Bcs Homeowner Grant Centralization

B.C. municipalities are no longer accepting home owner grant applications. All property owners must now claim their home owner grants with the Province.

How to apply?

- Apply online at gov.bc.ca/homeownergrant

It is quick, easy and secure. Be sure to have your social insurance number, jurisdiction number for Maple Ridge and your folio / roll number .

The Value Of The Property

-

Assessors who work for the local taxing authority track the value of every piece of land and real estate in a taxing district, such as a city or county. They maintain databases of local property values, often using sophisticated mapping software.

-

Your homes assessed value will likely be less than its market value. By how much less will vary by location, but it’s common.

-

The county may have many ways to detect changes in your homes value, including inspections, permit applications from a remodeling project, reports from neighbors or regular updates.

-

Cars, machinery and other property might be subject to personal property tax.

Your Property Tax Is Proportional To The Value Of Your Property

In this example, a small municipality with three properties worth $125,000, $175,000 and $200,000 has services costs of $2,000 that are paid by property owners through property taxes.

Each property owner in the municipality pays a proportion of that $2,000 based on their property’s assessed value. This is calculated by first adding up the value of all three properties, for a total of $500,000. Since the cost of services is $2,000, the tax rate is 2,000/500,000 = 0.004, or 0.4%. Therefore:

- The owner of the $125,000 property pays $500.

- The owner of the $175,000 property pays $700.

- The owner of the $200,000 property pays $800.

- The total of the property tax paid by the three property owners is $2,000.

Read Also: Do You Claim Plasma Donation On Taxes

Where To Find Property Taxes Plus How To Estimate Property Taxes

Thankfully, in many cases, you may not have to calculate your own property taxes. You can often find the exact amount youll pay on listings at realtor.com®, or else you can enter a homes location and price into an online home affordability calculator, which will not only estimate your yearly taxes but also how much you can anticipate paying for your mortgage, home insurance, and other expenses.

Where Are Property Taxes Lowest And Highest

Note that the five states with the highest property taxes are:

STATE

|

$1,221 |

Please note: This data is based on WalletHubs 2021 findings however, the numbers pull from the 2019 census. So, you may see some fluctuation between the numbers mentioned above and other reports, particularly the median home value. Prices may also change depending on market influences.

You May Like: Www Aztaxes Net

Property Taxes In Manitoba

The property tax in Manitoba is made out of four parts:

Every year, the education tax is set by the provincial Minister of Education while the rest is set by the City Council the rates are expressed in mills based on how much revenue they predict to need to fund services, where 1 mill = 0.001.

Manitoba uses a portioned assessment system which was introduced in 1990 to distribute the taxes since market values increase at different rates for each class of property. Thus, each class of property will have a different sized portion of their assessed value that is taxable.

Making A Single Payment

You can pay your LPT in full by:

- Debit/credit card: This option is available online. Note that if you pay by debit/credit card the payment will be processed immediately.

- Annual Debit Instruction : Under a single debit instruction you can authorise your bank or financial institution to pay Revenue the LPT due. The specified amount is taken from your bank account in one deduction on 21 March 2022. Your ADI will carry forward each year unless you change your payment option online or contact Revenue.

- Cash payments: you can pay in full by cash through an approved Payment Service Provider . A transaction charge usually applies. You can view providers and charges here.

- Cheque: You can pay by cheque if you make your return using the paper form. Write your Property ID on the back of the cheque. See the paper Form LPT1 for further information on paying your LPT Charge for 2022 by cheque.

Also Check: Doordash Write Offs

Electronic And Phone Options:

Online with a Debit or Credit Card – Convenience fees apply. American Express not accepted.

Online through your Bank or Credit Union – Check with your bank or credit union to find out if they provide online bill pay services for their customers. Allow adequate processing time for this service set up payment early as it must be received by the due date.

Pay by Phone – 1-833-610-5715 – Point and Pays automated phone system is available 24 hours a day, seven days a week. You can pay with an electronic check, credit and debit card. Convenience fees apply.

Personal Teller Option – Call 1-877-495-2729 to use Point and Pay’s Personal Teller Option and make your payment with a live teller. Personal Tellers are available from 8 am to 11 pm EST, Monday through Friday. A $5.00 convenience fee will be charged in addition to the payment fee.

Note: Electronic and phone payments must be electronically delivered by 11:59 pm on the due date to be considered timely.

Ask For Your Property Tax Card

Few homeowners realize they can go down to the town hall and request a copy of their property tax cards from the local assessor’s office. The tax card provides the homeowner with information the town has gathered about their property over time.

This card includes information about the size of the lot, the precise dimensions of the rooms, and the number and type of fixtures located within the home. Other information may include a section on special features or notations about any improvements made to the existing structure.

As you review this card, note any discrepancies, and raise these issues with the tax assessor. The assessor will either make the correction and/or conduct a re-evaluation. This tip sounds laughably simple, but mistakes are common. If you can find them, the township has an obligation to correct them.

