State Small Business Workshops

As part of our commitment to provide tax assistance to the business community, Tax Specialists within the Kansas Department of Revenue conduct small business workshops on Kansas taxes at various locations throughout Kansas. Whether you are a new business owner, an existing business owner, or an accountant, these workshops will give you the tools and understanding necessary to make Kansas taxes easier and less time consuming for you. Topics covered include filing and reporting requirements and methods, what is taxable, what is exempt and how to work with the department in collecting and remitting Kansas taxes.

For a schedule of our workshops, click here. Pre-registration is required and a fee may be charged by the sponsoring Small Business Development Center .

LATEST TWEETS

Kansas Governor Announces Tax Rebate For Working Kansans And No More Sales Tax On Food

During the Condition of the State Address, Governor Kelly announced two taxpayer friendly changes. First, working Kansans, who filed personal income tax returns in 2021, will receive a $250 dollar rebate this year, and married couples filing a joint return will receive a $500 dollar rebate. In addition, the state sales tax on food will be eliminated, effective immediately, once the legislature sends a clean budget bill to the Governor. The budget bill is due on or before January 29th, 2022.

I Need To Renew Placards That Are About To Expire What Do I Do

Print and fill out this form:

Get in line with No Wait Inside at our Downtown or South location.

Put your form in an envelope. Make a note if you want 1 or 2 placards. Write your last name on the outside of the envelope and disabled placard. Leave in one of our drop box locations.

Your placards will be mailed to you.

Don’t Miss: Tax Form For Doordash

When Are Taxes Due

Federal income taxes for tax year 2021 are due April 18, 2022. Most state income tax returns are due on that same day. A handful of states have a later due date, April 30, 2022, for example.

Income tax returns must be postmarked on or before the 2022 filing due date to avoid penalties and late fees.Keep your post office receipt and ensure it is date stamped. The receipt date must be legible. Ask the clerk to stamp it again if it is not. To get a late filing fee removed, you may be required to mail a copy of your post office receipt to the IRS or DOR.

State Of Kansas Extends Tax Filing Deadline To July 15

Joshua Cicora at Market Tax Services says just because you have extra time doesn’t mean that you should wait to file. He says once you file and determine how much you owe, you have months to plan financially to make that payment by the mid-July deadline. If you file and get a refund, the extra money could be helpful right now.

Cicora says you can also still make 2019 contributions toward an HSA or IRA until July 15 as well.

He says the IRS is also not opening mail right now, so if you owe, he recommends paying online rather than mailing a check.

Cicora recommends filing as soon as possible, especially given the uncertainty. “Six weeks ago we never would have guessed that we would be in this situation. so where we’re going to be when it gets to be July 15, who knows. so it’s always better to be proactive. get things done now,” he says.

For those who pay quarterly estimated taxes in Kansas, deadlines did not change for the first and second quarters. The IRS moved the Q1 and Q2 payments to July 15, but Kansas did not. Kansas estimated quarterly taxes are still due on April 15 and June 15.

Cicora says tax preparers are still working through the pandemic while making changes to ensure social distancing. He says he is working with clients over the phone, via email, and sending documents in the mail and does not require face-to-face meetings.

—–

The date has been pushed back from April 15 to July 15, aligning the state deadline with the recently extended federal deadline.

