How Is A Connecticut Llc Taxed

Meaning, an LLC is just taxed in the default status set by the IRS and the LLC doesnt elect to be taxed as a Corporation .

The default tax status for a Connecticut Single-Member LLC is a Disregarded Entity, meaning if the LLC is owned by an individual, the LLC is taxed like a Sole Proprietorship. If the LLC is owned by a company, it is taxed as a branch/division of the parent company.

The default tax status for a Connecticut Multi-Member LLC is Partnership, meaning the IRS taxes the LLC like a Partnership.

If instead, you want your Connecticut LLC taxed as a C-Corp, youll first apply for an EIN and then later file Form 8832. If you want your LLC taxed as an S-Corp, youll first apply for an EIN and then later file Form 2553.

If you choose to have your Connecticut LLC taxed as a Corporation, make sure you speak with an accountant as there are a lot of details you need to consider. Having an LLC taxed as an S-Corporation is a much more popular choice than having an LLC taxed as a C-Corporation. S-Corporation taxation usually makes sense once an LLC generates about $70,000 in net income per year.

How To Find The Ein For Your Business

More often than not, there will be an instance when you’re working through a business document or application, and you come upon a question asking for your EIN. What if you cant remember it? The three best places to find your business EIN are:

- Your business tax return from a previous year

- The original document of your receipt or the document you received from the IRS when you applied for your EIN

- Your states business division website, if you registered your partnership, LLC, or corporation with your state

You could also look for your EIN on other business documents or applications, including:

- A business bank account application

- An application for a business loan

- The application for a business credit card

- A copy of a state or local license or tax permit

- On a 1099-NEC form you received for your work as an independent contractor or freelancer

- On the 1099-MISC form or 1099-NEC form that you used to report payments by your business

Wait For Your Georgia Llc To Be Approved

Wait for your Georgia LLC to be approved by the Secretary of State before applying for your EIN. Otherwise, if your LLC filing is rejected, youll have an EIN attached to a non-existent LLC.

However, if this does happen, you can always cancel your EIN and then apply for a new one. And you dont have to wait for your cancellation to go through before applying for a new EIN.

Don’t Miss: How Do You File Taxes For Doordash

Ein Lookup: Finding Your Ein Is Simple And Easy

How do I find my EIN number?! Its so hard!

It can be frustrating to attempt to open a new business account or apply for financing, be asked for your EIN, and proceed to find out that youve lost it and all relevant paperwork with your EIN or Tax ID number on it .

However, there are several simple and easy ways to obtain your EIN even if you dont have a single tax return or your confirmation letter.

If you cant find your EIN or Tax ID number, look around for your confirmation letter, and if you cant find it, look through your relevant tax and business documents. If that doesnt work, simply give the IRS a call and provide the necessary information.

No matter what, obtaining your EIN should be easy. So, if youve lost it, and not having it is holding you back from moving forward with something important, dont sweat it.

Other Uses Of Federal Tax Id Numbers

Just like SSNs, TINs and EINs are used in financial and legal transactions. If your business gets a loan, establishes a line of credit or applies for credit with a supplier, the other party will want your ID number. Additionally, these numbers are used to track your business’s credit rating. You may run into legal forms and government applications such as a municipal business license or fictitious business name application that also require a TIN or EIN.

References

Also Check: How Do You Do Taxes For Doordash

How To Do An Ein Lookup

There may come a time when you need to search for another businessâs EIN, either for your own tax purposes or to validate someone elseâs information.

Hereâs how:

-

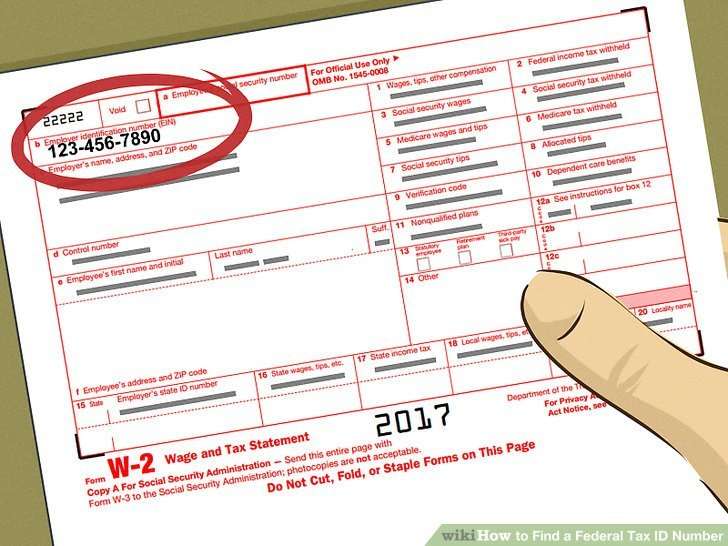

If youâre an employee and need your employerâs EIN, itâs on the back of your W-2 form

