provides two ways for taxpayers to prepare and file their federal income tax online for free:

- Traditional IRS Free File provides free online tax preparation and filing options on IRS partner sites. Our partners are online tax preparation companies that develop and deliver this service at no cost to qualifying taxpayers. Please note, only taxpayers whose adjusted gross income is $72,000 or less qualify for any IRS Free File partner offers.

- Free File Fillable Forms are electronic federal tax forms you can fill out and file online for free. If you choose this option, you should know how to prepare your own tax return. Please note, it is the only IRS Free File option available for taxpayers whose income is greater than $72,000.

Find what you need to get started, your protections and security, available forms and more about IRS Free File below.

About IRS Free File Partnership with Online Tax Preparation Companies

The IRS does not endorse any individual partner company.

- A copy of last year’s tax return in order to access your Adjusted Gross Income

- Valid Social Security numbers for yourself, your spouse, and any dependent, if applicable

Income and Receipts

Other income

ACA Filers

File Electronically

Contact Information

Information Safety

Prior-Year Returns

Free Canadian Tax Software

TurboTax Free costs $0. File your simple Canadian tax return for free with no hidden fees.

Follow a simple step-by-step process to fill out your return and our software does the math for you and stores your information to use on next year’s return.

Save time by importing your tax slips into your return from the CRA with Auto-fill my return.

TurboTax Free protects all your personal tax info so you can file your taxes confidently.

Browse our TurboTax Community forum 24/7 or post a tax question for our users and experts.

TurboTax Free is ideal for simple tax situations:

Employment and unemployment income

Why customers love TurboTax Free

Read Also: Philadelphia Pa Sales Tax

Welcome To Maine Fastfile

Maine Revenue Services solution to fast and secure tax filing. The Maine Fastfile service provides three options:

Modernized e-File e-File using tax preparation softwareThis service is offered through the IRS and provides one stop processing of federal and state returns. This is the do it yourself option through the purchase of tax preparation software either over-the-counter or online, prepare your own return and press send to e-file. Your return is sent through safe and secure channels, not via e-mail. Prices do vary so shop around .

OR e-File through a paid tax professional

Find a tax professional you trust to prepare and e-file your return. Nearly all tax preparers use e-file now and many are now required by law to e-file. But it’s still a good idea to tell your tax preparer you want the advantages of e-file your refund in half the time, or if you owe, more payment options.

Maine i-File i-File free for Maine taxpayersThis service is available for filing your individual income tax return including the Maine property tax fairness credit. The advantages of Maine i-File are:

Certain restrictions apply. See the directions page of the i-File application for more information.

Choose A Netfile Certified Tax Software

You may have an accounting degree, but the CRA will still not allow you to go on its site and file your tax return through its NETFILE system. For that, youll need to choose from one of many online tax preparation software available. Naturally, to keep the riff raff from stealing any of your financial information, the CRA is pretty rigorous about kicking the tires of the companies that it allows to access NETFILE, the system used for filing to the government electronically. In fact, you can easily access a list of all certified software on the CRAs website. If youre at all concerned about bogus providers, use one of the links off the CRA page to link directly to one of the dozens of certified services.

Are all services the same? In one important way, they are. The certification process that the CRA subjects all electronic suitors to assure a uniformity in the results of the returns. In other words, no company offers a method to scoring a bigger refund than any other. They do, however, differ in other respects. Heres a few things worth checking on.

Read Also: Doordash Tax 1099

Get Your Federal Tax Refund Fast

Not only have we tried to make it as painless as possible to prepare and file your return, filing electronically will also get your tax refund much faster. After all, it’s your money. Why wait any longer than necessary to get it back.

At E-file.com, we work to get your federal tax refund as fast as possible thanks to the electronic filing program with the IRS. Filing electronically with the IRS and selecting to have your refund direct deposited to your bank allows you to get your refund as fast as possible.

Freefile Program For Individual Income Tax

The State of Arkansas is a member of the Free File Alliance.

The Free File Alliance is a group of software providers working with the State of Arkansas and the IRS to donate free tax preparation for taxpayers.

What this means to Taxpayers is that if you meet the qualifying criteria, you can prepare and efile your tax return for FREE.

eFile Online Providers

The following companies provide preparation and electronic filing services for both Arkansas and Federal individual income taxes. The services these companies offer allow taxpayers to prepare their tax returns with their personal computer, giving them the option of filing their returns electronically or printing paper tax returns for mailing. These companies have asked the Department of Finance and Administration to provide links to their websites, and we have done so as an accommodation to our taxpayers.

The State of Arkansas does not specifically endorse or recommend any of these sites. It is your choice as to whether to employ the service of any of these companies. If you have any specific questions concerning the prices or services offered, contact the appropriate company listed below. All website links open in new windows.

Online Taxes at OLT.com would like to offer free federal and free state online tax preparation and e-filing if your Federal Adjusted Gross Income is between $16,000 and $72,000 regardless of age.

Activity Duty Military with adjusted gross income of $72,000 or less will also qualify.

Read Also: Can Home Improvement Be Tax Deductible

How To File Your Federal Tax Return For Free

In the past, I have gone to the IRS free file webpage, because they have links to a bunch of tax preparers that offer free tax return filing . Some of them offer a state return to be filed for free as well, but most dont.

If you are interested in this option, you will have to use the links on the IRS page in order to get the free efile deal they are offering. Many of the tax preparation websites listed will not offer you the free efile if you go directly to their website.

Update Your Tax Software

Tax software must be certified by NETFILE every year.

Check the software list above to confirm that your software is certified for the year you need. If you are using uncertified software or an older version of the software, you may need to update or download a certified version from the developer.