Also Check: Taxes On Plasma Donation

Calendar Of Kansas Sales Tax Filing Dates

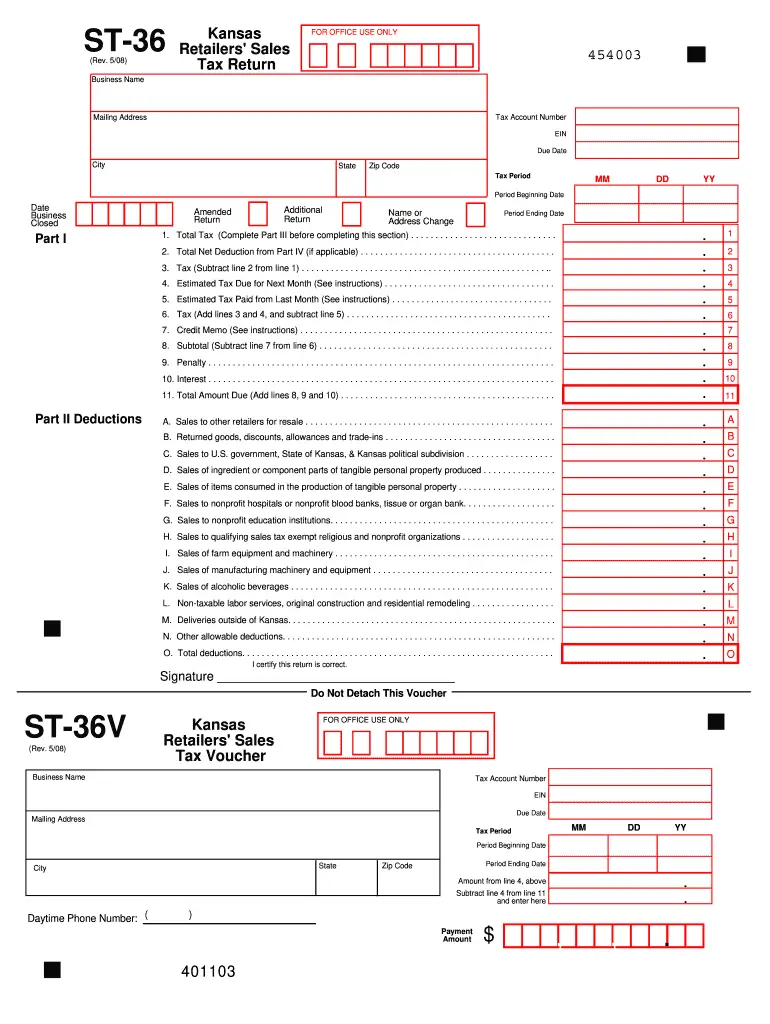

Depending on the volume of sales taxes you collect and the status of your sales tax account with Kansas, you may be required to file sales tax returns on a monthly, semi-monthly, quarterly, semi-annual, or annual basis.

On this page we have compiled a calendar of all sales tax due dates for Kansas, broken down by filing frequency. The next upcoming due date for each filing schedule is marked in green.

Simplify Kansas sales tax compliance! We provide sales tax rate databases for businesses who manage their own sales taxes, and can also connect you with firms that can completely automate the sales tax calculation and filing process.

Agriculture Vehicles And Industrial And Commercial Machinery

Your personal property is also taxed in Kansas. Youre responsible for registering and listing your taxable personal property with the county. The fair market value of your personal property is used to determine the taxes you owe.

The Kansas Personal Property Valuation Guide provides details on how your personal property is assessed and the taxes you may owe on this property. For example, the assessment rate used for a motor vehicle is 20%.

The first half of your property taxes are due on November 1. If the first half isnt paid by December 21, the full tax amount is due plus interest. The second half of your property taxes are by May 10 of the following year.

Don’t Miss: How Much Tax For Doordash

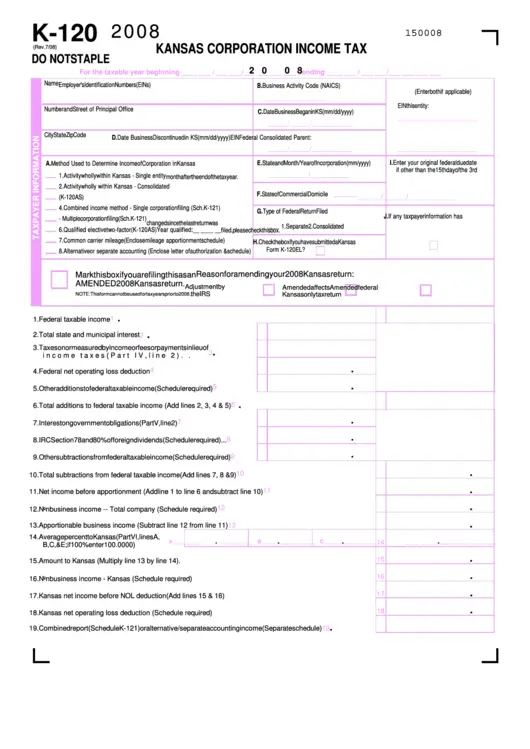

Kansas Income Tax Brackets

| 5.70% |

Additionally, taxes on small business income have been reinstated after being eliminated in 2012.