-

If the company is publicly traded, use the Security and Exchange Commissionâs EDGAR tool to look it up for free

-

If the company is privately held, you may need to track down its accountant to ask or use a lookup service

How To Obtain A Tax Id Number For An Llc

Be sure to meet your tax obligations as you move forward with your new LLC company.

Once an LLC is registered with the appropriate state government agency, usually the secretary of state, the entity’s owner must decide whether they wish or need to secure an Employer Identification Number from the Internal Revenue Service.

LLCs without employees don’t need to obtain an EIN to do business as they may file the business’ taxes using the owner’s Social Security Number . However, once an LLC hires its first employee, an EIN is required for the entity to file taxes.

Also Check: How To File Taxes Working For Doordash

Get An Ein For Small Business Disaster Loans

- Your business will need an EIN to apply for Small Business Administration loans, including disaster loans for businesses affected by the public health crisis and economic downturn, as well as the 2021 winter storms.

- The Economic Injury Disaster Loanprogram is an SBA disaster loan program for businesses with fewer than 500 employees, including sole proprietors, independent contractors, and self-employed persons. Check with your local lender to see whether they participate in this program.

Do I Need A Tax Id For An Llc

Related

Every limited liability company with employees is required to get a tax ID number from the Internal Revenue Service. Furthermore, LLCs with more than one owner are required to acquire a tax ID number. A tax ID number is also known as an employer identification number. A tax ID number is used to identify an LLC for tax purposes in the same way that a Social Security number is used to identify an individual.

Recommended Reading: Do You Have To Report Plasma Donations On Taxes

If You Are Starting A Business You May Need A Tax Id Number Number

Businesses that are employers are requiredto obtain aStateTax Id and a Federal Tax Id NOTE: Sole owners can use a federal Tax Id Number to build business credit. FeesHow Long Does it Take? Back to Top

Wholesale License Number / Resale / Reseller’s License / Tax Id Number

Wholesalers, retailers of taxable goods / services require a Wholesale License / Wholesale License Number / Reseller License. FeesHow Long Does it Take? Back to Top

Federal Tax Id Employer Identification Number FEIN

Obtaining An Ein For Single

If your LLC is a single-member LLC, you may not need an LLC EIN.

If you run LLC as a sole owner from your home, you dont need an EIN for it as long as you have opted to report your business dealings to the IRS as a disregarded entity. This is sometimes the only and default option for a sole proprietorship because the internal revenue service does not recognize such an LLC as a business entity.

If your business has any employees, then you must obtain an EIN for your LLC. Similarly, if you have no employees at a given time but plan to hire in future, you must apply for EIN at the time of hiring. You also have an option of reporting your single-member LLC as a corporation to internal revenue service, and if you opt for this option, you will need to obtain an EIN for your business.

If you add a new owner or member to your registered LLC, you are bound to obtain an EIN at that time. Another interesting situation in which you must have an EIN even when your LLC is a single-member is paying your taxes to the Bureau of Tobacco, Alcohol, Firearms, and Explosives or if your LLC participates in one of Keogh retirement plans.

Don’t Miss: Does Doordash Tax Tips

Wait For Your Connecticut Llc To Be Approved

Wait for your Connecticut LLC to be approved by the Secretary of State before applying for your EIN. Otherwise, if your LLC filing is rejected, youll have an EIN attached to a non-existent LLC.

However, if this does happen, you can always cancel your EIN and then apply for a new one. And you dont have to wait for your cancellation to go through before applying for a new EIN.

If You Misplace An Ein Number

If your EIN is misplaced, you can call the IRS’s Telephone Assistance for Businesses, Monday through Friday. Once the IRS verifies that the caller is the responsible party, it will provide the caller with the EIN.

An LLC needs a federal tax ID number for business purposes. While there are exceptions, if you open a business bank account or plan to hire employees, you will need an EIN. To simplify your life, and take one less chore off your to-do list when launching your new enterprise, you may want to contact a legal document firm that can handle this for you with no muss, no fuss.