Read Also: Do I Have To Claim Plasma Donations On My Taxes

All Deferment Applications Must Be Submitted Online Through The Service Bc Provincial Website

Renewal and New Deferment applications will not be accepted or given out at Maple Ridge City Hall. All deferment applications must be submitted on-line through the Service BC Website.

Remember you will still need to:

- Claim your Home Owner Grant and

- Pay the Total Utility Services amount to the City of Maple Ridge

Property Taxes Are Due On July 2 2021

Property tax notices are mailed each year in late May and include a brochure “How to do it all online” . Have you considered going paperless? Register for Property Account to access your City accounts information and opt-in to receive next year’s tax bill by email.

City Hall is located at 1435 Water Street, Kelowna BC V1Y 1J4.Our hours of operation are 8 a.m. to 4 p.m. Monday to Friday . In the interest of health and safety, we recommend taxpayers use one of the online payment options to pay property taxes instead of visiting City Hall in person. General enquiries can be emailed to,or sent byservice request.

The Speculation and Vacancy Tax is a provincial initiative. For more information, visit the BC Government’s Speculation Tax website or contact the Provincial office toll-free at .

Read Also: Louisiana Payroll Calculator

How To Pay Property Taxes

Typically, there are two ways to pay the bill:

Write a check or pay online once a year or once every six months when the bill comes from the taxing authority.

Set aside money each month in an escrow account when you pay the mortgage.

»MORE:See your options for making an IRS payment

Dont assume youre paying your property tax when you give money to the escrow company. Think of that as saving up for the tax bill. The escrow company uses the money in your escrow account to pay your tax when the bill arrives.

If you’re trying to pay property tax online, find tax records, or wondering how much the tax is in your area, check out your home countys tax assessor website.

|

State |

|---|

What Is Property Tax

Property tax, sometimes called an ad valorem tax, is a tax on real estate and some other types of property. Local governments typically assess property tax, and the property owner pays the tax. The property tax is usually based on the property location and how much its worth.

Generally, property taxes go to the local government in order to fund school districts, police and fire departments, road construction and other local services.

Failing to pay your property taxes can result in the taxing authority placing a tax lien on the property. A tax lien is a legal claim against property or financial assets you own or may have coming to you. Its not a seizure of your assets, but it is a claim on them. If you sell the asset, the government could be entitled to some or all of the proceeds.

Buyers and sellers often discover tax liens on properties by doing a title search.

Don’t Miss: Plasma Donation Taxable

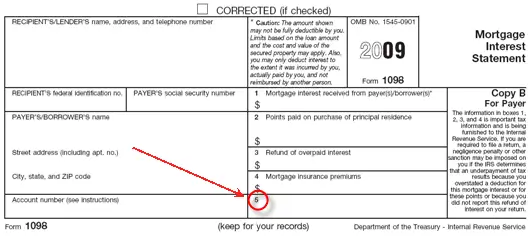

Mortgage Tax Statement: Form 1098

Mortgage companies commonly handle property tax payments on behalf of homeowners. That’s because it’s in the lender’s interest to make sure that the property taxes get paid, because if a government places a lien on a home for unpaid taxes, it makes it harder for the lender to recover its money in the event of a sale or foreclosure.

Usually, homeowners’ monthly mortgage payments include a portion designated for property taxes. The lender sets aside this amount in a special account, called “escrow,” and pays the tax bill when it’s due. At the end of each tax year, lenders must provide homeowners with a copy of IRS Form 1098, the “Mortgage Interest Statement.” If taxes have been paid out of escrow, Box 5 of this form usually lists the amount paid for the year.

The Bottom Line: Property Taxes Pay For The Things You Love In Your Neighborhood

As you look for a home to buy, consider the property taxes. While they are an important part of the community and how you have services to protect and nourish you, keep an eye on the cost to make sure they are affordable for you. As you choose your next neighborhood, Youll want to know exactly what to look for so you get what you want and what you can afford.

Get approved to buy a home.

Rocket Mortgage® lets you get to house hunting sooner.

Recommended Reading: Reverse Ein Lookup Irs

Apply Your Municipalitys Millage Rate

Youll typically see property taxes noted as millage rates. A mill rate is a tax you pay per $1,000 of your homes value. For every $0.001 mill rate, youll pay $1 for every $1,000 in home value.

It sounds complicated, but heres a simple formula. Find out your countys mill rate and divide it by 1,000. Next, multiply your homes assessed value by the mill rate, and thats your property tax liability.

For example, if your area’s mill rate is 8.5 and your homes assessed value is $200,000, youd do the following.

8.5/1000 = $0.0085

Youd owe $1,700 in taxes per year.

What Is A Homes Assessed Value

One factor that affects your property taxes is how much your property is worth. You probably have a good understanding of your homes market valuethe amount of money a buyer would pay for your place.

