Annual Income Taxes Due Every April

Well start with the big bugaboo and the tax youre probably already quite familiar with annual income tax. Annual income tax is simply a tax on any income youve made its what youve been filing and paying since you became an independent adult.

Etsy sellers also have to pay income taxes on their Etsy sales the only difference is that this is considered self-employment income, and Etsy sellers must fill out a form Schedule C Profit of Loss from Business. Dont let the term business fool you you must file Schedule C even if youre a sole proprietor and havent registered your business as a corporation.

You owe taxes on the net profit from your business that is, the total amount of income you made, minus your business expenses. The amount you pay increases as your Etsy businesss net profit increases.

One important thing to note is that the United States has a pay-as-you-go income tax meaning that youre supposed to pay your income taxes as you earn money, not just at the end of the year. This is why an employer takes taxes out of each paycheck for their employees. Self-employed people are also required to pay as you go, but the responsibility for remitting taxes to the IRS and state government taxing body is solely theirs. Self-employed people are required to pay these pay as you go taxes quarterly, which brings us to …

What Is Considered Taxable

It all depends on how you look at your online store. If its just an opportunity to clear your closet and make back a small amount of what you paid initially for your belongings, then youre probably not going to have to deal with taxes.

That will be the case for most eBay sellers, as 85% of users are mostly selling preowned items they no longer use, according to a recent report from the company.

But if your online store is how you make or supplement your income, you may be seen as a small business or independent contractor and youll be expected to pay taxes.

That principle extends beyond the digital world. If youre shopping yard or estate sales for vintage items that youre then selling online at a profit, that counts too.

The same goes for those whove turned hobbies or skills into profitable side hustles.

Any net earnings that exceed $400 should be reported to the IRS. If youre struggling to sort out whether your hobby makes you an independent contractor in the eyes of the agency, the IRS offers some helpful tips.

Owning A Small Business May Qualify You For More Tax Deductions

As a self-employed person or sole proprietor, you can deduct direct business expenses. That includes supplies, the costs of materials used in inventory you sell, advertising, and shipping.

Thats not all, however. You may be able to deduct vehicle expenses for travel to purchase supplies and promote your business. If you have a second phone line for business, you can deduct its cost. You may even be able to take a home office deduction as an Etsy seller.

Recommended Reading: When Does Doordash Send 1099

Determining Where To Charge Etsy Sales Tax

The standard procedure to handle sales tax in the past required determining if your business had a nexus with a particular state. If your business was located in a state or had a significant amount of sales in that state, you would be required to pay sales tax.

Now the requirement has been broadened to a degree. States have been permitted to set their own policies. Requirements vary, but some states like South Dakota require sales tax paid on a purchase if a seller has made $100,000 or has had at least 200 transactions with customers of a given state.

You will definitely need to charge a sales tax in states your company has a presence in, but taxes for other states may depend on the specific state requirements and how much business you have there.

Montana, New Hampshire, Oregon, Alaska, and Delaware do not collect any sales tax at the state level, although towns and cities within these states might collect their own.

