What A Tax Transcript Includes

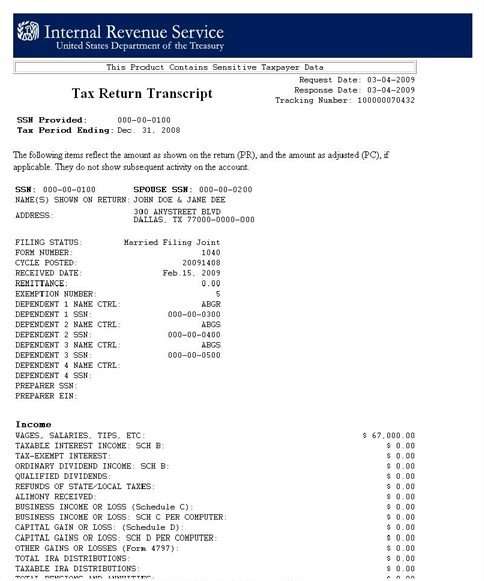

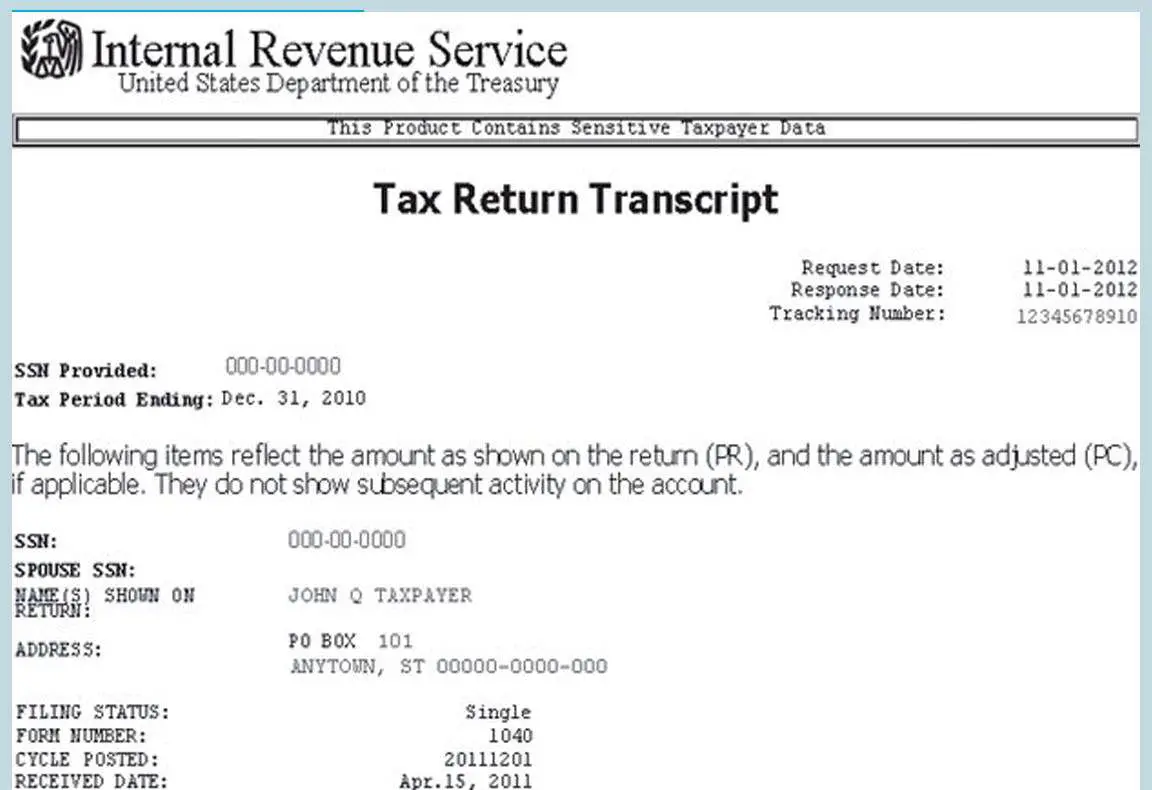

Your transcript will include all the same information that appears on your tax return, although its not laid out in the same format. Youll see your filing status, income, and any deductions and credits you claimed. However, your personal information wont appear on the transcriptat least not in its entirety.

The IRS has been actively taking steps to combat fraud and identity theft, and it now masks or blacks out portions of information on your transcript that thieves might like to know, such as the first five digits of your Social Security number and your complete telephone and account numbers. All of your tax financial information is displayed in full, however.

