Will I Save Money

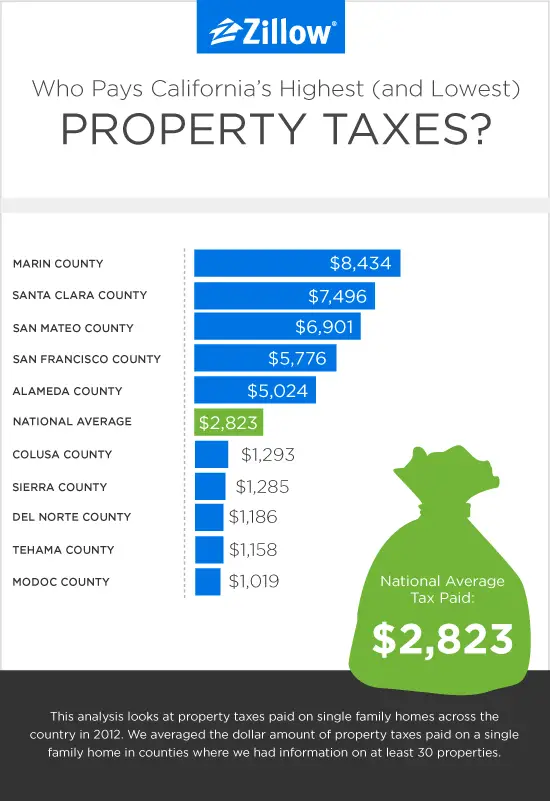

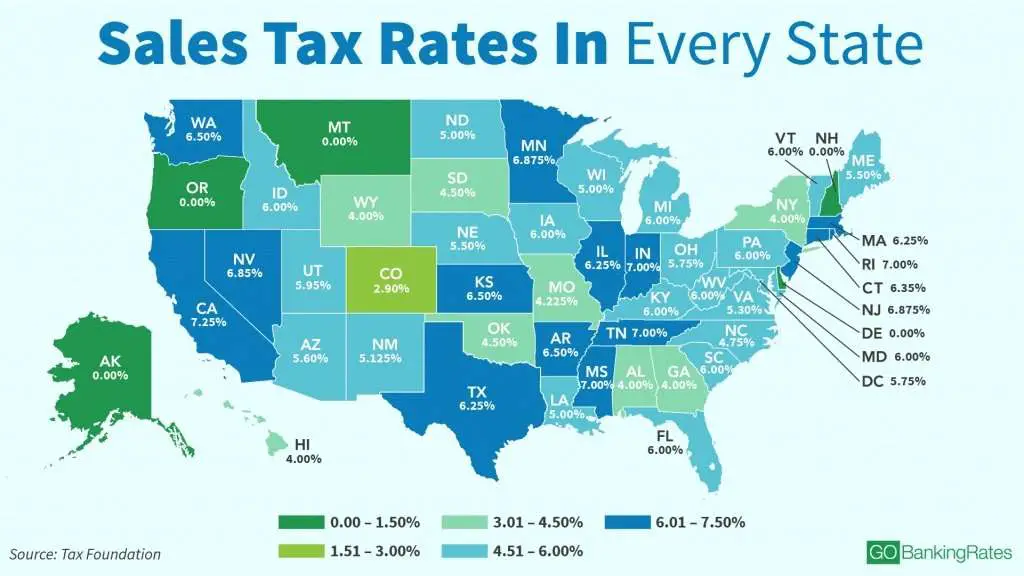

Sales tax varies by state, but overall it will add several hundred, or even a thousand, dollars onto the price of buying a car. If you are legally able to avoid paying sales tax for a car, it will save you some money.

For example, sales tax in California is 7.25%. If you purchase a used Honda Civic for $10,000, you will have to pay an additional $725 in sales tax.