File Your Etsy Sales Tax

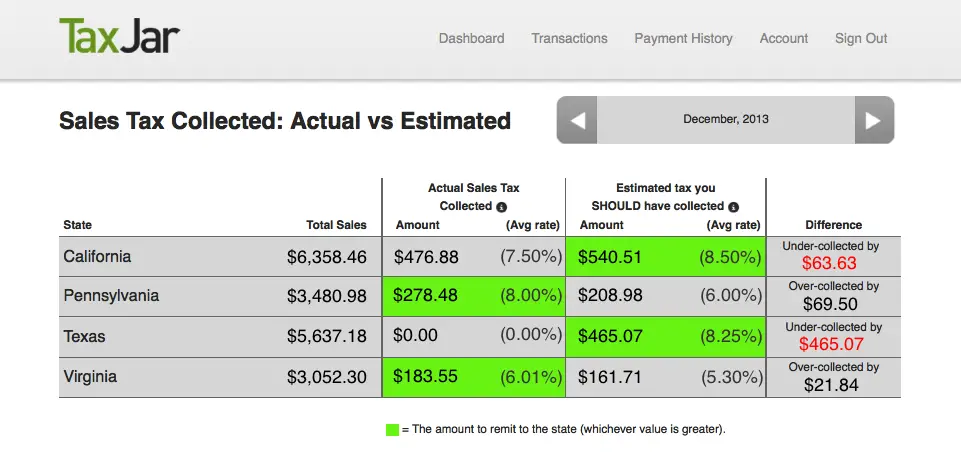

You can see how much sales tax youve collected on Etsy by . While Etsy breaks this information down for you by transaction, its your responsibility to remit and file returns.Each state has its own policies about when sales tax youve collected is due. While some will require you to pay sales tax quarterly, others may let you file annually, as long as the total amount of sales tax you owe is below a certain amount. To determine when you must file sales tax, visit the states department of revenue website.Also, each state has different requirements for filing sales tax returns. For example, some states require that you report how much sales tax you collected in each tax district, so familiarize yourself with sales tax information for each state in which your business has a sales tax nexus.You can file sales tax through the mail or online through a states department of revenue.

You May Like: Doordash Accounting Method

Small Is Beautiful When It Comes To Nexus

It used to be that being a small seller kept your nexus worries at bay. You have sales tax nexus in any state where you have a physical presence. For most of the crafters who sell on Etsy, the only point of nexus will be the location of their home or studio. South Dakota v. Wayfair, Inc. may have changed that for more successful Etsy selleres. Now, sales tax nexus may be triggered based on total sales revenue or total number of sales. Be sure to understand the latest nexus rules for the states into which you are selling your Etsy goods.

How To Register As An Etsy Seller

The quickest and easiest way to register your shop is to register as self-employed with HMRC. Youll need to make sure youve registered by the 5th October following the end of the tax year that you started your business or you went over the £1,000 threshold. So if you set up your Etsy shop on 1 January 2021 youll need to register with HMRC by 5th October 2021.

There are other business structures other than being self-employed, including:

- Limited Company

- Partnerships

Depending on how much you make as an Etsy seller and whether you have a business partner, these may offer you better tax savings depending on your earnings, but they often carry more reporting responsibilities meaning you need to engage an accountant.

For the rest of this guide, Ill assume that you are registered as self-employed.

Recommended Reading: Does Doordash Send You A 1099

Collect Sales Tax From Buyers

Your next step is to make sure youre charging sales tax to your customers. You need to set this up within Etsy, and can only do so when your store is live. Etsy allows you to choose the states in which you have nexus and set up a sales tax rate for each state, zip code or even a range of zip codes. How much you charge depends on whether your state is an origin-based sales tax state or a destination-based sales tax state.

Origin based states are simple you simply charge the sales tax rate at your location. So if you live in the 45750 zip code in Marietta, Ohio , then you simply charge all of your customers in Ohio that rate.