As of January 2019, your accountant or any other individual or entity who has a rightand your permissionto access your transcript must now enter a customer file number on line 5 of IRS Form 4506-T, the official Request for Transcript of Tax Return. Generally, the third party can assign the number. For example, a potential lender that wants a copy of your transcript might assign it with your loan number. What third parties cant use is your Social Security number. The IRS will enter the new number into its transcript database when it receives a Form 4506-T.

Paper Request Form Irs Form 4506t

ONLY the Tax Return Transcript can be obtained using the 4506T-EZ. If you require other IRS documents, as well, and you need or choose to use a paper request form, use the IRS Form 4506-T, instead, as all of the IRS documents may be ordered together on that one form.

NOTE: If any information does not match IRS records, the IRS will notify the tax filer that it was not able to provide the transcript.

How Does Irs Protect Against Identity Theft

In order to obtain your business transcript information, the IRS may ask you a series of questions to prove your identity. Be prepared when calling the IRS. Have your EIN, last years tax return, physical address, articles of incorporation and other important business documents to help prove who you are and your relationship to the business.

Recommended Reading: Do You Have To Pay Taxes On Plasma Donations

Requesting A Transcript By Phone

Requesting A Transcript For A Business

Also Check: Cook County Appeal Property Tax

Ways To Get Transcripts

You may register to use Get Transcript Onlineto view, print, or download all transcript types listed below.

If you’re unable to register or you prefer not to use Get Transcript Online, you may order a tax return transcriptand/or a tax account transcript using Get Transcript by Mailor call 800-908-9946. Please allow 5 to 10 calendar days for delivery.

You may also request any transcript type listed below by faxing/mailing Form 4506-T, Request for Transcript of Tax Returnas instructed on the form.

How To Complete Any Form Tax Return Transcript Online:

PDF editor permits you to help make changes to your Form Tax Return Transcript from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Recommended Reading: How To Get A Pin To File Taxes

Tax Professionals Can Now Order More Transcripts From The Irs

IR-2021-226, November 16, 2021

WASHINGTON The Internal Revenue Service today announced that, effective Nov. 15, 2021, tax professionals are able to order up to 30 Transcript Delivery System transcripts per client through the Practitioner Priority Service® line. This is an increase from the previous 10 transcripts per client limit.

“Increasing the number of transcripts a caller can receive addresses the concerns the IRS has received from PPS callers. This is another example of addressing concerns from our partners and stakeholders,” said Ken Corbin, the Wage and Investment Commissioner and the IRS Taxpayer Experience Officer.

Through PPS, tax professionals can order a variety of transcripts. Practitioners can receive transcripts for up to five clients per call. There’s no change to the number of clients.

Transcripts available under this newly-expanded limit include the:

- Tax Return Transcript,

How To Obtain Irs Tax Transcripts

Its easy to get your IRS tax transcript. You can obtain reports going back as far as three years. All transcripts are free, and you have several options for requesting a copy. The IRS2Go mobile app allows users to easily access their tax transcripts. If the IRS can verify your identity online, you can instantly access your transcripts through IRS2Go or the Get Transcript feature on IRS.com.

Unfortunately, you have to request a transcript by mail if you cant prove your identity online. You can request a tax transcript by mail using the IRS website and mobile app too. However, if youre not technically inclined, you can request a tax transcript the old fashioned way using an IRS form. You can use Form 4506-T to request your tax return transcript through the mail.

You can also use your phone to request your IRS tax transcripts. The IRS has a toll-free phone line that handles these requests, and you can call it at .

If you order your transcript online or via phone, it typically takes about 15 days to arrive. It can take up to 30 days to receive a transcript with a mailed request.

Also Check: How To Appeal Property Taxes Cook County

Request A Business Tax Transcript

As mentioned earlier, the most common use for tax transcripts is to provide income verification to a lending institution thats considering you for a loan. In 2019, the IRS ceased mailing tax transcripts to third parties, except participants of the Income Verification Express Service program. Therefore, the easiest means for an individual to acquire a tax transcript is simply to request it directly from the IRS.

To get a business tax transcript, go to the IRS website, where you can request a transcript by mail or online. Whereas in previous years, individuals couldnt get an electronic copy of a tax transcript from the IRS without using a third-party service, the online request form now allows taxpayers to access their transcripts quickly and easily.