California Sales Tax Overview

Sales tax is a tax paid to a governing body on the sale of certain goods and services. California first adopted a general state sales tax in 1933, and since that time, the rate has risen to 7.25 percent. On top of the state sales tax, there may be one or more local sales taxes, as well as one or more special district taxes, each of which can range between 0.1 percent and 1 percent. Currently, combined sales tax rates in California range from 7.25 percent to 10.25 percent, depending on the location of the sale.

As a business owner selling taxable goods or services, you act as an agent of the state of California by collecting tax from purchasers and passing it along to the appropriate tax authority. As of July 1, 2017, sales and use tax in California is administered by the California Department of Tax and Fee Administration . Previously, it was administered by the California State Board of Equalization.

Any sales tax collected from customers belongs to the state of California, not you. Its your responsibility to manage the taxes you collect to remain in compliance with state and local laws. Failure to do so can lead to penalties and interest charges.

When tangible personal property is purchased in California, sales tax is generally collected by the retailer at the point of sale. Should it not be collected or if goods are purchased out of state and no tax is collected, a use tax is likely due and it is up to the buyer to file it.

What Are Californias Sales Tax Deadlines

When you firt received your sales tax permit from the state of California, you were assigned a payment schedule. This schedule is either monthly, quarterly, or annually.

The following due dates apply to California sales tax returns. The due date is noted for each period for monthly, quarterly, and annual reporters. If a due date falls on a Saturday, Sunday, or legal holiday, then the return is due the following business day.

Monthly: Due the last day of the month following the reporting period month.

| Period |

|---|

You May Like: How Do I Protest My Property Taxes In Harris County

Digital Goods Or Services

A digital good or service is anything electronically delivered, such as an album downloaded from iTunes or a film purchased from Amazon.

California State does not require businesses to collect sales tax on the sale of digital goods or services.

However, California has one exception to this policy. Businesses must collect sales tax on pre-written computer software that is sold online.

Determining California Sales Tax Naxus

Any business with a physical location in California has nexus, and is therefore required to register to collect sales tax, and to file sales tax returns and pay sales tax to the state.

Other activities that create nexus include someone working for you who lives in the state, having California affiliates who advertise your products in exhange for commission when a sale is made from their affiliate link/marketing activities, or attending a tradeshow and making one or more sales at that show.

Retailers who sell on Amazon and use their Fulfillment by Amazon program, will have a physical presence in California if any of their products are stored within a California FBA warehouse.

