How Much You Have To Make To File Taxes

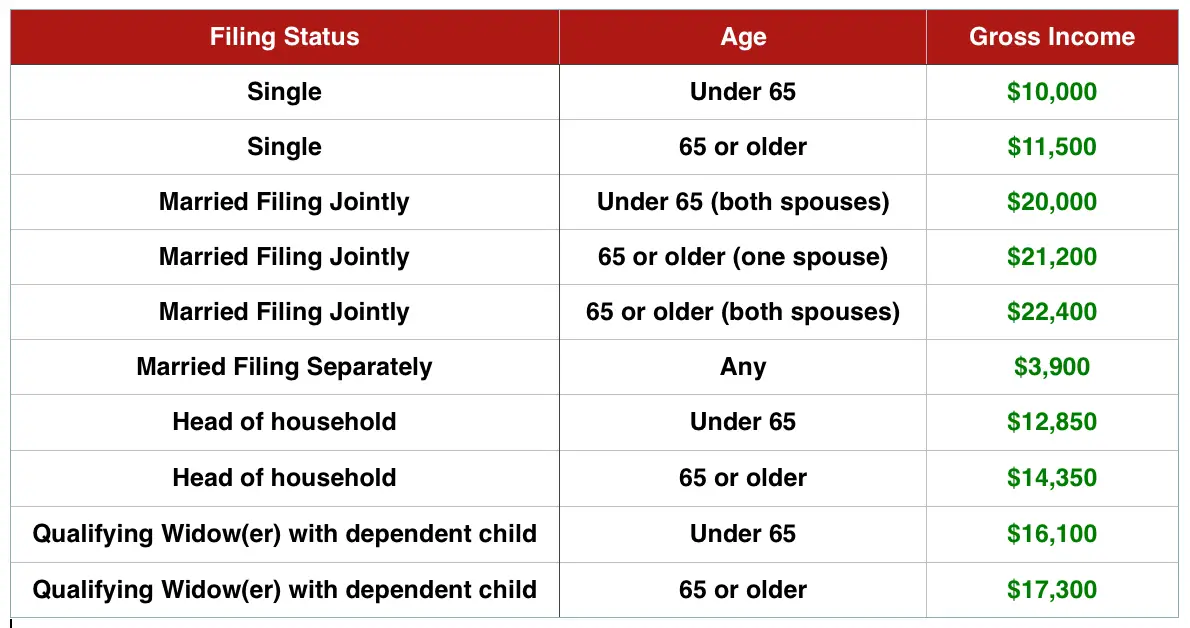

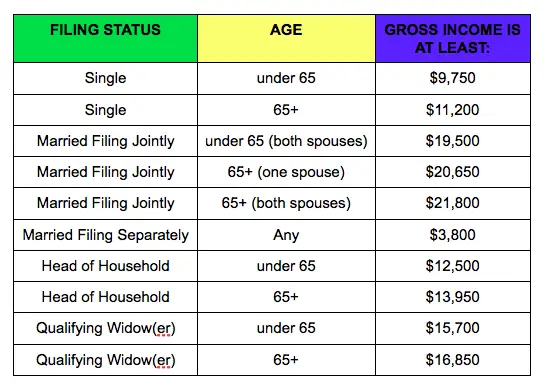

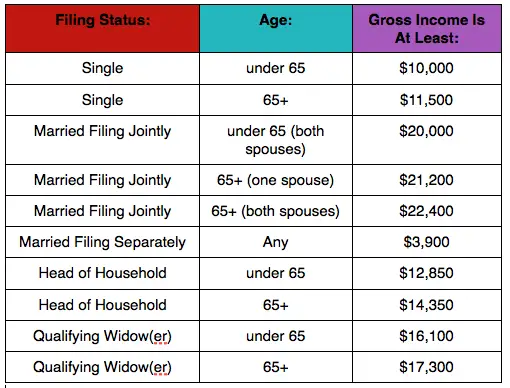

Your first consideration is: Does my level of earnings mean I must file taxes? If your gross income for 2021 is above the thresholds for your age and filing status, you must file a federal tax return. See the table below.

