What Are The Taxes And Fees When Buying A New Or Used Car In New Jersey

If you buy a car in New Jersey, then you’ll need to pay sales tax and other fees when you transfer ownership. According to NJ.com, the state assesses a 6.625 percent sales tax on the purchase price of any used or new vehicle. To calculate how much sales tax you’ll owe, simply multiple the vehicle’s price by 0.06625. For example, a $15,000 car will cost you $993.75 in state sales tax.

Car buyers in New Jersey also need to pay title transfer and registration fees. As per NJcashcars, these Motor Vehicle Commission fees vary depending on the type of vehicle you bought and how you paid for it. The state’s standard title transfer fee is $60. If the vehicle has one lien on it, then it costs $85 for the transfer. Two liens will cost $110. You have 10 days to transfer ownership from the previous owner to yourself. If you transfer the title after this time, then you must pay a $25 late fee.

Titling fees are only due at the time of ownership transfer. Registration fees, however, are due every year. They range from $46.50 to $98, depending on the age and weight class of your vehicle, shares ITSTILLRUNS. These fees include the cost of a new license plate. It costs $5 to transfer existing plates. You must also provide proof of auto insurance when you register a vehicle in New Jersey.

Budget And Finance Legislation

The following is a list of recent budget and finance bills that have been introduced in or passed by the New Jersey state legislature. To learn more about each of these bills, click the bill title. This information is provided by BillTrack50 and LegiScan.

Note: Due to the nature of the sorting process used to generate this list, some results may not be relevant to the topic. If no bills are displayed below, no legislation pertaining to this topic has been introduced in the legislature recently.

