Check Out Your Liability For The Alternative Minimum Tax

Tax planning usually means finding more deductions and postponing income but not always.

You might want to do just the opposite if you may lose certain deductions because of the Alternative Minimum Tax.

The Alternative Minimum Tax is a parallel tax system that calculates your tax liability without the benefit of certain tax breaks, such as substantial itemized deductions.

If your income tax calculated by AMT rules is greater than your tax under normal income tax rules, you pay the excess as AMT tax.

What If I Have Problems In Completing My Tax Return

If you get a tax return, please do not worry if you are not sure how to fill it in. You can contact HMRC for help. If you are concerned about completing the form contact the phone number on any of your Self Assessment correspondence or HMRCs Self Assessment helpline number. Alternatively, you may wish to contact the charity TaxAid who offer help to those on low incomes with tax problems. They can be contacted via their helpline 0345 120 3779 .

Use Our Money Navigator Tool

Have you got money worries because of coronavirus? If so, youre not alone.

For instant money guidance based on your circumstances, get started with ourMoney Navigator Tool

The very latest you can register with HMRC is by 5 October after the end of the tax year during which you became self-employed.

For example, if you started your business in June 2020, you would need to register with HMRC by 5 October 2021.

The tax year runs from 6 April one year to 5 April the next. If you register too late, you might need to pay a penalty.

To register with HMRC, go to the GOV.UK website

You May Like: How To Report Plasma Donation On Taxes

How Minimizing Taxes Minimizes Benefits

Besides the Social Security tax deductions you can take when you’re self-employed, many business expenses can reduce your tax liability.

“Business expenses reduce your overall tax, which ultimately lowers your Social Security taxes. Business tax deductions are a way of minimizing self-employment tax and Social Security taxes,” says Carlos Dias Jr., founder and managing partner of Dias Wealth LLC in Lake Mary, FL.

But keep in mind that this can work against you regarding Social Security benefit calculations, which are based in part on your taxable earnings. Here’s why. The more deductions you have, the lower your Schedule C income. Lowering your Schedule C income is a good way to reduce how much federal, state, and local income tax you owe. However, this lower amount becomes part of your Social Security earnings history and means you may receive lower benefits in retirement than if you didn’t take those deductions.

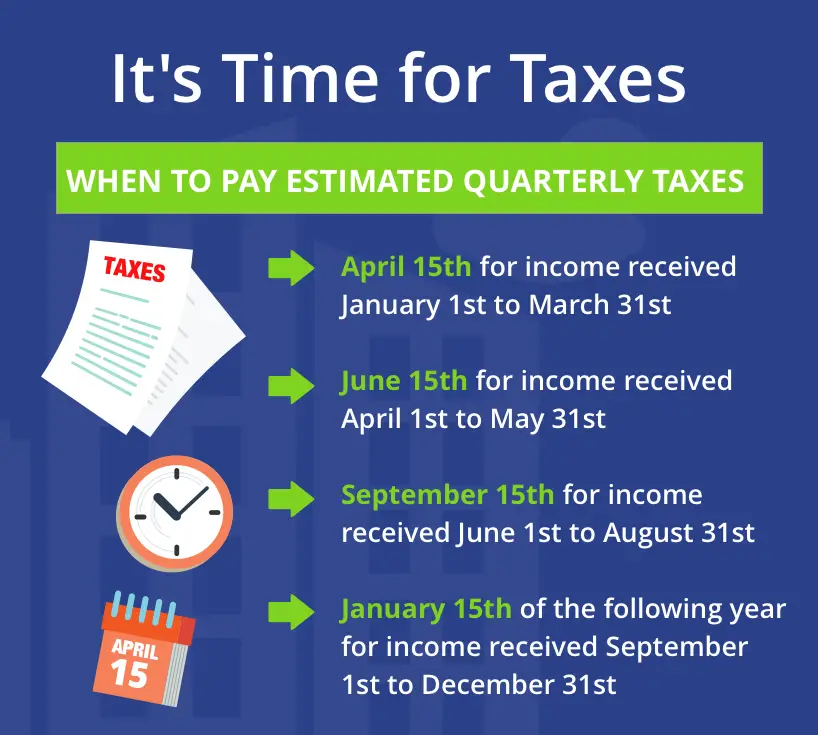

The Rules Governing Estimated Tax Payments

The rules governing the IRS require taxpayers to make tax payments throughout the course of the year. For most people, job income makes up the vast majority of what they make, and the requirement that employers withhold federal income tax from their employees’ paychecks is designed to ensure that most workers have enough of their money go toward prepaying their taxes that they typically won’t have to worry about estimated tax payments.