Kansas allows itemized deductions, but only for taxpayers who claim itemized deductions on their federal tax return. Otherwise, taxpayers can claim the Kansas standard deduction, which is $3,500 for single filers and $8,000 for joint filers.

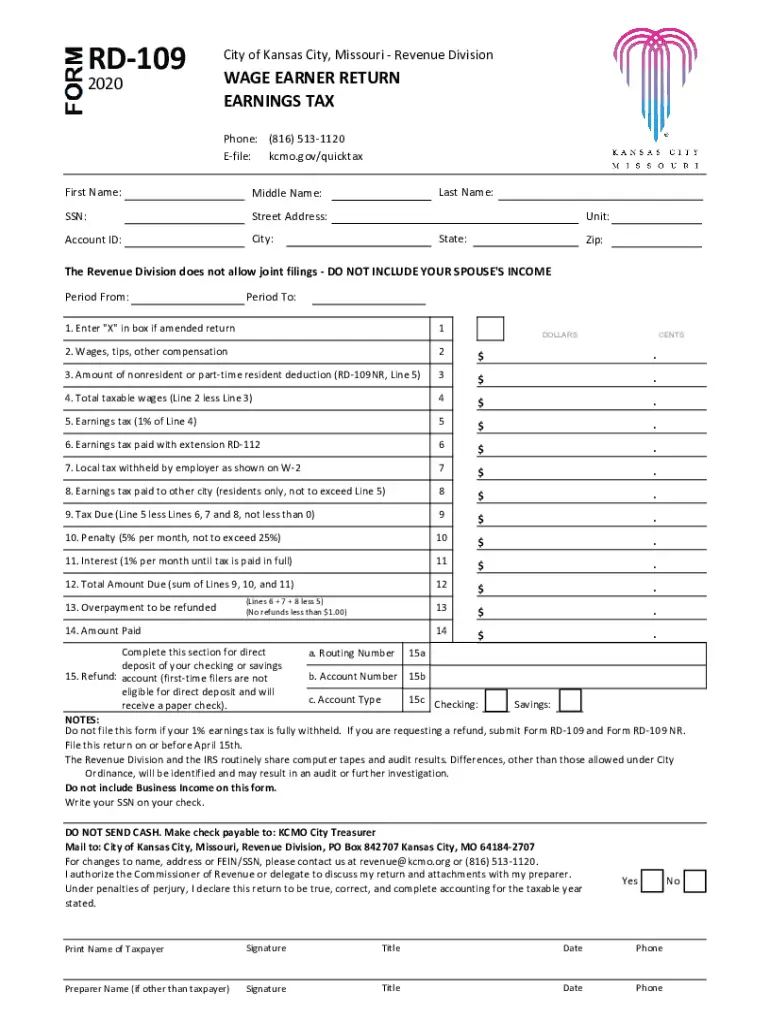

Kansas Estimated Tax Payments Due April 15 Other States Delay To July

Missouri and Colorado extended the due date for the 1st quarter 2020 estimated tax payments from April 15 to July 15, but the State of Kansas still wants those payments in April. For Kansas taxpayers who do business in multiple states, that means they still have to go through the process of preparing estimated 2020 income statements for their multi-state businesses in order to determine their Kansas allocations.

The Kansas Department of Revenue declined to explain their rationale for not delaying the due date but Public Information Officer Zach Fletcher emailed the following statement.

The feds have extended their April 15th estimated due date to July 15th. Kansas has not changed. In fact, most Kansas estimated filers only make 2-3 estimated payments a year. Kansas does not charge interest or penalty on estimated payments. The only time underestimate penalties are assessed in Kansas is when the K-40 return is filed, the balance due exceeds $500, and the taxpayer has not met the prepayment threshold of 90% of current year liability or 100% of the previous years liability. The underestimate penalty applies in those cases to taxpayers that have withholding, make estimated payments or no payments. Current statutes, KSA 79-32,107, allow the department to waive underpayment penalties that would be assessed when a taxpayer files their K-40.

- TAGS

You May Like: Tax Lien Investing California

Filing Taxes In Kansas

The easiest way to file taxes in Kansas is online through the DORs website. When you complete a free online application with the department and provide your bank account information, tax refunds are deposited directly into your account when applicable.

When you create an online account with the DOR, you may log in to file taxes, check the status of your filing, make electronic payments, and view your online activity. You can also view and print forms and publications related to your taxes when logged into the site.