How Long Does It Take

Time can vary greatly on receiving transcripts. Its influenced by several factors: type of report ordered, manner of the request, and the workload of CAF and FOIA, to name a few. You may be able to download certain reports in minutes, while others can take months.

My suggestion for this and most other IRS matters is: Keep a record of all your actions, dates, times and people you spoke with. A detailed record is your leverage when dealing with the IRS and FOIA. Dont forget to follow up on your requests at an appropriate time. If the IRS sends you a letter that states it will take them an additional 30 days to process your request, dont call in a week and demand answers. If you send mail, get a tracking number and call to make sure it was received.

If you feel that your rights to receiving the information in the time allotted are being violated, there is something you can do. Please know that most IRS decisions can be taken to a manager or appealed to the next level. If you are having a very difficult time getting through the red tape, your next step may be taxpayer advocates. If after all your hard work you find that you have made no progress, you can always pay a fee to a certified tax practitioner who works in tax resolution to retrieve your records on your behalf by filing form 2848 Power of Attorney.

Recommended Reading: Is Past Year Tax Legit

Receiving The Transcript By Mail

Why You Might Need An Irs Transcript

You might need your transcripts for any number of reasons. Maybe you just need your AGI, or you want to track and confirm payments youve made to the IRS. Most taxpayers access their transcripts because they must verify their income information for some reasonsuch as loan and student aid applications. You might also need transcripts to apply for housing assistance or federal health care programs.

Maybe youve just realized that your record-keeping habits arent all that they should be, and you have no record of your relationship with the IRS. In any case, getting transcripts isnt usually a prohibitive process for most taxpayers.

Recommended Reading: Turbo Tax 1099q

Getting An Online Transcript

Reviewing Before The End Of The Year

You should always review your IRS tax transcript at the end of the fiscal year to ensure your numbers line up. This information can help you ensure that your tax filings are correct. Sometimes, you can even find information that will help you reduce your tax bill. If youre unfamiliar with proper tax planning procedures, you should speak to a professional. A tax advisor can help you review your tax transcript and ensure that your filings match up with the data the IRS has on file. This can help you avoid the mistake that could result in expensive IRS penalties. Plus, a certified tax pro can help you find every available discount so you can minimize your tax bill.

Search

Don’t Miss: Have My Taxes Been Accepted

How Do I Get My Corporation Tax Transcript

How To Receive a Tax Transcript From the IRS

Subsequently, one may also ask, how do I get a corporate tax transcript?

To get a transcript, people can:

Additionally, how can I get my tax transcript online immediately? You can get your free transcripts immediately online. You can also get them by phone, by mail or by fax within five to 10 days from the time IRS receives your request. To view and print your transcripts online, go to IRS.gov and use the Get Transcript tool. To order by phone, call 800-908-9946 and follow the prompts.

Beside this, why is my tax transcript not available?

If you didn’t pay all the tax you owe, your transcript may not be available until mid-May or a week after you pay the full amount owed. Refer to transcript availability for more information.

How do I get my transcript from 1120s?

Types Of Irs Transcripts

There are several types of IRS transcripts you can request,depending on your needs. These include the following:

- Tax return transcript: The most common type, this includes the line-by-line details from your annual original tax return. Keep in mind that this is a record of your original return if you needed to make an amended filing, the amendments will not be found on this transcript. You can get this for the current year and three previous years.

- Tax account transcript: If you need even more details, this may be the record that you want to request. This transcript includes adjusted gross income, various types of taxable income and the types of tax payments you have made. It does include amended filings. You can receive this for the current tax year and up to 10 years previous.

- Record of account transcript: This document includes all of the data from both of these transcripts into one document. You can receive records for the current year and three past years.

- Wages and income transcript: This document records only your income. It does not show the deductions that you took that reduced your taxable income. This is available for the current year and up to 10 previous years.

- Verification of non-filing letter: This is a verification that affirms that you did not need to file a return for a certain year because your income was too low. This is also available for the current year and up to 10 previous years.

You May Like: Do You Have To Pay Taxes On Plasma Donations

How Can I Get My Irs Transcripts

stanleyblock

Image Credit:

The primary way to find out whats going on with a business and its taxes is for a tax practitioner to investigate its IRS transcripts. The first step is always analysis and investigation. Transcripts provide a comprehensive report of what has been filed, paid, not paid, penalties, interest and more.

If you want to obtain copies of your business transcripts and do some investigation on your own, its possible. IRS transcripts are easy to order and most of the time completely free or available for a nominal fee. The three most common ways of obtaining transcript records for your business are online