However, there are several reasons why you might have to deal with the estimated tax payment rules:

- Some workers don’t have enough tax withheld through payroll withholding to cover the required portion of their tax liability.

- If you’re self-employed, then you don’t have an employer to withhold taxes on your behalf. Instead, it’s up to you to figure out what your self-employment income will be and make tax payments throughout the year to cover it.

- If you no longer work but have income from investments, retirement accounts, or other taxable sources, then there’s no convenient mechanism in most cases to have taxes withheld. That leaves estimated tax payments as the only good option.

You May Like: How To Calculate Mileage For Doordash

Universal Social Charge Prsi And Vat

USC: Everyone must pay the Universal Social Charge iftheir gross income is over 13,000 in a year.

An extra charge of 3% applies to any self-employed income over 100,000regardless of age. This means that self-employed people pay a total of 11% USCon any income over 100,000. The USC does not apply to social welfare orsimilar payments. You pay your USC with your preliminary tax payment.

PRSI: Self-employed people pay ClassS PRSI on their income.

Value Added Tax

You must register forValue Added Tax if your annual turnover is more than or is likely tobe more than 75,000 for supply of goods or 37,500 for supply of service.As a trader you pay VAT on goods andservices acquired for the business and charge VAT on goods and servicessupplied by the business. The difference between the VAT charged by you and theVAT you were charged must be paid to Revenue. If the amount of VAT paid by youexceeds the VAT charged by you, Revenue will repay the excess. This ensuresthat VAT is paid by the ultimate customer and not by the business.

Revenue has information on how toaccount for and pay VAT.

If Your Net Earnings Are Above The Social Security Wage Base:

1. Figure out your net earnings subject to self-employment tax.

Letâs say your net earnings from self-employment were $150,000 for 2021. Only $147,000 of your earnings are subject to Social Security taxes, so we have to add an extra step in the calculation.

| Social Security |

|---|

Total self-employment tax: $18,228 + $4,017 = $22,245

Recommended Reading: Irs Employee Lookup

What Are Net Earnings

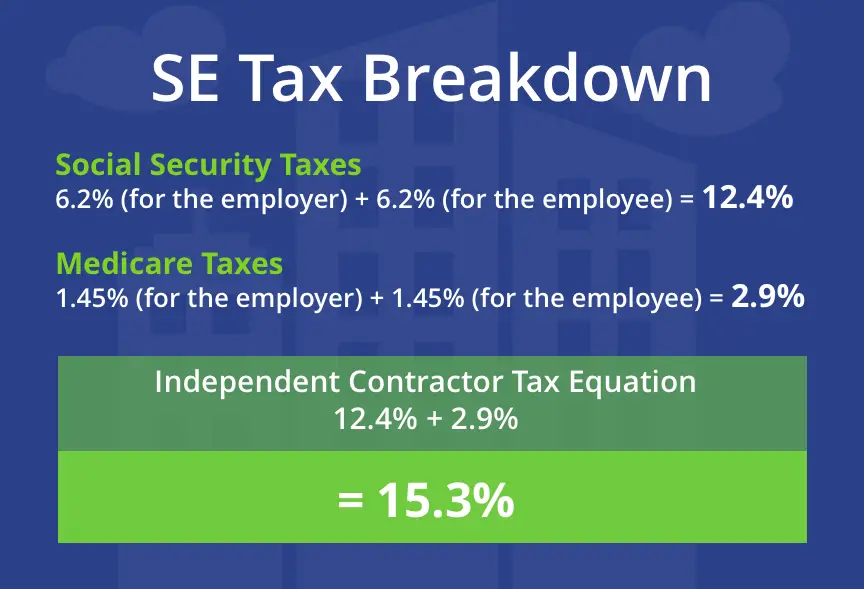

The 15.3% tax seems high, but the good news is that you only pay self-employment tax on net earnings. This means that you can first subtract any deductions, such as business expenses, from your gross earnings.

One available deduction is half of the Social Security and Medicare taxes. Thats right, the IRS considers the employer portion of the self-employment tax as a deductible expense. Only 92.35% of your net earnings are subject to self-employment tax. There are a number of other tax deductions that self-employed individuals can claim to reduce their taxable earnings, like if you use your home for business.

Lets say you earn $1,500 from a freelance job and claim $500 in deductions. You would then multiply the net $1,000 by 92.35% to determine your taxable earnings. In this example, only $923.50 is subject to self-employment tax.

Making Tax Digital Extended To All Vat

Making Tax Digital has been in place since 2019 for VAT-registered businesses with a taxable turnover of more than £85,000.