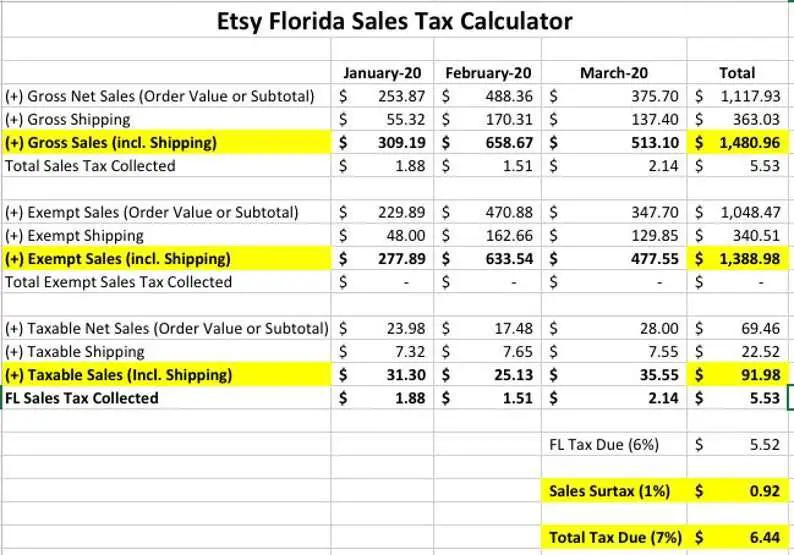

Destination-based sales tax states are tricker. In these states ,you are required to charge sales tax to buyers based on the location where you ship their order. So if you live in the 32009 zip code in Bryceville, Florida the sales tax rate you would pay for day-to-day purchases made in your zip code is 7.0%. But if you sell to a buyer in St. Augustine in the 32095 zip code, then you only need to charge them their sales tax rate of 6%.

For this reason, it can be a bit time consuming to set your rates in destination-based states through Etsy.

To help, you can look up sales tax rates in TaxJars handy Sales Tax Calculator.

If Your State Does Not Charge Sales Tax On Shipping

Take the sum of your filtered column Q Order Value, less any discounts issued in columns T or U, less any refunds noted in columns AB, AC, and AD. Unfortunately, Etsy doesnt directly state the coupon amount and the refunded amount, so you may need to get your caclulator out and do a little number crunching.

Note that the easiest way to get the sum of a filtered column is to simply highlight the cells youre trying to total, like so:

And then check out the bottom right-hand corner of Excel for an automatic total. You dont want to use the sum formula on a filtered column of data, because it will include all the filtered out numbers that you cant see and be incorrect .

So lets just reiterate, my total in-state sales equals whats in my filtered Order Value column. I may also need to take into account any discounts and/or refunds if applicable.

Also Check: How Does Doordash Do Taxes

Does Etsy Report Sales To Irs A Basic Tax Guide For Etsy Sellers

Etsy may be one of the most popular online shopping spaces but does Etsy report sales to IRS?

It is a common question that many people have in mind when they sign up to sell something on Etsy. Paying your taxes is important, and the legal way to run a business. A business must abide by the laws of the Internal Revenue Service if it wishes to avoid any legal troubles.

Not only big companies but also small businesses can be audited by the IRS at any time. Most of the sellers on Etsy are, in fact, small businesses. Thus, it is important for them to know if Etsy reports its sales to the IRS and how it is done.

Understanding all this makes it easier for businesses to find out the tax duties that they have to look into while selling on Etsy.

Etsy Sales Tax Reporting Tools

Etsy allows you to your transactions into a CSV file, which can be opened with a spreadsheet program such as Excel.

You can download a months or a year’s worth of sales. If you file your sales taxes on a quarterly basis , you will need to download each month in the quarter you are reporting.

The data you download will include sales taxes charged, and thats about where Etsy sales tax reporting support ends.

Ultimately, its up to you to determine whether you actually charge sales tax on Etsy. Aside from sales in states where Etsy automatically collects and remits tax, you have a choice as to whether or not to charge it. We recommend consulting with a tax professional to best define a tax process for your business.

All in all, only you can decide whats right for your business and if that means charging sales tax, Avalara Returns for Small Business can help make sure you get that right, too.

Don’t Miss: Irs Employee Search

Does Etsy Handle Nexus Taxes For Me

According to Etsy, if you sell items to customers in another state, but do not have nexus in that state, you do not have to collect sales tax on the items you sell to them. However, your customers are responsible for paying the tax in their state on the items when they receive them. So in essence, yes.

Quarterly Estimated Taxes Due Quarterly

To put it simply, if you have a business and youre expecting to owe more than $1,000 in taxes for the year, the IRS expects you to pay a fourth of the tax you owe each quarter. Quarterly estimated tax due dates are April 15, June 15, September 15, and January 15.