Local Sales Tax Rates

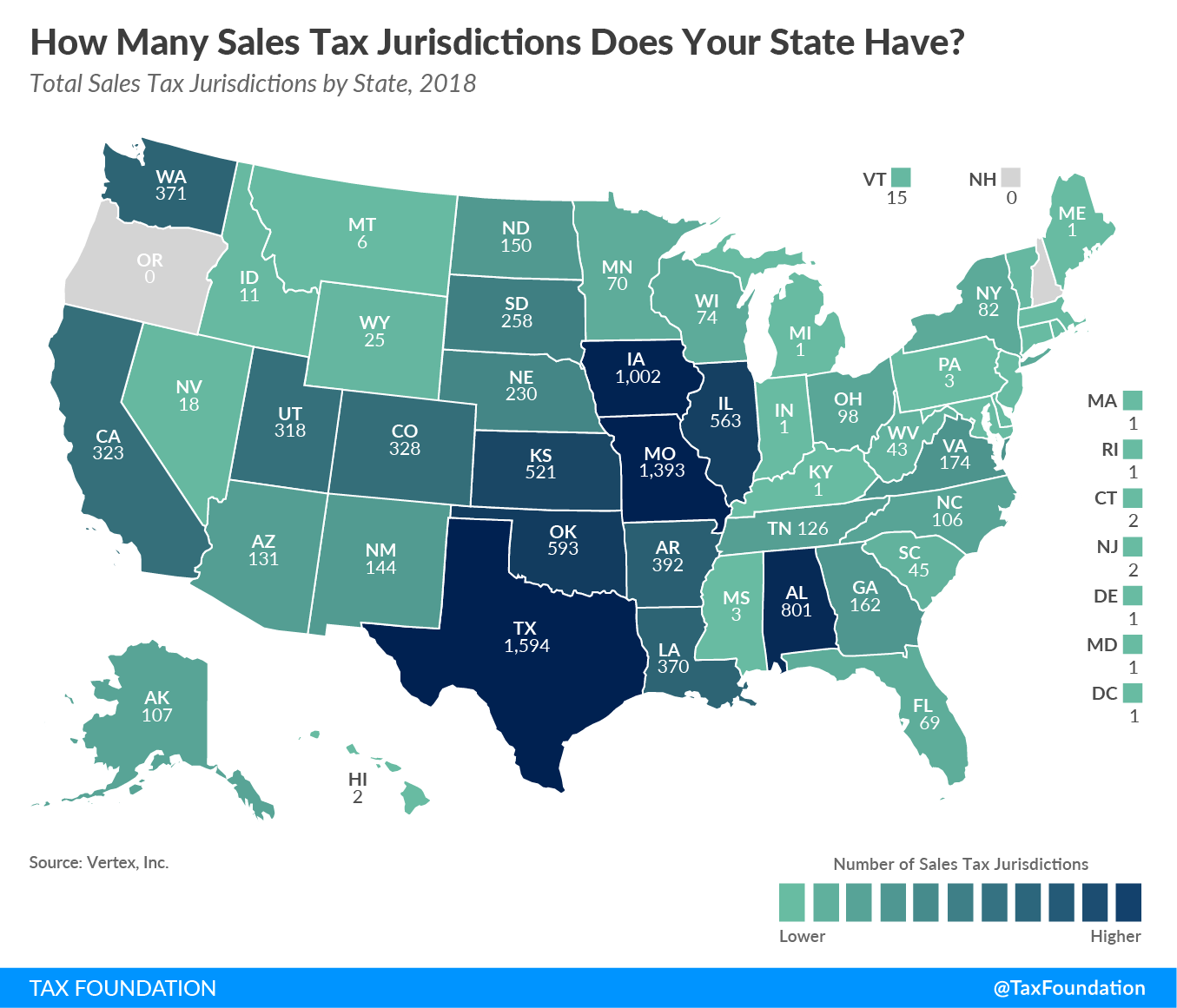

The five states with the highest average local sales tax rates are Alabama , Louisiana , Colorado , New York , and Oklahoma .

No states saw ranking changes of more than one place since July. Most states whose rankings improved did so only in comparison to those that enacted more substantial local rate increases.

Arkansas went from 2nd to 3rd highest on its own meritalthough the actual change in its local average was quite small. Crittenden County takes some of the credit for this improvement, as it reduced its local rate from 2.75 to 1.75 percent. Yell County also reduced its rate, from 1.875 to 1.125 percent.

Missouri moved in the opposite direction, going from 13th to 12th highest. This shift can be traced back to Kansas City increasing its fire protection sales tax by 0.25 percentage points and Platte and Butler counties levying new 0.25 percent sales taxes to support law enforcement.

Ohio saw a 0.8 percentage-point tax increase in Hamilton County in October that tipped the scales to move the state from the 21st to the 20th spot.

Colorado saw changes that did not result in a new ranking. Even though Colorado Springs saw a local sales tax decrease from 3.12 to 3.07 percent, a Denver increase raised the states overall local average. Voters in the Mile High City chose to increase their local taxes by 0.5 percentage points to fund efforts to reduce the citys carbon emissions and to support homelessness relief programs.

Read Also: How To Buy Tax Lien Properties In California

What Is Eligible For Sales Tax In New Jersey

Sales tax applies to most tangible goods in New Jersey and few services, though there are exceptions to both of these provisions depending on the industry and situation. Here is a brief summary of what is taxable in the state:

It is recommended that you review the State of New Jerseys guide to sales tax and exemptions to see what applies to your particular business situation.

Tax Policy In New Jersey

This article does not contain the most recently published data on this subject. If you would like to help our coverage grow, consider donating to Ballotpedia.

| Tax policy in New Jersey |

| Tax rates in 2017 |

New Jersey

Tax policy can vary from state to state. States levy taxes to help fund the variety of services provided by state governments. Tax collections comprise approximately 40 percent of the states’ total revenues. The rest comes from non-tax sources, such as intergovernmental aid , lottery revenues and fees. The primary types of taxes levied by state governments include personal income tax, general sales tax, excise taxes and corporate income tax.

HIGHLIGHTS

Read Also: Otter Tail County Tax Forfeited Land

The Role Of Competition In Setting Sales Tax Rates

Avoidance of sales tax is most likely to occur in areas where there is a significant difference between jurisdictions rates. Research indicates that consumers can and do leave high-tax areas to make major purchases in low-tax areas, such as from cities to suburbs. For example, evidence suggests that Chicago-area consumers make major purchases in surrounding suburbs or online to avoid Chicagos 10.25 percent sales tax rate.

At the statewide level, businesses sometimes locate just outside the borders of high sales-tax areas to avoid being subjected to their rates. A stark example of this occurs in New England, where even though I-91 runs up the Vermont side of the Connecticut River, many more retail establishments choose to locate on the New Hampshire side to avoid sales taxes. One study shows that per capita sales in border counties in sales tax-free New Hampshire have tripled since the late 1950s, while per capita sales in border counties in Vermont have remained stagnant. At one time, Delaware actually used its highway welcome sign to remind motorists that Delaware is the Home of Tax-Free Shopping.

State and local governments should be cautious about raising rates too high relative to their neighbors because doing so will yield less revenue than expected or, in extreme cases, revenue losses despite the higher tax rate.