Income requirements for filing a tax return| Filing status |

|---|

| $5 | $5 |

In addition to federal taxes, you may also have to pay state taxes. Currently, nine states dont tax income at all, while two other states only tax investment income. You can find out if you owe state income taxes by going to your states revenue, finance or taxation offices website. The IRS also has a link to every states tax office.

Should I File Taxes Even If I Dont Have To

People with income under a certain amount arent required to file a tax return because they wont owe any tax. Its very common to feel like you shouldnt need to file a return if you dont owe any tax. However, owing to tax and having filing requirements are two separate situations in the CRAs eyes.

Even if the amount of income from your childs job doesnt require a tax return, if a refund is coming, a return should be filed. A child should file a tax return for many reasons:

If your child had any income tax deducted at the source, chances are theyll receive those deductions back as a refund.

Filing a return sets up your childs information with CRA for future years. Many first returns still need to be mailed in, as opposed to NetFiling. Once the first return is processed, your childs info will be filed, enabling them to file electronically in the future. Trust me, sending in a paper return for a high schooler is generally much easier than waiting until they have tuition credits or medical expenses to claim.

RRSP contribution room begins as soon as earned income is reported. Even if your child doesnt purchase RRSPs , their contribution room will begin to accumulate as soon as they report their earned income on their tax return.

Save Time Ordering Tax Services From Taxory

As you see, you can prepare and file a nil corporate tax return yourself, but it is much safer to rely on a professional who can do it just for a small fee. Feel free to reach out to our team and get more details about our corporate tax return services. If you want to learn more about our prices, check out our pricing page

Recommended Reading: Do Doordash Drivers Have To Pay Taxes

Do I Need To File A Tax Return

Factors such as age, disability, filing status, and income will determine whether or not the U.S. federal government requires you to file a tax return. The charts below will assist you in determining this.

However, just because you are not required to file a tax return does not necessarily mean you shouldn’t. Later in this article, we will discuss the reasons to file a tax return even when it is not required.

You Can Start The Clock On The Statute Of Limitations

The IRS generally has three years from the date you filed to audit your tax returnsix years if your return includes a substantial understatement of income. But if you dont file a tax return, the clock on that statute of limitations never starts running. In effect, the IRS could come after you in a decade or more and claim that you should have filed a return.

If youre worried about an IRS audit, you may want to file a tax return even if you didnt earn enough to trigger a filing requirement.

Read Also: Find Employers Ein

How Income Tax Works

Federal and Ontario income taxes are paid to the Canada Revenue Agency , which is part of the federal government.

Income tax is commonly taken off your pay by your employer, or off your pension, and sent directly to the CRA. You may also have to calculate the tax you owe and send a payment to the CRA.

Each year, you should file a tax return with the CRA to:

- report the income youve made

- ensure youve paid the correct amount of income tax

- access tax credits and benefits

Learn more about how much tax you should pay on each portion of your income.

Other Circumstances That Require You To File

If you are self-employed, you are required to file taxes if you earned more than $400 in self-employment income.

If you pay special taxes, then you must file even if you dont meet the filing threshold. Special taxes include additional taxes on qualified retirement plans or when you must pay taxes on tips you did not report to your employer.

In addition, you must file taxes if you or anyone in your household enrolled in health coverage through the Healthcare.gov Marketplace and you received premium tax credits in 2021.

If you have special tax considerations, you may want to use the IRS interactive tool to determine whether you need to file.

Recommended Reading: Is Doordash Taxed

Making Money In Canada

Your Canadian residency status doesnt affect whether or not you have to file a Canadian income tax return, however, it does affect how you file your taxes, what income you need to report, and the availability of certain credits or deductions. If you meet any of the CRAs criteria listed above, for example, you have to file a tax return regardless of your residency status.

If you live in another country but receive income from a business you own in Canada, or from investments you have in Canada or if you have property in Canada, then you will need to file an income tax return.

How To Check Itr Status Online

Once you have filed your income tax returns and verified it, the status of your tax return is ‘Verified’. After the processing is complete, the status becomes ‘ITR Processed’.

If you wish to know which stage your tax return is after filing it and want to check your ITR status online, here’s how you can do it in easy steps.

Option One

Without login credentials

You can click on the ITR status tab on the extreme left of the e-filing website.