Kansas has unique tax laws and calculations so its important to know the types of taxes that apply to your situation. By learning more about the taxes you owe, how theyre calculated, and when theyre due, you can avoid serious consequences from the IRS.

Kansas Individual Income Tax Returns Are Due By The 15th Day Of The 4th Month After The Close Of The Tax Year For Calendar Year Filers This Date Is April 15 If You Cannot File On Time You Can Request A State Tax Extension

Kansas tax extensions are automatic, which means there is no state application to complete. If you have a valid Federal tax extension , you will automatically receive a Kansas tax extension. Make sure to include a copy of your Federal extension with your Kansas tax return when its filed.

Note that a tax extension does not give you more time to pay tax. If you owe Kansas income tax, it needs to be paid by the original deadline or interest charges will apply. You must pay at least 90% of your Kansas tax by the original deadline in order to avoid an additional penalty charge. You can make an extension payment using Kansas Form K-40V .

If you owe zero tax or youre due a state tax refund, you do not have to request a Kansas extension or file Form K-40V.

For more information, please visit the Kansas Department of Revenue website: www.ksrevenue.org

You May Like: How Do I Protest My Property Taxes In Harris County

Tax Deadline Extended For Kansas

- Tax deadline extended for Kansas

Kansas Governor Laura Kelly has announced that the deadline will be extended to May 17th for individual income tax, fiduciary income tax, and homestead or property tax releief refund claim filings.

The change is in line with the recent decision by the Internal Revenue Service to delay the income tax deadline from April 15th to May 17th.

Governor Kelly said in a press release, Though COVID-19 cases continue to decline, signaling our return to normalcy, Kansas families are still assessing the full scope of the economic challenges brought on by the pandemic. Extending the deadline gives needed relief for Kansans to fully account for the pandemics impact and complete their state returns accurately.

No additional forms will be needed to benefit from the extension. The due dates for Kansas individual estimated tax payments have not changed.

Is There A Tax Extension For 2020

Extension of the 2020 Tax Deadline In March, the COVID-19 epidemic prompted the Treasury Department and the Internal Revenue Service to postpone when Americans were due to file their tax returns, resulting in an automatic tax deadline extension to July 15, 2020 for anyone who filed their 2019 taxes in the previous year.

Recommended Reading: Do You Get Taxed For Donating Plasma

Where To Send Your Kansas Tax Return

| Estimated Income Tax Returns |

You can save time and money by electronically filing your Kansas income tax directly with the . Benefits of e-Filing your Kansas tax return include instant submission, error checking, and faster refund response times. Most tax preparers can electronically file your return for you, or you can do it yourself using free or paid income tax software, like the examples listed below.

Kansas encourages all taxpayers to utilize the state’s free WebFile program, which offers free efiling capabilities to all taxpayers regardless of income or filing type. To eFile your Kansas income tax return you’ll need a user account on Kansas.gov, which can be obtained in only a few minutes with an email account. Once you have a Kansas.gov account, you will be able to access the Kansas WebFile system and efile your tax return, as well as easily check for the status of your tax refund.

To e-file your Kansas and Federal income tax returns, you need a piece of tax software that is certified for eFile by the IRS. While most in-depth tax software charges a fee, there are several free options available through the states, and simple versions are also offered free of charge by most tax software companies.

Homes And Commercial Property

If you own a home or commercial property, a county appraiser values your property to determine how much you owe in taxes each year. When the appraiser completes the valuation, its mailed to your home by March 1. The amount of taxes you owe depends on your city and county governments current tax rate.

The appraised value of your home must be multiplied by 11.5% to determine its assessed value. Once the assessed value of your property is determined, its multiplied by your countys mill levy, which is the tax rate applied to the value of your property. One mill equals one dollar per $1,000 dollars of assessed property value.

You should receive your tax bill no later than the end of November. Your real estate taxes are due on or before December 20. If you only pay half of your taxes on this date, the other half is due on or before May 10 of the following year.

Also Check: Doing Taxes For Doordash

Does Kansas Require An Extension

Is it necessary for me to file an extension with the state of Kansas? Kansas has accepted the federal extension of time and will proceed in the same manner. The extension of time is only for the purpose of filing the return, not paying the tax. In order to avoid a late payment penalty, ninety percent of the tax must be paid by the due date.