Services Subject To Tax In New York City

New York City collects sales tax on certain services that the state doesnt tax. Examples include beautician services, barbering, tanning and massage services. The city also charges sales tax at health and fitness clubs, gymnasiums, saunas and similar facilities. If youre trying to improve your credit, keep in mind that New York City charges sales tax on most credit reporting services.

Recommended Reading: How Can I Make Payments For My Taxes

Bergen County New Jersey Sales Tax Rate

Bergen County Tax jurisdiction breakdown for 2021

What does this sales tax rate breakdown mean?

Sales tax rates are determined by exact street address. The jurisdiction-specific rates shown add up to your minimum combined sales tax rate. The total rate for your specific address could be more.

Need the exact sales tax rate for your address?

What is the sales tax rate in Bergen County?

The minimum combined 2021 sales tax rate for Bergen County, New Jersey is . This is the total of state and county sales tax rates. The New Jersey state sales tax rate is currently %. The Bergen County sales tax rate is %.

The 2018 United States Supreme Court decision in South Dakota v. Wayfair, Inc. has impacted many state nexus laws and sales tax collection requirements. To review the rules in New Jersey, visit our state-by-state guide.

Automating sales tax compliance can help your business keep compliant with changing sales tax laws. AvaTax delivers real-time sales tax rates and uses advanced technology to map rates to exact address locations, based on the latest jurisdiction requirements.

NOTE: The outbreak of COVID-19 may have impacted sales tax filing due dates in Bergen County. Please consult your local tax authority for specific details. For more information, visit our ongoing coverage of the virus and its impact on sales tax compliance.

Wise Is The Cheaper Faster Way To Send Money Abroad

Exporting or importing goods from abroad to sell in the US? Want to pay your sales tax via direct debit?

With Wise for Business, you can get a better deal for paying supplier invoices and buying goods overseas. Well always give you the same rate you see on Google, combined with our low, upfront fee so youll never have to worry about getting an unfair exchange rate.

That means you spend less on currency conversion, and have more to invest in growing your business.

Set up recurring direct debits from your Wise account, where payments will be automatically taken out on schedule. So it’s not only money you’ll be saving with Wise, but time as well.

Read Also: Where Is My Tax Refund Ga

How To Register For Sales Tax In New Jersey

Okay, so you have nexus! Now what?

The next crucial step in complying with New Jersey sales tax is to register for a sales tax permit. Itâs actually illegal to collect tax without a permit. So to get all your ducks in a row, start with tax registration first.

You can find directions about how to register in New Jersey on their Department of Revenue website.

When registering for sales tax, you should have at least the following information at hand:

- Your personal contact info

- Social security number or Employer Identification Number

- Business entity

- Bank account info where youâll deposit the collected sales tax

Other Taxes And Duties

Depending on your industry, you may be liable for certain other taxes and duties. For example, if you sell gasoline, you may need to pay a tax on any fuel you sell. Likewise, if you import or export goods, you may need to pay certain duties.

Speak to your accountant about any other taxes or duties you may need to withhold or pay.

Don’t Miss: Mcl 206.707

Congress Introduces Marketplace Fairness Act Of 2017 And Remote Transactions Parity Act Of 2017

Introduced on April 27, 2017, the Marketplace Fairness Act of 2017, if enacted, would authorize states meeting certain requirements to require remote sellers that do not meet a small seller exception to collect their state and local sales and use taxes.

The New Jersey Division of Taxation released a manual of audit procedures providing general audit guidance for the Divisions Audit Branches and taxpayers . It will be updated periodically to reflect changes.