You May Like: Tax Preparation License

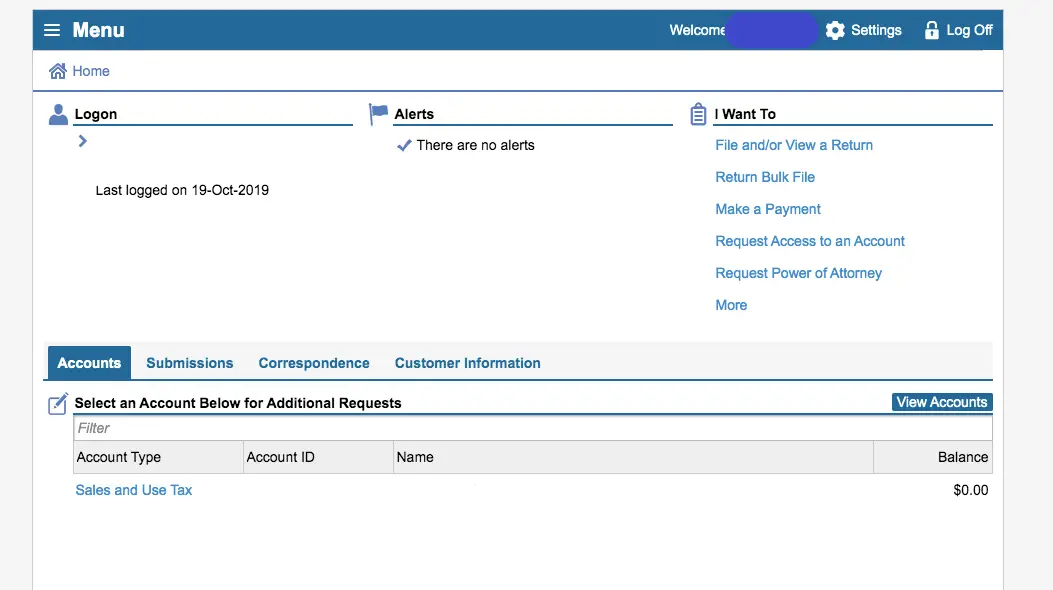

Your California Sales Tax Filing Requirements

If your monthly tax liability is over $10,000, you must file online via the California Board of Equalization’s web portal. Otherwise, you also have the option to file on paper with Form BOE-401-EZ. You will need to report your gross sales for the month, deduct any nontaxible transactions, and then calculate the total amount of sales tax due.Be aware that there are late-filing penalties, and late-payment penalties, of 10% of the sales tax owed . If you have no sales tax liabilities any given filing period, you will still be required to file a “zeroed-out” tax return. Failure to file a return can result in your sales tax license being revoked.

Larger Businesses Can Apply For A 12

A business is eligible for a twelve-month, interest-free payment plan to defer payments for up to $50,000 if its annual sales are less than $5 million. A business could instead pay sales taxes in twelve installments rather than paying all of them at once.

Eligible businesses are those that have sales tax returns originally due between December 15, 2020, and April 30, 2021. If the business pays in full by April 30, 2022, they are eligible for a no-interest payment plan.

This is the second program the state has offered, and those who took part in the previous program are eligible to apply for the new program as well. If a business wants to apply for this program, they must submit a request through the CDTFA online services system.

Recommended Reading: How Do I Protest My Property Taxes In Harris County

California Sales Tax: Where Does The Money Go

As mentioned above, the California sales tax is 7.25%. All cities must collect at least this much in sales tax. Only 6% actually goes to the state though. The remaining 1.25% goes toward county funds. Lets take a look at where that money is going.

The states 6% goes to a few different places. The majority of that money, 3.9375%, goes to the general fund that Californias government uses to finance itself. Another 1.0625% goes toward a Local Revenue Fund that the state established in 2011. The money in this fund goes toward programs and services that the state calls Public Safety Services. The remaining state sales tax is split between two funds. A Local Public Safety Fund get 0.5% to support local, criminal justice activities. A Local Revenue fund, which supports health and social service programs, gets the final 0.5%.

The remaining 1.25% of the California sales tax is a county tax. The entire state must pay this tax and the money all goes to county and/or city governments. The 1.25% breaks down into two different funds. A county or city operational funds gets 1%. The last 0.25% goes toward county transportation funds.

| Breakdown of California Sales Tax |

| Rate |

| 0.25% for county transportation funds 1.00% for city or county operational funds |

The Impact Of Failing To Collect California Sales Tax

If you meet the criteria for collecting sales tax and choose not to, youll be held responsible for the tax due, plus applicable penalties and interest.

Its extremely important to set up tax collection at the point of sale its near impossible to collect sales tax from customers after a transaction is complete.

Learn about sales tax automation

Introducing our Sales Tax Automation 101 series. The first installment covers the basics of sales tax automation: what it is and how it can help your business.

Read Also: Where Can I File An Amended Tax Return For Free

What California’s Sales Tax Could Mean And Beyond

Small businesses may benefit in the short term from interest-free payment plans and a longer filing period. By helping businesses remain afloat during this time, the California government hopes that local economies will recover from the pandemic faster.

However, California’s legislature may continue to address the pandemic with more tax changes in 2021 and beyond that could change how businesses can tax customers and file their returns. As tax legislation evolves, its important to monitor how future changes could affect California small businesses.

Using A Third Party To File Returns

To save time and avoid costly errors, many businesses outsource their sales and use tax filing to an accountant, bookkeeper, or sales tax automation company like Avalara. This is a normal business practice that can save business owners time and help them steer clear of costly mistakes due to inexperience and a lack of deep knowledge about California sales tax code.