About the Author

Roberta Codemo

Roberta Codemo is a former paralegal. Her areas of specialty include probate and estate law. Read more

Recommended Reading: Do You Get Taxed For Donating Plasma

Does Your Business Need An Ein

Since the IRS uses EINs to identify which business tax returns taxpayers must submit, most self-employed folks and small business owners will need an Employer ID Number at some point . But youâre legally required to get an EIN if you answer yes to any of the following questions:

-

Does your business have any employees?

-

Does your business operate as a C corporation, S corporation, limited liability company , or partnership?

-

Do you file employment or excise tax returns?

-

Do you withhold taxes on income, other than wages, paid to a non-resident?

According to the IRS, sole proprietorships donât require an EINâthey can just use their Social Security number . If youâre a sole proprietor that wants to do any of the above , though, youâll still need an EIN.

Even if youâre not legally required to have an EIN, we recommend getting one anyway. EINs are also required to open business bank accounts and credit cards, apply for business licenses, and secure some types of financing.

Further reading:Is Incorporating Right For You? A Starterâs Guide

Frequently Asked Questions: Ein Number Lookup

Do I need an EIN if Im self-employed?

You dont need an EIN if youre self-employed you can simply use your Social Security number. Some people who are self-employed choose to apply for an EIN instead of using their Social Security number to reduce the risk of identity theft its less likely for someone to break into your accounts when you keep business finances and personal finances separate.

I have a sole proprietorship with a DBA . Do I Need an EIN?

Having a DBA doesnt impact whether or not you are required to have an EIN for your sole proprietorship. The same rules apply to a sole proprietorship with a DBA as apply to a sole proprietorship without a DBA.

Per the IRS, A sole proprietor without employees and who doesnt file any excise or pension plan tax returns doesnt need an EIN. Once you hire employees or file excise or pension plan tax returns, you will immediately require an EIN.

Is there a difference between an EIN and a TIN?

No, there isn’t a difference between an Employer Identification Number and a Taxpayer Identification Number . Both refer to the nine-digit number issued by the IRS to identify your business.

Is there a difference between an EIN and a FEIN?

No, there is not a difference between an EIN and a Federal Employer Identification Number . A FEIN can also be referred to as a Federal Tax Identification Number.

Also Check: Tax Form For Doordash

How Do I Obtain A Federal Tax Id When Forming An Llc

If you open a business bank account or plan to hire employees, your LLC needs an EIN, or federal tax ID number. Find out your options for completing the simple form that’s required.