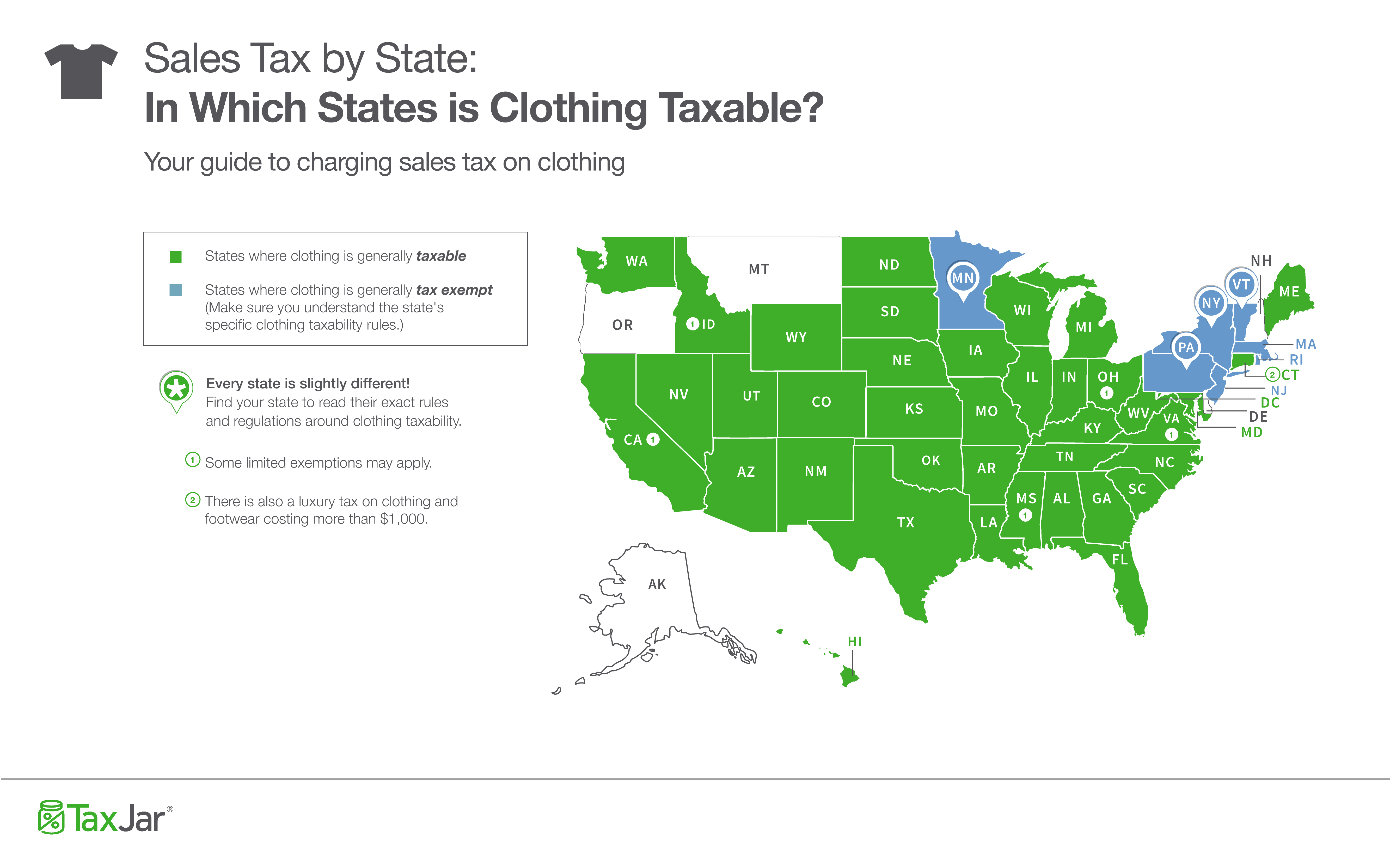

Sales Tax Bases: The Other Half Of The Equation

This report ranks states based on tax rates and does not account for differences in tax bases . States can vary greatly in this regard. For instance, most states exempt groceries from the sales tax, others tax groceries at a limited rate, and still others tax groceries at the same rate as all other products. Some states exempt clothing or tax it at a reduced rate.

Tax experts generally recommend that sales taxes apply to all final retail sales of goods and services but not intermediate business-to-business transactions in the production chain. These recommendations would result in a tax system that is not only broad-based but also right-sized, applying once and only once to each product the market produces. Despite agreement in theory, the application of most state sales taxes is far from this ideal.

Hawaii has the broadest sales tax in the United States, but it taxes many products multiple times and, by one estimate, ultimately taxes 105 percent of the states personal income. This base is far wider than the national median, where the sales tax applies to 34.25 percent of personal income.

Read Also: How Much Does H& r Block Charge To Do Taxes

Determining Sales Tax Nexus In New Jersey

In-state businesses are subject to collecting the 6.875% sales tax rate . Out of state businesses should determine if they have sales tax nexus in New Jersey first, however. Nexus can be identified if any of the following situations is true of your business:

- Any physical or tangible goods are stored in a warehouse in the state

- If you have any independent contractors, representatives or employees in the state

- If you have an office or other place of business located in the state

- If you deliver merchandise to individuals in New Jersey

- If you provide a maintenance program to anyone located in New Jersey

New Jersey has a Nexus questionnaire you can complete on their website that will help you determine if any of the above applies to you and if you need to acquire a permit. For those businesses that believe they do not have nexus, the state requires you to complete Form NJ-REG .