You are then directed to a new page where you have to fill in your PAN number, ITR acknowledgement number and the captcha code.

Once this is done, the status of your filing will be displayed on the screen.

Option Two

Read Also: Do You Pay Taxes On Doordash

When You Should File Even If You Aren’t Required To

Filing a tax return isn’t just for paying taxes. If you don’t owe income tax and aren’t required to file for any other reason, you may still want to so that you can get money back in your pocket.

If you had a job in 2021 that withheld taxes from your paycheck, you may be entitled to a refund if you paid too much. Filing a tax return is the only way to get that money.

Also, if you qualify for any of the following tax credits, you should file to get your refund:

- Earned income tax credit

- Child tax credit or additional child tax credit

- Child and dependent care credit

- American opportunity tax credit

- Premium tax credit

- Recovery rebate credit

Notes: The IRS begins issuing refunds for the child tax credit and the earned income tax credit in mid-February.

If you received advance child tax credit payments during 2021, you should get a notice from the IRS Letter 6419 detailing the amount you received. Use this to file your 2021 tax return and claim any remaining credit.

Affordable Care Act Premium Credit Claim

If you have health care coverage as required by the Affordable Care Act, also known as ACA or Obamacare, you might need to file a return.Specifically, this will be the case if you qualified for federal help in buying your health care coverage through the health insurance marketplace or exchange. If advance payments of the ACA premium tax credit were made for you, your spouse or a dependent who obtained such marketplace medical coverage, that amount must be reported by filing a Form 1040 tax return and Form 8962, Premium Tax Credit.

This will ensure that you got the appropriate tax credit in advance. If you received too much premium help, youll have to repay it when you file your return. If you did not get enough, you can collect the extra when you file.

Recommended Reading: Door Dash Driver Taxes

Save The Right Paperwork All Year Long

Stay on top of tax-related paperwork throughout the year it will make your life easier during tax season. You might want to keep receipts for things like charitable donations, work-related expenses and medical bills, or other items from step 4. You may also want to keep statements from student loans or investments and any grants or fellowships. Having these handy and organized can help you determine whether to itemize and make the process easier. You should keep your paperwork after you file, too. The IRS recommends keeping records for at least three years.

The Earned Income Tax Credit

The EITC is a refundable tax credit worth up to $6,728 for low- and moderate-income workers. The credit amount is based on how many children you claim up to three or more although you can still file if you have no children. In the case of no qualifying children being claimed, the payout is $1,502.To receive this credit, your qualifying adjusted gross income has to be below certain thresholds, based on how many qualifying children you are claiming. But you don’t have to worry about that if you don’t earn enough to justify a tax return your AGI is low enough to qualify for the full credit, whether you have kids or not.

There are some other eligibility requirements, too, but your best bet is using the IRS’EITC Assistant to determine whether you qualify. The claim for this credit is made in your tax return using the Schedule EIC.

Read Also: Efstatus.taxact

Minimum Income Requirements Based On Age And Status

There is no set minimum income for filing a return. The amount varies according to both filing status andage. The minimum taxable income level for each group is listed in the following chart. If your income fallsbelow what is listed for your age group and marital status, you are not required to file a return.

| Filing Status | |

|---|---|

| 65 or older 65 or older | $24,800 |

| Qualifying Widow with Dependent Children | Under 65 |

| $400 |

How To Lower Your Taxable Income & Save On Your Tax Return

No one wants to fork over their funds to the IRS each tax year, but for some, its inevitable. Fortunately, there are a number of legal ways that you can lower your taxable income, so you can lower your tax liability and keep more of your hard-earned money in your own pocket.

Ready to save on your taxes? Here are some ways that you can lower your taxable income:

| 4th Quarter Estimated Quarterly Taxes |

If youre filing taxes, there are a few key due dates to keep in mind. The dates generally remain the same from year to year. However, if a due date falls on a weekend or holiday, it is pushed back to the next business day. So, for 2022 taxes are due on April 18.

Once youve determined that you need to file taxes, there are a few steps you can take to make sure theyre filed quickly and accurately:

Read Also: Ein Free Lookup

Income Thresholds For Taxpayers 65 And Older Are Higher

If you are at least 65 years old, you get an increase in your standard deduction. You also get an increased standard deduction if:

- You are blind

- Or your spouse is also at least 65

- Or if your spouse is blind

The largest standard deduction would be for a married couple that are both blind and both over 65 years old.