This system requires businesses to keep digital records and file VAT returns digitally. Businesses need to use relevant accounting software.

The next phase of Making Tax Digital is starting in April 2022. It removes the turnover threshold, meaning all VAT-registered businesses will need to use the system.

Eventually all taxpayers will need to use Making Tax Digital, but it wont apply for Self Assessment returns until at least 2025.

Read more about Making Tax Digital.

Read Also: Do You Have To Report Plasma Donations On Taxes

A New Tax Introduced For 2022

If you manufacture or import plastic packaging as part of your business, you may be subject to the new plastic packaging tax from April 2022.

According to gov.uk, it applies if youve manufactured or imported 10 or more tonnes of finished plastic packaging components within the last 12 months, or will do so in the next 30 days.

If you meet either of those thresholds, then you need to register for the tax. Read more about the plastic packaging tax.

Phone And Internet Bills

Every business requires phone and internet services to run the operations. If you use a dedicated phone and internet connection, it is included in tax write-offs.

How it works:

- ~~Deduct the entire bill of the calls and internet connection if you have a separate line for the business.

- ~~If not, you can deduct a certain percentage used for business purposes.

Recommended Reading: Pastyeartax

Key Aspects Of Being Self

You work solely for yourself and contract directly with your clients.

It provides great job flexibility but can also come with greater risks and fluctuating income.

Without a paycheck from an employer, you will not have taxes withheld, so you are responsible for making payments towards your income taxes.

You are responsible for keeping good books and records so you can determine the amount of income you expect to make payments on.

New York State residents who are self-employed, or sole proprietors, may also be required to file:

- federal self-employment taxestaxes paid for Social Security and Medicare benefits

- federal Income taxtaxes paid to the IRS on income earned

- New York State income taxtaxes on income earned in and out of New York State

- New York City income taxtaxes on income earned in New York City by both full- and part-time residents

- Yonkers income taxtaxes on income earned in Yonkers by residents, part-year residents, and nonresidents

Whats The Personal Allowance 2022/23

The personal allowance in 2022/23 will remain £12,570. This is how much you can earn tax free.

The government has frozen this tax allowance until 2026. Businesses and taxpayers in general face rising costs throughout 2022, so could feel the pinch of this personal allowance freeze.

And over the long-term, if earnings rise and the personal allowance stays the same, then youll pay more in tax.

You May Like: Ein Free Lookup

More Time To Understand Points

While a new points-based system for tax penalties was due to start in April 2022, its been delayed until January 2023.

The new penalties were supposed to launch for VAT alongside Making Tax Digitals rollout to all VAT-registered businesses in April, but HMRCs systems wont be ready in time.

As the new points-based penalties have been postponed, businesses have more time to get up to speed with the changes.

Add Up Your Business Expenses

Ideally, youâve been using the Keeper Tax app to track your business expenses throughout the year. If not, shame on you. Kidding! We donât judge around here . Since you already have your bank statements open, go ahead and scan for business-related expenses while youâre at it. And donât forget to check your credit card purchases as well!

Recommended Reading: Do Doordash Drivers Get Taxed

Is It Better To Claim 1 Or 0 On Your Taxes

By placing a on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period. If your income exceeds $1000 you could end up paying taxes at the end of the tax year.

What Do You Claim To Have The Least Taxes Taken Out

The more allowances you claim on your W-4, the less income tax will be withheld. If you claim zero allowances, you will have the most tax taken out. Because you can write off that interest on your tax return and reduce your overall tax bill, you can claim more exemptions on your W-4 to reduce your withholding.

Recommended Reading: Www 1040paytax

Minimize Taxes Now Or Maximize Benefits Later

Should you skip some or all of the business tax deductions youre entitled to increase your future Social Security benefit? Maybe. The answer is complicated because lower-earning business people stand to gain more in the future than their higher-earning counterparts due to how Social Security retirement benefits are calculated.

Another critical factor is where your Schedule C earnings fall compared to your previous years earnings. If you have a full 35-year career behind you and youre not earning nearly as much in your current self-employed pursuits, it makes sense to take all the deductions you can, as your Social Security benefits will be calculated based on your 35 highest-earning years. In this case, you want to minimize your Social Security taxes.

But if youre currently in the high-earning part of your career, a higher Schedule C income can help you get higher Social Security benefits later. Unless you enjoy complex math problems or have a top-notch accountant, its probably not worth the headache to figure out whether youll earn more in future Social Security benefits than youd save by claiming all the deductions you can today.