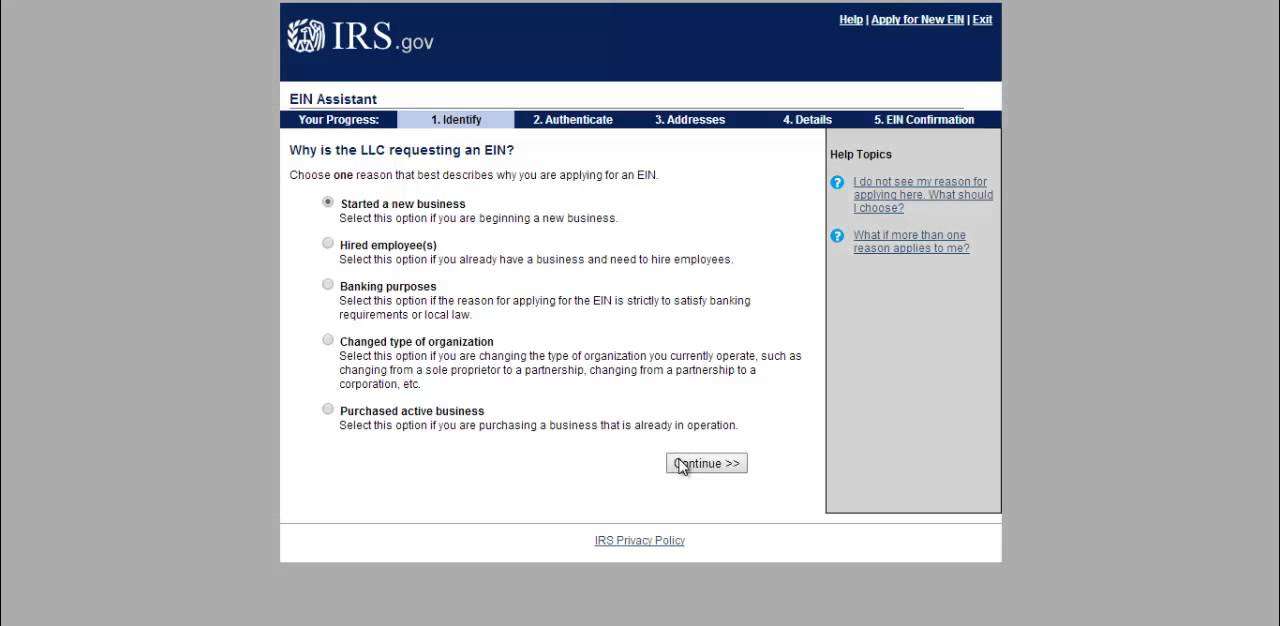

How To Get An Ein

You can apply to the IRS for an EIN in several ways: by phone, fax, or mail, or online. Filing online using the IRS EIN Assistant online application is the easiest way. You can get your number immediately using the online or phone option.

Its a good idea to print out a copy of the application form before you begin the application process. Work through the application questions so you have all the answers youll need.

Beware of Fake EIN application sites. They look like the IRS site, but they’ll charge you to file the form. The IRS never charges for this application. Here are some ways to tell whether the site is the “real” IRS:

- Look at the URL. It should be irs.gov, NOT irs.com.

- Most IRS pages have the letters “IRS” and a special symbol with a scale of justice.

- Look at the fine print on the bottom of the page. Non-IRS sites are required to state that they’re not affiliated with the U.S. Treasury Department or the IRS.

Recommended Reading: Is Plasma Donation Income Taxable

What Should An Llc Know About Obtaining A Tax Id Number

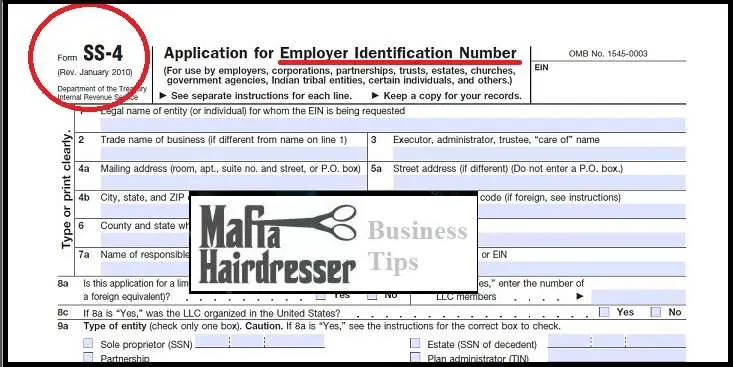

An LLC can get a tax ID number from the IRS with a choice of four methods:

When choosing to file by fax or mail, you must submit to the IRS a Form SS-4. Be sure to provide accurate information when completing Form SS-4, such as:

-

Nature of business activities

-

LLC business name and address

-

Address and Social Security number of an authorized representative of the LLC

When filing over the phone or via website, a tax ID number is issued immediately once you provide all the necessary information to the IRS. After faxing Form SS-4, the IRS will issue the federal tax identification number in four business days. The process takes longer when choosing to apply by mail. Once the IRS receives your Form SS-4, it sends the tax ID number for the LLC within four weeks.

You have the option to choose that a third-party service process your EIN application. However, using a service will come with service fees, while it’s completely free to apply directly to the IRS.

What Information Is Needed To Apply

The legal business name, location and the name and address of a responsible party who can answer questions that might arise this would usually be an officer or owner of the company. This person also provides his/her social security number on the application form.

Also required is a general statement about the type of business activity the company will be involved in as well as the business structure the State where the company is incorporated, and the reason for application and an estimate of the number and type of employees expected.

Read Also: Does Doordash Send You A 1099

When To Get Your Employer Identification Number

When you first start a business or hire employees, you should get your Employer ID Number. Also, if you are incorporating or filing as an LLC, this is also a good time to get it. Without a Federal Tax ID Number, you cant get a business bank account or file your business tax returns.

If you had an EIN as a sole proprietor and now want to incorporate or file as an LLC, you will need to reapply for a new Employer Identification Number, as, essentially, you as starting a new business, at least in business status. Keep in mind you will also need a new business bank account if you originally opened one as a sole proprietor.

Will You Ever Need To Change Your Ein

If you change entity type, you will need to change the EIN for the business. This usually happens when you go from a sole proprietor to a general partnership or S corporation.

When establishing a business, its a good idea to pick a business entity you can stick with to avoid having to change your EIN.

Recommended Reading: Do You Have To Pay Taxes With Doordash