There are two fulfillment centers in New Jersey for Amazon FBA. If you participate in the Amazon FBA program and your inventory is stored in these warehouses, you may be considered to have nexus in New Jersey.

Corporation Business Tax Overview

Description | Rate | Disposition of Revenues | HistoryInstallment Payments of Estimated Tax | Partnerships | Banking and Financial CorporationsInvestment Companies| Deferred Predissolution Payment | Allocation Factor

Corporations:

RateC Corporation Tax Rates: For taxpayers with Entire Net Income greater than $100,000, the tax rate is 9% on adjusted entire net income or such portion thereof as may be allocable to New Jersey.

For taxpayers with Entire Net Income greater than $50,000 and less than or equal to $100,000, the tax rate is 7.5% on adjusted entire net income or such portion thereof as may be allocable to New Jersey.

Tax periods of less than 12 months qualify for the 7.5% rate if the prorated entire net income does not exceed $8,333 per month.

For taxpayers with Entire Net Income of $50,000 or less, the tax rate is 6.5% on adjusted net income or such portion thereof as may be allocable to New Jersey.

Tax periods of less than 12 months qualify for the 6.5% rate if the prorated entire net income does not exceed $4,166 per month.

C Corporation – MINIMUM TAX: The minimum tax is assessed based on New Jersey Gross Receipts:

| Gross Receipts: | |

| $100,000 or more but less than $250,000 | $750 |

| $250,000 or more but less than $500,000 | $1,000 |

| $500,000 or more but less than $1,000,000 | $1,500 |

| $1,000,000 or more | $2,000 |

Tax periods of less than 12 months are subject to the higher minimum tax if the prorated total payroll exceeds $416,667 per month.

Also Check: Can You File Missouri State Taxes Online

Car Sales Tax By State 2021

Owning a vehicle is expensive from the day you purchase it until the day you quit driving it. Unfortunately, when you purchase a vehicle, you’re paying for much more than just the vehicle itself. In addition to your down payment and monthly payments, you’ll need to budget for dealer fees, registration fees, gas, insurance, and sales tax. Some states are better to buy cars in than others due to lower initial costs, less unexpected fees, and lower car insurance premiums.

Sales tax is charged on car purchases in most states in the U.S. While you may be used to paying sales tax for most of your purchases, the bill for sales tax on a vehicle can be shocking. If, for example, you pay a 10% sales tax on $20,000, that’s an additional $2,000 you must spend not counting doc fees and DMV fees.

Luckily, some states are more relaxed on their minimum sales tax requirements, and a handful don’t charge sales tax at all. For example, Alaska, Delaware, Montana, New Hampshire, and Oregon do not levy sales tax on cars.

Which states have low car sales tax rates? Fortunately, there are several states with low car sales tax rates, at or below 4%:

Sales Tax On Shipping Charges In New Jersey

New Jersey does apply sales tax to shipping costs. The rule of thumb is that if what youâre selling is subject to tax, then the shipping charges are also subject to tax.

If you happen to be shipping products that are both taxable and nontaxable, then shipping charges for the entire shipment are subject to tax.

You May Like: How Much Does H& r Block Charge To Do Taxes

How Often Should You File

How often you need to file depends upon the total amount of sales tax your business collects.

- Quarterly filing: If your business collects less than $500.00 in sales tax per month then your business should elect to file returns on a quarterly basis.

- Monthly filing: If your business collects $500.00 or more in sales tax per month then your business should file returns on a monthly basis.

Note: New Jersey requires you to file a sales tax return even if you have no sales tax to report.

More Public School Choices

If you have kids, you want them to attend the best schools. New Jersey has the second-highest high school graduation rate. In the 201819 school year, the most recent year for which data is available, 90.6% of public high school students in New Jersey graduated.

Although New York City is home to many superior public schools, placement into them depends on a myriad of factors, from high test scores to a student’s location.

You May Like: How Can I Make Payments For My Taxes

New York City Sales Tax

On top of the state sales tax, New York City has a sales tax of 4.5%. The city also collects a tax of 0.375% because it is within the MCTD. The total sales tax in New York City is 8.875%. This is the highest rate in the state. With such a high sales tax, its no wonder the cost of living in New York City is so high.