Kansas Enacts Tax Incentives To Encourage Investment In The State

On February 10, 2022, the governor of Kansas signed Senate Bill 347, which will go into effect starting fiscal year 2022. This is an economic incentive for businesses making substantial capital investments in the state. In order to qualify for the incentives, a business needs to be engaged in specified industries or involve the construction a national corporate headquarters with a minimum capital expenditure of $1 Billion. Incentives for qualified taxpayers include a 0.5% income tax rate reduction, payroll reimbursements, sales tax exemptions on capital purchases, and workforce training credits and reimbursements. If you have questions about whether you may qualify for these new incentives, please contact a Withum SALT practitioner.

Also Check: How To Get Doordash 1099

Kansas Filing Due Date: Individual Income Tax Returns Are Due By April 15 In Most Years Or By The 15th Day Of The 4th Month Following The End Of The Taxable Year

Extended Deadline with Kansas Tax Extension: Kansas offers a 6-month extension to taxpayers who have a valid Federal tax extension , which moves the filing deadline from April 15 to October 15 .

Kansas Tax Extension Form: Kansas tax extensions are automatic, so theres no application form or written request to submit. In order to automatically receive a Kansas extension, you must first obtain a Federal extension . Remember to include a copy of your approved Federal extension with your Kansas tax return when you file.

Kansas Extension Payment Requirement: An extension of time to file is not an extension of time to pay your Kansas income tax. All state tax payments are due by the original deadline of the return. Any Kansas tax that isnt paid by the proper due date will be subject to interest. Furthermore, to avoid a separate penalty charge, you must pay at least 90% of your Kansas tax due by the original deadline. You can use Form K-40V to make a tax payment for your Kansas extension.

Kansas Tax Extension Tip: Do not file Form K-40V if you owe zero Kansas income tax or you expect a Kansas tax refund. In those cases, an extension is not required.

Misplacing A Sales Tax Exemption/resale Certificate

Kansas sales tax exemption and resale certificates are worth far more than the paper theyre written on. If youre audited and cannot validate an exempt transaction, the Kansas Department of Revenue may hold you responsible for the uncollected sales tax. In some cases, late fees and interest will be applied and can result in large, unexpected bills.

Recommended Reading: Efstatus Taxact 2015

When Are State Income Tax Forms Due

- In order to avoid this, its critical that you complete your federal income tax returns before attempting to complete your state income tax returns.

- When Do Taxes Have to Be Paid?

- The deadline to file federal income taxes for tax year 2020 is April 15, 2021.

- The majority of state income tax returns are due on the same day as the federal return.

- A small number of states have a later deadline, such as April 30, 2021, in some cases.

Kansas To Exclude Unemployment Compensation From Taxable Income

The Kansas Department of Revenue has advised taxpayers that unemployment compensation should be excluded from gross taxable income in 2020 to align with the federal American Rescue Plan Act of 2021 which excludes up to $10,200 in unemployment compensation from gross income per taxpayer. The IRS is sending refunds to taxpayers affected by the change. In addition to the refunds, the IRS is sending affected taxpayers a letter after making the adjustment notifying the taxpayer of the change. In order for Kansas taxpayers to exclude unemployment compensation from Kansas taxable income, taxpayers must amend their Kansas income tax return and include a copy of the IRS letter. Only affected taxpayers who have filed and paid their Kansas income tax returns by the original due date are required to amend their returns. Kansas taxpayers whose returns are on extension can claim the exclusion for unemployment compensation on their original return.

Don’t Miss: Reverse Tax Id Lookup

Kansas Update On Extension Of Filing Deadline

Indiana Governor Eric Holcomb announced that the Indiana Department of Revenue is extending individual income tax filing and payment deadlines to align with the IRS deadline of May 17, 2021. Individual tax returns and payments, originally due by April 15, 2021, are now due on or before May 17, 2021. All other tax return filings and payment due dates remain unchanged. Individuals unable to file by the May 17, 2021, deadline can file an extension directly with the department or with the IRS. If the IRS extension is granted, the Indiana extension is automatically granted. A timely filed extension results in the federal tax filing deadline of October 15, 2021, and the Indiana filing deadline of November 15, 2021. The extension only shifts the filing deadline and not the payment deadline 90% of the taxes owed must still be paid by May 17, 2021, to avoid penalties and interest. +C17+C18