Avalara Returns for Small Business is an affordable third-party solution that helps business owners simplify the sales tax returns process and stay focused on growing their business. Learn how automating the sales tax returns process could help your business. See our offer to try Returns for Small Business free for up to 60 days. Terms and conditions apply.

You May Like: Michigan Gov Collectionseservice

How To Register And Collect Sales Tax

You may register with the CDTFA online at the Taxpayer Online Services Portal. Scroll down to Registration, select Register a New Business Activity or Location, and follow the prompts. You’ll be issued a seller’s permit. For more information, see the online guide Use Tax Collection Requirements Based on Sales into California Due to the Wayfair Decision at the CDTFA website.

Sales Tax Filing Frequency

The CDTFA will assign you a filing frequency. Typically, this is determined by the size or sales volume of your business. State governments typically ask larger businesses to file more frequently. See the filing due dates section for more information.

California sales tax returns and payments must be remitted at the same time both have the same due date.

Read Also: How Does Doordash Do Taxes

Other Taxes And Fees Applicable To California Car Purchases

State and local sales taxes are not the only expenses you will incur when purchasing a vehicle in California. There are several additional taxes and fees that apply to car purchases in the state of California, which typically add up to $2441 for a new car. These are typically collected by the California Department of Motor Vehicles rather than the California Board of Equalization and include:

- Registration Fee: Up to $500

- Plate Transfer Fee: $65

Sales Tax Nexus Is Just A Fancy Legalese Way To Say Significant Connection To A State

If you, as an online retailer, have nexus in a state, then that state considers you on the hook for charging sales tax to buyers in the state.

Youll always have sales tax nexus in your home state. However, certain business activities create sales tax nexus in other states, too.

Ways to Have Sales Tax Nexus in Different States

- A location: an office, warehouse, store, or other physical presence of business.

- Personnel: an employee, contractor, salesperson, installer or other person doing work for your business.

- Inventory: Most states consider storing inventory in the state to cause nexus even if you have no other place of business or personnel.

- Affiliates: Someone who advertises your products in exchange for a cut of the profits creates nexus in many states.

- A drop shipping relationship: If you have a 3rd party ship to your buyers, this may create nexus.

- Selling products at a trade show or other event: Some states consider you to have nexus even if you only sell there temporarily.

- Economic nexus: You exceed a state-mandated dollar amount of sales in a state, or you make over a certain state-mandated number of transactions in a state.

Recommended Reading: How To Calculate Federal Tax

Import Fees Duty Foreign Taxes Value

In general, you may not take a credit for sales tax paid to a foreign country against the California use tax you owe.

Federal import duties or taxes are imposed under United States Code, Title 19, section 1505 and have no bearing on the application of California sales or use tax. The fact that a certain purchase is exempt from federal duty does not exempt that item from California use tax. For example, purchases of antiques more than 100 years old are subject to California use tax even if the purchase was exempt from the import duties.

If your purchase is subject to California use tax, any amounts you paid as import fees, duty, or other miscellaneous charges at the time of entry into California are generally not includable in the measure of tax.

Please note: the Federal import duties are imposed on the importer of record. If the importer of record is a consignee and the consignee is the seller, import duties included in the price of the property sold are subject to sales and use tax. See Regulation 1617, Federal Taxes.

If you paid any Value-Added Tax on your foreign purchase, those charges must be included as part of the purchase price subject to tax when you report and pay the use tax. You may not take a credit for VAT paid against the California use tax due.

How Does California Sales Tax Work

Overview of Sales and Use Taxes

Sales taxes are imposed on individuals and businesses which sell goods within the State of California. The amount is calculated by the CDTFA as the total receipt of sales minus any non-taxable sales.

An item is taxable if it is tangible personal property, which includes retail goods of all kinds. Although in general services are excluded, they may be subject to sales tax if they result in the production of a retail good.