Having a larger standard deduction can allow you to have more income than someone under age 65 and still not have to file a return. TurboTax can help you estimate if you’ll need to file a tax return and what income will be taxable.

Talk To A Tax Attorney

Need a lawyer? Start here.

Self-help services may not be permitted in all states. The information provided on this site is not legal advice, does not constitute a lawyer referral service, and no attorney-client or confidential relationship is or will be formed by use of the site. The attorney listings on this site are paid attorney advertising. In some states, the information on this website may be considered a lawyer referral service. Please reference the Terms of Use and the Supplemental Terms for specific information related to your state. Your use of this website constitutes acceptance of the Terms of Use, Supplemental Terms, Privacy Policy and Cookie Policy. Do Not Sell My Personal Information

Also Check: How To Pay Taxes With Doordash

How Much Does Nil Corporate Tax Return Cost

by Anna Grigoryan | Taxes |

Last Updated on June 5, 2022 by Anna Grigoryan

Thousands of new businesses are opened every month to be successful and produce a profit. While such companies are successful in most cases, it is still pretty common to have a loss or no income throughout the tax year. Some companies, such as startups, run with losses for years until they become profitable, and some companies stop their operation and have no income and expenses.

Nevertheless, CRA still expects a tax return from companies with zero activities . Still, CRA understands that it does not make sense to send a full T2 Corporate income tax return form in such a case. That is why CRA introduced a T2 Short return form or zero corporate tax return.

Compared with the full T2 Income Tax Return Form, the short version is much more compact. It is just two pages compared to the nine-page of the T2 form. The T2 Short return form requires the absolute minimum information about your business and lets CRA know they should not expect any tax payment from your company.

As a business with no income and no expenses, you wonder how much does nil corporate tax return cost you? If you want to hire a professional account company, such as Taxory, preparing and filing a nil corporate tax return would cost you $300 per one return.

How To Link Aadhar To Income Tax Returns

it is compulsory for every individual taxpayer to quote their Aadhar number while filing tax returns. He/she is also required to link their PAN card to their Aadhar number. One cannot file a tax return either digitally or manually unless the Aadhar number is quoted. Senior citizens can file their tax returns manually but those below 80 years of age have to file it electronically.

To link your Aadhar number to your income tax return-

Type or write down the number in the additional spaces provided in the new ITR forms provided in the Income Tax website.

If you have applied for an Aadhar number but have not received it, you can use the 28 digit enrolment ID in place.

The Aadhar number gets automatically populated in the ITR forms if it has been electronically added before.

Don’t Miss: Is Doordash Money Taxed

The Child And Dependent Care Credit

This credit covers some of the costs associated with caring for a child or dependent with disabilities, including after-school programs, babysitters or daycare, if that care enabled you to work.

The American Rescue Plan made this credit fully refundable in 2021 only. The maximum eligible expense for this credit is $8,000 for one qualifying person and $16,000 for two or more.

The exact credit amount you might qualify for depends on a few factors, including income. To find out what you might be owed, use this IRS tool. The claim for this credit is made using Form 2441.

Do You Need To File A Tax Return

Here’s how to figure out if you should file a tax return this year:

- Look at your income to see if you made the minimum required to file a tax return

- Decide which filing status is best for you

- If you’re retired, find out if your retirement income is taxable

- Find out if you qualify to claim certain to lower the amount of tax you owe

- Use the Interactive Tax Assistant to see if you need to file

You May Like: Payable Com Doordash

How Much Money Do You Have To Make To Not Pay Taxes

The amount that you have to make to not pay federal income tax depends on your age, filing status, your dependency on other taxpayers and your gross income. For example, in the year 2018, the maximum earning before paying taxes for a single person under the age of 65 was $12,000.

If your income is below the threshold limit specified by IRS, you may not need to file taxes, though its still a good idea to do so.

What this article covers:

NOTE: FreshBooks Support team members are not certified income tax or accounting professionals and cannot provide advice in these areas, outside of supporting questions about FreshBooks. If you need income tax advice please contact an accountant in your area.