To pay your estimated quarterly taxes, you can do one of two things: You can fill out a form 1040-ES and send it to the IRS address nearest you, or you can file electronically using the Electronic Federal Tax Payment System . You have to enroll in the EFTPS before you use it, but after you are all set up, you can use it like an automatic debit for tax payments if you wish, and can even pay taxes over the phone.

Of course, the big question here is, how do you know early in the year what your annual net profit is going to be? First off, thats why these are called estimated taxes. While you cant quite know your net profit, you also often dont know which tax deductions you can take, which will lower your tax burden.

Fortunately, since this number is difficult to determine, you will not be penalized by the IRS as long as you pay an amount equal to the amount of taxes you owed last year.

Looking for more information on Quarterly Estimated Taxes? Read Wrapping Your Head Around Quarterly Estimated Taxes for more detail.

Recommended Reading: Aztaxes Gov Refund

Does Etsy Report Sales To Irs

You must pay taxes if you own a shop on Etsy and also treat it as a business. Etsy will report your sales to the IRS through the 1099-K forms. Etsy sellers dont have to worry about making any additional reports as Etsy takes care of the 1099-K forms itself.

However, just like any brick and mortar business, you must deduct the business expenses that you bear from your Etsy shop. It includes the cost of materials, advertising, and shipping, etc. This will reduce your taxable income, and you will have to pay less in the form of taxes.

Is My Etsy Hobby A Business

This isn’t as simple a question as it might seem. Here are a few things to consider:

- Is your main goal to make money?

- Are you selling regularly or often?

- Are you buying stock or materials just to continue selling your products?

If you’re answering yes to any of these, then HMRC might decide that what you do counts as a business. It’s not always so cut-and-dried, though, so it’s worth talking to RIFT to find out exactly where you stand.

You May Like: Do You Have To Do Taxes For Doordash

How To Report A Business

Where it goes: Your business will get its own form for taxes. For a lot of us creative business owners, that form will be the Schedule C . If not the Schedule C, it will be a similar form. With the Schedule C, youll report all your business revenue and expenses to calculate your net profit or loss. Your net profit or loss travels back over to your Schedule 1, line 3. Then it too travels to your personal Form 1040, where its lumped in with your personal wages and family income and taxed accordingly. I delve into the Schedule C here.

How deductions work: Unlike with hobbies, you can deduct any expenses that are considered ordinary and necessary to operate your business. Your business is taxed on its net income. You can even have a loss, and your loss can reduce your personal income on your Form 1040, lowering your tax bill. Its worth mentioning here that there is a minimum threshold for self-employment tax, which applies to businesses , and thats a net income of $400 or more. So thats why a lot of times youll hear the rumor that you dont have to claim your sales until you net $400. Thats still not correct, since it only applies to self-employment tax specifically, not federal income tax. If youre just figuring out your a business, dont get anxious! Check out to help you get everything set up correctly.

Tax Tips For Etsyshop Owners

Also Check: How Does Doordash Do Taxes

Etsy Tracks Your Etsy Payments Sales For You

After the end of the year, Etsy sends out Form 1099-K, Payment Card and Third Party Network Transactions, to both you and the IRS. Form 1099-K reports your total sales using Etsy Payments, plus other information. Etsy must issue a 1099-K form if you have $20,000 or more in sales through Etsy Payments and you receive 200 or more payments through Etsy Payments during the year.

Certain payments are not considered to be Etsy-processed payments, for purposes of Form 1099-K. That includes payments through your PayPay account, checks, money orders, and so on.

Etsy requires you to provide your full taxpayer information by the time you reach 100 transactions totaling over $10,000. Your Etsy shop may be disabled if you continue to receive payments and do not provide this information.

The IRS matches your business sales to the total on all 1099 forms you receive for your business. Its important that you report at least as much in sales as on these forms to avoid getting a notice from the IRS.