Of course, suppose youre on the cusp of not having enough Schedule C income to give you the work you need to qualify for Social Security. In that case, it may be worth foregoing some deductions to make sure youre entitled to any benefits at all.

Filing Your Taxes Can Be Tricky When You’re Self

There’s no avoiding giving Uncle Sam his due, and if you want to avoid an audit, it’s important to do it right the first time. Unlike W-2 employees, self-employed individuals do not have taxes automatically deducted from their paychecks. It’s up to them to keep track of what they owe and pay it on time.

Because taxes aren’t automatically deducted, take-home pay for the self-employed tends to be higher than it is for wage earners. However, unless you want the IRS to come knocking, it’s wise to set aside a chunk of those funds to cover your tax obligations.

“Business owners, whether they are self-employed freelancers or corporation owners, are responsible for complying with tax law with respect to their business,” said Shoshana Deutschkron, vice president of communications and brand at Upwork. “Financial literacy is a critical skill, that literacy includes an understanding of taxation.”

“You need to hold on to some of your money,” added Lise Greene-Lewis, CPA and tax expert for TurboTax. “You should pretend you don’t have that much money because your income varies so often. You have to think about paying your taxes.”

Not only are government forms daunting, but learning the ropes of taxation can be truly complicated. If you’re filing as self-employed with the IRS, here are the basics of filing, paying and saving for taxes.

Recommended Reading: Doordash Mileage Calculator

Applying Taxes On Imported Goods:

As much as the government pays importance to pay taxes on the local people, it also lays great interest in applying taxes on imported goods. European countries export more of their goods, but their import bill has started to cripple their already unstable economy. Thus the European governments have to take steps to decrease their import bill and comparatively increase their export bill.

So how does the government do this? If the first thing that comes to your mind is taxes, then you are right. Yes, the government imposes extra money on imported items to help decrease their import bill. But how are taxes related to decreasing import bills? When the government imposes heavy taxes on goods, then the public does not buy those imported products as they become too expensive to afford. It helps the government in two ways. Number one, it increases tax revenue due to higher taxes, and number two, the public focuses on buying items that are make the country. It gives a boost to the GDP and thus helps the country in healing its economy.

Reporting And Paying Employment Taxes

FICA taxes and income taxes that have been withheld from employee pay are reported to the employee by the employer on Form W-2, the annual wage and tax report. The employee then includes this information on their tax return .

Federal Unemployment tax is also considered part of employment taxes. This tax is paid by employers to provide unemployment benefits to employees. Self-employed individuals don’t pay unemployment taxes, and they can’t collect unemployment benefits.

Don’t Miss: How Do You File Taxes For Doordash

How Do You File A Tax Return As A Self

You can either submit your tax return online, fill out a paper tax return or use commercial software. HMRC has a list of commercial software providers you can choose from.

When you first decide to be self-employed, you should register your business with HMRC as soon as possible.

If you’ve never submitted a self-assessment tax return before, you’ll be assigned a Unique Taxpayer Reference number and you’ll also be registered for Class 2 National Insurance contributions .

- Submit your return: to tot up your bill and send your tax return direct to HMRC, use the Which? tax calculator.

Family Caregivers And Self

Special rules apply to workers who perform in-home services for elderly or disabled individuals . Caregivers are typically employees of the individuals for whom they provide services because they work in the homes of the elderly or disabled individuals and these individuals have the right to tell the caregivers what needs to be done. See the Family Caregivers and Self-Employment Tax page and Publication 926 for more details.

You May Like: How Does Doordash Taxes Work

Deduct Valid Business Expenses

The IRS allows business owners and entrepreneurs to deduct all ordinary and necessary business expenses. Here, ordinary and necessary is the operative phrase. You cannot take a trip to Hawaii and write it off, for instance, unless you genuinely went there to work. You can, however, deduct anything used to generate your income: office space, supplies, advertising costs, business travel, even a pro-rated portion of your mortgage and utilities Therefore, if you rack up, say, $10,000 in business-related expenses during the year, you can reduce your taxable income from $50,000 to $40,000. Your self-employment tax obligation will now be 15.3% of $40,000 rather than $50,000

Self Employment Tax Deductions

As work from home became more common in the last two years, it also turned many people towards self-employment. Since many people lost their jobs, resorting to small businesses and freelancing proved viable for them.

Self-employed individuals are their boss, and hence, they alone reap the benefits of their venture. However, self-employed individuals must also take the sole responsibility of the business, from daily operations to tax filing.

Hence, it is crucial to understand self-employment deductions. This article will simplify how tax deductions work for the self-employed.

Recommended Reading: Efstatus.taxact 2014