A use tax differs in that it applies where a good is purchased from an out-of-state retailer who is selling the good within California but does not have sales nexus within California such that they are required to collect sales tax. The applicable tax rate is the same for both sales and use taxes.

As a business owner, you are responsible for paying the sales tax to be remitted to the CDTFA and you carry the liability for any unpaid amounts. However, you may pass the cost of that sales tax onto the consumer as long as the buyer is made aware that they are paying sales tax as part of the transaction.

Business owners must have a permit in order to collect sales tax and should register for the permit as soon as possible.

Rates of Sales Tax

Sales tax is measured by determining the businesss gross receipts and subtracting any non-taxable sales. The CDTFA may conduct an audit of sales/use tax at their discretion.

Exemptions and exclusions from sales and use taxes

What Sales are Subject to Sales Tax?

How Does Sales Tax Work?

Food

Recommended Reading: How Do You Do Taxes For Doordash

Determine The Sales Tax Rate To Collect

The sales tax process is complex because there are many localities who have sales taxes, each has its own sales tax rate, and different ways of determining tax – origin-based or destination-based. Some states are origin-based and other states are destination-based . Some states, like California, have both origin-based and destination-based sales tax localities.

The rate changes, depending on your location. If you are selling in multiple locations, you must include the correct sales tax for each location. For example, if you are selling products in several cities or counties within your state, the correct amount must be collected from each locality. This gets complex if you have many places where your products are being sold. If you are selling in several states, you must also program the correct amount for each location within each state.

If this makes your head spin, join the club. If you do business in several locations, within and between states, or you sell online, you might want to use an online sales tax service like TaxJar or Avalara.

Collect Sales Taxes From Customers

After you have received your sales tax permit, you can begin collecting sales tax from customers. You must show the tax amount separately, so the customer can see the amount of the tax this typically isn’t a problem, since most sales receipts are programmed to show the amounts. If you are selling online, your “shopping cart” page will show the sales tax calculation. You will need to program the computer for the applicable sales tax amount or amounts or start using the services of an online sales tax service.

Don’t Miss: How Does Doordash Do Taxes

When To Charge Another State’s Tax

You would typically collect sales tax for another state only if you have a physical presence in that state. In legal terms, this is known as having sales tax nexus there.

Your physical presence might be a retail store, a warehouse, or a corporate office, even if the facility is not open to the public. Entering into an affiliate agreement with a resident of the state may also establish a physical presence or nexus there in some states.

Check with your tax advisor as to whether traveling to a state and conducting business there would create nexus if you do business at your customer’s locations. This might cause that state’s sales tax rules to trigger.

Do I Have To Pay Sales Tax On A Used Car

Buying used is a great way to save on the cost of a vehicle, but it wont eliminate state taxes. The California sales tax applies to used and new cars. The state taxes are still 7.25% for used cars. Of course, this often means youll pay less in sales tax for used cars because the price of the vehicle is less expensive.

Don’t Miss: Where Can I File An Amended Tax Return For Free

New Rules On Collecting Sales Tax For Remote Sellers

Effective April 1, 2019, retailers located outside of California are required to register with the California Department of Tax and Fee Administration and collect California sales tax if they sell more than $500,000 in tangible personal property for delivery in California. The registration requirement applies if you sold more than $500,000 in property during the prior calendar year. It also comes into effect any time you sell more than $500,000 during the current year. For example, if you had more than $500,000 in California sales during 2018, you must register and collect sales taxes. If you didn’t have more $500,000 in California sales in 2018, you must register and collect sales tax the moment you meet that threshold during 2019. You should keep records of your sales into California.

These rules apply to all remote sellers located outside of California that sell tangible goods for delivery into California through the Internet, mail-order catalogs, telephone, or by any other means. The $500,000 sales threshold includes sales made by the retailer itself and people related to the retailer. This includes family members and any person or entity that owns 50% or more of the retailer’s business.