Still, tax municipalities use a slightly different number its called your homes assessed value.

Tax assessors can calculate a homes current assessed value as often as once per year. They also may adjust information when a property is sold, bought, built, or renovated, by examining the permits and paperwork filed with the local municipality.

Theyll look at basic features of your home , the purchase price when it changes hands, and comparisons with similar properties nearby.

Sometimes a homes assessed value will be strikingly similar to its fair market valuebut thats not always the case, particularly in heated markets. In general, you can expect your homes assessed value to amount to about 80% to 90% of its market value. You can check your local assessor or municipalitys website, or call the tax office for a more exact figure for your home. You can also search by state, county, and ZIP code on publicrecords.netronline.com.

If you believe the assessor has placed too high a value on your home, you can challenge the calculation of your homes value for tax purposes. You dont need to hire someone to help you reduce your property tax bill. As a homeowner, you may be able to show how you determined that your assessed value is out of line.

Also Check: Efstatus.taxact.com

Example : Equal Percentage Value Change

Every four years the properties are reassessed. If they all go up equally in valuefor example, by 5%their proportions stay the same.

- The $125,000 property is now valued at $131,250.

- The $175,000 property is now valued at $183,750.

- The $200,000 property is now valued at $210,000.

The total value of the three properties is now $525,000. If the total cost of services hasn’t changedit’s still $2,000the tax rate is now 2,000/525,000 = 0.00381, or 0.381%, which is a decrease in the tax rate. But when you apply that rate to each of the properties, everyone still pays the same amount as they did before.

- $131,250 x 0.381% = $500

- The total of the property tax paid by the three property owners remains $2,000.

Where Can I Find How Much I Paid In Property Taxes

If you own property, youre taxed on the value of that property. In most cases, its an amount you pay as part of your mortgage, but if you own your home or land outright, youll pay those taxes to the city rather than to a financial institution. Whether your taxes go through a mortgage company or directly to the government, though, youll probably occasionally be interested in finding out just how much tax youre paying. You can get information on property taxes you paid through your mortgage company or the county assessors office.

Read Also: Doordash 1099 Nec

Establish An Escrow Account

If you financed your house, you might be able to set up an escrow account to pay your taxes. Your escrow payment will increase your monthly mortgage payments, but some borrowers are required to have an escrow account.

An escrow account is a separate account set up with your mortgage provider or mortgage servicer. Your servicer will estimate your property taxes for the next year, then break that amount into 12 payments added to your monthly mortgage payment. That money is put into an escrow account and the lender uses that account to pay the taxes for you when theyre due.

Lenders often require an escrow account to avoid borrowers from defaulting on their property taxes. You may apply for an escrow waiver if you dont want an escrow account, but a lender doesnt have to approve it. Approval depends on your loan to value ratio, payment history and the age of your loan.

If you include an escrow account with your mortgage payment, your total monthly payment would include principal, interest, real estate taxes and mortgage insurance monthly.

How Property Tax Is Computed

Property tax is computed at the standard rate on the net assessable value of the property for the relevant year of assessment. A year of assessment runs from 1 April to 31 March of the following year.

The net assessable value is computed as follows:

| Statutory allowance for repairs and outgoings | |

| Net Assessable Value |

The following links provide you with more information on computing property tax.

Recommended Reading: Does Doordash Send You A 1099

Who Pays The Property Taxes

Property taxes are paid by homeowners of their own real property. However, the homeowner is not always the entity sending in the payment. A homeowner who has a mortgage escrow account might be paying a monthly amount toward the property tax bill. When the bill is due, the escrow company is responsible for paying it.

Whether you send the check in yourself or have an escrow company managing the property taxes, you should check a week after the check clears. Confirm the bill payment was properly recorded.

Additionally, if you are new homeowners or if your home has been reassessed for any reason due to improvements, you will receive a supplemental property tax bill. This is in addition to anything you pay to the county directly or through escrow. If you receive a supplemental tax bill, review it and confirm that it is indeed a new bill and pay it to avoid being delinquent.

Property Tax Payment Options

The easiest and fastest way to pay your property taxes is with online banking, or setting up a pre-authorized payment plan with the City of Surrey. Credit card payments are currently not accepted.

Get your property tax information electronically and avoid lineups. Log in to MyProperty Accounts and change your bill delivery method to email by May 1 of the year to get your bill online.

You can also mail your payment to City Hall, or pay in person at City Hall.

Our customer service team is happy to assist you if you have any questions. For property tax and utility information, call 604-591-4181 or email .

Pay by Online Banking

Pay your property taxes online through your bank’s website. When you pay online, we suggest you pay 3 days before the property tax due date. With most banks, you can schedule your payment ahead of time so you don’t forget.

Contact your financial institution directly if you require assistance or have questions about payment services

Read Also: Www..1040paytax.com