Information on how to update your software is available on the developer’s website or from within the software itself.

Don’t Miss: How Do You Pay Taxes With Doordash

Use The Smartest Software You Can Find

What if you went to a shrink who every week introduced himself and started the session by saying, Tell me about your mother. Youd probably find another therapist, no? Your tax software is the same way. It should ideally know everything about you and remember it in perpetuity. When you sign in, it should automatically import some of your data from your previous return into your current year tax return. It will save you a lot of time and also greatly reduce the chance of data entry errors. The smartest software will also be able to recommend strategies that will save you money, for instance suggesting that you should consider carrying forward deductions that wont help you on your current tax return but will in coming years.

How And When To File Your Tax Return

Learn how to fill out your return using tax preparation software or on paper.

The deadline for filing personal income tax returns and paying outstanding income tax is . After April 30, penalties and interest start to apply to any outstanding balance owed.

If you are self-employed or filing for someone who has passed away, please see the CRAs website for filing deadlines.

Don’t Miss: Is Doordash A 1099

General Information About Individual Income Tax Electronic Filing

Filing electronically is a fast growing alternative to mailing paper returns. The Missouri Department of Revenue received more than 2.7 million electronically filed returns in 2019. Convenience, accuracy, and the ability to direct deposit your refund are just a few of the reasons why electronic filing is becoming one of the Department’s most popular filing methods.

Paid Tax Software Some With Free Offerings

- Each Tax $5.99 first return, $3.99 thereafter

- Fast and Easy Tax $10.99 or free if income under $20,000. Android/iOS apps available.

- TaxTron Free if $31,000 or under. $12.99 if over

- TurboTax Online Free if a simple tax situation

- UFile Online $19.95 and up

- WebTax4U Free if submitting non-employment income. $13.99 otherwise.

From all of these, I suggest you use Studio Tax. Ive been using it for years without any issues. Its free with no ads and is easy to use. They also have a Windows and Mac version. Although it is free, there is a maximum of 20 returns you can file. Not sure why you would need that many anyway.

Studio Tax can also connect to your Revenue Canada account and auto-fill in your slips!

Also Check: Doordash Deductions

Filing Your Tax Return

What you need to know about filing your personal income tax and benefit return.

Get help this tax season with the Ontario Child Care Tax Credit and the Low-Income Workers Tax Credit.

Save your receipts for the new Seniors’ Home Safety Tax Credit in 2021, which you can apply for during the 2022 tax season.

You may be eligible for tax credits and benefits to help you with living costs.

List Of Commercial Websites And Software Providers

We have authorized the following companies to provide software or websites for preparing and filing taxes. These companies have completed the authorization process. Testing occurs in November and December of each year. The Tax Commission does not endorse any specific product or website.

In the list below, No means the vendor does not support this form.

| Company Name |

|---|

Read Also: How To Get Tax Form From Doordash

Free File Is Now Closed

Check back January 2022 to prepare and file your Federal taxes for free.

IRS Free File lets you prepare and file your federal income tax online for free. File at an IRS partner site with the IRS Free File Program or use Free File Fillable Forms. It’s safe, easy and no cost to you for a federal return.

To receive a free federal tax return, you must select an IRS Free File provider from the Browse All Offers page or your Online Lookup Tool results. Once you click your desired IRS Free File provider, you will leave the IRS.gov website and land on the IRS Free File providers website. Then, you must create an account at the IRS Free File providers website accessed via Irs.gov to prepare and file your return. Please note that an account created at the same providers commercial tax preparation website does NOT work with IRS Free File: you MUST access the providers Free File site as instructed above.

Can I File My Taxes Online For Free If Im A Non

Yes. TurboTax makes it easy to file your Candian tax return as a non-resident. In fact, if youre a non-resident you can use any of the TurboTax Online products, including TurboTax Free. For more info, read about How Residency Status Impacts Your Tax Return

With more than 20 years experience helping Canadians file their taxes confidently and get all the money they deserve, TurboTax products, including TurboTax Free, are available at www.turbotax.ca.

Don’t Miss: Doing Taxes For Doordash

How Income Tax Works

Federal and Ontario income taxes are paid to the Canada Revenue Agency , which is part of the federal government.

Income tax is commonly taken off your pay by your employer, or off your pension, and sent directly to the CRA. You may also have to calculate the tax you owe and send a payment to the CRA.

Each year, you should file a tax return with the CRA to:

- report the income youve made

- ensure youve paid the correct amount of income tax

- access tax credits and benefits

Learn more about how much tax you should pay on each portion of your income.

Why File Your Itr Electronically

Aside from the convenience, filing your ITR electronically can save you up some time because you no longer need to fill out three copies of your income tax return. You also dont need to do any computation as the software will do it for you, making it less prone to human error.

You can also file your ITR electronically at any time of the day, even during the Holy Week break. You dont even have to go out of your home to file your ITR, as long as you have a desktop computer or laptop and an internet connection.

ALSO READ:

Recommended Reading: Efstatus.taxact 2015

Make Sure Youve Got Online Access To The Cra

Every Canadian taxpayer hoping to file online needs to be able to access My Account through the CRA, which the agency explains is a secure portal that lets you view your personal income tax and benefit information and manage your tax affairs online. There are two ways to sign in. The first is you have an account with one of the sixteen big banks the CRA calls sign in partners. If you can access your account online, you can easily use that sign in info to get directly into the My Account section. The second method is by using a CRA user ID and password to log into the CRA website. If you dont have a login and password register for one here. To confirm you are indeed you, theyll ask for your social insurance number as well as one of the figures from a past T4 slip.